-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI EUROPEAN OPEN: Asian CB’s Continue To Tighten, Eyes On Russia-Ukraine Matters & ECB

EXECUTIVE SUMMARY

- FED’S WALLER SEES LIKELIHOOD OF MULTIPLE HALF-POINT INTEREST RATE HIKES AHEAD (CNBC)

- RUSSIA READY TO ATTACK IN DONETSK, KHERSON DIRECTIONS, UKRAINE SAYS (RTRS)

- RUSSIA EVACUATES FLAGSHIP CRUISER AFTER FIRE

- U.S. WEIGHS SENDING TOP-LEVEL OFFICIAL TO MEET ZELENSKYY IN KYIV (POLITICO)

- EU SAYS RUBLES-FOR-GAS VIOLATES SANCTIONS (BBG)

- BANK OF RUSSIA CONSIDERS EASING MANDATORY FX-SALES TERMS (RBC)

- BOK & MAS ADD TO RECENT ROUNDS OF MONETARY TIGHTENING

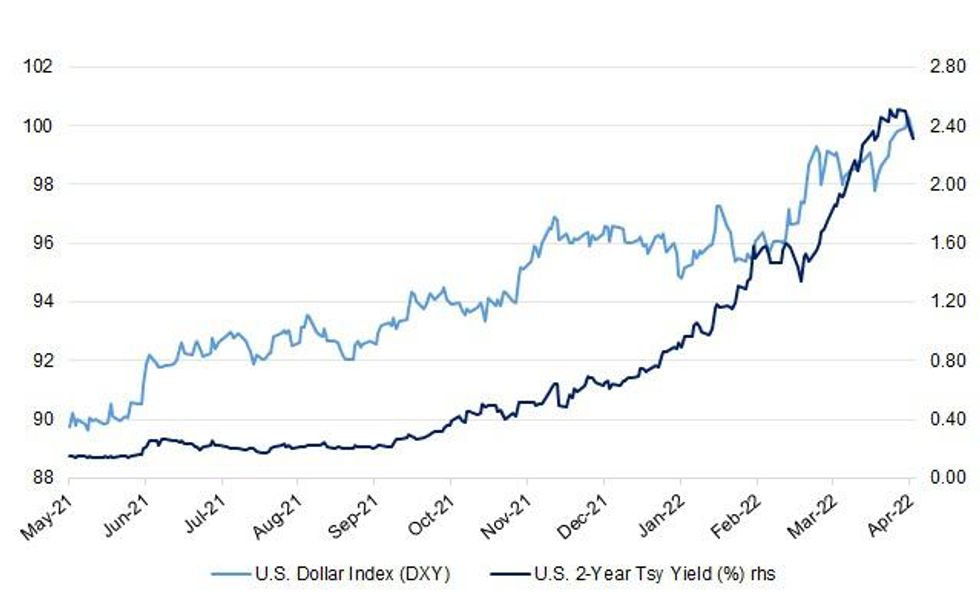

Fig. 1: U.S. Dollar Index (DXY) Vs. U.S. 2-Year Tsy Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: A Conservative peer has resigned as a justice minister over Covid law-breaking in Downing Street. It comes after Prime Minister Boris Johnson and Chancellor Rishi Sunak were fined for attending a party in No 10 during lockdown. In a letter to Mr Johnson, Lord David Wolfson criticised the "official response" to "repeated rule-breaking". He is the first person to quit the government since reports of lockdown parties emerged. (BBC)

PROPERTY: U.K. asking prices for rental homes surged at a record pace as demand from tenants outstripped the supply of properties on the market. Rightmove Plc said the average price landlords sought rose 10.8% from a year ago in the first quarter and by 1.8% from the previous three months. With a 6% increase in tenant demand and a 50% drop in available properties, the online property portal said the rental market was the most competitive it had ever seen. Higher living costs will further squeeze British consumers, who already face inflation that has reached a 30-year high. The Bank of England warns that price growth could rise to double digits this year, and those figures add to pressure on the central bank to raise interest rates again in May. (BBG)

EUROPE

ECB: MNI SOURCES: Early Work On ECB Crisis Tool Focuses On Legality

- Work by the European Central Bank on a new tool to cap any blow-out in bond spreads is still at a preliminary stage and is focussing on the legal design of an instrument that could be used without need for approval by eurozone member states, Eurosystem sources told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

U.S.

FED: Getting inflation under control will require raising interest rates at a faster pace than normal even though the pace of price increases probably has peaked, Federal Reserve board member Christopher Waller said Wednesday. “I think the data has come in exactly to support that step of policy action if the committee chooses to do so, and gives us the basis for doing it,” he said during a live “Closing Bell” interview with CNBC’s Sara Eisen. “I prefer a front-loading approach, so a 50-basis-point hike in May would be consistent with that, and possibly more in June and July.” (CNBC)

POLITICS: Americans harbor some of the most downbeat views on the economy since the recovery from the Great Recession, and some of their attitudes are in line with those seen only during recessions, according to the latest CNBC All-America Economic Survey. Amid soaring inflation, 47% of the public say the economy is “poor,” the highest number in that category since 2012. Only 17% rank the economy as excellent or good, the lowest since 2014. Only one in five Americans describe their personal financial situation as “getting ahead,” the weakest showing in eight years. Most say they are “remaining in place,” and one in 10 say they are “falling backward.” Meanwhile, 56% say they expect a recession in the next year — a level only achieved in the survey during an actual recession. “The angst was previously more about what was going to happen in the economy, and we’ve now shifted into a new place where we’re much more much pessimistic about what’s currently happening,” said Micah Roberts, a partner at Public Opinion Strategies and the Republican pollster for the survey. “There’s no overwriting the pessimism in this survey. It is on every page, and it is inescapable.” The survey of 800 Americans nationwide was conducted April 7 through April 10 and has a margin of error of plus or minus 3.5%. The pessimism is clearly dragging on Americans’ opinions of President Joe Biden. In fact, nothing looks to be working in the Biden presidency from the public’s viewpoint. The president’s approval rating sank to a new low of just 38%, with 53% disapproving. Biden’s -15% net approval rating is measurably worse than his -9% approval in the CNBC December survey. What’s more, his approval rating on the economy dropped for a fourth straight survey to just 35%, with 60% disapproving, putting the president a deep 25 points underwater. (CNBC)

OTHER

GLOBAL TRADE: The World Bank, International Monetary Fund, United Nations World Food Program and World Trade Organization on Wednesday called for urgent, coordinated action on food security, and urged countries to avoid export bans on food or fertilizer. In a joint statement, the leaders of the four institutions warned that the war in Ukraine was adding to existing pressures from the COVID-19 crisis, climate change and increased fragility and conflict, threatening millions of people worldwide. Sharply higher prices for staples and supply shortages were fueling pressure on households, they said. The threat is greatest to the poorest countries, but vulnerability was also increasing rapidly in middle-income countries, which host the majority of the world’s poor. (RTRS)

GLOBAL TRADE: Apple Inc. shoppers are facing longer wait times for the company’s flagship MacBook Pro laptops, a sign that Covid-19 lockdowns in China may be contributing to delays. U.S. consumers trying to order Apple’s latest high-end models are now seeing delivery estimates pushed into June. And the date range for the lower-end configuration of the 14-inch MacBook Pro was as late as May 26 as of Wednesday. Those wait times represent a jump from recent days, before supply chain snags worsened again. (BBG)

GLOBAL TRADE: President Biden is planning to pressure Congress to pass an innovation and competition bill that would boost the semiconductor industry, among others, when he travels to Greensboro, N.C., on Thursday, Axios has learned. Recent international sanctions on Russia have shown how any country that’s too reliant on one export — energy exports, in Moscow's case — can be hurt economically. The bill is meant to increase U.S. competition globally, but especially with China. The trip to North Carolina comes after a visit by the president on Tuesday to Menlo, Iowa, where he discussed a plan to lower gas prices in part by granting a waiver to use cheaper ethanol fuel into this summer. (Axios)

U.S./CHINA/RUSSIA: Treasury Secretary Janet Yellen has sketched out her vision for a new era of economic cooperation among nations that share key values and principles, in a sweeping speech that laid down a stern challenge to China. Yellen, speaking a week before global finance chiefs meet in Washington, called Beijing to account for its ever-closer relationship with Moscow and blasted China for practices that “unfairly damage” the national-security interests of others. While she said she didn’t want the evolution of a “bipolar” global system between U.S.-led and China-led elements, the Treasury chief said that Russia’s invasion of Ukraine marked a moment where nations need to decide where they sit. “The future of our international order, both for peaceful security and economic prosperity, is at stake,” she said. (BBG)

BOJ: MNI INSIGHT: BOJ Sees JGB Tweaks Only Short-Term Impact On Yen

- A wider yield curve control range for the 10-year Japanese Government Bond (JGB) or a focus on a shorter-dated tenor would at best have a short-lived impact on the yen's level against the USD, which is now driven by an expected increasingly wide interest rate gap to U.S Treasuries, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BOJ: Bank of Japan Deputy Governor Masazumi Wakatabe says that it’s desirable for foreign exchange rates to reflect economic fundamentals and move in a stable manner. When asked about the yen hitting the lowest level in two decades on Wednesday, Wakatabe declined to make specific comments on the currency. (BBG)

JAPAN: Japan's ruling Liberal Democratic Party (LDP) will urge the government to top up aid to soften the blow from rising fuel costs, including by adding jet fuel to the target for subsidies, a draft proposal obtained by Reuters showed on Thursday. The LDP will look into measures beyond the relief package currently being crafted by the government as rising raw material costs could persist and weigh on the economy, the draft proposal said. The party's executives are expected to present the proposal to Prime Minister Fumio Kishida later on Thursday. (RTRS)

JAPAN: Japan must compile an extra budget as early as possible and implement it decisively to help households cope with surging fuel costs and other economic consequences of the war in Ukraine, according to a draft proposal from the Komeito party, a junior partner in the ruling coalition. The draft, seen by Reuters on Thursday, also called for establishing funds to help businesses affected by sanctions against Russia and boosting budget reserves to respond swiftly and flexibly to unexpected spending needs. The party's executives will hand the proposal to Prime Minister Fumio Kishida later on Thursday. (RTRS)

JAPAN: More than three-quarters of Japanese firms say the yen has declined to the point of being detrimental to their business, a Reuters poll found, with almost half of companies expecting a hit to earnings. The results of the Reuters Corporate Survey are one of the clearest signs yet that much of Japan Inc is struggling with higher costs and worsening consumer demand caused by the yen's weakness. The survey also showed almost 60% think the government should move quickly to restart nuclear reactors, evidence that higher energy costs - driven in part by the currency's slide - may be changing opinion on nuclear policy. (RTRS)

RBNZ: MNI INTERVIEW: RBNZ Needs Neutral Rates Faster-Ex-Official

- Another 50-basis point rate hike could come in May from the Reserve Bank of New Zealand to get ahead of the curve on a headline inflation rate expected to reach around 7%, but the current forecast end point for the Official Cash Rate in this tightening cycle is still valid, a former senior official told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BOK: The Bank of Korea added to a wave of global action against inflation this week by raising its key interest rate on Thursday, brushing aside concerns about a leadership vacuum at the bank and global risks to the export-dependent economy. The central bank raised its seven-day repurchase rate by a quarter percentage point to 1.5% in the board’s first-ever decision without a governor in place. Some 11 economists surveyed by Bloomberg had expected the hike, while 10 forecast policy would remain unchanged. While the BOK warned that the economy would grow less than previously forecast this year, the decision highlights the more pressing sense of urgency among policy makers to tackle inflation fueled by the war in Ukraine. The bank last week warned it’s likely to remain in a 4% range for the foreseeable future. “Big changes have happened since the February meeting,” Joo Sang-yong, acting chairman of the policy committee, said at a press briefing after the decision. “We concluded the existing inflationary pressures could go on for longer than expected due to the Ukraine situation. So despite the vacancy of the governor position, we had no choice but to respond.” (BBG)

NORTH KOREA: The United States is pushing the U.N. Security Council to further sanction North Korea over its renewed ballistic missile launches by banning tobacco and halving oil exports to the country and blacklisting the Lazarus hacking group, according to a draft resolution reviewed by Reuters on Wednesday. The United States circulated the draft to the 15 council members this week. It was not immediately clear if or when it could be put to a vote. A resolution needs nine "yes" votes and no vetoes by Russia, China, France, Britain or the United States. (RTRS)

HONG KONG: Hong Kong will from April 21 start to ease social-distancing rules that have been in place for months, including an extension of dine-in hours for restaurants. Chief Executive Carrie Lam Cheng Yuet-ngor and her officials announced the long-awaited plan on Thursday morning detailing a phased exit from the restrictions imposed during the fifth Covid-19 wave. From April 21, restaurants can operate dine-in services until 10pm with four people per table. Bars will remain closed. Catering staff must be vaccinated and undergo rapid antigen tests every three days. Gyms, beauty massage parlours, cinemas, game centres, theme parks and places of worship to reopen. Limited to four people per group. Cinema-goers and staff must have had three vaccine doses if the operator wants to serve food and drinks. Public sports venues, libraries, museums and children’s playgrounds will reopen. Public beaches, pools and barbeque sites will remain closed. (SCMP)

SINGAPORE: Singapore’s central bank further tightened monetary settings and raised its inflation forecast, sending the currency higher, as it seeks to fight cost pressures that threaten the recovery from the pandemic. The Monetary Authority of Singapore, which uses exchange rates as its main policy tool, said Thursday that it’s taking steps to strengthen the local dollar, which will help slow inflation momentum as global shocks feed into local prices. The specific moves -- re-centering its policy band higher and raising the slope of appreciation -- mark the first time since April 2010 that both tools were used at the same time to tighten. Thursday’s decision builds on a tightening in October and another surprise move in January. (BBG)

BOC: Hours after delivering the biggest interest-rate hike in 22 years in Canada, Tiff Macklem had a message for investors: There’s no reason to worry about inflation getting out of hand. While there is plenty of uncertainty in the global economy, the Bank of Canada governor told Bloomberg News he’s quite certain that policy makers will be able to avoid a return of 1970s-style stagflation.Macklem said the world’s central bankers have learned the hard lessons from letting inflation get too high. They’re adjusting policy quickly to avoid a scenario where price pressures remains elevated and the global economy sinks into a recession, he said in an interview. “A lot has changed since the 1970s,” said Macklem, who earlier Wednesday delivered a half-percentage point rate increase in a bid to wrestle inflation down from a three-decade high. “Central banks are going to be much more ahead of it than they were.” (BBG)

BOC: MNI INTERVIEW: BOC Set For Another 50BPs at June Meet-Ex Fellow

- The Bank of Canada is setting the stage for another 50bp interest-rate hike at its next meeting on June 1 and perhaps another aggressive option of lifting borrowing costs beyond neutral, former central bank research fellow Michael Devereux told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

MEXICO: Texas governor Greg Abbott backed down on extra inspections for vehicles from part of Mexico on Wednesday as a domestic US clash over immigration policy created delays threatening billions of dollars in international trade. The additional checks introduced by Abbott last week — which he said were meant to reduce crime and increase vehicle safety — added hours to usual crossing times and led to long backlogs at important ports of entry along Texas’s more than 1,200-mile border with Mexico. Truck drivers south of the border had blockaded some of the entry points in protest at the onerous measures, adding to the chaos and further imperilling supply chains already under strain. (FT)

BRAZIL: Brazil's Economy Minister Paulo Guedes said on Wednesday that the federal audit court TCU will vote on the Eletrobras' (ELET6.SA)privatization next week, adding the schedule is tight for the planned share offering. Speaking at an official event, Guedes said that if the timing is lost, the country's people will face "an obscure future" as presidential elections approach. If the offer time frame fails, the government may try to carry out the operation in the second half of the year, starting in August. However, there's a risk of the market window worsening or even close, given the proximity of the electoral race and other uncertainties, such as the unfolding of the war in Ukraine. (RTRS)

BRAZIL: The Brazilian government plans an across-the-board 5% salary increase for public servants starting in July in an attempt to end protests and strikes affecting public services, three Economy Ministry sources said on Wednesday. According to two of the sources, who requested anonymity to discuss private deliberations, the increase will cost the federal government around 6 billion reais ($1.28 billion) this year. Brazil has a constitutional spending cap so the government will have to cut other expenses to increase salaries, as Congress approved the 2022 budget with only 1.7 billion reais for such raises. The government had also analyzed options within that limit, including boosting meal vouchers by 400 reais ($85) for all employees, a possibility that they largely rejected. Another alternative was to favor a few categories of civil servant, including those at the central bank and public revenue service, which were leading noisy protests after President Jair Bolsonaro said earlier this year that only civil servants providing public security would be allowed to receive raises. (RTRS)

BRAZIL: Petrobras’s shareholders appointed Jose Mauro Coelho as a board member on Wednesday, a key step for the former energy ministry official to become chief executive officer and end a tumultuous leadership transition. The board of directors at Petroleo Brasileiro SA, as the state-controlled oil producer is known, will hold a separate vote to name Coelho as CEO on Thursday. It is expected to be a formality because the government, which controls the board, nominated him as a candidate. Minority shareholders scored a victory by electing four members to the board for the first time, up from three, in a meeting that lasted more than six hours. (BBG)

RUSSIA: Russian forces are fully ready for a fresh assault in Ukraine's eastern Donetsk region and southern Kherson region, Ukraine's armed forces command said on Wednesday. "In the Donetsk and Tavria (Kherson) directions, according to available information, the enemy is ready for offensive actions," the armed forces said in a Facebook post. (RTRS)

RUSSIA: U.S. Secretary of State Antony Blinken made the following remarks on Wednesday as part of a U.S. Dept of State statement announcing the authorisation of $800mn in military assistance to Ukraine, “Russia has failed in its initial objective of capturing Kyiv and failed to subjugate Ukraine, but we cannot become complacent. The United States and the international community will make Putin’s war of choice a long-term strategic failure for the Kremlin.” (MNI)

RUSSIA: Russian forces continue to face major morale problems even as they prepare helicopters, artillery and troops for a renewed push in the east of Ukraine, a senior U.S. defense official told reporters. Javelin missiles and other forms of military assistance continue to flow into Ukraine through airlift deliveries and ground movement, the official said. The official added that there are no indications that China has offered tangible lethal or non-lethal assistance to Russia. (BBG)

RUSSIA: The Russian defence ministry said on Wednesday that if attacks on Russian territory continue then its forces will strike at the places in Ukraine, including Kyiv, where such decisions are made. It also said that Mariupol's trade sea port was under full control, while all the "hostages" from the vessels at the port have been freed. (RTRS)

RUSSIA: The most important ship in Russia's Black Sea fleet, the Moskva missile cruiser, was badly damaged after ammunition on board blew up, Interfax news agency quoted the Russian defence ministry as saying on Thursday. Interfax said the crew had all been evacuated and the cause of the fire was being investigated. A Ukrainian official had said earlier that the ship had been hit by two missiles but did not give any evidence for the claim. (The Telegraph)

RUSSIA: The United States is considering whether to send a high-level official to Kyiv, Ukraine’s capital, in the days ahead as a sign of support for Ukraine in its war with Russia, according to a person familiar with the internal discussions. It is highly unlikely that Mr. Biden or Ms. Harris would go to Kyiv, according to the person familiar with the deliberations. The security requirements for the president or vice president in a war zone are enormous and would require a huge number of American personnel and equipment to make the trip. But it is possible that another official — perhaps a cabinet secretary or senior member of the military — could make the trip safely with a smaller security entourage. (NYT)

RUSSIA: The Biden administration is moving to significantly expand the intelligence it is providing to Ukraine’s forces so they can target Moscow’s military units in Russian-occupied Donbas and Crimea, part of a shift in U.S. support that also includes a new security assistance package with heavier weaponry. The new intelligence guidance comes as the White House said that it will send $800 million in additional weapons to Kyiv, including artillery, armored personnel carriers and helicopters, to help Ukrainian forces hold off a major Russian offensive in the eastern part of the country that is expected to unfold in coming days. (WSJ)

RUSSIA: Some of the new military equipment the United States said on Wednesday it was sending to Ukraine will require training for Ukrainian forces, Pentagon spokesperson John Kirby told reporters. "The systems that will probably require some additional training for Ukrainian forces are the howitzers (and) ... the counter artillery radar, not a very difficult system to operate, but it's not one that they have in their inventory," he said. Kirby said the Pentagon tried to reach Russia's defense minister less than a week or so ago but there was no interest on the Russian side to talk. (RTRS)

RUSSIA: The US State Department has defended President Joe Biden's charge that Russia is carrying out a genocide in Ukraine, saying its forces are trying to destroy the country and its civilian population. "I am going to predict that what President Biden called it is what we will ultimately likely find when we are able to gather all of this evidence," the State Department's number three official, Victoria Nuland, said on CNN. (The Telegraph)

RUSSIA: French presidential hopeful Marine Le Pen said she wants NATO to enter an alliance with Russia once the war in Ukraine ends. The far-right leader told reporters France should exit NATO’s military command but that she would pursue collaboration. She also agrees with sending “defense equipment” to Ukraine but cautioned that she doesn’t want France to deliver weapons directly because that would make the country a co-belligerent. (BBG)

RUSSIA: The United States has a wide variety of additional sanctions that it can impose on Russia over its invasion of Ukraine, White House press secretary Jen Psaki told reporters on Wednesday. Psaki said secondary sanctions and the targeting of additional financial firms are among a range of potential sanctions actions remaining that could be aimed at Russia. (RTRS)

RUSSIA: The European Union has warned member states that President Vladimir Putin’s demand that “unfriendly countries” effectively pay for Russian gas in rubles would violate existing sanctions the bloc imposed on Moscow following its invasion of Ukraine. The European Commission, the EU’s executive arm, presented the analysis of Putin’s decree to the member nations, according to a person familiar with the matter. The commission’s assessment raises the stakes for Europe’s energy security since Putin threatened to halt gas supplies to buyers that don’t comply with the edict. (BBG)

RUSSIA: Australia imposed targeted financial sanctions on 14 Russian state-owned enterprises on Thursday, including defense-related entities such as truckmaker Kamaz, and shipping companies SEVMASH and United Shipbuilding Corp. Sanctions will also extend to electronic company Ruselectronics, responsible for the production of around 80% of all Russian electronics components, and Russian Railways over Moscow’s invasion of Ukraine, Foreign Minister Marise Payne said in a statement. (RTRS)

RUSSIA: Russia is imposing tit-for-tat sanctions on 398 members of the U.S. House of Representatives and 87 Canadian senators and will move against other people, Interfax news agency cited the foreign ministry as saying on Wednesday. Russia's foreign ministry said the sanctions announced on Wednesday would mirror the U.S. punitive measures but gave few details, apart from saying all those on the list will be barred from visiting Russia. (RTRS)

RUSSIA: Bank of Russia considers easing requirements for mandatory FX-sale by exporters, RBC reports, citing central bank’s press service. In particular, central bank is considering extending the the deadline to sell proceeds and changing the minimum sales threshold from 80% now. (BBG)

MIDDLE EAST: Secretary of State Tony Blinken apologized to Abu Dhabi Crown Prince Mohammed bin Zayed last month for the U.S. response to January's Houthi attacks against the United Arab Emirates, two sources briefed on the issue tell Axios. A senior State Department official declined to speak about Blinken’s private conversation, but didn’t deny this account. “The Secretary made clear that we deeply value our partnership with the UAE and that we will continue to stand by our partners in the face of common threats," the senior State Department official said. (Axios)

ARGENTINA: Argentina's central bank raised its benchmark interest rate by 250 basis points to 47% on Wednesday, its fourth hike this year as it tries to slow a surge in prices which has pushed inflation to a two-decade high. The bank had raised the benchmark 28-day Leliq rate to 40% in January, then to 42.5% in February and 44.5% in March. In a statement, the bank said the acceleration of inflation in March was a result of "an international shock that especially affected the prices of food and energy, caused by the war in Ukraine." The central bank said that it expected inflation to start to decelerate gradually from April and May. Earlier Wednesday, the state statistics agency said Argentina's monthly inflation rate had soared to 6.7% in March, far above forecasts and hitting an annual rate of 55.1%. (RTRS)

ENERGY: A German portal that will collect live data from the country's biggest gas consumers will go live in October, the country's network regulator said on Wednesday, marking the latest step in preparations for an eventual halt in supplies from Russia. All major gas consumers in Europe's largest economy need to register with the platform to give the Bundesnetzagentur - which would be in charge of rationing in case of an emergency - a detailed overview over consumption. The regulator said an initial data collection would take place May 2-15. (RTRS)

OIL: Major global trading houses are planning to reduce crude and fuel purchases from Russia’s state-controlled oil companies as early as May 15, sources said, to avoid falling foul of European Union sanctions on Russia. The EU has not imposed a ban on imports of Russian oil in response to Russia’s invasion of Ukraine, because some countries such as Germany are heavily dependent on Russian oil and do not have the infrastructure in place to swap to alternatives. Trading companies are, however, winding down purchases from Russian energy group Rosneft as they seek to comply with language in existing EU sanctions that were intended to limit Russia’s access to the international financial system, the sources said. (RTRS)

OIL: Oil is backing up through Russia’s energy supply chain and leading to a drop in crude-oil production, a blow to Moscow’s main economic engine as the war in Ukraine rages. Refiners are trimming output and in some cases closing down because of falling demand at home and abroad. Storage space is running low in pipelines and tanks. Wells, which pump from some of the world’s biggest crude reserves, are dialing down production. (WSJ)

OIL: Libya's national unity government said in a statement late on Wednesday that it has adopted a plan to develop the country's oil sector with the aim of increasing its output to 1.4 mln barrels per day. "The national unity government is keen to raise its production rates in conjunction with the rise of global crude prices", the statement on the Cabinet's Facebook official account said. (RTRS)

CHINA

PBOC: The People’s Bank of China will cut the reserve requirement ratio in a timely manner to to help banks provide credit to increase financial support for industries and small and medium enterprises affected by the pandemic, according to a State Council executive statement late Wednesday. China will boost consumption, promote spending on services such as medical and health care, and encourage purchases of cars and home appliances. Local authorities should gradually increase the quota for car purchases instead of adding new restrictions, the statement said. (MNI)

POLICY: China should implement more expansionary monetary and fiscal policies against the risk of a rapid economic downturn in the short term, Zhang Ming, deputy director of state-affiliated National Institution for Finance Development, said on WeChat. Reductions in the reserve requirement ratios to provide liquidity and interest rate cuts are among the measures needed, said Zhang. China’s monetary policy must be driven by domestic needs and tolerate a moderate depreciation of the yuan against the dollar, which will leave room to lower risk-free long-term rates. China can still tighten controls on capital outflows should the yuan depreciate too fast, Zhang added. (MNI)

ECONOMY: China’s export growth may continue to decelerate, but import growth will also lag, which will maintain a high trade surplus and support the yuan, according to a report by state-owned investment bank CICC. This will leave room for further monetary easing. With overseas inflation much higher, other countries still have the incentive to buy from China. However imports will continue to be dragged down by the pandemic and real estate market downturn, the report said. (MNI)

CORONAVIRUS: Northeastern Chinese province of Jilin says community spread at all cities has been halted with new cases only reported among those already in isolation at several cities, the state television reports, citing a local government briefing. (BBG)

EQUITIES: Chinese stocks rose as expectations grew that the central bank may cut its key policy interest rate on Friday, boosting sentiment among investors who are waiting on authorities to take more steps to revive growth. Fifteen of the 20 economists surveyed by Bloomberg predict the People’s Bank of China will lower the interest rate on one-year policy loans on Friday -- 11 of them forecast a 10 basis-point reduction to 2.75% and four expect a 5-point drop. The rest see no change. (BBG)

EQUITIES: China’s top anti-graft watchdog was among the agencies involved in a recent inquiry into links between Jack Ma’s Ant Group Co. and state-owned Chinese companies, according to people familiar with the matter, escalating the risks for the country’s most recognizable tech tycoon and his internet empire. The Central Commission for Discipline Inspection was seeking to understand the influence of Ma’s fintech empire and the extent of its transactions with state banks and enterprises, the people said, asking not to be identified discussing a sensitive issue. The agency’s involvement hasn’t been previously reported. (BBG)

EQUITIES: China's securities regulator on Thursday ordered Lenovo Group (0992.HK) to rectify information disclosure issues. The China Securities Regulatory Commission (CSRC) said in a statement that a regular on-site inspection found that the Chinese computer firm released its 2020 annual report in Hong Kong earlier than it did in mainland China. Lenovo's disclosure via the Shanghai Stock Exchange of its acquisition of Banque Internationale a Luxembourg SA also lagged its announcement through the Hong Kong bourse, it said. The company also failed to disclose that shares of some Lenovo subsidiaries were used as collateral, while information involving non-operational lending activities was not accurate. (BBG)

OVERNIGHT DATA

AUSTRALIA MAR EMPLOYMENT CHANGE +17.9K; MEDIAN +30.0K; FEB +77.4K

AUSTRALIA MAR FULL TIME EMPLOYMENT CHANGE +20.5K; FEB +121.9K

AUSTRALIA MAR PART TIME EMPLOYMENT CHANGE -2.7K; FEB -44.5K

AUSTRALIA MAR UNEMPLOYMENT RATE 4.0%; MEDIAN 3.9%; FEB 4.0%

AUSTRALIA MAR PARTICIPATION RATE 66.4%; MEDIAN 66.5%; FEB 66.4%

AUSTRALIA APR CONSUMER INFLATION EXPECTATIONS +5.2%; MAR +4.9%

NEW ZEALAND MAR BUSINESSNZ M’FING PMI 53.8; FEB 53.6

New Zealand’s manufacturing sector saw another, albeit slight, improvement in its level of expansion, according to the latest BNZ - BusinessNZ Performance of Manufacturing Index (PMI). The seasonally adjusted PMI for March was 53.8 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 0.2 points higher than February, and above the long-term average of 53.1 for the survey. BusinessNZ’s Director, Advocacy Catherine Beard said that the March result was another encouraging step towards getting the sector back on track. “In terms of the main sub-indices, New Orders (61.0) continued its healthy momentum upwards, although Production (50.9) did fall back to its level of expansion experienced in January. Employment (52.4) rose to its highest level since September 2021, while Finished Stocks (53.5) also picked up to its highest result since October 2021.” Comments from manufacturers were still firmly in negative territory (64.2%), although down from 69.9% in February. Unsurprisingly, COVID dominates discussion, with supply chain disruptions one of the key outcomes. BNZ Senior Economist, Doug Steel stated that “Omicron’s impact may not be as harsh as the first 2020 COVID lockdown or last year’s Delta lockdown, but it’s there. Production has struggled, with the index slipping to 50.9 in March and a bit further below its long-term average.” (BNZ)

NEW ZEALAND MAR REINZ HOUSE SALES -33.5% Y/Y; FEB -32.8%

SOUTH KOREA MAR EXPORT PRICE INDEX +22.8% Y/Y; FEB +20.5%

SOUTH KOREA MAR EXPORT PRICE INDEX +5.7% M/M; FEB +2.2%

SOUTH KOREA MAR IMPORT PRICE INDEX +35.5% Y/Y; FEB +30.7%

SOUTH KOREA MAR IMPORT PRICE INDEX +7.3% M/M; FEB +4.6%

UK MAR RICS HOUSE PRICE BALANCE 74%; MEDIAN 75%; FEB 78%

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0333% at 09:37 am local time from the close of 1.9150% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 52 on Wednesday vs 44 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3540 THURS VS 6.3752

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3540 on Thursday, compared with 6.3752 set on Wednesday, marking the biggest daily rise since Mar 17.

MARKETS

SNAPSHOT: Asian CB’s Continue To Tighten, Eyes On Russia-Ukraine Matters & ECB

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 314.65 points at 27154.59

- ASX 200 up 47.285 points at 7526

- Shanghai Comp. up 23.254 points at 3210.078

- JGB 10-Yr future up 19 ticks at 149.47, yield down 0.4bp at 0.236%

- Aussie 10-Yr future up 9.5 ticks at 96.970, yield down 9.8bp at 2.976%

- U.S. 10-Yr future +0-09 at 121-02+, yield down 3.4bp at 2.665%

- WTI crude down $0.45 at $103.78, Gold down $2.77 at $1975.09

- USD/JPY down 29 pips at Y125.33

- FED’S WALLER SEES LIKELIHOOD OF MULTIPLE HALF-POINT INTEREST RATE HIKES AHEAD (CNBC)

- RUSSIA READY TO ATTACK IN DONETSK, KHERSON DIRECTIONS, UKRAINE SAYS (RTRS)

- RUSSIA EVACUATES FLAGSHIP CRUISER AFTER FIRE

- U.S. WEIGHS SENDING TOP-LEVEL OFFICIAL TO MEET ZELENSKYY IN KYIV (POLITICO)

- EU SAYS RUBLES-FOR-GAS VIOLATES SANCTIONS (BBG)

- BANK OF RUSSIA CONSIDERS EASING MANDATORY FX-SALES TERMS (RBC)

- BOK & MAS ADD TO RECENT ROUNDS OF MONETARY TIGHTENING

US TSYS: A Little Firmer In Asia

The overnight uptick in U.S. Tsys has seemingly been all about cross-market spill over from the ACGB space, which was linked to the Australian labour market report release that we have fleshed out in earlier bullets. TYM2 last +0-08+ at 121-02, just off recent session highs, operating in a 0-17+ range on volume of ~130K. The cash curve has bull steepened with yields running 1.5-4.5bp richer as 3s outperform and 30s lag.

- Note that some speculation re: imminent policy easing from China’s PBoC may be providing additional support, after Wednesday’s guidance from Premier Li ahead of tomorrow’s MLF operations (there is also speculation that a RRR cut may come ahead of the weekend). Note that the last week or so has seen the Chinese Premier provide several warnings re: economic growth, while the pro-growth pivot when it comes to wider policymaking has been well-documented in recent months, with the government looking to achieve an ambitious GDP growth target for calendar ’22.

- There may have also been an element of geopolitical risk in the uptick (the flagship Russian warship had to be abandoned due to a fire, while the U.S. continues to mull sending a senior official to Kyiv), although the lack of immediate reaction to those stories detracts from that particular avenue of explanation.

- A combination of the above factors allowed the space to unwind a modest round of early Asia cheapening and more.

- U.S. retail sales, weekly jobless claims, the prelim UoM survey and Fedspeak from Williams, Mester & Harker is due during Thursday’s holiday-shortened NY session (cash markets will close at 14:00 Eastern). Note that the latest ECB decision will provide some cross-market interest during early NY hours.

JGBS: Firmer & Flatter, Even With Questionable 20-Year Supply Apparent

Spill over from Wednesday’s U.S. Tsy bid ultimately provided support to JGBs in early Tokyo dealing, with the Aussie-bond led bid in core global FI markets leading the space higher during the Tokyo afternoon.

- JGB futures are +21 late in the Tokyo day, while cash JGBs run 0.5-4.5bp richer across the curve, with the long end leading.

- It wasn’t all one-way traffic for the long end. The latest round of 20-Year JGB supply wasn’t well received, with the low price missing wider dealer expectations and tailing widening vs. the previous auction, although the cover ratio did nudge higher, albeit from a low base, holding below the 6-auction average in the process. This provided some limited headwinds for longer dated paper during the early rounds of afternoon trad before the aforementioned bid dominated.

- Elsewhere, fiscal support initiatives from the parties that form the ruling Japanese coalition were eyed but didn’t provide much in the way of market impact.

JGBS AUCTION: Japanese MOF sells Y974.4bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y974.4bn 20-Year JGBs:

- Average Yield 0.724% (prev. 0.644%)

- Average Price 101.31 (prev. 97.47)

- High Yield: 0.742% (prev. 0.648%)

- Low Price 101.00 (prev. 97.40)

- % Allotted At High Yield: 98.7309% (prev. 97.0087%)

- Bid/Cover: 3.102x (prev. 2.928x)

AUSSIE BONDS: Feeling The Squeeze

The market squeezed higher in the wake of the latest batch of domestic labour market data, with short/paid positioning in Aussie rates squeezed.

- To recap, March’s Australian labour market report provided a modest disappointment, but the labour market remains unequivocally strong. Headline job growth fell short of the +30.0K median exp. observed in the BBG survey, rising by 17.9K, driven solely by full-time job gains as part-time employment recorded a modest fall in March. The participation rate held steady at 66.4%, with the headline unemployment rate also holding steady at cycle/multi-decade lows of 4.0% vs. the BBG median 3.9%. Note that the unemployment rate nearly made it to rounding territory, printing a 3.9542%. ABS noted that seasonally adjusted hours worked decreased by 0.6%, “with floods in New South Wales and Queensland, a higher than usual number of people reported working reduced hours due to bad weather in March. This was in addition to the high number of people away from work due to illness.” The underemployment & underutilisation rates hit fresh cycle lows of 6.3% & 10.3%, respectively. Note that the labour market remains extremely tight, with forward-looking indicators pointing to further tightening. This report will not be a gamechanger for the RBA.

- That leaves YM +14.0 & XM + 11.0 at typing. EFPs are marginally wider, with the 3-/10-Year box flattening.

- The IR strip runs -3 to +18 through the reds. Underperformance in IRM2 was facilitated by a higher 3-month BBSW fixing.

- A reminder that the proximity to the elongated Syndey weekend may have accentuated the short covering, with geopolitical worry remaining elevated.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Thursday 21 April it plans to sell A$1.0bn of the 22 July 2022 Note & A$500mn of the 12 August 2022 Note.

EQUITIES: Higher As Tech Names Lead Bid, Chinese Easing Bets In Focus

Virtually all major Asia-Pac equity indices are higher at writing, with blue-chip and tech-related names across the region catching a bid following a positive tech-led rally from Wall St.

- The Nikkei 225 outperformed major regional peers at +1.1%, on track for a second day of gains with ~200 of its 225 constituents in the green. Cyclical and tech-related plays were notably firmer, with large-caps Fast Retailing and Tokyo Electron leading gains in the index for a second day.

- The Hang Seng sits 0.4% better off at writing, on track for a third straight day of gains. Broad gains were seen across nearly all sectors of the index although financials struggled, mostly trading flat to lower at writing. China-based tech caught a bid as well, seeing the Hang Seng Tech Index deal 0.9% firmer at writing. Large-cap Alibaba Group notably underperformed its HSTECH peers however, grabbing headlines as reports pointed to co-founder Jack Ma’s Ant Group coming under investigation from China’s top anti-graft agency (among other agencies).

- The Chinese CSI300 trades 0.7% higher at writing, with a rise in consensus towards impending PBoC easing measures evident. Of note, a BBG report has highlighted that 15 of 20 economists surveyed currently predict that the PBoC will lower rates on the one-year MTLF on Friday, with 11 calling for a 10bp cut to 2.75%.

- U.S. e-mini equity index futures are 0.2% to 0.5% firmer, dealing a little below their respective session highs at writing.

OIL: Slightly Lower In Asia

WTI is -$0.60 and Brent is -$0.30 at typing, both operating a little below their respective session highs made on Wednesday.

- To recap, both benchmarks closed ~$4 higher on Wednesday, hitting one-week highs late in the session as worry re: tightness in global supply continues to build.

- To elaborate, the International Energy Agency on Wednesday estimated that ~3mn bpd of Russian oil would be removed from global markets in May, double the decline currently predicted for April, effectively projecting that the impact of sanctions and buyer aversion on Russian crude exports will only kick in from next month onwards.

- Elsewhere, a note that IEA and OPEC data on production figures for the latter crossed earlier this week, pointing to the group missing its collective output increase target for March and underscoring well-documented concerns re: the ability of some OPEC members to hit production quotas.

- U.S. EIA data crossed on Wednesday, with little initial reaction observed in major crude benchmarks despite a larger than expected (~9.4mn bbl build vs. 256.3K BBG median) build in U.S. crude inventories and an increase in hub stocks. The data release mostly corroborated Tuesday’s reports on the latest round of API inventory estimates, with larger than expected drawdowns in distillate and gasoline stockpiles observed.

GOLD: Flat In Asia; A Touch Below One-Month Highs

Gold is virtually unchanged, printing $1,977/oz and operating a little below Wednesday’s best levels at typing in fairly limited Asia-Pac dealing. The precious metal has struggled for direction in Asia amidst a lack of meaningful headline flow, although a downtick in the USD (DXY) and nominal U.S. Tsy yields (with positive spillover to U.S. Tsys from the bid in ACGBs flagged earlier) has helped to facilitate a limited move off its session lows.

- To recap, gold added ~$11/oz on Wednesday, hitting fresh one-month highs ($1,981.6/oz) during the session and recording a sixth straight day of gains. The move higher comes as U.S. real yields have broadly remained below recent cycle highs, with the DXY backing away from fresh two-year highs made on Wednesday as well.

- U.S. PPI on Wednesday came in above expectations with the annual print hitting a fresh record high, although there was little by way of immediate reaction in the price of bullion.

- From a technical perspective, initial resistance at $1,980.3/oz (50.0% retracement of Mar8-29 downleg) has been broken, exposing further resistance at $2,001.6/oz (61.8% retracement of Mar8-29 downleg). Support is seen some distance away, at around ~$1,915.1/oz, the 50-Day EMA.

FOREX: Yen Gets Some Reprieve, Antipodean Divergence Unfolds

The kiwi dollar extended its rebound from post-RBNZ lows, diverging from its Antipodean cousin. Australia's labour market report provided a modest disappointment, although the labour market remained extremely tight. Slightly softer crude oil prices may have generated another headwind for the Aussie dollar.

- The yen got some reprieve after a relentless sell-off in recent weeks, with USD/JPY slipping through yesterday's low. Speculation was rife about the possible terminal levels of USD/JPY rally, with the yen caught in the cross-currents of the BoJ's commitment to ultra-loose policy and escalating attempts by Japanese officials to jawbone the currency off worst levels.

- The greenback eased in tandem with U.S. Tsy yields and underperformed all of its major peers.

- Central bank focus turns to the ECB who will review monetary policy settings. Eurozone's single currency has been treading water in early Asia trade.

- Besides the press conference with ECB Pres Lagarde, we will also hear from Fed's Williams, Mester & Harker today.

- Swedish CPI as well as U.S. jobless claims & Uni. of Mich. Sentiment take focus on the data front.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/04/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 14/04/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Deposit Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Main Refi Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 14/04/2022 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 14/04/2022 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 14/04/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 14/04/2022 | 1230/0830 | *** |  | US | PPI |

| 14/04/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/04/2022 | 1230/1430 |  | EU | ECB President Lagarde Post-meet presser | |

| 14/04/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/04/2022 | 1400/1000 | * |  | US | Business Inventories |

| 14/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 14/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 14/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 14/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/04/2022 | 1920/1520 |  | US | Cleveland Fed's Loretta Mester | |

| 14/04/2022 | 2200/1800 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.