-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China CPI Falls To 14-Yr Low

EXECUTIVE SUMMARY

- FED WILL CUT RATES BEFORE INFLATION HITS 2% - COLLINS - MNI BRIEF

- HIGH UNCERTAINTY, DESPITE 2% STRENGTHENING - BOJ UCHIDA - MNI

- CHINA JANUARY CPI FALLS TO OVER 14-YEAR LOW - MNI BRIEF

- HIGH LOCAL TARGETS HINT AT FURTHER CHINA GOV. LEVERAGE - MNI

- CHINA'S MEGA CITIES TO EASE HOMEBUYING LIMITS PROGRESSIVELY - MNI

- CHIEF ECONOMIST FUELS DEBATE OVER RBNZ RATE CUT TIMING - MNI

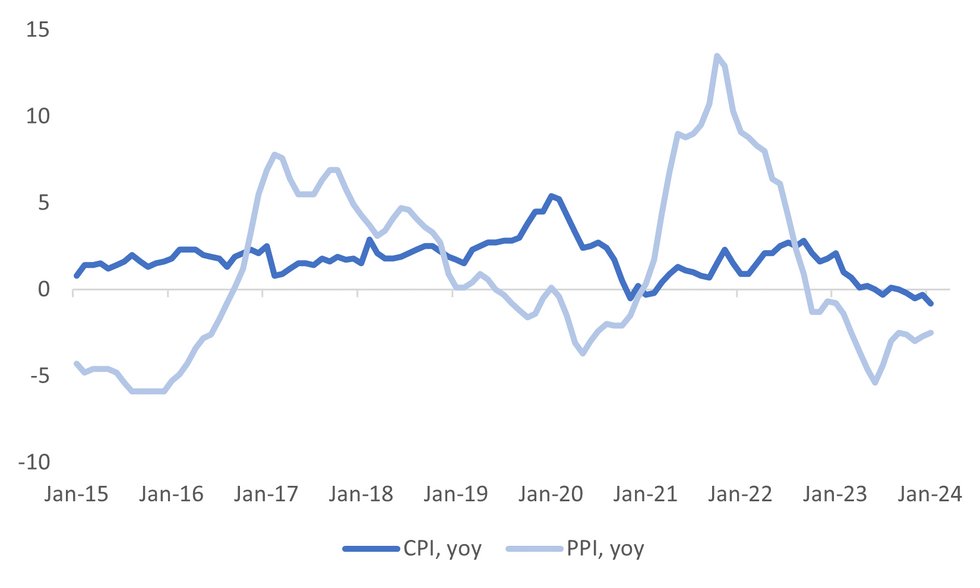

Fig. 1: China CPI & PPI Y/Y

Source: MNI - Market News/Bloomberg

U.K.

FISCAL (BBG): Labour leader Keir Starmer is expected to announce changes to his £28 billion ($35 billion) green investment pledge, after weeks of internal wrangling over whether to roll back the costly flagship policy.

HOUSE PRICES (BBG): The UK Royal Institution of Chartered Surveyors house price balance jumped to -18% in January from a revised -29% in the previous month, signaling the British real estate sector's continued recovery, according to data released Thursday.

ENERGY (BBC): Countries should secure supplies of oil and gas by sourcing locally, the boss of energy giant Equinor has said. Equinor is the biggest investor in the Rosebank oil field in the North Sea - the largest new UK oil and gas field development in decades.

EUROPE

TRADE (BBG): The European Union is working on a formal evaluation of what a Donald Trump presidency would look like and is planning how to respond to any punitive trade measures that would hit the bloc if he wins the US election.

TURKEY (ECONOMIST): Fatih Karahan, the new head of Turkey’s central bank, will present a quarterly inflation report on Thursday.

U.S.

MIDEAST (BBG): The US conducted an airstrike Wednesday evening that killed the commander of an Iran-backed militia in Iraq, as the Biden administration pressed ahead with its campaign to target those responsible for the killing of three US soldiers last month.

FED (MNI BRIEF): The Federal Reserve's balance sheet run-off has proceeded smoothly and reserve supply remains above ample, but there has been incremental signs of a shift in money market conditions, the New York Fed's Deputy SOMA Manager, Julie Remache, said Wednesday, suggesting shifts to QT are coming into focus.

FED (MNI BRIEF): The Federal Reserve can be patient about making any adjustments to monetary policy as it seeks more evidence that the recent decline in inflation is sustainable, Richmond Fed President Thomas Barkin said Wednesday.

FED (MNI BRIEF): Federal Reserve Bank of Boston President Susan Collins on Wednesday said waiting until 12-month inflation hits 2% for the central bank to begin cutting interest rates would be waiting too long.

FED (MNI BRIEF): Federal Reserve Governor Adriana Kugler said Wednesday she could not close the door to policy action at any upcoming meetings, including March.

FED (MNI): The Congressional Budget Office is projecting the Federal Reserve will respond to slowing inflation and rising unemployment by starting to lower the federal funds rate in the second quarter, with the effective fed funds rate averaging 5.1% for the year, a tenth higher than its 2023 average, then falling to annual averages of 4.1% in 2025 and 3.3% in 2026.

FISCAL (RTRS): Republicans in the U.S. Senate on Wednesday defeated a bipartisan effort to bolster border security that had taken months to negotiate, but said they could still approve aid for Ukraine and Israel that had been tied up in the deal.

OTHER

JAPAN (MNI BRIEF): A senior Bank of Japan official said on Thursday that accommodative financial conditions will continue should the BOJ remove its negative interest rate policy.

JAPAN (MNI): Bank of Japan Deputy Governor Shinichi Uchida's comments on Thursday has somewhat weakened the chance of a March policy change, despite noting the probability of the Japanese economy achieving the 2% price target had increased.

SOUTH KOREA (BBG): South Korean President Yoon Suk Yeol said in a television interview with national TV broadcaster KBS that the so-called Korean discount for the financial sector must be reduced and he will push to bring the country’s market to global standards.

NORTH KOREA/SOUTH KOREA (YONHAP): North Korea has abolished laws on inter-Korean economic cooperation, state media said Thursday, as tensions between the two Koreas have deepened after the North declared there is no point in seeking reunification with the South.

CANADA (MNI BRIEF): Bank of Canada officials explored alternate scenarios around potential interest-rate cuts at their meeting last month and strongly agreed on the need to avoid any U-turn once they move, according to minutes of the Jan. 24 decision to hold rates at their highest since 2001.

NEW ZEALAND (MNI): A recent presentation by the Reserve Bank of New Zealand's chief economist aimed at tempering market rate cut expectations has fuelled debate among former staffers over when the central bank will likely make its move, with some calling the Reserve's bluff, and others making the case for a reduction in the third quarter.

CHINA

PRICES (MNI BRIEF): China's Consumer Price Index fell more than expected by 0.8% y/y in January, falling further from December's 0.3% decline to hit the lowest level since September 2009, sending a deflationary signal amid softened demand, data from the National Bureau of Statistics showed Thursday.

GDP (MNI): Chinese local governments have set lofty GDP targets they aim to meet with increased investment and consumption, but tighter scrutiny over debt raising and falling fiscal revenue will restrain their capacity and could lead the central government to issue more bonds, policy advisors told MNI.

PROPERTY (MNI): First-tier cities in China will likely ease homebuying restrictions progressively to stimulate demand without stirring up house prices, however, limited policy intensity and low consumer confidence could still stunt any durable sales rebound, advisors and analysts told MNI.

CHINA MARKETS

MNI: PBOC Injects Net CNY302 Bln Via OMO Thur; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY90 billion via 7-day reverse repo and CNY255 billion via 14-day reverse repo on Thursday, with the rates unchanged at 1.80% and 1.95%, respectively. The reverse repo operation has led to a net injection of CNY302 billion reverse repos after offsetting CNY43 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8363% at 09:36 am local time from the close of 1.9538% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 44 on Wednesday, compared with the close of 43 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1063 on Thursday, compared with 7.1049 set on Wednesday. The fixing was estimated at 7.1919 by Bloomberg survey today.

MARKET DATA

JAPAN DEC. ADJUSTED CURRENT ACCOUNT SURPLUS 1.810T YEN; PRIOR 1.885T YEN

JAPAN DEC. CURRENT ACCOUNT SURPLUS 744.3B YEN; EST. +1.139T YEN; PRIOR 1.926T YEN

JAPAN DEC. TRADE SURPLUS 115.5B YEN; EST. 183.1B YEN; PRIOR -724.1B YEN

JAPAN JAN. BANK LENDING +3.5% Y/Y; PRIOR +3.4%

CHINA JAN. CONSUMER PRICES FALL 0.8% Y/Y; EST. -0.5%; PRIOR -0.3%

CHINA JAN. PRODUCER PRICES FALL 2.5% Y/Y; EST. -2.6%; PRIOR -2.7%

UK JAN RICS HOUSE PRICE BALANCE -18%, MEDIAN -22%; PRIOR -29%

MARKETS

US TSYS: Yields Grind Lower, Yellen To Testify

TYH4 is currently trading at 110-05, - 00+ from New York closing levels.

An uneventful session today, with the only thing of note being BoJ Deputy Governor Uchida's comments on financial conditions and interest rates. It, however, hasn't shed too much light on when the end of NIRP will come.

- Treasuries futures have been trading in a very small range of 111-03 lows/ 111-07+ highs, Key support lies at 110-22+, the February 5th lows, with resistance at 111-20, the 20-day EMA.

- Cash yields opened 1bp lower and have drifted just a touch to be 1.5-2bps lower for the day, the 2Y yield -1.5bp at 4.414%, the 10Y yield trade -1.7bp at 4.104% while the 2y10y, is -1.7 at -31.80.

- US Secretary Treasury Janet Yellen will testify on the 2023 Financial Stability Oversight Council annual report, at 9am ET Thursday.

- Thursday Data Calendar: Weekly Claims, Fed Speak, 30Y Bond Sale.

JGBS: BoJ Dep. Gov. Uchida's Comments Move The Market, 5Y Supply Tomorrow

JGB futures are sitting with an uptick, +2 compared to the settlement levels, after a volatile session. JBH4 was sharply lower in morning trade before spiking higher following BoJ Deputy Governor Shinichi Uchida's speech to local business leaders in Nara.

- (MNI) BoJ Deputy Governor Shinichi Uchida's comments on Thursday have somewhat weakened the chance of a March policy change, despite noting the probability of the Japanese economy achieving the 2% price target had increased. A press conference is due at 1430 JT. (See link)

- This morning's data drop of weekly International Investment Flows, BoP Current Account Balance and Bank Lending data failed to be market-moving, as expected. Also, Tokyo Avg Office Vacancies declined to 5.83% in January from 6.03% in December.

- Cash JGBs are dealing flat to 2bps richer after cheapening 1-2bps in pre-Uchida dealings. The benchmark 10-year yield is 1.0bp lower at 0.708% after dealing as high as 0.734% in morning trade.

- Swaps rates are flat to 1bp lower. Swap spreads are generally tighter out to the 5-year and slightly wider beyond.

- Tomorrow, the local calendar is light, with M2 & M3 Money Stock data as the highlights. The MoF plans to sell Y2.5tn of 5-year JGBs.

AUSSIE BONDS: Little Changed, Light Calendar, RBA Gov. Bullock In Parliament Tomorrow

ACGBs (YM flat & XM flat) are weaker after trading in narrow ranges during the Sydney. With the domestic calendar empty, local participants have likely been monitoring US tsys watch after yesterday’s moderate rise in yields. Cash US tsys are currently dealing 1-2bps richer in today’s Asia-Pac session.

- Cash ACGBs are unchanged, with the AU-US 10-year yield differential 1bp tighter at flat.

- Swap rates are 1bp lower, with EFPs slightly tighter.

- The bills strip is slightly cheaper, with pricing flat to -1.

- RBA-dated OIS pricing is flat to 4bps softer across meetings. A cumulative 47bps of easing is priced by year-end.

- (AFR) Central banks around the world are at pains to push back on the wave of rate cut optimism that is driving sharemarkets higher, yet bond traders still believe an easing cycle is imminent, including in Australia. (See link)

- TCorp has issued A$500mn of its existing 3.00% Feb-30 (A$272mn) and 2.00% Mar-31 (A$228mn) benchmark bonds, with cover ratios of 3.60x and 8.00x respectively.

- Tomorrow, the local calendar will see RBA Governor Bullock appear before the House of Reps Economics Committee at 0930 AEDT.

NZGBS: Cheaper, Closed Mid-Range, Year-End Easing Expectations Under 70bps

NZGBs closed 1-2bps cheaper and in the middle of the local session’s ranges. In the absence of domestic data, local participants were likely on headlines and US tsys watch.

- US tsys are dealing 1-2bps richer in today’s Asia-Pac session, reversing yesterday’s modest cheapening.

- Nevertheless, it has been an uneventful session so far, with the only thing of note being BoJ Deputy Governor Uchida’s remarks on financial conditions and interest rates. It, however, didn’t shed too much light on when the end of NIRP will come.

- Today’s weekly supply saw a respectable range (2.0x to 2.83x) for the auction cover ratios.

- Swap rates closed 2bps higher.

- RBNZ dated OIS pricing closed 2-6bps firmer for meetings beyond May. A cumulative 67bps of easing is priced by year-end compared to 96bps last Friday.

- (BBG) NZ construction spending is projected to slow in coming years as fewer homes are built, according to a government report. The value of total construction is projected to drop to NZ$54.6bn in 2027 from NZ$61bn in 2023. (See link)

- Tomorrow, the local calendar is empty.

FOREX: Yen Underperforms Post Deputy BoJ Governor's Speech

The USD is marginally lower in the first part of Thursday dealing, the BBDXY off modestly and holding above 1240 at this stage. The yen has underperformed though, as the BoJ Deputy Governor didn't suggest a policy shift at the March meeting was likely and noted when rate hikes do commence they will be modest.

- USD/JPY sits around session highs in recent dealings above 148.45, down close to 0.20% for the session. Focus is on the 148.80/90 region, which has marked recent highs. Softer US yields, down 1-2bps across the benchmarks haven't aided the yen much.

- AUD and NZD are marginally higher, but have maintained tight ranges overall.

- For AUD/USD we sit near 0.6525. Less positive impetus from the China/HK space has been evident today, but it has been a 14pip range at this stage.

- For NZD/USD we last track at 0.6610/15, with equally tight ranges. It was reported earlier that a quarter of all NZ apartments sales are now being made at a loss, while 10% of all residential property sales in Auckland and made at a loss, according to CoreLogic. While ASB has raised is milk price forecast to $8.00/kg from $7.85/kg.

- Looking ahead, later the Fed’s Barkin speaks, and BoE’s Mann, ECB’s Lane & Elderson appear. There is little on the data front.

CHINA EQUITIES: Mixed Ahead of Lunar New Year, CPI Declines Fastest Since Sept 09

Final day of trading ahead of the Lunar New Year holiday, after a very eventful week with multiple headlines out supporting Chinese and Hong Kong Equities markets, equities indices have seen some wild swings particularly in the small cap space.

China data was released before with CPI -0.8% YoY vs -0.5% est, Dec -0.3% (Fastest decline since Sept 2009) while PPI -2.5% YoY vs. -2.6% est, Dec -2.5%

- Hong Kong indices were somewhat volatile today largely on the back of CPI and PPI data, HSI opened down 0.60% to recover back to flat, only to then reverse that move to trade 1% lower going into lunch, Alibaba led the move lower down 6.80%, meanwhile HSTech is 0.35% lower, after being up as much as 1%, while the Mainland property index is higher up 2.00%, this outperformance could be attributed to the announcement that Shenzhen has lowered the threshold for non-local homebuyers, by easing the requirement of tax and social insurance payments to three from five years.

- China Mainland equities are outperforming Hong Kong indices, led by small caps with the CSI 1000 higher by 4.8%, CS1 300 is up 0.30% for the day.

ASIA PAC EQUITIES: Asia Equities Continue Higher On Strong Earnings

Regional Asia Equities are higher today, all moving higher in unison as the US market hit record highs. It has been a slow data and news headline day in Asia, as well as China heading into Lunar New Year holiday break tomorrow. The Japanese BoJ Deputy Governor Uchida has been speaking this morning on financial conditions and interest rates, however hasn't shed too much light on when the end of NIRP will come.

- Japan equities are the top performer in Asia higher today, as the yen weakened during Uchida's speech. Tech names are trading well as market expectations of strong corporate profits, while strong performance during the US session for chipmakers is lending supporting to trading here in Asia. The Topix is higher 0.70% higher led by Toyota again up 3.00%, while the tech heavy Nikkei is higher by 2.20%.

- Australian equities are higher today, after solid earnings from the likes of AGL, Mirvac and Cochlear. the ASX 200 is higher 0.30% led by Utilities.

- South Korea equities are up today, led by semiconductor names, after TSMC posted a rise in monthly sales of 7.9%YoY, while US names also climbed. Headlines out earlier from SK President Yoon, saying the "Korea Discount" in equity markets must be reduced, the KOSPI is 0.20% higher, off it's highs from earlier though as inflows into SK equities taper off, with just $75m today

- Elsewhere in SEA, many regions markets are closed. Philippines is 1.50% higher, while India is lower by 0.60% after the RBI kept rates on hold.

OIL: Crude Finding Support From Geopolitics & Risk Sentiment

Oil prices are moderately higher during APAC trading today after rising around a percent on Wednesday as the situation in the Middle East deteriorated with the US killing an Iranian-backed militant leader in Baghdad and Israel rejecting Hamas’ ceasefire terms. Crude has also been supported by better risk sentiment. The USD index is down slightly.

- WTI has traded above $74 for much of today and is currently up 0.4% to $74.14/bbl just off the intraday high of $74.27. Brent is also 0.4% higher at $79.52 down from the $79.65 high.

- Brent’s prompt spread is in a bullish structure, whereas WTI’s is bearish, according to Bloomberg.

- Data today showing an increase in deflationary pressures in China in January didn’t worry crude. Jet fuel and gasoline usage will be monitored to gauge the strength of travel over the upcoming Lunar New Year holiday. China is the world’s largest oil importer.

- Later the Fed’s Barkin speaks, and BoE’s Mann, ECB’s Lane & Elderson appear. There is little on the data front.

GOLD: Struggling For Direction Amid Fed Policy Outlook Uncertainty

Gold is little changed in the Asia-Pac session, after closing unchanged at $2035.36 on Wednesday.

- The precious metal spiked shortly after the cash US equity open on Wednesday, which was closely linked to further concerns over New York Community Bancorp. It rose to a session high of $2044.60, however, the subsequent stabilisation for broader sentiment halted the rally. The price moderated back to unchanged.

- More generally, bullion has been struggling for direction amid a lack of clarity regarding when the Fed is likely to start easing monetary policy.

- On Wednesday, there was a continued focus on Fed speakers: Fed Kashkari popped up in morning trade positing that 2-3x 25bp cuts this year "seems appropriate". Fed Kugler said she could not close the door to policy action at any upcoming meetings, including March, “Every meeting is live". Fed Collins said waiting until 12-month inflation hits 2% for the central bank to begin cutting interest rates would be waiting too long.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 08/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/02/2024 | 1500/1000 | ** |  | US | Wholesale Trade |

| 08/02/2024 | 1500/1500 |  | UK | BoE's Mann Speaks At OMFIF | |

| 08/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 08/02/2024 | 1530/1630 |  | EU | ECB's Lane at Brookings Institution | |

| 08/02/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 08/02/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 08/02/2024 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/02/2024 | 1705/1205 |  | US | Richmond Fed's Tom Barkin | |

| 08/02/2024 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.