-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI EUROPEAN MARKETS ANALYSIS: Hawkish RBA Supports AUD, Weighs On Bonds

- Hawkish 25bp rate hike from the RBA weighs on Aussie bonds and supports AUD.

- Hang Seng tech names whipsaw on Alibaba headlines, with wider Asia liquidity hampered by holidays in China, Singapore & Japan.

- Focus will turn to U.S. factory orders & final durable goods orders, EZ jobs data as well as comments from RBA Governor Lowe & BoC's Rogers.

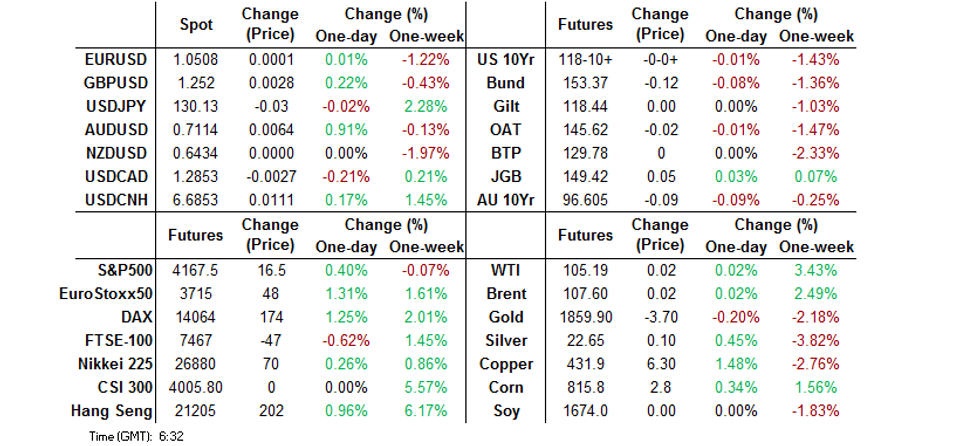

US TSYS: Pressured BY RBA After Quiet Asia Session

The hawkish RBA decision has applied pressure to Tsy futures into London hours, allowing the Asia-Pac session range in TYM2 to extend to a still narrow 0-07 band. The contract last sits +0-00+ at 118-11+, operating on a lowly ~45K lots.

- A reminder that cash Tsys are closed until London hours owing to a Japanese holiday, while holidays in both Singapore and China are further limiting liquidity.

- A brief Alibaba-related sell off in the Hang Seng provided the most modest of bids during early Asia dealing, although that faded and allowed Tsys to move back from best levels pre-RBA.

- There wasn’t anything in the way of meaningful macro headline news flow to digest, leaving participants sidelined ahead of this week’s impending even risk (FOMC {& NFPs).

- Wednesday’s NY docket will see the release of factory orders, final durable goods readings and JOLTS job openings.

AUSSIE BONDS: Fresh Cycle Lows As RBA Surprises With 25bp Hike

Fresh cycle lows for both YM & XM as the RBA provides a larger than expected 25bp cash rate, while marking its near-term inflation forecast notably higher, indicating that both headline and underlying inflation will only fall back to the upper end of its target band by around mid-24.

- This provided a very hawkish tinge to the statement, with the Bank noting that the inflation outlook “will require a further lift in interest rates over the period ahead. The Board will continue to closely monitor the incoming information and evolving balance of risks as it determines the timing and extent of future interest rate increases.”

- A markdown in GDP expectations and a slight mark lower for the unemployment track were also indicated.

- It is had to get a handle on why the RBA chose to deploy a 25bp rate hike, did it view 40bp as too aggressive with the risk of destabilising bond/funding markets? Or did it want to show that it was willing to think outside of the box?

- YM last prints 15.5 ticks lower on the day, with XM -9.0 as the curve bear flattens. Note that both contracts hover a touch above session lows.

- Bills run 10-22 ticks lower through the reds with IRU2 & IRZ2 underperforming.

- Governor Lowe will speak ahead of the Sydney session close (16:00 Sydney/07:00 London).

FOREX: Hawkish RBA Rate Decision Boosts Aussie Dollar

Risk-on flows took hold in a partial reversal of Monday's price action, while hawkish surprises provided by the RBA’s monetary policy decision boosted the Aussie dollar.

- Australia's central bank raised the cash rate target by 25bp and signalled that meeting its inflation target “will require a further lift in interest rates over the period ahead”. Consensus was looking for a 15bp hike, while the swaps market was pricing just shy of that amount.

- It was a live meeting and ahead of the rate decision announcement, AUD/USD overnight implied volatility reached its highest point since the eve of the RBA's monetary policy decision delivered on Mar 2, 2021.

- Post-RBA impetus allowed AUD/USD to surged above the $0.7100 mark, which kept a lid on gains earlier in the Asia-Pac session. AUD/NZD took out resistance from the psychologically significant NZ$1.1000 figure, which limited gains on Apr 21, and attacked next resistance from Aug 18, 2020 high of NZ$1.1044.

- The greenback dropped back after yesterday's rally. Reminder that the FOMC also holds a policy meeting this week, with the outcome due to be announced on Wednesday.

- Offshore yuan reversed its initial gains after CCTV reported that the authorities in Hangzhou slapped curbs on an individual surnamed "Ma", even as Alibaba's shares rebounded as a statement from local police suggested that the tech giant’s co-founder could not be the person in question.

- Activity in Asia was limited by holiday closures in some major regional financial centres including mainland China, Japan and Singapore.

- Later in the day, focus will turn to U.S. factory orders & final durable goods orders, EZ jobs data as well as comments from BoC's Rogers.

FX OPTIONS: Expiries for May03 NY cut 1000ET (Source DTCC)

- USD/JPY: Y127.00($860mln), Y129.75($550mln)

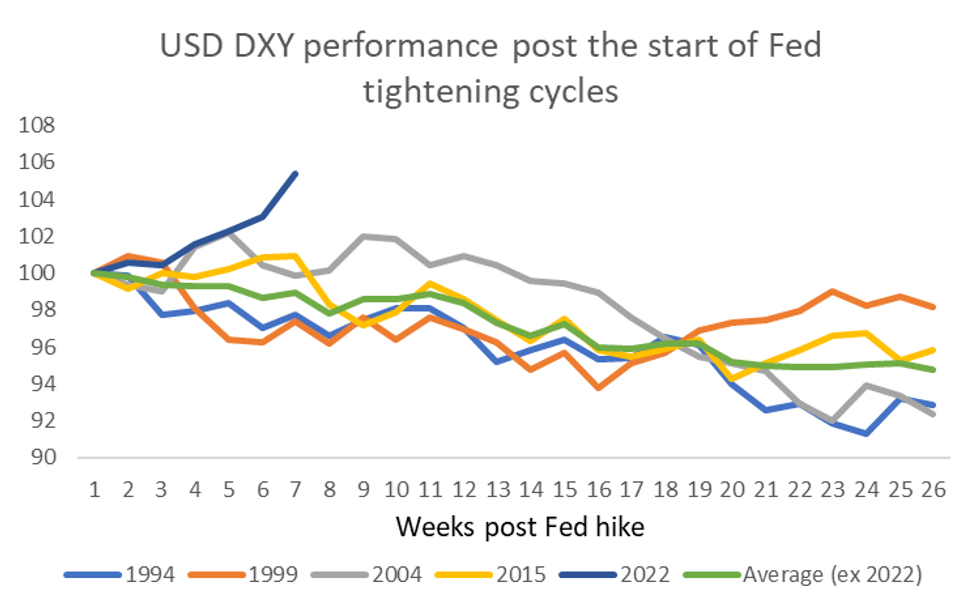

FOREX: MNI MARKET ANALYSIS: USD, Still Smiling

EXECUTIVE SUMMARY

- The USD has outperformed since the first Fed hike of the current tightening cycle, bucking the historical ‘norm’ whereby the USD typically peaks shortly after the first hike in the cycle, before depreciating.

- So why haven't we seen the 'sell the fact' scenario unfold? Well, firstly, yield differentials have continued to move in favour of the USD.

- A big part of the recent widening in the USD’s yield advantage is derived from a shift higher in Fed hike expectations, as the central bank looks to fight off inflation. This has been amplified by immediate recessionary fears in the Eurozone, while the ultra-dovish BoJ has also played a part in keeping G3 yields anchored at lower levels.

- In many respects the USD is benefiting from the dollar smile theory at present.

- Click for full piece: MNI Markets Analysis - USD, Still Smiling.pdf

ource: MNI - Market News/Bloomberg

ource: MNI - Market News/Bloomberg

ASIA FX: Holidays Sap Liquidity, Alibaba Headlines Take Focus

Offshore yuan gave up its initial gains despite a slip in the U.S. dollar index (DXY), with regional liquidity sapped by numerous market closures.

- CNH: Speculation surrounding the fate of a Hangzhou individual named "Ma" moved offshore yuan around, partly in tandem with Alibaba shares. The initial CCTV report pointing to cubs being imposed on such person prompted initial redback strength to evaporate. The rate continued to creep higher, even as Alibaba shares regained poise on the back of a subsequent clarification that the tech giant's founder could not be the person targeted by reported measures.

- KRW: Spot USD/KRW pared its initial gains amid broader greenback sales. South Korea's inflation accelerated more than forecast (again), raising pressure on the BoK to tighten policy further.

- THB: Spot USD/THB advanced, closing in on its five-year high printed on Apr 28. Pent-up market impetus was in play, as onshore markets re-opened after a long weekend, only to close again on Wednesday.

- Markets in mainland China, Indonesia, Malaysia, India and the Philippines were closed in observance of public holidays.

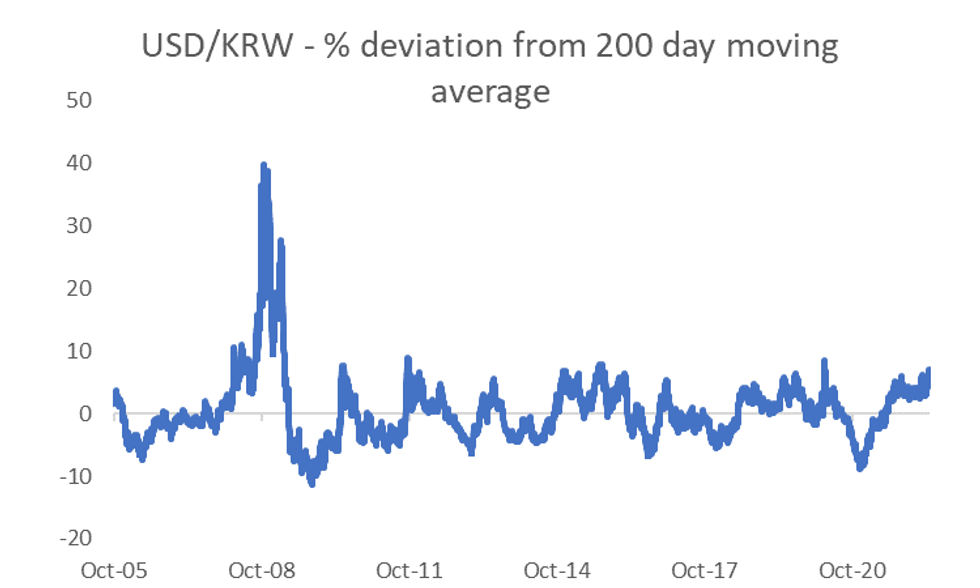

KRW: Rhetoric Around Won Weakness Rising

April's 3.6% surge in USD/KRW was the largest monthly rise since late 2016 for the pair. This puts us within striking distance of early 2020 highs close to KRW1,300.

- Still, the market may not expect further sharp won weakness in the near term.

- Rhetoric from the finance ministry is rising, with the ministry stating it was ready to stabilize currency sentiment if needed. The weaker won is also getting more domestic press (see this Korean Times article).

- Dividend outflows to offshore of just under $4bn in April will not be as large in May.

- USD/KRW is also quite elevated relative to its own 200-DMA, see the chart below. Post the 2008 financial crisis, this deviation has tended to peak ahead of +10%. We currently sit close to 7% on this metric.

There are medium term headwinds to be mindful of though, which may keep USD/KRW dips still relatively shallow.

- Weaker global growth, particularly from China, suggests export growth can slow further.

- Correlations with USD/JPY and USD/CNH are running at +90% for the past month.

- JPM highlighted continued domestic capital outflow pressures as well. NPS need to buy +$25bn in foreign assets to achieve their 55% foreign allocation by 2025. Retail investors are also expected to continue to invest offshore.

- Such outflows come when the terms of trade remain a headwind.

EQUITIES: Alibaba Headlines Dominate In Asia

Hong Kong equity trade provided one of the focal points of a holiday-constrained Asia-Pac session.

- The Hang Seng Tech Index shed over 4.0% in early dealing as participants returned from their elongated weekend. Softer than expected Chinese PMI data released over the weekend applied some pressure, but there was also some idiosyncratic news to factor in. Alibaba shares tumbled by nearly 10% after CCTV reported that China imposed “compulsory measures” on an individual with the surname of Ma, with the matter tied to national security. Speculation did the rounds that the individual involved could be Alibaba founder Jack Ma. We then saw some reprieve for both the tech sector and the wider Hang Seng as it became apparent that Jack Ma was not the individual in question. That, coupled with news of the next stage of relaxation of COVID curbs in Hong Kong, allowed the Hang Seng to recover. The Hang Seng Tech is now 0.5% lower on the day, comfortably above its early session trough, with Alibaba shares now in positive territory. The benchmark Hang Seng index is +0.3%.

- The ASX 200 unwound early losses and is little changed on the session.

- E-mini futures are 0.3-0.5% higher on the day, after the major Wall St. indices recovered Monday’s early losses ahead of the NY close, before pushing higher.

- Elsewhere, it is worth noting that Citi confirmed that its trading desk was behind Monday’s flash crash in Swedish equities. The bank noted that one of its traders “made an error when inputting a transaction. Within minutes, we identified the error and corrected it.”

GOLD: U.S. Real Yields Weigh Early In The Week

Gold has stuck to a narrow range in Asia-Pac dealing, last sitting just above $1,860/oz, little changed on the day. Monday’s shunt higher in U.S. real yields, which saw 10-Year real yields register a fresh cycle high and the first close in positive territory during the current cycle, allowed bears to force bullion below last week’s low. They now look to the 76.4% retracement of the Jan 28-Mar 8 rally ($1,848.8/oz) as the next area of meaningful technical support as the bearish threat intensifies

OIL: Marginally Higher In Asia After Monday’s Recovery

WTI & Brent crude futures sit ~$0.25 above their respective settlement levels at typing, with participants having little to trade off in overnight dealing.

- A reminder that Monday saw the early Chinese-inspired weakness, stemming from worry re: the COVID situation in Beijing & soft PMI data, countered by demand for refined products. This allowed the early losses in crude to be reversed, as the two major benchmarks finished with modest gains, aided by the continued global distaste (in general, not absolute terms) for Russian fuel.

- Weekly API inventory data is due late in the NY day on Tuesday.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/05/2022 | 0755/0955 | ** |  | DE | unemployment |

| 03/05/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 03/05/2022 | 0900/1100 | ** |  | EU | PPI |

| 03/05/2022 | 0900/1100 | ** |  | EU | unemployment |

| 03/05/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/05/2022 | - |  | EU | ECB Lagarde & Panetta in Eurogroup Meeting | |

| 03/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 03/05/2022 | 1300/1500 |  | EU | ECB Lagarde High School Q&A | |

| 03/05/2022 | 1400/1000 | ** |  | US | factory new orders |

| 03/05/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 03/05/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 03/05/2022 | 1515/1615 |  | UK | BOE Mutton Panellist at Bankers Association | |

| 03/05/2022 | 1630/1230 |  | CA | BOC Sr Deputy Rogers speaks on operational independence |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.