-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: Canada Apr-Dec Budget Deficit CAD21.7B Vs Prior CAD23.6B

MNI Credit Weekly: Fault Lines

MNI EUROPEAN MARKETS ANALYSIS: ACGBs Recover, Yen Fall Deepens

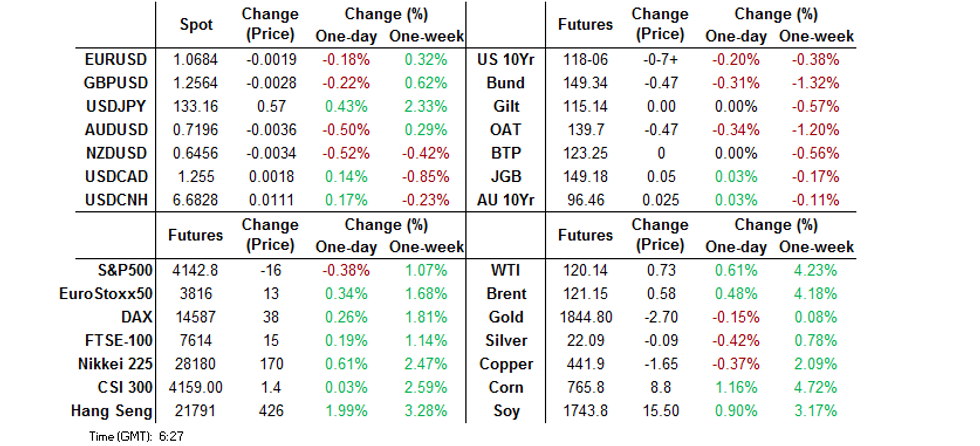

- The greenback outperforms in G10 FX space as yen weakness persists, with USD/JPY running to fresh cycle highs. Antipodeans are weighed on by offshore yuan sales.

- China equities retrace initial upswings amid suspected profit-taking. Earlier strength is linked to new game approvals issued by local entertainment authorities.

- Core FI come under pressure but ACGBs buck the trend. Overnight moves in U.S. Tsys spill over into Aussie bonds, as they correct post-RBA sell-off.

BOND SUMMARY: Overhang U.S. Tsy Impetus, Correction Of Post-RBA Slide Underpin ACGB Resilience

Wednesday brought a rebound in ACGBs which appeared keen to recoup some of their post-RBA losses. Headline flow was limited, offering little in the way of notable catalysts to nudge core FI space in any definite direction.

- Cash ACGBs turned bid as correction of their post-RBA sell-off was facilitated by the initial catch-up with overnight strength in U.S. Tsys. When this is being typed, ACGB yields sit 4.5-7.3bp lower in cash Sydney trade, with the curve running steeper. Futures contracts firmed, with YM last +7.0 & XM +4.5, both slightly off session highs. Bills trade 2-13 ticks higher through the reds. There was no reaction to an auction for A$800mn of ACGB Sep '26, which drew a bid/cover ratio of 3.28x (prev. 4.64x).

- T-Notes came under light pressure, grinding further away from their best levesl from Tuesday. TYU2 changes hands -0-06 at 118-07+ at typing, printing fresh session lows. Eurodollar futures run 0.5-2.0 ticks lower through the reds. Cash U.S. Tsy yields firmed a tad and last sit 1.4-2.2bp higher across the curve, with 10-Year yield within touching distance from the 3.0% level.

- JGB futures went offered in tandem with T-Notes. They last trade at 149.56, 5 ticks above previous settlement and close to session lows. Cash JGB yields are generally lower across the curve, but only marginally. Data released out of Japan failed to provoke any response, even as Q1 GDP figures were revised to reflect a smaller contraction. The BoJ conducted its Rinban operations covering 1-3, 3-5, 5-10 & 10-25 Year baskets, which saw the following offer/cover ratios:

- 1- to 3-Year: 2.57x (prev. 2.47x)

- 3- to 5-Year: 1.98x (prev. 2.23x)

- 5- to 10-Year: 2.23x (prev. 2.67x)

- 10- to 25-Year: 2.98x (prev. 4.27x)

FOREX: Yen Weakness Persists, Pullback In Chinese Equities Weighs On Yuan

The initial reprieve provided to Chinese tech space by a suite of new game approvals issued by Beijing did not last long as local equity benchmarks swung into losses, sending reverberations across financial markets. There were no obvious headline drivers behind the turnaround in Chinese stocks, stoking speculation of possible profit-taking. Offshore yuan dropped to fresh session lows in sync with the equity move, creating a drag on the Antipodeans. Spot USD/CNH remained comfortably within the confines of yesterday's range.

- The PBOC pledged to extend trading hours of China's onshore FX market as part of the broader push to open up domestic financial markets.

- Yen weakness remained a key theme amid firm conviction that the BoJ's ultra-loose monetary policy settings are here to stay. EUR/JPY breached the prior day's high ahead of the Tokyo open, resulting in broader yen weakness and facilitating the eventual upswing in USD/JPY to new two-decade highs. Spot USD/JPY last trades ~50 pips better off, with its 1-month risk reversal consolidating near the highest point since May 10.

- Gains vs. the yuan and yen helped the greenback to cement its position as the best G10 performer, with BBDXY rising steadily as the session progressed.

- Final EZ GDP, German industrial output & U.S. wholesale inventories take focus from here.

FOREX OPTIONS: Expiries for Jun08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E606mln), $1.0650(E658mln), $1.0680-85(E510mln), $1.0750-60(E880mln), $1.0800(E880mln)

- USD/JPY: Y130.00-15($709mln)

- GBP/USD: $1.2450(Gbp702mln)

- EUR/GBP: Gbp0.8585-95(E662mln)

- NZD/USD: $0.6315(A$1.1bln)

ASIA FX: Weaker As JPY & Equities Weigh

USD/Asia pairs are mostly higher today, with sentiment deteriorating as the session progressed. Higher USD/JPY levels remain a headwind, while equity sentiment also softened.

- CNH: USD/CNH has pushed back above 6.6800, with earlier onshore equity gains unwound. We remain below yesterday's highs of just under 6.6900. Tomorrow May trade figures are on tap. Hong Kong shares are still stronger, led by tech shares on positive regulatory news.

- KRW: Spot USD/KRW dips have generally been supported. We are back above 1256, same for the 1 month NDF. Q1 GDP was revised down slightly, while the Kospi has struggled to stay in positive territory. Offshore investors have sold $111mn in local equities today.

- INR: USD/INR is unchanged, currently sitting just above 77.70. As expected, the RBI hiked the policy rate by 50bps. There is more work to do as the central bank raised its inflation forecast to 6.7%, from 5.7% previously.

- MYR: Spot USD/MYR has backed further away from a test of 4.4000. We currently sit at 4.3925. FX reserves data for May are due later today.

- PHP: USD/PHP 1-month NDF trades +0.040 at PHP53.090. Topside focus falls on Jun 6 high of PHP53.280, while bears keep an eye on May 30 low of PHP52.230. BSP's Medalla, who is set to become Governor on July 1, said in an interview that the central bank will likely deliver at least two more rate hikes to curb inflation.

- THB: USD/THB is a touch higher, but found some resistance above 34.50, last at 34.49. The Bank of Thailand is expected to keep its policy rate unchanged at 0.50% today despite accelerating inflation, as it considers price pressures to be driven by supply-side factors and sees the need to continue supporting economic recovery. See the full preview at this link.

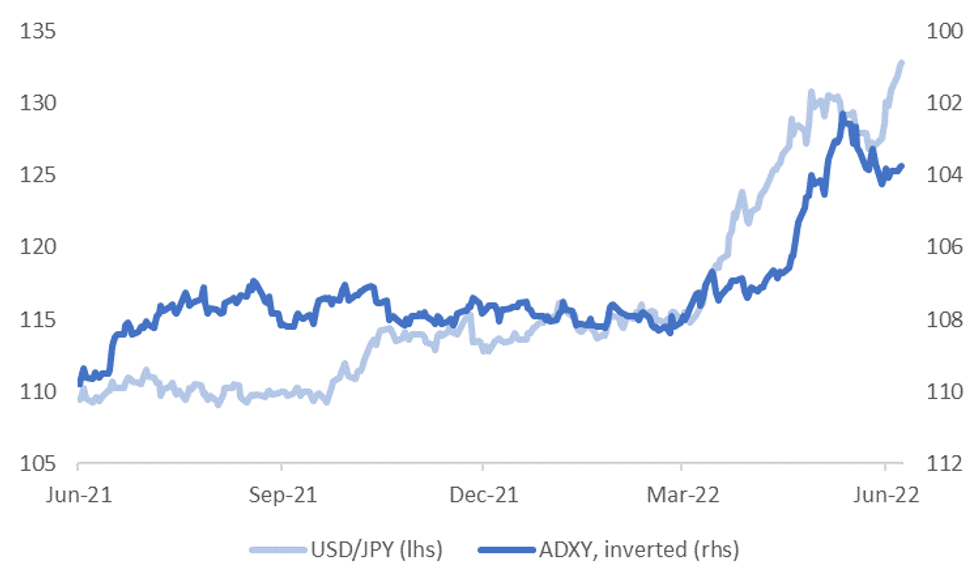

ASIA FX: USD/JPY & USD/Asia Correlations

All of Asia FX has outperformed the JPY sell-off this year. That's not to say higher USD/JPY moves can't influence USD/Asia pairs. As we outline below, correlations this year between USD/JPY and Asian FX have generally been positive, although more so for North East Asia FX and currencies with strong trade links to Japan, such as THB and PHP.

- The first chart below overlays USD/JPY against the ADXY index, which is inverted on the chart.

- The ADXY has only fallen modestly during the recent surge higher in USD/JPY. Still, higher USD/JPY levels can still influence USD/Asia pairs, even if we see this relative divergence persist.

Fig 1: USD/JPY & ADXY Trends

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

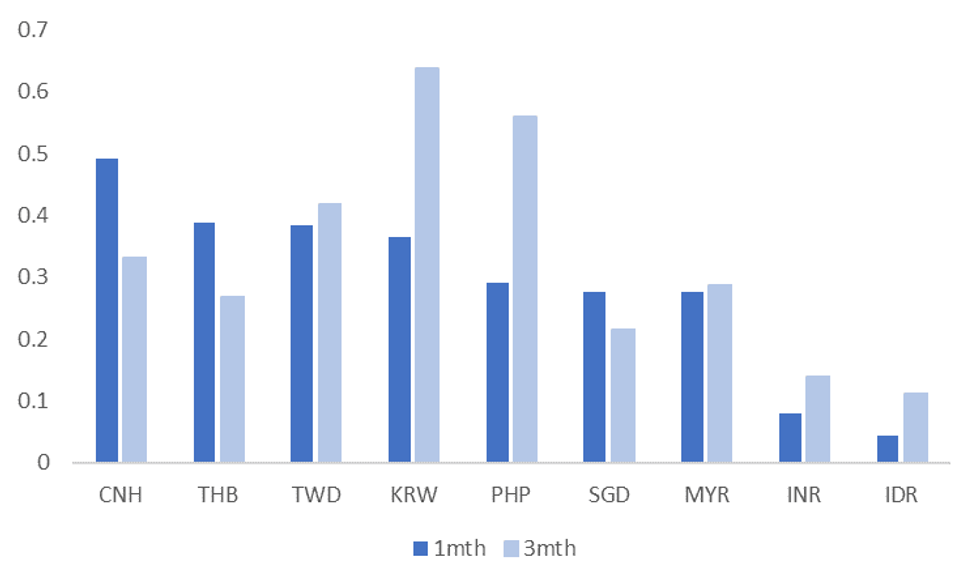

- The second chart below plots the average correlations between USD/JPY and all the major USD/Asia pairs for 2022. We do this for both rolling 1 month and 3 month correlations.

- Correlations are higher for north east Asia currencies, like CNH, TWD and KRW. They are also elevated for THB and PHP. Yen weights in trade weighted indices for THB and PHP are quite high at 15.7% and 15.3% respectively. They are also high for the NEA bloc.

- As we have also noted in relation to KRW, Japan represents export competition for Korea and other NEA economies to some extent. So, a weaker yen will leave the respective central banks mindful of reduced competitiveness.

- Correlations are lower for INR and IDR. For INR, trade linkages are much lower with Japan compared to the rest of the region. For IDR trade linkages are quite high, but relative IDR/JPY performance may be more influenced by capital flows, particularly in relation to carry trades, given IDR's high yielder status relative to JPY.

Fig 2: USD/JPY & USD/Asia Average 2022 Correlations

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Chinese Tech Pares Gains; Australian Financials Founder Post-RBA

Major Asia-Pac equity indices are mostly higher at typing, mirroring a lead from Wall St. An initial region-wide equity rally led by Hong Kong and Chinese stocks was later reduced on a reversal in the latter, taking most regional benchmarks off of their session highs in the process.

- The Hang Seng Index sits 1.5% firmer at typing, backing away from session highs as initial strength in China-based tech and financials moderated through Asia-Pac dealing. The Hang Seng Tech Index is 2.7% better off (back from session highs at +4.3%), with well-known tech large-caps catching a bid on as worry re: regulatory crackdowns on the sector have continued to ease. To elaborate, authorities on Tuesday approved a second, larger batch of video games for ‘22, lifting sentiment in the tech sector (keeping in mind the crackdown on the sector that began in ‘21), and adding to positive sentiment after previously-flagged reports that regulators were looking to wrap up investigations in Didi Global and other tech companies.

- The CSI300 is 0.4% worse off at typing, sharply flipping from gains of as much as 1.1% to losses on a broad market-wide retreat, and underperformance in the industrials sub-index (-2.5%), led by weakness in major battery manufacturer CATL (-6.8%).

- Equity trading volumes for Chinese stocks crossed CNY1.0tn on two consecutive days this week (Mon and Tue) - the first time this has happened since mid-March, and before the most recent in-country COVID flare-up.

- The Nikkei 225 sits 0.9% higher at writing with some optimism evident, aided by the release of better-than-expected final Q1 GDP figures earlier in the session. Broader JPY weakness again provided a tailwind to Japanese equities as well, with real estate and export-related names leading gains.

- The ASX200 is 0.4% better off at typing, operating a little above worst levels after paring gains from best levels near the open(~+0.9%) . Gains in energy, materials, and technology names were able to offset steep losses in the “Big 4” Australian banks, which each sit 2.6% to 5.6% lower apiece at writing. A note that the underperformance in the latter four comes after the RBA’s surprise 50bp hike on Tuesday, with the ASX200 Financials sub-index now on track for a third-consecutive day of losses, down ~5.3% for the week so far.

- U.S. e-mini equity index futures trade 0.3% to 0.4% lower at typing, operating a little below their respective best levels made late in Tuesday's NY session.

CHINA: Trade Data Out Tomorrow, Authorities Cautious on Outlook

China trade figures for May are out tomorrow. The market expects an improvement in conditions versus April, with export growth to rise to 8.0% YoY from 3.9%, while imports are also expected to rise to 2.8% from flat. The trade surplus is forecast to widen to $57.70bn from $51.12bn.

- Stronger than expected South Korea export growth for May and a resumption of trade activity through Shanghai port, which is reportedly back to 95% of normal activity, are positive partial indicators.

- Of course, the recovery in Shanghai trade activity may show up better in June figures.

- Earlier comments from the China commerce minister suggest some caution though. The Deputy Commerce Minister stated that global demand is low, and that China faces pressure stabilizing trade.

- Logistics and high transport costs are other headwinds. More work will be done to secure orders, but orders lost to date are manageable the ministry stated.

GOLD: Weaker In Asia Trading

Gold is edging lower today, down around 0.30% from the NY close, to be back on a $1846 handle.

- Today's weakness is mainly reflective of the rebound in USD sentiment. The DXY is up around 0.25% on the day.

- Firmer US yields haven't helped either, with the 10yr almost back above 3.00% (+2bps since the open).

- Equities have been mixed, opening firmer, but have lost ground as the session progressed. US equity futures are lower.

- Overnight, gold got close to $1856, as the USD weakened and US yields came off. The World Bank lowered its 2022 global growth forecasts, which also reportedly helped demand.

- Note support should still be seen just below $1840 and around the low $1830 level.

OIL: WTI Holds Near Recent 13-Week Highs; U.S. Inventories Eyed

WTI and Brent deal ~$0.40 firmer apiece at typing, putting them narrowly on track to close higher for the fourth session in five.

- To recap, both benchmarks whipped between gains and losses on Tuesday to ultimately close ~$1 firmer, with WTI struggling to make headway above the $120 handle after backing away from 13-week highs ($120.99) made on Monday.

- Prevailing worry re: tightness in global crude supplies has continued to mix with expectations for a rise in global fuel demand for the remainder of ‘22, helping crude to catch a bid in recent sessions. Adding to the debate, the U.S. EIA has forecast Russian fuel exports to decline by ~18% come end-’23 (~2mn bpd decline in supply), mainly on the EU’s incoming, phased ban on Russian crude.

- Production at Libya’s recently-restarted Sharara oilfield (~280K bpd capacity) has been reportedly halted since late Monday, while ~10% of Norway’s offshore oil and gas workers are due to strike later on Sunday should relevant negotiations fail.

- The latest round of U.S. API crude inventory estimates crossed late on Tuesday, with reports pointing to a surprise build in crude inventories and an increase in gasoline and distillate stockpiles, while Cushing hub stocks declined.

- Looking ahead, U.S. EIA inventory data is due later on Wednesday (1530 BST), with WSJ and BBG estimates pointing to expectations for a drawdown in crude inventories.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/06/2022 | 0545/0745 | ** |  | CH | unemployment |

| 08/06/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 08/06/2022 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 08/06/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 08/06/2022 | 0645/0845 | * |  | FR | Current Account |

| 08/06/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 08/06/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 08/06/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 08/06/2022 | 0900/1100 | *** |  | EU | GDP (2nd est.) |

| 08/06/2022 | 0900/1100 | * |  | EU | Employment |

| 08/06/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 08/06/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/06/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 08/06/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.