-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Blue Wave Odds Surge

EXECUTIVE SUMMARY

- 'BLUE WAVE' ODDS SURGE IN WAKE OF GEORGIA SENATE VOTING, STILL DEEMED TOO CLOSE TO CALL BY MOST POLLSTERS

- NYSE WEIGHS REVERTING TO ORIGINAL PLAN TO DELIST CHINA TELCO SHARES (BBG)

- S&P DOW JONES SAYS IT WILL CANCEL DELETION OF CHINA TELCO ADRS (BBG)

- TRUMP SIGNS EXEC ORDER BANNING TRANSACTIONS WITH 8 CHINESE SOFTWARE APPS (RTRS)

- AMERICAN LAWYER ARRESTED BY HK POLICE IN NATIONAL SECURITY CRACKDOWN (RTHK)

- ANALYSTS EXPECT YUAN APPRECIATION TO SLOW (CSJ)

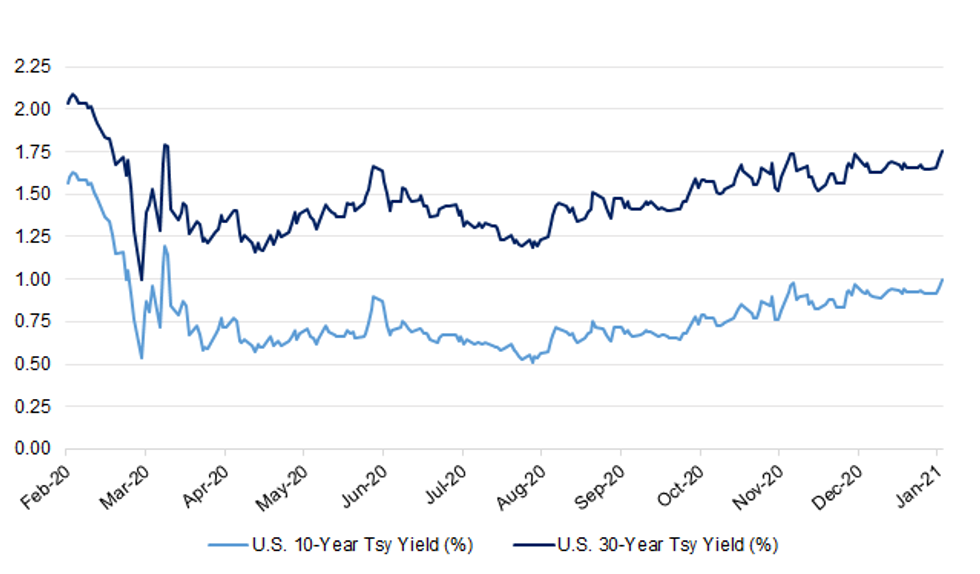

Fig. 1: U.S. 10- & 30-Year Tsy Yields

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The U.K. reported 60,916 new coronavirus cases on Tuesday, the most on record since the pandemic began. The country also reported 830 deaths, compared with a seven-day average of 611. (BBG)

CORONAVIRUS: One person in every 50 now has coronavirus in England, the British government said, as medics raced to vaccinate millions of people against the disease. (BBG)

CORONAVIRUS: More than 1m people across the UK have now been vaccinated, Prime Minister Boris Johnson said on Tuesday as he pledged to increase transparency surrounding the rollout of vaccination. (FT)

CORORNAVIRUS: Millions more coronavirus jabs will reach vaccination centres within days, The Times has been told, as Boris Johnson announced that almost a quarter of the over-80s had been given a dose. Two million doses of the Pfizer jab held back for booster shots will be distributed this week and next after the strategy shifted to prioritising as many people as possible for a first injection. (The Times)

CORONAVIRUS: High street pharmacies are "desperate" to roll out more than one million doses of the Oxford vaccine every week but have been snubbed by the Government, senior industry leaders have revealed. (Telegraph)

CORONAVIRUS: Chris Whitty, England's chief medical officer, has warned that some social-distancing restrictions could be in place next winter. Speaking at a televised press briefing, Professor Whitty said the risk level of coronavirus would decline over time, adding: "We will get to the point where we say this level of risk is one we can tolerate." He said: "The risk will be walking down a path, things will be lifted by degrees, possibly in different parts of the country at different times. (FT)

CORONAVIRUS: The national lockdown is "too heavy-handed" and a clearer exit strategy linked to the vaccine roll-out is needed to help struggling businesses, a senior Tory rebel has said. (Telegraph)

CORONAVIRUS: Tory lockdown-sceptics are poised to back the government's new restrictions today but are piling pressure on ministers to increase the pace of their vaccination programme. The Covid Recovery Group (CRG), which was formed to resist lockdown measures, is preparing to vote in favour of them in the Commons today after a meeting last night. "There's no choice this time," one of its members said. (The Times)

CORONAVIRUS: Labour leader Sir Keir Starmer has challenged the government to ensure the UK is the first country in the world to vaccinate its population against coronavirus. In a TV address aired on Tuesday evening, Sir Keir called for a "massive, immediate, and round the clock" effort to vaccinate the public. (Sky)

ECONOMY: British new car sales fell nearly 30% last year in their biggest annual drop since 1943 as lockdown measures to curb the spread of the coronavirus hit the sector, a trade industry body said on Wednesday. Demand stood at 1.63 million cars in 2020, preliminary data from the Society of Motor Manufacturers and Traders (SMMT) showed. It was particularly hard hit by a 97% fall in April, the first full month of a national lockdown. Dealerships gradually reopened in June across the United Kingdom's four nations. "We lost nearly three quarters of a million units over three or four months, which we never got back," said SMMT Chief Executive Mike Hawes. (RTRS)

EUROPE

GERMANY: Chancellor Angela Merkel extended Germany's lockdown and tightened restrictions as pressure mounts on her government to contain the coronavirus spread and speed up vaccinations. (BBG)

PORTUGAL: Portuguese President Marcelo Rebelo de Sousa proposed to parliament a new extension of the state of emergency as the government tries to contain the coronavirus pandemic. The president's proposal seeks to extend the state of emergency by one week until Jan. 15, according to a statement posted on the presidency's website. The government currently has in place certain limits on movement in municipalities with a higher number of new infections. (BBG)

GREECE: Greece's government said the country's primary schools would reopen on January 11, according to official media. Education authorities shut down most educational institutions in mid-November 2020. (FT)

IRELAND: Irish services activity expanded by the thinnest of margins in December after parts of the sector were allowed to reopen early in the month, a brief respite before being shut down again last week, a survey showed on Wednesday. The AIB IHS Markit Purchasing Managers' Index (PMI) forservices rose to 50.1 from 45.4 in November, only the third time it has crossed the 50-mark separating expansion from contraction since the COVID-19 pandemic took hold in March. (RTRS)

SWEDEN: Private health-care workers in Sweden are threatening to go on strike as the pandemic leaves them feeling overworked and underpaid. The escalation in tensions comes as Sweden's hospitals and care homes struggle to keep up with the spread of the coronavirus. (BBG)

U.S.

FED: MNI POLICY: Evans: Tightening to Aid Stability May be Lose-Lose

- Chicago Federal Reserve President Charles Evans warned on Tuesday that reducing asset purchases or hiking interest rates in a bid to curtail investor excesses could undermine the strength of markets and the economy. "The result could be a lose-lose scenario," Evans said in text of a speech to the the Allied Social Science Associations annual meeting. "Premature tightening of monetary policy could not just threaten the achievement of our dual mandate objectives, but might not even improve financial stability either, given that financial stability is bolstered by a strong economy" - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: President-elect Joe Biden will make remarks Wednesday focusing on delivering relief to small businesses amid the coronavirus pandemic with a focus on helping minority-owned businesses, a transition spokesperson tells CNN. The planned speech in Wilmington, Delaware, the details of which were shared first with CNN, will come as a group of Republicans in the House and Senate mount a futile effort Wednesday to block the counting of the electoral votes that delivered the presidency to Biden. (CNN)

ECONOMY: MNI INTERVIEW: ISM's Fiore Sees More Fiscal Relief in February

- The U.S. will need to pass another fiscal relief package shortly after Joe Biden and a new Congress are sworn in because faltering demand outweighs concern that more benefits deter people from working, Institute for Supply Management manufacturing chair Tim Fiore told MNI Tuesday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: U.S. bankruptcy filings for 2020 hit their lowest level since 1986 as a flood of government support programs offset at least temporarily the full brunt of the coronavirus pandemic and a related recession, Epiq AACER reported on Friday. The firm's compilation of bankruptcy cases showed the Chapter 11 filings used to reorganize larger businesses still jumped 29% in 2020 to 7,128, compared to 5,158 in 2019, a tally that included major retailers like J.C. Penney driven under by the biggest economic downturn in a century. (RTRS)

CORONAVIRUS: Hospitalisations in the US topped 130,000 for the first time as several Sunbelt states experienced their highest levels of coronavirus patients since the pandemic began. (FT)

POLITICS: Two US Senate elections in the state of Georgia that will determine whether Democrats or Republicans control the upper chamber of Congress were too close to call hours after polls closed on Tuesday night. (FT)

POLITICS: Cleta Mitchell, a lawyer who assisted President Donald Trump on the January 2 call when Trump pressured Georgia officials to "find" him votes, has resigned from her law firm. National law firm Foley & Lardner previously said it was "concerned" with Mitchell's involvement in Trump's call with Georgia Secretary of State Brad Raffensperger, and said the firm wasn't engaged in any legal work challenging the election results. Tuesday, it announced Mitchell was no longer with the firm. (CNN)

POLITICS: Before senators begin debating an expected challenge to Arizona's Electoral College vote Wednesday, Sen. Mitch McConnell will deliver a weighty speech trying to save the Senate from itself, people familiar with his plans tell Axios. (Axios)

POLITICS: A day before he presides over a joint session of Congress to ratify Joseph R. Biden Jr.'s victory, the vice president tried to lower the president's expectations while seeking ways to mollify him. Vice President Mike Pence told President Trump on Tuesday that he did not believe he had the power to block congressional certification of Joseph R. Biden Jr.'s victory in the presidential election despite Mr. Trump's baseless insistence that he did, people briefed on the conversation said. (New York Times)

POLITICS: "The Vice President and I are in total agreement that the Vice President has the power to act," President Trump says in statement about vice president's powers in election certification, scheduled for tomorrow. (BBG)

OTHER

U.S./CHINA: The New York Stock Exchange is considering proceeding in delisting three major Chinese telecommunications firms after Treasury Secretary Steven Mnuchin criticized its shock decision to grant the companies a reprieve, said three people familiar with the matter. (BBG)

U.S./CHINA: S&P Dow Jones Indices will no longer remove the the American depository receipts of three major Chinese telecommunications firms after the New York Stock Exchange reversed plans for delisting, according to a statement. Index provider originally planned to delete ADRs of China Mobile Ltd, China Telecom Corp. and China Unicom Hong Kong Ltd. from its indexes prior to the open on January 7: emailed statement. Company adds it has no comment on Bloomberg report of a possible revert to original plan. (BBG)

U.S./CHINA: U.S. President Donald Trump on Tuesday signed an executive order banning transactions with eight Chinese software applications, including Ant Group's Alipay, the White House said, escalating tensions with Beijing before President-elect Joe Biden takes office this month. The order, first reported by Reuters, tasks the Commerce Department with defining which transactions will be banned under the directive and targets Tencent Holdings Ltd's QQ Wallet and WeChat Pay as well. The move is aimed at curbing the threat to Americans posed by Chinese software applications, which have large user bases and access to sensitive data, a senior official told Reuters. (RTRS)

U.S./CHINA/HONG KONG: An American lawyer was arrested by Hong Kong police during a raid of a law firm linked to a national security crackdown launched on Wednesday, RTHK reported on Wednesday. John Clancey, chairman of the Asian Human Rights Commission and a member of a group linked to pro-democracy protesters in the city, was arrested during the raid of law firm Ho, Tse, Wai Partners, RTHK said, citing comments from one of the law firm's partners. The law firm and police did not immediately respond to a Reuters request for comment. (RTRS)

U.S./CHINA/HONG KONG: Secretary of State-designee Tony Blinken says "the sweeping arrests of pro-democracy demonstrators are an assault on those bravely advocating for universal rights." "The Biden-Harris administration will stand with the people of Hong Kong and against Beijing's crackdown on democracy," Blinken says in Twitter post. (BBG)

HONG KONG: Hong Kong democracy activists and opposition politicians were among dozens of people taken into custody on suspicion of violating the city's controversial national security law, in what appeared to be the largest roundup yet under the China-imposed legislation. Former lawmakers Alvin Yeung, James To, Andrew Wan and Lam Cheuk-ting, as well as prominent academic and activist Benny Tai, were arrested Wednesday morning by the police's national security branch on allegations of subversion, according to Facebook postings and media reports. The allegations were in relation to an informal primary that drew more than 600,000 voters in July to choose candidates for a September legislative election that was subsequently postponed by the government. (BBG)

CORONAVIRUS: Indian drugmaker Cadila Healthcare is about to start a phase three clinical trial for a potential coronavirus vaccine, its chairman told CNBC. "We're now moving into phase three, which is going to start very, very soon," Pankaj Patel told CNBC's "Street Signs Asia" on Tuesday. (CNBC)

CORONAVIRUS: Dr. Scott Gottlieb warned that vaccinating Americans against Covid is more critical than ever, especially as the new South Africa variant appears to inhibit antibody drugs. "The South Africa variant is very concerning right now because it does appear that it may obviate some of our medical countermeasures, particularly the antibody drugs," said the former FDA chief in the Trump administration in an interview on CNBC's "The News with Shepard Smith" on Tuesday evening. "Right now that strain does appear to be prevalent in South America and Brazil, the two parts of the world, right now, that are in their summer, but also experiencing a very dense epidemic, and that's concerning. (CNBC)

CORONAVIRUS: England's Chief Medical Officer, Prof Chris Whitty, gave a simple clear public health justification for extending the gap between the two necessary vaccine doses to three months. Widening the gap will allow twice as many people to be vaccinated than would otherwise be the case; and even the first dose gives "significantly more" than 50% protection against the virus. Ergo, there is a net benefit from giving lesser vaccine protection to more people. But Whitty does accept that by widening the gap between doses the risk of what he calls "an escape mutant" would be increased (that is the virus would mutate and build up resistance to the existing vaccines - which would be something of a setback). (ITV)

CORONAVIRUS: Experts advising the World Health Organization on vaccine policies recommended against spreading the interval between two doses beyond 28 days, following a move by the U.K. to extend the period between shots to as much as 12 weeks in an effort to maximize coverage. Countries facing "exceptional circumstances of vaccine supply constraints" can delay administration of the second dose of two-shot vaccines for a few weeks, according to a statement from Alejandro Cravioto, chairman of the Strategic Advisory Group of Experts on Immunization, but data on safety and efficacy after only one dose is lacking. (BBG)

CORONAVIRUS: Scientists at the National Institutes of Health and the drugmaker Moderna are analyzing vaccine research data to see if they can double the supply of the company's coronavirus vaccine by cutting doses in half, a move that would help alleviate vaccine shortages as the country surpassed more than 21 million virus cases. (New York Times)

CORONAVIRUS: World Health Organization director-general Tedros Adhanom Ghebreyesus admonished China on Tuesday for delaying authorization that would allow groups of scientists from other countries to investigate the origins of the novel coronavirus in Wuhan. (Axios)

JAPAN: Stability is desirable in the foreign exchange market, according to a Japanese finance ministry official following the yen's ascent to a nine-month high early Wednesday. The yen briefly hit 102.59 against the greenback on Wednesday morning in Tokyo, pushing Japanese exporters closer to loss-making levels when they are already facing lower demand amid the pandemic. The finance ministry will continue to closely watch market movements and communicate with the Bank of Japan and the Financial Services Agency, the official said. (BBG)

JAPAN: The state of emergency expected to be declared Thursday for Tokyo and neighboring areas is likely to last for some time based on the Japanese government's criteria for ending its decree. The planned emergency covering Tokyo and the prefectures of Kanagawa, Saitama and Chiba will be lifted in any given area as its coronavirus outbreak drops below the most severe level in Japan's four-stage scale. That scale is based on six indicators including hospital bed capacity, test positivity rates and cases without a traceable route of transmission. "Naturally, we'll consider lifting it once various benchmarks drop to Stage 3," Yasutoshi Nishimura, the minister in charge of Japan's virus response, told reporters Tuesday. Japan expects the decree, which will help local authorities restrict economic and social activity, to last about a month. But bringing the outbreak under sufficient control may take longer in Tokyo, where new cases have skyrocketed. (Nikkei)

JAPAN: The Japanese government will re-introduce tighter restrictions on event capacity in Tokyo and three neighboring prefectures where it is considering a state of emergency order, Mainichi reports, citing an unidentified government official. (BBG)

AUSTRALIA: The Australian Prudential Regulation Authority (APRA) has issued a letter to authorised deposit-taking institutions (ADIs) announcing a $46 billion reduction in the aggregate amount in the Committed Liquidity Facility (CLF), from the amount as at 1 December 2020. The CLF was established between the Reserve Bank of Australia (RBA) and certain locally incorporated ADIs that are subject to the Liquidity Coverage Ratio (LCR). (APRA)

NEW ZEALAND: Dominant Auckland realtor Barfoot & Thompson has finished 2020 strongly with sales volumes up +28% over 2019 and their median price exceeding $1 mln for the first time. They sold 11,944 properties in the year, enough to give them about 40% market share in the large Auckland market. In December, the finish was very strong, selling 1479 properties, almost double the 779 sold in December 2019. Even more impressive, that 1479 sales level was a record high for any December for the company. December average prices were $1,092,518, also a record high. Median prices hit a new record high as well, reaching $1,005,000, +3.2% above the November level, and a whopping +16.2% higher than in December 2019. That is the fastest price growth since May 2015. (Interest NZ)

NORTH KOREA: North Korean leader Kim Jong Un kicked off the country's first ruling party congress in five years, saying that its economic development plan fell far short of goal and that the party would explore a "new path" for making a "big leap forward." The start of the days-long Workers' Party Congress came shortly after Kim skipped his usual New Year's Day address to lay out his policy agenda. In remarks to open the congress Tuesday, Kim said that the country's five-year economic development plan, which ended last year, missed its targets by a "great degree" as both "internal and external challenges are undermining its progress," according to the Korean Central News Agency. (BBG)

SINGAPORE: Singapore's government has announced that from Wednesday, newly arrived foreign workers would have to undergo an additional seven-day testing regime after completing a mandatory 14 days of self-isolation. (FT)

MEXICO: Mexico can look forward to an 80 per cent drop in Covid-19 mortality once a fifth of the population has been vaccinated, according to the country's coronavirus tsar, Hugo López-Gatell. (FT)

RUSSIA: Russians were likely behind the SolarWinds hack that breached U.S. government networks, according to a joint statement issued by several U.S. agencies on Tuesday. Until now, the breach appeared to have been Russian, according to Reuters, which first reported on it in December, but this is the first time the government has publicly supported that. President Trump on Dec. 19 said he had been briefed on the hack but suggested he did not believe it was Russia and that it "may be China." (CNBC)

SOUTH AFRICA: South Africa's hope of securing an order of 1.4 million doses of the Covid-19 vaccine designed by AstraZeneca Plc and the University of Oxford from an Indian company may have been thwarted by a ban on exports imposed by the Asian country's government, Business Day reported, citing unidentified people. Until Monday South Africa was confident it had secured the order from the Serum Institute of India Ltd., which is making the vaccine under license, the Johannesburg-based newspaper said. Talks are now being held directly with India's government, two people familiar with the situation said, according to the newspaper. (BBG)

MIDDLE EAST: Four Arab states agreed to fully restore ties with Qatar, Saudi Arabia said on Tuesday, ending a more than three-year dispute that divided the major energy-producing region at a time of heightened tensions over Iran. Saudi Arabia, Bahrain, the United Arab Emirates and Egypt made the pledge after the kingdom hosted a Gulf Cooperation Council summit of regional leaders. (BBG)

ISRAEL: Israel will impose new restrictions in its countrywide lockdown, closing schools and nonessential businesses beginning Friday to combat surging cases of the coronavirus, government ministers voted Tuesday. (Axios)

METALS: China's first deals to import scrap steel since lifting a two-year ban on it last week are "symbolic" and do not signal that the country is set to significantly reduce its demand for iron ore as the key steelmaking ingredient, according to analysts. The ban on scrap steel for steel production was lifted from the start of January after China had prohibited its import to prevent the global dumping of low-grade scrap "waste" since late-2018. (SCMP)

OIL: Saudi Arabia has delivered what Russian Deputy Prime Minister Alexander Novak called "a new year's gift" to the oil market with its surprise announcement of an extra 1 million b/d production cut, blowing away expectations that the OPEC+ alliance would merely roll over its collective output ceiling. The kingdom will hold its February and March crude production to 8.119 million b/d – well below its quota of 9.119 million b/d – to help bring down oil inventories that had bloated from the pandemic, Saudi energy minister Prince Abdulaziz bin Salman said Jan. 5, after two days of OPEC+ talks. "We do that with the purpose of supporting our economy, the economies of our friends and OPEC+ countries, and for the betterment of the industry at all levels," he said in a post-meeting press conference. The cut is unilateral, with no other countries following suit. It will more than offset modest rises granted to Russia and Kazakhstan after hard-won negotiations. Those two countries will be allowed to boost their production by a combined 75,000 b/d in February and another 75,000 b/d in March, with all other OPEC+ members holding their quotas steady from January. (Platts)

CHINA

CORONAVIRUS: China's Dalian city announced that people in mid-to-high Covid-19 risk areas shouldn't leave the city, and those in lower-risk areas have to provide a negative Covid test proof from the past three days if they need to depart, according to a statement from the city. Separately, Shijiazhuang city, which reported 30 asymptomatic Covid-19 cases on Jan. 4, will suspend in-person classes at primary schools, middle schools and kindergartens, according to the city's education bureau. (BBG)

YUAN: The foundation still exists for the yuan to continue to appreciate in 2021, but the pace may slow due to global economic recovery and normalization of major economies' monetary policies, China Securities Journal reports. The report cites unidentified analysts. (BBG)

YUAN: The strengthening of the yuan may continue into H2 given the weakening dollar index and as China scales back lending, the PBOC owned Financial News reported citing CIB Research. China recent reduction in the dollar's weighting in the China Foreign Exchange Trade System (CFETS) currency basket is intended to reduce the influence of one single currency, the newspaper said citing Ming Ming, the deputy director of CITIC Securities Research Institute. China should beware of inflation as a strong yuan leads to higher asset valuations, the newspaper reported citing Qu Qiang, a researcher from the Renmin University. (MNI)

PBOC: China should avoid tightening its monetary policies in the short term as investment growth and consumption expansion are too slow to sustain the recovery, the Economic Information Daily, run by the official Xinhua News Agency, said in a commentary. Tightening too soon may increase the cost of corporate financing and burden businesses with credit risks, wrote the newspaper. Letting the yuan rise too quickly and by too much could also weaken the competitiveness of exporters, the newspaper commented. (MNI)

FISCAL: China will keep the fiscal deficit ratio and the scale of local government debts at rational levels this year, Minister of Finance Liu Kun said in an interview with the People's Daily. Liu's comments suggest the government may not continue last year's approach, which included setting the fiscal deficit/GDP ratio above 3.6% and selling CNY1 trillion in special bonds. China will also ensure the macro-leverage ratio stays stable in 2021 and will continue its efforts to rein in illegal debt raisings by local governments, Liu said. (MNI)

FINTECH: China's regulators are trying to get Jack Ma to do something the beleaguered billionaire has long resisted: share the troves of consumer-credit data collected by his financial-technology behemoth. (WSJ)

OVERNIGHT DATA

CHINA DEC CAIXIN SERVICES PMI 56.3; MEDIAN 57.9; NOV 57.8

CHINA DEC CAIXIN COMPOSITE PMI 55.8; NOV 57.5

In December, the Caixin China General Services Business Activity Index came in at 56.3, down from 57.8 the previous month, as the post-epidemic services recovery continued. Supply and demand continued to expand in the services sector, though at a slightly slower pace than in the previous two months. Business activity and total new business both expanded for the eighth month in a row, as the post-epidemic services recovery remained strong. The expansion of overseas demand was moderate, as surveyed companies said that the pandemic restrained overseas demand. Employment continued to improve. The employment gauge remained in positive territory for the fifth straight month as the market improved, though the expansion slowed, just like with the business activity index and the gauge for new business. As a result, New Business Index Sources: Caixin, IHS Markit Employment Index Sources: Caixin, IHS Markit there was a further slight reduction in backlogs of work compared with the previous month. Input costs and the prices charged by service providers both rose. The rise in costs of raw materials and employment continued to push up the gauge for input costs, which stayed in expansionary territory for the sixth straight month. The prices charged by service providers rose at the quickest pace since January 2008, with inflationary pressure becoming evident. Entrepreneurs remained very confident about the economic outlook. The gauge for business expectations reached the highest since April 2011. A majority of surveyed service providers were confident that the epidemic was under control and the economy was recovering. (Caixin)

JAPAN DEC, F JIBUN BANK SERVICES PMI 47.7; FLASH 47.2

JAPAN DEC, F JIBUN BANK COMPOSITE PMI 48.5; FLASH 48.0

Businesses in the Japanese service sector provided further evidence that the recovery in the services economy faltered at the end of a tumultuous year which saw the postponement of the Tokyo Olympics amidst the COVID-19 pandemic. As the country battled a third wave of COVID-19 infections, latest data indicated both activity and incoming business contracted. Firms often cited that demand had been dampened by rising infection rates. Encouragingly, services firms noted that employment levels remained broadly stable for the third month in succession, while expectations regarding the year ahead outlook for activity remained positive. Overall private sector activity decreased in the final month of the year, although at the softest pace for 11 months. Manufacturers posted a stabilisation of production, while the service sector saw an eleventh consecutive fall in activity. The outlook for overall business conditions was positive in December, despite headwinds surrounding the resurgence in COVID-19 cases curbing optimism. Private sector firms were hopeful that the pandemic would diminish over the course of the next 12 months to induce a broad-based economic recovery, which would be supported by the rescheduled Tokyo Olympics and stable business conditions. As a result, IHS Markit currently expects the Japanese economy to expand by 2.6% in 2021. (IHS Markit)

JAPAN DEC CONSUMER CONFIDENCE 31.8; MEDIAN 32.5; NOV 33.7

AUSTRALIA DEC, F MARKIT SERVICES PMI 57.0; FLASH 57.4

AUSTRALIA DEC, F MARKIT COMPOSITE PMI 56.6; FLASH 57.0

The Australian service sector ended a turbulent year firmly in expansion territory, with business activity increasing at the fastest pace since July. This was matched by a similarly strong rise in new orders as Australian service providers welcomed the lowering of domestic COVID-19 restrictions. Sustained increases in both activity and demand for services buoyed Australian service providers to increase capacity for the second month running via another round of employment growth. The picture for the Australian services economy remains positive at the end of the year, with expectations for an expansion in activity remaining at high levels. However, concern surrounding the pandemic persists with the re-imposition of restrictions in southern states following a resurgence in infection rates. (IHS Markit)

SOUTH KOREA DEC FOREIGN RESERVES $443.10BN; NOV $436.38BN

UK DEC BRC SHOP PRICE INDEX -1.8% Y/Y; NOV -1.8%

CHINA MARKETS

PBOC NET DRAINS CNY130BN VIA OMOS WEDS

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged on Wednesday. This resulted in a net drain of CNY130 billion given the maturity of CNY140 billion of reverse repos today, according to Wind Information.

- The operations aim to maintain the liquidity in the banking system reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:31 am local time from 1.6461% for Tuesday's close.

- The CFETS-NEX money-market sentiment index stayed flat from the previous day at 38 on Tuesday when the market closed. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4604 WEDS VS 6.4760

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a second day at 6.4604 on Wednesday. This compares with the 6.4760 set on Tuesday.

MARKETS

SNAPSHOT: Blue Wave Odds Surge

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 63.84 points at 27094.66

- ASX 200 down 74.755 points at 6607.1

- Shanghai Comp. down 5.353 points at 3523.531

- JGB 10-Yr future down 6 ticks at 151.97, yield up 0.4bp at 0.015%

- Aussie 10-Yr future down 8.5 ticks at 98.92, yield up 8.5bp at 1.066%

- U.S. 10-Yr future -0-11+ at 137-15+, yield up 4.19bp at 0.997%

- WTI crude up $0.08 at $50.02, Gold down $5.16 at $1944.91

- USD/JPY up 5 pips at Y102.77

- 'BLUE WAVE' ODDS SURGE IN WAKE OF GEORGIA SENATE VOTING, STILL DEEMED TOO CLOSE TO CALL BY MOST POLLSTERS

- NYSE WEIGHS REVERTING TO ORIGINAL PLAN TO DELIST CHINA TELCO SHARES (BBG)

- S&P DOW JONES SAYS IT WILL CANCEL DELETION OF CHINA TELCO ADRS (BBG)

- TRUMP SIGNS EXEC ORDER BANNING TRANSACTIONS WITH 8 CHINESE SOFTWARE APPS (RTRS)

- AMERICAN LAWYER ARRESTED BY HK POLICE IN NATIONAL SECURITY CRACKDOWN (RTHK)

- ANALYSTS EXPECT YUAN APPRECIATION TO SLOW (CSJ)

BOND SUMMARY: An Impending Blue Wave?

Increased chances of a 'Blue Wave' scenario in U.S. Congress drove price action overnight, with the U.S. Tsy curve bear steepening as a result of growing expectations re: deeper fiscal stimulus, with U.S. 10-Year yields threatening to break above the 1.00% psychological level. T-Notes last -0-12+ at 137-14+, which represents lows of the day. While the Georgia Senate run-offs are still officially deemed too close to call by most, the composition of the votes yet to be counted has resulted in a couple of early calls for Democrat Warnock in one of the races, while the Cook Report has called victory for both Democratic Party candidates.

- JGB futures were also softer, last -8, with a bland 10-Year JGB auction doing little to add support. Cash JGBs deal up to 1.0bp cheaper across the curve at typing. Local focus continues to fall on the impending declaration of a state of emergency surrounding the COVID-19 situation, with expectations for an announcement to be made at some point on Thursday.

- Elsewhere, Aussie bonds traded in sympathy with Tsys, steepening, with -1.5 & XM -9.0 against a limited backdrop of local catalysts.

JGBS AUCTION: Japanese MOF sells Y2.1103tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.1103tn 10-Year JGBs:- Average Yield 0.019% (prev. 0.019%)

- Average Price 100.80 (prev. 100.79)

- High Yield: 0.022% (prev. 0.021%) Low Price 100.77 (prev. 100.77)

- % Allotted At High Yield: 32.9842% (prev. 69.6232%)

- Bid/Cover: 3.404x (prev. 3.425x)

EQUITIES: Larger Fiscal Stimulus Vs. Higher Yields

Higher U.S. Tsy yields, which were a result of developments surrounding the U.S. Senate run-offs in Georgia (and increased chances of a 'Blue Wave' scenario in Congress), and to a lesser extent, worry re: Sino-U.S. tensions surrounding President Trump's banning of 8 Chinese payment apps, NYSE flip-flopping re: the delisting of 3 major Chinese telecoms firms & the arrest of a U.S. lawyer in Hong Kong weighed on sentiment in Asia-Pac hours, although broader ranges were largely contained. Still, e-minis are off worst levels as participants continue to balance the outlook for enhanced U.S. fiscal stimulus under a 'Blue Wave' scenario in the Senate vs. higher U.S. Tsy yields.

- Russell index e-minis were the exception to the rule, with that particular contract edging higher on the back of the reflation trade mantra that would surround Democrats securing control of the U.S. Senate.

- Nikkei 225 -0.3%, Hang Seng -0.8%, CSI 300 -0.2%, ASX 200 -1.3%.

- S&P 500 futures -15, DJIA futures -23, NASDAQ 100 futures -159.

OIL: Crude Little Changed After Tuesday's Rally

WTI & Brent sit marginally above their respective settlement levels, after a surprise, unilateral 1.0mn bpd crude production cut from Saudi Arabia (which will go into play during the months of February & March) put a bid into oil on Tuesday, allowing the metrics to add over $2.00 come settlement.

- Saudi's surprise move more than offsets marginal increases for Russia & Kazakhstan over the same period, while the remainder of the OPEC+ cohort agreed to leave their respective production quotas unchanged during those two months.

- Elsewhere, post-settlement trade saw the latest API inventory estimates reveal a roughly in-line with exp. drawdown in headline crude stocks, a small build in stocks at the Cushing hub and much larger than expected builds in both distillate and gasoline stocks.

- DoE inventory data will hit on Wednesday.

GOLD: Tight Range In Asia

The U.S. Senate situation has provided little impetus for bullion during Asia-Pac hours, with U.S. real yields continuing to hover around recent lows. Spot gold last deals $5/oz or so softer around the $1,945/oz mark, with initial support and resistance levels as previously outlined.

- Known ETF gold holdings have nudged up in recent days, after flatlining in the month of December

FOREX: Greenback Has Georgia On Its Mind

DXY bounced off a fresh 33-month low and swung from losses to a gains in sync with U.S. Tsy yields as tight races for Georgia Senate seats grabbed attention. The greenback briefly showed atop the G10 pile as betting market odds flipped to favour the Dems, amid a growing perception that we may witness a "red mirage," with absentee ballots expected to play a key role after early results pointed to razor-thin leads for GOP candidates. The Cook Report and Decision Desk called the Warnock (D) - Loeffler (R) race for Warnock. Election matters overshadowed Sino-U.S. frictions, keeping most G10 crosses trapped within relatively tight ranges. USD corrected its earlier move ahead of the London morning, with DXY pulling back from highs.

- JPY was among the worst G10 performers, limited by Japanese MoF's jawboning. A ministry off'l stressed the importance of FX market stability, adding that the Ministry will monitor financial markets and remain in touch with the BoJ & FSA.

- The Antipodeans outperformed their G10 peers, but although AUD/USD and NZD/USD peeked above fresh cycle highs printed yesterday, they failed to make much headway beyond there.

- The yuan was happy to hug a tight range, leaving the prior day's extremes intact, as Caixin Services PMI released out of China was ignored.

- Per the minutes from the BoT's Dec MonPol meeting, Thai policymakers judged that the new coronavirus outbreak in Thailand may inspire some FX volatility, while warning that the baht will encounter challenges going forward.

- Flash German and French CPIs, U.S. ADP employment report & final durable goods orders, comments from BoE Gov Bailey & FOMC Dec MonPol meeting minutes, as well as further updates on Georgia runoff polls take focus from here.

FOREX OPTIONS: Expiries for Jan06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2035-50(E664mln-EUR puts), $1.2255-70(E670mln-EUR puts), $1.2300(E1.1bln-EUR puts), $1.2465-70(E507mln-EUR puts)

- USD/JPY: Y101.00($501mln), Y103.25-35($890mln-USD puts), Y104.00($1.1bln)

- AUD/USD: $0.7500(A$659mln)

- USD/MXN: Mxn20.85 $800mln-USD puts)

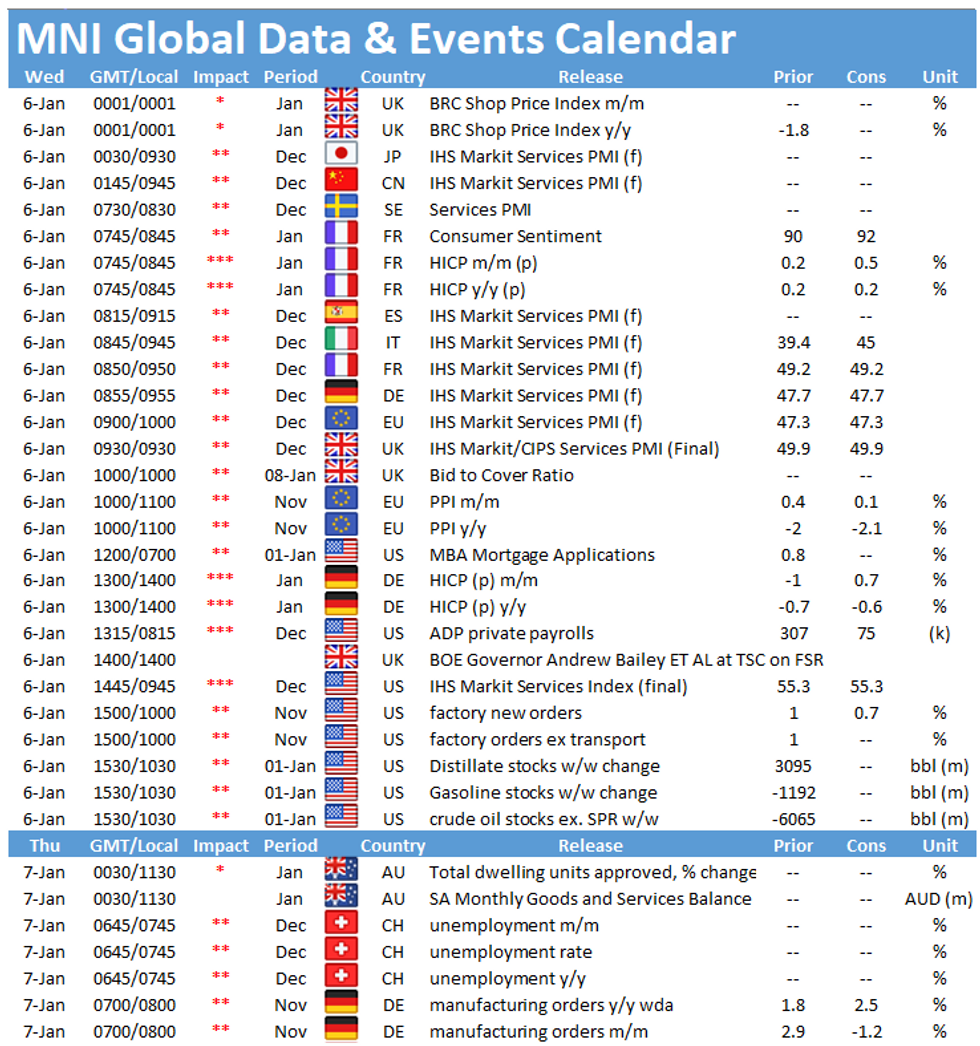

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.