-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI EUROPEAN OPEN: BoJ Doubles Down On Yield Target Defence

EXECUTIVE SUMMARY

- BOJ MAINTAINS ULTRA-LOOSE MONETARY POLICY SETTINGS

- BOJ PLANS TO CONDUCT UNLIMITED FIXED-RATE BOND PURCHASES EVERY BUSINESS DAY

- BOC’S MACKLEM: HOW HIGH RATES GO WILL DEPEND ON ECONOMY, INFLATION OUTLOOK (RTRS)

- EU ENERGY GROUPS PREPARE TO MEET VLADIMIR PUTIN’S TERMS FOR RUSSIAN GAS (FT)

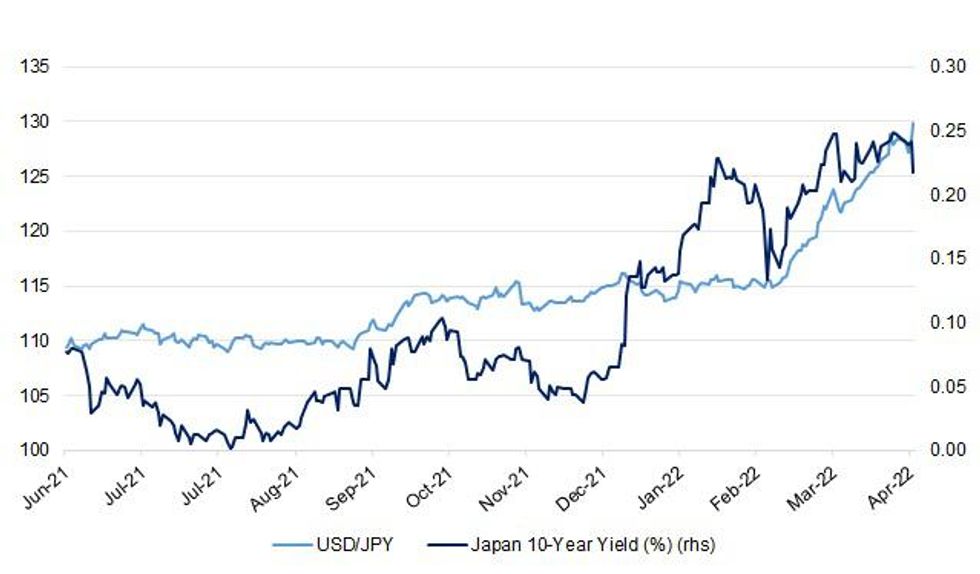

Fig. 1: USD/JPY & Japan 10-Year Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Rishi Sunak has told the cabinet that interest rates are expected to increase to 2.5 per cent over the next year as he warned ministers against borrowing more to fund public spending. The chancellor told colleagues on Tuesday that homeowners could see their mortgage payments rise by more than £1,000 a year if they are not on fixed-rate deals. (Times)

ECONOMY: Rishi Sunak has opened the door to a windfall tax on oil and gas companies despite previously dismissing the policy, as Labour accused the government of burying its head in the sand over spiralling bills. The chancellor hinted at a possible U-turn on a tax on oil and gas providers, having repeatedly refused to countenance the idea in the past when suggested by Labour and the Liberal Democrats. (Guardian)

ECONOMY: The U.K. should focus on closer cooperation with the U.S. to bolster its finance industry following Brexit and move on from attempts to push for access to European Union markets, according to a report by two think tanks. Greater ties with the U.S. could help the U.K. grow its capital markets business by 40%, Atlantic Council and New Financial said in a report Thursday. The focus should be accompanied by “deep reform” of the U.K.’s financial system, including taking action on taxation, regulation and ways to attract top talent, the report said. (BBG)

POLITICS: Sajid Javid used an offshore trust while working as an MP in the heart of the Treasury – but did not declare it in the register of members’ interests, The Independent can reveal. (Independent)

EUROPE

EU: European Commission President Ursula von der Leyen warned companies not to bend to Russia’s demands to pay for gas in rubles, as the continent scrambles for a united response to Moscow’s weaponization of its energy resources. According to a person close to Gazprom, some European companies have now met Vladimir Putin’s demands. (BBG)

EU: Some of Europe’s largest energy companies are making arrangements to comply with a new payment system for Russian gas sought by the Kremlin, which critics say will undercut EU sanctions, threaten the bloc’s unity and deliver billions in critical cash to Russia’s economy. Gas distributors in Germany, Austria, Hungary and Slovakia — including two of the single largest importers of Russian gas, Düsseldorf-based Uniper and Vienna-based OMV — are preparing to open rouble accounts at Gazprombank in Switzerland, according to people with knowledge of the preparations. Negotiations between utilities and Gazprom, the Russian state-controlled gas supplier, have intensified as payment deadlines approach, they said. (FT)

EU: Several European Union nations are pushing for clearer guidance from the bloc on Russia’s demand to pay for gas in rubles, saying the current advice is too ambiguous. The European Commission told the ambassadors at a closed-door meeting Wednesday that it will fine-tune the wording of its guidelines, according to people familiar with the discussions. A number of countries who raised the issue want the commission to clarify that buyers don’t have any workarounds to acquiesce to the Kremlin’s demands, one of the people said. (BBG)

EU: The European Commission on Wednesday proposed a new package of measures to strengthen the bloc’s approach to legal migration, after some 5 million Ukrainian refugees have entered the EU since the Russian invasion. The aim is not only to provide simpler, legal pathways for migrants and reduce illegal migration but also to address labor shortages, especially in sectors such as healthcare. As for the Ukrainians who have come to the EU, and to whom the bloc has temporarily provided full rights, the Commission proposal includes a pilot project just for them. (POLITICO)

UKRAINE: U.S. President Joe Biden will deliver remarks on Thursday morning in support of Ukraine, the White House said. "The President will deliver remarks on support for Ukrainians defending their country and their freedom against Russia's brutal war," the White House said. (RTRS)

UKRAINE: The U.S. has lifted some restrictions on sharing intelligence with Ukraine as it confronts a renewed Russian military assault in the east and south, according to two people familiar with the matter. Director of National Intelligence Avril Haines told Congress of the moves this month, according to one of the people. That came after Representative Mike Turner, the top Republican on the House Intelligence Committee, and Senator Marco Rubio, the vice chairman of the Senate Intelligence Committee, wrote separate letters urging the Biden administration to remove the restrictions. (BBG)

UKRAINE: The White House plans to send to Congress this week a proposal for emergency funds for Ukraine that will cover the rest of the current fiscal year that ends Sept. 30, White House Press Secretary Jen Psaki said. The proposal will include “security or military assistance, humanitarian economic assistance” to “help address a range of needs the Ukrainians have,” Psaki said. Separately, Secretary of State Antony Blinken told senators the proposal would also include funds to help remove land mines and to combat food insecurity. (BBG)

UKRAINE: Germany risks stumbling in its effort to bolster Ukraine’s defense with 50 anti-aircraft tanks as there’s little ammunition readily available for the vehicles. Currently, there is only enough for about 20 minutes of intense action, according to a report by tabloid Bild. Germany is in talks with Brazil, Qatar and Jordan to fill the gap, but could also run into issues with transfer approvals from the Swiss government. (BBG)

UKRAINE: The United Nations said its humanitarian office is mobilizing a team from around the world to coordinate the evacuation of civilians from a steel plant in the port of Mariupol, the Associated Press reported, citing deputy spokesman Farhan Haq. (BBG)

UKRAINE: Finland’s government will donate part of the proceeds from the sale of a Bitcoin stash seized in drug busts to help Ukraine’s defense against Russia, newspaper Helsingin Sanomat reported. Ukraine will receive “a sizable part” of the planned sale of 1,981 Bitcoins -- valued at about $78 million and forfeited to the state by court order -- the newspaper said, citing government sources it didn’t identify. The exact share has yet to be determined, it added. (BBG)

U.S.

FED: Senate Banking Committee Chairman Sherrod Brown said Wednesday that the Senate would wait to confirm President Joe Biden’s Federal Reserve picks until the return of Democrats recovering from the coronavirus. Brown, an Ohio Democrat, blocked votes this week on a second term for Jerome Powell as chair of the Federal Reserve and the nomination of Philip Jefferson to the Fed’s board of governors after top Banking Republican Pat Toomey of Pennsylvania refused on Tuesday to postpone a procedural vote on the nomination of Lisa Cook as a governor. Brown said there is “no doubt” all three will eventually be confirmed. (BBG)

POLITICS: In a blow to Democrats' chances of maintaining a majority in the U.S. Congress, New York's highest court on Wednesday ruled the state's new congressional map was unconstitutionally designed to favor Democrats and ordered the lines redrawn. (RTRS)

OTHER

GLOBAL TRADE: Port bottlenecks that have increased supply-chain congestion because of the war in Ukraine and lockdowns in China may be showing signs of easing, according to one of the world’s biggest shipping companies. Currently, the number of ships waiting outside of the ports in Los Angeles and Long Beach have been reduced to less than 40, from more than 100 earlier this year, according to Cheng Cheng-mount, chairman of Taiwan-based Yang Ming Marine Transport Corp. The waiting time for ships at Shanghai ports is two or three days, compared with 10 to 14 days at the U.S. ports. (BBG)

UK/RUSSIA: The foreign secretary believes that the war in Ukraine could last for years and fears President Putin could deploy weapons of mass destruction in a desperate attempt to break the deadlock. Liz Truss, in a speech at Mansion House in London, said that Putin was a “rogue operator” and warned that he could invade other countries, including Georgia and Moldova. (Times)

UK/CHINA: British Foreign Secretary Liz Truss on Wednesday warned China that failure to play by global rules would cut short its rise as a superpower, and said the West should ensure that Taiwan can defend itself. "They will not continue to rise if they do not play by the rules. China needs trade with the G7. We (the Group of Seven) represent around half of the global economy. And we have choices," she said. "We have shown with Russia the kind of choices that we're prepared to make when international rules are violated." (RTRS)

U.S./SOUTH KOREA: Incoming President Yoon Suk-yeol and U.S. President Joe Biden will hold their first summit in Seoul on May 21 to discuss the alliance between the two countries, North Korea policy, and other regional and international issues, officials said Thursday. (Yonhap)

U.S./TAIWAN: The U.S. House of Representatives unanimously passed legislation on Wednesday calling on the State Department to submit a plan to help Taiwan regain its observer status at the World Health Organization, seeking to boost the island as it faces pressure from China. The House passed the bill 425 to 0, sending it to the White House because it passed the Senate in August. read more Congressional aides said they expected President Joe Biden to sign the measure into law. (RTRS)

U.S/RUSSIA: The United States and Russia swapped prisoners on Wednesday amid their most tense relations in decades over the war in Ukraine, with former U.S. Marine Trevor Reed released in exchange for Russian pilot Konstantin Yaroshenko. The swap was not part of broader diplomatic talks and did not represent an American change in approach on Ukraine, U.S. officials said. (RTRS)

U.S./ASIA: U.S. President Joe Biden will visit South Korea and Japan from May 20 to May 24 and hold talks with his Korean and Japanese counterparts, the White House said on Wednesday. "In Tokyo, President Biden will also meet with the leaders of the Quad grouping of Australia, Japan, India, and the United States," the White House said in a statement. (RTRS)

SOUTH KOREA: South Korea's top economic policymaker said Thursday the government plans to take measures to stabilize the foreign exchange market, if needed, as the Korean currency has fallen against the U.S. dollar at a fast pace. (Yonhap)

AMERICAS: Cuba, Nicaragua and Venezuelan President Nicolas Maduro's government are likely to be excluded from the U.S.-hosted Summit of the Americas to be held in June in Los Angeles, a senior State Department official said on Wednesday. (RTRS)

BOC: Canada needs higher interest rates, though how high those rates go will depend on how the economy responds and how the outlook for inflation evolves, Bank of Canada Governor Tiff Macklem said on Wednesday. "The economy needs higher rates and can handle them," Macklem told a Senate committee, reiterating recent comments. "How high rates go will depend on how the economy responds and how the outlook for inflation evolves." (RTRS)

CANADA: The Canadian House of Commons on Wednesday unanimously voted to recognize Russian President Vladimir Putin’s butchery and brutality during the invasion of Ukraine as genocide. (Global News)

BRAZIL: Brazil's lower house approved on Wednesday a measure that makes permanent the 400 reais ($80.58) Auxilio Brasil monthly welfare program for families in poverty situations, months ahead of the country's October presidential election. The proposal, which still needs to be cleared by the Senate, must be completely approved by May 16 or it will become invalid. Originally, the measure allowed only the granting of an extraordinary benefit to complement Auxilio Brasil from December 2021 to December 2022. (RTRS)

RUSSIA: According to three Meduza sources close to Putin’s administration, the self-declared Donetsk and Luhansk “People’s Republics” (the DNR and LNR) may be set to hold Kremlin-engineered referendums on joining the Russian Federation in mid-May. Two of these people even gave specific dates for the planned “votes” — May 14 and 15, 2022. According to Meduza’s sources, another pseudo-referendum may also be held on these same dates in Ukraine’s Kherson region, which Russian forces have partially occupied. Allegedly, the “vote” would be on the issue of the occupied region declaring independence from Ukraine and proclaiming itself the “Kherson People’s Republic” (modeled on those in the Donbas). Meduza’s sources also believe that Russia could move to annex the region at a later date. At the same time, Meduza’s sources noted that these “referendums” were initially set for late April, but were postponed several times due to the Russian army’s failures at the front. As such, they said, the dates could very well be pushed again for the same reason. (Meduza)

RUSSIA: Russia's National Wealth Fund (NWF), a rainy-day cushion containing oil revenues, will be the main source of financing for a budget deficit seen at 1.6 trillion roubles ($21.6 billion) or more in 2022, the finance minister said on Wednesday. Russia will also channel 50 billion roubles from the NWF to top up the capital of Gazprombank (GZPRI.MM) as the lender needs additional funds to carry out infrastructure projects. (RTRS)

RUSSIA: The authorities are considering an extraordinary increase in the minimum wage (SMIC) and living wage (PM) by 9%. This was reported to Izvestia by sources familiar with the discussion. Now the minimum wage is 13,890 rubles, and the minimum wage in Russia as a whole is 12,654. Thus, after indexation, the minimum wage should exceed 15 thousand rubles. The business community called the 9% increase in numbers a balanced decision, explaining that such an indexation would not put undue pressure on business contributions. At the same time, an increase in payments could accelerate inflation, some experts pointed out. (Izvestia)

RUSSIA: The House on Wednesday overwhelmingly passed a mostly symbolic bill urging President Biden to sell the frozen luxury assets of Russian oligarchs hit with sanctions and use the funds to provide additional military and humanitarian aid to Ukraine. (NYT)

IRAN: The White House is worried Iran could develop a nuclear weapon in weeks, press secretary Jen Psaki said on Tuesday, after Secretary of State Antony Blinken noted earlier in the day the country has accelerated its nuclear program. "Yes it definitely worries us," Psaki said. The White House clarified on Wednesday that although Psaki responded to a question about nuclear weapons, she was referring to the breakout time, which is the time it would take to obtain sufficient fissile material for one nuclear bomb, and was not referring to the production of an actual nuclear weapon. (RTRS)

TURKEY: Turkish President Tayyip Erdogan will travel to Saudi Arabia on Thursday for a two-day visit, his office said, marking the culmination of a months-long effort by Ankara to repair ties with Riyadh. (RTRS)

METALS: Peruvian police said on Wednesday they had evicted an indigenous community that had established a camp inside a huge open pit owned by MMG's Las Bambas copper mine that had forced the Chinese-owned company to halt operations. Las Bambas, owned by China's MMG Ltd (1208.HK), supplies 2% of global copper and had suspended copper production a week ago due to the protest. (RTRS)

GAS: The Biden administration has approved more requests to export U.S. natural gas as it seeks to counteract Russia’s efforts to use the fuel as a weapon against Ukraine’s allies. Golden Pass LNG, a liquefied natural gas project Qatar Petroleum and Exxon Mobil Corp. are building in Texas, and Glenfarne Group LLC’s Magnolia LNG project planned for Louisiana received Energy Department authorization to ship gas to countries that don’t have a free trade agreement with the U.S. That would include Europe, which has seen its gas prices surge as Russia halted flows to Poland and Bulgaria. (BBG)

OIL: Exxon Mobil Corp (XOM.N) said on Wednesday that its Russian unit Exxon Neftegas Ltd has declared force majeure for its Sakhalin-1 operations, where it has become increasingly difficult to ship crude due to sanctions on Russia. (RTRS)

OIL: China’s biggest oil refiner is confident demand will recover by the end of the second quarter and still reach full-year growth despite taking a hit from pandemic measures. Demand has fallen in the second quarter amid lockdowns in Shanghai and other cities, but a “strong rebound” is expected once those measures stop the spread of the virus, a Sinopec official said on the company’s first-quarter earnings call. The company has reduced refinery utilization rates, but is keeping fuel inventory levels high in anticipation of the demand pick-up, another official said. With case numbers dropping in Shanghai, fuel demand will soon start to recover gradually. Based on the company’s experience after the 2020 Covid outbreak and the SARS epidemic in 2003, pent-up consumption will be strong, officials said. (BBG)

CHINA

CORONAVIRUS: The Asia Securities Industry and Financial Markets Association (ASIFMA) in a letter dated April 26 urged the authorities to let financial firms rotate staff who need to work from offices. More than 20,000 bankers, traders and other workers had to bed down in office towers in Shanghai's Lujiazui district as they sought to keep China's giant financial hub running during the lockdown. Employees bedding down in offices were given air mattresses, pillows and blankets, and were relying on limited facilities. They have not been able to step outside since March 28, when Shanghai started imposing lockdown curbs on areas east of its Huangpu river, according to a post from the district government's official WeChat account. (RTRS)

CORONAVIRUS: The Chinese city of Hangzhou, home to tech giant Alibaba Group Holding Ltd., will start mass testing for Covid-19, while cases in Shanghai fell for a fifth day. The testing drive will cover most of Hangzhou’s downtown area, with 10,000 free test sites to be set up, the municipal government said in a statement late Wednesday. It urged residents to get tested every 48 hours. (BBG)

CORONAVIRUS: China's capital Beijing closed some public spaces and stepped up checks at others on Thursday, as most of the city's 22 million residents embarked on more COVID-19 mass testing aimed at averting a Shanghai-like lockdown. Universal Studios in Beijing announced late on Wednesday it would require visitors to show negative test results before they could enter the theme park, starting on Friday. Across Beijing, positive cases were found among the nearly 20 million samples acquired in the first round of mass testing, but numbers remained small. The city on Thursday reported 50 new infections for April 27, up from 34 a day earlier. (RTRS)

CORONAVIRUS: Some schools in Beijing’s Chaoyang, Haidian and Xicheng districts are suspending in-person classes and switching to online teaching, China National Radio reports. Beijing’s Tongzhou distict has halted all in-person classes in middle, primary schools and kindergartens from Wednesday, Beijing Daily has reported. (BBG)

OVERNIGHT DATA

JAPAN MAR, P INDUSTRIAL PRODUCTION -1.7% Y/Y; MEDIAN -1.3%; FEB +0.5%

JAPAN MAR, P INDUSTRIAL PRODUCTION +0.3% M/M; MEDIAN +0.5%; FEB +2.0%

JAPAN MAR RETAIL SALES +0.9% Y/Y; MEDIAN +0.3%; FEB -0.9%

JAPAN MAR RETAIL SALES +2.0% M/M; MEDIAN +1.0%; FEB -0.9%

JAPAN MAR DEPT STORE & SUPERMARKET SALES +1.5% Y/Y; MEDIAN +1.7%; FEB +0.1%

JAPAN MAR HOUSING STARTS +6.0% Y/Y; MEDIAN -0.5%; FEB +6.3%

JAPAN MAR ANNUALISED HOUSING STARTS 0.927MN; MEDIAN 0.857MN; FEB 0.872MN

AUSTRALIA Q1 EXPORT PRICE INDEX +18.0% Q/Q; MEDIAN +11.0%; Q4 +3.5%

AUSTRALIA Q1 IMPORT PRICE INDEX +5.1% Q/Q; MEDIAN +7.0%; Q4 +5.8%

NEW ZEALAND MAR TRADE BALANCE -NZ$392MN; FEB -NZ$691MN

NEW ZEALAND MAR TRADE BALANCE 12 MTH YTD -NZ$9,108MN; FEB -NZ$8,676MN

NEW ZEALAND MAR EXPORTS NZ$6.67BN; FEB NZ$5.22BN

NEW ZEALAND MAR IMPORTS NZ$7.06BN; FEB NZ$5.91BN

NEW ZEALAND APR ANZ BUSINESS CONFIDENCE -42.0; MAR -41.9

NEW ZEALAND APR ANZ ACTIVITY OUTLOOK 8.0; MAR 3.3

Firms remain somewhat wary of the outlook and continue to find the profitability picture hard going in an environment of rising costs and now, in some consumer-facing areas, the prospect of softer demand. However, on the plus side, activity levels appear to have picked up as the disruption to labour supply and activity from the Omicron outbreak has passed its peak. Overall, there was mildly encouraging news for the RBNZ in April’s ANZ Business Outlook survey. While inflation pressures remain extreme, and inflation expectations jumped further, there were some tentative signs of the acceleration in costs easing, at least in the construction sector, which has been leading the domestic cost and inflation charge for some time. But with plenty of wage and other cost inflation in the pipeline, it’ll be some time before the RBNZ can conclude that they’re getting ahead of the inflation game. We continue to expect another 50bp hike in May, and steady 25bp increases thereafter taking the OCR to a peak of 3.5%. (ANZ)

SOUTH KOREA MAR BUSINESS SURVEY M’FING 88; FEB 85

SOUTH KOREA MAR BUSINESS SURVEY NON-M’FING 85; FEB 82

SOUTH KOREA MAR RETAIL SALES +7.1% Y/Y; FEB +4.7%

SOUTH KOREA MAR DEPT STORE SALES +7.8% Y/Y; FEB +9.3%

SOUTH KOREA MAR DISCOUNT STORE SALES +0.0% Y/Y; FEB -24.0%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People’s Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

PBOC SETS YUAN CENTRAL PARITY AT 6.5628 THURS VS 6.5598 WED

The People’s Bank of China (PBOC set the dollar-yuan central parity rate higher at 6.5628 on Thursday, compared with 6.5598 set on Wednesday.

MARKETS

SNAPSHOT: BoJ Doubles Down On Yield Target Defence

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 379.04 points at 26761.44

- ASX 200 up 77.435 points at 7338.6

- Shanghai Comp. up 7.282 points at 2965.564

- JGB 10-Yr future up 27 ticks at 149.58, yield down 2.5bp at 0.221%

- Aussie 10-Yr future down 3.5 ticks at 96.865, yield up 3.7bp at 3.092%

- US 10-Yr future down 12.5 ticks at 119.671875, yield down 0bp at 2.8318%

- WTI crude down $1.38 at $100.64, Gold down $6.79 at $1879.33

- USD/JPY up 146 pips at Y129.87

- BOJ MAINTAINS ULTRA-LOOSE MONETARY POLICY SETTINGS

- BOJ PLANS TO CONDUCT UNLIMITED FIXED-RATE BOND PURCHASES EVERY BUSINESS DAY

- BOC’S MACKLEM: HOW HIGH RATES GO WILL DEPEND ON ECONOMY, INFLATION OUTLOOK (RTRS)

- EU ENERGY GROUPS PREPARE TO MEET VLADIMIR PUTIN’S TERMS FOR RUSSIAN GAS (FT)

BOND SUMMARY: JGBs Soar On BoJ Daily Unlimited Bond Buying Plan

The BoJ provided a shot in the arm for Japanese FI space by announcing its plan to conduct unlimited fixed-rate bond buying operations every business day, "unless it is highly likely that no bids will be submitted". The move reaffirmed the central bank's resolve in defending the 0.25% upper end of its permitted trading band for 10-year JGB yield. Apart from announcing daily bond buying operations, the Bank maintained its ultra-loose policy settings, while forecasting that faster inflation won't last.

- JGB futures re-opened sharply higher after the Tokyo lunch break, drawing support from the BoJ decision. JBM2 last changes hands at 149.64, 33 ticks above previous settlement. Cash JGBs rallied, with yields broadly lower, as the curve flattens. Japanese retail sales (beat) and flash industrial output (miss) released earlier in the session were shrugged off. As a reminder, Japanese financial markets will be closed from tomorrow, owing to a public holiday.

- The spillover into U.S. Tsys was limited, although T-Notes indeed moved away from session lows. TYM2 last deals -0-02 at 119-23+, while Eurodollar futures run 0.5-2.5 ticks through the reds. Cash Tsy yields sit 0.5bp-0.8bp lower across the curve. Advance U.S. GDP & weekly jobless claims headline the local data docket today, with a 7-Year Tsy auction also due.

- Australian YM trades -1.5 & XM -4.0. Bills last -9 to +2 ticks through the reds. Cash ACGB yields sit 1.5bp-3.5bp higher across the curve. Australia's terms of trade came and went.

EQUITIES: Higher As Meta Surprises, Targeted Support Pledged For Chinese Workers And Tech Companies

Virtually all Asia-Pac equity indices are bid following a somewhat mixed picture from Wall St., with positive spillover from Meta’s after-hours earnings beat adding to positive sentiment in China-based equities after authorities pledged another round of support.

- To elaborate, China’s State Council announced measures to specifically support the growth of internet platform companies, sparking a surge in Hong Kong-listed tech giants such as JD.com (+2.6%) and Baidu (+3.6%). Measures were also announced to deliver cash handouts to a specific segment of unemployed individuals, albeit without further details on the payout amount etc. A note that unemployment in China released on 18 Apr came in at 5.8%, ahead of expectations and at its highest level since May ‘20.

- The CSI300 correspondingly sits 0.4% better off at typing, on track to close higher for a second consecutive day following Chinese President Xi Jinping’s “all-out” declaration for infrastructure investment made on Tuesday. High-beta consumer staples again led gains, with earnings-driven momentum from large-cap Kweichow Moutai (+2.4%) providing tailwinds for another day.

- The Nikkei 225 outperformed, dealing 1.2% firmer at typing after building on a positive lead after the lunch break on JPY weakness, with the move lower in the latter facilitated by the BoJ’s decision to hold rates steady while keeping YCC settings and asset purchases steady. A note that Japan retail sales data that crossed earlier in the session surprised to the upside as well, while industrial data broadly missed estimates.

- U.S. e-mini equity index futures sit 0.1% to 1.3% higher at typing. Tech-focused NASDAQ contracts predictably led gains, catching a bid from Meta’s (+18.4% after hours) well-received earnings beat.

- Looking ahead, Amazon and Apple are expected to report earnings after the NY bell later on Thursday.

OIL: WTI Revisits $100 As Dollar Rallies; Shanghai Cases Ease But Outbreak Expands Nationwide

WTI and Brent are ~$1.60 weaker at typing, operating a touch above Wednesday’s trough at typing. Both benchmarks have come under pressure as the USD (DXY) continues to trade a little below 5-year highs made on Wednesday in the NY session, while debate re: the trajectory of China’s current COVID outbreak has done the rounds in Asia.

- To elaborate, fresh reported COVID cases in Shanghai have declined for a fifth day to ~10.7K, the lowest in over three weeks. The outbreak however continues to spread to other key population hubs, with the city of Hangzhou (home to several Chinese large-caps) implementing a mass testing regime and Beijing reporting the limited suspension of in-person classes. A note that this comes as other areas such as the port cities of Qingdao and Qinhuangdao have been reportedly placed under full/partial lockdown.

- Keeping within the region, Sinopec has issued a forecast that crude demand in China would recover by end-Q2 in ‘22, led by predictions of “pent-up demand” once COVID case numbers recede.

- Looking to the U.S., EIA inventory data on Wednesday offered a relatively mixed picture, with figures pointing to a build in crude and Cushing hub inventories, with a surprise drawdown in gasoline stocks and a decline in distillate stockpiles observed as well.

- WTI and Brent futures largely rose off their session lows after the EIA data release, with events in China (re: demand destruction worry) Europe (re: possible sanctions on Russian crude and the cutting of Russian gas supplies to Europe) returning into focus.

GOLD: Sent Lower By King Dollar; Demand For Physical Gold Remains Elevated

Gold deals ~$4/oz lower at typing to print ~$1,882/oz, operating around session lows at typing.

- To recap Wednesday’s price action, the precious metal closed ~$20/oz lower, coming under pressure from the USD (DXY) hitting five-year highs during the session, with a broad uptick in U.S. real yields observed as well.

- May FOMC dated OIS now price in ~50bp of tightening for that meeting, although hikes implied for the June meeting has spiked to >75bp at writing (cumulative ~129bp priced for both months), facilitated by a ~25bp move in early Asia-Pac dealing. A note that this move comes as the cumulative pricing for calendar ‘22 continues to move lower throughout the week (~230bp at typing).

- Elsewhere, the World Gold Council (WGC) released their quarterly trends report on Wednesday, highlighting that demand for physical gold had increased by 34% Q/Q for Q1, led by inflows into gold-related ETFs. This comes as known ETF holdings of gold have backed away slightly from one-year highs witnessed late last week, however remaining ~4% adrift of COVID-induced all-time highs seen in ‘20.

- From a technical perspective, gold remains vulnerable after breaking below the bear trigger at $1,890.2/oz (Mar 29 low), opening the way for a further descent to $1,878.4/oz (Feb 24 low).

FOREX: Yen Gets Hammered As BoJ Unveils Unlimited Bond Buying Plan

The yen tumbled as the Bank of Japan announced its plan to conduct unlimited fixed-rate bond purchase operations every business day "until it is highly likely that no bids will be submitted". The Board stuck to its existing ultra-loose policy settings, despite an upgrade to its inflation outlook, with price growth expected to slow in 2023. The decision to strengthen YCC enforcement signalled that policymakers prioritise working towards their inflation target over rapid yen weakening.

- The yen showed some weakness even before the BoJ announcement. It went offered into the final Tokyo fix of the month, with Japan set to observe Golden Week holidays starting tomorrow.

- USD/JPY cleared resistance from Apr 20 high/0.764 proj of the Feb 24 - Mar 28 - 31 price swing at Y129.40/44 and topped out just a handful of pips shy of the psychologically important Y130.00 figure. Renewed buying activity allowed the pair to print its best levels in two decades.

- The greenback received a boost on the back of post-BoJ cross flows and easily outperformed its G10 peers. The U.S. dollar index (DXY) rallied to new cycle highs.

- Reminder that the Riksbank is also due to announce its closely watched monetary policy decision today. The Swedish krona went offered ahead of the announcement, only the yen fared worse.

- Today's data highlights include advance U.S. GDP & weekly jobless claims as well as flash German CPI. Comments are due from ECB's Wunsch & de Guindos as well as Norges Bank Gov Bache.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/04/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/04/2022 | 0600/0800 | *** |  | SE | GDP |

| 28/04/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 28/04/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 28/04/2022 | 0700/0900 |  | EU | ECB de Guindos Presents Annual Report 2021 | |

| 28/04/2022 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 28/04/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/04/2022 | 0800/1000 |  | EU | ECB publishes May economic bulletin | |

| 28/04/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/04/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/04/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/04/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/04/2022 | - |  | JP | Bank of Japan policy meeting | |

| 28/04/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 28/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 28/04/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 28/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 28/04/2022 | 1400/1600 |  | EU | ECB Elderson Panels ECOSOC UN Forum | |

| 28/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 28/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 28/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 28/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 28/04/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.