-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: CPI Front & Centre

EXECUTIVE SUMMARY

- TORY LEADERSHIP RACE: RISHI SUNAK AND LIZ TRUSS HEAD FIELD OF EIGHT CANDIDATES (THE TIMES)

- BOE’S BAILEY SAYS GOAL IS TO CURB INFLATION, ‘NO IFS OR BUTS’ (BBG)

- RBNZ DELIVERS EXPECTED 50BP RATE HIKE

- BANK OF KOREA HIKES KEY RATE BY HALF A POINT TO FIGHT INFLATION (NIKKEI)

- PRESSURE ON CHINA’S YUAN TO WEAKEN IS MANAGEABLE (SEC NEWS)

- SHANGHAI COVID CASES STEADY, THOUGH LOCKDOWN ANGST REMAINS (BBG)

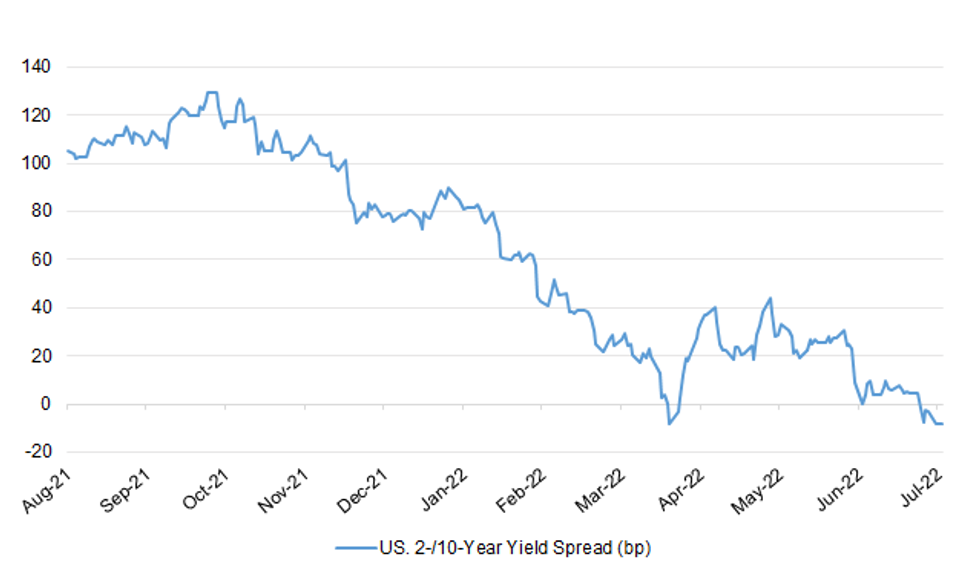

Fig. 1: U.S. 2-/10-Year Yield Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Rishi Sunak and Liz Truss secured the endorsement of senior cabinet ministers yesterday as the Tory leadership contest descended into vitriol. Eight candidates will battle today to succeed Boris Johnson after Sajid Javid, the former health secretary, withdrew when he failed to win enough support. Sunak, the frontrunner, opened his campaign with a warning that it was “not credible to promise lots more spending and lower taxes”. (The Times)

POLITICS: Britain's government said on Tuesday that it would allow an attempt by the opposition Labour Party to call a confidence vote if the wording of the motion was changed to remove reference to Prime Minister Boris Johnson. (RTRS)

BOE: Bank of England Governor Andrew Bailey said policy makers are prepared to move borrowing costs higher in bigger steps to control inflation, his most explicit comment yet on the scale of tightening under consideration. Bailey said the BOE’s aim is to bring inflation back to the 2% target, and there’s “no ifs or buts” about that goal. Answering questions after a speech, he said “we want people to see that there are more options on the table than another 25 basis points.” (BBG)

ECONOMY: Candidates to be the UK's next prime minister should focus on growth and an overhaul of the tax system over quick cuts, a business group has said. Promises of tax reductions feature heavily in the leadership campaigns but the CBI business group said the wrong cuts could fuel inflation further. In an open letter, CBI director general Tony Danker called for "serious, credible and bold plans for growth". (BBC)

BREXIT: Ministers will push ahead with legislation to rip up Boris Johnson’s post-Brexit trading arrangements for Northern Ireland on Wednesday with no sign that any of the Tory leadership contenders plans to stop it. (FT)

EUROPE

FRANCE: Fewer French firms expect to raise their prices this month in a possible sign inflation has reached an inflection point, while labour shortages have hit record levels, France's central bank said on Tuesday in monthly business climate survey. (RTRS)

ITALY: Mario Draghi said he won’t continue leading Italy’s government if the Five Star Movement leaves his coalition, in a sign of growing impatience for the constant squabbling among parties. (BBG)

IRELAND: Ireland’s coalition government won a confidence vote in parliament following a motion tabled by opposition party Sinn Fein. (BBG)

U.S.

FED: Federal Reserve Bank of Richmond President Thomas Barkin kept his options open on how big the central bank should go when it raises interest rates later this month, following an increase of 75 basis points in June. “I am one of the guys who like the option value of deciding the week of the meeting as opposed to two weeks before the meeting,” he told reporters Tuesday after a speech in Charlotte, North Carolina. “But I thought Jay’s guidance the last time was very sound. We’ll get a little bit more information before the meeting and importantly we’ll get CPI. I’ll reserve judgment.” (BBG)

FED: Most of the boards of directors of the 12 regional Federal Reserve banks favored a 50-bps interest-rate hike ahead of the June FOMC meeting and before May consumer-price data showed inflation accelerating. (BBG)

FED: Michael Barr, U.S. President Joe Biden's pick to fill the last remaining vacancy on the seven-member Federal Reserve Board, advanced toward confirmation on Tuesday after clearing a procedural hurdle in the U.S. Senate. (RTRS)

INFLATION: The US Bureau of Labor Statistics said Tuesday that a release circulating online purporting to show hotly-anticipated June inflation figures was a forgery. “We are aware of a fake version of the June 2022 Consumer Price Index news release that is being circulated online,” BLS spokesperson Cody Parkinson said in an emailed statement. (BBG)

INFLATION: White House officials are preparing the country for a hot inflation rate ahead of the release of Wednesday's Consumer Price Index, but they insist that some key inflation components — including gas prices — are coming down. (Axios)

ECONOMY: The International Monetary Fund on Tuesday warned that avoiding recession in the United States will be "increasingly challenging" as it again cut its 2022 U.S. growth forecast to 2.3% from 2.9% in late June as recent data showed weakening consumer spending. (RTRS)

ECONOMY: The United States appears to be shifting to a period of slower job and economic growth, and recent economic data was not consistent with recession in the first or second quarters of this year, White House officials said on Tuesday. (RTRS)

POLITICS: U.S. President Joe Biden's public approval rating rose three percentage points this week to 39%, rebounding from a week earlier when it matched the lowest level of his presidency, a Reuters/Ipsos opinion poll completed on Tuesday found. (RTRS)

EQUITIES: Twitter filed suit against Elon Musk in the Delaware Court of Chancery on Tuesday after the billionaire said he was terminating his $44 billion deal to buy the company. (CNBC)

OTHER

GLOBAL TRADE: The US Department of Agriculture trimmed its outlook for Ukraine’s 2022 wheat harvest by 2 million tons in a monthly global crop report. Despite rising food prices worldwide, Ukraine is now expected to reap 19.5 million tons of wheat, about 40% less than the prior season. That’s because of cuts to the harvested area, signaling farmers are unable to collect all the grain they planted last autumn. USDA’s estimate is similar to recent forecasts from Agritel, UkrAgroConsult and the Ukrainian Grain Association. (BBG)

GLOBAL TRADE: Ukraine's infrastructure ministry said in a statement Tuesday that 16 ships had passed through the Danube's newly-reopened Bystre rivermouth in the last four days and that the opening up of the Bystre was an important step towards speeding up grain exports. (RTRS)

U.S./CHINA: China's military said on Wednesday it monitored and drove away a U.S. destroyer which entered the South China sea near the Paracel Islands, and noted the actions of the U.S. military seriously violated China's sovereignty and security. "On July 13, the U.S. guided missile destroyer "Benfold" illegally broke into China's Paracel territorial waters without the approval of the Chinese government," said Chinese military's Southern Theater spokesperson Tian Junli. The move "seriously damaged the peace and stability of the South China Sea, and seriously violated international law and the norms of international relations," Tian said in a statement. (RTRS)

JAPAN: The latest batch of opinion polls circulated by Japanese media outlets suggest that the approval of Fumio Kishida's Cabinet leapt higher after the ruling coalition secured a resounding victory in the Upper House election held last weekend. The Cabinet's approval rating rose to 63.2% in a Kyodo News poll, up 6.3 percentage points from the previous survey taken in June. In a poll taken by Yomiuri, 65% of respondets said they approved of the Cabinet, up 8 percentage point from the June survey. Kishida's Liberal Democratic Party remains by far the most popular political party. In the Yomiuri poll, a combined 86% of respondents said that they believed the assassination of former Prime Minister Shinzo Abe affected the outcome of the election slightly (54%) or greatly (32%). But the phrasing of the question and extensive media coverage of the incident may have encouraged people to give affirmative answers. The Kyodo survey showed that just 15.1% of people said their voting intentions were influenced by the incident. In addition, the public showed little interest in facilitating the process of amending Japan's pacifist constitution. 58.4% of respondents in the Kyodo poll said there is no need to hurry, with 37.5% saying the contrary. In the Yomiuri survey, constitutional amendments were relatively far on the list of issues voters think the Cabinet should prioritise, with economy and employment, inflation and national security topping the ranking. Post-election opinion polling highlights the strength of the mandate handed to the ruling coalition, with Prime Minister Kishida looking at three "golden years" of peace until the next general election. Strong popular support for his Cabinet gives him more scope to proceed to pursuing his policy agenda, although the experience of his foreign peers shows that the tide of public sentiment may eventually turn if current economic headwinds persist. (MNI)

JAPAN: The Japanese government plans to postpone the start of its nationwide tourism incentive program amid a rebound in coronavirus cases, public broadcaster NHK reports, without attribution. (BBG)

RBNZ: New Zealand's central bank delivered its sixth straight interest rate hike on Wednesday and signaled it remained comfortable with its planned aggressive tightening path as authorities seek to reduce second-round effects of runaway inflation. (RTRS)

BOK: The Bank of Korea raised its benchmark interest rate by half a percentage point on Wednesday, taking a more active inflation-fighting role as the import-dependent country struggles with soaring energy and food prices. (Nikkei)

SOUTH KOREA: South Korean government will extend the operation of credit market support program by end-March and spend up to additional 6t won on buying lower-rated corporate bonds and commercial paper, to help stabilize the market, according to Financial Services Commission. (BBG)

NORTH KOREA: North Korea fired an artillery shot into the Yellow Sea earlier this week, presumably from a multiple rocket launcher, a defense source here said Wednesday, as the US has deployed six F-35A stealth fighters on the peninsula for combined drills. (Korea Herald)

HONG KONG: Hong Kong’s new health chief said conditional quarantine-free travel could be allowed by November in time for a global bankers’ summit to be held in the city, the South China Morning Post reported Wednesday. (BBG)

BRAZIL: Brazil's Economy Ministry will raise its forecast for economic growth this year to 2% from 1.5%, ministry sources said, backed by recent stronger-than-expected economic indicators. The review will come out this week and serve as the basis for calculating government income and expenses in a bi-monthly report to be released on July 22, said the sources on condition of anonymity since the figures are not public. (RTRS)

BRAZIL: Brazil’s lower house suspended a session to approve a $7.6 billion package of social aid after its remote voting system failed, according to a webcast. The bill had 393 votes in favor to 14 against in a first round vote when the glitch happened, leading lower house speaker. (BBG)

RUSSIA: Germany will completely stop buying Russian coal on Aug. 1 and Russian oil on Dec. 31, marking a major shift in the source of the country's energy supply, deputy finance minister Joerg Kukies said at a conference in Sydney. "We will be off Russian coal in a few weeks," Kukies told the Sydney Energy Forum, co-hosted by the Australian government and the International Energy Agency. Russian coal previously made up 40% of Germany's coal mix and Russian oil makes up 40% of its oil mix, he said. (RTRS)

IRAN: France's new foreign minister said on Tuesday there were only a few weeks before the window of opportunity to revive Iran's 2015 nuclear deal with world powers would close. (RTRS)

ENERGY: U.S. natural gas production and demand will both rise to record highs in 2022 as the economy grows, the U.S. Energy Information Administration (EIA) said in its Short Term Energy Outlook (STEO) on Tuesday. (RTRS)

OIL: U.S. crude production and petroleum demand will both rise in 2022 as the economy grows, the U.S. Energy Information Administration (EIA) said in its Short Term Energy Outlook (STEO) on Tuesday. (RTRS)

OIL: Brazil is looking to buy as much diesel as it can from Russia and the deals are being closed "as recently as yesterday," Brazilian Foreign Minister Carlos Franca said on Tuesday, without giving further details on the transactions. (RTRS)

OIL: National Oil Co. of Libya lifts force majeure declaration for two key ports and a ship, according to statement on Facebook. (BBG)

OIL: Libya's Government of National Unity (GNU) has decided to replace the National Oil Corp board and Chairman Mustafa Sanalla, a GNU source said on Tuesday, confirming widespread reports on social media and in local press. (RTRS)

OIL: Ecuador’s Energy and Mines Ministry has lifted the force majeure on the oil industry value chain, including exports, according to a statement sent by text message. (BBG)

OIL: Oil traders are willing to pay the highest premiums in years to obtain North Sea crude, underscoring an undiminished appetite for actual barrels despite another collapse in the futures market on Tuesday. (BBG)

CHINA

ECONOMY: China policymakers will implement support measures and make efforts to ensure the economy grows at a good and healthy pace, the People’s Daily reported in its commentary on Wednesday. Fiscal policy needs to be more positive in term of cutting taxes and fees and expanding domestic demand via issuing local government special bonds to boost infrastructure. At the same time, monetary policy remains flexible and works to stabilise market sentiment, it said. The authorities needs to prepare additional tools for the new downward pressure to maintain economic growth, it noted. (MNI)

YUAN: The yuan has remained stable and resilient versus a stronger dollar, supported by the domestic economy’s recovery and equity inflows, Shanghai Securities News said, citing analysts. (BBG)

FISCAL: China policy makers will implement supportive measures and make efforts to ensure the economy grows at a good and healthy level, the People’s Daily in its commentary on Wednesday. Fiscal policy needs to be more positive in term of cutting taxes and fees and expanding domestic demand via issuing local government special bonds to boost infrastructure. And monetary policy needs to remain flexible and work to stabilise market sentiment, it said. The authorities needs to prepare additional tools for the new downward pressure to maintain economic growth, it noted. (MNI)

CORONAVIRUS: Shanghai’s Covid-19 cases appear to be leveling off following a recent spike, though some residents have been urged to stockpile food and medicines as the fear of returning to lockdown hangs over the city. (BBG)

PROPERTY/CREDIT: Chinese developers have turned to domestic markets to raise funds but default risks are still growing as debt maturities peak in July and August, the Securities Daily reported on Wednesday. The financing amount of developers slumped by 56.5% year-on-year in the first half as they have been downgraded due to credit risks, it said. Debt issuance in offshore markets is also shrinking with no issuance in both February and May. As restrictions on the fund-raising in the sector relax and market confidence is recovering, the financing environment is expected to improve in the second half. But for those heavily-indebted developers, the default risk remains big, the report warned. (MNI)

CHINA MARKETS

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0276% at 9:32 am local time from the close of 1.5399% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Tuesday vs 49 on Monday

CHINA SETS YUAN CENTRAL PARITY AT 6.7282 WEDS VS 6.7287 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7282 on Wednesday, compared with 6.7287 set on Tuesday.

OVERNIGHT DATA

NEW JUN ZEALAND REINZ HOUSE SALES -38.1% Y/Y; MAY -28.4%

NEW JUN ZEALAND FOOD PRICES +1.2% M/M; MAY +0.7%

SOUTH KOREA JUN UNEMPLOYMENT RATE SA 2.9%; MEDIAN 2.8%; MAY 2.8%

MARKETS

SNAPSHOT: CPI Front & Centre

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 98.06 points at 26435.23

- ASX 200 up 1.017 points at 6607.3

- Shanghai Comp. up 11.822 points at 3293.289

- JGB 10-Yr future up 13 ticks at 149.33, yield down 0.8bp at 0.234%

- Aussie 10-Yr future up 3.5 ticks at 96.575, yield down 4.7bp at 3.374%

- U.S. 10-Yr future -0-01+ at 118-19+, yield down 0.18bp at 2.967%

- WTI crude down $0.16 at $95.67, Gold down $0.12 at $1725.96

- USD/JPY up 14 pips at Y137.02

- TORY LEADERSHIP RACE: RISHI SUNAK AND LIZ TRUSS HEAD FIELD OF EIGHT CANDIDATES (THE TIMES)

- BOE’S BAILEY SAYS GOAL IS TO CURB INFLATION, ‘NO IFS OR BUTS’ (BBG)

- RBNZ DELIVERS EXPECTED 50BP RATE HIKE

- BANK OF KOREA HIKES KEY RATE BY HALF A POINT TO FIGHT INFLATION (NIKKEI)

- PRESSURE ON CHINA’S YUAN TO WEAKEN IS MANAGEABLE (SEC NEWS)

- SHANGHAI COVID CASES STEADY, THOUGH LOCKDOWN ANGST REMAINS (BBG)

US TSYS: No Conviction Ahead Of CPI, Options Flow Noted

TYU2 trades just above the middle of its 0-10+ Asia-Pac range heading into London hours, -0-01+ at 118-19+, on sub-par volume of 75K. Cash Tsys run -/+0.5bp across the curve, with very modest twist steepening in play.

- Tsys meandered through Asia-Pac dealing, lacking anything in the way of meaningful conviction ahead of Wednesday’s CPI report.

- An uptick in equities reversed the early carry over bid in Tsys (which spilled over from Tuesday’s light richening), before the space regained some poise to trade away from cheaps.

- There hasn’t been much in the way of wider macro headline flow to digest, with the RBNZ & BoK delivering the widely expected 50bp rate hikes, while Shanghai noted that there were no new cases of COVID discovered outside of quarantine.

- Market flow provided the focal point with 4x block buys of the FV 112.75 calls lodged throughout the session (4x +5.0K blocks), with a block buyer of TYU2 futures (+1.3K) also observed.

- The aforementioned CPI print headlines domestic matters on Wednesday (see our full preview of that release here), with 30-Year Tsy supply also due (hot on the heels of Tuesday’s poorly received 10-Year auction). The latest BoC monetary policy decision will provide some interest across the border.

- A quick reminder that a falsified “leak” of the CPI print did the rounds on social media late yesterday (indicating a headline print above +10% Y/Y), with the Labour Department subsequently acknowledging the existence of the tweet and stressing that it was a fake.

JGBS: Firmer & Flatter

JGB futures nudged higher at the Tokyo re-open, as local participants reacted to Tuesday’s richening in wider core global FI markets, before the contract eased back towards late overnight session levels, hugging a tight range, last +11.

- Cash JGBs sit little changed to ~4bp richer across the curve, with super long end demand evident (domestic life insurers may be at work further out the curve) during the Tokyo morning, allowing a bull flattening theme to develop.

- BoJ Rinban operations revealed a downtick in the offer/cover ratios covering 1- to 3-, 5- to 10- & 25+-Year paper, which probably provided some incremental support to the space during the Tokyo afternoon.

- Note that the richening in JGBs came even as swap rates moved higher, pulling swap spreads wider from both sides of the equation.

- Looking ahead, 20-Year JGB supply headlines Thursday’s local docket.

AUSSIE BONDS: Limited By Impending Event Risk

Futures coiled through Sydney trade, with participants lacking anything in the way of meaningful conviction.

- Across the Tasman, the latest RBNZ decision saw the Bank deliver the widely expected 50bp rate hike (see earlier bullets for more details/colour on the matter), although there wasn’t anything much in the way of surprises when it came to the tone of the accompanying statement, leaving participants with little to trade off as we work towards the U.S. CPI print. YM deals +1.5, with XM +3.5 at typing. A similar degree of bull flattening has been observed on the wider cash ACGB curve, with the 7- to 12-Year zone providing the firmest point on the curve. EFPs have narrowed for a second day. The IR strip runs 1-6bp firmer through the reds, bull steepening.

- The latest ACGB Nov-32 auction was digested smoothly, with the weighted average yield pricing 0.73bp through prevailing mids, while the cover ratio topped the 2.50x mark, just. As we noted in our preview, prevailing market conditions meant that a solid auction was likely, although the cover ratio was likely limited by the proximity to the impending U.S. CPI print (and perhaps even the RBNZ decision), in addition to a continued lack of meaningful foreign demand.

- Looking ahead, the aforementioned U.S. CPI release provides the immediate headline risk event, while Thursday will see the release of the monthly Australian labour market report.

AUSSIE BONDS: ACGB Nov-32 Auction Result

The Australian Office of Financial Management (AOFM) sells A$800mn of the 1.75% 21 November 2032 Bond, issue #TB165.

- Average Yield: 3.4150% (prev. 3.4942%)

- High Yield: 3.4175% (prev. 3.4975%)

- Bid/Cover: 2.5250x (prev. 2.7687x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 49.9% (prev. 4.2%)

- Bidders 43 (prev. 41), successful 20 (prev. 19), allocated in full 12 (prev. 12)

EQUITIES: Intervention In Taiwan Stocks Helps Stabilise Asia-Pac Equities

A rally in Taiwan equities, after the country confirmed that it will deploy its stock stabilisation fund after hours on Tuesday, coupled with the Chinese city of Shanghai finding 0 COVID cases outside of quarantine helped stabilise wider equity markets in Asia-Pac dealing, with focus squarely on the impending U.S. CPI report. The major regional equity benchmarks sit little changed to 0.5% firmer on the day, with e-minis running 0.1-0.2% above settlement levels. The TAIEX is the best part of 3% higher on the day, albeit operating off of best levels.

GOLD: Slightly Up From Recent Lows, US CPI Eyed

Gold dipped below $1725 in early trade, but we recovered from there and now sit back above $1727. This follows a volatile overnight session, where the precious metal ultimately lost just under 0.50%. Current levels are slightly above the NY close.

- Support is still evident for gold in the low $1720 region. This coincides with lows from late September last year. As we noted yesterday beyond that is the $1690 low from August last year.

- Cross asset drivers have been mixed today. The USD has lost a little ground against higher beta plays, with firmer equities evident in the region and in terms of US futures.

- Overall moves are modest though. US yields are relatively steady. Overnight , the US real yield edged down a touch to 64bps, although it remains fairly close to recent highs.

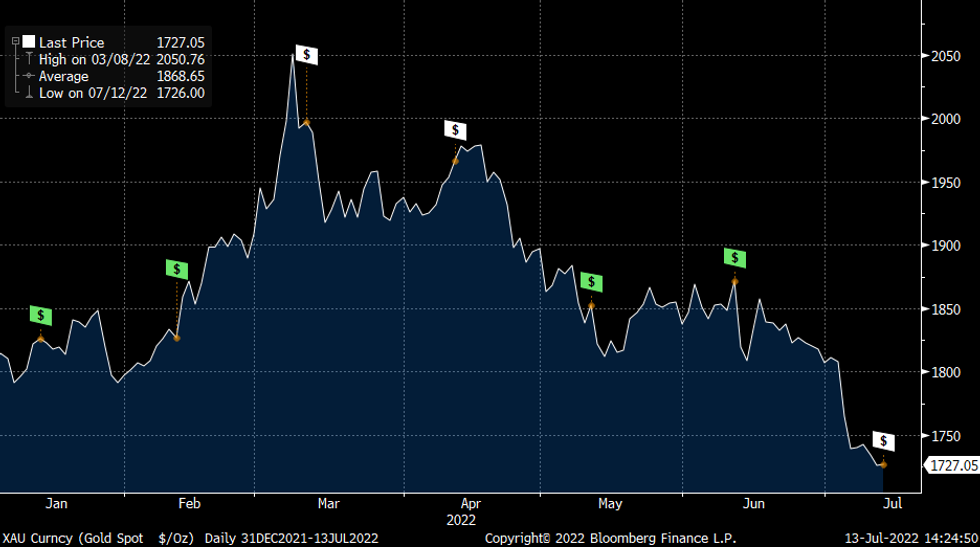

- No doubt the market is waiting for tonight's US CPI report. Recent upside surprises on CPI have produced downside momentum in gold, see the chart below.

- This chart plots spot gold prices against US CPI release dates, with green dollar symbols representing months where inflation has surprised on the upside relative to expectations.

Fig 1: Gold & US CPI Releases In 2022

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

OIL: Steadies After Sharp Overnight Drop

Oil is modestly higher from earlier lows. Brent is just $100/bbl (versus earlier low of $98.30), while WTI is back close to $96/bbl from sub $94/bbl at the start of the session. This comes after yesterday's ~7% drop. Risk appetite is a little firmer through the Asian region today. Equities are higher, although so in tech sensitive markets. US futures are modestly higher. Other commodities have also firmed a touch.

- Demand concerns were at the forefront of the overnight fall in oil, as recession fears continue to play out in the major economies. Also, the American Petroleum Institute reported that US crude stockpiles rose by 4.76mn barrels last week. The Energy Information Administration (EIA) will report more data tonight in the US.

- The EIA also cut its gasoline demand estimate for July through to October by -2.2% versus the June forecast. This follows weaker demand conditions in the US during the summer driving season, relative to seasonal norms.

- Elsewhere, Libya has lifted force majeure at two ports according to a Bloomberg report. Ecuador has also officially lifted force majeure on oil exports, although this was seen as a formality following an earlier agreement, which ended domestic protests at the end of June.

- More broadly, OPEC's first 2023 outlook suggests little relief in terms of the supply/demand balance. The group expects demand to exceed supply by 1mn barrels per day next year.

- Finally, note US President Biden's trip to the Middle East kicks off today. He is expected to be in Saudi Arabia on Friday.

FOREX: Yen Loses Shine Amid Better Risk Backdrop, Kiwi Slips Post-RBNZ

Light risk-on flows took hold as the Asia-Pac session progressed, with the regional equity space supported by Taiwan's announcement that it will activate its stock stabilisation fund. The lack of new COVID-19 cases outside of quarantine facilities in Shanghai may have also helped prop up market sentiment.

- The kiwi dollar underperformed the likes of AUD and CAD which capitalised on risk-on impetus, as participants parsed the RBNZ's monetary policy review. The Reserve Bank delivered a widely expected 50bp rate rise but signalled marginally deeper concern about economic headwinds and said it was comfortable with the current OCR forecast, with NZ 2-Year swaps ticking lower as a result.

- Spot USD/JPY turned bid over the Tokyo fix, running as high as to Y137.25 before trimming gains. The yen remains the worst G10 performer, with U.S./Japan 10-Year yield spread widening a tad.

- The greenback lost its initial allure, even as U.S. Tsys cheapened across the curve. That said, the dollar index (BBDXY) sits within touching distance from two-year highs, while EUR/USD oscillates ~35 pips above parity, as focus turns to U.S. CPI data, due for release in NY hours.

- Other points of note today include a rate decision from Canada's central bank, final German & French CPIs, as well as comments from Fed's Waller, ECB's Centeno & BoC's Macklem.

FX OPTIONS: Expiries for Jul13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0195-00(E1.0bln)

- GBP/USD: $1.2035(Gbp1.2bln)

- USD/JPY: Y134.40-55($1.1bln), Y136.00($830mln)

- EUR/JPY: Y137.00(E936mln), Y138.00(E641mln), Y139.00(E823mln)

- NZD/USD: $0.6180(N$794mln)

- USD/CAD: C$1.3000($1.6bln)

- USD/CNY: Cny6.7500($615mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/07/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 13/07/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 13/07/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 13/07/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 13/07/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 13/07/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/07/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 13/07/2022 | 0900/1100 | ** |  | EU | industrial production |

| 13/07/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/07/2022 | - | *** |  | CN | Trade |

| 13/07/2022 | 1230/0830 | *** |  | US | CPI |

| 13/07/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 13/07/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 13/07/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 13/07/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 13/07/2022 | 1500/1100 |  | CA | BOC press conference | |

| 13/07/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 13/07/2022 | 1800/1400 | ** |  | US | Treasury Budget |

| 13/07/2022 | 1800/1400 |  | US | Federal Reserve Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.