-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: JPY Sees A Modest Bid As Equities Struggle

- Asia-Pac equities moved lower in reaction to Monday's Wall St. weakness, while Tsys coiled overnight and the JPY outperformed in the G10 FX sphere.

- Press reports flagging the potential for further easing from the PBoC failed to provide meaningful support for Chinese equities. E-minis gave up a modest uptick and are now marginally lower into European hours.

- Flash PMI readings from across the globe are due throughout the day, with U.S. new home sales & Eurozone consumer confidence also slated. Elsewhere, ECB's Panetta will participate in a policy panel.

US TSYS: Coiling, Eying Event Risk

TYU2 stuck to a narrow 0-04+ range in Asia, last dealing +0-05 at 117-28 on volume of ~63K.

- Cash Tsys run ~1bp richer across the curve after a very limited round of overnight dealing, with participants sidelined ahead of the impending event risk, with no continuation of Monday’s cheapening evident.

- The market looked through Chinese press headlines flagging the potential for further easing from the PBoC.

- Flash PMI data out of Europe and the UK will provide the focal point during London hours, as central banks continue to tighten monetary policy in a bid to quell inflation, with recession risks on the rise.

- Tuesday’s NY session will be headlined by flash PMI readings from S&P Global, new home sales data and the Richmond Fed manufacturing index. Elsewhere, 2-Year Tsy supply is due and Minneapolis Fed President Kashkari (’23 voter) is due to speak late in the NY day/early in Wednesday’s Asia session.

- Participants remain primed for the impending Jackson Hole symposium (Thursday-Saturday), which will be headlined by Fed Chair Powell’s Friday address.

JGBS: Futures Recover, Curve Twist Steepens

JGB futures have recovered from their early downtick to print +7 ahead of the close, more than paring their overnight losses in the process.

- The early downtick may have been facilitated by press reports flagging an uptick in FY23 debt servicing costs (~11% higher than initial estimates for FY22) and hope surrounding the relaxation of COVID testing for vaccinated international visitors journeying to Japan.

- The broader space moved away from session cheaps as equities struggled in the wake of Monday’s Wall St. weakness, with the JGB curve twist steepening as yields run 0.5bp richer to 2.0bp cheaper, pivoting around the 10- to 20-Year zone.

- It seems that the domestic life insurer & pension fund investor cohort is on hiatus this week after signs of demand from that cohort became apparent in the super-long end last week.

- Looking ahead, BoJ Rinban operations covering 1- to 10-Year JGBs headlines the local docket on Wednesday.

AUSSIE BONDS: Bear Flattening

Aussie bonds are off their extremes but sit comfortably cheaper on the day, having maintained the bulk of their early cheapening bias (which was attributable to the bearish impetus from core FI markets observed on Monday), as Asia-Pac equity weakness helped the space find a bit of a base.

- Cash ACGBs run 5.5-9.0bp cheaper across the curve, bear flattening. YM is -8.5 while XM is -7.5, with both contracts operating a little above their respective session lows. EFPs have widened, with the 3-/10-Year box steepening, while Bills run 3 to 17 ticks cheaper through the reds, bear steepening.

- The weekly ANZ-Roy Morgan consumer confidence index saw a second consecutive uptick, but remains comfortably below the breakeven 100 level.

- Wednesday’s local docket will see A$800mn of ACGB Apr-29 on offer, with no economic data releases of note scheduled.

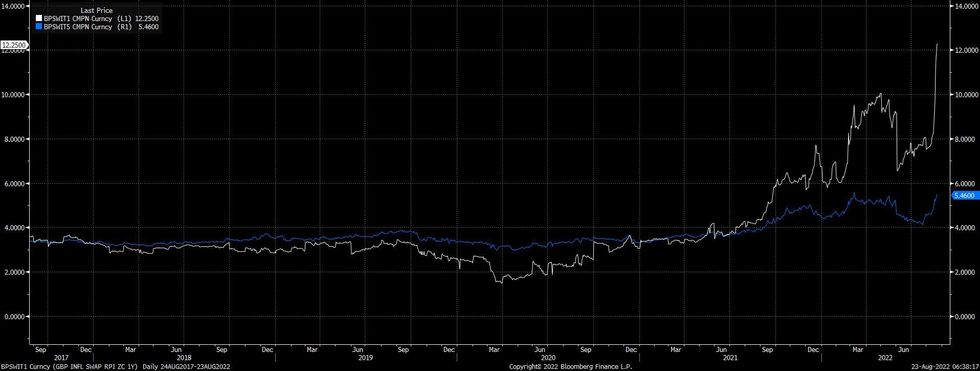

GILTS: Inflation Worry Surging

The well documented inflation issues in the UK are being compounded, at least in the immediate term, by the effective leadership void atop the ruling Conservative Party, with outgoing Prime Minister Boris Johnson pointing to a need for the next Prime Minister to make the choices when it comes to the next round of fiscal measures to alleviate some of the burden that UK households face at present.

- Friday’s announcement re: the latest energy price cap setting is expected to open the gates to the latest round of headwinds for UK households, with the measure set to rise comfortably above the £3,000 p/a mark from the current £1,971 p/a (after jumping from $1,277 p/a earlier this year). Meanwhile, projections suggest that the measure will sit atop $4,500 p/a after the January price cap review then comfortably above £5,000 p/a come April, at a minimum. The Russian invasion of Ukraine and related sanctions/slowing of Russian gas supply to the west is the key driver of inflation here.

- UK 1-Year RPI zero coupon inflation swaps have registered fresh all-time highs (going back to late ’03) in recent days, with the above topics coming into greater focus and July’s UK inflation data topping expectations. The metric has topped 12%.

- A reminder that Citi suggested that CPI could peak at 18.6% Y/Y in January, also outlining the potential for the need for the BoE to hike interest rates to 6 or 7 percent in the case of deeper inflation becoming embedded in the UK. This view has got plenty of airtime in the local press over the last 24 hours.

- Note that Citi’s projections assume that the new Prime Minister will cut green levies and VAT surrounding energy bills, which will save households ~£300.

Fig. 1: UK 1- & 5-Year RPI Zero Coupon Inflation Swaps

Source:

Source:

FOREX: Risk Gets Some Reprieve, Yen Turns Bid Into Tokyo Fix

The commodity-tied bloc paced gains in G10 FX space, with the Antipodeans sitting comfortably atop the pile. Risk took a breather after Monday's rout caused by pre-Jackson Hole musings amid thin headline flow.

- From a cross-asset perspective, the aggregate Bloomberg Commodity Index advanced, with both crude oil and iron ore creeping higher. U.S. e-mini futures operated in the green, even as Asia-Pac equity benchmarks declined on a negative lead from Wall Street.

- AUD and NZD each added a handful of pips against the greenback, with the kiwi dollar getting some relief after registering losses for six days in a row. Both AUD/USD and NZD/USD traded within yesterday's ranges.

- Light pressure on the greenback emerged in early Asia hours as South Korean authorities warned that they are monitoring offshore speculative factors. USD/KRW pulled back from session/cycle highs, which spilled over into other UDS crosses, to a degree.

- Aforesaid greenback sales underpinned the initial round of USD/JPY sales, with the rate extending losses into the Tokyo fix to last trades ~25 pips worse off. This puts the pair on track to snap a five-day winning streak.

- The Eurozone's single currency remained on he defensive, with EUR/USD holding near its worst levels from yesterday, when it sank below parity.

- Manufacturing PMI readings from across the globe will keep hitting the wires through the day, with U.S. new home sales & EZ consumer confidence also due. ECB's Panetta will participate in a policy panel.

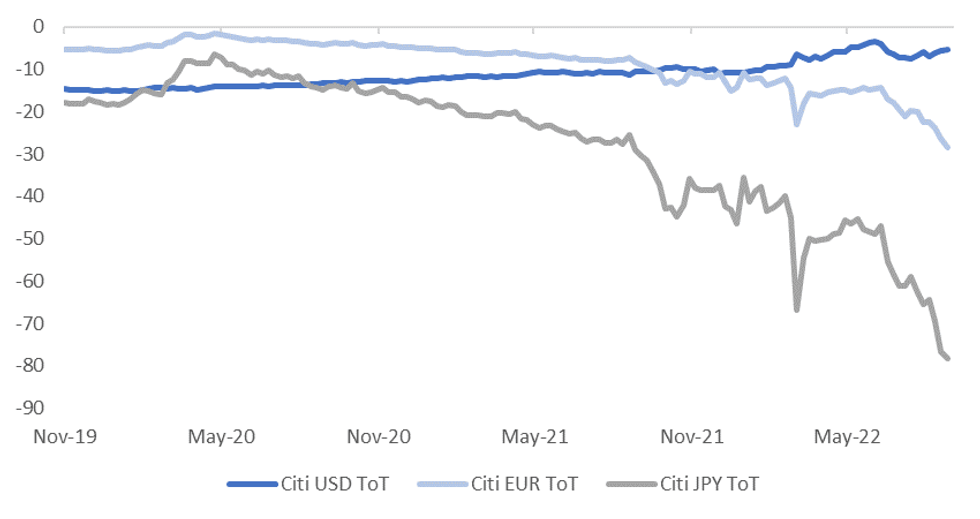

USD: Relative Terms Of Trade Still Moving In the USD's Favor

Relative terms of trade trends continue to favor the USD over EUR and JPY. The first chart below plots the Citi terms of trade proxies for each of these currencies. Whilst the USD measure has edged higher in recent weeks, the EUR and JPY measures continue to trend down. It's also not just price measures that are trending wrong for these economies, but also actual supply. This is obviously a focus point for the EU area at the moment and as we approach the winter months.

Fig 1: Citi Terms Of Trade Proxies for USD, EUR & JPY

Source: Citi/MNI - Market News/Bloomberg

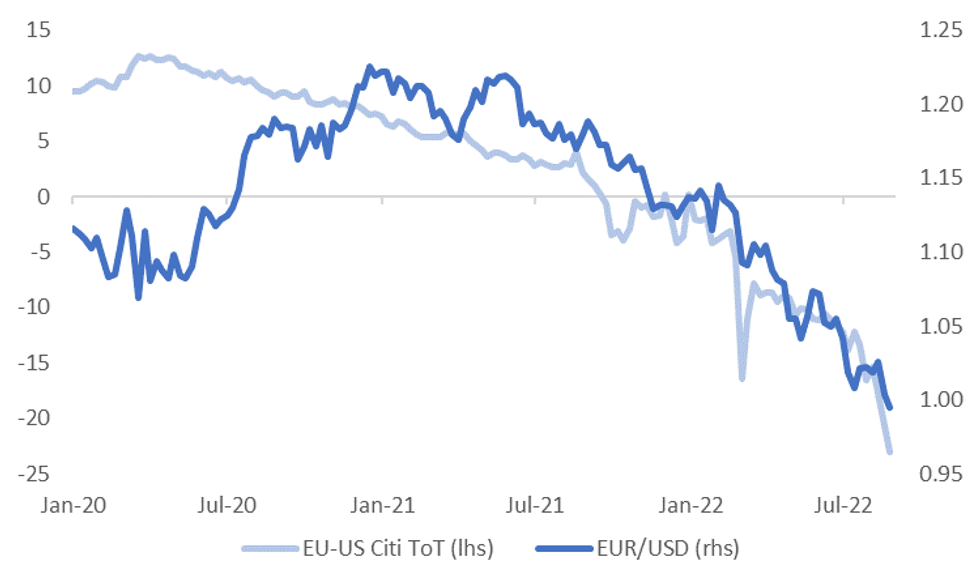

- The second chart below plots the differential between the EU and US Citi ToT proxies, against spot EUR/USD. As we have highlighted previously, the correlation between the two series has strengthened over the past 12 months. The rolling 6 month correlation is only just off recent highs at 72% (versus 80%).

- All else equal, the relative ToT proxy continues to suggest downside in EUR/USD.

- For JPY, the negative terms of trade shock, coupled with record wide trade deficits, has likely helped reduced its sensitivity to broader risk aversion moves, albeit at the margins.

- This year, the USD/JPY correlation with the VIX has been close to flat, but last year it was -37%.

- Relative terms of trade shifts have clearly aided the recent USD's ascent. This support may persist from sometime yet, although focus towards the end of the week will clearly shift to Powell/Jackson Hole.

Fig 2: EUR/USD & Relative Citi EUR-USD Terms Of Trade Proxy

Source: Citi/MNI - Market News/Bloomberg

Source: Citi/MNI - Market News/Bloomberg

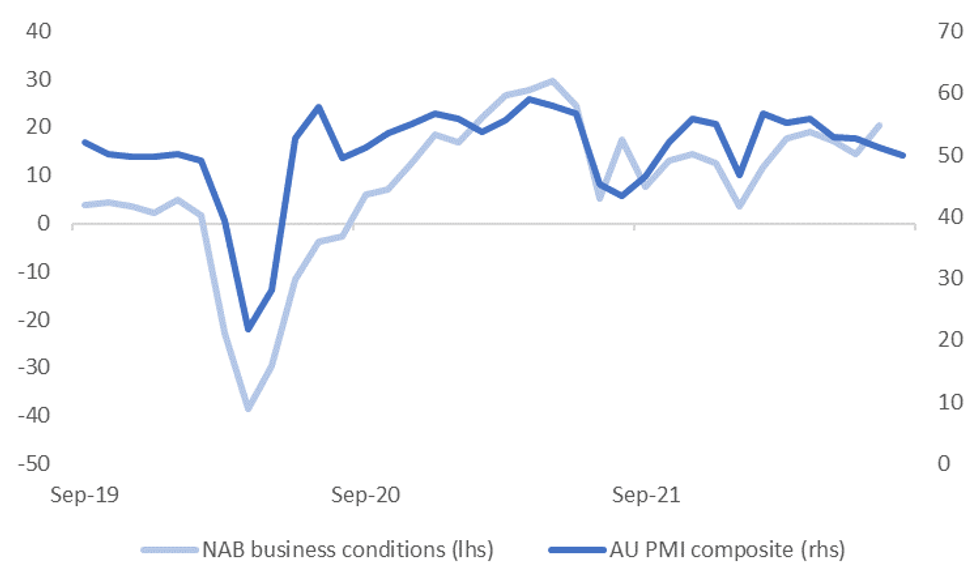

AUSTRALIA: Is The Australian Growth Backdrop Losing Some Shine?

The earlier preliminary PMI prints for Australia didn't produce much of a reaction in the AUD FX or rates space. This is not a huge surprise as the releases aren't forecast by the market. However, the results point to some softening to Australia's resilient business conditions backdrop. The services PMI is now in contraction territory, (49.6), as is the composite index. The manufacturing index eased back to 54.5 but remains comfortably in expansion territory.

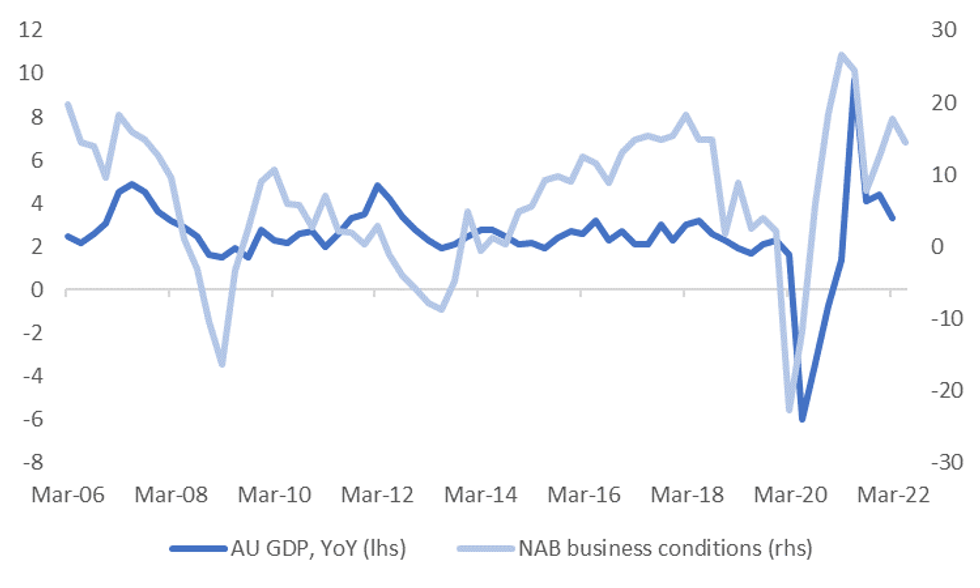

- The caveats with the PMI prints are the relative short history (at least available on Bloomberg). Still, the first chart below shows the reasonable correlation between the PMI composite against the NAB business conditions index, which has a much longer history, over recent years.

- The loss of momentum in the composite index does suggest some downside risks to the next NAB business conditions reading, although the next print is not out until mid-September.

Fig 1: AU PMI Composite Versus NAB Business Conditions

Source: S&P/NAB/MNI - Market News/Bloomberg

Source: S&P/NAB/MNI - Market News/Bloomberg

- The second chart below plots the NAB business conditions index against Australian GDP YoY. The rolling 5yr correlation between the two series sits at just under 50%.

- Note as well, the correlation between the PMI composite and service readings is reasonably elevated with Australian retail sales. This is the next major data print in Australia, out next Monday.

- Levels of the PMIs (services and composite) and YoY retail sales have a correlation of around 57%. For MoM retail sales the correlation remains positive, but is around half this level.

- In any event, today's PMI prints suggest some of the softness in global sentiment is starting to seep into Australian conditions, along with tighter financial conditions domestically.

Fig 2: NAB Business Conditions & AU GDP YoY

Source: NAB/MNI - Market News/Bloomberg

Source: NAB/MNI - Market News/Bloomberg

ASIA FX: USD Gains Slow

The USD has stayed on the front foot for the most part today, although gains are more modest compared to previous sessions. The South Korea authorities are more focused on speculative behaviour in FX markets, which aided the won, although it is unlikely to change trends. Coming up is the BI decision in Indonesia, with no change expected.

- CNH: USD/CNH has edged away from overnight highs. The pair is back below 6.8700, but has traded a tight range for the most part. Lower USD/KRW levels helped, but a slightly weaker than expected CNY fix curbed gains. Dips to the low 6.8600 region are being supported. Equities are weaker but are away from worst levels.

- KRW: Spot USD/KRW dipped as far as 1337, after the South Korean authorities stated that were monitoring speculative factors in the FX market. However, the pair has crept higher this afternoon, we are back above 1342. Onshore equities remain in the red, with the Kospi down close to 1%.

- IDR: Spot USD/IDR has climbed above its 50-DMA this morning and last deals +13.5 figs at IDR14,901 amid weakness in the broader Asia EM space. Majority (24/31) of economists in a Bloomberg survey expect Bank Indonesia to keep the 7-Day Reverse Repo Rate unchanged today, while the rest have forecast a 25bp hike. In light of recent rhetoric from the Bank's top brass, we expect policymakers to stand pat this time (see our full preview here).

- PHP: Overseas investors were net sellers of Philippine stocks on Monday for the first time in six days. They shed a net $6.1mn in local equities. The PSEi has extended yesterday's losses today to last trade ~1.6% lower on the day. USD/PHP is relative steady though around the 56.20 level today.

- THB: Spot USD/THB trades +0.014 at THB36.202 with pre-Jackson Hole Fed musings in the driving seat. Bulls look for an attack on THB36.945, a cycle high printed on Jul 21. Thailand's tourism arrivals were 1.124mn last month, according to an update from the Ministry of Tourism and Sports. Malaysian visitors topped the list. Looking further afield, Thailand's Customs Dept will publish monthly trade data tomorrow.

- MYR: Bullish momentum remains behind spot USD/MYR which printed new cyclical highs this morning. The pair last operates +28 pips at MYR4.4888 as hawkish Fed positioning ahead of the Jackson Hole symposium applied pressure to emerging Asian FX. Participants look ahead to the release of monthly CPI data this Friday.

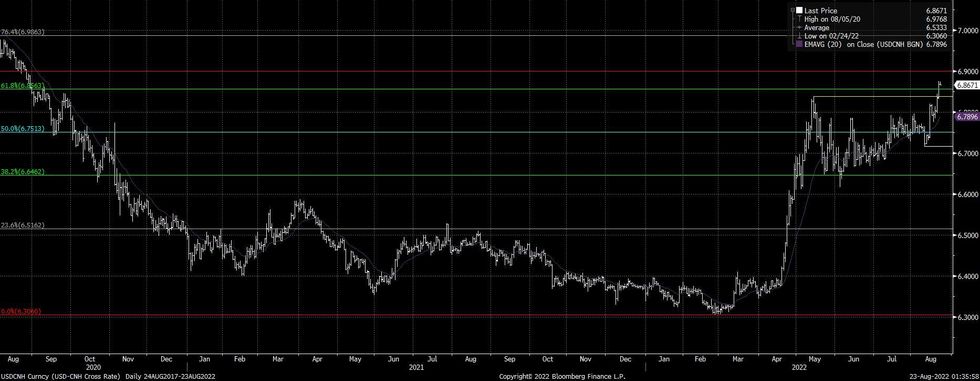

CNH: Technical Recap After USD/CNH Clears Key Resistance Levels

USD/CNH has started the week on a firm note, trading as high as CNH6.8754 on Monday as the broader USD rallied. Worries surrounding the Chinese economy have generated a favourable yield differential environment (vs. CNH) in recent weeks, facilitating a bid in the cross.

- A reminder that our technical analyst noted the following on Monday:

- Friday’s gains saw USD/CNH pierce key resistance at CNH6.8380, the May 13 high. Monday’s move then confirmed a clear break of this resistance.

- The move higher confirms a resumption of the uptrend that started late February 2022.

- This suggests potential for an extension near-term and note that the pair has pierced an important retracement level at CNH6.8563 - 61.8% of the 2020-2022 bear cycle.

- Moving average studies remain in a bull mode, highlighting the current market sentiment.

- The focus is on the CNH6.9000 level next.

- The 20-day EMA at 6.7814 marks initial support.

- The key short-term trend support has been defined at 6.7164, the Aug 10 low.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Lower In Asia

Asia-Pac equity indices are mostly softer at writing, tracking a negative lead from Wall St. Tech stocks notably showed resilience despite the tech-led weakness from U.S. equities on Monday, with relevant benchmarks in China, Hong Kong, and Australia outperforming their respective, broader equity indices.

- The Hang Seng deals 0.5% weaker at writing, a little above freshly-made three-month lows earlier in the session. The finance and property sub-indices bring up the rear amongst peers, with investors little convinced by recent/potential measures such as Monday’s cut to the 5-Year LPR, and source reports pointing to ~US$29bn in special loans for delayed housing projects.

- The Nikkei 225 trades 1.2% lower, on track for a third consecutive lower daily close, extending a sharp pullback from 8-month highs made last week. The energy sector bucked the broader trend of losses observed across virtually every other peer sector, aided by an uptick in energy commodity prices during Asian hours.

- The ASX200 sits 1.0% worse off, operating around fresh two-week lows at typing. The healthcare (-1.8%) and consumer staples (-3.5%) sub-indices were by far the worst performers, easily offsetting shallower gains in commodity-related sectors.

- E-minis are 0.2% firmer apiece at writing, consolidating a little above their respective multi-week lows made on Monday.

GOLD: Just Off Four-Week Lows; Dollar Strength Eyed Ahead Of Jackson Hole

Gold sits $3/oz to print ~$1,739/oz at writing, consolidating a little above Monday’s lows as the USD has seen some light selling pressure, with the DXY sliding back below the 109 mark.

- The path of least resistance remains downwards for gold amidst proximity to the Fed’s Jackson Hole Symposium, with bullion sent to fresh four-week lows on Monday ($1,727.8/oz) on an uptick in the DXY and U.S. real yields, ultimately closing $10/oz softer on the day for a sixth consecutive lower daily close.

- Investor interest as seen in total ETF holdings of gold continues to remain weak, with the measure declining for a tenth straight week last Friday, operating at levels last witnessed in end-Feb.

- From a technical perspective, conditions for gold remain bearish following its failure to convincingly clear trendline resistance (drawn from the Mar 8 high), with initial support seen at $1,729.5/oz (61.8 retracement of the Jul 21-Aug 10 climb), and further support at $1,711.7/oz (Jul 26 low). On the other hand, key resistance is situated at $1,807.9/oz (Aug 10 high and bull trigger).

OIL: Higher In Asia As Potential For OPEC Supply Cuts Raised

WTI and Brent are ~$0.90 firmer apiece, extending a rebound off their respective troughs made on Monday, with participants in Asia reacting to news of potential oil output cuts by Saudi Arabia in the near-term.

- To elaborate, Saudi Energy Minister Prince ABS on Monday brought up the possibility of cuts to OPEC+ production quotas at the group’s next meeting (early Sep), citing “extreme volatility” in crude futures as a key reason.

- Keeping to OPEC+, RTRS sources reported that the group missed collective production targets for July by ~2.9mn bpd (corroborating Argus source reports from late last week), with the gap between stated quotas and actual production continuing to grow.

- Elsewhere, crude exports from the Caspian Pipeline Consortium’s (CPC) Black Sea terminal remain partially suspended due to damage to loading facilities. Output through the pipeline during Aug-Sep is nonetheless likely to “significantly down” (as per earlier CPC statements), due to scheduled maintenance work at major Kazakh oil fields.

- Turning to ongoing U.S.-Iran nuclear talks, the Biden administration has yet to formally respond to Iran’s comments re: the EU’s “final draft”, with evidence of concrete progress towards a deal remaining scant as the two sides traded accusations of procrastination on Monday.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/08/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/08/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 23/08/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 23/08/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/08/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/08/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 23/08/2022 | 1100/1300 |  | EU | ECB Panetta at ECB Policy Panel at EEA Annual Congress | |

| 23/08/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/08/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/08/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 23/08/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/08/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.