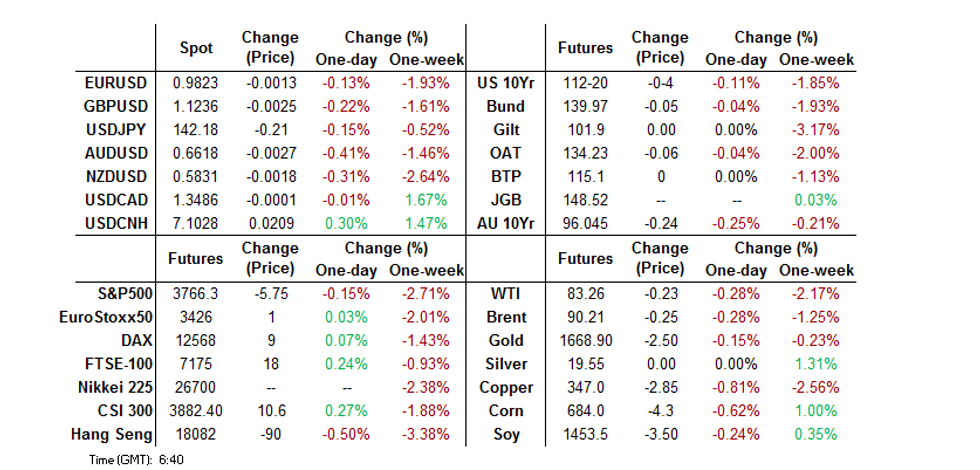

-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Remains Underpinned In Asia, Equities Struggle

- Risk appetite was subdued as the dust settled after Wednesday's hawkish Fed monetary policy decision and a marathon of central bank decisions on "Super Thursday." Japan observed a public holiday, which came in between markets closures in Australia (Thursday) and New Zealand (Monday), limiting regional activity. Riskier currencies sold off as e-mini futures slipped into the red.

- Fed's Powell, SNB's Jordan, as well as ECB's Nagel & Kazaks will speak later on Friday. Data highlights include a slew of PMI readings and Canadian retail sales. Elsewhere, the UK government will present its mini budget.

US TSYS: Futures Little Changed To A Touch Lower, Cash Closed On Japanese Holiday

Tsy futures sit little changed to marginally below Thursday’s settlement levels, after recovering from their respective Asia-Pac session bases. TYZ2 is -0-03 at 112-21, 0-02+ off the base of its 0-07 overnight range, through Thursday’s low.

- Note that cash Tsys are closed until London hours owing to the observance of a Japanese national holiday.

- Thursday saw fresh cycle highs for all of the major U.S. Tsy benchmark yield metrics, as the 10-Year Tsy yield broke decisively through the upper end of the upward sloping channel that we have identified on several occasions. Consolidation above allows Tsy bears to switch focus to the ’11 high at (3.7760%). A move beyond that level would expose the psychological 4.00% area, as well as the double top from ‘09/’10, which resides just above the round number.

- There wasn’t much in the way of market moving headline flow observed in Asia, which left regional reaction to the latest leg of global core FI cheapening at the fore.

- Friday’s NY docket will see the release of flash S&P PMI data. Elsewhere, Fed Chair Powell is set to give opening remarks at a Fed Listens event as the post-FOMC blackout comes to an end.

- Flash PMI data out from across Europe & the UK mini budget prevent some areas of interest in pre-NY hours.

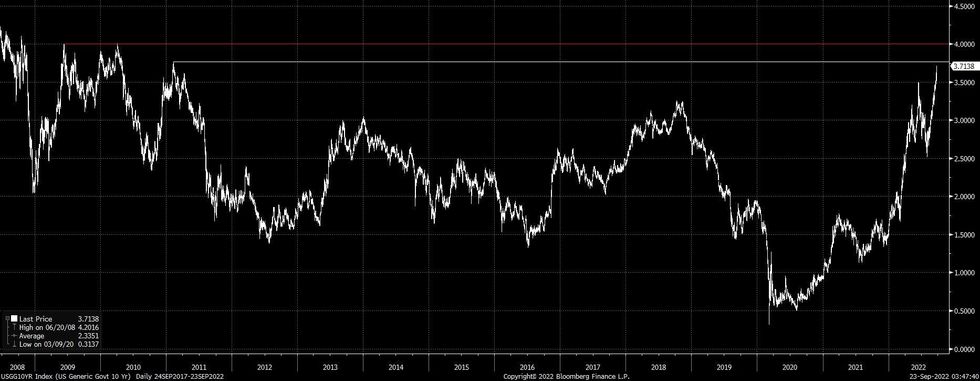

US TSYS: Uptrend Channel In 10-Year Yields Broken, Shifting Focus Higher

Thursday’s move higher in yields saw fresh cycle highs for all of the major U.S. Tsy benchmark yield metrics, as the 10-Year Tsy yield broke decisively through the upper end of the upward sloping channel that we have identified on several occasions. Consolidation above allows Tsy bears to switch focus to the ’11 high at (3.7760%). A move beyond that level would expose the psychological 4.00% area, as well as the double top from ‘09/’10, which resides just above the round number.

Fig. 1: U.S. 10-Year Tsy Yield (%

Source: MNI Market News/Bloomberg

Source: MNI Market News/Bloomberg

AUSSIE BONDS: Sharp Sell Off After Holiday, RBA Terminal Pricing Jumps

Aussie yields surged as domestic participants played catch up after Thursday’s holiday, with bearish pressure increasing on technical breaks in YM & XM futures, which allowed bears to switch focus to the June cycle lows in the respective contracts. YM -21.5 & XM -24.0 at typing.

- Yields run 21-27bp higher across the curve, with the 3- to 5-Year sector leading the weakness.

- The 3-/10-Year EFP box has flattened, with 3-Year EFP the best part of 5bp wider and 10-Year EFP little changed.

- Bills run 5-26bp lower through the reds, steepening.

- RBA dated OIS sees a bit of a reluctance to price much more into the Oct meeting (last ~44bp), given the Bank’s reference to a need to slow the pace of hikes at some point and pre-meeting outline of discussions surrounding 25 & 50bp hikes. Further out, terminal rate pricing moves up to 4.15%, sharply higher on the day, although nowhere near challenging the cycle peaks of ~4.50% printed back in June.

- Next week’s domestic data docket is headlined by retail sales, job vacancies and the new monthly CPI print.

- Nothing really stands out when it comes to next week’s AOFM issuance slate, outside of a chunky A$2.5bn return of Note issuance after this week’s holiday-inspired hiatus.

NZGBS: Global Forces & Higher RBNZ Terminal Rate Weigh

NZGBs have continued to leak lower during the final session of the week, with the impetus from Thursday’s global FI trade and spill over from weakness in ACGBs providing the driving factors ahead of the elongated holiday weekend in NZ.

- Swap spreads have narrowed notably on the session given the pressure in bonds, with NZGB yields running 13-16bp higher across the curve, as intermediates lead the weakness, while comparable swap rates are 2-8bp higher.

- 2-Year NZGB yields have extended to fresh cycle peaks.

- RBNZ OIS pricing for October is sticky, hovering just above 50bp, while terminal rate pricing has moved closer to cycle peaks, last printing ~4.70%, per RBNZ dated OIS.

- Looking ahead, a Tuesday address from RBNZ Governor Orr (based on August’s MPS) and the monthly ANZ business & consumer confidence prints present the highlights ahead of the Oct RBNZ meeting.

FOREX: Risk Comes Under Pressure, Yuan Sell-Off Continues

Risk appetite was subdued as the dust settled after Wednesday's hawkish Fed monetary policy decision and a marathon of central bank decisions on "Super Thursday." Japan observed a public holiday, which came in between markets closures in Australia (Thursday) and New Zealand (Monday), limiting regional activity. Riskier currencies sold off as e-mini futures slipped into the red.

- The likes of USD, JPY and CHF capitalised on their safe-haven status, albeit yen volatility was very limited relative to Thursday, when Japanese authorities intervened in currency markets after the BoJ kept its ultra-loose monetary policy settings unchanged. Heightened risk of repeated intervention on Monday likely gave the yen an edge over its safe-haven peers.

- Selling pressure hit the Antipodeans, albeit nearby cycle lows in AUD/USD and NZD/USD remained intact. Regional risk barometer AUD/JPY was the big mover overnight, shedding ~45 pips through the session.

- Yuan depreciation showed no signs of exhaustion, despite the 22nd consecutive stronger-than-expected PBOC fixing. The mid-point of permitted USD/CNY trading band was set 838 pips below sell-side estimate, not enough to promote yuan recovery. Spot USD/CNH climbed to a new cyclical high (CNH7.1134), which may have had knock-on effect on the Antipodeans.

- Fed's Powell, SNB's Jordan, as well as ECB's Nagel & Kazaks will speak later on Friday. Data highlights include a slew of PMI readings and Canadian retail sales.

FX OPTIONS: Expiries for Sep23 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9900(E536mln), $0.9950(E724mln), $0.9986-00(E3.1bln), $1.0150(E1.2bln)

- USD/JPY: Y139.85-00($513mln)

- AUD/USD: $0.6675(A$751mln), $0.6865(A$554mln)

- USD/CNY: Cny6.9500($940mln), Cny7.0000($828mln)

ASIA FX: USD/CNH Through 7.1100, PHP Outperforms On Intervention Rhetoric

Outside of a few pockets, the USD has remained on the front foot. CNH has hit fresh cyclical lows, while INR has traded to fresh record lows against the USD. Elsewhere USD dips have been mostly supported. Looking ahead, the main highlights for next week are the BoT decision (due next Wednesday). On Friday the RBI decision is due, along with China PMI prints.

- USD/CNH traded above 7.11, before selling interest emerged. Onshore spot has largely kept pace with USD/CNH moves. Spot got beyond +1.5% above the fixing rate, which hasn't happened too much over the past decade (see this link for more details).

- USD/KRW has edged higher in the 1 month space, back close to 1410. Onshore equities are down 1.7%, with offshore investors strong sellers of local equities (-$356.8mn).

- USD/TWD is at fresh cyclical highs, following yesterday’s modest 12.5bps rate hike. The pair is now close to 31.70 (last 31.682). Onshore equities are not as weak as the Kospi though.

- USD/INR is above 81.00, following yesterday's sharp rally higher. We are seeing INR unwind some of its recent NEER outperformance.

- The Philippine peso outperforms in emerging Asia as BSP Gov Medalla rattled the FX intervention sabre and signalled more rate hikes may be on the horizon after yesterday's 50bp increase. The pair was last at 58.365, up from earlier session lows around 58.30.

- USD/IDR was last at 15033, +15 figs on yesterday's close. IDR has outperformed at the margin, following yesterday's larger than expected BI hike (+50bps). The decision was taken "as a front-loaded, pre-emptive and forward-looking measure to lower inflation expectations and return core inflation to the 3.0%±1% target corridor in the latter half of 2023, while simultaneously strengthening exchange rate stabilisation policy."

- USD/SGD remains sub 1.4200 for now, last 1.4188. Inflation data just released was stronger than expected, strengthening the case for another MAS tightening in mid-October.

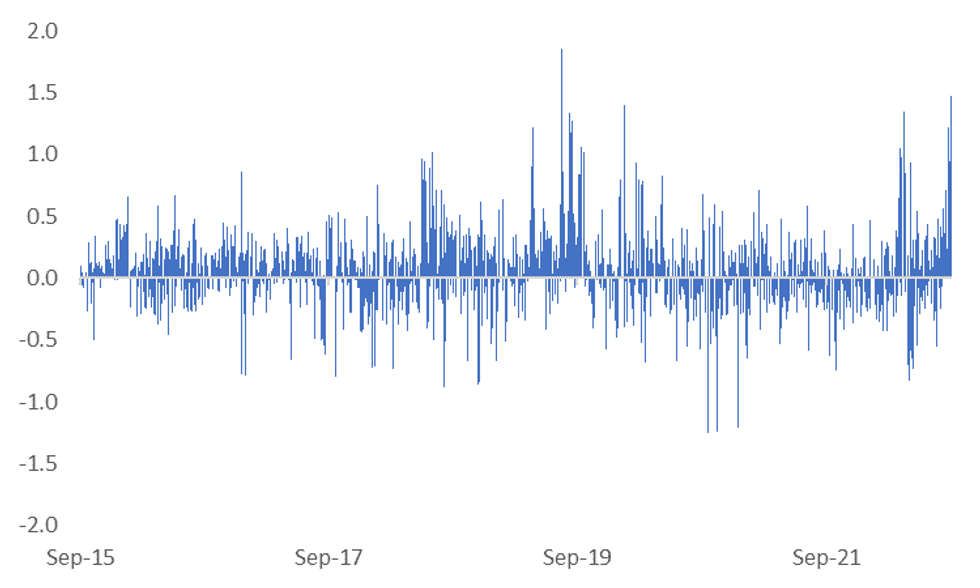

CNY: Fresh FX Policy Action Risks Rising?

USD/CNH is at fresh cyclical highs, we currently sit around 7.1100. This comes despite today’s fixing outcome, which was again much stronger than market expectations and remained sub 7.0000.

- Onshore USD/CNY spot has kept pace with USD/CNH gains this past week, leaving little spread between the two rates.

- The spot rate onshore (last above 7.1000) is now +1.55% above the level of today's fixing. As the chart below suggests, we haven't too much time at such elevated levels relative to the fixing (as spot is allowed to trade -/+2% either side of the fixing rate).

Fig 1: Spot USD/CNY Deviation With Onshore USD/CNY Fixing Rate

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- Without a sharp turnaround in broader USD sentiment, it's difficult to close this gap without allowing the USD/CNY fix to set higher.

- If we see this occur it may only fuel further depreciation expectations, as the market may interpret it is a sign the authorities are more comfortable with current CNY levels.

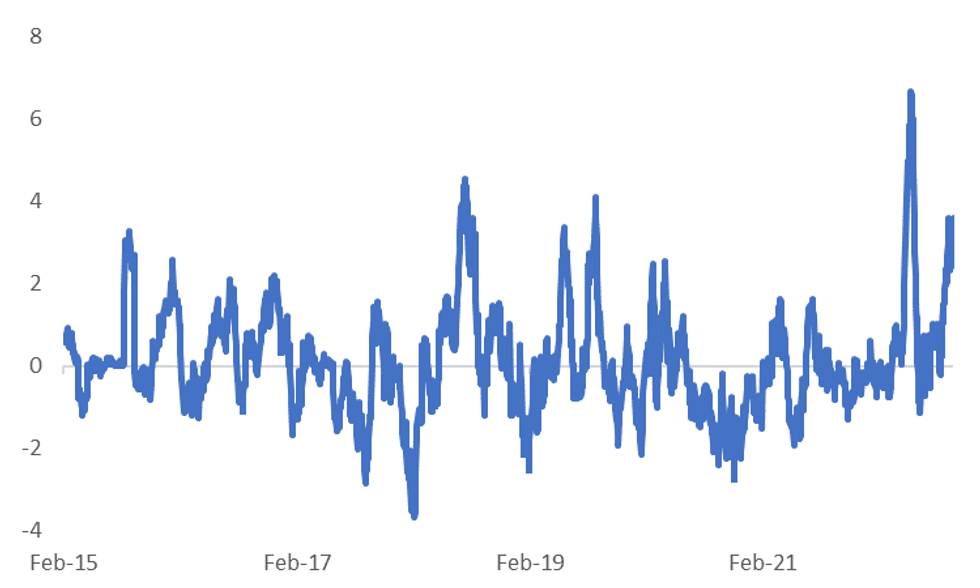

- To be sure, the rate of change in onshore spot over the past month is below previous higher, see the second chart below. The likely concern though is we are closer to previous highs from a level’s standpoint. Onshore spot is around 1.15% away from 2019 highs.

- Such a backdrop may push us closer towards fresh policy actions by the authorities to defend the FX (we outlined some options in this piece).

- Still, it may be difficult to call a peak in USD/CNY give continued widening in the respective policy outlooks.

Fig 2: USD/CNY - Rolling 1 Month Change

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

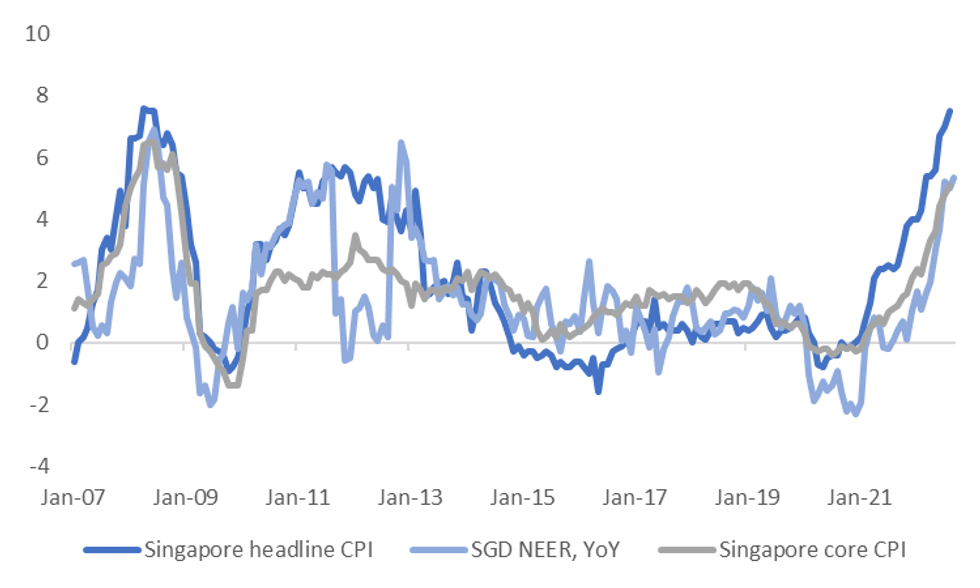

SINGAPORE: Singapore Inflation Beat Raises Odds Of Further MAS Tightening

Singapore August inflation data surprised again on the upside. Headline printed at 7.5% y/y, versus 7.2% expected. Core was also strong at 5.1% y/y (5.0% forecast). Only one category (out of 10) showed a weaker y/y pace compared to July. This may seal the deal in terms of another MAS tightening at the mid October policy meeting.

- The chart below plots SGD NEER changes against the headline and core y/y inflation prints. Note we assume further SGD NEER strength in September.

- SGD NEER y/y changes (+5.34%) are slightly ahead of core inflation but still below headline.

- USD/SGD moved lower post the CPI print, back sub 1.4185. The NEER also rebounded, with the Goldman Sachs estimate now at -0.38% from the top end of the band, we were at -0.48% earlier in the session.

Fig 1: SGD NEER Versus Singapore Inflation Outcomes

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Asia Pac Tech Underperforms

It's a sea of red across the Asia Pac equity space. Asian markets have taken their cue from negative offshore leads overnight, with tech sensitive sectors underperforming. Weaker US futures, which are only marginally off session lows (around -0.20% currently), has also weighed.

- Note Japan markets are closed today, which has probably impacted regional liquidity to a degree.

- Hong Kong stocks have taken little comfort, in an aggregate sense, from an end to hotel quarantine for overseas arrivals, although the move was well flagged earlier in the week.

- The main HSI bourse is off around -0.85%, while the tech sub-index is down 1.90%, at the time of writing. Mainland China stocks haven't fared much better, down around 1% at this stage for the Shanghai Composite.

- The Kospi is off by 1.6%, offshore investors selling -$333.6mn in local stocks today. Higher core yields (particularly US real yield yields) are weighing on the regional tech backdrop. TWSE losses are now close to 1.20% for the session.

- The ASX 200 is off over 2.2%, but this reflects some catch up after onshore markets were closed for a public holiday yesterday.

OIL: Brent Eyeing Fresh Test Of $90/bbl

Early resilience in Brent crude didn't last, we are now back close to $90/bbl. It's a similar story for WTI, back to the low $83/bbl region. Overall ranges have been modest, albeit with a downside bias. Tighter policy from major central banks and clouds over the global economic outlook remain the main concerns on the demand outlook.

- Brent is on track for its fourth straight weekly decline. Focus is likely to remain on whether we can break below the $90/bbl and trend down further. Dips sub this level have been supported so far in September.

- Still, the sell-side consensus is for a recovery in oil prices through Q4 (see this Bloomberg article for more details).

- Nigeria's oil minister stated that OPEC+ may be forced to make additional production cuts if prices continue to fall. A call between Russian President Putin and Saudi Crown Prince Mohammed bin Salman also committing to maintaining current OPEC+ agreements.

- Earlier headlines, from Reuters, also suggested little progress in terms of a fresh US-Iran nuclear deal.

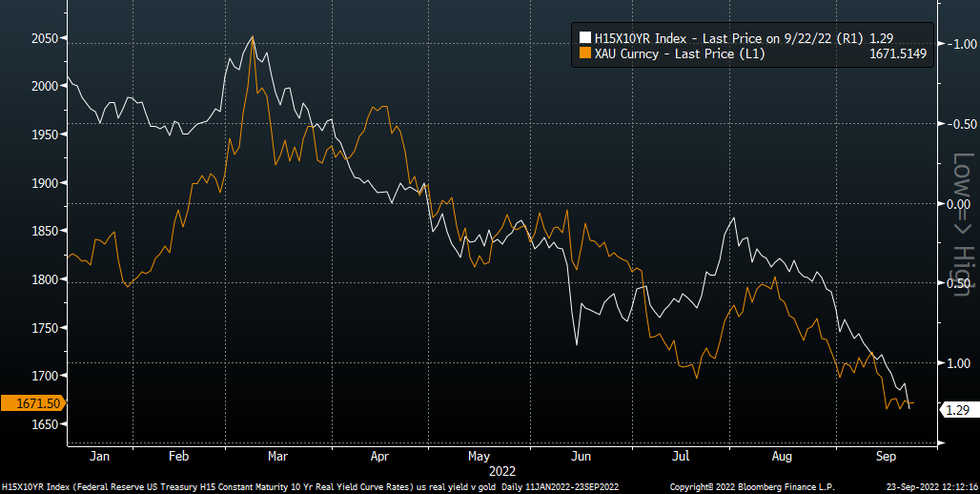

GOLD: Respecting Recent Ranges

Gold continues to respect recent ranges, as it has done for much of the past week. We currently sit in the middle of the recent range at $1670, down slightly from NY closing levels. The precious metal has spent little time outside of $1660/$1680 this past week.

- The metal has found support on a number of occasions around the $1655 in recent weeks, so this level is offering some support on the downside.

- Still, a test and potential break remains a medium term risk. The chart below overlays spot gold against the US 10yr real yield (which is inverted on the chart). Higher real yields should weigh further on gold, all else equal.

- The metal outperformed the continued run higher in core yields overnight, although did find some relief from firmer yen levels.

- Also note the continued fall in gold ETF holdings, which paints a negative flow picture. Such holdings are still above lows from the beginning of the year.

Fig 1: Gold & US Real Yield (10yr)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/09/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 23/09/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 23/09/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 23/09/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 23/09/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 23/09/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 23/09/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 23/09/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/09/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/09/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/09/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 23/09/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 23/09/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/09/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/09/2022 | 1800/1400 |  | US | Fed Listens Event |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.