-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Australian Wage Growth Eases

EXECUTIVE SUMMARY

- FED’S SCHMID - RATES COULD STAY HIGH ‘FOR SOME TIME’ - MNI

- SCHMID SAYS FED SHOULD HAVE LEFT QT AT FASTER PACE - MNI BRIEF

- FED’S POWELL URGES PATIENCE, SAYS INFLATION TO MOVE DOWN - MNI

- PBOC CONDUCTS CNY125BN 1Y MLF WEDS: RATES UNCHANGED - MNI

- CHINA MULLS GOVERNMENT PURCHASES OF UNSOLD HOMES TO EASE GLUT - BBG

- AUSSIE WAGES GROWTH LOWER AT 4.1% Y/Y - MNI BRIEF

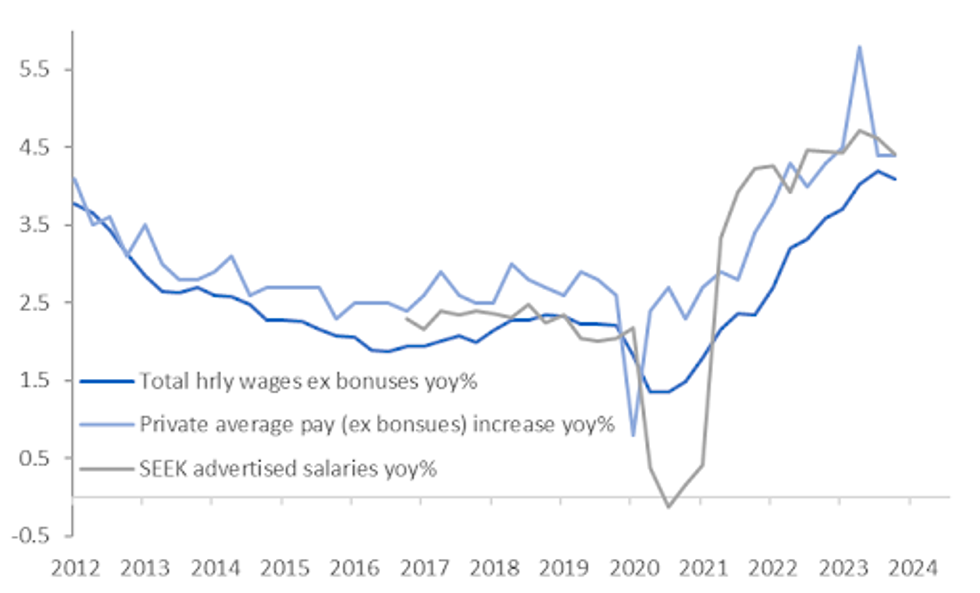

Fig. 1: Australia: Wages Growth Ex Bonuses

Source: MNI - Market News/Bloomberg

UK

ECONOMY (BBC): Taylor Swift's Eras Tour will boost UK spending by almost £1bn this year, with more than a million fans gearing up to see the pop sensation perform live, new data suggests. Spanning six continents, the tour will hit the UK for 15 dates in June and August, with fans expected to spend an average of £848 on tickets, travel, accommodation and outfits, according to Barclays.

EUROPE

EU (MNI BRIEF): The European Commission will soon propose "a few practical improvements" to speed disbursements of NGEU funds to EU states, EC Vice President Valdis Dombrovskis said Tuesday.

ECB (BBG): The European Central Bank’s next policy meeting may be the right time to start lowering borrowing costs, Governing Council member Klaas Knot said — reinforcing expectations that monetary easing is imminent.

RUSSIA/CHINA (BBG): Russian President Vladimir Putin is heading to China for the first foreign visit of his new term, underlining the vital importance of the relationship as Beijing faces growing US pressure to curtail support that’s helping Moscow continue its war in Ukraine.

FRANCE (BBG): The French economy will continue to expand in the second quarter of the year, according to estimates from the country’s central bank.

U.S.

FED (MNI): U.S. interest rates could stay high for a while and Federal Reserve policymakers can be patient about keeping borrowing costs at 23-year highs, Kansas City Fed President Jeffrey Schmid said Tuesday. “My own view is that interest rates could remain high for some time. The economy has undergone seismic shifts so far this decade,” he said in prepared remarks to a summit at the Kansas City Fed, adding that "policy is in the correct place."

FED (MNI BRIEF): Kansas City Fed President Jeffrey Schmid on Tuesday said he would have preferred the central bank had not announced plans to begin slowing the speed of its balance sheet drawdown.

FED (MNI): Federal Reserve Chair Jerome Powell on Tuesday called for patience in allowing higher interest rates to do their work to slow the economy and bring inflation back to 2% but said his confidence in the path of disinflation has fallen.

FED (MNI): Federal Reserve Vice Chairman for Supervision Michael Barr will tell Congress Wednesday that regulators expect “broad, material” changes are coming to the proposed Basel III endgame capital standards.

FED (MNI BRIEF): Federal Reserve Chair Jerome Powell on Tuesday said the central bank has "without question" the tools to defend its independence and Fed independence is "broadly understood and supported" on Capitol Hill.

ECONOMY (MNI): U.S. consumer delinquency rates increased on the whole in the first quarter of the year with 3.2% of outstanding debt in some stage of delinquency at the end of March, the New York Fed said Tuesday in its quarterly report on household debt and credit. Delinquency transition rates increased for all debt types.

OTHER

AUSTRALIA (MNI BRIEF): Australia’s Wage Price Index rose 0.8% in the March quarter, 10 basis points lower than expected, and 4.1% y/y, according to seasonally adjusted data released Wednesday by the Australian Bureau of Statistics (ABS).

NEW ZEALAND (BBG): New Zealand’s population growth is slowing as the pace of inward immigration wanes and more citizens look overseas for job opportunities and better wages.

JAPAN (NIKKEI): Honda Motor is cutting its full-time production workforce in China as sales slump, with about 1,700 workers having agreed to leave so far, Nikkei reports, without saying where it got the information.

BRAZIL (BBG): Brazil’s President Luiz Inacio Lula da Silva has fired Jean Paul Prates, the chief executive of state-owned oil company Petroleo Brasileiro SA, following a dispute over dividend payments.

CHINA

MLF (MNI): The People's Bank of China (PBOC) conducted CNY125 billion via 1-year MLF and CNY2 billion via 7-day reverse repo on Wednesday, with the rates unchanged at 2.50% and 1.80%, respectively. The operation has led to no change to the liquidity after offsetting the CNY125 billion MLF and CNY2 billion maturity today, according to Wind Information.

HOUSING (BBG): China is considering a proposal to have local governments across the country buy millions of unsold homes, people familiar with the matter said, in what would be one of its most ambitious attempts yet to salvage the beleaguered property market.

CHINA/US (BBG): China blasted the Biden administration’s move to increase US tariffs on a wide range of Chinese imports, vowing to take its own action, without giving specifics.

YUAN (CSJ): China’s yuan is expected to remain stable, supported by an economic recovery, China Securities Journal reported, citing analysts.

HOUSING (SHANGHAI SECURITIES): More cities in China are expected to roll out “trade-in” programs that offer residents incentives for selling their old homes and upgrading to new properties as part of efforts to boost housing demand, Shanghai Securities News said in a front-page report, without citing anyone.

CHINA MARKETS

PBOC Conducts CNY125 Bln 1Y MLF Weds; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY125 billion via 1-year MLF and CNY2 billion via 7-day reverse repo on Wednesday, with the rates unchanged at 2.50% and 1.80%, respectively. The operation has led to no change to the liquidity after offsetting the CNY125 billion MLF and CNY2 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8069% at 09:40 am local time from the close of 1.8402% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 41 on Tuesday, compared with the close of 42 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1049 on Wednesday, compared with 7.1053 set on Tuesday. The fixing was estimated at 7.2274 by Bloomberg survey today.

MARKET DATA

AUSTRALIA 1Q WAGE PRICE INDEX RISES 0.8% Q/Q; EST. +0.9%; PRIOR +1.0%

AUSTRALIA 1Q WAGE PRICE INDEX RISES 4.1% Y/Y; EST. +4.2%; PRIOR 4.2%

MARKETS

US TSYS: Treasury Futures Steady, Volumes Low Ahead Of US CPI

- It has been a very quiet session here in Asia, volumes are low, while ranges have been very tight and trade just off the overnight highs, the 10Y contract trades down ( - 00+) at 109-02+, initial resistance is 109-06+/08+ (Channel top from Feb 1 high / 50-day EMA), while the 2Y trades at 101-22.875 down (- 00.25).

- Cash Treasuries are 0.5bp higher to 0.5bp lower, the curve slightly flatter. The 2Y yield +0.4bps at 4.819%, 10Y unchanged at 4.439%, while 2y10y is -0.829 at -38.565

- US CPI will be the focus today, a upside surprise will dial up concerns that the Q1 acceleration wasn’t just a bump and could see 2Y Treasury yields eye 5% again, with the start point to Fed cuts pushed further out amidst a still high bar to a rate hike, while a downside surprise would still see sensitivity but the onus is on multiple low inflation readings before cut expectations are meaningfully brought nearer.

- U.S. CPI Preview: May 2024 MNI View: Testing Persistence Of Q1 “Bump” In Disinflation Path - (See link)

- Looking Ahead: Busy session today with MBA Mortgage Applications, Empire Manufacturing, Retail Sales & CPI while ECB's Rehn, Muller, Villeroy & Makhlouf and Fed's Kashkari & Bowman are due to speak.

JGBS: Tracking Recent Ranges, Q1 GDP & 20yr Supply On Tap Tomorrow

JGB futures have had an uneventful first part of Wednesday trade. JBM4 was last at 143.88, +.04. We have stuck to recent ranges, with downside limited to 143.84, while moves above 143.90 have not extended.

- Local news flow has been light with no data out today and a quiet auction calendar. Tomorrow there will be focus on the Q1 GDP print (which is expected to be negative), while a 20yr debt auction is due.

- US Tsy futures have been steady, the 10yr sitting unchanged in latest dealings. We have the US CPI print later, which is no doubt keeping some market participants on the sidelines.

- In the cash JGB space, most yields sit close to unchanged. The 10yr was last near 0.96%. The 30- and 40yr tenors have seen a further uptick in yields though.

- Swap rates are mostly lower, the 10yr last close to 1.01%.

AUSSIE BONDS: ACGB Curve Flattens, US CPI Later & AU Employment Data Thursday

ACGBs (YM -2.0 & XM 0.0) are mixed today, with the curve slightly flatter. Earlier, The Q1 wage price index rose a less-than-expected 0.8% q/q to be up 4.1% y/y, the third straight quarter above 4%. Q4 was revised up 0.1pp to 1.0% q/q. The focus will now turn to US CPI due out later tonight and more locally AU Employment data on Thursday.

- Cross-asset moves: US equity futures are little changed today, the ASX200 is up 0.50% to be a top performer in the region, while in the FX space, AUD and NZD were the top performing G10 currencies as they were supported by positive news from China around the property sector, Iron Ore is down 0.65% at $115.30/ton.

- Issuance: Australia sold A$800m 2.75% 2035 bonds at 4.3516% average yield for a bid/cover ratio of 2.9250x up from 2.8437x prior

- Front-end ACGBs are a touch weaker today as the curve bear-flattened, the 2y10y -1.520 at 28.940 with yields flat to 2bps higher, while the AU-US 10-year yield differential is 1bps lower, now -11bps

- Swap rates are 1-2bps lower

- The bills strip is 1bp lower

- RBA-dated OIS implied rate now pricing 1bps lower into the November meeting, market has softened a touch and is now pricing 7.5bps of easing into year-end to a terminal rate of 4.275%

- Looking ahead, Employment data is due out at 11.30 AEST on Thursday

NZGBS: Richer Ahead of US CPI

NZGBs are 3-4bps richer with the curve slightly flatter, we are trading at best levels of the session as we head into the close, yields have now fallen for the fourth straight day. It has been a quiet day for data int he region, while China announced new plans to support the struggling local property market, focus now turns to US CPI due out later today.

- US treasury futures initially opened a touch weaker this morning, although those moves have been erased and we now trade little changed across the curve with the 10Y at unchanged at 109-03, while the 2Y is (- 00.375) at 101-22.75

- NZGB yields opened lower this morning, and continued that move into the close to finishing the session 3-4bps richer, the 5y10y is little changed -0.400 at 11.80

- NZ population growth is slowing due to reduced inward immigration and increasing emigration of citizens seeking better job prospects abroad. Despite ongoing immigration, which contributes to housing demand and inflation concerns, the pace of population increase in the first quarter was the slowest since 2022, as per BBG.

- Swap rates are 1-3bps lower.

- RBNZ dated OIS is unchanged this morning, with a cumulative 46.5bps of easing is priced by year-end.

- Looking Ahead: Non Resident Bond Holdings on Thursday and PPI input/output on Friday

FOREX: Risk Currencies Buoyed By Potentially More China Property Support

Risk currencies have continued to outperform, with the latest leg higher driven by headlines that China is mulling further support for the troubled onshore property sector.

- China is contemplating a significant proposal to address its struggling property market by having local governments purchase millions of unsold homes, with the aim of converting them into affordable housing (per Bloomberg).

- Both AUD and NZD are +0.30% firmer against the USD. AUD/USD was last around 0.6645/50, just off session highs (0.6651). This right around the May 3 high, while 0.6668 represents the Mar 8 high and is also viewed as key short term resistance.

- The currency largely shrugged off a slightly weaker than expected Q1 wages print. Commodities are higher, led by copper, although iron ore is showing less enthusiasm to the China news, the active contract last near $114/ton.

- NZD/USD was last near 0.6060, not too far from the 200-day EMA (0.6068).

- USD/JPY is close to unchanged, last around 156.40/45. This leaves the yen weaker on crosses, particularly AUD and NZD.

- In the cross asset space, US equity futures sit a touch higher, while regional equities are mostly higher. China mainland markets are lower, but property sub-indices are higher.

- US yields are relatively steady. The BDXY sits down a touch, last at 1251.2 (off just under 0.10%).

- Looking ahead we have the US CPI as the main focus point coming up. Outside of the US inflation print, appearances from ECB's Rehn, Muller, Villeroy & Makhlouf and Fed's Kashkari & Bowman are due.

ASIA STOCKS: China Equities Mostly Lower On US Tariffs, Property Up On Policy Support

Chinese equities are mostly lower today, on the back of mixed earnings from the like of Alibaba who reported a sharp drop in net income with a buyback doing little to help the stock, while Tencent beat expectations, but gave a more cautious tone on the outlook for the Chinese economy while US tariffs on a wide range of Chinese imports including semiconductors, EVs and batteries have done little to help the market today. The property sector has been the only sector higher, after China has announced they are looking into allowing local governments to purchase unsold homes. Earlier, China kept the 1yr MLP on hold at 2.50% and looking ahead the market now awaits earnings from Baidu and JD.com. Hong Kong markets were closed today for Buddha's Birthday.

- China onshore markets are lower today, the CSI300 down 0.29%, we still hold above all moving averages with support now the 20-day EMA at 3,607, the CSI300 Real Estate Index is up 5.20%, while small and growth indices are also lower today although faring slightly better than the large-cap space with the CSI1000 is down 0.17% while the ChiNext off 0.13%.

- In the property space, China is contemplating a significant proposal to address its struggling property market by having local governments purchase millions of unsold homes, with the aim of converting them into affordable housing. This ambitious plan, currently under review by the State Council, involves state-owned enterprises buying distressed developer properties at discounted rates, funded by loans from state banks, as per BBG.

- Looking ahead, Industrial Production & Retail Sales on Friday

OIL: US Crude Drawdown Supports Prices, US CPI, EIA Data & IEA Report Out Later

Oil prices are up during APAC trading today on the back of a reported crude drawdown. WTI is 0.7% higher at $78.57/bbl off the intraday high of $78.75. Brent is up 0.6% to $82.90 after reaching $83.07 but the benchmark struggled to hold breaks above $83. The USD index is down slightly.

- Bloomberg reported that there was a US crude inventory drawdown of 3.1mn barrels last week, according to people familiar with the API data. Gasoline stocks fell 1.27mn while distillate rose 349k. The official EIA data is released later today, as well as the IEA’s monthly report.

- OPEC members have been producing above quotas in 2024 but the group meets on June 1 to discuss whether to extend output cuts into H2. At the same time though, some large producers want their recognised capacity to be revised upwards. Saudi Arabia needs high prices for fiscal purposes while others want to produce more, which is likely to make agreement difficult.

- Later the focus will be on US April CPI (see MNI preview) which is expected to show a moderate improvement in the annual rates. Recent inflation-related data have printed to the upside and the Fed wants more evidence of slowing inflation before easing, which concerns oil markets re its impact on energy demand.

- There are also US April retail sales and real earnings data. The Fed’s Barr, Kashkari and Bowman speak. Euro area Q1 GDP/employment and March IP are released.

GOLD: Edging Higher, Softer USD Helping, US CPI Coming Up Later

Gold is just under session highs last near $2360.4. We are modestly up from end Tuesday levels, where bullion rallied just under 1%. The main supports came from a weaker USD/softer yield backdrop.

- The USD has remained softer today, particularly against higher beta currencies. This has helped keep dipped in gold supported. Earlier lows were at $2355.

- Levels wise for gold, next resistance is at $2,431.50 - the bull trigger. Any return lower would eye $2,269.1, the 50-day EMA.

- Focus coming up will be on the US CPI print.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/05/2024 | 0600/0800 | *** |  | SE | Inflation Report |

| 15/05/2024 | 0645/0845 | *** |  | FR | HICP (f) |

| 15/05/2024 | 0900/1100 | ** |  | EU | Industrial Production |

| 15/05/2024 | 0900/1100 | *** |  | EU | GDP (p) |

| 15/05/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 15/05/2024 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 15/05/2024 | 1230/0830 | *** |  | US | CPI |

| 15/05/2024 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/05/2024 | 1230/0830 | *** |  | US | Retail Sales |

| 15/05/2024 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/05/2024 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/05/2024 | 1400/1000 | * |  | US | Business Inventories |

| 15/05/2024 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/05/2024 | 1400/1000 |  | US | Fed Vice Chair Michael Barr | |

| 15/05/2024 | 1405/1505 |  | UK | Bernanke Review of Bank of England Forecasting | |

| 15/05/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 15/05/2024 | 1600/1200 |  | US | Minneapolis Fed's Neel Kashkari | |

| 15/05/2024 | 1920/1520 |  | US | Fed Governor Michelle Bowman | |

| 15/05/2024 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.