-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS - Week Ahead 9-15 Dec

MNI US MARKETS ANALYSIS - AUD/JPY Finds Bottom on China News

MNI EUROPEAN MARKETS ANALYSIS: Fed Emphasis On Higher Real Yields Supporting USD Trend

- Much of today’s session focused on the continued surge in the USD, with the DXY reaching fresh cyclical highs. Acute pressures are evident for the yen, with USD/JPY above 144.00, as officials warned they stand ready to act against continued one-sided moves.

- Other asset classes were quieter, on a relative basis. Equities remained under pressure in Asia with tech/yield sensitive plays the worst performers. Yields traded tight ranges. More broadly, it remains to be seen what fundamental changes can occur in the near term from a risk standpoint. The Fed’s Barkin (’24 voter) emphasized the need to push real rates above 0 and keep them there. We will hear from him again this evening along with a host other Fed speakers, with Mester (voter) and Brainard (voter) speaking later today.

- More broadly, it remains to be seen what fundamental changes can occur in the nearterm from a risk standpoint. The Fed’s Barkin (’24 voter) emphasized the needto push real rates above 0 and keep them there. We will hear from him againthis evening along with a host other Fed speakers, with Mester (voter) andBrainard (voter) speaking later today.

US TSYS: Tight Trade After Tuesday’s Cheapening; Fed Speeches And Beige Book Eyed

Price action across the Asia-Pac session saw Tsys consolidate within relatively narrow ranges after the cheapening in core FIs on Tuesday (that saw 30-Year yields hit eight-year highs), with regional data prints provided little by way of lasting, meaningful direction for the space as well.

- TYZ2 is -0-01+ at 115-17+, sitting towards the middle of a tight 0-06 range established throughout the Asia-Pac session, a short distance above freshly made three-month lows.

- Cash Tsys run flat to 2.5bp richer across the curve, with long-end Tsys leading the way higher, while 2-Year yields were unable to establish a clear break above the 3.50% mark.

- Looking ahead, U.S. trade balance data, weekly mortgage applications, and the Fed’s Beige Book will cross later in the NY session amidst Fedspeak from the Fed’s Barkin (‘24 voter), Mester (voter), and Brainard (voter), with the BoC’s policy decision due as well.

JGBS: Off Lows, 10-Year Yields Approach BoJ’s YCC Tolerance Band

JGBs have edged away from session lows throughout the Asia-Pac session, with cash JGBs running 0.5-6.0bp cheaper across the curve, bear steepening, while JGB futures print -26 on the day.

- There was much focus centred around the latest round of JPY weakness, with USD/JPY back below 144.00 amidst rhetoric from Japanese officials.

- The BoJ announced an increase to the purchase of its 5- to 10-Year bonds in its Rinban ops (from the Y500bn scheduled to Y550bn), coming as 10-Year JGB yields (~0.243%) have continued inching higher to the upper limit of the BoJ’s permitted +/- 0.25% trading band.

- Thursday will see final Q2 GDP, balance of payments data, bank lending, and weekly international security flow figures headline the domestic docket, with a liquidity enhancement auction for off-the-run 5-15.5 Year JGBs due as well.

AUSSIE BONDS: Off Lows; Gov. Lowe’s Speech Eyed After Solid Q2 GDP Print

Aussie bonds have edged away from session lows, having unwound a downtick observed after the release of Q2 GDP, which met expectations on a Q/Q basis (+0.9% Q/Q vs. BBG median +0.9%), while recording a slight beat on the Y/Y print (+3.6% vs. BBG median +3.4%).

- Cash ACGBs run 3.5-7.5bp cheaper across the curve, with the 10- to 15-Year zone leading the way lower.

- YM is -5.0 and XM is -9.0, with both contracts having failed to stage a clear breach of their respective overnight bases so far. EFPs are little changed, while Bills run 1 to 6 ticks cheaper through the reds.

- The Q2 GDP result was contributed in part by the 2.2% rise in household spending and 5.5% increase in exports, with the solid headline print possibly validating expectations from some quarters re: further RBA hawkishness.

- Focus domestically now turns to a speech by RBA Gov. Lowe on Thursday.

FOREX: USD Off Highs

USD upside momentum has cooled somewhat during the afternoon session. Within the G10 space, all currencies are away from worst levels against the USD. The DXY is back to around 110.50, versus earlier highs of 110.70. USD/JPY hit a high just shy of 144.40, but we are now back sub 144.00. The market is likely to be wary of further rhetoric from the authorities around FX over coming sessions.

- EUR/USD has edged back up towards 0.9900, headlines that Norway is open to an EU gas price cap likely helping at the margin. The pair is nearly back to unchanged for the session.

- The Fed's Barkin said in an interview with the FT that his bias is to move quickly on rates and that real rates need to above zero and stay there. We hear from Barkin again during the US session, along with a host of other Fed speakers, see below.

- US yields have been steady for the most part, with the 2yr not drifting too far away from 3.50%. Equities are in the red for Asia Pac markets, while US futures are lower but away from session lows.

- AUD/USD has held above 0.6700. Q2 GDP showed the economy maintains solid momentum. China trade figures were disappointing, although iron ore import volumes still rose over 5% in August. Corporate related demand for the A$, related to dividend inflows, may be driving some demand at lower levels.

- NZD/USD has underperformed, dipping sub 0.6000 for the first time since 2020, although we are now back above this level.

- Looking ahead, U.S. trade balance data, weekly mortgage applications, and the Fed’s Beige Book will cross later in the NY session, with Fedspeak from the Fed’s Barkin (‘24 voter), Mester (voter), and Brainard (voter) in focus. The BoC decision is also due, with the market looking for a 75bps hike (taking the policy rate to 3.25%).

AUSTRALIA DATA: GDP Details Show Solid Economy

Q2 rose 0.9% q/q after a downwardly revised 0.7% in Q1. This was in line with expectations, although the annual rate was slightly stronger. The details are very solid and show that both domestic demand and net exports contributed 1pp (exports +5.5%q/q) to headline growth and that the drag came from inventories (worth -1.2pp). These data show that the Australian economy was on a strong footing going into Q3 and there is nothing to suggest a change in the RBA’s course.

- On the inflation front, the domestic demand implicit price deflator rose 1.6%q/q to be 4.9%y/y – this was the highest since June 1990. While this data is backward looking, it shows that domestically driven inflation was at multi-decade highs going into the second half of the year. Unit labour costs rose 1.7%q/q but are only up 3%y/y.

- Within domestic demand, household consumption rose 2.2%q/q (boosted by travel and restaurant spending). But the savings rate fell to 8.7% from 11.1%, suggesting that the consumer can remain robust but may have a bit less impetus going forward.

- Private machinery & equipment investment surged 4%. As expected, there was weakness in the construction components (due to wet weather and labour shortages), but overall gross fixed capital formation still managed to increase by 0.2%q/q helped by public investment.

- Both inventories and government spending came in weaker than the data this week had suggested but both had seen strong growth in Q1 and so some payback was not unexpected. Both of these components could bounce back in Q3.

Source: MNI - Market News, ABS

Australia: Component contributions to quarterly GDP, percentage points

Source: MNI - Market News, ABS

BOC: MNI BoC Preview: Looking For New Guidance

- The Bank of Canada is widely expected to hike its overnight rate 75bps to 3.25% on Wednesday with only 5 of 30 analysts calling for a 50bp hike instead, following last month’s surprise front-loaded 100bp hike.

- Taking it above the BoC’s neutral 2-3% range, keen interest is on rate guidance and especially how strongly the Bank sees the need to increase rates ahead or whether it shifts to a more conditional stance.

- Any ambiguity will see particularly close focus on Rogers speaking on Thursday, with a subsequent appearance by Beaudry on Sep 20 coming after US CPI and just ahead of the Sept FOMC.

- With terminal rate expectations of circa 3.75%, there are two-sided risk with an arguable tilt to a dovish surprise.

- Full note here: https://marketnews.com/mni-boc-preview-looking-for-new-guidance

FX OPTIONS: Expiries for Sep07 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9875-00(E1.6bln), $0.9950(E803mln), $0.9960-75(E1.1bln), $1.0000(E691mln)

- USD/JPY: Y140.85-00($1.6bln)

- GBP/USD: $1.2730-50(Gbp1.2bln)

- EUR/GBP: Gbp0.8575(E1.1bln)

- USD/CNY: Cny7.0000($2.2bln)

ASIA FX: USD/Asia Dips Still Supported

USD/Asia strength has been a little more uniform today. Like the majors though, the dollar is down from best levels compared with earlier in the session. The market bias is likely to remain buying dips in USD/Asia pairs, particularly in North East Asia.

- The much stronger than expected CNY fixing did little to calm USD/CNH, with the pair following USD/JPY’s path for most of the session. We got just above 6.9950, but we are now back sub 6.9850 region. China trade figures disappointed in August, with both export and imports weaker than expected, which added to the bearish mood. FX reserves are still due later today.

- USD/KRW is off recent highs, now back to 1385 from earlier +1388 levels. The South Korean Finance Minister warned against one-sided FX moves. This has aided the won, but is unlikely to give lasting relief. South Korean and Taiwan equities have been among the weakest in the region, both down over 1.50%.

- SGD and MYR are both weaker against the USD but to a lesser degree than KRW and TWD (USD/TWD is further 0.50% to 30.93). USD/MYR has found some resistance ahead of 4.5050, note also BNM is expected to hike by 25bps tomorrow (see this link for more details).

- USD/THB is higher (36.73) but remains below 37.00 for now. The Thai constitutional court will brief the media later today about tomorrow's special hearing on the plea challenging Prayuth Chan-Ocha's ability to stay on as PM,

- USD/INR (79.92) and USD/IDR (14923) are higher, but both currencies are outperforming broader USD strength.

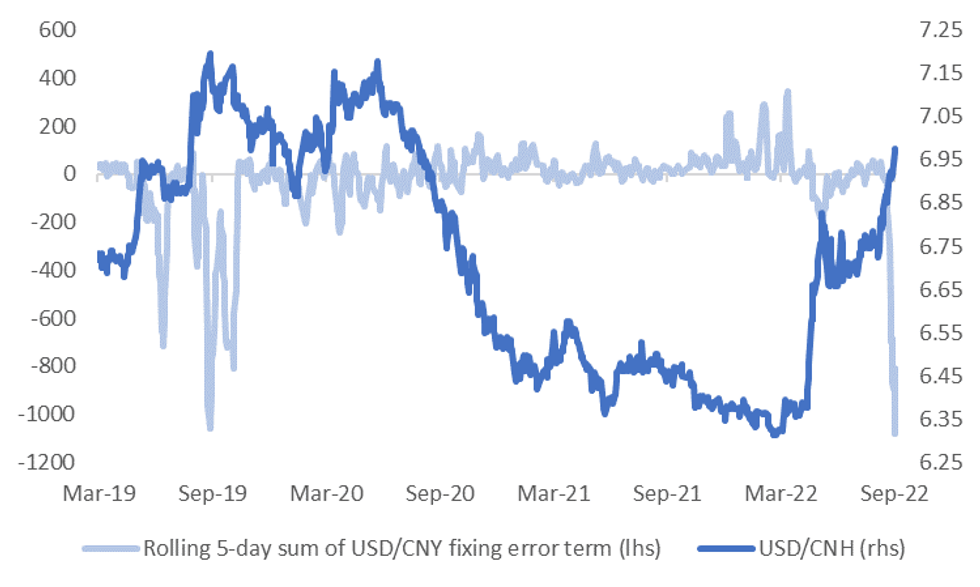

CNH: CNY Fixing Strongest On Record Relative To Estimates, But Little CNH Follow Through

The USD/CNY fixing came in at 6.9160, versus a Bloomberg consensus of 6.9614.

- Today's fix is a -454 pip surprise in USD/CNY terms. This is the largest downside surprise since Bloomberg started compiling consensus estimates (back to 2018).

- The rolling 5-day sum of the error term is now at -1083pips, compared with -806pips yesterday. This is also fresh wides for this metric, see the chart below. This is a clear step up from a fixing bias standpoint relative to the past 2 session.

- The authorities may view a breach of 7.00 as inevitable though. The onshore Securities Times stated in a front-page article today that the PBoC is more concerned about the pace of depreciation rather than specific levels. It also warned on betting against one-way moves in the currency.

- USD/CNH has moved lower post the fixing, but remains above 6.9700 for now (last at 6.9750). Earlier highs were just above 6.9830. Overall, not a great deal of follow through to the downside in the pair.

- Coming up later today is August trade figures and FX reserves.

Fig 1: USD/CNY Fixing Error Term to Fresh Wides

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

BNM: MNI BNM Preview - September 2022: Another 25bps Hike Likely

EXECUTIVE SUMMARY

- The broad consensus is for BNM to hike the policy rate by 25bps to 2.50% at tomorrow’s meeting. All 17 economists surveyed by Bloomberg expect such a move, while a Reuters survey painted a similar picture (with one economist expecting a 50bps move). We also see risks tilted towards a 25bps hike.

- Since the last policy meeting, in early July, domestic economic activity indicators have all pointed towards the need for tighter policy. Most notably was the Q2 GDP beat. Import growth is also just over 40% y/y, suggesting robust domestic demand. Falling unemployment and an improving income outlook should mean that the domestic economy remains well supported. On the inflation front, headline pressures have continued to accelerate despite inflation being at least partly contained by fuel subsidies, price controls and existing spare capacity.

- Such a backdrop creates the risk of a 50bps move at tomorrow’s meeting. However, the current balancing act between inflation pressures and global growth uncertainties means that BNM’s gradualism is unlikely to change.

- Click to view the full preview:

EQUITIES: Following Wall St. Lower; Hang Seng Approaches 10-Year Lows

Virtually all Asia-Pac equity indices are in the red at typing, building on a bearish lead from Wall St. amidst pressure from Tuesday’s surge in U.S. yields and continued strength in the USD.

- The Nikkei 225 is 1.0% worse off at writing, erasing virtually all of its gains since rallying in mid-July while the broader TOPIX (-0.8%) has fared a little better. Accordingly, large caps such as Tokyo Electron (-2.3%) and Softbank Group (-2.3%) contributed the most to drag on the index, with major exporters finding little relief amidst the latest round of JPY weakness.

- The Hang Seng deals 1.7% softer after opening lower, hitting fresh six-month lows at writing, approaching ten-year lows last witnessed in mid-March (at ~18,235.5). China-based tech led the way lower (HSTECH: -2.3%), adding to underperformance in the financials sub-index (1.9%)

- The CSI300 is flat at writing, having traded on either side of neutral throughout Asia-Pac dealing. Tech equities outperformed, with the tech-heavy ChiNext (+1.2%) gaining on local news of Chinese Pres Xi Jinping calling for a “whole nation system” to strengthen technology critical to national security, likely in response to recent U.S. tech-related curbs.

- E-minis sit 0.5-0.6% weaker apiece, showing a little through their respective Tuesday’s troughs, with S&P500 contracts operating just above seven-week lows at typing.

GOLD: Slipping Below $1,700/oz As Yields Rally; Further Central Bank Action In Focus

Gold deals ~$5/oz weaker to print ~$1,697/oz at writing, pressured by a rally in the USD, with the DXY operating just shy of fresh cycle highs at writing.

- The precious metal operates a little above six-week lows observed last Thursday (at $1,688.9/oz), cutting short its recent, limited bounce amidst Dollar strength and rising bond yields globally (with U.S. 10-Year real yields operating just shy of multi-year lows), coming as several central banks worldwide will raise rates by the end of the week.

- Looking ahead, the BoC’s policy decision and a spread of Fedspeak from the Fed’s Barkin (‘24 voter), Mester (voter), and Brainard (voter) are due later today, while further out, the ECB’s policy decision will come on Thursday.

- From a technical perspective, the downtrend in gold remains intact, with initial support seen at $1,681.0 (Jul 21 low and bear trigger). On the other hand, key resistance remains some distance away, at $1,765.5 (Aug 25 high).

OIL: Fresh Multi-Month Lows As Demand Worry Rises

WTI and Brent are ~$1.30 worse off apiece, with both benchmarks hitting their lowest levels observed since Jan ‘22 amidst elevated demand-related worry.

- To elaborate, the expansion of COVID-related control measures across China has driven the outlook for crude demand lower, with an indefinite lockdown on the city of Chengdu (pop. ~21mn) keeping worry elevated re: further mass lockdowns on major cities.

- The outlook for travel-related fuel demand has also weakened, with reports pointing to international air travel remaining a fraction of pre-COVID levels, while authorities have continued to postpone/cancel major events in view of the ongoing outbreak (e.g. the Lujiazui financial forum in Shanghai and Asia’s biggest pet fair in Shenzhen).

- Elsewhere, an ongoing rally in the USD (DXY) to fresh cycle highs has continued to provide headwinds to crude.

- Looking ahead, the EIA will release their Short-Term Energy Outlook (STEO) for September.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/09/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/09/2022 | 0600/0800 | ** |  | SE | Private Sector Production |

| 07/09/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 07/09/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/09/2022 | 0900/1100 | *** |  | EU | GDP (2nd est.) |

| 07/09/2022 | 0900/1100 | * |  | EU | Employment |

| 07/09/2022 | 0900/1000 |  | UK | BOE Committee Hearing on August MonPol Report | |

| 07/09/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 07/09/2022 | - | *** |  | CN | Trade |

| 07/09/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 07/09/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/09/2022 | 1300/0900 |  | US | Richmond Fed's Tom Barkin | |

| 07/09/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/09/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 07/09/2022 | 1400/1000 |  | US | MNI Webcast With Cleveland Fed's Loretta Mester | |

| 07/09/2022 | 1635/1235 |  | US | Fed Vice Chair Lael Brainard | |

| 07/09/2022 | 1800/1400 |  | US | Fed Beige Book | |

| 07/09/2022 | 1800/1400 |  | US | Fed Vice Chair Michael Barr |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.