-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: The Dust Settles After ECB

EXECUTIVE SUMMARY

- ECB SEES NO NEED FOR NOW TO UNLEASH NEW BOND-BUYING SCHEME IN ITALY (RTRS SOURCES)

- SOME ECB OFFICIALS WERE INITIALLY IN FAVOR OF SMALLER HIKE (BBG SOURCES)

- ITALY'S NATIONAL ELECTIONS TO BE HELD ON SEP 25 (RAI)

- UK LEADERSHIP CANDIDATE TRUSS LEADS RIVAL SUNAK BY 24 POINTS (RTRS)

- NORD STREAM TURBINE STUCK IN TRANSIT AS MOSCOW DRAGS FEET ON PERMITS (RTRS SOURCES)

- US SAYS RUSSIA OIL CAP NEEDED AS EU SANCTIONS NOT YET PRICED IN (BBG SOURCES)

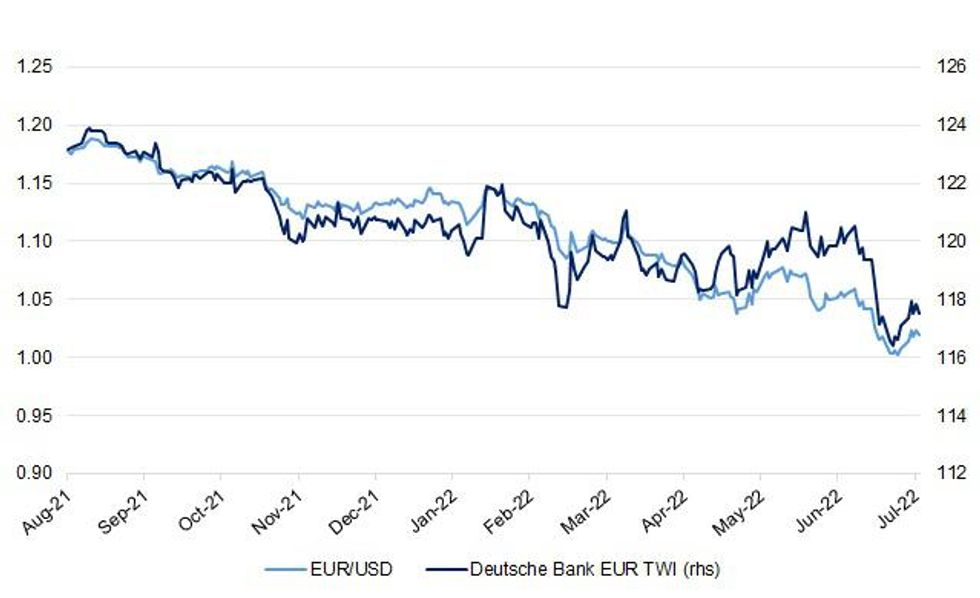

Fig. 1: EUR/USD vs. Deutsche Bank EUR TWI

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: British leadership candidate Liz Truss held a 24 point lead over her rival Rishi Sunak in a YouGov poll of Conservative Party Members published on Thursday. (RTRS)

POLITICS/FISCAL: Rishi Sunak and Liz Truss escalated their battle over tax yesterday by warning that the other’s plan would wreck the economy and make families poorer. (The Times)

ECONOMY: The UK risks a sudden surge in joblessness as firms which have kept hiring despite deepening pessimism among businesses and consumers encounter a “Wily E Coyote” moment and stop recruitment, the Bank of England’s former head of international research Greg Thwaites told MNI. (MNI)

EUROPE

ECB: A small number of European Central Bank officials initially would have preferred a quarter-point increase in interest rates at Thursday’s Governing Council meeting, according to people familiar with the debate. The official proposal made by Chief Economist Philip Lane was for a half-point step, said the people, who asked not to be identified because the discussions were private. Officials ultimately supported that as they also agreed on a new instrument to prevent disorderly bond-market moves, the people said. (BBG)

ECB: ECB European Central Bank policymakers did not discuss bond market turmoil in Italy at Thursday's meeting and do not expect to use their newly unveiled bond-buying scheme imminently as conditions do not warrant it, sources told Reuters. (RTRS)

FRANCE: French economic growth will slow sharply next year in the face of mounting geopolitical risks, pushing back improvement in the public sector budget deficit until afterwards, the Finance Ministry said on Thursday. Updating its long-term forecasts, the ministry said growth in the euro zone's second-biggest economy was now expected to slow from 2.5% this year to 1.4% next year. (RTRS)

FRANCE: France set out a five-year plan to gradually reduce its crisis-swollen budget deficit, relying on expectations of strong economic growth to avoid sharp spending cuts. Despite a “difficult economic situation in coming months” and “major geopolitical uncertainties on energy and trade,” Finance Minister Bruno Le Maire said President Emmanuel Macron’s promised economic overhauls in the next five should drive annual growth to 1.8% growth in 2027 and bring unemployment down to 5%. (BBG)

ITALY: Italy's national elections will be held on Sept. 25, the journalist who covers the Italian presidency for state broadcaster RAI said on Thursday. Earlier, President Sergio Mattarella announced he had dissolved parliament and said elections would have to be held within 70 days. Sept. 25 is the last Sunday before that deadline expires. (RTRS)

ITALY: Italy's caretaker government must continue dealing with emergencies related to the war in Ukraine, inflation, the cost of energy and COVID-19, Prime Minister Mario Draghi told his cabinet on Thursday. Earlier in the day, President Sergio Mattarella called snap elections after Draghi lost the support of three key coalition parties and handed in his resignation. (RTRS)

RATINGS: Rating reviews of note scheduled for after hours on Friday include:

- Fitch on Hungary (current rating: BBB; Outlook Stable), Ireland (current rating: AA-; Outlook Stable) & Poland (current rating: A-; Outlook Stable)

- DBRS Morningstar will review the European Financial Stability Facility (current rating: AAA, Stable Trend) and the European Stability Mechanism (current rating: AAA, Stable Trend)

U.S.

FED: Senate Banking Committee Chair Sherrod Brownsays he is open to a congressional examination on what led to the Federal Reserve’s monetary policy mistakes in order to avoid repeating them. (BBG)

POLITICS: President Joe Biden tested positive for Covid-19 on Thursday, finally contracting the virus whose control and ultimate defeat he had made a centerpiece of his campaign for the White House. Biden, 79, is experiencing mild symptoms and has begun taking Pfizer Inc.’s Paxlovid treatment for the disease, White House Chief of Staff Ron Klain said in a memo to staff obtained by Bloomberg. (BBG)

OTHER

GLOBAL TRADE: Ukraine, Russia, Turkey and U.N. Secretary-General Antonio Guterres will sign a deal on Friday to resume Ukraine's Black Sea grain exports, Turkish President Tayyip Erdogan's office said on Thursday. Ankara said a general agreement was reached on a U.N.-led plan during talks in Istanbul last week and that it would now be put in writing by the parties. Details of the agreement were not immediately known. It is due to be signed on Friday at the Dolmabahce Palace offices at 1330 GMT, Erdogan's office said. (RTRS)

GLOBAL TRADE: The US can’t keep relying on Taiwan for semiconductors and needs to pass legislation to support the domestic production of high-end computer chips, Commerce Secretary Gina Raimondo said. “Our dependence on Taiwan for chips is untenable and unsafe,” Raimondo told a crowd at the annual Aspen Security Forum in Colorado, a gathering of White House officials, diplomats and executives. She appeared via video conference from Washington, DC. (BBG)

JAPAN: The government respects the Bank of Japan’s stand-pat policy decision on Thursday, Japanese Finance Minister Shunichi Suzuki says. Need to watch possible negative impact of inflation on households and companies, Suzuki tells reporters in Tokyo after release of latest price figures for June. (BBG)

JAPAN: The Japanese government plans to shorten home quarantine for people who have been in close contact with those infected with Covid-19 by 2 days, Nikkei reports, without attribution. (BBG)

NORTH KOREA: President Yoon Suk-yeol said Friday that North Korea is ready to conduct a nuclear test at any time it decides. (Yonhap)

MEXICO: Mexico could be hit with between $10 billion and $30 billion in tariffs if it loses a trade spat with the US and Canada, according to two former officials who negotiated the pact under which the dispute was brought. (BBG)

RUSSIA: Russia's foreign ministry on Thursday said that the latest round of European Union sanctions were illegitimate and would have "devastating consequences" for security and parts of the global economy. "The European Union is continuing to drive itself into a dead end with enviable persistence," ministry spokeswoman Maria Zakharova said in a statement. (RTRS)

RUSSIA: The European Union blocked a proposal to sanction Russian metals company VSMPO-Avisma PJSC at the last minute, EU diplomats said, after France and other member states objected to the move over fears of a potential retaliatory ban by Russia on titanium exports to the bloc. (WSJ)

METALS: A group of indigenous Peruvian communities that have been protesting MMG Ltd's Las Bambas copper mine said on Thursday there has been no progress after a full month of talks, risking the end of a precarious truce. (RTRS)

ENERGY: A missing turbine that Moscow says has caused the Nord Stream 1 pipeline to pump less gas to Europe is stuck in transit in Germany because Russia has so far not given the go-ahead to transport it back, two people familiar with the matter said. (RTRS)

ENERGY: Russia will consider a request from Hungary to buy more Russian gas, Russian Foreign Minister Sergei Lavrov said on Thursday, after meeting his Hungarian counterpart in Moscow. (RTRS)

ENERGY: Portugal is totally opposed to an EU proposal for member states to cut gas usage until March because it would hamper electricity production through gas-fired plants when the country faces an extreme drought, Energy Secretary Joao Galamba said on Thursday. (RTRS)

OIL: The oil market hasn’t yet priced in the impact of European Union sanctions aimed at Russian supplies, which adds impetus to a US plan to cap the price of the country’s exports to avoid a price spike, according to a US Treasury Department official. The US is aiming to get an international agreement on a Russian oil price cap to go into effect the same time as EU actions in December, or possibly even earlier, said the official, who asked not to be identified because the discussions aren’t public. (BBG)

OIL: TC Energy has reduced operating rates on a segment of the Keystone pipeline running from Canada’s oil sands to America’s largest crude hub by about 15% following a disruption to power supplies. The rate cut impacts the section stretching from Hardisty, Canada, to Cushing, Oklahoma, according to people familiar with the matter. (BBG)

OIL: Russian President Vladimir Putin and Saudi Crown Prince Mohammed bin Salman spoke by phone on Thursday and underlined the importance of further cooperation within the OPEC+ group of oil producers, the Kremlin said. (RTRS)

CHINA

YUAN: The Chinese currency will keep basically stable at a reasonable and balanced level in the second half of the year, Wang Chunying, spokesperson for the State Administration of Foreign Exchange, says at a press conference. The yuan will remain flexible and two-way fluctuations are possible. There are no obvious yuan depreciation or appreciation expectations. (BBG)

POLICY: China should expand government debt financing in the second half of 2022 to fill a funding gap of not less than CNY3 trillion to help boost infrastructure investment and support economic growth, as local governments with falling land sales and tax revenues are finding it hard to meet their spending targets, according to a report by China Finance 40 Forum. Issuing special treasury bonds, fiscal discount bonds and policy financial loans can be considered. Meanwhile, the central bank should cut the policy rate by 25 basis points, and should continue until the economy revives with high vitality for more than two consecutive quarters, as rate cuts will greatly help improve corporate cash flow and increase demand, the report said. (MNI)

PROPERTY: China’s top banking regulator said it will support local governments to ensure the delivery of unfinished property projects, guide banks to actively help resolve funding gaps, and provide credit to qualified developers, the Securities Daily reported citing the China Banking and Insurance Regulatory Commission. The CBIRC will maintain the continuity and stability of real estate financial policies, the newspaper said. MNI notes that a wave of disgruntled homebuyers vowed to stop making mortgage payments on stalled projects has spread across the country starting in July. (MNI)

PROPERTY: Chinese cities may continue to lower mortgage interest rates to lure buyers to shore up the still bleak housing market, including big cities with relatively high rates and smaller cities with poor transaction data, the Securities Daily reported citing Yan Yuejin, director of E-house China Research and Development Institution. The average rates of first- and second-home mortgages in 103 key cities was 4.35% and 5.07%, respectively, down 139 and 93 basis points from the high point in September 2021, hitting a new low since 2019, according to Beike Research Institute. Among them, 74 cities have reached the lower limit of 4.25% for the first and 5.05% for the second housing, the newspaper said. (MNI)

CHINA MARKETS

PBOC INJECTS CNY3 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY3 billion via 7-day reverse repos with the rate unchanged at 2.1% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY3 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1000% at 9:32 am local time from the close of 1.5236% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 46 on Thursday, flat from the close of Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7522 FRI VS 6.7620

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7522 on Friday, compared with 6.7620 set on Thursday.

OVERNIGHT DATA

CHINA JUN FX NET SETTLEMENT - CLIENTS CNY39.5BN; MAY CNY1.7BN

JAPAN JUN NATIONAL CPI +2.4% Y/Y; MEDIAN +2.4%; MAY +2.5%

JAPAN JUN NATIONAL CORE CPI +2.2% Y/Y; MEDIAN +2.2%; MAY +2.1%

JAPAN JUN NATIONAL CORE-CORE CPI +1.0% Y/Y; MEDIAN +0.9% MEDIAN; MAY +0.8%

JAPAN JUL, P JIBUN BANK M’FING PMI 52.2; JUN 52.7

JAPAN JUL, P JIBUN BANK SERVICES PMI 51.2; JUN 54.0

JAPAN JUL, P JIBUN BANK COMPOSITE PMI 50.6; JUN 53.0

Flash PMI data indicated that activity at Japanese private sector businesses rose at a softer rate during July. The expansion in output was the softest recorded since March and only marginal as companies noted that shortages of raw materials and rising energy and wage costs had increasingly dampened output and new order inflows. This was notably evident at manufacturers, who recorded a reduction in production levels for the first time in five months. Service providers meanwhile reported the slowest rise in activity since April. Positively, there was tentative evidence that price pressures were peaking, as the rate of input cost inflation eased for the first time in six months among private sector firms, yet remained rapid overall. (S&P Global)

AUSTRALIA JUL, P S&P GLOBAL M’FING PMI 55.7; JUN 56.2

AUSTRALIA JUL, P S&P GLOBAL SERVICES PMI 50.4; JUN 52.6

AUSTRALIA JUL, P S&P GLOBAL COMPOSITE PMI 50.6; JUN 52.6

Australia’s private sector economy expanded for a sixth consecutive month in July, according to the S&P Global Flash Australia Composite PMI. However, latest survey data has pointed to a further deceleration in the rate of private sector growth. Panellists suggested that interest rate increases, alongside persistent inflationary pressures, have been a pivotal factor contributing to the weakened private sector improvement this month. Further interest rate increases by Australia’s central bank present a downside risk to the private sector, with sentiment slipping to a 27-month low. On the positive side, employment levels continue to rise at a solid pace. Firms also continue to report challenges in filling vacancies, indicating that we can hope to see continued improvement in workforce numbers in the coming months as staffing levels are rebuilt. (S&P Global)

SOUTH KOREA JUN PPI +9.9% Y/Y; MAY +9.7%

UK JUL GFK CONSUMER CONFIDENCE -41; MEDIAN -42; MAY -41

MARKETS

SNAPSHOT: The Dust Settles After ECB

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 133.04 points at 27936.31

- ASX 200 up 4.22 points at 6798.50

- Shanghai Comp. down 10.883 points at 3261.118

- JGB 10-Yr future up 34 ticks at 149.69, yield down 1.2bp at 0.224%

- Aussie 10-Yr future up 13.5 ticks at 96.525, yield down 13.9bp at 3.430%

- U.S. 10-Yr future +0-03+ at 119-00+, yield up 1.66bp at 2.891%

- WTI crude up $0.84 at $97.19, Gold down $5.36 at $1713.49

- USD/JPY up 48 pips at Y137.84

- ECB SEES NO NEED FOR NOW TO UNLEASH NEW BOND-BUYING SCHEME IN ITALY (RTRS SOURCES)

- SOME ECB OFFICIALS WERE INITIALLY IN FAVOR OF SMALLER HIKE (BBG SOURCES)

- ITALY'S NATIONAL ELECTIONS TO BE HELD ON SEP 25 (RAI)

- UK LEADERSHIP CANDIDATE TRUSS LEADS RIVAL SUNAK BY 24 POINTS (RTRS)

- NORD STREAM TURBINE STUCK IN TRANSIT AS MOSCOW DRAGS FEET ON PERMITS (RTRS SOURCES)

- US SAYS RUSSIA OIL CAP NEEDED AS EU SANCTIONS NOT YET PRICED IN (BBG SOURCES)

US TSYS: Asia Fades Thursday’s Move

Asia-Pac participants were happy to fade Thursday’s richening. The early weakness extended as the major cash Tsy benchmarks run 2.5-5.0bp cheaper, with the front end leading the weakness and the early bear flattening of the curve holding. TYU2 last +0-02+ at 118-31+, 0-01+ off the base of its 0-08 range, operating on volume of ~90K (an uptick from what has been seen in recent sessions).

- As we noted earlier, the front-end led nature of the overnight move in Tsys would suggest to us that regional participants are happy to express faith in the continuation of the expeditious Fed tightening cycle at the levels that prevailed at the NY close, given the lack of meaningful macro headline flow observed thus far.

- A block sale of TY futures (-4K) headlined on the flow side during the overnight session..

- Weakness in in e-mini futures in lieu of a soft earnings print from Snapchat has been noted, with the NASDAQ 100 contract leading the way lower, last -0.7%, which may have provided some counter to the cheapening.

- Eurodollar futures run 2.0-4.5 lower through the reds.

- Flash PMIs from across Europe headline the broader docket ahead of Friday’s NY session, with the U.S. suite of flash Markit PMI prints set to headline the domestic docket.

JGBS: Futures Lead Space Higher On Breach Of Recent High

JGB futures shunted higher during the Tokyo morning, extending on their overnight bid, last +36.

- The move came as Japanese Finance Minister Suzuki reaffirmed the independence of the BoJ, while he flagged the need to monitor the downside risks that inflation poses to the Japanese economy. This wasn’t particularly new news, but the language deployed may have supported the space. Elsewhere, Chief Cabinet Secretary Matsuno highlighted the need to monitor downside risks to the economy.

- A break through the 7 July high for futures may provide a better explanation of the shunt higher, introducing a technical element to the bid, with the fact that 7s represent the joint-firmest point on the curve pointing to a futures driven move for JGBs on the whole (wider cash JGBs are flat to 3.5bp richer on the session)

- Elsewhere, weekly international security flow data pointed to the continued covering of short JGB positions by foreign investors.

- The latest liquidity enhancement auction covering off-the-run 5-15.5 Year JGBs saw firm pricing, with spreads firming vs. the previous auction (likely linked to demand for the CtD bond of JBU2 futures, as we flagged in our auction preview), while the spread tail narrowed a little. Elsewhere, the cover ratio came in at 3.66x, sharply lower vs. the high print observed in the last auction (6.15x), with short covering already well underway in the space after June’s BoJ meeting/defence of YCC (likely limiting wider demand at today’s auction). Note that this metric was below the six-auction average of 4.40x.

- Looking ahead, BoJ Rinban operations covering 1- to 25-Year JGBs headline the domestic docket on Monday.

JGBS AUCTION: Japanese MOF sells Y4.52874tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.52874tn 3-Month Bills:

- Average Yield: -0.1527% (prev. -0.1386%)

- Average Price: 100.0381 (prev. 100.0342)

- High Yield: -0.1443% (prev. -0.1317%)

- Low Price: 100.0360 (prev. 100.0325)

- % Allotted At High Yield: 81.5694% (prev. 80.9887%)

- Bid/Cover: 2.778x (prev. 2.818x)

JGBS AUCTION: Japanese MOF sells Y499.3bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y499.3bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.027% (prev. -0.006%)

- High Spread: -0.026% (prev. -0.003%)

- % Allotted At High Spread: 77.2058% (prev. 80.6374%)

- Bid/Cover: 3.660x (prev. 6.153x)

AUSSIE BONDS: Off Best Levels But Comfortably Firmer

Aussie bonds have edged away from their extremes, having unwound a blip lower after Westpac’s Bill Evans revised guidance for the RBA’s terminal cash rate to 3.35% (prev. 2.60%), with the revised rate ultimately undershooting the rate of tightening priced into the market (IBs see a cash rate of ~3.40% by year end, per BBG WIRP). Cash ACGBs run 8.0-13.0bp richer across the curve, with the 7- to 12-Year zone leading the bid. YM and XM are +11.0 and +13.5, respectively, a little off best levels after bettering their respective overnight highs early on. Bills run 7 to 13 ticks richer through the reds, bull flattening.

- The latest round of ACGB Sep-26 supply went well, with the weighted average yield printing 1.65bp through prevailing mids (per Yieldbroker). The cover ratio ticked higher to 3.40x (albeit with a slightly smaller amount on offer), coming in above 3.00x and bettering the previous auction’s 3.28x, pointing to solid demand. The result builds on the recent strong run of shorter-dated ACGB auctions, supported by the stabilisation of Aussie bonds away from outright cycle cheaps.

- The AOFM issuance slate announced for next week will see a “reduced” A$1.3bn in ACGBs on offer (from the “usual” A$1.5bn), with the issuance of Notes moderating to A$2.0bn as well (from the “usual” A$2.5bn).

- Looking to next week, Monday will see A$300mn of the ACGB Mar-47 Bond on offer, while the domestic data docket is virtually empty, with Q2 CPI expected to provide the first point of interest on Wednesday.

AUSSIE BONDS: The AOFM sells A$700mn of the 0.50% 21 Sep ‘26 Bond, issue #TB164:

The Australian Office of Financial Management (AOFM) sells A$700mn of the 0.50% 21 Sep ‘26 Bond, issue #TB164:

- Average Yield: 3.2120% (prev. 3.2491%)

- High Yield: 3.2150% (prev. 3.2550%)

- Bid/Cover: 3.4029x (prev. 3.2812x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 42.8% (prev. 26.3%)

- Bidders 48 (prev. 42), successful 19 (prev. 12), allocated in full 11 (prev. 6)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Monday 25 July it plans to sell A$300mn of the 3.00% 21 March 2047Bond.

- On Thursday 28 July it plans to sell A$1.0bn of the 9 September 2022 Note & A$1.0bn of the 11 November 2022 Note.

- On Friday 29 July it plans to sell A$1.0bn of the 3.00% 21 November 2033 Bond.

EQUITIES: Cautiously Higher In Asia; Nikkei Hits Six-Week High

Major Asia-Pac equity indices are mostly higher at typing, following a positive lead from Wall St.

- The Nikkei 225 sits 0.5% better off, operating around freshly made six-week highs at typing, and on track for a sixth higher daily close. The tech and real estate sectors lead the way higher, countering losses in utilities and energy.

- The ASX200 sits 0.2% firmer at typing, reversing earlier losses as a steady rally in financials (+0.9%) eventually offset losses observed in commodity-related equities. The “Big 4” banks led by ANZ deal 0.5-3.3% firmer apiece, adding to gains observed in real estate and tech.

- The Hang Seng sits 0.2% better off at typing, trimming earlier gains of as much as 1.0%. A rise in the financials sub-index (+0.3%) narrowly neutralised losses in the utilities sub-gauge (-0.6%), while elsewhere, a strong bid in China-based tech in the wake of Didi’s ~$1.2bn fine on Thursday evaporated over the course of the session, with the Hang Seng Tech Index (+0.3%) back from its own highs of as much as +1.8%.

- The CSI300 has reversed earlier gains despite opening higher, dealing 0.2% weaker at writing. The IT sub-index underperformed, with the broader tech space contributing the most to the pullback in Chinese equities, seeing the ChiNext and STAR50 indices trade 0.6% lower apiece.

- E-minis deal 0.1-0.7% worse off apiece, maintaining relatively tight ranges throughout the session, with NASDAQ contracts leading losses in the wake of Snap Inc’s earnings disappointment.

OIL: Off Best Levels In Asia; Demand Worry Remains In Focus

WTI is ~+$1.20 and Brent is ~+$1.40, with both benchmarks edging away from their respective session highs after a ~$1.50 surge earlier, with that move higher potentially being a delayed reaction to reports of a disruption to the Canada-U.S. Keystone pipeline.

- To elaborate, BBG sources pointed to Keystone operator TC Energy reducing flows to the crude storage hub in Cushing (where WTI is delivered) by ~15% due to a “power supply glitch”, raising worry re: tightness in Cushing inventories.

- WTI and Brent have however come nowhere near challenging their respective best levels on Thursday, with the well-documented rise in recession-related worry on Thursday (particularly in the U.S. and EU) exacerbating concern from some quarters re: reduced energy demand.

- Elsewhere, Libyan crude output has risen above 700K bpd, short of the ~1.2mn bpd pre-crisis (keeping in mind the NOC had promised to restore production “within a week”, last Friday).

- Brent’s prompt spread continues to point to rising worry re: near-term crude supply, with the measure hitting ~$4.69 at typing, compared to ~$4.00 at the start of the week.

- Elsewhere, daily COVID case counts in China remain near two-month highs, with 880 reported for Thu vs. 826 for Wed. While the situation in major cities continues to stabilise, worry re: the country’s economic output remains elevated, with some participants likely eyeing industrial profit data next week, following warnings from the country’s steel industry earlier this week re: weak demand and other business challenges.

GOLD: A Little Lower In Asia; Clinging To Post-ECB Gains

Gold deals ~$3/oz weaker to print ~$1,716/oz at typing, operating within a fairly limited ~$4/oz range since the re-open. The precious metal has edged away from Thursday’s best levels amidst an uptick in nominal U.S. Tsy yields, but holds on to the bulk of its post-ECB gains.

- To recap, gold closed ~$20/oz higher on Thursday, having reversed losses from fresh 15-month lows ($1,680.99/oz) made earlier in the session. The rebound was facilitated by the ECB’s larger-than-expected 50bp rate hike, with the USD (DXY) whipsawing between session highs and lows before closing lower on the day. Elsewhere, recession-related worry resurfaced as well, aiding some haven demand amidst the previously-flagged miss in Philly Fed expectations and weekly jobless claims coming in at eight-month highs.

- The move higher in gold on Thursday ultimately failed to breach highs witnessed earlier in the week ($1,723.9/oz, Jul 18 high), with debate continuing to focus on bullion’s vulnerability amidst recent Dollar strength, aggressive Fed expectations, and technical weakness.

- From a technical perspective, gold remains in a downtrend, with moving average studies continuing to point to bearish conditions. The yellow metal has successfully tested support $1,680.5/oz (1.764 proj of the Mar8-29-Apr18 price swing), and sits at a comparable distance to initial resistance at $1,745.4/oz (Jul 13 high).

FOREX: Greenback Outperforms Amid Reluctance To Take On Risk

U.S. e-mini futures faced some headwinds after Snap Inc. released a disappointing earnings report, while regional players parsed disappointing U.S. data released Thursday. This generated demand for traditional safe havens, but the yen had to give way to the greenback as U.S. Tsy yield curve bear flattened.

- USD/JPY recouped its initial losses, with good demand emerging over the Tokyo fix. Renewed buying of the spot rate was out of sync with the move lower in USD/JPY 1-month risk reversal, which pulled back from a multi-week high registered Thursday.

- Japan's CPI figures fell in line with expectations, with core prices posting the biggest one-month increase since Sep 2008 (when adjusted for the sales tax hike impact). While core CPI growth is above the BoJ's target of +2.0% Y/Y, the Bank continues to stress that current price pressures are being driven by supply-side factors rather than demand-pull matters.

- NZD paced losses in G10 FX space, which allowed AUD/NZD to climb past NZ$1.1100 and plumb a fresh multi-week high at NZ$1.1107 (y'day's peak was NZ$1.1106).

- The European FX bloc showed some weakness amid lingering concerns over Russian gas supplies & Italian political turmoil.

- Manufacturing PMIs from across the globe will keep hitting the wires going forward, other data highlights include UK & Canadian retail sales. ECB's Villeroy will speak on payments security.

FX OPTIONS: Expiries for Jul22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0080-00(E1.4bln), $1.0140-50(E925mln), $1.0200-10(E562mln)

- USD/JPY: Y135.00($1.1bln), Y139.00($630mln), Y140.00($990mln)

- EUR/JPY: Y141.00(E485mln)

- AUD/USD: $0.6800(A$1.2bln), $0.6900(A$1.1bln)

- USD/CAD: C$1.2900($965mln), C$1.3000($602mln)

- USD/CNY: Cny6.7500($1.7bln), Cny6.8000($1.1bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/07/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 22/07/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 22/07/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 22/07/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 22/07/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 22/07/2022 | 0800/1000 |  | EU | ECB Survey of Professional Forecasters | |

| 22/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 22/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 22/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 22/07/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 22/07/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 22/07/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 22/07/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 22/07/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 22/07/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 22/07/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.