-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBA Cash Rate "Well Below Neutral," China COVID Cases Keep Ticking Higher

EXECUTIVE SUMMARY

- RISHI SUNAK TOPS TORY LEADERSHIP POLL, AS TOM TUGENDHAT OUT OF RACE

- CHINA’S COVID CASES NEAR 700 AS SHANGHAI WIDENS TESTING

- RBA MINUTES: CURRENT LEVEL OF CASH RATE WELL BELOW NEUTRAL

- RUSSIA'S GAZPROM TELLS EUROPEAN BUYERS GAS SUPPLY HALT BEYOND ITS CONTROL (RTRS)

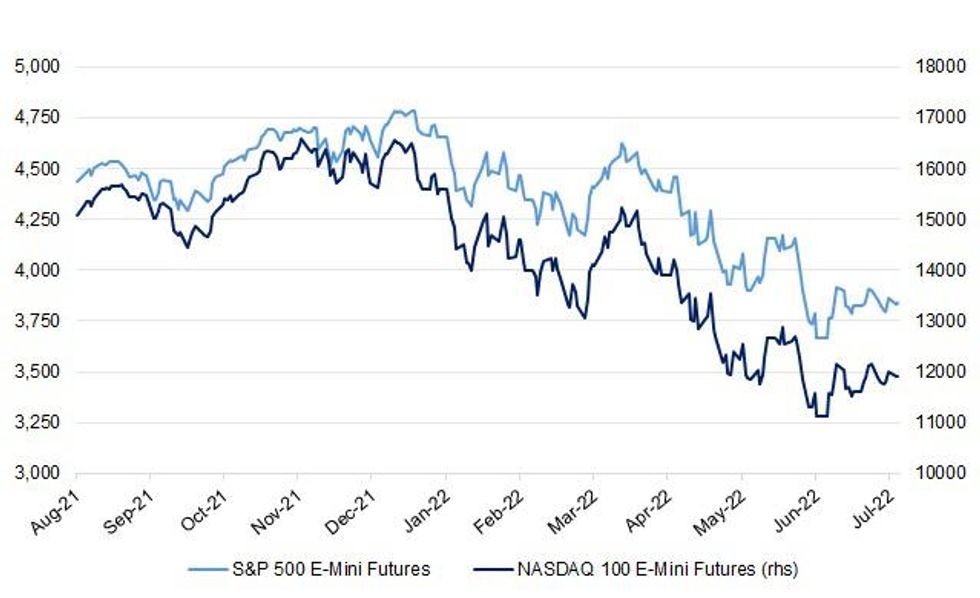

Fig. 1: S&P 500 Vs. NASDAQ 100 E-Mini Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Former Chancellor Rishi Sunak has topped the third MPs' vote for the next Tory leader and prime minister, with backbencher Tom Tugendhat eliminated. Trade Minister Penny Mordaunt took second place, while Foreign Secretary Liz Truss was third and ex-Equalities Minister Kemi Badenoch was fourth. (BBC)

POLITICS: Kemi Badenoch has emerged as the potential kingmaker in the Tory leadership race as she picked up votes in the third ballot on Monday night. (Telegraph)

POLITICS: Boris Johnson has easily survived a vote of no confidence in the House of Commons, but the prime minister used a swansong debate to claim “the deep state” was plotting with Labour to reverse Brexit. Tory MPs who mobilised this month to oust Johnson on Monday night rallied behind his caretaker government, defeating Labour in a confidence vote by 349 votes to 238, a majority of 111. (FT)

FISCAL: Britain's government must focus on sound public finances and avoid further fuelling inflation by pumping up demand, new finance minister Nadhim Zahawi is due to say in his first major speech on Tuesday. Zahawi will address the City of London's annual Mansion House dinner, where he is set to confirm a post-Brexit reworking of financial regulation inherited from the European Union, including Solvency II insurance rules. (RTRS)

FISCAL: Millions of public sector workers will be awarded below-inflation pay deals today, prompting unions to threaten another wave of strikes. Ministers will accept recommendations for pay rises averaging between 4 per cent and 5 per cent across the NHS, schools, police, justice system and armed forces in what has been condemned as “a massive national pay cut”. (The Times)

EUROPE

ECB/FISCAL: Eurogroup and European Commission officials are concerned that the European Central Bank’s proposed anti-fragmentation tool, which would cap member states’ bond spreads on condition they make efforts towards improving their finances, could undermine other European institutions’ role in monitoring fiscal policy, sources told MNI. (MNI)

GERMANY: German utility group Uniper on Monday applied to extend its 2 billion euro ($2.03 billion) credit line with state-owned lender KfW after drawing down the full amount in response to supply shortfalls of Russian gas. (RTRS)

ITALY: Some lawmakers in Mario Draghi’s coalition are working on a last-ditch plan to convince the Italian prime minister not to resign. A group of deputies from the Five Star Movement are ready to turn their backs on party leader Giuseppe Conte and maintain their support for Draghi’s government, according to people familiar with the discussions. They are still trying to determine whether that would be enough to persuade Draghi to stay on ahead of confidence votes on Wednesday. (BBG)

ITALY/RATINGS: Mario Draghi’s resignation as Italy’s Prime Minister after a split in his national unity government heralds greater political uncertainty even if early elections are avoided, Fitch Ratings says. Near-term implications for economic and fiscal policymaking depend on political outcomes, but structural reform and fiscal consolidation are likely to become more challenging. (Fitch)

SPAIN: Spain's government is readying a levy of just below 5% on net interest income and banking commissions as part of a package to raise 3 billion euros ($3.05 billion) to help tackle the impact of inflation, two sources with knowledge of the matter said. (RTRS)

U.S.

FED: The Federal Reserve should have started hiking interest rates before it was done tapering its bond purchases to avoid falling behind on the fight against inflation, Randal Quarles, the Fed’s former vice chair for supervision, said. Policy makers were focused on unwinding the central bank’s asset purchases in a predictable manner to avoid disrupting markets, Quarles said during an interview with the Macro Musings podcast published Monday by the Mercatus Center. (BBG)

INFLATION: White House economic adviser Jared Bernstein said on Monday he expects to see average gasoline prices falling below $4 a gallon in some places around the country in the coming weeks. "We think it is reasonable to expect more gas stations to lower their prices in response to lower input costs," Bernstein said. "Barring unforeseen market disruptions, (we expect) to see average prices fall below $4 per gallon in more places in coming weeks." (RTRS)

EQUITIES: Apple Inc. plans to slow hiring and spending growth next year in some divisions to cope with a potential economic downturn, according to people with knowledge of the matter. (BBG)

OTHER

GLOBAL TRADE: Democratic Majority Leader Chuck Schumer said the U.S. Senate would begin voting on Tuesday on legislation to boost the U.S. semiconductor industry and improve competitiveness with China. The legislation is a slimmed-down version of a bill that members of Congress have been working on for well over a year, expected to include $52 billion in subsidies for the industry and a tax credit for companies that manufacture semiconductors in the United States. (RTRS)

GLOBAL TRADE: U.S. allies appear committed to following Washington's lead banning forced labor goods from China's Xinjiang region, a senior U.S. official told Reuters on Monday, warning companies they could not maintain "deliberate ignorance" about their supply chains. (RTRS)

GLOBAL TRADE: Truck drivers choked traffic at the Oakland, California, seaport on Monday protesting a state law that makes it harder for independent contractors to transport goods and could limit labor at the state's already clogged seaports, threatening to worsen the nation's pandemic-fueled supply chain jams. (RTRS)

U.S./CHINA: U.S. Treasury Secretary Janet Yellen will call on Tuesday for deeper trade ties among allies to fortify their supply chains, combat inflation and thwart China's "unfair trade practices" and efforts to dominate key raw materials and technologies markets. (RTRS)

U.S./CHINA/TAIWAN: Nancy Pelosi plans to visit Taiwan next month to show support for Taipei as it comes under mounting pressure from China, in what would be the first visit by a Speaker of the US House of Representatives to the country in 25 years. (FT)

EU/CHINA: Top European leaders have been invited to meet Chinese President Xi Jinping in Beijing in November but have yet to decide whether to accept. Invitations have been sent to German Chancellor Olaf Scholz, French President Emmanuel Macron, Italian Prime Minister Mario Draghi and Spanish Prime Minister Pedro Sánchez, according to a senior source familiar with the situation. (SCMP)

EU/TAIWAN/CHINA: Nicola Beer, vice president of the European Parliament (EP), will visit Taiwan from Tuesday to Thursday (July 19 - 21), during which she will meet with President Tsai Ing-wen and other Taiwanese politicians, marking the first time an EP official of such rank has visited the country, the Ministry of Foreign Affairs (MOFA) said in a press release on Monday. (Taiwan News)

JAPAN: Japan's economy is likely to grow at a slower pace than previously thought throughout the rest of the fiscal year, a Reuters poll showed, as growing risks of a global economic slowdown and supply woes torment Japanese exporters. (RTRS)

RBA: The Reserve Bank of Australia, in minutes of its July policy meeting released Tuesday, said “further steps” would need to be taken to normalize monetary conditions over the months ahead. Minutes contained a section on the neutral interest rate. “Current level of the cash rate is well below the lower range of estimates for the nominal neutral rate. This suggests that further increases in interest rate will be needed to return inflation to the target over time”. (BBG)

RBA: Australian households are in a “fairly good position” to cope with higher interest rates, Reserve Bank No. 2 Michele Bullock said, while adding that risks are “a little elevated” and the path of the labor market will be central to how they play out. In a speech on the impact of rising rates on borrowers, the deputy governor pointed out that much of the debt is held by high-income earners who have the ability to meet their obligations. Still, she said, how households respond to higher repayments will be important in judging how much to raise rates. (BBG)

BRAZIL: President Jair Bolsonaro invited the diplomatic corps on Monday to hear his charges that Brazil's election system was open to fraud ahead of October elections in which he is trailing in a bid for a second term. "The system is completely vulnerable," he told some 40 diplomats invited to his residence in an unprecedented briefing three months before a general election. (RTRS)

RUSSIA: U.S. Treasury Secretary Janet Yellen said on Tuesday that the United States will impose harsh consequences on those countries that abuse or break international economic order. "Economic integration has been weaponized by Russia," she said, calling for all responsible countries to unite in opposition to Russia's war in Ukraine. She said she was heartened by conversations with Korean counterparts on a proposed cap on Russian oil price while visiting South Korea, the final leg of her 11-day visit to the Indo-Pacific region. (RTRS)

METALS: BHP Group on Tuesday joined rival Rio Tinto in warning that a tight labour market, supply-chain snags, and inflationary pressures would continue through fiscal 2023, and reported a fourth-quarter iron ore output that missed estimates. (RTRS)

METALS: Chilean state-owned Codelco, the world's largest copper producer, is keeping its Rajo Inca project construction on hold to investigate a fatal accident that happened earlier this month, authorities and the company said on Monday. (RTRS)

ENERGY: A gas pipeline has been damaged as a result of a strike by the Ukrainian armed forces near the Kakhovka hydroelectric power plant in Ukraine's Kherson, a region currently controlled by Russian forces, TASS reported on Monday, citing the regional administration. A spokesperson for Ukraine's state gas system Naftogaz said there was no immediate evidence that the developments in the Kherson region had affected the transit of Russian natural gas to Europe. (RTRS)

ENERGY: A gas cut-off from Russia would pose a major hurdle but the EU is ready to deal with the consequences, the bloc’s foreign policy chief Josep Borrell said following a meeting of EU foreign ministers in Brussels. Borrell said the EU wasn’t considering new sanctions against Russia when it comes to gas but the bloc is discussing how to deal with a swift decrease in the supply of gas. “It’s not going to be an easy scenario, but we should be prepared for that,” he said. (BBG)

ENERGY: Russia's Gazprom has told customers in Europe it cannot guarantee gas supplies because of "extraordinary" circumstances, according to a letter seen by Reuters, upping the ante in an economic tit-for-tat with the West over Moscow's invasion of Ukraine. (RTRS)

OIL: The 590,000 barrel-per-day Keystone pipeline was operating at reduced capacity on Monday, operator TC Energy said, after a third-party power utility in South Dakota was damaged. TC Energy said a force majeure has been declared on Keystone and repairs are underway, but there is currently no timeline for restoration of full service. (RTRS)

OIL: The recovery in Russian oil production has continued this month as higher domestic demand offset a slight drop in exports to key markets. The nation’s producers pumped 10.78 million barrels a day on average from July 1 to 17, according to data from the Energy Ministry’s CDU-TEK unit that was seen by Bloomberg. That’s 0.6% above the June level, according to calculations based on the data, indicating that the pace of the country’s output recovery has slowed. (BBG)

OIL: Russia is seeking payment in United Arab Emirates dirhams for oil exports to some Indian customers, three sources said and a document showed, as Moscow moves away from the U.S. dollar to insulate itself from the effects of Western sanctions. (RTRS)

OIL: Total output in the major U.S. shale oil basins will rise 136,000 bpd to 9.068 million bpd in August, the highest since March 2020, EIA projected. (RTRS)

CHINA

POLICY: China should strengthen the coordination of fiscal and monetary policy to better support enterprises and help stabilise employment, Guan Tao, a former official and now chief economist at BOC Securities wrote in a blog post. China can learn from the practice of the U.S. and the UK to rescue enterprises by providing liquidity support and improving companies’ solvency to help them repair their balance sheets, said Guan. The central bank can also launch new structural tools to support the key areas and weak links of the economy, Guan added. (MNI)

ECONOMY: The Chinese economy is expected to gradually return to its potential growth level of about 5% and 5.5% in Q3 and Q4, respectively, which may bring the annual growth to 4.1% to 4.5%, the Securities Daily reported citing Wang Qing, chief macro analyst of Golden Credit Rating. Boosting consumption should be a key to drive growth in H2, including the promotion of car and home appliance sales, as well as the issuance of consumer coupons and subsidies to the low-income groups, Wang was cited as saying. Retail sales may rebound to around 4.5% y/y by year-end from the 0.7% decline in H1, the newspaper said citing Wang. (MNI)

INFLATION: China’s 2022 consumer price target of about 3% is achievable, thanks to government efforts to strengthen food and energy supplies and Covid-19 prevention and control measures, the official Economic Daily says in a front-page commentary Tuesday. (BBG)

CORONAVIRUS: New Covid-19 cases in China jumped to almost 700, with more infectious strains of the virus continuing to test the country’s hardline approach as outbreaks spread beyond the major cities. China reported 699 cases for Monday -- the highest daily tally since May 22 -- after recording more than 1,000 infections over the weekend. (BBG)

CHINA MARKETS

PBOC INJECTS NET CNY4 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY7 billion via 7-day reverse repos with the rate unchanged at 2.1% on Tuesday. This led to a net injection of CNY4 billion after offsetting the maturing CNY3 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9333% at 9:24 am local time from the close of 1.5967% on Monday.

- The CFETS-NEX money-market sentiment index closed at 51 on Monday vs 48 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7451 TUES VS 6.7447

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7451 on Tuesday, compared with 6.7447 set on Monday.

OVERNIGHT DATA

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 81.8; PREV 81.6

Consumer confidence steadied as concerns about the economic outlook ebbed, likely driven by the strong labour market print last week. High inflation and rising interest rates are feeding into households’ weak assessment of their financial conditions. That is yet to show up in spending behaviour, however. Inflation expectations dropped to a one month low, with global fuel prices moderating. Australia’s wholesale petrol prices declined last week fuelling hopes that retail prices will moderate. This will likely be good news for sentiment if it occurs. (ANZ)

MARKETS

SNAPSHOT: RBA Cash Rate "Well Below Neutral," China COVID Cases Keep Ticking Higher

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 210.01 points at 26997.51

- ASX 200 down 46.037 points at 6641.1

- Shanghai Comp. down 9.585 points at 3268.518

- JGB 10-Yr future unch. ticks at 149.29, yield down 0.3bp at 0.234%

- Aussie 10-Yr future down 6.5 ticks at 96.46, yield up 5.9bp at 3.495%

- U.S. 10-Yr future -0-03 at 118-12, yield down 2.04bp at 2.965%

- WTI crude down $0.28 at $102.32, Gold down $1.02 at $1708.17

- USD/JPY down 5 pips at Y138.10

- RISHI SUNAK TOPS TORY LEADERSHIP POLL, AS TOM TUGENDHAT OUT OF RACE

- CHINA’S COVID CASES NEAR 700 AS SHANGHAI WIDENS TESTING

- RBA MINUTES: CURRENT LEVEL OF CASH RATE WELL BELOW NEUTRAL

- RUSSIA'S GAZPROM TELLS EUROPEAN BUYERS GAS SUPPLY HALT BEYOND ITS CONTROL (RTRS)

US TSYS: Marginally Firmer In Asia

Tsys have nudged higher during Asia-Pac dealing, unwinding a little of Monday’s cheapening in the process. Note that the richening isn’t sizable, with a downtick in Chinese equities (which struggled alongside a move higher in the latest Chinese daily COVID case figures) and some spill over from Monday’s move away from NY session cheaps (which came alongside reports that tech giant Apple plans to trim spending and headcount growth in some areas during ’23) supporting the space during Asia-Pac hours.

- That leaves the major cash Tsy benchmarks running 1.5-2.5bp richer across the curve, with very modest bull steepening in play. Meanwhile, TYU2 deals -0-03 at 118-12, 0-00+ off the peak of its 0-06+ session range, on very limited volume of ~40K.

- Geopolitical-tied headlines e.g. FT sources suggesting that U.S. House Speaker Pelosi is getting ready to visit Taiwan in the coming weeks, had nothing in the way of tangible impact on Tsys during overnight dealing, with the space also looking through a downtick in ACGBs.

- Looking ahead, housing starts and building permits data headline the NY docket on Tuesday.

JGBS: Twist Steepening On Conflicting Forces

Cash JGBs twist steepened as Tokyo returned from the elongated weekend, with a moderation in expectations surrounding the prospect of a 100bp rate hike from the U.S. Federal Reserve later this month supporting paper out to 10s, while super-long JGBs struggled after Monday’s cheapening in the wider core global FI space. That leaves the major JGB benchmarks running 1.5bp richer to 5.0bp cheaper, with the wings of the curve representing the respective extremes.

- Paper out to 5s also drew support from a downtick in the offer/cover ratio in BoJ Rinban operations across 1- to 5-Year JGBs, with less movement observed in the metric covering 5- to 10-Year Rinban operations (although the BoJ’s presence likely provided some incremental support there as well).

- The Tokyo open saw JGB futures unwind Friday’s post-Tokyo bid on the back of the aforementioned Monday cheapening in wider core global FI markets, with that contract last dealing little changed ahead of the Tokyo bell, operating within the confines of a relatively narrow range.

- A liquidity enhancement auction for off-the-run 1- to 5-Year JGBs headlines the domestic docket on Wednesday.

JGBS AUCTION: Japanese MOF sells Y2.83079tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.83079tn 1-Year Bills:

- Average Yield: -0.1308% (prev. -0.0949%)

- Average Price: 100.131 (prev. 100.095)

- High Yield: -0.1308% (prev. -0.0909%)

- Low Price: 100.131 (prev. 100.091)

- % Allotted At High Yield: 66.1925% (prev. 9.0046%)

- Bid/Cover: 3.626x (prev. 3.397x)

AUSSIE BONDS: Cheaper Post-Bullock

Aussie bonds cheapened in the wake of a speech from RBA Deputy Gov Bullock. The language that Bullock deployed in her initial round of remarks provided little in the way of RBA worry surrounding households in the rising rate environment. She did note that risks to the household sector from rising rates “are a little elevated”, although she pointed out that “while housing prices have started falling in recent months, they would have to fall a fair way for negative equity to become a systemic concern.” Note that in the subsequent Q&A Bullock pointed to previous RBA work (from ’17) which suggested that the neutral real rate is somewhere between 0.5-1.5%, when questioned on the matter. This allowed Aussie bond futures to register fresh session lows, before the contracts nudged away from worst levels, aided by a light bid in U.S. Tsys.

- Cash ACGBs run 7.0-8.5bp cheaper across the curve. YM is -7.5, operating through its overnight low, while XM is -7.0 after briefly showing below its own overnight low. Bills run 5 to 12 ticks lower through the reds, bear steepening.

- The release of RBA minutes earlier in the session provided little in the way of surprises, with the Bank reaffirming the need to tighten policy further, ultimately provoking little reaction in ACGBs at the time. The highlight of the release revolved around the RBA’s acknowledgement that the cash rate is “well below” the lower estimates of neutral, alongside a clear desire to continue to anchor medium-term inflation expectations.

- Wednesday will see RBA Governor Lowe speak at the Australian Strategic Business Forum, while A$800mn of ACGB May-32 will be on offer.

EQUITIES: Tech Stocks Lead The Way Lower In Asia

Major Asia-Pac equity indices are mostly lower at typing on a negative lead from Wall St., with Japanese benchmarks bucking the broader trend of losses on their first day back from the extended weekend. High-beta equities region-wide struggled, likely in the wake of BBG source reports on Monday pointing to Apple Inc considering plans to slow some hiring and spending growth (following similar announcements from other tech giants earlier), fanning fears re: economic slowdowns.

- The Nikkei 225 deals 0.6% firmer at typing, on track for a fourth straight higher daily close. Energy and materials equities contributed the most to gains in the index, with major exporters trading mostly higher as well. Apart from that, the Nikkei may have come up against technical resistance at ~27,050, having failed to break through that level since end-June.

- The CSI300 sits 0.9% worse off, more than reversing Monday’s gains at typing. The consumer staples and healthcare sub-gauges posed the most drag on the index, tracking the broader sell-off in high-beta stocks, with the ChiNext and STAR50 indices dealing 1.1% and 1.9% lower respectively at typing as well. Elsewhere, the CSI300 Real Estate index sits 0.8% worse off, with previously-flagged source reports on a potential stay of mortgage payments for homeowners failing to provide relief for the space.

- The ASX200 trades 0.6% worse off at writing, with the healthcare sub-index (-2.3%) and tech equities (S&P/ASX All Tech Index: -2.3%) leading the way lower. Energy and utilities provided the lone bright spot, tracking the recent rally in major crude benchmarks.

- E-minis sit flat to 0.1% better off at typing, operating firmly within the bottom end of their respective ranges established on Monday.

OIL: Little Changed In Asia After Monday’s Rally; Chinese COVID Cases Rise Further

WTI and Brent are ~$0.20 worse off apiece, operating a little shy of their respective best levels made on Monday. Crude has struggled to make headway above neutral levels in Asia as China has reported 699 COVID cases for Mon (highest since May 22), stoking simmering fears re: reduced Chinese energy demand owing to pandemic control measures.

- To elaborate, Shanghai is carrying out mass testing in 12 of the city’s 16 districts, with daily cases continuing to be reported in the low double-digits. China’s current outbreak epicentre has shifted steadily from the east to Guangxi (south) and Gansu (northwest), with the latter’s provincial capital locked down for the past week thus far.

- To recap Monday’s price action, WTI reclaimed the $100 handle after both benchmarks closed ~$5 higher, catching a bid as no concrete measures re: crude production increases were forthcoming from the Saudis after U.S. Pres Biden’s visit, unwinding some of the sell-off in crude observed since the meeting was confirmed in June.

- Worry re: tightness in global supplies again takes centre stage, with Brent’s prompt spread sitting at ~$4.40 (against ~$3.95 observed during yesterday’s Asian session), operating around its highest levels observed for ‘22 so far.

- The Keystone pipeline running from Canada to the U.S. is operating at a “reduced rate” (usual capacity ~590K bpd) due to damage to a power supply facility, with operator TC Energy declaring force majeure, and offering no timeline for its restoration at writing.

GOLD: Little Changed In Asia; Spinning Wheels Around $1,700/oz

Gold sits ~$2/oz weaker to print ~$1,707/oz at typing, operating a shade above Monday’s session lows after briefly showing below those levels earlier. The precious metal has established a tight $5/oz channel across Asia-Pac dealing thus far, struggling for direction amidst a limited uptick in the USD (DXY), with little reaction observed on news of China reporting 699 fresh COVID infections for Monday (highest since May 22).

- To recap, gold was little changed on Monday, closing within ~$10 of the $1,700/oz handle for a third consecutive day as debate re: the aggressiveness of Fed tightening vs. economic slowdowns (particularly in the U.S. and Europe) remains in focus. A continued pullback in the DXY from last Thursday’s cycle highs has also likely lent some support to the precious metal, helping it tread water above $1,700/oz in recent sessions.

- July FOMC dated OIS have drifted lower from last week’s extremes, and now price in around ~80bp of tightening for that meeting, pointing to ~20% odds of a 100bp rate hike (vs. ~93bp observed last Thursday).

- From a technical perspective, gold remains in a downtrend, with our technical analyst flagging that moving average studies are pointing to bearish conditions. Initial support is located at $1,690.6/oz (Aug 9 ‘21 low), while resistance is situated at $1,745.4/oz (Jul 13 high).

FOREX: RBA Speak Generates Antipodean Outperformance

Antipodean currencies found poise as an uptick in U.S. e-mini contracts sparked hopes for rebound after yesterday's Wall Street rout. The Aussie dollar outperformed as participants parsed the latest round of comments from the local central bank.

- The minutes from the RBA's most recent monetary policy meeting revealed that the Bank still saw the cash rate "well below" the lower estimates of neutral and recognised the need to keep tightening policy.

- Later in the session, RBA Dept Gov Bullock expressed confidence that most households are well positioned to weather tighter monetary conditions.

- The Aussie dollar crept higher since the release of RBA minutes. It extended gains to session highs on Bullock remarks, which inspired a notable upswing in 3-Year ACGB yield.

- The kiwi dollar firmed in tandem with its Antipodean cousin. AUD/NZD crept to a one-week high.

- The European FX bloc showed some weakness amid lingering worry surrounding gas supplies from Russia.

- On tap today are the final reading of Eurozone's CPI, UK labour market report, U.S. building permits as well as comments from Fed's Brainard, ECB's Makhlouf & BoE's Bailey.

FX OPTIONS: Expiries for Jul19 NY cut 1000ET (Source DTCC)

- EUR/USD: Jul20 $1.0100(E1.0bln); Jul21 $1.0000(E1.2bln), $1.0200(E1.4bln)

- AUD/USD: Jul22 $0.6800(A$1.1bln)

- USD/CAD: Jul20 C$1.3285-00($1.0bln)

- USD/CNY: Jul20 Cny6.6000($3.7bln), Cny6.7000($3.7bln), Cny6.8000(1.1bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/07/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 19/07/2022 | 0800/1000 |  | EU | ECB Bank Lending Survey | |

| 19/07/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/07/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/07/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 19/07/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 19/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/07/2022 | 1700/1800 |  | UK | BOE Bailey at Mansion House Dinner | |

| 19/07/2022 | 1835/1435 |  | US | Fed Vice Chair Lael Brainard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.