-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese PMIs Disappoint, Beijing Tightens Restrictions Further

EXECUTIVE SUMMARY

- ECB RATE HIKE POSSIBLE BUT NOT LIKELY IN JULY, GUINDOS SAYS (BBG)

- ECB’S HOLZMANN SAYS TWO RATE HIKES MAY BE NEEDED THIS YEAR (BBG)

- HUNGARY WOULD VETO EU SANCTIONS ON RUSSIAN ENERGY, MINISTER SAYS (BBG)

- CHINA MEETS BANKS TO DISCUSS PROTECTING ASSETS FROM U.S. SANCTIONS (FT)

- COVID RESTRICTIONS TIGHTENED IN BEIJING, WHILE CASE SITUATION IN SHANGHAI IMPROVES

- CHINA PMIS DISAPPOINT

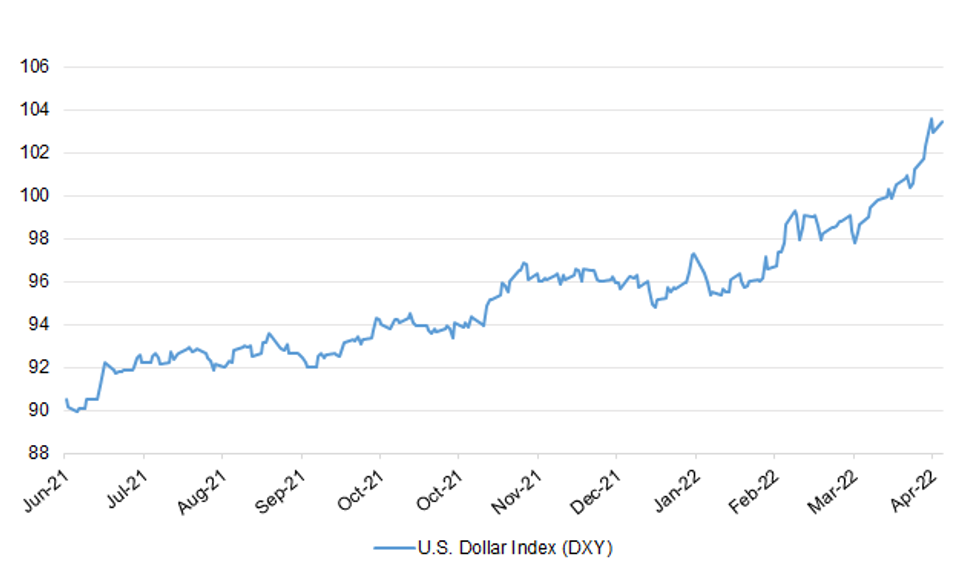

Fig. 1: U.S. Dollar Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: There can be no return of the Stormont powersharing Executive until the Northern Ireland Protocol is removed, a rally in Co Antrim has been told. TUV leader Jim Allister addressed the protest meeting in Ballymena where he said the protocol had separated Northern Ireland from the rest of the UK and that this "cut to the very heart" of the union. (BBG)

POLITICS: Labour and the Liberal Democrats have denied forging a secret electoral pact for Thursday’s local elections. The Conservatives argued that Labour’s decision to stand fewer candidates in some parts of southern England where the Liberal Democrats are strong was “far too substantial to be a mere coincidence”. (The Times)

POLITICS: Boris Johnson will "absolutely" remain as the Conservatives' leader after the local elections - even if the results are disappointing for the party, Kwasi Kwarteng has said. The business secretary told Sky News' Ridge on Sunday programme that Mr Johnson's leadership is not under threat "at all", adding that he is "the right man by far to lead us into the next election". (Sky)

POLITICS: Rebel Conservative MPs fear Boris Johnson could gamble on a general election within months in a make-or-break bid to save his premiership – but the party chairman, Oliver Dowden, has privately dismissed the idea as electorally disastrous. One MP hoping to oust Johnson said they are “deadly serious” in their belief that the prime minister could seek to win himself another term by calling a vote this autumn, especially if he manages to buy time in No 10 by winning a confidence vote before the summer. Some of his critics are convinced that the threshold of 54 Tory MPs required to trigger a confidence vote could be crossed shortly after further expected fines over the Partygate scandal, a bad result in next week’s local elections or the probable loss of the marginal Wakefield seat in its upcoming byelection. However, they think Johnson stands a good chance of winning a vote requiring the support of more than 50% of his MPs – giving him a year’s reprieve before he can face another. (Guardian)

POLITICS: Boris Johnson has been rendered “incapable of governing” by a series of scandals and rows that have left him unable or unwilling to tackle the cost of living crisis, Keir Starmer has warned. In a final pitch before Thursday’s local elections, the Labour leader said that voters were hearing “the dying groans of a clapped-out government” that was attempting to use “desperate attacks and deflections” to distract from inaction over rising bills and tax increases. Writing in the Observer, Starmer said that the government’s decision to press ahead with an increase in national insurance in April was a policy of “profound stupidity and short-sightedness” that was coming at precisely the wrong time. He also launched a personal attack on both Johnson and the chancellor, Rishi Sunak. (Observer)

POLITICS: Neil Parish has told the BBC he is resigning as an MP after admitting he watched pornography twice in Parliament. Mr Parish, who has represented Tiverton and Honiton in Devon since 2010, said it had been a "moment of madness". He said the first time was accidental after looking at a tractor website, but the second time - in the House of Commons - was deliberate. He was suspended by the Conservative Party on Friday over the allegations. Two female colleagues claimed they had seen him looking at adult content on his phone while sitting near them. (BBC)

POLITICS: Lord Frost is being urged by allies to stand in the by-election that will be created by Neil Parish's departure from his traditionally safe Conservative seat, The Telegraph can disclose. (Telegraph)

POLITICS: Hostile states buying access to MPs and peers could be "the next great parliamentary scandal" unless reforms are made, a report has warned. It found All-Party Parliamentary Groups (APPGs) were at risk of "improper lobbying" by foreign actors. Labour's Chris Bryant said the groups "must never be a backdoor means of peddling influence". It comes after MI5 warned of political interference by a Chinese agent. In January the security service said Christine Lee fostered links with British politicians to promote the interests of the Chinese Communist Party (CCP). (BBC)

POLITICS: Half of the Conservative MPs returned at the next election must be women, the party’s chairman has said, as he warned that substantially increasing female representation would be key to tackling Westminster sleaze. In an interview with The Telegraph, Oliver Dowden said the Conservatives were committed to a goal of equal gender representation in the Commons. As a first step, he pledged to ensure that the party’s candidates list “reflects the fact that half the population are women”. (Telegraph)

FISCAL: The Chancellor's pledge that councils in England would make a £150 payment towards domestic energy bills "in April" has been broken in some areas. While some have paid, Radio 4's Money Box has found many have not and the guidance has changed to "from April". The deadline for payment, which applies to homes in council tax bands A-D, is September. The government said councils were expected to begin making payments as soon as possible from April. (BBC)

PROPERTY: Boris Johnson wants to give millions of people the right to buy the homes they rent from housing associations in a major shake-up inspired by Margaret Thatcher. The Prime Minister ordered officials to develop the plans in the last fortnight after becoming convinced the idea would help “generation rent”, The Telegraph can reveal. The proposal is intended to give the 2.5 million households in England who rent properties from housing associations the power to purchase their homes at a discounted price. It would be a new version of the famous Thatcher scheme that allowed families to buy properties from councils - one of the most well-known policies of her premiership. A connected idea being pursued by officials is for the tens of billions of pounds paid by the Government in housing benefit to be used to help recipients secure mortgages. (Telegraph)

EUROPE

ECB: A European Central Bank rate increase in July is possible but not “likely,” Vice President Luis de Guindos said. “There’s no reason why” an end to net asset purchases “shouldn’t happen in July,” Guindos told the Spanish newspaper El Correo in an interview published Sunday. Rates will rise after that and may happen within “months, weeks or days. July is possible, but that’s not to say it’s likely,” he said. (BBG)

ECB: European Central Bank policymaker and hawk Robert Holzmann expects an initial interest rate increase this summer or autumn and for rates to rise gradually before settling next year around 1% or 1.5%, he told Austrian broadcaster ORF on Friday. "I belong to the group that is now in favor of rapid action. That means in summer, maybe in autumn. In addition and if necessary in December," he said. The "equilibrium rate" of around 1% or 1.5% will probably be reached next year, compared to a current deposit rate of -0.5%, he added. (RTRS)

INFLATION: Tens of thousands of people marched Sunday in cities around Europe for May Day protests to honor workers and shame governments into doing more for their citizens. (AP)

FRANCE: Tens of thousands of people joined politically charged May Day marches across France on Sunday, with many protesters fired up at newly re-elected president Emmanuel Macron’s plan for a pensions reform that will be one of the big tests of his second term in office. The demonstrations also focused on demands for higher salaries, after an election season dominated by concerns over the cost of living and soaring fuel prices. The protests were marred by clashes between anarchist groups and police in the capital, where a real estate office, bank branches and a McDonald’s restaurant were attacked. (FT)

GREECE: Greece lifted COVID-19 restrictions on Sunday for foreign and domestic flights, its civil aviation authority said, ahead of the summer tourism season that officials hope will see revenues bouncing back from the pandemic slump. (RTRS)

RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed Germany at AAA; Outlook Stable

- Moody's affirmed Estonia at A1; outlook stable

- Moody's affirmed Latvia at A3; outlook stable

- Moody's affirmed Lithuania at A2; outlook stable

- Moody's affirmed Poland at A2; outlook stable

- S&P affirmed the Czech Republic at AA-; Outlook Stable

- DBRS Morningstar confirmed Italy at BBB (high), Stable Trend

U.S.

ECONOMY: The Trimmed Mean PCE inflation rate over the 12 months ending in March was 3.7 percent. According to the BEA, the overall PCE inflation rate was 6.6 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 5.2 percent on a 12-month basis. (Dalas Fed)

FISCAL: President Joe Biden’s ask for $33 billion in aid to Ukraine hit an early snag on Capitol Hill, where a dispute over immigration policy threatens to hamstring urgently needed assistance to Kyiv. Congressional Republicans object to Democrats’ attempt to link the $33 billion requested for Ukraine with a separate bipartisan compromise providing $10 billion in additional Covid funding. Republicans, who oppose a $10 billion plan to expand Covid relief, say they want to advance the aid to Ukraine without the coronavirus legislation tacked on. Should Democrats insist that the bills be linked, Senate Republicans will likely force a vote on the Biden administration’s controversial decision to end a pandemic-era policy called Title 42, which allowed border agents to turn away migrants at the U.S.-Mexican border. (CNBC)

FISCAL: President Biden plans to move forward with student loan debt forgiveness, with two sources telling The Hill he is considering action to expunge at least $10,000 per borrower. The debt forgiveness would be through executive action and follows the president asking the Education Department to look into his authority to act unilaterally on student loans a year ago, the results of which have not been publicly announced. Bloomberg first reported that Biden is weighing forgiving at least $10,000 in student loans per borrower, citing people familiar with the matter. (The Hill)

FISCAL: A close ally of President Joe Biden said congressional Democrats will keep up pressure on him to use his executive authority to forgive as much as $50,000 in student loan per borrower rather than the more limited plan being considered by the White House. “When you see a student coming out of college -- law school or professional schools -- with $130,000, $150,000 in debt, that cripples the economy in more ways than one,” Representative James Clyburn, a South Carolina Democrat, said in an interview Saturday. “So the extent to which you can give some relief I think will stimulate the economy in many ways.” (BBG)

EQUITIES: Berkshire Hathaway CEO Warren Buffett lambasted Wall Street for encouraging speculative behavior in the stock market, effectively turning it into a “gambling parlor.” Buffett, 91, spoke at length during his annual shareholder meeting Saturday about one of his favorite targets for criticism: investment banks and brokerages. “Wall Street makes money, one way or another, catching the crumbs that fall off the table of capitalism,” Buffett said. “They don’t make money unless people do things, and they get a piece of them. They make a lot more money when people are gambling than when they are investing.” (CNBC)

EQUITIES: Berkshire Hathaway Vice Chairman Charlie Munger blasted stock trading app Robinhood on Saturday, saying the company is now “unraveling.” “It’s so easy to overdo a good idea. ... Look what happened to Robinhood from its peak to its trough. Wasn’t that pretty obvious that something like that was going to happen?” Munger said at Berkshire Hathaway’s annual shareholder meeting Saturday. Munger lambasted what he characterized as Robinhood’s “short-term gambling and big commissions and hidden kickbacks and so on.” (CNBC)

OTHER

GLOBAL TRADE: China will require exporters of products that can have military applications to provide documentation of the intended use by the buyers in an effort to halt the militarization of sensitive technology. There are concerns, however, that the process could be arbitrarily enforced against countries that have poor diplomatic relations with Beijing. China's Export Control Law, which strengthens controls over strategic goods and advanced technology exports, went into effect in December 2020. The Ministry of Commerce is now working on regulations for exports of products that can be converted to military use under the act and recently put out a proposal for public comment. According to the proposed regulations, the government will conduct a risk assessment of the country or region to which the product is being exported. The risk grade is determined based on national security and interests as well as foreign policy needs. Export licenses for high-risk destinations are expected to be subject to strict screening. (Nikkei)

GLOBAL TRADE: Ukraine’s farmers continue to plant spring grains and oilseeds despite Russian airstrikes on agricultural infrastructure, including grain elevators, local authorities said. Empty grain storage facilities in the Dnepropetrovsk were shelled early Saturday. Planting is ongoing in all but one region despite fighting in the east and south, with sowing of early crops already completed in six out of 24 regions apart from annexed Crimea, Ukraine’s agriculture ministry said. (BBG)

GLOBAL TRADE: Russian forces have ramped up grain theft in areas of Ukraine they invaded and now occupy, according to agriculture officials in the nation under siege. The Kremlin has denied Ukraine’s account of the matter, saying it did not know where that information was coming from. Ukraine’s deputy agriculture minister Taras Vysotskiy said on national TV in Ukraine that Russia has already stolen “several hundred thousand tonnes” of 1.5 million tonnes of grain farmers had stored in the country. Agriculture minister Mykola Solskyi said the grain theft had increased in April, and could comprise a threat to global food security while creating food insecurity in parts of Ukraine that are not controlled by Russia. (RTRS)

U.S./CHINA: Chinese regulators have held an emergency meeting with domestic and foreign banks to discuss how they could protect the country’s overseas assets from US-led sanctions similar to those imposed on Russia for its invasion of Ukraine, according to people familiar with the discussion. Officials are worried the same measures could be taken against Beijing in the event of a regional military conflict or other crisis. President Xi Jinping’s administration has maintained staunch support for Vladimir Putin throughout the crisis but Chinese banks and companies remain wary of transacting any business with Russian entities that could trigger US sanctions. The internal conference, held on April 22, included officials from China’s central bank and finance ministry, as well as executives from dozens of local and international lenders such as HSBC, the people said. The ministry of finance said at the meeting that all large foreign and domestic banks operating in China were represented. (FT)

U.S./CHINA: Biden administration officials are debating how — and even whether — to lower some of former President Trump’s tariffs against China to help ease inflation, people familiar with the matter tell Axios. The administration has limited options to lower prices for American consumers but knows it will be punished in this fall's midterms if higher prices persist throughout the year. Providing so-called “exclusions” for some goods — not subjecting them to the Section 301 tariffs imposed by Trump — is one tool the current president has at his disposal.But Biden, like his predecessor, has pursued a confrontational approach toward China, and officials have been reluctant to relax the tariffs without extracting something in return.In August 2019, Trump imposed $300 billion worth against China, saying it had failed to follow through on promises to buy more American agricultural products and stem the sales of fentanyl.The debate is pitting economists at Treasury, including Secretary Janet Yellen, against China hawks on the National Security Council. They want to keep pressure on China. Spokespersons for both entities declined comment. (Axios)

GEOPOLITICS: The US has held top-level talks with the UK on how they can co-operate more closely to reduce the chances of war with China over Taiwan and to explore conflict contingency plans for the first time. Kurt Campbell, the White House Indo-Pacific co-ordinator, and Laura Rosenberger, the top National Security Council China official, held a meeting on Taiwan with UK representatives in early March, according to people familiar with the situation. It occurred during a broader two-day meeting with their respective teams on Indo-Pacific strategy. Three people familiar with the stepped-up engagement said the US wanted to boost co-operation with European allies, such as the UK, to raise awareness about what the administration regards as Beijing’s increasingly assertive attitude towards Taiwan, which it considers part of China. (FT)

GEOPOLITICS: Finland and Sweden will have made up their minds on whether to join NATO before an official heads of state meeting in mid-May, Finland’s President Sauli Niinisto said, according to newspaper Ilta-Sanomat. Niinisto is due to travel to Stockholm May 17-18 to meet Sweden’s King Carl XVI Gustaf, as well as policy makers and dignitaries. (BBG)

GEOPOLITICS: Sweden’s prime minister, Magdalena Andersson, told party members that joining NATO would give the country “a special responsibility” for security in the Baltic Sea, according to an article by news agency TT. “If Sweden is attacked then we have better opportunities to get support from other countries, but you also give security guarantees,” Andersson told party members in Sundbyberg, Sweden, ahead of a May 1 speech in central Stockholm. Sweden, along with is Nordic neighbor Finland, began deliberating membership in the North Atlantic Treaty Organization after Russia’s Feb. 24 invasion of Ukraine. Andersson told her party members that if Finland chooses to join the military alliance, “Sweden will be more vulnerable if we do not become members.” (BBG)

GEOPOLITICS: German Chancellor Olaf Scholz plans to invite Indian Prime Minister Narendra Modi as special guest to a Group of Seven leaders’ summit next month as part of an effort to forge a broader international alliance against Russia. Germany, which currently holds the rotating G-7 presidency, will also welcome the leaders of Indonesia, South Africa and Senegal to the gathering in the Bavarian Alps June 26 to June 28, said people with knowledge of the matter. The decision could be announced as early as Monday, when Scholz welcomes Modi for talks in Berlin and a joint German-Indian cabinet meeting. Scholz was undecided on Modi’s invitation until a few weeks ago given the prime minister’s reluctance to condemn Russia’s invasion of Ukraine and a jump in fossil fuel deliveries to India from Russia. (BBG)

AUSTRALIA: Voters have cut their support for the Coalition from 35 to 33 per cent and marked down Prime Minister Scott Morrison on his personal performance, giving Labor a strong lead at the halfway point in the federal election campaign. Labor has held its primary vote steady at 34 per cent over the past two weeks and Opposition Leader Anthony Albanese has narrowed the gap with Morrison as preferred prime minister after disputes on the economy, security and climate change. Anthony Albanese has narrowed the gap with Scott Morrison as preferred prime minister. The exclusive survey, conducted by Resolve Strategic for The Sydney Morning Herald and The Age, also shows the Greens increased their primary vote from 11 to 15 per cent while Pauline Hanson’s One Nation and Clive Palmer’s United Australia Party rose from 4 to 5 per cent each. When voters were asked to name the parties that would receive their preferences, the results showed Labor held a clear lead of 54 to 46 per cent over the Coalition in two-party terms. (Sydney Morning Herald)

AUSTRALIA: Australia’s center-right Liberal National coalition is struggling to make up ground against the opposition Labor Party at the half-way point of the 2022 election campaign, with new polling indicating the government is on track to lose power on May 21. The Labor Party is leading the coalition government by 53% to 47% for the fourth week in a row, according to a new opinion survey by Newspoll published in The Australian newspaper on Sunday. If the result was replicated on election day, the newspaper said Labor would win power with about 79 seats in Australia’s 151-seat parliament. (BBG)

SOUTH KOREA: South Korea’s President-elect Yoon Suk Yeol announced more picks for his government including a chief national security adviser as the leader assembles his team before succeeding Moon Jae-in this month. Kim Sung-han, a professor of foreign affairs and trade and former second vice foreign minister, was nominated for the chief national security adviser role on Sunday. Yoon also nominated former first vice finance minister Choi Sangmok as the senior secretary of economy, and former lawmaker Lee Jin-bok as senior political secretary. Yoon is scheduled to succeed President Moon in office on May 10. Last month, Yoon nominated Choo Kyung-ho as the next finance minister and Lee Chang-yang as his trade minster. (BBG)

SOUTH KOREA: The nominee to be the first finance minister of South Korea's incoming government said on Monday he respects the foreign exchange rates set by the market forces but that rapid changes in the rate are a problem. Finance minister nominee Choo Kyung-ho made the remarks in response to a lawmaker's question during a confirmation hearing, while refusing to comment on the possibility of the won falling as low as the psychological 1,300-won level per dollar. (RTRS)

SOUTH KOREA: The nominee to be the first finance minister of South Korea's incoming government, due to be inaugurated next week, said on Monday he preferred lower taxes on investors in the domestic stock market. Finance minister nominee Choo Kyung-ho said he preferred a delay by about two years of a planned financial investment income tax and a reduction in the stock transaction tax. (RTRS)

MEXICO: Mexican Deputy Finance Minister Gabriel Yorio told a press conference on Friday that the economy and public finances remain solid, following the publication of first quarter economic growth data. Mexico's economy grew 0.9% in the first quarter from the previous three-month period for the first time in three quarters, a preliminary estimate from the national statistics agency INEGI showed earlier in the day. (RTRS)

MEXICO: A major Pemex oil refinery under construction in Mexico is running over budget and unlikely to come online this year as promised, according to documents seen by Reuters and sources close to the project, despite being a presidential priority. The Olmeca refinery has an official $8.9 billion price tag approved by the board of the national oil company in 2020. President Andres Manuel Lopez Obrador has long pitched the refinery as essential to weaning Mexico off its dependence on foreign gasoline and diesel supplies, which he argues undermines the country’s energy security. But two sources with direct knowledge of the project’s finances say the latest cost estimate has reached $14 billion, or some $5 billion over budget. Officials at Pemex, the energy and finance ministries did not respond to requests for comment. (RTRS)

BRAZIL: Brazil's state-run oil company Petrobras said on Friday it will increase natural prices for distributors in the country by an average 19% starting May 1. (RTRS)

RUSSIA: The Russian invasion of Ukraine failed in multiple locations, a representative for the Ukrainian military said. Russian forces “tried to lead offensive actions” near Izium, a city on the Donets River in eastern Ukraine, but they “had no success” and “suffered losses in manpower and equipment,” according to a Facebook post from the spokesman of the general staff of the Ukrainian armed forces, Alexander Štupun. The Russian military forces also tried to take the settlements of Rubížne and Popasna, also in the eastern part of Ukraine, but they had “no success” and took losses, Štupun said. He said the Ukrainians withstood Russian attacks in Maryinka, Ozerne, Vremivka and Green Field, among others. In other locations, where the Russians were unsuccessful in their efforts, they were gathering information about the Ukrainian position with aircraft, Štupun said. In other locations, where the Russians were unsuccessful in their efforts, they were gathering information about the Ukrainian position with aircraft, Štupun said. Meanwhile, Russia is gathering troops in the south part of Ukraine to move on the Dnipropetrovsk region, according to a video posted on Telegram from Ukrainian President Volodymyr Zelenskyy. The movement “may be Russia’s strategic success in the war,” Zelenskyy said, according to an NBC News translation. Zelenskyy reiterated Ukraine’s resolve to fight. “Honestly, I do not know — the lives of people destroyed, burned or stolen property will not do anything to Russia, but will increase the toxicity of the Russian state and the number of those in the world who will work to isolate Russia,” Zelenskyy said. “The Armed Forces of Ukraine are responding to the aggressors with all their blows and will continue to respond until the occupiers leave our land.” (CNBC)

RUSSIA: Kharkiv residents in the northern and eastern districts of the city should stay in their shelters due to heavy Russian shelling, regional governor Oleh Synehubov said in a Telegram post. Kharkiv, Ukraine’s second largest city, has been faced with intermittent bombing since Russia began its full scale invasion in late February. But fighting around the city has intensified in recent days as Ukrainian troops have worked to push back Russian forces, according to the New York Times. (CNBC)

RUSSIA: Some civilians were evacuated from Mariupol's Azovstal steel plant this weekend, as Maxar Technologies' satellite images showed the besieged complex has been all but destroyed after weeks of Russian shelling. While some women and children were confirmed by Ukrainian and Russian officials to have been evacuated from the plant, it's believed hundreds of civilians are still trapped in the last foothold of Ukrainian resistance in the port city. (Axios)

RUSSIA: Ukrainian President Volodymyr Zelenskyy said there was a high risk that peace talks with Moscow would end. (RTRS)

RUSSIA: The upcoming anniversary of Russia's liberation at the end of World War II will have no bearing on Moscow's military operations in Ukraine, the country's foreign minister said on Italian television on Sunday. "Our soldiers won't base their actions on a specific date," Sergei Lavrov said when asked whether the May 9 anniversary would mark a turning point in the conflict. "We'll commemorate our victory in a solemn manner but the timing and speed of what is happening in Ukraine will hinge on the need to minimise risks for civilians and Russian solders," he added, speaking in Russian through an Italian interpreter. (RTRS)

RUSSIA: Russia is committed to working to prevent a nuclear war ever beginning, Foreign Minister Sergei Lavrov said in an Italian television interview on Sunday. "Western media misrepresent Russian threats," Lavrov said, speaking in Russian through an Italian interpreter. "Russia has never interrupted efforts to reach agreements that guarantee that a nuclear war never develops," he said. (RTRS)

RUSSIA: Russia’s foreign minister says Moscow does not consider itself at war with NATO In an interview with Saudi Arabia’s Al-Arabiya TV channel, Sergei Lavrov said: “Unfortunately, NATO, it seems, considers itself to be at war with Russia.” “NATO and European Union leaders, many of them, in England, in the United States, Poland, France, Germany and of course European Union chief diplomat Josep Borrell, they bluntly, publicly and consistently say, ‘Putin must fail, Russia must be defeated,’” he told the network. “When you use this terminology,” he said, “I believe you think that you are at war with the person who you want to be defeated.” (CNBC)

RUSSIA: Russian Foreign Minister Sergey Lavrov made another string of assertions in an interview with Chinese state media agency Xinhua, published Saturday morning. Lavrov claimed that NATO was interfering with a political settlement in Ukraine and that the West intended to fight until “the last Ukrainian,” according to an NBC News translation. He also claimed the Ukraine conflict “contributes to the process of freeing the world from the neo-colonial oppression of the West.” (CNBC)

RUSSIA: A Russian defence ministry facility in the southern Belgorod region bordering Ukraine has caught fire, Belgorod region governor said on Sunday. There was no immediate information about damage or casualties, the governor said in a post on Telegram. Images posted to social media showed a large funnel of smoke rising above the ground. (RTRS)

RUSSIA: Russia’s foreign minister says Moscow has evacuated over 1 million people from Ukraine since the war there began. The comments Saturday by Sergey Lavrov in an interview with Chinese state news agency Xinhua come as Ukraine has accused Moscow of forcefully sending Ukrainians out of the country. Lavrov said that figure included more than 300 Chinese civilians. Lavrov offered no evidence to support his claim in the interview. Lavrov also said that negotiations continue between Russia and Ukraine “almost every day.” However, he cautioned that “progress has not been easy.” (AP)

RUSSIA: Ukraine told the International Atomic Energy Agency that Russia sent a team of specialists to the Zaporizhzhya nuclear power plant, which is controlled by Russian forces but still operated by its Ukrainian staff, according to the IAEA website. The officials from Russia’s state nuclear company Rosatom are demanding daily reports about “confidential issues” related to the plant’s operations and management, the IAEA said, citing what it’s been told by the Kyiv government. The IAEA’s director general said the situation at the plant “continues to be challenging and requires continued attention.” (BBG)

RUSSIA: U.S. Defense Department spokesman John Kirby denounced Putin for the “depravity” of Russia’s tactics in Ukraine and the “bizarre” claims he has made about his reasons for waging war there. “There’s not even an attempt by Russia to be precise in their targeting,” Kirby told reporters, pausing at times in delivering what he acknowledged was an unusually emotional broadside. “It’s just brutality of the coldest and most depraved sort.” (BBG)

RUSSIA: U.S. troops in Germany have started training Ukrainian soldiers on the use of heavy weapons to defend their country against Russian attacks, the Pentagon said Friday. “These efforts build on the initial artillery training that Ukraine’s forces already have received elsewhere and also includes training on radar systems and armored vehicles that have been recently announced as part of security assistance packages,” Press Secretary John F. Kirby said. (CNBC)

RUSSIA: Pentagon spokesman John Kirby slammed Russia’s recent rhetoric on expanding its war past Ukraine’s borders. “We absolutely respect Moldova’s sovereignty. We want every other nation in the world to respect it. A Russian general out there claiming that Moldova is next is clearly irresponsible rhetoric,” Kirby said, referencing remarks made by Russian commander Rustam Minnekayev. Last week, Minnekayev said that Moscow wanted “full control” of eastern and southern Ukraine and would seek to create a “land corridor” from Russia in the east to Transnistria to Crimea, a peninsula on the Black Sea that Russia forcefully annexed from Ukraine in 2014. (CNBC)

RUSSIA: Rep. Nancy Pelosi (D-Calif.) met with Volodymyr Zelensky in Kyiv, per a Twitter post Sunday from the Ukrainian president showing the U.S. house speaker visiting Ukraine's capital. Pelosi's visit is a reflection of the growing pressure for the U.S. to send high-level officials to Kyiv, after recent visits by U.K. Prime Minister Boris Johnson and the prime ministers of Spain and Denmark. It comes less than a week after Secretary of State Antony Blinken and Defense Secretary Lloyd Austin III visited Ukraine.What we're watching: The trip, which was not previously announced, also includes House Foreign Affairs Committee Chair Gregory Meeks (D-N.Y.), House Intelligence Committee Chair Adam Schiff (D-Calif.), House Rules Committee Chair Jim McGovern (D-Mass.)and Reps. Jason Crow (D-Colo.), , Barbara Lee (D-Calif.), and Bill Keating (D-Mass.). (Axios)

RUSSIA: Foreign Minister Dmytro Kuleba said he was grateful to the U.S. for standing by Ukraine “resolutely” after speaking with U.S. Secretary of State Antony Blinken. “We discussed further sanctions on Russia, arms deliveries and financial support to Ukraine,” Kuleba said in a tweet. (CNBC)

RUSSIA: Ukraine's foreign minister, Dmytro Kuleba, said he told the European Union's top diplomat on Sunday that the bloc's next round of sanctions must include an oil embargo on Russia. (RTRS)

RUSSIA: Dialogue between Moscow and Washington on strategic stability is formally "frozen", the TASS news agency cited a Russian foreign ministry official as saying on Saturday. Vladimir Yermakov, head of nuclear non-proliferation and controls at the foreign ministry, told TASS those contacts could be resumed once what Russia calls its "special military operation" in Ukraine was complete. (RTRS)

RUSSIA: In a new push to increase sanctions against Russian oligarchs, Senate Majority Leader Chuck Schumer, D-N.Y., detailed a plan to liquidate billions in frozen assets and donate the proceeds to Ukraine. Already, more than $30 billion in Russian assets has been frozen. However, under U.S. law and most laws in Europe, assets that are frozen remain under the ownership of the oligarch and can’t be transferred or sold. (CNBC)

RUSSIA: The Biden administration has a plan to rob Vladimir Putin of some of his best innovators by waiving visa requirements for highly educated Russians, according to people familiar with the strategy. One proposal, which the White House included in its latest supplemental request to Congress, is to drop the rule that Russian professionals applying for an employment-based visa must have a current employer. It would apply to Russian citizens who have earned master’s or doctoral degrees in science, technology, engineering or mathematics in the U.S. or abroad. Key targets include Russians with experience in semiconductors and cybersecurity, among other fields. (BBG)

RUSSIA: Brussels is drawing up plans for a new round of emergency lending to Ukraine as it seeks to contribute to efforts by allies to plug a yawning government financing gap running to billions of euros a month. Valdis Dombrovskis, European Commission executive vice-president in charge of economic policy, said EU officials were looking both to accelerate a payment of €600mn under the bloc’s existing emergency support plan and to bring forward a new round of lending. This could be achieved either by topping up the funding or extending a fresh emergency loan, he said. “We are currently assessing both options,” Dombrovskis told the Financial Times in an interview. “The aim is of course to really bridge this financing gap.” (FT)

RUSSIA: German Foreign Minister Annalena Baerbock made clear that sanctions against Russia would only be lifted after a complete withdrawal of its troops from Ukrainian territory, including the Donbas region and Crimea. “It is important that we can withstand every sanction that we introduce, if necessary, for years,” Baerbock told public broadcaster ARD on Sunday. “We will only lift these sanctions once the Russian troops have left.” (BBG)

RUSSIA: Sweden says a Russian military plane has violated Swedish airspace. The incident happened late Friday in the Baltic Sea near the island of Bornholm. In a statement Saturday, the Swedish Armed Forces said a Russian AN-30 propeller plane flew toward Swedish airspace and briefly entered it before leaving the area. The Swedish Air Force scrambled fighter jets that photographed the Russian plane. Swedish Defense Minister Peter Hultqvist told Swedish public radio that the violation was “unacceptable” and “unprofessional.” (CNBC)

RUSSIA: Russia should respond symmetrically to the freezing of Russian assets by some "unfriendly countries," Vyacheslav Volodin, chairman on Russia's state Duma, the lower house of parliament, wrote in a social media post on Sunday. "It is right to take mirror measures towards businesses in Russia whose owners come from unfriendly countries, where such measures were taken: confiscate these assets," Volodin wrote. (RTRS)

RUSSIA: The head of Russia’s space program said Moscow has decided to pull out of the International Space Station, state media reported, a move it’s blamed on sanctions imposed over the invasion of Ukraine. “We’ll inform our partners about the end of our work on the ISS with a year’s notice,” Roscosmos general director Dmitry Rogozin said on state television, TASS and RIA Novosti reported. Rogozin had threatened earlier this month to end Russia’s ISS mission unless the U.S., Europe and Canada lifted restrictions against enterprises involved in the Russian space industry. (BBG)

RUSSIA: Russia is seeking to move away from the U.S. dollar and rely less on imports while strengthening its independence in key technologies in response to sanctions over the war with Ukraine, Chinese state media reported, citing Foreign Minister Sergei Lavrov. “We will continue to push and strengthen special economic programs to ensure the stability of the Russian economy,” Lavrov was quoted as saying in a written interview with the Xinhua news agency, without elaborating. (BBG)

RUSSIA: A group of individuals and entities filed a lawsuit against Credit Suisse Group AG and some of its officers, alleging that the bank violated federal securities laws given its business dealings with Russian oligarchs, according to law firm Pomerantz LLP. The class action, filed in a district court in New York, is on behalf of those who purchased Credit Suisse securities between March 19, 2021 and March 25, 2022, Pomerantz said in a statement. The complaint alleges that during the period, Credit Suisse and its officers in question made materially false and misleading statements regarding the bank’s business, operations, and compliance policies, according to the statement. The defendants made such statements or failed to disclose that among other things, Credit Suisse’s practice of lending money to Russian oligarchs subject to U.S. and international sanctions created a significant risk of violating rules pertaining to those sanctions and future ones, it said. (BBG)

SOUTH AFRICA: South Africa has likely entered a new wave of COVID-19 earlier than expected as new infections and hospitalizations have risen rapidly over the past two weeks, the country’s health minister said on Friday. (AP)

SOUTH AFRICA: South African President Cyril Ramaphosa abandoned his Workers’ Day speech in the northwestern city of Rustenburg on Sunday when striking mineworkers stormed the stage. (AP)

COLOMBIA: Colombia's central bank board raised the benchmark interest rate by 100 basis points to 6% on Friday, its highest level in nearly five years, as it continues increases in response to persistent inflation pressures. (RTRS)

IRAN: European officials are preparing to make a fresh push to salvage a nuclear deal with Iran, offering to send a top European Union negotiator to Tehran in an effort to break a stalemate in talks, according to Western diplomats. Enrique Mora, the European Union coordinator of the negotiations, has told Iranian counterparts he is ready to return to Tehran to open a pathway through the deadlock, the people said. So far, Iran hasn’t responded with an invitation, the people added. (WSJ)

ENERGY: Russia clarified the rules on how European customers are required to pay for natural gas supplies in rubles, easing the terms slightly as concerns grow the mechanism could force companies to violate European Union sanctions if they want to keep the fuel flowing. Putin last month demanded buyers switch to paying in rubles, threatening to cut off supplies to countries that don’t. But the EU said the process Russia set up for making the payments, which requires customers to open both foreign-currency and ruble accounts with state-controlled Gazprombank, was in breach of sanctions on the central bank. (BBG)

ENERGY: Russia’s key partners, who buy its gas, have already agreed to pay for it in rubles, Russian Foreign Minister Sergey Lavrov said in an interview with Al-Arabiya TV on Friday. "Most of Russia’s key partners, who buy its gas, have already shifted to this payment method [in rubles]," he noted. According to the Russian top diplomat, the payment method suggested by Moscow changes nothing for the buyers. "If they refuse from paying in rubles, they, as a matter of fact, don’t want us to receive money for our commodity. This is their choice," he said. "If Poland and Bulgaria put their ideological ambitions before the interests of their people, the interests of their budgets, this is their choice." (TASS)

ENERGY: The European Commission will review whether efforts by utilities to meet Russian demands on natural gas payments are legal, ECB Governing Council member Robert Holzmann told Austrian public broadcaster ORF. Holzmann, Austria’s National Bank Governor and one of the nation’s officials responsible for upholding sanctions, said that while he’d heard that gas importers in Europe may be opening ruble accounts to make payments, it is ultimately up to the European Union’s executive to make a decision on the legality. (BBG)

ENERGY: Germany wants to build four instead of three floating storage and regasification units (FSRUs) as it strives to replace Russian gas with liquefied natural gas (LNG) that can be sourced from many countries, the economy ministry said on Sunday. (RTRS)

ENERGY: MNI: Canada Can Backfill Russia Energy in Europe- Ex-Ministers

- Canada looks set to ramp up production to displace Russian oil and gas in Europe and in the short run needs to send the product via pipelines into the U.S. to "backfill" that market as America's overseas exports climb, former ministers told MNI on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

ENERGY: Business minister Kwasi Kwarteng has written to the North Sea oil and gas industry asking it to set out a clear plan to reinvest its profits into British energy projects, his department said on Saturday. (RTRS)

OIL: Western support of Ukraine hardened Friday as the European Union was poised to approve an embargo on Russian oil, amid fresh assessments that the Russian military’s eastern offensive was faltering, hampered by logistical issues and stiff Ukrainian resistance. The oil embargo, which would be phased in over a period of some months, is expected to be approved by E.U. ambassadors next week, in a step that should avoid the time-consuming process of gathering heads of state. Word of the European oil embargo came amid a surge of activity to provide Ukraine with more weapons and support, while shoring up NATO’s defenses, as the Kremlin and Western allies seemed to gird for a drawn-out struggle that risked spilling over Ukraine’s borders. (New York Times)

OIL: The German government has come round to the idea of an import ban on Russian oil, making an EU-wide embargo more likely, according to dpa sources in Brussels. The European Union has already implemented a ban on Russian coal imports, but oil and gas supplies are more difficult to replace and discussions on further sanctions are ongoing. Germany has been criticized by Kiev, as well as by other EU member states, for its dependency on Russian fossil fuel supplies and for not moving faster to place an embargo on them. Only Hungary, Austria, Slovakia, Spain, Italy and Greece are now considered to be resisting the oil embargo, the sources told dpa. (DPA)

OIL: Hungary would veto any European proposal that leads to the restriction of energy imports from Russia, according to a senior minister in Prime Minister Viktor Orban’s government. “We’ve made it clear that we’ll never support” extending European Union sanctions against Russia to the field of energy, Cabinet Minister Gergely Gulyas told HirTV on Sunday. The EU is set to propose a ban on Russian oil by the end of the year over its war in Ukraine, with restrictions on imports introduced gradually until then, Bloomberg reported Saturday, citing people familiar with the matter. (BBG)

OIL: Germany could end its dependence on Russian oil by the end of the summer, according to the Economy Ministry’s latest energy security report published Sunday. (BBG)

OIL: Dutch dockworkers refused to unload a tanker carrying Russian diesel, as European states edge closer to penalizing Moscow’s energy exports in the wake of its invasion of Ukraine. The Sunny Liger took on about 60,000 tons of diesel at Russia’s Primorsk port in late April, according to a port report and tanker-tracking data compiled by Bloomberg. It was refused entry to a Swedish port, before being turned away from Rotterdam and then Amsterdam in recent days, according to Niek Stam, director of FNV Havens, the harbor arm of the Dutch labor union FNV. “If dockworkers somewhere else in the world refuse the cargo we will also refuse,” he said in an interview on Sunday. “We do that on the basis of international solidarity.” (BBG)

OIL: Russia’s crude oil exports in the first 28 days of April jumped more than 17%, with hikes recorded for flows via all key pipelines and ports even as the nation’s production declined. The country exported an average of 4.66 million barrels a day over the period to its key markets via pipelines and port facilities operated by Transneft PJSC, according to Bloomberg calculations. (BBG)

OIL: Six missiles landed near an oil refinery in Iraq’s northern city of Erbil on Sunday, Kurdistan anti-terrorism authorities said in a statement. The missiles were launched from Nineveh province and fell near the KAR refinery, the authorities said without reporting any casualties or damage. Three missiles also fell near the refinery on April 6, without causing any casualties. Sources in the Kurdistan Regional Government told Reuters then that the refinery is owned by Iraqi Kurdish businessman Baz Karim Barzanji, the CEO of major domestic energy company the KAR Group. (RTRS)

OIL: Iraq exported a total of 101.4 million barrels of oil in April, raising revenues of $10.55 billion, the oil ministry said in a statement on Sunday. Over the month, exports averaged 3.4 million barrels per day, it added. (RTRS)

OIL: Libya’s National Oil Corporation (NOC) announced on Sunday the “temporary” lifting of force majeure and resumption of operations at the Zueitina oil terminal in order to reduce stock and free up storage capacity. The state oil company had warned of “imminent environmental disaster” at the facility unless tanks were emptied, after last week declaring force majeure due to a political standoff. (RTRS)

CHINA

POLICY: China should strengthen its anti-monopoly efforts and prevent disorderly expansion of capital, President Xi Jinping has told a meeting, the state news agency, Xinhua, said on Saturday. China will prevent financial risks, and focus on tackling risks from non-performing assets and bubbles, said Xi, who chaired Friday's meeting, and promised punishment for corrupt behaviour in the capital sector. (RTRS)

CORONAVIRUS: China's financial hub of Shanghai has reined in COVID transmission risks at the community level, excluding cases in quarantine centres, with six of its 16 districts attaining zero-COVID status, an official said on Sunday. This status is achieved when a district has three consecutive days with no new daily increases in infections, city government official Gu Honghui told a news conference. Public transport will be allowed to resume in five of the six districts, a city health official added, but did not say when. Despite the fall in transmissions, Shanghai will launch a new round of citywide PCR and antigen tests from Sunday until May 7, Gu added. (RTRS)

CORONAVIRUS: Beijing tightened COVID-19 restrictions on Sunday as it battled a fresh wave of the coronavirus. Beijing has logged about 300 locally transmitted cases since April 22. It has not yet locked down, but it has toughed social distancing rules and begun a new round of mass testing, particularly in the city's worst-hit districts. Officials in the capital have also closed entertainment venues and banned indoor dining, adding another blow to some of the industries that have been hit the hardest by the pandemic, particularly ahead of the May 1 International Labor Day holiday. (Deutsche Welle)

COAL: China's state planner warned domestic thermal coal producers and traders on Saturday not to hoard stock or engage in a list of other practices that it said amounted to pushing up prices. (RTRS)

OVERNIGHT DATA

CHINA APR OFFICIAL MANUFACTURING PMI 47.4; MEDIAN 47.3; MAR 49.5

CHINA APR OFFICIAL NON-MANUFACTURING PMI 41.9; MEDIAN 46.0; MAR 48.4

CHINA APR OFFICIAL COMPOSITE PMI 42.7; MAR 48.8

CHINA APR CAIXIN MANUFACTURING PMI 46.0; MEDIAN 47.0; MAR 48.1

Overall, in April, local Covid outbreaks continued, and activity in the manufacturing sector weakened. Supply shrank, demand was under pressure, external demand deteriorated, supply chains were disrupted, delivery times were prolonged, backlogs of work grew, workers found it difficult to return to their jobs, inflationary pressures lingered, and market confidence remained below the long-term average. Since April, the Covid-19 situation in regions like Shanghai remained severe, and the impact on business production and people’s lives continued, especially in logistics. Currently, the most important job of policymakers is to optimize the flow of personnel and goods and focus on stabilizing supply chains, while resolutely adhering to the established policy of “dynamic zero Covid". In addition, for enterprises in industries that are greatly affected by the outbreaks, the government should boost support to stabilize market expectations. During the recent round of outbreaks, many company employees, gig workers and low-income groups have watched their incomes shrink and their lives grow more difficult. That’s something policymakers shouldn’t ignore. (Caixin)

JAPAN APR, F JIBUN BANK MANUFACTURING PMI 53.5, PRELIM 53.4; MAR 54.1

Latest PMI data pointed to a sustained expansion in the Japanese manufacturing sector at the start of the second quarter of 2022. That said, the rate of growth eased from March as firms noted softer growth in new orders and a broadly unchanged expansion in production levels. Domestic demand was a key driver of growth as firms launched new products, but the reintroduction of lockdown restrictions in China hindered international demand. These measures coupled with the fallout from war in Ukraine continued to disrupt supply chains across the sector. Delivery delays and price rises remained a dampener on production and sales, as manufacturers commented on sustained difficulty in sourcing and receiving inputs amid material shortages and surging input costs. Sharply rising cost burdens pushed Japanese manufacturers to raise selling prices to the greatest extent in the survey history. Though still optimistic, Japanese goods producers were increasingly wary of the continued impact of price and supply pressures, and also the impact of the war and extended lockdowns in China. As a result, confidence dipped to the weakest since July 2020. (S&P Global)

AUSTRALIA APR MELBOURNE INSTITUTE INFLATION EXPECTATIONS +3.4% Y/Y; MAR +4.0%

AUSTRALIA APR MELBOURNE INSTITUTE INFLATION EXPECTATIONS -0.1% M/M; MAR +0.8%

AUSTRALIA APR ANZ JOB ADVERTISEMENTS -0.5% M/M; MAR +0.7%

ANZ Job Ads dropped 0.5% m/m in April but remained 57.3% above the pre-pandemic level. Labour market conditions are very tight, as confirmed by the 3.7% increase in newly lodged job ads (or 10,200 new job ads) in March recorded by the National Skill Commission’s Internet Vacancy Index. Another employment report, this time by SEEK, showed that job ads increased in 26 of 28 industry categories in March, with hospitality and tourism roles registering the greatest growth. In March, employment rose by 18k, below market expectations of 30k. The participation rate remained stable at its all-time high of 66.4% and the unemployment rate declined to 3.95%, its lowest since 1974. However, a lot of people struggling were still struggling to find work, the long-term unemployment rate2relatively high at 1%, despite the record high number of job vacancies recorded by the ABS in February. This shows that even with a very strong labour market there are areas that need attention. We expect strong labour demand to lead to solid employment gains in the coming months. We see the unemployment rate dropping well below 4% in the second half of 2022, which should reinforce the momentum toward higher wages growth. (ANZ)

AUSTRALIA APR CORELOGIC HOUSE PRICE INDEX +0.3% M/M; MAR +0.3%

AUSTRALIA APR, F S&P GLOBAL MANUFACTURING PMI 58.8, PRELIM 57.9; MAR 57.7

Australia’s manufacturing sector continued to expand at a strong pace according to the latest S&P Global Australia Manufacturing PMI, recovering from the latest COVID-19 Omicron wave. Business confidence also improved at the start of the second quarter, which was a positive sign for the near-term outlook and was reflected in higher buying activity and employment. That said, supply and capacity issues were prominent as seen through the record rise in backlogged work, coupled with the lengthening of lead times and rising prices. These will be issues worthy of continued monitoring given their potential to limit future output. (S&P Global)

SOUTH KOREA APR TRADE BALANCE -$2.661BN; MEDIAN -$1.643BN; MAR -$115MN

SOUTH KOREA APR EXPORTS +12.6%; MEDIAN +14.3%; MAR +18.2%

SOUTH KOREA APR IMPORTS +18.6%; MEDIAN +20.9%; MAR +27.9%

SOUTH KOREA APR S&P GLOBAL MANUFACTURING PMI 52.1; MAR 51.2

Data covering the start of the second quarter of 2022 provided tentative evidence of improving conditions at South Korean manufacturers. A renewed rise in output coincided with a stronger expansion in incoming order inflows in April, which pushed the headline PMI index up from March's recent low, yet firms continued to comment that rising prices and supply chain disruption had held back a much stronger recovery. Price and supply pressures were exacerbated by the ongoing war in Ukraine and the reimposition of strict COVID-19 restrictions across China, both of which stifled export orders partly due to port congestions and a lack of available containers. As part of efforts to protect themselves from future disruption and higher cost burdens, manufacturers looked to increase and store additional stocks of raw materials and semi-finished goods. Yet, an accelerated rise in material and commodity prices placed further strain on margins at South Korean manufacturers, as input prices rose at the third-fastest rate in the survey history. Firms increasingly passed these increases on to clients through higher output charges, which rose at an unprecedented rate. It was these price and supply pressures emanating from the twin issues of the Ukraine war and China lockdowns that dampened business confidence, as the level of positive sentiment eased to a four-month low. (S&P Global)

MARKETS

SNAPSHOT: Chinese PMIs Disappoint, Beijing Tightens Restrictions Further

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 37.28 points at 26885.02

- ASX 200 down 92.815 points at 7342.2

- Shanghai Comp. is closed

- JGB 10-Yr future down 33 ticks at 149.29, yield down 0.1bp at 0.229%

- Aussie 10-Yr future down 13.5 ticks at 96.700, yield up 13.2bp at 3.257%

- U.S. 10-Yr future down 0-12+ at 118-24+, yield up 0.61bp at 2.9397%

- WTI crude down $1.06 at $103.63, Gold down $13.35 at $1883.63

- USD/JPY up 65 pips at Y130.36

- ECB RATE HIKE POSSIBLE BUT NOT LIKELY IN JULY, GUINDOS SAYS (BBG)

- ECB’S HOLZMANN SAYS TWO RATE HIKES MAY BE NEEDED THIS YEAR (BBG)

- HUNGARY WOULD VETO EU SANCTIONS ON RUSSIAN ENERGY, MINISTER SAYS (BBG)

- CHINA MEETS BANKS TO DISCUSS PROTECTING ASSETS FROM U.S. SANCTIONS (FT)

- COVID RESTRICTIONS TIGHTENED IN BEIJING, WHILE CASE SITUATION IN SHANGHAI IMPROVES

- CHINA PMIS DISAPPOINT

US TSYS: Little Changed To Cheaper In Light Asia Trade

The cash Tsy curve has bear flattened in early dealing this week, with the front end of the curve likely showing some regional Asia-Pac reaction when it comes to Friday’s front end/belly-led cheapening, while the 7+-Year zone of the curve was a little better bid on the risk negative factors we have outlined in the weekend news (namely softer than expected Chinese PMIs & worry re: various areas of geopolitical tension), before that impulse faded. That leaves cash Tsys little changed to ~1.5bp cheaper across the curve. TYM2 is -0-13 at 118-24, 0-01+ off the base of the contract’s 0-07 Asia range, operating on volume of ~85K.

- Eurodollar futures sit 1.5 to 5.5 ticks softer through the reds.

- Note that the OIS strip currently prices a ~50% chance of a 75bp hike at the Fed’s June meeting, in line with market pricing observed on Friday (a 50bp hike at this week’s FOMC meeting is fully priced).

- Market and headline flow has been limited by the observance of holidays across China, Hong Kong & Singapore.

- Looking ahead, ISM manufacturing data headlines the NY docket on Monday, although more focus will be placed on Wednesday’s FOMC decision and Friday’s NFP print.

- Note that the observance of a UK holiday during London hours will limit wider liquidity and result in a halt of cash trade until NY hours commence.

JGBS: One-Way Traffic

Friday’s weakness in U.S. Tsys seeped through into JGBs, with JGB futures opening lower and moving in a downward direction for the bulk of the Tokyo session. The contract sits 35 ticks below Thursday’s settlement levels at typing, after Japanese participants returned from their elongated weekend.

- Meanwhile, cash JGBs sit little changed to ~3bp cheaper across the curve. 10s provide the firmest point on the JGB curve (aided by the presence of the BoJ’s fixed rate operations), while 7s and 30+-Year paper provide the weakest points, the former on the weakness in futures and the latter on the relative lack of BoJ control in that area of the curve.

- Domestic headline flow has been light, with wider affairs driving price action.

- This has left little to counter the offshore-driven weakness, as Tokyo participants prepare for a three-day break, which will be observed from Tuesday through Thursday.

AUSSIE BONDS: Curve A Touch Steeper With RBA Expectations Capping Early Bid

YM was happy to operate in the bottom half of its overnight session range during the first Sydney session of the week, while XM extended on post-settlement losses as we moved through the day. That leaves YM -12.0 & XM -14.0 as we move towards the bell, with the 10- to 15-Year sector of the ACGB curve providing the weakest point in wider cash trade. 10-Year ACGB yields tagged a fresh cycle high, breaching 3.25%.

- The wider tone was set by Friday’s U.S. Tsy-driven post-Sydney losses, with expectations re: RBA lift off at Tuesday’s meeting capping the early uptick.

- Both the 3- & 10-Year EFPs have tightened by ~2bp as of typing.

- There was no reaction in the space to the M/M dip in Melbourne Institute inflation expectations (-0.1%), while the Y/Y reading cooled a little (to 3.4% from the multi-year high of 4.0% observed in March). The space was back from best levels ahead of the prints, with no subsequent bid emerging.

- ANZ Job Ads dropped by 0.5% in April, although the measure remains 57.3% above the pre-pandemic level, with the data collator noting that “labour market conditions are very tight.”

- Focus is squarely on Tuesday’s RBA decision (the MNI markets team leans towards a 15bp rate hike come the end of tomorrow’s meeting, expect our full preview of the event to be released during the London morning).

EQUITIES: E-Minis Nudge Higher After Friday’s Weakness

Friday’s negative lead from Wall St. (which was seemingly based on guidance from tech giants Apple & Amazon, in addition to the impending spectre of further Fed tightening & higher U.S. Tsy yields, at least from a fundamental perspective) applied pressure to the major Asia-Pac equity indices that were open for trade on Monday. That leaves the Nikkei 225 -0.1% and the ASX 200 -1.2% at typing.

- Meanwhile, e-minis managed to recover some ground after the S&P 500 & NASDAQ 100 lost over 3.0% & 4.0%, respectively, during Friday’s cash trade. The 3 major e-mini contracts have managed to add 0.5-0.8% to their respective Friday settlement levels after non-committal, two-way dealing during early Asia hours. This came despite a more risk-negative feel to weekend headline flow.

GOLD: Bullion Starts The Week On The Defensive

A firmer USD has weighed on bullion during Asia-Pac dealing, with spot gold last down the best part of $10/oz, just below $1,890/oz. Gold continues to hold within the confines of the recently observed range, with our technical analyst noting that the precious metal remains vulnerable despite the recovery from Thursday’s low. That same Thursday low ($1,872.2/oz) provides the initial point of technical support, with any sustained breach there set to expose the 76.4% retracement of the Jan 28-Mar 8 rally ($1,848.8/oz). Bulls need to retake firm resistance in the form of the 20-day EMA to start turning the technical tide back in their favour.

- Known ETF holdings of gold seem to have found a bit of a short-term plateau after rising by 10% from the late December trough. Note that the metric currently operates ~4% below the record peak observed in ’20.

- Participants will be attuned to all things U.S. in the coming week, with the ISM manufacturing report (Monday), FOMC meeting (Wednesday) & NFP release (Friday) providing the major macro reference points over the coming days.

OIL: A Touch Lower To Start The Week

WTI & Brent crude futures have started the week on the backfoot, sitting ~$1.00 below their respective settlement levels at typing.

- A combination of a firmer USD and worries re: the COVID situation in China, after Beijing introduced stricter mobility restrictions (while the situation in Shanghai has improved), has weighed on crude prices.

- Elsewhere, Sunday saw Libya’s National Oil Corporation announce the “temporary” lifting of force majeure and resumption of operations at the Zueitina oil terminal to drawdown stock and free up storage space. This came after the NOC warned of “imminent environmental disaster” at the facility unless tanks were emptied. This could be providing an incremental amount of pressure to crude futures.

- Finally, a BBG source report re: the EU looking for an embargo of Russian oil by year end has failed to impact the space, with the NYT running a similar story on Friday and after Hungary expressed its willingness to veto such a move on the EU stage.

FOREX: USD Firmer In Asia

A firmer USD became apparent after a fairly non-committal start to Asia-Pac dealing, with the greenback moving to the top of the G10 FX table, although the DXY operates a little shy of its recent cycle peak.

- No doubt the early moves higher in USD/CNH (linked to soft Chinese PMI data, angst surrounding Sino-U.S. relations & COVID worry, as Beijing deepened COVID limitations, while the case situation improved in Shanghai) & USD/JPY have played into the broader USD uptick. Note that both crosses remain comfortably within the recently observed ranges, with USD/CNH last +400 pips or so, just above CNH6.6800, while USD/JPY is ~65 pips firmer on the day, hovering around Y130.35.

- More broadly, the likely 50bp hike from the Fed on Wednesday, coupled with global recession fears and the expectation for further Fed tightening is playing into the USD bid at the start of a new week.

- Broader liquidity has been limited by holidays in Hong Kong, Singapore & China, while the observance of a holiday in London will hamper liquidity during European hours.

- Tier 1 headline flow has been relatively non-existent since the Asia open owing to widespread holidays across the region.

- The latest U.S. ISM manufacturing survey headlines the wider docket on Monday, with final Eurozone m’fing PMI data also due.

FX OPTIONS: Expiries for May02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E684mln), $1.0700-15(E1.1bln), $1.0800(E1.6bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/05/2022 | 0600/0800 | ** |  | DE | retail sales |

| 02/05/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/05/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 02/05/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/05/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/05/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 02/05/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 02/05/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 02/05/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 02/05/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 02/05/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 02/05/2022 | 1400/1000 | * |  | US | Construction Spending |

| 02/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 02/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.