-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: U.S. Tsys Cheapen & JPY Weakens At Start Of Q2

- JPY weakness and cheaper U.S. Tsys were the order of the day as a new quarter got underway in Asia-Pac hours.

- The latest Chinese Caixin m’fing PMI print was softer than expected, representing the fastest rate of contraction observed in the reading since the COVID outbreak-driven contraction in Feb ’20. The survey collator noted that production fell at the quickest rate observed for just over two years amid tighter COVID restrictions. Steep declines in total new work and foreign demand were also seen, while suppliers' delivery times worsened and cost pressures intensified. That made for pretty grim reading all around.

- The latest U.S. NFP report provides the main point of note on today's data docket, with flash EZ CPI and a slew of Manufacturing PMI readings also due. Comments are due from ECB's de Cos, Centeno, Schnabel, Knot & Makhlouf, Fed's Evans & Riksbank's Ohlsson. Elsewhere, Russia-Ukraine discussions will resume, in an online format.

US TSYS: A Soft Start To Q2

We got a weaker start to Q2 for the U.S. Tsy space as Asia-Pac participants reacted to late NY dealing weakness, before a light bid came in as the latest Chinese Caixin m’fing PMI print was softer than expected, representing the fastest rate of contraction observed in the reading since the COVID outbreak-driven contraction in Feb ’20. The survey collator noted that production fell at the quickest rate observed for just over two years amid tighter COVID restrictions. Steep declines in total new work and foreign demand were also seen, while suppliers' delivery times worsened and cost pressures intensified. That made for pretty grim reading all around. The space then drifted lower again, with TYM2 making fresh session lows. The contract is last -0-19 at 122-09, 0-01+ off the base of its 0-14 overnight range, while cash Tsys are 4-5bp cheaper across the curve. Flow was dominated by block buying of the FVK2 113.75 puts (8.0K in total).

- Looking ahead, NY hours will be dominated by the latest NFP print (see our full preview of that release here). Elsewhere, the monthly ISM m’fing print & Fedspeak from Chicago Fed President Evans (’23 voter) are due. We also note that Russia-Ukraine discussions will resume (in an online format).

MNI US Payrolls Preview - Eyes On Wages, Slack

EXECUTIVE SUMMARY

- March nonfarm payrolls are expected to have risen by 490k according to the Bloomberg median. There are a few much softer forecasts although the majority of views are relatively tightly packed between 450-550k and the primary dealer median sits at 520k.

- Watch average hourly earnings to see how much of a bounce there is after the surprising pause in February, in conjunction with other measures of slack.

- We see two-sided risks to May pricing for Fed hikes and somewhat asymmetric risk to the downside for the broader rate path, but acknowledge that there's a long way to go between this report and the next FOMC decision on May 4, especially in the current geopolitical climate.

PLEASE FIND THE FULL REPORT AT THE BELOW LINK, INCLUDING PREVIEWS FROM EIGHT SELL SIDE ANALYSTS PLUS THE ST LOUIS FED'S MODEL:

US DATA PREVIEW: Primary Dealer NFP Estimates

| Dealer | Estimate | Dealer | Estimate |

|---|---|---|---|

| Goldman Sachs | +575K | Jefferies | +560K |

| Nomura | +560K | Barclays | +550K |

| Credit Suisse | +550K | J.P.Morgan | +550K |

| Morgan Stanley | +550K | RBC | +550K |

| Bank of America | +525K | Societe Generale | +525K |

| UBS | +525K | Amherst Pierpoint | +520K |

| Daiwa | +500K | BMO | +490K |

| Citi | +490K | HSBC | +475K |

| Scotiabank | +450K | Wells Fargo | +450K |

| Deutsche Bank | +400K | BNP Paribas | +375K |

| Mizuho | +350K | TD Securities | +350K |

| NatWest | +200K | -- | -- |

| Dealer Median | +520K | BBG Whisper | +529K |

US: MNI BRIEF: St Louis Fed Model Signals 300k Gain For March Jobs

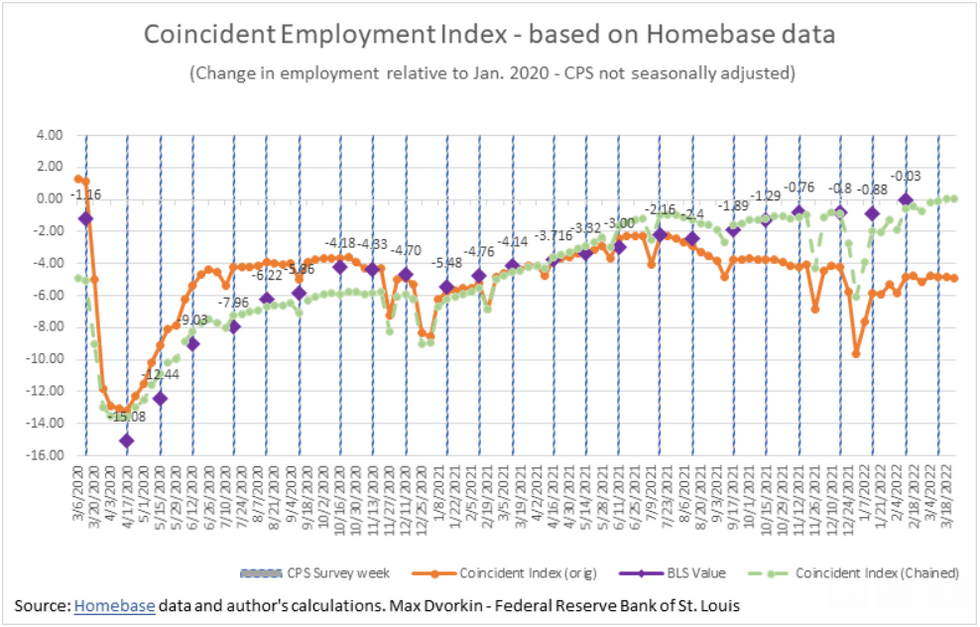

U.S. hiring in March likely took a step down from a month earlier, according to the St. Louis Federal Reserve's analysis of real-time employment data from the scheduling software company Homebase, showing a seasonally adjusted rise of 300,000 employed persons, economist Max Dvorkin told MNI.

The Fed bank's coincident employment index uses high-frequency data from scheduling software company Homebase, which shows a "mild improvement" for March, with the index increasing by 0.43 points. "This translates into a projected increase in CPS employment of 722,000, not seasonally adjusted, and 300,000 seasonally adjusted," Dvorkin said.

In February, the model forecast a seasonally-adjusted gain of 450,000 jobs as measured by the BLS's household survey. The official payrolls figure based on the "establishment" survey of businesses came in at 678,000, though the household survey found employment increased by 548,000 during the month.

JGBS: Early Tokyo Bid Fades From Extreme

The bull flattening of the JGB curve extended at the Tokyo re-open, as the impulse from the BoJ Rinban plan tweaks for Q2 (announced after Tokyo hours yesterday) initially provided support, before the broader FI cheapening evident since late NY trade limited the rally (40s failed to cross back below 0.90% in yield terms) and started to apply some pressure. Note that 10-Year yields traded as low as 0.195% this morning but sit around 0.205% ahead of the close. Cash JGBs sit little changed to 2.5bp richer across the curve, with the early bull flattening giving way to bely outperformance.

- Early Tokyo futures trade was two-way and volatile in nature, given the above inputs, with a show above the overnight high, before gains were pared back. That left the contract +9 late in the Tokyo day.

- There hasn’t been much in the way of market pertinent local news flow to outline.

- The latest BoJ Tankan survey saw large businesses downgrade their outlook (although the related readings were mostly in line to a touch better than expected), with a similar story playing out for small firms. Do note that large firms’ capex expectations moderated, providing a softer than expected reading.

AUSSIE BONDS: A Higher Cash Rate Setting, New RBA Deputy & Syndication News

An active start to the new quarter for the space, with the weakness in U.S. Tsys applying some pressure early on, before Australian Treasury Sec Kennedy (who also sits on the RBA board) noted that inflation risks are on the upside, while stressing that an orderly movement of fiscal/monetary policy to maintain low unemployment will be pivotal. He went on to note that there is an opportunity for monetary policy to “normalise,” while tipping his hat to risks that wage growth may exceed forecasts (notable wage growth is the need that the RBA constantly refers to when it comes to outlining its views on the path of policy). Also note that the effective interbank overnight cash rate set at 0.09%, 1bp off the RBA’s 10bp target, after setting at 5bp and below since Nov ’20. This would have provided further pressure for the space, on top of Kennedy’s relatively hawkish remarks. Resultant price action was volatile, with losses pared relatively quickly.

- XM then blipped lower on the ACGB Nov-33 syndication announcement (due in the w/c 11 April), before recovering above pre-announcement levels. Note that many expected such an announcement (some even expected pricing next week), while next week’s AOFM issuance slate is light in the runup to syndication, with that combination likely facilitating the bounce after the initial early hedging flows subsided.

- The space then meandered through the remainder of Sydney hours, blipping higher into the close. YM -3.5 & XM +1.5, comfortably off of lows and session flats.

- Elsewhere, RBA Assistant Governor Bullock was promoted to Deputy Governor after Debelle’s recent, impromptu resignation, in turn making her the favourite to succeed RBA Governor Lowe at the end of his term (while seemingly promoting a feeling of continuity as opposed to upheaval).

FOREX: Yen Turns Tail Again, Antipodeans Diverge

Yen sales resumed on Friday with USD/JPY running as high as Y122.73 (more than 1 big figure better off) at its intraday peak. The pair's well-defined technical lines in the sand remained intact, albeit its RSI flirted with overbought territory. The move may have been driven by Tokyo reaction to the BoJ once again re-affirming its dovish credentials via its Q2 Rinban plan, as it looks to exert greater control over the yield curve via more frequent and larger (in cumulative terms) operations after the recent test of its YCC parameters. U.S./Japanese yield spreads widened from both ends in Tokyo trade, with Tsys cheaper and JGBs richer, which likely amplified the impact of yield spread movements. To top it all off, the BoJ's Q1 Tankan survey suggested that sentiment among Japan's large manufacturers deteriorated for the first time in seven quarters, underscoring the need for the central bank to stick to its ultra-loose monetary policy stance.

- Japan's FinMin Suzuki reiterated that sudden moves in FX markets are "undesirable," with officials closely watching their impact on the economy. The official added that the BoJ does not directly target currency rates.

- The Aussie dollar caught a bid after Treasury Secretary Kennedy (who also sits on the RBA Board) said that the balance of risks to inflation outlook were to the upside, pointing to the opportunity for monetary policy to "normalise." AUD/USD climbed to $0.7500 but rejected that round figure and gave away the bulk of its earlier gains, while AUD/NZD crossed above the NZ$1.0800 mark.

- In contrast to its Antipodean cousin, the kiwi dollar went offered. The latest ANZ survey showed that consumer confidence in New Zealand plunged to an all-time low (data begins in 2004) amid rising costs of living, rising interest rates, retreating housing market and spread of Omicron.

- U.S. NFP report provides the main point of note on today's data docket, with flash EZ CPI and a slew of Manufacturing PMI readings also due.

- Comments are due from ECB's de Cos, Centeno, Schnabel, Knot & Makhlouf, Fed's Evans & Riksbank's Ohlsson.

FOREX OPTIONS: Expiries for Apr01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1085-00(E844mln)

- USD/JPY: Y120.00($575mln), Y121.50-60($930mln)

- AUD/USD: $0.7525(A$522mln), $0.7550(A$564mln), $0.7600(A$551mln)

- USD/CAD: C$1.2660-80($1.1bln)

- USD/CNY: Cny6.3800($525mln)

ASIA FX: Peso Lodges Gains Despite Weakness Of Most Asia EM Currencies

The DXY pushed higher with most USD/Asia crosses rising in tandem, as U.S. Tsy yields advanced ahead of the release of monthly NFP report. Continued concern over China's Omicron outbreak overlapped with the familiar combination of Russia's war on Ukraine and the prospect of hawkish Fed action.

- CNH: Spot USD/CNH inched higher on the back of firmer greenback, ignoring the release of China's Caixin M'fing PMI. The survey showed that the manufacturing sector slipped into contraction last month, echoing insights from official data released earlier this week.

- KRW: The won went offered as U.S. Tsy yields climbed. South Korea's monthly trade balance flipped into a deficit amid higher energy costs, albeit exports ballooned to a record amount. South Korean currency was the worst performer in the Asia EM basket.

- IDR: The rupiah stuck to a narrow range, with eyes on local inflation data. Headline CPI growth accelerated to a two-year high and topped expectations, but it remained within Bank Indonesia's target range.

- MYR: Spot USD/MYR advanced after the results of the latest S&P Global PMI survey showed that Malaysia's manufacturing sector contracted in March.

- PHP: Spot USD/PHP extended losses past its 50-DMA and the peso outperformed its regional peers. Expansion in the local manufacturing sector picked up steam in March, as S&P Global M'fing PMI rose to 53.2 from 52.8. Meanwhile, the authorities kept Metro Manila under Covid-19 Alert Level 1.

- THB: Spot USD/THB crept higher as Thailand reported record daily Covid-19 cases and deaths.

EQUITIES: Asia-Pac Equities Mixed, With Plenty Of Headline Worry Apparent

A negative lead from Wall St., worries surrounding Chinese economic growth (with the latest Caixin m’fing PMI print missing exp., providing the sharpest rate of contraction observed since Feb ’20, which represented the onset of the wider COVID breakout), questions re: the potential delisting of Chinese equities in the U.S. and the ongoing conflict in Ukraine provided pressure for regional equity benchmarks during the early part of the first Asia-Pac session of the new quarter.

- A more downbeat BoJ Tankan survey (although the headline metrics were largely in line to a touch better than expected), including softer than expected capex intentions, provided further headwinds.

- Elsewhere, dozens of Hong Kong equities were halted after missing a deadline re: filing annual reports.

- Still, mainland Chinese equities bounced from early lows, with most pointing to hope re: increased policymaker support for the economy, with the CSI 300 adding ~1% during the Chinese morning session.

- The Nikkei 225 and Hang Seng also recovered from worst levels, aided by the bounce in Chinese equities. Continued BoJ easing and a weaker JPY added some f support for Japanese equities, but the Nikkei 225 is still ~0.5% lower on the day, given the early headwinds. While U.S. e-mini futures added 0.3% to settlement levels, after a sharp month-/quarter-end related sell off late in the NY day.

GOLD: Rangebound In Pre-NFP Asia Session

Bullion has meandered through Asia-Pac dealing to trade little changed, just shy of $1,935/oz. This comes after spot tested $1,950/oz in NY hours, before pulling back from best levels, with the late shunt higher in U.S. real yields (based on our weighted U.S. real yield monitor) capping, then pressuring, bullion. The move higher in U.S. real yields has continued during Asia-Pac hours, accompanied by a modest uptick in the DXY, but bears have been wary of attempting to push gold lower, perhaps given the proximity to Friday’s U.S. NFP print.

- Note that Gold ETF holdings have surged since the onset of the Russia-Ukraine crisis, which has provided a leg of support on the flow side, as fund participation picks up. Note that ETF holdings of gold remain elevated in historical sense, and after the recent run higher sit a little over 5% shy of the all-time peak observed in late ’20.

- The aforementioned NFP print provides the notable risk event ahead of the weekend, while Russia-Ukraine matters will keep participants on headline watch.

OIL: WTI Looks Below $100 In Asia

WTI has managed a marginal extension through Thursday’s low during Asia-Pac dealing and last sits a little over $0.50 softer on the day, just below $100 (after the level provided support on Thursday), while Brent futures have also extended Thursday’s move lower, losing a handful of cents, with $104.00 providing a bit of a floor for now.

- A reminder that Thursday’s sharp losses were a product of the sizeable U.S. SPR stock release initially touted in Asia-Pac hours, and later confirmed by the Biden administrations (1mn bpd set to be released over a ~6 month period), with the prospect of further action from the IEA later today (the Biden admin have flagged the potential for another 30-50mn bbl release on the part of the IEA).

- While most of the sell-side acknowledge a fairly short-term downside risk/bias to prices on the above, most continue to flag the structural support for crude, especially with OPEC+ maintaining their gradual approach when it comes to providing an uptick in production.

- Elsewhere, Russian energy pricing matters, the continued Russia-Ukraine conflict and the resumption of talks between the two nations (in an online format), set for Friday, provide plenty of other headline risk to keep an eye on.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/04/2022 | 0630/0830 | ** |  | SE | Manufacturing PMI |

| 01/04/2022 | 0630/0830 | *** |  | CH | CPI |

| 01/04/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0800/1000 | * |  | NO | Norway Unemployment Rate |

| 01/04/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/04/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 01/04/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/04/2022 | 1230/0830 | *** |  | US | Employment Report |

| 01/04/2022 | 1305/0905 |  | US | Chicago Fed's Charles Evans | |

| 01/04/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/04/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/04/2022 | 1400/1000 | * |  | US | Construction Spending |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.