-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Headline CPI Back Into Negative Territory

EXECUTIVE SUMMARY

- FED’S HARKER STILL LEANING AGAINST FURTHER HIKES - MNI

- CHINA SLIPS BACK INTO DEFLATION AS RECOVERY REMAINS FRAGILE - BBG

- BOJ DISCUSSED POLICY OPTIONS WITH AN EYE ON POTENTIAL EXIT - BBG

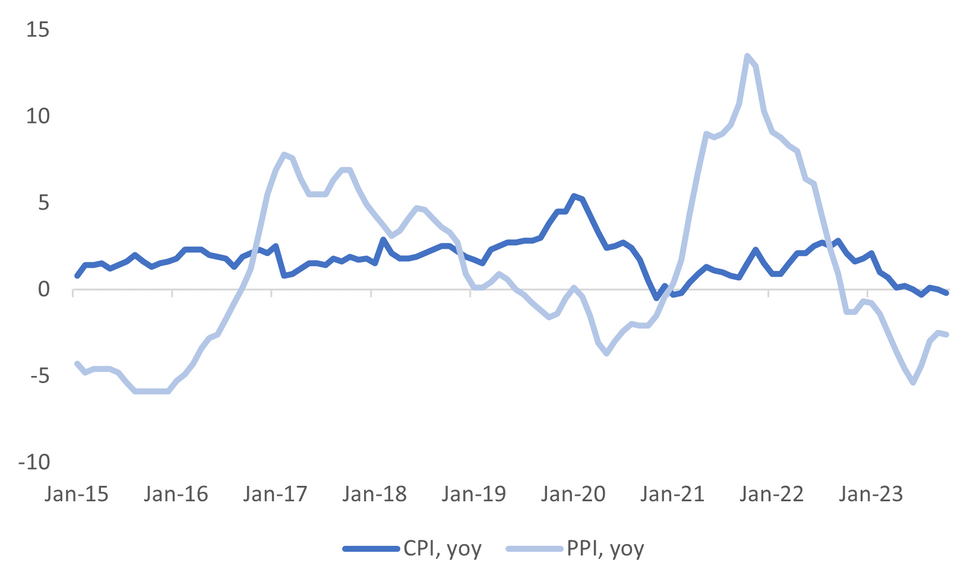

Fig. 1: China CPI Y/Y Slips Back Into Negative Territory, PPI Deflation Continues

Source: MNI - Market News/Bloomberg

U.K:

PROPERTY (BBG): London’s home rental cost showed signs of easing, with a drop in demand and evidence that tenants are refusing to pay record costs to secure a place to live, a survey of property appraisers showed.

EUROPE:

ECONOMY (BBG): Europe’s economy is on course for a modest rebound next year, European Commission Vice President Valdis Dombrovskis said on Wednesday. “It’s clear that currently we are in a period of economic weakness,” he told reporters ahead of a meeting of euro-area finance ministers in Brussels. “We have managed to avoid recession, but still growth is very slow.”

ECONOMY (TELEGRAPH): The former president of the European Central Bank has said the EU will be in recession by the end of the year amid surging energy costs. Mario Draghi, the former Italian prime minister, said the continent’s economy is also struggling with low productivity and a lack of skilled labour.

ENERGY (BBG): The European Union is set to propose extending emergency rules first aimed at stemming an unprecedented energy crisis last year as conflict in the Middle East and concerns about the security of the region’s gas infrastructure pose new risks.

FRANCE (BBG): France’s economy is set to maintain slight growth in the final quarter of the year, dodging a contraction that has already hit the euro area as a whole, according to a survey by the country’s central bank.

UKRAINE (BBC): The European Commission has recommended that formal talks should begin with Ukraine on joining the European Union. The step takes Kyiv closer to the coveted prize of EU membership, five months after the 27 member states gave it candidate status.

U.S.

FED (MNI): Philadelphia Fed President Patrick Harker on Wednesday again argued the Federal Reserve should stop raising interest rates and hold them at their current 22-year highs, while warning rate cuts are not forthcoming in the near future.

MIDEAST (BBG): US warplanes launched airstrikes on a weapons-storage facility in eastern Syria that allegedly belonged to Iran and its affiliates, a fresh show of military force after previous strikes two weeks ago failed to stem a surge in attacks against US forces in the region.

ECONOMY (RTRS): U.S. Council of Economic Advisers Chair Jared Bernstein said on Wednesday he did not "thus far" see the Israel-Gaza war as an exogenous shock that could derail U.S. economic growth, but noted that Washington was watching its impact on oil prices.

CORPORATE (WSJ): Morgan Stanley’s wealth management practice is being scrutinized by the Federal Reserve over lapses tied to doing business with rich clients outside the US, according to the Wall Street Journal.

OTHER:

ISRAEL (RTRS): Street battles raged in Gaza City with Hamas fighters using tunnels to ambush Israeli forces, as the United States said Palestinians must govern Gaza post-war, countering Israeli comments that it would control security indefinitely.

JAPAN (BBG): Japanese Prime Minister Fumio Kishida has decided against calling an election before the end of the year, Kyodo News and other media reported, after a promise of tax rebates failed to stop a slide in his support rates.

JAPAN (BBG): Bank of Japan board members meeting last month discussed policy options with an eye on a potential exit from the world’s last negative-rate regime, according to a summary of opinions from the gathering.

JAPAN (RTRS): The Bank of Japan may end its negative interest rate policy as early as January, and keep raising short-term borrowing costs if the economy can weather risks from overseas uncertainties, said former central bank executive Eiji Maeda.

CHINA

PRICES (BBG): China slid back into deflation in October, highlighting the country’s struggle with shoring up growth through domestic demand.

CAPITAL MARKETS (SECURITIES TIMES): China Securities Regulatory Commission, the country’s top securities regulator will quicken the development of domestic “smart money” and strengthen supervision of institutions and market behaviour, said CSRC Chairman Yi Huiman at the Financial Street Forum. The CSRC will crack down on illegal fraudulent activities in finance, issuance, and market manipulation.

EQUITIES (CSJ): The Shanghai and Shenzhen stock exchanges will tighten refinancing rules aimed at guiding resources towards high-quality companies. The exchanges will restrict refinancing of listed companies whose share price falls below their initial offer price or their net asset value. Meanwhile, listed companies with a relatively high proportion of financial investments must reduce the amount of funds raised through refinancing, and refinancing projects must be closely related to their existing main businesses.

CHINA MARKETS

MNI: PBOC Injects Net CNY8 Bln Via OMO Thurs; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY202 billion via 7-day reverse repo on Thursday, with the rate unchanged at 1.80%. The operation has led to a net injection of CNY8 billion after offsetting the maturity of CNY194 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8049% at 09:39 am local time from the close of 1.8345% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 42 on Wednesday, compared with the close of 45 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1772 Thursday vs 7.1773 Wednesday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1772 on Thursday, compared with 7.1773 set on Wednesday. The fixing was estimated at 7.2721 by Bloomberg survey today.

MARKET DATA

JAPAN SEP BOP CURRENT ACCOUNT ADJUSTED ¥2010.9bn; MEDIAN ¥2297bn; PRIOR ¥1503bn

JAPAN SEP TRADE BALANCE BOP BASIS ¥341.2bn; MEDIAN ¥244.5bn; PRIOR -¥749.5bn

JAPAN OCT BANK LENDING INCL TRUSTS Y/Y 2.8%; PRIOR 2.9%

JAPAN OCT TOKOY AVG OFFICE VACANCIES 6.1%; PRIOR 6.15%

JAPAN OCT ECO WATCHERS SURVERY CURRENT 49.5; MEDIAN 50.0; PRIOR 49.9

JAPAN OCT ECO WATCHERS SURVERY OUTLOOK 48.4; MEDIAN 49.5; PRIOR 49.5

UK OCT RICS HOUSE PRICE BALANCE -63%; MEDIAN -65%; PRIOR -67%

CHINA OCT CPI Y/Y -0.2%; MEDIAN -0.1%; PRIOR 0.0%

CHINA OCT PPI Y/Y -2.6%; MEDIAN -2.7%; PRIOR 2.5%

MARKETS

US TSYS: Futures Move Above Wednesday Highs, But No Follow Through, Fed Speak Later

After a brief spike to 108-17 in early trade (above Wednesday session highs), futures have reverted back to late NY session ranges from Wednesday this afternoon. We last tracked at 108-14 +03, on volumes of just over 101k.

- The earlier spike appeared to coincide with comments from the Fed's Harker, where the Philadelphia Fed President again argued the Federal Reserve should stop raising interest rates and hold them at their current 22-year highs, while warning rate cuts are not forthcoming in the near future.

- The weaker than expected China headline CPI may have also aided the bid tone, but there was little follow through.

- In the cash space, tight ranges have prevailed. 10yr yields are a touch higher, last near 4.50%, the 2yr yield is sub 4.93%, but little changed.

- Looking ahead we have initial jobless claims later on, Fedspeak in terms of the Barkin MNI Webcast, followed by Powell comments later on. Bill and 30yr bond sales are also on tap.

JGBS: Futures Near Session Highs, 30yr Auction Sees Rise in Bid To Cover Ratio

Futures sit at 144.83 +.16, which is below session highs (144.89), but dips are generally being supported and remain shallow.

- BoJ Governor's second appearance at parliament in as many days hasn't shed any new light (at this stage) on the BoJ outlook, with similar comments to yesterday. Critically, the central bank doesn't have enough certainty around attaining the price goals yet (BBG).

- Earlier the BoJ summary of opinions from the October policy meeting produced a wide variety of views and justification for the YCC shift, but didn't shift the sentiment needle.

- Reuters noted an ex central bank executive suggests the BoJ may end negative rates in January of next year (see this link for more details).

- In the cash JGB space, yields are mostly lower. 10yr sits at 0.84%, for swaps it is a similar story, the 10yr at 1.01%.

- 30yr debt supply saw a 3.60 bid to cover ratio, the highest since Jan 2022 (see this BBG link). Earlier sell-side analysts noted Japan lifers may support this debt sale.

- Tomorrow on the data calendar we just have Oct money supply figures.

AUSSIE BONDS: 10yr Yields Lower, AU-US10yr Spread Narrows, RBA SoMP Out Tomorrow

ACGBs have exhibited the same flattening trend evident elsewhere in the bond space. 10yr futures opened higher, but couldn't breach the 95.50 level. We last tracked at 95.46, +.05, largely holding on to Wednesday gains. 3yr futures have tracked slightly lower, last at 95.82, -.01, largely moving sideways in recent sessions.

- In the cash space, the 10-30yr segments are down around 5bps in yield terms. The 10yr yield now back to 4.53%, close to mid-October levels.

- AU-US 10yr spreads have retreated further, back to +4bps, well off earlier Nov highs above +20bps.

- There has been little in the way of domestic news flow, with RBA watchers waiting for updated forecast projections from tomorrow's quarterly monetary policy statement.

- RBA terminal rate hikes expectations remain near 4.46%, so around half another hike priced in between now and May next year.

NZGBS: Yields Tracking Lower, 10yr Yield Back To Mid September Levels

NZGBS have seen lower yields through Thursday Asia Pac trade. This follows weaker core yields in Wednesday offshore trade, with little in the way of fresh domestic news flow.

- The fiscal deficit to end Q3 was slightly better than expected, by a little over NZ$220mn. BNZ also noted a pull back in October job ads (-5.6%). This is consistent with NZ Treasury analysis around a softening labor market backdrop. Weaker headline China CPI may have also helped at the margins.

- The 10yr yield is back sub 5.00% (last 4.8%), off a little over 8 bps. This is back to mid September lows. 2yr yields were also lower, but only marginally, settling just under 5.30% (-1bps).

- This left the 2/10s curve in a continued flattening trend. We are back to -31bps, after being near flat at the start of the month.

- Tomorrow on the data front we have the October manufacturing PMI out, the last print was 45.3.

FOREX: NZ$ & A$ Outperform, Others Little Changed

G10 currencies are little changed during APAC trading today and have been moving in narrow ranges. Aussie and kiwi have outperformed and are trading close to intraday highs. The USD index is flat but off the day’s lows. Brent crude rose above $80 earlier but is currently up only 0.1% to $79.64/bbl. US Treasury yields are little changed.

- AUDUSD is up 0.2% to 0.6415 but given no Aussie data has been in a narrow range of 0.6401/17 finding support at 64c.

- NZD has outperformed today against the greenback with NZDUSD up 0.3% to 0.5929, close to high of 0.5930. It fell to 0.5907 early in the session. AUDNZD is down 0.1% to 1.0821 but has traded between 1.0814/1.0844 today.

- USDJPY is little changed at 150.93 after range trading between 150.83/151.00.

- European currencies are almost unchanged against the dollar with EURUSD at 1.0709, GBPUSD 1.2286 and USDSEK 10.894.

- Later there are more Fed speakers with Chairman Powell scheduled to participate on a panel discussing monetary policy challenges at the IMF research conference at 1900 GMT. Harker, Bostic, Barkin and Paese are also on today’s calendar. The ECB’s Lagarde and Lane are due to appear.

EQUITIES: Weaker China CPI & Property Sector Headwinds Weigh On China Related Bourses

Regional equity markets are mixed in Thursday trade to date. Hong Kong and China markets are struggling for positive direction amid renewed property headwinds. There are more positive trends elsewhere, but they aren't evident across the board. US futures sit slightly lwoer at this stage. Eminis last near 4396, down 0.08%, Nasdaq futures are slightly worse, down 0.10%.

- China October inflation data showed a slip back into negative territory for headline CPI in y/y terms, although this was largely due to lower food prices. Still, easing core inflation and a PPI dragged down by weaker consumer related is not painting a very strong domestic demand picture.

- The data should, at the margins, raise monetary easing hopes. At the break the CSI 300 is +0.09% higher while the Hang Seng is down 0.31%. The properties sub index is off nearly 1%. Fresh concerns for troubled developer Country Garden have weighed (Ping An denied it would take over the company late yesterday).

- Japan markets have recovered some ground, the Topix up 0.70%, the Nikkei 225 around 1% at this stage. Gains are fairly broad based, with the transport sector leading the way.

- South Korea's Kospi is +0.40% higher, but the Kosdaq is down 1%. The Taiex index is slightly weaker in Taiwan.

- In SEA, Philippines stocks were aided at the margin by a better than expected Q3 GDP result, but are away from session highs, last +0.50%. Thailand stocks are off by over 1%. Local company JKN Global fell sharply after it filed a petition in bankruptcy court.

OIL: Crude Off Highs Following Soft China CPI, US & China Remain The Focus

Oil prices rose close to a percent today on better risk sentiment following US equities trending higher this month. They gave up most of those gains following CPI data showing that China has returned to deflation and are now only around 0.3% higher in the session. WTI reached a high of $76.06/bbl but is now down to $75.60. Brent rose to $80.27 but is now back below the $80-level at around $79.78. The USD index is flat but off the intraday lows.

- What the Fed is thinking of doing next has been a focus of the market this week, with some officials saying that the inflation fight is not over yet. Yesterday Powell didn’t comment on the outlook for policy or the economy. He is speaking again today, as well as a number of others. The other areas to continue to monitor are activity in China and oil & product inventories.

- The MNI Commodity Weekly looks at how Saudi’s output cuts have been mainly negated by higher output from Russia and Iran.

- Later there are more Fed speakers with Chairman Powell scheduled to participate on a panel at the IMF conference at 1900 GMT. Harker, Bostic, Barkin and Paese are also on today’s calendar. The ECB’s Lagarde and Lane are due to appear. The focus is on central bankers as in terms of data there are only US jobless claims.

GOLD: Bullion Slightly Lower Again, Upcoming Fed Comments Important

Gold is down slightly during the APAC session after rising to $1954.62/oz. It is currently trading around $1949.44/oz, close to the intraday low of $1947.86. It is 2.2% lower this week as comments from Fed officials suggesting that there could be further tightening weighed on bullion. Yesterday Powell didn’t comment on the outlook for policy or the economy, but he is speaking again today, as well as a number of others. The USD index is flat but off session lows.

- The USD OIS market has very little priced in for the December and January Fed meetings, which should be supportive of gold, but any change in this position would be significant for bullion.

- Gold has also begun to trend lower as the conflict in the Middle East currently looks contained and so the flight-to-quality flows that followed the October 7 Hamas attack are unwinding.

- Later there are more Fed speakers with Chairman Powell scheduled to participate on a panel discussing monetary policy challenges at the IMF research conference at 1900 GMT. Harker, Bostic, Barkin and Paese are also on today’s calendar. The ECB’s Lagarde and Lane are due to appear. The focus is on central bankers as in terms of data there are only US jobless claims.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/11/2023 | 0810/0910 |  | EU | ECB's Lane remarks at ECB conference | |

| 09/11/2023 | 0830/0830 |  | UK | BOE's Pill speaks at ICAEW UK Regions Economic Summit | |

| 09/11/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 09/11/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/11/2023 | 1430/0930 |  | US | Fed's Raphael Bostic and Tom Barkin | |

| 09/11/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 09/11/2023 | 1600/1100 |  | US | MNI Webcast with Fed's Tom Barkin | |

| 09/11/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 09/11/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 09/11/2023 | 1645/1145 |  | CA | BOC Sr Deputy Rogers speech | |

| 09/11/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/11/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 09/11/2023 | 1900/1400 |  | US | Fed Chair Jerome Powell |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.