-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Nudges Lower, Hang Seng Rallies

- E-minis nudged lower after hours owing to Walmart’s disappointing earnings guidance, although that impulse moderated throughout Asia hours as regional equities received a lift from Chinese real estate and large-cap tech names.

- Swings in the long end of the JGB curve around a 40-Year auction garnered plenty of attention.

- Today's data highlights include U.S. new home sales & Conf. Board Consumer Confidence. Elsewhere, the FOMC will begin its two-day monetary policy meeting.

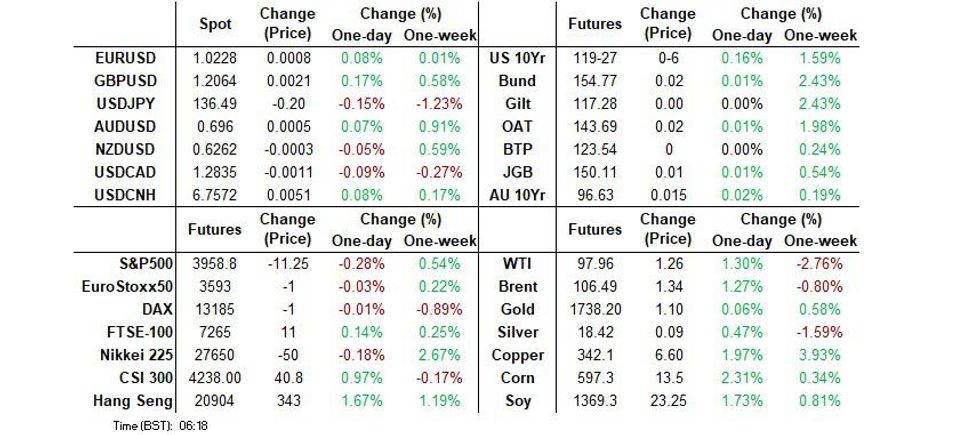

US TSYS: Coiling In Asia

An early, modest Asia-Pac bid in U.S. Tsys has faded from extremes. The light bid was linked to soft guidance from U.S. retail giant Walmart, which spurred after-hours pressure for the retail sector, resulting in a small downtick for e-minis (-0.3% last). Equities have since found a bit of a base as continued focus on support for the Chinese property space provided a helping hand for broader risk appetite.

- Still, the combination of the proximity to Wednesday’s FOMC and lack of meaningful macro headlines made for generally limited Asia-Pac dealing. TYU2 deals in the middle of a 0-07 range, +0-06 at 119-27, on sub-standard volume of 43K. Meanwhile, cash Tsys run 0.5bp cheaper to 1.0bp richer, twist flattening, with a pivot around 3s.

- A 2K block sale of FVU2 113.00 calls headlined on the flow side overnight.

- Tuesday’s NY calendar includes various house price metrics, the Richmond Fed m’fing index print, Conference Board consumer confidence and 5-Year Tsy supply.

JGBS: Fierce Moves In Long End Around 40-Year Supply

JGB futures gave back their limited overnight gains at the Tokyo re-open, but have recovered a little into the Tokyo close as the longer end of the curve firms, last dealing +8

- The curve steepened in a relatively aggressive manner ahead of 40-Year JGB supply, with pre-auction concession combining with what seemed to be limited liquidity further out the curve, weighing on 10+-Year paper. The auction went well, allowing the curve to rebound from session steeps as the long end recovered from extremes. Benchmark cash JGBs run 1bp cheaper to 4bp richer as a result, twist flattening, with 30s and 40s now richer on the day, firming notably post-auction in directional dealing.

- In terms of auction specifics, the cover ratio printed above the 6-auction average, with the high yield over 2.0bp below wider dealer expectations (as proxied by the BBG dealer poll). The auction benefitted from the supportive conditions we outlined in our auction preview, which included yields operating just off cycle cheaps, the steepness of the JGB curve, the Japanese investor base’s aversion when it comes to adding to international debt holdings (as seen in Japanese weekly international security flow data) and the preference of domestic life insurers to accumulate super-long JGB holdings (per their semi-annual investment intention interviews).

- Services PPI data met expectations, ticking up to 2.0% in Y/Y terms while the stale minutes from the BoJ’s June meeting was inconsequential for markets, as expected.

- There isn’t much of note on tomorrow’s domestic docket.

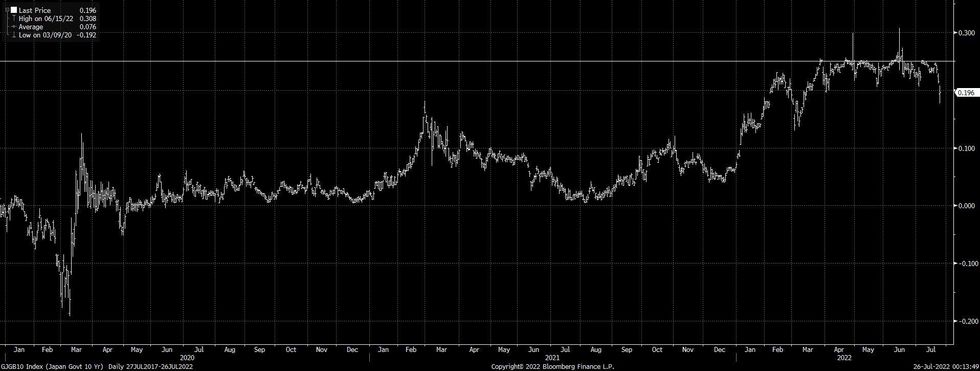

BOJ: BoJ Resilience & Wider Recession Worry Sees Off Vigilantes

The BoJ has seen off the vigilantes that tested it’s will in mid-June, at least for now, leaving it as the last dove standing in major central bank circles.

10-Year JGB yields touched the lowest level observed since March on Monday, pulling away from the upper end of the Bank’s permitted -/+0.25% trading range.

Fig. 1: 10-Year JGB Yields (%)

Source: MNI – Market News/Bloomberg

Source: MNI – Market News/Bloomberg

Elsewhere, 10-Year Japanese swap rates have cratered after the BoJ upped its bond buying during June (to a record monthly level), employed some creative tactics when it came to limiting the futures/cash JGB basis blowout and reaffirmed the need to maintain its current policy settings owing to a lack of demand-pull inflation. Wider recession-based worry, centred on the U.S. & Europe, has also helped.

Note that gains in swap rates beyond 10s have been a little stickier given the lack of relative BoJ control further out the JGB curve, although those metrics are still back from cycle highs.

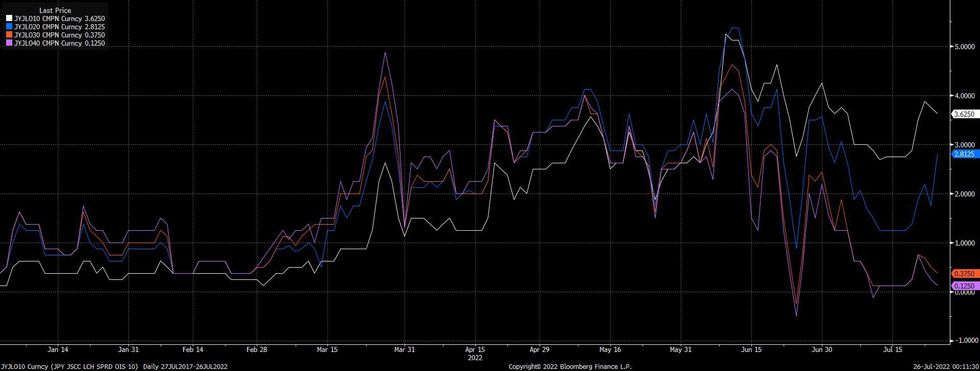

Fig. 2: Japan 10- To 40-Year Swap Rates (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

We have documented the recent BoJ-driven covering of short positions in both JGB futures and Japanese bonds on the part of foreign investors in some detail, with that particular investor cohort seen as the main driving force behind the June challenge of the BoJ’s YCC parameters. We would also highlight the post-June BoJ pullback in LCH/JSCC swap spreads covering the 10+-Year zone of the curve, with the moves in these spreads once again indicating that offshore participants were driving the market challenge of the BoJ in June, widening into the June BoJ decision, before narrowing as offshore participants pared their bets re: BoJ YCC capitulation

Fig. 3: LCH/JSCC 10- to 40-Year Swap Spreads (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

AUSTRALIA: Q2 CPI In Focus Tomorrow

The main data event for Australia this week lands tomorrow, with Q2 CPI data out. To recap, market expectations are headline CPI to ease to 1.9% QoQ, from 2.1% in Q1. The YoY pace would still accelerate to 6.3% from 5.1% in Q1. For the RBA's preferred measure of underlying inflation, the trimmed mean, the market expects a further pick up to 1.5% QoQ from 1.4% in Q1. This would take YoY momentum, to 4.7% from 3.7% previously.

- The table below shows quarterly outcomes for headline and trimmed inflation over the past year.

- As has been the case elsewhere, in recent quarters inflation has been surprising on the upside. 0.4ppts and 0.3ppts for the headline in the past 2 quarters, 0.2ppts and 0.3ppts for the trimmed mean for the same reference periods.

- Q1 CPI data, which printed on April 27th produced a decent intra-day bounce in AUD/USD. We got to a high of 0.7191 on the day, but closed little different (0.7126 versus 0.7123) versus the previous session. The DXY was trending higher at this time though, so that may have influenced the AUD.

- 2yr AU bond yields ended April 27th around 3bps higher and continued to push higher over subsequent sessions.

Table 1: Australian CPI Outcomes - Actual & Expected QoQ Past 12 months

| Headline Actual | Headline Expected | Core Actual | Core Expected | |

| Q2 22 | -- | 1.9 | 1.5 | |

| Q1 22 | 2.1 | 1.7 | 1.4 | 1.2 |

| Q4 21 | 1.3 | 1.0 | 1.0 | 0.7 |

| Q3 21 | 0.8 | 0.8 | 0.7 | 0.5 |

| Q2 21 | 0.8 | 0.7 | 0.5 | 0.5 |

AUSSIE BONDS: Twist Flattening

Aussie bonds are off best levels, aided by U.S. Tsys backing away from their own extremes, with an initial bid in core FI (owing to Walmart’s disappointing earnings guidance after the bell) moderating throughout Sydney hours as equities in Asia received a lift from Chinese real estate and large-cap tech names. Cash ACGBs run 3.0bp cheaper to 2.0bp richer across the curve, twist flattening, pivoting around 3s, while YM and XM are -1.0 and +1.0, respectively, with the latter having briefly shown through its own overnight highs earlier in the session. Bills run 6 ticks cheaper to 2 ticks richer through the reds, twist flattening.

- Recent comments in a BBG interview from RBA Board member Harper coincided with a light cheapening in the front end of the cash ACGB curve, with the RBA board member stating that the Australian economy was “robust” enough to endure higher rates, emphasising the need to fight “broad-based” price pressures, while stating that concerns re: “overreach” on rate hikes was “overblown”.

- ACGBs looked through the release of weekly ANZ-Roy Morgan consumer confidence (the sole domestic data release due today), which saw a slight improvement to 82.4 (vs. 81.8 prev.).

FOREX: Greenback Loses Ground As Early Risk-Off Impulse Dissipates

Walmart's disappointing profit outlook spooked markets, but initial defensive flows petered out as U.S. e-mini futures found a base and retraced the bulk of their early losses. This applied renewed pressure to the greenback, sending it to the bottom of the G10 pile, with the BBDXY index extending Monday's weakness.

- Decent enough performance from Chinese tech space provided reprieve to risk, with Alibaba shares doing the heavy lifting. The company said it will seek a primary listing in Hong Kong, which would make its shares directly accessible to investors from mainland China.

- The kiwi dollar remained one of the worst G10 performers alongside the USD and CHF. This comes after the kiwi lagged its commodity-tied peers on Monday. AUD/NZD retraced its earlier upswing to NZ$1.1130 but remains a handful of pips above neutral levels as we type.

- The Norwegian krone outperformed amid good demand for crude oil futures.

- Today's data highlights include U.S. new home sales & Conf. Board Consumer Confidence. Elsewhere, the FOMC will begin its two-day meeting.

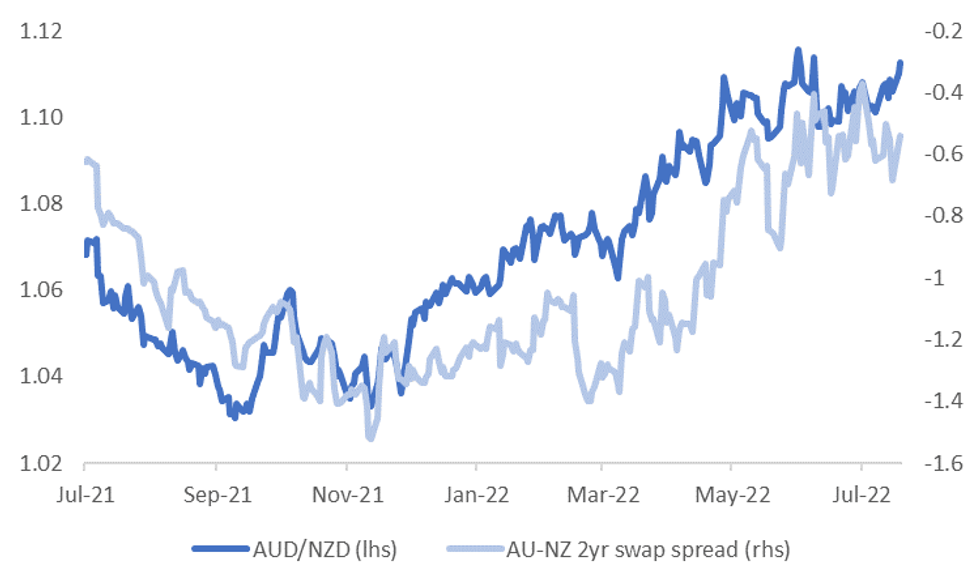

AUD/NZD: Pushes To Multi-Week Highs, As Iron Ore Rebounds Helps The A$

AUD/NZD continues to track higher, building a base above 1.1100, last trading at 1.1130. This is highs for the pair going back to mid-June (just under 1.1170). As the chart below highlights there is a modest wedge between the AUD/NZD cross and the 2yr AU-NZ swap spread. To be sure, the swap spread is moving in AUD's favor but the last time AUD/NZD was at these levels, the 2yr spread was 10-15bps firmer in AUD's favor. On a government bond spread basis it is a similar story.

- The other support for the AUD is higher iron ore prices, which is helping drive outperformance against other G10 FX as well. The active future in Singapore is up a further 3.3% today, for a cumulative +10.6% gain in the past 3 sessions. We are now back to $110/tonne, versus last week's lows of $97-$98.

- China property stocks continue to find support, with the sub-index up another 3% so far today, after yesterday's 1.29% gain. This follows the recent announcement around a proposed property fund in China which would support the ailing property sector. The fund size could reportedly be as large as 300bn yuan ($44bn), with the aim is getting stalled construction projects going again. We may find out more post this week's Politburo meeting in China.

Fig 1: AUD/NZD & AU-NZ 2yr Swap Spread

Source: MNI/Market News/Bloomberg

Source: MNI/Market News/Bloomberg

FX OPTIONS: Expiries for Jul26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0190-00(E623mln), $1.0260-65(E896mln)

- USD/JPY: Y139.00($970mln)

- EUR/JPY: Y141.00(E727mln), Y143.00(E734mln)

- USD/CAD: C$1.2750($700mln), C$1.2900($763mln)

ASIA FX: Outside PHP Bounce, Familiar Ranges Prevail

Outside of a sharp rally in PHP (+0.7%), USD/Asia pairs have respected recent ranges to a large degree during today’s session.

- CNH: USD/CNH couldn't break down through 6.7450 in early trade, despite a firmer lead from onshore equities. Property stocks have bounced strongly since the start of this week, as the authorities look to step up support of the sector. USD/CNH last tracked 6.7575 though, in line with the USD moving off lows this afternoon.

- KRW: USD/KRW attempted another test of 1306, but once again found support at this level. We last traded just above 1309 in terms of the 1 month NDF. Q2 GDP was stronger than expected, with YoY growth holding close to 3%. The Kospi is modestly higher at +0.30%.

- IDR: Spot USD/IDR opened on a softer footing but has trimmed losses since and last deals unchanged at IDR14,998. President Widodo is set to meet with his Chinese counterpart Xi today, for what will be Xi's first face-to-face talks with a foreign leader since the Beijing Winter Olympics. From there, Jokowi will travel on to Japan and South Korea.

- PHP: USD/PHP has fallen sharply today. The dipped got close to 55.60 before support kicked in. We last tracked 55.695. Most analysts assessed the first State of the Nation Address from President Marcos positively, as the leader pledged commitment to "prudent" fiscal management and laid out plans to boost economic growth to an ambitious target of +8% Y/Y. With the new President's maiden SONA seen removing some near-term uncertainties and having pro-growth implications, local equities may now get some reprieve. The local bourse was tracking 0.2% higher for the session.

- THB: USD/THB is higher today, but after an earlier bounce towards 36.75 we are now back at 36.665. The Thai Finance Ministry raised the projection for foreign tourist arrivals this year to 8mn from 6.1mn previously. This should aid THB, all else equal, although a fresh concern for tourism related businesses comes in the way of the outbreak of monkeypox. The government raised surveillance measures over the weekend after confirming the first local case.

EQUITIES: Mostly Higher In Asia; Chinese, Hong Kong Benchmarks Outperform

Major Asia-Pac equity indices are flat to 1.5% better off at typing, bucking a mixed lead from Wall St. that saw the tech-heavy NASDAQ close in the red.

- The Hang Seng leads the way higher, sitting 1.5% firmer on gains in the real estate (+1.6%) and finance (+1.5%) sub-indices. China-based tech ticked higher as well (HSTECH: +1.6%), led by Alibaba Group (+6.0%) after it announced plans to pursue a dual primary listing in Hong Kong and the U.S., potentially allowing the company to apply for the Stock Connect scheme as well.

- The CSI300 deals 0.9% firmer, led by gains in industrials and real estate. The CSI300 Real Estate Index trades 5.4% higher at typing, surging to two-week highs after a RTRS source report on Monday pointed to China potentially planning to launch a $44bn fund aimed at rescuing property developers. The CSI300 however trades a little above fresh six-week lows made on Monday, with the benchmark index shedding ~5.9% for July thus far.

- The Nikkei 225 sits a little below neutral levels at typing, back from trading as much as 0.6% lower as weakness in the healthcare and IT sectors neutralised a rally in energy-related equities, as well as gains from index heavyweight Softbank Group (which deals 3.5% firmer after news of Alibaba’s dual primary listing plans).

- E-minis sit 0.3% worse off apiece at writing, off session lows, with the wider fallout from Walmart’s disappointing earnings guidance seeing the contracts struggle to break above neutral levels throughout Asia-Pac dealing.

GOLD: Higher In Asia As Dollar Softens

Gold sits $6/oz firmer to print $1,726/oz, operating a little below session highs at typing. The precious metal has caught a bid amidst a limited downtick in the USD (DXY), remaining some distance away from Monday’s peak ($1,736.3/oz).

- To recap, gold closed ~$8/oz weaker on Monday, softening as an uptick in U.S. real yields countered a marginal decline in the DXY. The move lower unwound all of the previous session’s gains, keeping gold a short distance away from multi-month lows, with the proximity to the upcoming FOMC decision perhaps sapping conviction for a sustained move in either direction, keeping in mind price movements prior to the meeting.

- To elaborate, gold has shed ~$80 so far this month (on track for a fourth consecutive lower monthly close), with the move lower coming as OIS markets have pointed to rising expectations for Fed tightening over the same period (~82bp of tightening for the Jul FOMC at typing vs. ~69bp at the beginning of July).

- From a technical perspective, short-term gains in gold appear to be corrective, following its bounce off $1,681.0/oz last Thursday, with a break above resistance at $1,745.4/oz (Jul 13 high) having the potential to strengthen a bullish set-up (and scope for a further corrective bounce). On the other hand, initial support is seen at $1,697.7 (Jul 14 low).

OIL: Higher In Asia On Supply Worry; WTI-Brent Spread Widens

WTI is ~+$1.60 and Brent is ~+$1.80, with the latter unwinding virtually all of last Friday’s steep, recession worry-inspired selloff in crude. Familiar debate re: tightness in crude supplies vs. demand destruction continues to do the rounds, with participants likely eyeing the upcoming FOMC over the potential impact to energy demand from the Fed’s rate hikes.

- Looking at the supply side of things, an Argus Media source report has pointed to OPEC+ producing ~2.84mn bpd below production targets for June (after the group reported falling short by ~2.7mn bpd for May), pointing to deepening production woes in the bloc.

- Brent’s prompt spread sits a little under fresh cycle highs (when discounting recent month-end, expiry-related volatility) at ~$5.05, on track to rise for a eight session in nine, reflecting rising worry re: tightness in near-term crude supplies.

- Elsewhere, Libya has announced that crude output has risen to a “little over” 1mn bpd, approaching pre-crisis levels of 1.2mn bpd.

- On the demand side of the equation, a survey by the U.S. AAA has shown over half of respondents driving less amidst higher gasoline prices (also coming after last week’s EIA inventory data showed a large, surprise build in gasoline stockpiles). The WTI-Brent spread has accordingly widened to ~$8.60, the widest since Jun ‘19, reflecting expectations of weaker U.S. oil demand.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/07/2022 | 0600/0800 | ** |  | SE | PPI |

| 26/07/2022 | 0700/0900 | ** |  | ES | PPI |

| 26/07/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/07/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/07/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/07/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/07/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/07/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/07/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/07/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.