-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: U.S. Gasoline Tax Holiday Imminent

EXECUTIVE SUMMARY

- BARKIN: FED TO DO 'WHAT IT TAKES' ON INFLATION (RTRS)

- BIDEN TO CALL ON CONGRESS WEDNESDAY TO PASS GAS TAX HOLIDAY (BBG)

- GERMANY PREPARES TO TRIGGER SECOND STAGE OF EMERGENCY GAS PLAN (BBG)

- ITALY UNVEILS MEASURES TO BOOST GAS STORAGE AFTER DROP IN RUSSIAN FLOWS (RTRS)

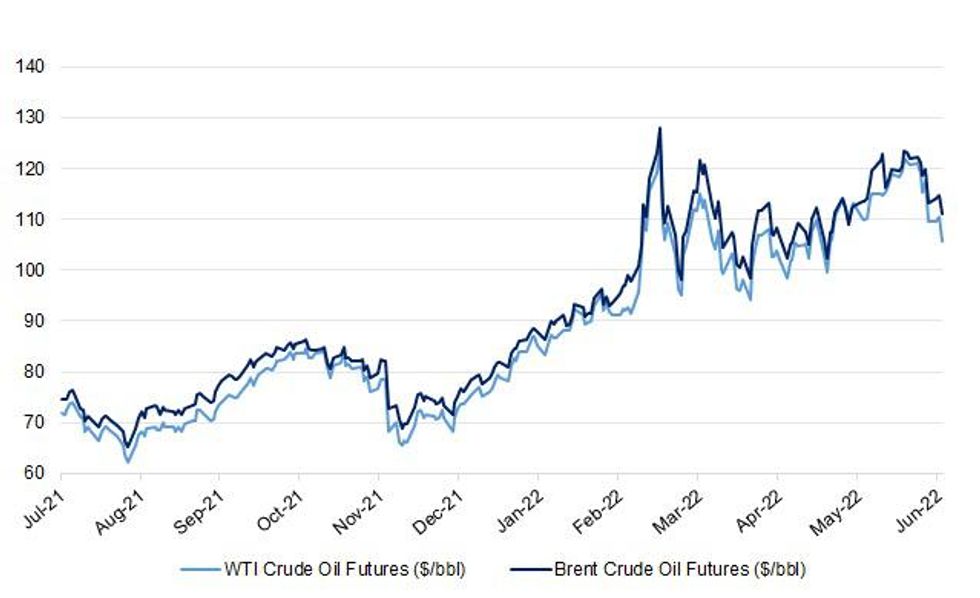

Fig. 1: WTI & Brent Crude Oil Futures ($/bbl)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Brexit has damaged Britain's competitiveness, will reduce productivity and leave the average worker poorer than they otherwise would have been, according to a new study. The Resolution Foundation said leaving the EU has reduced how open and competitive Britain's economy is. And it goes further to say it has also led to an increase in cost of living and the level of business investment falling. The report, in collaboration with the London School of Economics, said this was all as a result of a "depreciation-driven inflation spike" following Brexit. (Sky)

POLITICS: Correspondence exists confirming that Boris Johnson attempted in 2019 to secure a senior role for his then girlfriend, Carrie Johnson, at the Foreign Office, a source has said, amid growing calls for an inquiry. The source, who worked with Johnson at the time, said Carrie Johnson – now the prime minister’s wife – had never progressed as far as formally applying for the role. But they claimed that Johnson, then foreign secretary, had repeatedly pressed for her to be picked for the senior taxpayer-funded job, a fact reflected in internal documentation from the period that could be examined by an inquiry. (Guardian)

FISCAL/ENERGY: UK Chancellor of the Exchequer Rishi Sunak is due to meet with oil and gas producers amid discontent over the windfall tax he announced last month. The discussion, which is scheduled take place on Thursday in Aberdeen, Scotland will include senior management and chief executives of oil and gas companies that operate in the North Sea, according to people with knowledge of the meeting, who asked not to be named because the information isn’t public. (BBG)

EUROPE

GERMANY: Germany is preparing to trigger the second stage of a three-stage gas emergency gas plan, a move that may mean passing along higher prices to industry and households. The government may soon move to the “alarm” stage, according to a person familiar with the matter. The country has been at the “early warning” stage since March 30. Germany is seeking to reduce gas use to shore up inventories after Russia cut deliveries last week by about 60% through a key pipeline. Economy Minister Robert Habeck said the move by Russia was aimed at unsettling the markets. (BBG)

FRANCE: France's economy will slow more than expected this year due to the current energy price shock, while inflation will climb higher than previously expected, the central bank said on Tuesday. The euro zone's second-biggest economy was set to grow 2.3% this year, before slowing to 1.2% in 2023 and picking up to 1.7% in 2024 as the impact of the crisis subsided, the Bank of France said in its quarterly outlook. The central bank estimated that the fallout from the war in Ukraine would cost France's economy the equivalent of 2 percentage points of gross domestic product over 2022-2024. (RTRS)

ITALY: Italy's Foreign Minister Luigi Di Maio said on Tuesday he was leaving the 5-Star Movement to form a new parliamentary group backing the government of Prime Minister Mario Draghi. Di Maio's move comes after he accused 5-Star leader and former Prime Minister Giuseppe Conte of undermining government efforts to support Ukraine and weakening Rome's standing within the European Union. "Today's is a difficult decision I never imagined I would have to take ... but today me and lots of other colleagues and friends are leaving the 5-Star Movement," Di Maio, himself a former 5-Star leader, told a news conference. (RTRS)

ITALY: Italy's government on Tuesday announced initial measures to boost gas storage after energy company Eni reported a shortfall in flows from Russia for more than a week. Ecological Transition Minister Roberto Cingolani said in a statement thatRome planned to purchase coal to be ready to maximise the use of coal-fired power plants if needed to save gas. He also asked gas grid operator Snam to adopt measures to help bring gas stockpiles to around their targeted level for June. Italy gets about 40% of its imported gas from Russia and, like other European Union nations, has begun efforts to diversify its energy supply mix in the wake of Moscow's invasion of Ukraine. The Italian government plans to have the country's gas storage system filled to at least 90% of its capacity by November, in line with an EU-wide target. Italy reached a level of 55% on Tuesday and, according to a source with knowledge of the matter, aims to hit 60% by the end of this month. (RTRS)

ITALY/BTPS: Italy plans to sell up to EU4 billion ($4.22 billion) of bonds due May 30, 2024 in an auction on June 24. (BBG)

ITALY/BTPS: Italy sold 2.45 billion euros ($2.59 billion) of its latest BTP Italia inflation-linked bond due in June 2030 to retail investors on Tuesday, taking total orders to 5.87 billion euros in the first two days of its offering. The bond underperformed the May 2020 issue of a similar note, with a 5-year maturity, data by Italy's bourse showed. The past issue had raised 4.77 billion euros on the second day it was offered to retail investors, with total orders at 8.79 billion euros in the first two days of offer. (RTRS)

SWEDEN: Swedish residential property prices fell 1.6% on the month in May, according to the Nasdaq OMX Valueguard-KTH Housing Index. HOX Sweden index fell 2.0% in the 3 months through May and rose 2.9% y/y. Adjusted for seasonal effects, the index fell 1.2% m/m in May. (BBG)

U.S.

FED: The U.S. Federal Reserve has made clear it will be resolute in bringing down high inflation even though it raises the risk of a recession, Richmond Fed President Thomas Barkin said on Tuesday. "We are meeting the test we face and have made clear we will do what it takes," Barkin told a local risk management association in Richmond, Virgina. "There is of course recession risk along the way, but there's also the prospect of the economy returning closer to normal." Earlier on Tuesday at a separate event, Barkin said he saw an interest rate increase of 50 or 75 basis points at the U.S. central bank's next meeting in July as "pretty reasonable." (RTRS)

FED: Demand pressures account for just a third of the recent U.S. PCE inflation run-up, signaling price pressures may remain tied to how fast supply bottlenecks are resolved, according to a San Francisco Federal Reserve report published Tuesday. Supply-side issues account for about half of elevated prices, with demand driving another third and the remainder coming from products not clearly tied to either, according to research by economist Adam Hale Shapiro. (MNI)

ECONOMY: U.S. Treasury Secretary Janet Yellen said on Tuesday she still views two quarters of negative growth as a good rule of thumb to indicate a recession, but believes it is possible to bring down inflation while maintaining full employment. "A shorthand of two quarters of negative growth has typically worked, and so a lot of people think of it that way," Yellen told reporters during a visit to the Rosebud Sioux Tribe reservation in South Dakota when asked how she would measure a recession. "But recessions aren't all the same. (RTRS)

ECONOMY: President Joe Biden’s aides have repeatedly pointed to Americans’ robust pandemic-era savings as a cushion against inflation -- yet the money is rapidly evaporating for 26 million low-income families. From Treasury Secretary Janet Yellen to Press Secretary Karine Jean-Pierre, top administration officials are counting on cash that households built up in the Covid years to serve as a buffer against consumer prices rising at the fastest clip in four decades. “Right now, we don’t see a recession right now,” Jean-Pierre said. “We are not in a recession right now. Right now we are in a transition where we are going to go into a place of stable and steady growth and that’s going to be our focus.” (BBG)

FISCAL/INFLATION/OIL: President Joe Biden will call on Congress to enact a gasoline tax holiday, a person familiar with the plans says, as he looks to cool soaring pump prices heading into summer. Biden will make a statement Wednesday calling on Congress to enact the pause, the person said, speaking on condition of anonymity ahead of an announcement. The White House did not immediately respond to a request for comment. (BBG)

FISCAL: President Joe Biden said on Tuesday the United States has enough COVID funding to get through at least this year but it needs more money to plan for the next pandemic. "We need more money to plan for the second pandemic. There's going to be another pandemic. We have to think ahead," Biden said in remarks at the White House to mark availability of vaccines for young children. (RTRS)

OTHER

GLOBAL TRADE: Russian President Vladimir Putin is weaponizing food by blocking Ukraine grain exports and President Joe Biden is examining options on how to get the grain out, the White House said on Tuesday. "President Putin is, no kidding, weaponizing food. Let's just call it what it is, he's weaponizing food," John Kirby, a White House national security spokesperson, told reporters. (RTRS)

GLOBAL TRADE: Russia's defence ministry will hold talks with Turkey about the possible creation of a Black Sea corridor for Ukrainian grain supplies, TASS news agency reported on Tuesday, citing Kremlin spokesman Dmitry Peskov. President Vladimir Putin does not plan to take part in these talks, Peskov was quoted as saying. A Turkish military delegation will travel to Russia this week to discuss details of the possible corridor, Turkish broadcasters said earlier on Tuesday, citing sources from Turkey's presidency. (RTRS)

GLOBAL TRADE: Target CEO Brian Cornell cited inflation and "historic highs with inventory levels" as he pulled back the curtain on his major decision to aggressively markdown inventory amid "an environment many of us haven't seen before" in remarks on Tuesday. "I recognized after a few weeks of looking at our own stores, analyzing our business, looking at competition, and hearing from our team that we [had] to address this problem upfront," Cornell explained at an event held at The Economic Club of New York. "We are in an environment many of us haven't seen before," Cornell added. (Yahoo Finance)

U.S./CANADA: U.S. Treasury Secretary Janet Yellen said on Tuesday that President Joe Biden is not expected to cut U.S. tariffs on Canadian lumber as part of potential tariff relief he is considering to fight inflation. "To the best of my knowledge, they're not under consideration, at least as part of the things that the president is currently looking at," Yellen said of the anti-subsidy duties of 11.64% on most Canadian lumber imports. She made the remarks to reporters during a visit to the Rosebud Sioux Tribe reservation in South Dakota. (RTRS)

U.S./CHINA: President Joe Biden said Tuesday he plans to talk with his Chinese counterpart Xi Jinping as he considers lifting some tariffs imposed on Beijing in a bid to ease US inflation. "I plan on having a conversation with President Xi. We haven't set a time yet," Biden told reporters. Over the weekend, Biden said a call could be "soon." (AFP)

GEOPOLITICS: China’s purchases of Russian oil are “another example of growing collaboration” between the countries as the West tries to enact sanctions on Moscow, a spokesman for the US National Security Council said. “I think this is just a piece of China’s willingness to continue to go along with Russia,” NSC Spokesman John Kirby told reporters at the White House. “We have, as we said at the outset, called on China to be a responsible power here and to join the rest of the world in condemning what Russia has done in Ukraine and enforcing sanctions against Russia for it.” China snapped up a record quantity of Russian crude last month, lifting purchases to $7.47 billion -- about $1 billion more than April and double the amount of a year ago. (BBG)

BOJ: Some Bank of Japan board members said the central bank needed to clearly communicate to the public that monetary policy was aimed at fulfilling its mandate of achieving price stability, rather than to control foreign exchange rates, according to the minutes of the bank’s policy meeting in April. Excessive forex moves increase uncertainties for businesses. Yen’s depreciation has had positive impact. The effects of the yen’s slide vary among businesses and economic entities. Need to carefully explain 2% inflation goal’s significance. Members discussed the relationship between monetary policy and currencies. The BOJ’s challenge is not to curb inflation, but to overcome inflation that’s still low. Various speculations over 10-year JGB yields had risen mainly among overseas market participants. (BBG)

RBA: Bradley Jones has been promoted to assistant governor of Reserve Bank of Australia, moving from the central bank’s economic analysis department to overseeing its financial system group. Dr Jones joined the RBA in 2018 after a five-year stint at the International Monetary Fund’s monetary and capital markets department in Washington and prior to that working for Deutsche Bank in London and Hong Kong. (Australian Financial Review)

AUSTRALIA: Australia's energy market operator said on Wednesday it would lift its unprecedented suspension of the spot electricity market in stages, starting at 4 a.m. (1800 GMT) on Thursday. "The first step is that at 4 a.m. tomorrow we will allow the market to set the price again," Australian Energy Market Operator Chief Executive Daniel Westerman told reporters. He said the operator would monitor the market for at least 24 hours before making a decision to formally lift the market suspension, which began a week ago. (RTRS)

NORTH KOREA: Kim Jong Un for the first time in a year convened a top-level meeting of North Korea’s military that could set the stage for his first nuclear test since 2017, as international attention is diverted to the war in Ukraine. The North Korean leader presided over a Central Military Commission that will look at policies for the “the crucial and urgent tasks to build up national defense,” the official Korean Central News Agency reported Wednesday. It’s the first time the commission of military leaders has met at this level since June 2021 and the gathering is expected to take several days, NK News reported. (BBG)

HONG KONG: Hong Kong’s de facto central bank bought the local dollar at the fastest pace on record to defend its currency from crossing the weak end of its trading band. The Hong Kong Monetary Authority bought HK$78.1 billion ($10 billion) so far this month, including its HK$25.6 billion purchase last week, which was the largest for a single day as per Bloomberg data going back to 2003. The currency still continues to linger near the weak end of its 7.75-to-7.85 per greenback trading band. (BBG)

BRAZIL: Brazilian Economy Minister Paulo Guedes said on Tuesday that Brazil's accession to the Organization for Economic Co-operation and Development (OECD) may "take some time," but stressed that the Jair Bolsonaro government is committed to the task. Speaking at an event about the relationship between the country and the OECD, he highlighted that it is important for the organization that Brazil becomes an effective member, as it is a great democracy that preserves the environment. (RTRS)

BRAZIL: An "assertive" action by the Brazilian central bank is necessary for inflation to converge to the government's official target, the central bank's director of international affairs, Fernanda Guardado, said on Tuesday. Speaking at an event about the relationship between the country and the OECD, she said the global economy would slow in the following quarters, while Brazil would face more moderate growth. (RTRS)

BRAZIL: More government ministers and lawmakers are supporting the measures to create a 400 reais monthly allowance for self-employed truck drivers, as well as increasing the value and scope of the gas voucher, O Globosays mentioning people familiar with the matter. Measures yet to be included in the constitutional amendment bill pending in the Senate, aimed at containing the rally of fuel prices in the country. (BBG)

BRAZIL: Brazil’s government is proposing a monthly financial aid of BRL 1,000 ($195) to help truck drivers offset rising diesel costs together with the expansion of an existing cooking gas voucher for low-income families at a combined cost of 5 billion reais, according to two people with knowledge of the matter. In exchange, the executive wants lawmakers to suspend a proposal to change governance rules for state-owned companies including Petrobras, the people added, requesting anonymity because the discussion isn’t public. (BBG)

BRAZIL: Procedure for the appointment of Caio Paes de Andrade as Petrobras CEO has already received a nod at the state-owned company, reports the newspaper O Globo, citing a person with knowledge of the matter. Petrobras’s Eligibility Committee is yet to present to the firm’s board a final recommendation on the nomination, which should take place on Friday. The intention is that, once the recommendation is formally made, the board can already define, in an extraordinary meeting, the appointment of Andrade as a board member and CEO. (BBG)

RUSSIA: Biden, asked about Johnson’s remarks of a rising risk of “fatigue” over Ukraine, said he doesn’t have any such fears. “I’m not afraid,” Biden said at the White House. “But what I do think is there at some point, this is going to be a bit of a waiting game -- what the Russians can sustain and what Europe is going to be prepared to sustain.” Biden said he’d be addressing that latter issue during a meeting of NATO leaders in Spain next week. (BBG)

RUSSIA: The United States disagrees "vigorously" with the Russian position that the U.S. citizens captured in Ukraine are not covered by the Geneva Conventions, a senior State Department official said on Tuesday, adding that Washington has conveyed its stance on the issue to the Russian government. (RTRS)

RUSSIA/IRAN: Russian Foreign Minister Sergei Lavrov will pay an official visit to Iran on Wednesday, Tass news agency said on Tuesday, citing Russia's ambassador in Vienna. It did not give further details. Last month Moscow said Russia and Iran - which are both under Western sanctions and sit on some of the world's largest oil reserves - had discussed swapping supplies for oil and gas as well as setting up a logistics hub. (RTRS)

EQUITIES: The Tokyo Stock Exchange will start operation of its new electronic platform for exchange-traded funds on Feb. 1, Nikkei reports, without attribution. Platform will enable investors to ask brokerages and market makers directly for pricing and trade at the best price, improving transparency and efficiency. (BBG)

OIL: Energy Secretary Jennifer Granholm is slated to meet with oil executives on Thursday, the White House said, as the administration seeks solutions to lowering sky-high gas prices. White House press secretary Karine Jean-Pierre confirmed plans for the meeting in a briefing on Tuesday, saying it would include all seven executives that President Biden sent letters to last week urging them to boost the supply of gasoline and diesel. “Our goal is to make sure that we have a sit-down conversation where we come up with solutions, that we work with the CEOs and figure out what else that we can do to move that capacity forward,” Jean-Pierre said. Biden is not planning on sitting in on the meeting, she said. (The Hill)

OIL: The Indian government has asked state oil companies to scoop up huge volumes of cheap crude from Russia, according to industry executives, strengthening commercial ties with the country even as the West tightens sanctions on Moscow. Western countries have sought to hamper Russia’s ability to use its vast oil and gas exports to fund the war in Ukraine. The emergence of India as a major buyer of Russian oil has the potential to take the sting out of the sanctions. Other nations, including China and Turkey, have also stepped up their purchases of Russian oil, though the country’s exports remain below prewar levels. (WSJ)

CHINA

FISCAL: The issuance of local government bonds in June is expected to hit a new high this year, likely exceeding CNY1.5 trillion, the China Securities Journal reported. The incremental debt funds will support local fiscal spending in the next two months, as it is expected to leverage trillions of funds to promote infrastructure investment, the newspaper said citing Zuo Yiming, senior analyst at Pengyuan International. According to the current issuance plans, all the CNY3.65 trillion of infrastructure-backed special bonds set for this year will be basically sold by end-June as scheduled, the newspaper said. (MNI)

CORONAVIRUS: Total electricity use in Shanghai has recovered to 92.48% of year-ago level in the first three weeks of June after the financial hub reopened from a two-month lockdown due to Covid outbreak, state broadcaster CCTV reports, citing data from local branch of State Grid Corp of China. Power use of major companies in the city has recovered to 99.59% of year-ago level. (BBG)

PROPERTY: Chinese developers will meet financial institutions in late July to discuss measures to lift them out of difficulties, according to the Shanghai Securities News, citing a notice from industry group China Real Estate Association. Agenda of the meeting includes introduction of relief programs by financial institutions, consultations with companies interested in mergers and acquisitions, and transformation of developers through developing long-term leasing business, the newspaper reports. The event is to be held on July 26-27 in the eastern city of Hangzhou, the report says. (BBG)

BANKS: More Chinese rural banks will be restructured as regulators speed up risk disposal, Yicai.com reported citing analysts following a brewing banking scandal in Central China’s Henan Province. China has a total 1,651 rural banks in China, even more than the number of counties, and 122 of them were labeled as high-risk institutions by the central bank as of Q2 2021, accounting for about 29% of all high-risk institutions, the newspaper said. Rural banks in general bear a higher rate of non-performing loan ratios than other banks, with the NPL rate standing at 4% in 2020, which compared to the 2% of city commercial banks and 2.4% of rural commercial banks, Yicai said citing report by HuaAn Securities. (MNI)

CHINA MARKETS

PBOC Injects CNY10 Billion via OMOs, Liquidity Unchanged

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0184% at 9:37 am local time from the close of 1.7037% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 46 on Tuesday vs 51 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7109 WEDS VS 6.6851

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7109 on Wednesday, compared with 6.6851 set on Tuesday.

OVERNIGHT DATA

AUSTRALIA MAY WESTPAC LEADING INDEX -0.06% M/M; APR -0.15%

The six-month annualised growth rate in the Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, fell from 1.09% in April to 0.58% in May. The components of the Index are indicating an important emerging theme around Australia’s growth prospects – a significant shock to consumer confidence. Declining consumer sentiment was a major contributor to the slowdown in May – the Westpac-MI CSI Consumer Expectations Index being one of the nine components. As we reported last week, the headline Westpac-MI Consumer Sentiment Index fell a further 4.5% in June, with the Consumer Expectations Index falling 4.2%. Despite this, the overall growth rate in the Leading Index is still indicating above trend growth momentum heading into the three to nine month ‘window’. Westpac concurs that the economy’s momentum will carry through the June and September quarters. Gains will centre on consumer spending which will continue to benefit from post COVID reopening and support from high household savings rate and strong balance sheets. (Westpac)

NEW ZEALAND MAY TRADE BALANCE +NZ$263MN; APR +NZ$440MN

NEW ZEALAND MAY EXPORTS NZ$6.95BN; APR NZ$6.16BN

NEW ZEALAND MAY IMPORTS NZ$6.69BN; APR NZ$5.72BN

NEW ZEALAND MAY TRADE BALANCE 12 MTH YTD -NZ$9,521MN; APR -NZ$9,287MN

NEW ZEALAND MAY CREDIT CARD SPENDING +2.2% Y/Y; APR +1.3%

NEW ZEALAND MAY CREDIT CARD SPENDING +1.8% M/M; APR +0.9%

MARKETS

SNAPSHOT: U.S. Gasoline Tax Holiday Imminent

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 9.28 points at 26237.03

- ASX 200 down 4.203 points at 6519.6

- Shanghai Comp. down 10.772 points at 3295.947

- JGB 10-Yr future down 16 ticks at 147.8, yield up 0.2bp at 0.240%

- Aussie 10-Yr future up 4.5 ticks at 95.905, yield down 4.9bp at 4.015%

- U.S. 10-Yr future +0-09 at 116-02+, yield down 1.32bp at 3.262%

- WTI crude down $3.75 at $105.77, Gold down $6.87 at $1826.12

- USD/JPY down 26 pips at Y136.32

- BARKIN: FED TO DO 'WHAT IT TAKES' ON INFLATION (RTRS)

- BIDEN TO CALL ON CONGRESS WEDNESDAY TO PASS GAS TAX HOLIDAY (BBG)

- GERMANY PREPARES TO TRIGGER SECOND STAGE OF EMERGENCY GAS PLAN (BBG)

- ITALY UNVEILS MEASURES TO BOOST GAS STORAGE AFTER DROP IN RUSSIAN FLOWS (RTRS)

US TSYS: Firmer As Crude Tumbles

Lower crude oil prices (WTI & Brent are down the best part of $4 apiece at typing) and a downtick in e-mini futures (S&P 500 contract -0.9% at typing) provided support for the Tsy space in Asia dealing, as participants looked ahead to day 1 of Fed Chair Powell’s testimony on the Hill. That leaves TYU2 +0-10 at 116-03+ at typing, 0-02+ off the peak of its Asia session range, while cash Tsys run 0.5-2.0bp richer across the curve, with the belly leading.

- There wasn’t much in the way of meaningful macro headline flow to digest, outside of various news outlets pointing to U.S. President Biden formally declaring a short-term gasoline tax holiday later on Wednesday.

- A 5.0K block trade in the TYN2 119.25/118.00 put spread headlined on the flow side. The direction of the trade wasn’t immediately clear, but owing to the open interest, recent market moves and perceived cash flow surrounding such a position, some pointed to a seller of the put spread.

- Looking ahead, Fedspeak dominates Wednesday’s NY docket, with Chair Powell’s aforementioned appearance in DC headlining. Elsewhere, Evans, Harker & Barkin are all due to speak. 20-Year Tsy supply will also take place, with only second tier local data evident, in the form of the weekly MBA mortgage applications print.

JGBS: Twist Steepening

JGBs mostly richened during the Tokyo morning, as a pull lower in crude oil prices and general downtick in equities provided support, with the front end of the curve outperforming. The exception to that rule came in 7s, which cheapened on catch up to the overnight weakness in futures.

- The curve then developed more of a twist steepening pattern in the afternoon, although the move was generally modest, with the major cash JGB benchmarks running 1bp richer to 0.5bp cheaper, pivoting around the 5- to 7-Year zone.

- The breakdown of the latest round of BoJ Rinban operations seemed to be the driving factor behind the modest steepening, with the following offer/cover ratios observed:

- 1- to 3- Year: 2.73x (prev. 2.00x)

- 5- to 10- Year: 1.80x (prev. 3.22x)

- 25+- Year: 4.91x (prev. 1.89x)

- Note that the jump in cover ratio observed in 25+-Year JGBs was a function of the BoJ operations reverting to “normal” size after last week’s impromptu purchases (the market offered to sell Y248.1bn of 25+-Year paper to the Bank to vs. the Y283.4bn seen in last week’s off-schedule operation).

- Futures oscillated around late overnight session levels and head into the Tokyo close 16 ticks softer on the day.

AUSSIE BONDS: Pushing Higher Post-Lowe

ACGBs turned bid in the wake of comments on the RBA by Westpac Chief Economist Bill Evans (Evans sees the Bank reaching a terminal rate of 2.35% in February ’23, which is much less aggressive than market pricing). A downtick in major crude benchmarks and U.S. e-mini futures also lent support to the space, ultimately seeing ACGBs extend their rally following RBA Governor Lowe’s pushback against market pricing of tightening on Tuesday, with yields across the curve operating around one-week lows in the process, with ACGBs bull steepening.

- YM and XM are +9.0 and +5.0 respectively, backing away from their respective best levels of the session heading towards the Sydney close. Bills run +9 to +18 through the reds.

- The latest round of ACGB Apr-25 supply went smoothly, with the cover ratio comfortably above the 3.00x level, and the weighted average yield sitting comfortably through the prevailing mids (1.43bp, per Yieldbroker).

- STIR markets continue to show moderating expectations for tightening in July, with the IB strip pricing in ~45bp of tightening at that meeting, and a cumulative ~255bp of tigthening priced in for the remaining six meetings of calendar ‘22.

- The S&P Global Services and Composite PMIs will headline the domestic data docket on Thursday, with little else on tap for the rest of the week.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 3.25% 21 Apr ‘25 Bond, issue #TB139:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 3.25% 21 Apr ‘25 Bond, issue #TB139:

- Average Yield: 3.4785% (prev. 2.8988%)

- High Yield: 3.4800% (prev. 2.9050%)

- Bid/Cover: 3.1650x (prev. 3.2150x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 90.9% (prev 17.6%)

- Bidders 47 (prev. 46), successful 9 (prev. 17), allocated in full 4 (prev. 11)

EQUITIES: Lower In Asia As Risk Sentiment Sours

Virtually all major Asia-Pac equity indices are lower at typing, bucking a strongly positive lead from Wall St. High-beta equities across the region broadly underperformed, tracking a similar decline in U.S. e-mini equity index futures, with defensive flows in the G10 FX space pointing to drag on sentiment towards richly-valued equities.

- The Nikkei 225 sits 0.3% worse off at typing after reversing opening gains, with the broader TOPIX Index posting a (marginally) more modest 0.1% decline. The move in the Nikkei effectively halts momentum from the +1.8% recovery seen on Tuesday, which had come after the steep sell-off in Japanese stocks through much of mid-June. Limited gains in large caps and export-related names such as Fast Retailing and Keyence Corp were unable to overcome losses in energy and material names, with financials posting a relatively flat performance as well.

- The Hang Seng Index trades 1.3% lower at typing after opening lower, shedding the bulk of Tuesday’s gains, and putting it on track to snap a three-day streak of gains in the process. China-based tech underperformed, dealing 2.5% weaker with gains in electric vehicle names (led by Li Auto after they had announced a new SUV model) unable to overcome broad losses observed in large-cap constituents such as the internet platform companies (JD.com: -5.1%, Meituan: -3.3%, Alibaba Group: -2.2%).

- The ASX200 trades 0.1% lower at writing after opening higher, slipping below neutral levels as gains in energy and utility names were countered by shallower losses observed across most other sub-indices. Tech names have lagged peers, seeing the S&P/ASX All Technology Index 0.9% worse off, while large-cap financials and the major miners are mostly flat to lower at typing.

- U.S. e-minis sit 0.9% to 1.0% worse off, operating around session lows at typing, with NASDAQ contracts narrowly leading losses.

OIL: WTI Retreats Below $110; U.S. Gasoline Woes Take Focus

WTI and Brent are ~$4.00 worse off apiece following our earlier writing on crude, a little off their respective session lows at writing.

- Both benchmarks currently sit at five-week lows, with the sharpest declines of the session coming after U.S. President Biden was announced to be speaking on Wednesday (1400 ET) re: gasoline prices (keeping in mind previously-flagged caution re: the significance of the development on crude prices).

- To elaborate, BBG and RTRS source reports have pointed to expectations for Biden to call for a suspension of the federal gasoline tax, a development that has been well-documented by a slew of source reports over the past week.

- Turning to the debate re: demand destruction, gasoline savings app GasBuddy (tracks prices at gas stations through crowdsourced data) announced that U.S. gasoline demand ending last Sunday was 5.5% firmer than the week before, while being 11.4% higher than the rolling average of the last four weeks.

- Looking to supply-related issues, data from the EIA has shown that U.S. refining capacity has declined for another straight year, coming as the Biden administration is setting up a showdown this Thursday with U.S. oil executives over high profits and perceptions of low refining output. A note that Chevron CEO Mike Wirth had earlier this month stated that “I don’t think you are ever going to see a refinery built again in this country”, alluding to the potential trajectory of the upcoming talks.

- The International Energy Forum (IEF) has flagged that global investment in crude production will likely come in below 2019 levels in ‘22 for a third consecutive year, with rising project costs and supply chain issues likely to prove supportive of oil prices in the face of tight global supply. The IEF’s view corroborated with broader remarks made by the CEOs of Vitol and Exxonmobil on Tuesday, with the latter predicting at least three to five years of tightness in oil markets.

GOLD: Lower In Asia; Powell MonPol Comments Eyed

Gold sits ~$6/oz weaker to print $1,827/oz at typing, operating below Tuesday’s worst levels, and taking it to one-week lows in the process. The move lower comes amidst a fresh bid in the USD (DXY), seeing the latter rising above Tuesday’s best levels in Asia-Pac dealing.

- To recap, the precious metal closed ~$6/oz lower on Tuesday despite limited downticks in U.S. real yields and the USD (DXY). Debate re: the possibility of a Fed-led recession has continued to do the rounds, possibly lending support to bullion, with Richmond Fed Pres Barkin being the latest on Tuesday to voice support for a possible 75bp rate hike in July.

- July FOMC dated OIS continue to squarely price in 75bp of tightening for that meeting, with a cumulative ~193bp of tightening priced in for calendar ‘22 - a decline from earlier in the week (as high as >210bp).

- Looking ahead, focus will be turn to Fed Chair Powell’s comments re: monetary policy to the Senate Banking Committee (1430 BST), where he is expected to provide details on the Fed’s ongoing inflation fight and the corresponding recessionary risks.

- From a technical perspective, previously outlined support and resistance levels remain intact at $1,787.0/oz (May 16 low) and $1,889.1/oz (trendline resistance from Mar 8 high) respectively.

FOREX: Flight To Safety

Risk sentiment soured as the three main U.S. e-mini futures contracts retreated, shedding ~1% apiece. There were no particular headline catalysts behind the defensive moves, with yesterday's spell of reprieve for risk seemingly running its course. The proximity of a key address from Fed chief may have helped fray the nerves of market participants.

- Traditional safe havens gained on the back of general aversion to risk, with the yen sitting atop the G10 pile. Spot USD/JPY has shed some 50 pips thus far after refreshing its 24-year highs in early Tokyo trade.

- The Antipodeans paced losses, closely followed by their commodity-tied peers CAD & NOK. Retreating crude oil and iron ore prices amplified selling pressure that weighed on the space.

- Regional risk barometer AUD/JPY fell 1 full figure, but struggled to return below Y94.00 or challenge Tuesday's lows.

- Greenback strength drove spot USD/CNH higher, with a weaker than expected PBOC fix facilitating the move. The People's Bank set the mid-point of permitted USD/CNY trading band 27 pips above sell-side estimate, which represented the weakest bias in two months.

- On the data front, UK & Canadian inflation figures take focus from here. Elsewhere, Fed Chair Powell will deliver his semi-annual monetary policy testimony today. His address provides the highlight of the global central bank speaker slate, which also features Fed's Barkin, Evans & Harker, BoE's Cunliffe & BoC's Rogers.

FOREX OPTIONS: Expiries for Jun22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E594mln), $1.0580(E595mln), $1.0595-00(E714mln), $1.0630-35(E554mln), $1.0650-60(E760mln)

- USD/JPY: Y134.40-57($710mln)

- GBP/USD: $1.2245(Gbp738mln)

- EUR/GBP: Gbp0.8700(E570mln)

- USD/CAD: C$1.3020($550mln)

- NZD/USD: $0.6300(N$998mln)

- USD/CNY: Cny6.70($920mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/06/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 22/06/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 22/06/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 22/06/2022 | 0700/0900 |  | EU | ECB de Guindos Q&A at Universidad Internacional Menendez Pelayo | |

| 22/06/2022 | 0735/0935 |  | EU | ECB Elderson Speech on Climate & Q&A at Frankfurt School of Finance | |

| 22/06/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 22/06/2022 | 0840/0940 |  | UK | BOE Cunliffe Panels Point Zero Forum | |

| 22/06/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/06/2022 | 1230/0830 | *** |  | CA | CPI |

| 22/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/06/2022 | 1300/0900 |  | US | Richmond Fed President Tom Barkin | |

| 22/06/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/06/2022 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 22/06/2022 | 1440/1040 |  | CA | BOC Deputy Rogers "fireside chat" | |

| 22/06/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 22/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 22/06/2022 | 1600/1200 |  | US | Richmond Fed's Tom Barkin | |

| 22/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 22/06/2022 | 1730/1330 |  | US | Fed's Patrick Harker and Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.