-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: German FI Sees Modest Bid As Traders Try To Extract Noise From CPI Data

- Core FI firms a little as German NRW state CPI slows in M/M terms.

- PBoC leans harder against CNY weakness via mid-point fixing, posting biggest downside surprise in USD/CNY fixing since '19 in the process.

- German CPI, Eurozone sentiment gauges and U.S. Conf. Board consumer confidence take focus on the data front today. Elsewhere, comments are due from Fed's Williams & Barkin, ECB's Vasle, Holzmann, Stournaras, Wunsch & Muller, as well as Riksbank's Ingves.

US TSYS: Richer, Aided By Regional German CPI

The Monday move off of session cheaps extended in Asia-Pac hours, with the modest early richening getting further traction on the back of a slowing in the regional NRW CPI M/M print out of Germany.

- That leaves cash Tsys 3.0-3.5bp richer across the curve.

- TYZ2 prints +0-09 at 117-12+, 0-01 off the peak of its 0-09+ range on volume of ~65K, with ~18K of residual futures roll activity aiding volume.

- A downtick in the major Hong Kong & Chinese equity indices also helped at the margin.

- E-minis have firmed to best levels in recent trade, with the 3 major contracts running 0.3-0.5% firmer on the day.

- Note that the richening move even came after Minneapolis Fed President Kashkari (’23 voter) told BBG that he “was actually happy to see how Chair Powell's Jackson hole speech was received” i.e. pleased that the hawkish messaging got through, via a podcast on Monday.

- Looking ahead, further German state and national CPI data will be eyed on Tuesday, particularly with the debate re: the need for a 75bp ECB hike in Sep stepping up and some arguing that the degree of hawkishness priced into EUR money markets at present is perhaps near the viable extreme. Various ECB speakers will also cross throughout the day.

- The NY docket will be headlined by JOLTS jobs data, various house price metrics and the Conference Board consumer confidence print. Elsewhere, NY Fed President Williams (permanent voter) and Richmond Fed President Barkin (’24 voter) will speak.

JGBS: Curve Twists Steeper, Futures Lead Richening

JGB futures tracked the wider core FI impetus observed since Monday’s Tokyo close, which allowed them to extend further away from their overnight base, last +24, while cash JGBs saw some twist steepening, with 40s marginally cheaper on the day (although the super-long end is off session cheaps on the broader bid), while 7s lead the bid on the rally in futures.

- 2-Year JGB supply passed smoothly, with the low-price printing above wider exp., although the cover ratio wasn’t anywhere near as strong, likely owing to the steepness of the domestic curve.

- Elsewhere, Finance Minister Suzuki offered little new in his latest address outside of noting that Japan is watching moves in the financial markets.

- Domestic labour market data provided nothing by the way of meaningful surprises.

- Elsewhere, BBG source reports flagged a 0.1ppt uptick for Japan’s accumulated interest rate, which is used to calculate the country’s debt servicing costs.

- Looking forward, industrial production and retail sales data headlines domestically on Wednesday, with the latest round of BoJ Rinban operations also due.

AUSSIE BONDS: Building On Early Gains

Aussie bonds have richened throughout the Sydney session, hitting fresh session highs on the release of German regional NRW CPI, with tailwinds from a slowing in the M/M print adding to the earlier bullish impetus derived from a recovery in wider core global FI markets from Monday’s lows.

- Cash ACGBs run 4.5-9.0bp richer across the curve, bull steepening.

- YM is +9.5 and XM is +4.5, with both contracts operating just shy of session highs. The 3-/10-Year EFP box is steeper, with 3-Year EFP a little narrower and 10-Year EFP little changed, while Bills run 2 to 11 ticks richer through the reds.

- ACGBs were little changed on a large miss in headline building approvals data for July (-17.2% M/M vs. BBG median -3.0%), likely as the decline was driven by a plunge in the historically volatile large apartment dwellings component.

- Wednesday will see A$1.0bn of ACGB Nov-32 on offer at auction, followed by the release of Jul private sector credit and Q2 construction work.

FOREX: Yen Gains Amid Lower U.S. Tsy Yields, PBOC Repeats Pushback Against Yuan Depreciation

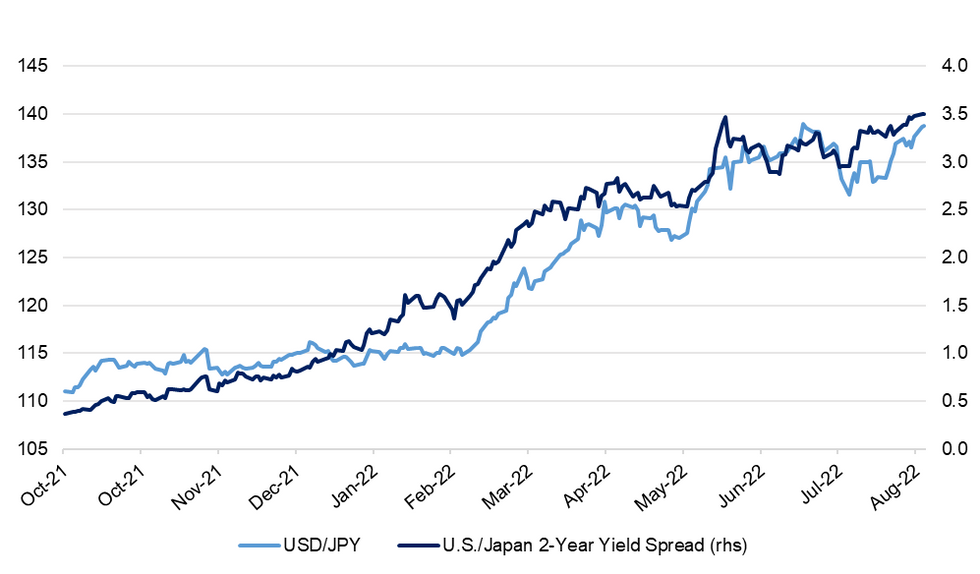

The yen took the lead, extending gains over the Tokyo fix, in a slight correction of yesterday's rout. Its outperformance was not disturbed by the fact that e-mini futures turned bid, albeit China tech equities were softer. A tad lower U.S. Tsy yields likely provided some support to the yen, given the strong correlation between U.S./Japan yield gap and USD/JPY price action.

- In the latest round of jaw-boning, Japanese FinMin Suzuki said that the authorities will monitor moves in U.S. monetary policy and markets.

- Weak iron ore prices and domestic construction data weighed on the Aussie dollar. Building approvals in Australia shrank 17.2% M/M, missing the consensus call for a 3.0% contraction by a notable margin.

- The kiwi dollar was the second-worst G10 performer, taking its cue from the Antipodean cousin. AUD/NZD extended its move away from recent cyclical highs and tested the NZ$1.20 mark.

- The PBOC delivered another pushback against yuan depreciation via a stronger than expected fixing of the USD/CNY mid-point (~250-pip error). Offshore yuan got only brief reprieve and USD/CNH bounced back shortly after.

- German CPI, EZ sentiment gauges and U.S. Conf. Board Consumer Confidence take focus on the data front today.

- Comments are due from Fed's Williams & Barkin, ECB's Vasle, Holzmann, Stournaras, Wunsch & Muller as well as Riksbank's Ingves.

JPY: Yen Gets Beating With Monetary Policy Divergence In Spotlight

The yen got battered Monday as participants digested Fed Chair Powell's hawkish Jackson Hole speech, which drew renewed attention to interest rate spread with Japan.

- Powell's assertion that the Fed would continue to hike interest rates included in his Jackson Hole speech last Friday stood in contrast with comments delivered by his Japanese peer during the symposium. Gov Kuroda reiterated that the BoJ "have no choice other than continued monetary easing until wages and prices rise in a stable and sustainable manner."

- Negative equity sentiment failed to accentuate the yen's safe haven allure, even as benchmarks retreated and the VIX index gained. The European safe haven CHF was also softer.

- U.S. Tsy yields were wobbly but gaps with JGBs widened. 10-year spread rose ~4bp, while 2-year differential rose ~2bp. The latter gap reached its widest levels since 2007.

- USD/JPY risk reversals advanced across the curve. One-month tenor had a look above par, moving through the zero level again this morning; one-year skews showed at their best levels since 2015.

- Latest data from the CFTC showed that leveraged funds trimmed net JPY short positions by 1,779 contracts to 9,863 in the week through Aug 23. By contrast, asset managers boosted their net short positions by 29,637 contracts, the most on record, to 66,172.

- Spot USD/JPY last deals at Y138.73, little changed on the day, with bulls looking for a rally towards Jul 14 multi-year high/round figure of Y139.39/140.00. Bears look for a dip through the 50-DMA, which kicks in at Y135.89.

- On the data front, focus turns to flash industrial output, unemployment, retail sales, housing starts and consumer confidence, all due tomorrow. Later this week, capex & company profits/sales data will cross the wires Thursday.

Fig. 1: USD/JPY vs. U.S./Japan 2-Year Yield Spread (rhs)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

ASIA FX: Mixed Fortunes

Asian FX has been mixed today. Dips in USD/CNH and USD/KRW have been supported, while USD/PHP has played some catch-up after markets were closed yesterday. THB and SGD FX have fared better though, along with the high yielders.

- CNH: We had an even larger CNY fixing surprise today (-249pips in USD/CNY terms). USD/CNH dipped initially, but we couldn't get beyond 6.9050. We moved back above 6.9200, but remain below yesterday's highs above 6.9300. The market bias remains to buy USD/CNH dips post the fixing. China equities have underperformed, while onshore commodity prices are also down, adding to the bearish mood.

- KRW: Korean equities have rebounded, but this hasn't aided the won to any great degree. The pair remains within recent ranges, in line with USD/CNH moves. USD/KRW hasn't breached the 1350 level today though. The government plans to lower fiscal spending next year, with projections today indicating a 6% reduction on total 2022 outlays.

- INR: USD/INR is back sub 80.00, with the pair last tracking just under 79.80. Onshore equities are higher, shrugging off the continued move higher in Brent crude prices.

- SGD: USD/SGD struggled to make much headway beyond Aug 23/one-month high of SGD1.4003 and gave back the bulk of its initial gains on Monday. Singapore's Ministry of Manpower announced an overhaul of visa rules to attract foreign workers and alleviate the current tightness of domestic labour market.

- PHP: Spot USD/PHP deals +0.26 at PHP56.288 as onshore Philippine markets re-open after a holiday. A break above Aug 23 high of PHP56.338 would shift focus to record highs at PHP56.500. Philippine bank lending data may hit the wires in the coming days, with S&P Global M'fing PMI coming up Thursday.

- THB: Spot USD/THB changes hands -0.06 at THB36.402, consolidating gains registered Monday as the pair gapped higher at the start to the week. There's a wealth of data coming up tomorrow, including manufacturing production index, BoP current account balance & trade data. Later this week, S&P Global M'fing PMI & Business Sentiment Index will hit the wires on Thursday.

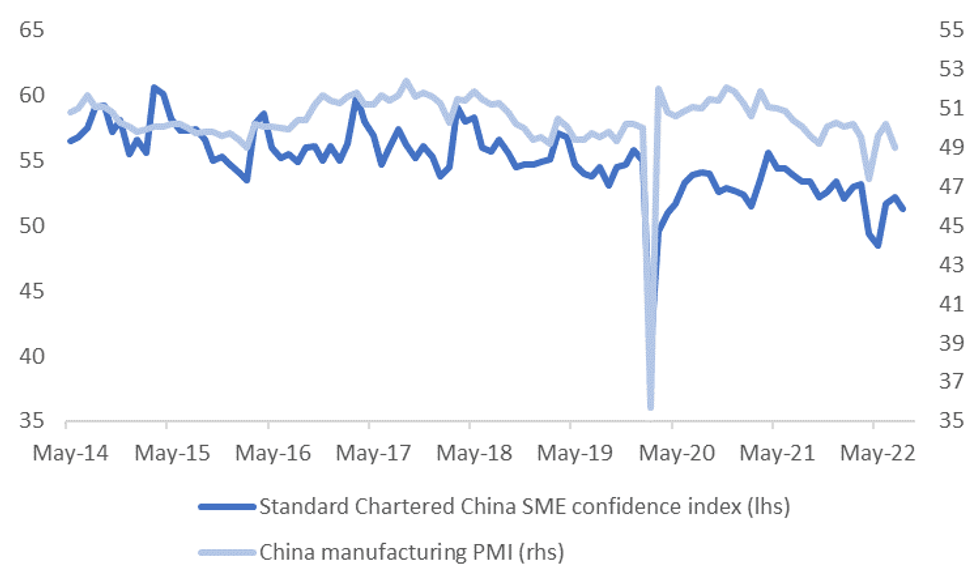

CHINA DATA: Official PMIs On Tap Tomorrow

A reminder that the official PMI prints are out tomorrow for August. The market consensus for the manufacturing PMI is a slight improvement to 49.2 versus 49.0 in July. For the non-manufacturing PMI, the forecast is 52.3 versus 53.8 previously.

- The relative divergence in expectations is not surprising given August saw a fresh Covid wave hit a number of China cities. No major cities were locked down, but case numbers were still above 3000 by the middle of the month before the trend improved.

- In any case, such a backdrop would be expected to weigh more on the services backdrop relative to manufacturing, although power outages could also impact on this sector. The authorities have stated the current episode isn't as bad as last year's coal shortages.

- The authorities also announced fresh stimulus measures towards the end of August, which hints at concern around the growth backdrop, all else equal.

- Note, the Standard Chartered SME survey, which has already printed for August, eased back in the month to 51.30, from 52.16 in July, suggesting some loss of momentum. Still, we remain comfortably above the May trough of 48.50 for this index, see the chart below.

Fig 1: China Manufacturing PMI Versus Standard Chartered SME Survey

Source: Standard Chartered/MNI - Market News/Bloomberg

Source: Standard Chartered/MNI - Market News/Bloomberg

CHINA: Yuan Defense Steps Up

EXECUTIVE SUMMARY

- The China authorities are pushing back aggressively against yuan depreciation pressures, via the USD/CNY fixing mechanism.

- While the China currency is still very elevated in NEER terms, the domestic focus is likely to rest with USD/CNY levels. In the lead up to the party congress, expected in late October/early November and where Xi Jinping is expected to be confirmed for a third term, the emphasis on stability across all aspects of financial markets, including FX, is likely to be fairly strong.

- Runaway depreciation pressures create the risk of shifting onshore expectations as well, particularly around breaking key levels such as 7.00.

- Outside of the fixing mechanism, China officials could also deploy other tools that have been utilized in the past, to curb depreciation pressures. These include changing reserve requirements on FX forward transactions. It could lower the reserve requirement for banks’ FX reserve holdings as well.

- Still, until we get relative policy cycles moving back in the yuan’s favor (i.e. US-China yield differentials trending back down), it may be difficult to call a peak in USD/CNY. At this stage, such a shift may be more driven by the Fed changing course rather than China, unless we see a move away from the country's dynamic-Covid zero strategy.

- Link to the full PDF USDCNY Threatening 7 (Aug 30 2022).pdf

EQUITIES: Mixed In Asia; Chinese PMIs Await

Major regional equity indices are mixed at writing, with Chinese and Hong Kong stocks struggling as participants await the release of official PMI data on Wednesday following well-documented challenges to the Chinese economy in August.

- The Hang Seng (-1.3%) leads the way lower on losses across ~85% of its constituents. China-based tech has borne the brunt of the selling pressure (HSTECH: -2.1%), with the likes of Bilibili (-5.1%) and Trip.com (-4.6%) struggling.

- A note that the stocks of Chinese companies with listings in the U.S. have declined despite the announcement of a Sino-U.S. audit deal last week, with evident caution amongst investors amidst historically elevated bilateral tensions.

- The CSI300 is 0.5% worse off, with losses in high-beta consumer staples and healthcare posing the most drag. Elsewhere, developer stocks bucked the broader downtrend, with the CSI300 Real Estate Index (+1.5%) rallying after hitting two-week lows on Monday.

- The Nikkei 225 is 1.1% better off on gains in over 90% of its constituents, although the move higher comes nowhere close to unwinding Monday’s 2.7% lower close. IT stocks outperformed, led by gains in index heavyweight Tokyo Electron (+1.6%).

- E-minis sit 0.2-0.3% better off at writing, consolidating a little above their respective one-month lows established on Monday.

GOLD: Slightly Lower In Asia; Technical Outlook Remains Bearish

Gold deals ~$3/oz weaker to print $1,734/oz, operating around session lows and extending a pullback from Monday’s best levels at writing.

- To recap, gold ended virtually unchanged on Monday after a limited rebound from one-month lows (at $1,720.5/oz), tracking a pullback in the USD from fresh cycle highs, with the DXY ending little changed on the day as well.

- The precious metal remains on track for a fifth consecutive lower monthly close amidst persistent weakness in some measures of investor interest, with ETF holdings of gold recording its 11th straight weekly decline last Friday.

- From a technical perspective, gold remains in a short-term downtrend following the recent breach of support at $1,727.8/oz (Aug 22 low). Initial support is seen at $1,711.0/oz (76.4% retracement of the Jul21-Aug10 upleg), and a break of that level will expose further support at $1,700.0/oz (round number support). On the other hand, initial resistance is seen at ~$1,765.5/oz (Aug 25 high).

OIL: Holding On To Recent Gains Amidst Supply Worry

WTI is ~-$0.20 and Brent is ~-$0.50, with both benchmarks keeping to tight <$1 ranges so far, consolidating a little below their respective Monday’s peaks at writing.

- To recap, WTI and Brent closed ~$4 firmer apiece on Monday, aided by an escalation in supply-related worry particularly around Libyan political unrest and potential OPEC+ supply cuts.

- On the former, Libya stated on Monday that crude production remains >1.2mn bpd despite a recent spike in politically-related violence.

- Looking to OPEC+, several members such as Iraq, Venezuela, and Kazakhstan have signalled support for future production cuts, with participants eyeing the group’s next meeting on Sep 5.

- Elsewhere, International Energy Agency (IEA) Chief Birol pointed out that western sanctions are likely to crimp Russian production later this year, even as Russian crude exports have declined by less than expected so far.

- Dr. Birol also observed that the ongoing release of crude from the strategic reserves of IEA members is due to expire, although further releases may be discussed, citing a “substantial amount of stocks” held by members.

- The prompt spreads for WTI and Brent have risen in recent sessions to ~$0.85 and ~$1.95 respectively, pointing to an uptick in worry re: supply tightness.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/08/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 30/08/2022 | 0700/0900 |  | ES | Retail sales | |

| 30/08/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/08/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/08/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 30/08/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/08/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 30/08/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 30/08/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 30/08/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 30/08/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/08/2022 | 1200/0800 |  | US | Richmond Fed's Tom Barkin | |

| 30/08/2022 | 1230/0830 | * |  | CA | Current account |

| 30/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 30/08/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 30/08/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/08/2022 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 30/08/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 30/08/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 30/08/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 30/08/2022 | 1500/1100 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.