-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Chinese Equities Claw Back Losses, Focus Turns To U.S. CPI

- Moderation in price pressures shown by the latest Chinese inflation data provides some reprieve despite worrying COVID-19 goings-on in China. Local equity benchmarks recoup initial losses.

- The greenback loses ground ahead of the release of U.S. CPI report. The yen finds poise after a five-day losing streak.

- U.S. Tsys & ACGBs come under pressure but JGBs prove resilient, with Japanese financial officials due to hold a meeting on financial markets later in the day.

BOND SUMMARY: 10-Year JGB Yield Wary Of Testing 0.25% Ceiling, Tsys & ACGBs Slip

Benchmark JGB futures crept higher as T-Notes and Aussie bond futures struggled for momentum. Regional headline flow was fairly light and centred around Chinese inflation figures, as the perceived moderation in price pressures sparked speculation re: PBOC easing prospects.

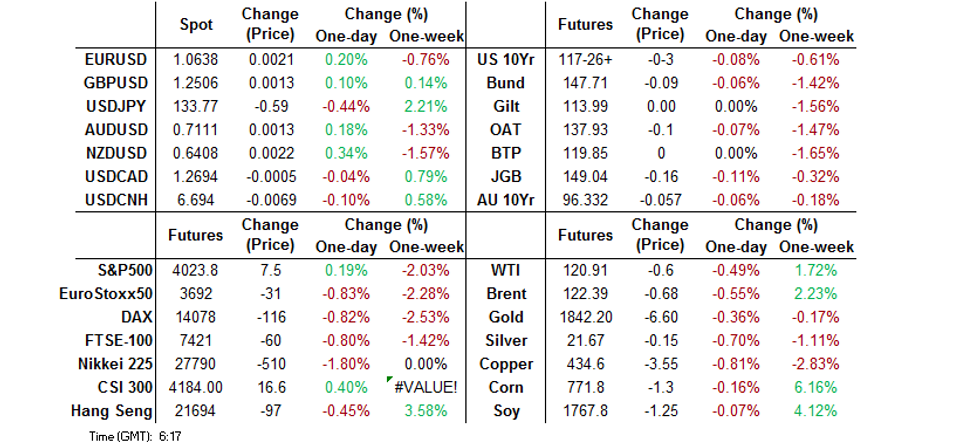

- T-Notes found support at 117-25+ after its initial downtick and stabilised within a narrow range thereafter. They last trade -0-02 at 117-27+, close to the mid-point of that range. Eurodollar futures run 0.25-1.0 tick lower through the reds. Cash Tsys slipped across the curve, with yields last seen 0.8-2.4bp higher. All eyes will be on U.S. CPI data, with headline inflation expected to have topped 8% in May. Also coming up is the flash reading of June Uni. of Mich. Sentiment, but inflation data will obviously take precedence.

- JGB futures ground higher but buying pressure lacked conviction. They last change hands at 149.58, 7 ticks shy of yesterday's settlement/session high. Cash JGB yields are barely changed across the curve, with 10-year yield operating within touching distance from the 0.25% cap of its permitted trading band. That said, it refrained from testing that level, as participants seem confident about the BoJ determination to enforce its interest-rate peg.

- Cash ACGBs weakened from the off as spillover from the NY session weighed. The curve runs steeper at typing, with yields last seen 2.2-5.0bp higher as 10s underperform. Light steepening impetus materialised in futures space as well, YM now trades -2.6 & XM -5.2. Bills last 2-5 ticks through the reds. The AOFM's issuance slate for next week provided nothing to rock the boat, with local financial markets due to be shut on Monday.

FOREX: Greenback Loses Shine, Yen Finds Poise

News flow quietened towards the end of the week in Asia, with participants watching mild oscillations in risk appetite. While widening partial lockdown measures in Shanghai provided a source of worry, China's latest inflation figures revived sentiment. Headline CPI coming in at +2.1% Y/Y vs. +2.2% expected and an in-line deceleration in factory-gate price growth suggested that price pressures are moderating, opening some scope for the PBOC to ease policy, even if there have been no concrete announcements on that front as of yet.

- The yen eked out some gains and USD/JPY is on track to snap a five-day winning streak. Technical conditions for the pair remain overbought, with the RSI still above 70. USD/JPY 1-month risk reversal extended its pullback from a one-month high printed earlier this week. FinMin Suzuki stuck to his usual lines on the yen, vowing to watch FX moves with urgency and stressing the importance of yen stability, without citing any specific levels.

- The greenback faltered against all of its G10 peers, even as Tsy yields edged higher, ahead of the key U.S. CPI report which is expected to show that the rate of consumer price growth topped 8%. Despite trimming some gains today, the U.S. dollar remains the best G10 performer this week.

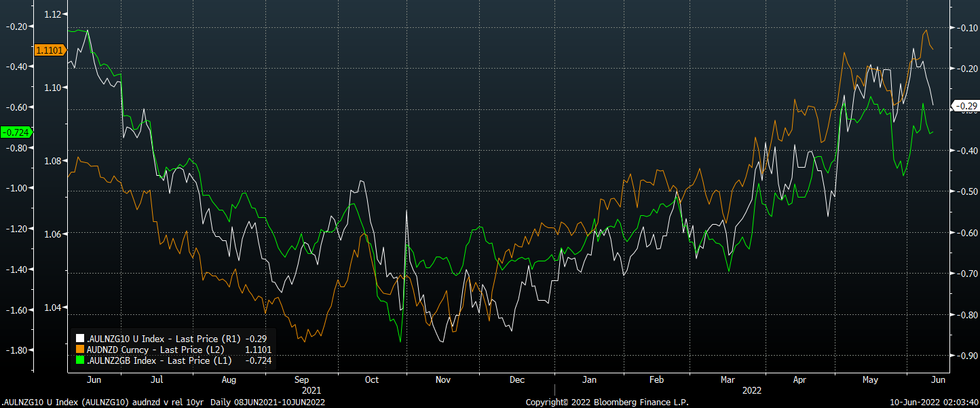

- The Aussie dollar struggled for any topside impetus, diverging from its Antipodean cousin, with AUD/NZD moving sub-NZ$1.1100. Back-end yield spreads continued to move against AUD relative to NZD, but we have seen stability at the 2-year tenor.

- With China inflation data already out, focus turns to the closely watched update on U.S. consumer prices. Also on tap are flash U.S. Uni. of Mich. Sentiment & Canadian unemployment as well as comments from ECB's Villeroy, Holzmann & Nagel.

FOREX OPTIONS: Expiries for Jun10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E905mln), $1.0790-00(E1.8bln), $1.0900(E1.3bln)

- USD/CAD: C$1.2600($525mln), C$1.2735-50($1.1bln)

ASIA FX: Mixed Trends

Asian FX has been mixed today. Spot KRW and TWD remain under pressure, but CNH has outperformed to a degree. THB and INR weaker trends persist.

- CNH: USD/CNH continues to see offers above 6.7000. We saw another firmer than expected CNY fixing today, which helped. Inflation data was slightly weaker than expected, fueling some speculation of easier policy settings. Local equities rebounded from earlier losses, which aided sentiment.

- KRW: The won has found little joy from some USD softness against the majors. Equity outflows persist, well over $1bn in the past 2 sessions combined. Earlier, the current account dipped into deficit in April, but this trend should improve in May.

- INR: USD/INR is edging higher in early trade, tracking above 77.80, which is at fresh record highs for the pair. There is little relief from the dip in oil prices, but onshore equities are more 1% weaker, so this is likely to be offsetting the crude dip.

- IDR: Spot USD/IDR has extended its bullish run as it gapped higher at the re-open, but buying momentum petered out thereafter. The rate last deals at IDR14,578, up 15 figs on the day. Indonesia revised its rule on palm oil export tax, setting its maximum rate at $288/ton for CPO trading north of $1,500/ton. The revised rule takes effect today.

- PHP: USD/PHP has been relatively steady, with spot hugging the 52.95 level. The Philippines' unemployment rate slipped to 5.7% in April from 5.8% recorded in March as the labour market continued to tighten. The underemployment rate also moderated (to 14.0% from 15.8%), but so did the participation rate (to 63.4% from 65.4%).

- THB: Spot USD/THB has pushed up to 34.66, +0.5% above yesterday's closing levels. The opposition is preparing to file a no-confidence motion against PM Prayuth and nine of his ministers next Wednesday. A source told the Bangkok Post that this will be the last no-confidence debate before the government's term expires in March 2023.

AUD: A$ Struggling Against Other Commodity FX

AUD/USD has moved up from earlier lows to be back close too unchanged on the day at 0.7100. AUD/JPY shifts are a key driver at the moment, although as we note below A$ underperformance against other commodity FX has been a theme post the RBA this week.

- AUD/USD's bounce from 0.7085, coincided with AUD/JPY rebounding off the 95.00 level. We are now back to 95.20 on this cross. The USD/JPY dip below 134.00 was supported.

- US equity futures are close to flat and while the mood for Asia Pac remains weak, China/HK markets are off early lows.

- AUD/NZD is not far from its recent lows though. The pair is trying to break back sub 1.1100. Back end yield spreads continue to move against AUD relative to NZD, but we have seen stability at the 2yr tenor, see the chart below. The AUD/NZD cross is now down 0.55% from its post RBA peak (around 1.1160).

Fig 1: AUD/NZD & Relative Yield Spreads

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

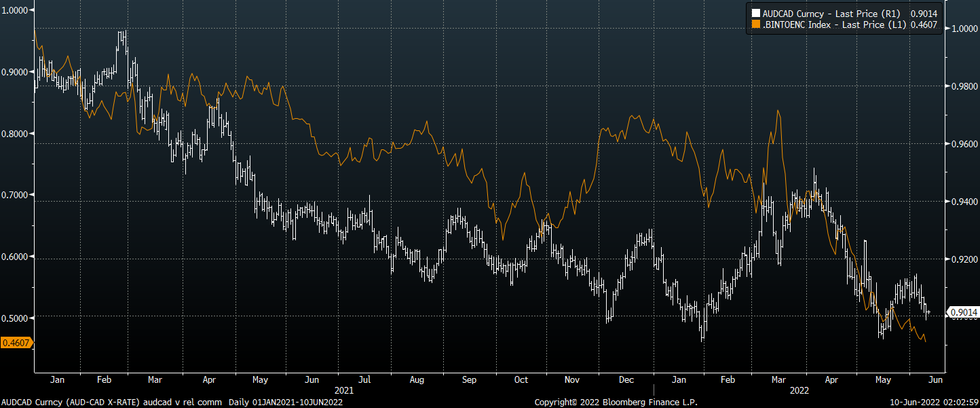

- AUD/CAD is down by more from its post RBA peak. Higher risk aversion is one factor, while AU-CA yield differentials have actually recovered in AUD's favor in recent sessions.

- Still, relative commodity trends are biasing this cross lower. The second chart below overlays the AUD/CAD cross against the ratio of base metal prices to energy commodity prices.

- Bleak global growth updates presented by both the OECD and World Bank this week hasn't helped at the margin in terms of the commodity demand outlook, while iron ore is back sub $139/tonne from recent highs of $146/tonne.

- This weekend's lockdown of 7 districts in Shanghai a likely factor in tempering recent optimism in the iron ore space.

- Note AUD/CAD is quite close to the 0.9000 level (last 0.9020). The pair has troughed ahead of 0.8900 in the past 6 months.

Fig 2: AUD/CAD & Relative Commodity Prices

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

KRW: USD/KRW Back To Late May Highs On Equity Outflows

Spot USD/KRW continues to push higher, with the won not seeing much benefit from a slightly weaker USD against the majors. We were last at 1267.25, with weaker onshore equities and continued net equity outflows remaining meaningful headwinds.

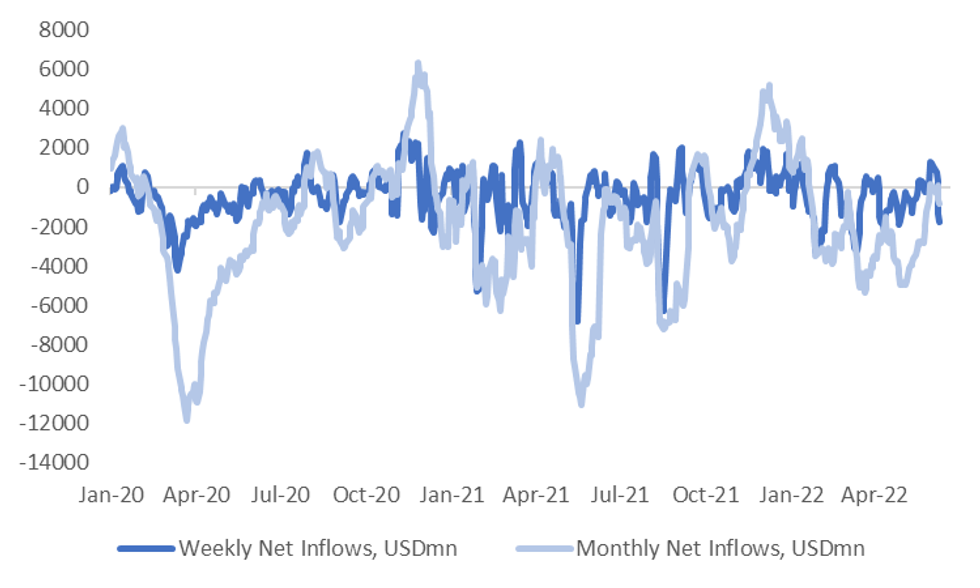

- Today has seen the Kospi dip a further 1.40%, while offshore investors have sold an additional $519mn in local equities so far. This comes on top of the $837 sold yesterday, which was the largest net daily outflow since early April.

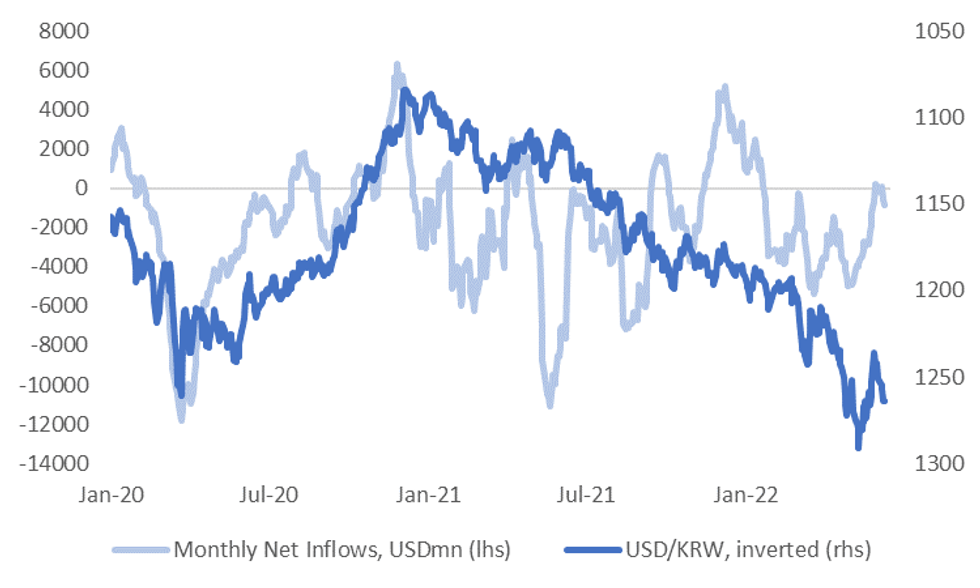

- The first chart below shows the rolling weekly and monthly net inflow trends. The past 5 trading sessions has seen just over $1.7bn in net outflows. For the past month it is a more modest -$858mn in net outflows.

- We did see a burst of positive inflow momentum at the end of May but this clearly hasn't carried over into June.

Fig 1: South Korean Equity Outflows Persist

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- Correlations between USD/KRW and equity flows remain fairly strong at the moment. The second chart plots USD/KRW, which is inverted on the chart, and the rolling monthly net inflow trend.

- If we see a period of sustained outflow momentum this could coincide with USD/KRW revisiting earlier highs of close to 1290, which would likely test the resolve of Korean authorities around FX stability.

- For flow prospects to improve, equity sentiment needs to be on a better footing, particularly in the tech space. Correlations between Korean equity inflows and local equities sits above 80%, likewise for the SOX semiconductor index and the MSCI IT index.

- These sectors haven't been able to sustain upturns this year, with tighter global monetary policy conditions and concern around the demand outlook weighing.

Fig 2: USD/KRW & Net Equity Inflows, Rolling Monthly Total

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Lower In Asia Ahead of U.S. CPI; China Covid Worry Drives Materials Lower

Most major Asia-Pac equity indices are lower at typing on a negative lead from their U.S. and European counterparts. Energy and commodity-related equities have broadly declined throughout the session, with worry surrounding China’s well-documented, partial re-introduction of pandemic control measures have sent commodity benchmarks a little lower.

- The Hang Seng Index deals 0.2% softer at typing, staging a dramatic recovery from session lows near the open at around -3.1%. The Hang Seng Tech Index sits 0.9% firmer at typing, with broader optimism surrounding an easing in China-based tech re: regulatory crackdowns neutralising growth worry from some quarters following an earnings miss from video streaming giant Bilibili Inc (-14.8%).

- The CSI300 bucked the broader trend of regional peers, trading 0.4% higher and operating around session highs at typing after opening lower. Tech-related names lead the bid, with the ChiNext and STAR50 indices sitting 1.0% firmer apiece. Zooming out, debate re: the “investability” of Chinese equities continues to take focus, with HKEX data pointing to net foreign inflows through the Hong Kong Stock Connect of around CNY26.1bn for the first five days of June - more than that seen in May (CNY16.9bn) and April (CNY6.3bn).

- The ASX200 sits 1.3% worse off at typing, with energy and material names underperforming. Closely-watched Australian financials are on track for a fifth straight day of losses, although the sub-index has remained clear of Thursday’s 14-month lows through Asia-Pac dealing, aided by marginal gains in the ‘Big 4’ banks.

- The Nikkei 225 trades 1.4% lower at typing, on track to snap a five-session streak of gains. Major exporters and large-caps have given up some of their recent gains as the JPY has seen a little strength, with broader appetite for equities sapped by COVID-related growth concerns in China.

- U.S. e-mini equity index futures sit 0.2% to 0.4% better off at writing. The contracts currently operate a little above their respective, recently-made 2-week lows, following a 1.9% - 2.7% lower close on Thursday.

- Looking ahead, U.S. CPI crosses at 1330 BST.

GOLD: Edging Lower Ahead Of US CPI Data

Gold has edged lower today. back sub $1846, but we remain above the overnight lows of close to $1840.

- The precious metal is experiencing mixed cross asset drivers at the moment, but we remain very much within recent ranges ahead of key US CPI data tonight.

- In many respects, gold outperformed the USD bounce overnight, although safe haven demand emerged as US equity losses mounted.

- Higher US yields today has likely weighed at the margin as well.

- US real 10yr yields are now at 0.29%, not too far away from recent cyclical highs (0.34%). A move above 0.30% or higher could see gold test lower, although support is evident around $1840 and again around $1830 from the start of the month.

- For the week, gold is still lower, consistent with higher USD levels and the rise in yields.

OIL: Lower Amidst Possible Shanghai Lockdown Redux

WTI and Brent deal $0.80 weaker apiece at typing, edging away from session lows after breaking under Thursday’s worst levels earlier despite a lack of obvious headline catalysts. The move lower has mostly unwound gains made following Wednesday’s U.S. EIA oil inventory data release - which had pointed to tightness in crude supplies.

- To recap Thursday’s price action, WTI and Brent extended a pullback from mid-week highs to close ~$0.50 lower, with some downward pressure from an uptick in the USD (DXY) to its own three-week highs. WTI is nonetheless on track to record a seventh straight week of gains (sixth in seven weeks for Brent).

- The outlook for Chinese energy demand has again begun a descent into uncertainty, seeing crude benchmarks operate off recent highs. Shanghai authorities on Thursday announced mass testing to begin on Saturday, with the earmarked ~15mn residents to be under “closed-off management” until testing ends. Fresh COVID cases for the city remains low at 11 reported for Thursday, although six of those cases were found outside of quarantined areas - a key metric that officials have cited in past decisions re: lockdowns.

- A note that Beijing on Thursday closed entertainment venues in the Chaoyang and Dongcheng districts on COVID concerns, with the city today reporting eight cases for June 9.

- Commentary surrounding the EIA’s mid-week report has pointed out that demand for gasoline in the U.S. remains high despite higher pump prices, weighing against earlier expectations for demand destruction amidst the U.S. “summer driving season”.

- An S&P Platts survey released on Thursday has pointed to OPEC+ collectively increasing output by 120K bpd in May, with the group’s shortfall in production from current output quotas topping out at 2.616mn bpd - largely corroborating earlier remarks from the UAE’s energy minister.

- Elsewhere, hope surrounding Iranian nuclear talks have taken a sharp turn southwards as Iran has removed 27 cameras used by the UN’s IAEA to monitor nuclear sites (albeit in supposed retaliation for the agency’s recent resolution condemning the country), with IAEA chief Rafael Grossi calling it a “fatal blow” to a nuclear deal.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/06/2022 | 0001/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 10/06/2022 | 0130/0930 | *** |  | CN | CPI |

| 10/06/2022 | 0130/0930 | *** |  | CN | Producer Price Index |

| 10/06/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 10/06/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 10/06/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 10/06/2022 | 0830/0930 | ** |  | UK | Bank of England/TNS Inflation Attitudes Survey |

| 10/06/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 10/06/2022 | 1230/0830 | *** |  | US | CPI |

| 10/06/2022 | 1345/1545 |  | EU | ECB Lagarde Message for Goethe Uni Law & Finance Institute | |

| 10/06/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 10/06/2022 | 1400/1000 | * |  | US | Services Revenues |

| 10/06/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 10/06/2022 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.