-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Chinese PMI Data Steals The Headlines

- Demand for safe haven currencies fizzled away even as U.S. e-mini futures were heavy. Sentiment improved after the release of China's official PMI figures. The data revealed a considerably faster than expected recovery in the non-manufacturing sector coupled with a marginal miss in the manufacturing gauge.

- The early bid in in ACGBs faded after the aforementioned Chinese data, with domestic also applying some pressure.

- On the data front, final UK GDP, German unemployment & flash French CPI take focus from here. Elsewhere, Sweden's Riksbank will announce its monetary policy decision. An overwhelming majority of analysts expect the bank to lift its policy rate by 50bp.

US TSYS: Marginally Cheaper Ahead Of London Hours

Tsys softened as we worked our way through Asia trade, with the early, modest bid that was a result of spill over from NY dealing and/or cross-market support from rallying ACGBs fading in the wake of a much firmer than expected non-manufacturing PMI reading out of China. That leaves TYU2 -0-00+ at 117-16, 0-02 off the base of its 0-07+ range, operating on volume of ~70K lots. Meanwhile, cash Tsys run little changed to 1bp cheaper across the curve.

- In terms of the general feel of the Chinese data, the m’fing PMI provided a slight miss (50.2 vs. BBG median 50.5) while the non-m’fing PMI came in well above expectations (54.7 vs BBG median 50.5), with the NBS suggesting that the economy bottomed in May.

- There hasn’t been much in the way of major macro headlines to digest since the Chinese PMIs crossed.

- A modest round of screen buying in TYU2 futures (+2.5K) provided the highlight in a relatively limited round of Asia-Pac dealing.

- Thursday’s NY session brings the latest round of monthly PCE data, the MNI Chicago PMI print and weekly jobless claims readings. It also represents the last full session before the Independence Day weekend, with a market closure in Hong Kong also set to hamper liquidity on Friday.

US TSYS: What Is Powell’s Preferred Curve Inversion Metric Doing?

With general recessionary worry on the rise, we highlight the distance from inversion when it comes to Fed Chair Powell’s previously outlined gauge of choice re: Tsy curve inversion. That is the U.S. 3-month yield 18 months forward less the current 3-month yield. The spread continues to operate well clear of flat levels, which seemingly gives the Fed scope to tighten further.

- The early rounds of Fed tightening have resulted in the spread moving from its recent peak of ~2.70% in early April (with the peak observed a couple of weeks after the first hike of the current Fed tightening cycle) to a little above 1.50% at typing.

- Note that Chair Powell continues to stress that fighting inflation is the central bank’s priority (affirming the Fed’s stance when it comes to the trade-off between inflation and economic growth), although recent addresses have seen the Chair concede that this poses risks to economic growth, as he noted that while a soft landing is achievable, attaining such a scenario is “quite challenging” (less optimistic than he had been in previous weeks/months).

- A Fed paper on the use of this particular yield spread can be found at this link.

Fig. 1: U.S. 3-Month Yield 18 Months Forward Less The Current 3-Month Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Paring Initial Bid

Aussie bonds backed away from best levels as we worked through the Sydney day, with the initial bid pared after the release of Australian and Chinese data. Cash ACGBs have twist steepened, running 5.0bp richer to 1.5bp cheaper across the curve, pivoting around 15s, with 30s providing the weak point. YM and XM are +4.0 and +0.5 respectively, while bills run 1-5 ticks firmer through the reds.

- In terms of details, better than expected Australian private sector credit data for May came alongside a jump in job vacancies (the latest signal of continued tightening in the labour market), while official Chinese m’fing and non-m’fing PMIs returned to expansionary territory (the non-m’fing reading provided a notable beat vs. expectations).

- It was hard to ascertain a reason for the early bid in the space, with spill over from NY Tsy trade cited. Quarter-end rebalancing may have been at play, although month-end rebalancing should have been pretty neutral based on sell-side calculations (if not marginally negative for the space).

- Friday’s domestic data docket will be headlined by final S&P Global m’fing PMI reading. Elsewhere, the AOFM will release its weekly issuance slate.

JGBS: Flatter Ahead Of Release Of BoJ Rinban Plan

JGB futures have traded off the wider impetus observed in global core fixed income markets during Tokyo hours. JGB futures sit little changed on the day ahead of the bell as a result.

- Much softer than expected domestic industrial production data (which resulted in the government lowering its assessment of the state of industrial production to “weak”) had no impact on the space.

- Cash JGBs have richened by 0.5-4.0bp, with the long end outperforming, perhaps on the back of market speculation re: the prospect of the BoJ upping the size/frequency of Rinban purchases covering JGBs with more than 10 years until maturity, in a bid to defend its existing YCC settings. The BoJ will reduce its quarterly Rinban plan after hours today.

- Looking a little further ahead, Tokyo CPI and the latest Tankan survey headline domestic matters on Friday.

JAPAN: Japan Shed Foreign Bonds Last Week

The latest round of weekly international security flow data revealed that Japanese investors upped their net sales of foreign bonds last week, recording the largest round of net weekly sales observed since late March into early April in the process. This represented a fifth consecutive week of net selling of foreign paper for Japanese investors.

- Elsewhere, foreign investors were net buyers of Japanese bonds after recording a record round of net sales in the previous week (when they were seemingly keen to test the BoJ’s resolve re: protecting its current YCC settings). This broke a streak of two weeks of net selling, although the 4-week rolling sum of the measure remains in heavy selling territory.

- Japanese investor flows surrounding foreign equities were virtually neutral in net terms.

- Meanwhile, foreign investors recorded sales of Japanese equities for a fourth week in five, although the pace moderated a touch vs. the previous week.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1600.6 | -489.5 | -3783.2 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 51.4 | 9.7 | 666.4 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 660.9 | -4804.6 | -5187.9 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -429.7 | -941.6 | -1289.0 |

FOREX: China's Off'l PMIs Support Risk, Kiwi Takes Hit From Weak NZ Biz. Conditions

Demand for safe haven currencies fizzled away even as U.S. e-mini futures were heavy. Sentiment improved after the release of China's official PMI figures. The data revealed a considerably faster than expected recovery in the non-manufacturing sector coupled with a marginal miss in the manufacturing gauge.

- Some of the details of the Chinese survey were concerning, as steel PMI plunged to a record low, while accompanying commentary warned that "attention still needs to be paid to imbalances between the recoveries in supply and demand."

- Offshore yuan caught a bid upon the release of PMI data, but spot USD/CNH failed to sink through yesterday's lows. The yuan fixing offered no real impetus, with the mid-point of permitted USD/CNY trading band set just 10 pips above sell-side estimate.

- Both yen and greenback underperformed on the back of reduced demand for safe haven assets. Spot USD/JPY operated within close proximity to the Y137.00 mark, which capped gains on Wednesday. The pair's 1-month risk reversal is poised to extend its advance to three consecutive days.

- The Aussie outperformed in G10 FX space but the kiwi lagged behind owing to a dismal ANZ Business Confidence reading released out of New Zealand. Activity indicators were weak across the board, with the drop in expected profitability particularly pronounced.

- AUD/NZD climbed to its best levels in two weeks as Australia/New Zealand 2-Year swap spread tightened. Today's data showed that relative momentum in business conditions continues to support the Antipodean cross.

- On the data front, final UK GDP, German unemployment & flash French CPI take focus from here. Elsewhere, Sweden's Riksbank will announce its monetary policy decision. An overwhelming majority of analysts expect the bank to lift its policy rate by 50bp.

FX OPTIONS: Expiries for Jun30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0400(E503mln), $1.0500(E619mln), $1.0550-60(E1.2bln), $1.0750-75(E1.2bln)

- EUR/GBP: Gbp0.8650(E702mln)

- USD/CAD: C$1.2750($1.5bln), C$1.3000($585mln)

- USD/CNY: Cny6.6700($1.6bln), Cny6.70($515mln), Cny6.7500($608mln), Cny6.8000($1.4bln)

RIKSBANK: MNI Riksbank Preview - June 2022: 50bp likely, but where next?

- 11/12 of the analyst previews that we have read look for a 50bp hike this month, as do almost 80% of market participants in the SEB investor survey. The MNI Markets team agrees that this is the most likely outcome.

- With inflation higher than the Riksbank's April alternate scenario, we would be very surprised if we did not see a 50bp hike and note that the MNI Markets team thinks that the market is generally looking for the alternate path from April to become the baseline path at this week’s meeting.

- However, there are some risks around this view which we discuss in the full preview.

ASIA FX: Mixed Trends Despite China PMI Beat

Mixed performances for USD/Asia pairs today. China PMI beat boosts CNH, but we remain within recent ranges. USD/KRW posts fresh cyclical high before dipping. THB unwinds recent bounce, as China's Xi sticks with Covid zero strategy. PHP bounces on more hawkish BSP rhetoric.

- CNH: USD/CNH is back below 6.7000, as we saw a sharp bounce in the non-manufacturing PMI, 54.7 versus 50.5 expected. China equities have outperformed, up over 1%, with the rest of the region mixed. The CNY fixing was weaker than expected, but only modestly.

- KRW: USD/KRW spiked to fresh cyclical highs above 1303, before the China PMI data helped push us back sub 1300. There hasn't been a great deal of follow through though, as onshore equities remain down just over 1%. Offshore investors have sold a further $287.1mn in local equities today.

- INR: The rupee has been fairly steady in early trade, holding above 78.90 for the most part. Onshore equities are firmer by around 0.40% at this stage, while lower crude is helping at the margin. The focus remains on a break above 79.00.

- IDR: Spot USD/IDR deals +28 figs at IDR14,878 as we type, extending this week's advance. New regulations are in store for Indonesia's commodity space. The government announced that it will seek to manage exports to prevent tin oversupply and wants to set progressive rates for coal royalty. The local data docket is virtually empty today, with monthly CPI coming up tomorrow.

- PHP: USD/PHP has dropped sharply, falling close to 0.50% to be back at 54.835. Incoming BSP Governor Medalla told reporters Wednesday that the central bank "would clearly consider increasing policy rates by more than our planned 25bp" if it sees "that the exchange rate is overshooting too much, and that selling foreign exchange will not make the problem go away."

- THB: Baht has fallen 0.3% from yesterday's closing levels, pushing USD/THB back above 35.30. The rate has now unwound its losses posted on Tuesday in reaction to the news re: China loosening border controls. Chinese President Xi yesterday lauded his flagship dynamic Zero-COVID strategy. His hard-line stance bodes ill for the recovery of Thailand's tourism industry, China being the largest pre-pandemic contributor of foreign visitors.

CHINA: PMIs Reinforce Outperformance Theme

We noted late last week that China's PMI prints may reinforce the China outperformance theme (see this link for more details). Today's non-manufacturing PMI printed much stronger than expected, coming in at 54.7 versus 50.5 expected and is back to close to highs from May of last year. The manufacturing PMI missed estimates (50.2 versus 50.5 expected), although it still managed to move back into expansionary territory.

- The surprising aspect of today's result is the extent of the non-manufacturing PMI bounce, particularly given on-going covid related restrictions observed during June.

- In any case, today's outcomes should be enough to push the Citi China Economic Activity Surprise Index (EASI) higher. The chart below plots the China EASI versus the US EASI, which have crossed over recently.

Fig 1: Citi China & US EASI Trends - Crossing Over

Source: Citi, MNI - Market News/Bloomberg

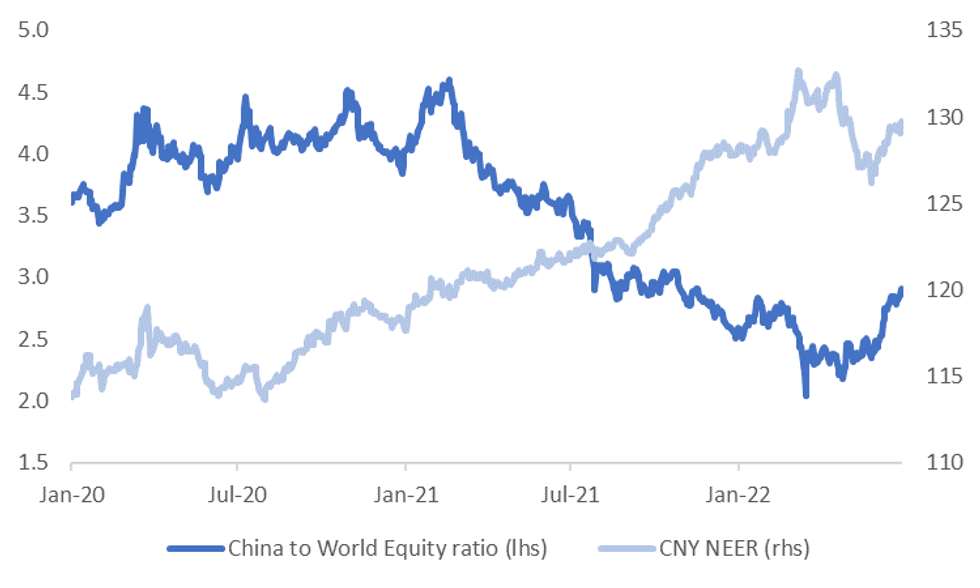

- Such a backdrop may reinforce the China outperformance theme that has been evident in FX and equities. The second chart below plots the ratio of China to world equities against the CNY NEER.

- Correlations between these two series swing about, but sharp periods of China equity outperformance have coincided with rising NEER levels.

- A good analogy with the current episode is late Q1 2020. China was emerging from its first Covid wave just at the rest of the world was going into its first. China is currently emerging from its second wave, while economic conditions in the US/EU are more uncertain as tighter financial conditions bite.

- There are of course caveats, a lot will depend on how Covid cases evolve given China's dynamic Covid zero strategy. Note we get more updates on China's economic momentum tomorrow, with the Caixin manufacturing PMI due, while the Caixin services PMI prints early next week.

Fig 2: Chine To World Equity Ratio Versus J.P. Morgan CNY NEER

Source: J.P Morgan, MNI - Market News/MNI

Source: J.P Morgan, MNI - Market News/MNI

EQUITIES: Mixed In Asia; Chinese Travel Catches A Bid

Major Asia-Pac equity indices are mixed at typing, with Chinese and Hong Kong stocks bucking the broader trend of losses.

- The CSI300 leads gains at +1.6%, with broad sentiment boosted by Chinese PMIs returning to expansionary territory. The consumer staples sub-index (+2.2%) contributed the most to gains on outperformance in the major Chinese liquor stocks, while travel and tourism stocks have continued to benefit from upbeat sentiment surrounding previously-flagged easing in nationwide pandemic control measures. The FTSE China A600 Travel & Leisure Index sits +3.3% firmer at typing to operate around four-month highs at typing, with index heavyweight China Tourism Group Duty Free Corp (+6.6%) leading gains.

- The Hang Seng Index is virtually unchanged at typing, having traded on either side of neutral levels throughout the session. Performance was mixed across the index, with limited gains in financials and utilities countered by weakness in China-based tech.

- The ASX200 sits 0.8% worse off at typing, on track for a second consecutive daily loss. Commodity-related names (particularly the major miners) lead the way lower, neutralising outperformance in tech equities.

- The Nikkei 225 trades 1.5% lower, shedding all of the week’s gains to date. Limited gains in smaller-cap equities did little to stem losses in >80% of the index’s constituents, with large-cap names such Tokyo Electron (-3.5%) and Fanuc Corp (-4.0%) contributing the most drag.

- U.S. e-mini equity index futures deal 0.2% to 0.3% weaker at typing, operating a little above Wednesday’s worst levels in fairly limited Asia-Pac dealing.

GOLD: A Little Firmer In Asia; Third Straight Monthly Decline Eyed

Gold is ~$3/oz firmer to print $1,821/oz at typing, a little below best levels, but operating comfortably within Wednesday’s range. The precious metal remains on track for a third consecutive monthly decline.

- To recap Wednesday’s price action, gold whipped between two-week lows ($1,812/oz) to session highs ($1,833/oz) leading up to the release of U.S. Q1 GDP, ultimately closing ~$2/oz weaker amidst an uptick in U.S. real yields and the USD (DXY).

- Fed Chair Powell on Wednesday nodded to the possibility of Fed-led economic slowdown, calling it “challenging” to hike rates “without a hit to growth” or employment. His remark that “the bigger mistake would be to fail to restore price stability" likely drew some focus, reiterating the Fed’s focus on aggressive hikes to control inflation despite recessionary worry from some quarters.

- July FOMC dated OIS continue to price in ~70bp of tightening, pointing to an ~80% chance of a 75bp hike for that meeting, with a cumulative ~197bp priced in through calendar ‘22.

- From a technical perspective, gold’s lows made on Wednesday sees it approach initial support at $1,805.2/oz (Jun 14 low), a break of which would expose further support at $1,787.0/oz (May 16 low and bear trigger).

OIL: Higher In Asia; Supply Tightness Remains In Focus

WTI is ~+$0.40 while Brent (Sep ‘22 contract) is ~+$0.60, with WTI on track for its first monthly decline in seven months.

- The latest round of EIA inventory data released on Wednesday, saw WTI and Brent reverse course from fresh two-week highs to close $1-2 lower as a surprise build in gasoline and distillate stocks drew focus, easing worry re: tightness in domestic supply of oil products. On the other hand, a larger than expected drawdown in crude stockpiles (against BBG median) was observed, while Cushing hub stocks declined, hitting inventory levels last witnessed around Oct ‘14.

- Ecuador has declared a 30-day state of emergency including the entirety of two oil-producing provinces, drawing out ongoing production disruptions to its ~500K bpd crude output.

- Renewed, indirect Iran-U.S. nuclear talks in Doha have ended without any breakthroughs, with a U.S. official saying that talks have effectively progressed “backwards”.

- Up next, OPEC+ will end a two-day meeting later on Thursday, with headline risks appearing limited owing to previously-flagged coverage pointing to tightness in the group’s spare output capacity. RTRS source reports have also pointed to the group discussing August output policies, with seemingly little focus on discussion re: production afterwards.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/06/2022 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 30/06/2022 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 30/06/2022 | 0630/0830 | ** |  | CH | retail sales |

| 30/06/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/06/2022 | 0645/0845 | ** |  | FR | PPI |

| 30/06/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 30/06/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/06/2022 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 30/06/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 30/06/2022 | 0900/1100 | ** |  | EU | Unemployment |

| 30/06/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 30/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 30/06/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 30/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/06/2022 | 1330/1530 |  | EU | ECB Lagarde Speech at Simone Veil Pact | |

| 30/06/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 30/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 30/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 30/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 30/06/2022 | 1600/1200 | *** |  | US | USDA Acreage - NASS |

| 30/06/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.