-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Outlines Optimised COVID Controls As New Case Count Pulls Higher

EXECUTIVE SUMMARY

- BOE TO START LONG GILTS UNWIND FROM NOV 29 (MNI)

- JEREMY HUNT PLOTS TO HIT SMALL BUSINESSES WITH STEALTH VAT RAID (TELEGRAPH)

- ECB MUST ACT ‘DECISIVELY’ TO FIGHT HIGH INFLATION, NAGEL SAYS (BBG)

- SNB'S MAECHLER SAYS MORE RATE HIKES COULD BE NECESSARY (RTRS)

- YUAN WEAKNESS SEEN RESUMING AS EXPORTS SLOW AMID OUTFLOWS (MNI)

- CHINA COVID CASES TOP 10,000, BEIJING HIGHEST IN OVER A YEAR (BBG)

- CHINA NHC UNVEILS DETAILED MEASURES OPTIMIZING COVID CONTROLS (BBG)

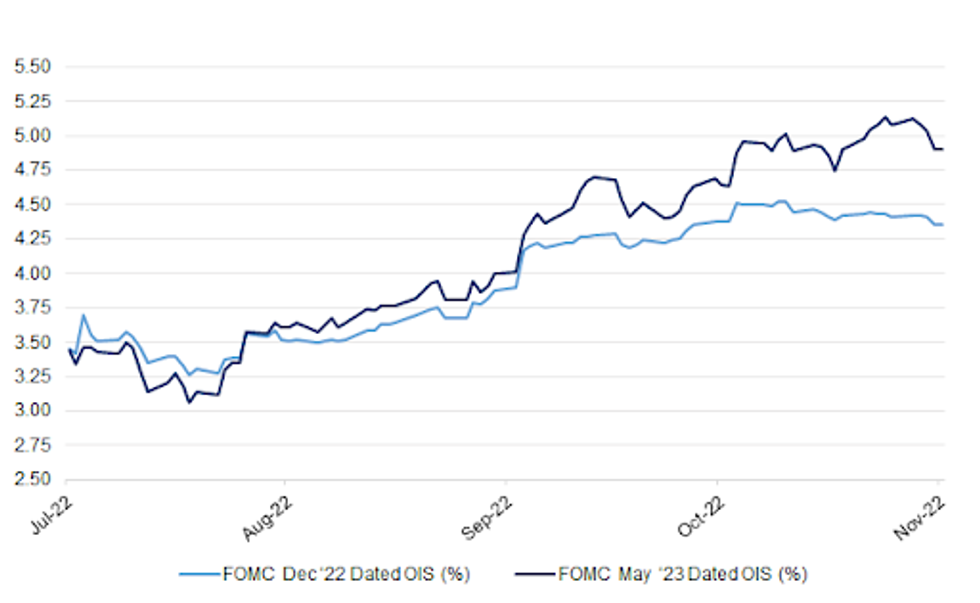

Fig. 1: Fed Dec ‘22 & May ‘23 Dated OIS

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England will begin a "timely" unwind of its recent GBP19.3 billion long gilt purchases, the central bank said in a statement late Thursday, with sales to interested parties to start from Nov. 29. (MNI)

FISCAL: Jeremy Hunt is plotting a stealth tax raid on small businesses that will force thousands more to pay VAT as he scrambles to balance the country’s books. (Telegraph)

BREXIT: Prime Minister Rishi Sunak has said he is confident that "with goodwill and pragmatism" a breakthrough can happen in negotiations over the Northern Ireland Protocol. (BBC)

RATINGS: Potential sovereign rating reviews slated for after hours on Friday include:

- DBRS Morningstar on the United Kingdom (current rating: AA (high), Under Review With Negative Implications)

EUROPE

ECB: The European Central Bank must take clear steps to bring down record-high inflation, Bundesbank President Joachim Nagel said. “We must act decisively,” Nagel said in a speech in Ettlingen, Germany, on Thursday, adding that he sees the prospect of more interest-rate hikes. (BBG)

SPAIN: Spanish Prime Minister Pedro Sanchez signaled that his government may make a two-year windfall tax on banks permanent. (BBG)

ITALY: The Italian government is considering excluding companies that pay dividends or buy back shares from support measures on their energy bills. (BBG)

SNB: The Swiss National Bank could hike interest rates again to combat Swiss inflation which remains "too high", SNB governing board member Andrea Maechler said in an interview published on Friday. (RTRS)

RATINGS: Potential sovereign rating reviews slated for after hours on Friday include:

- Fitch on Malta (current rating: A+; Outlook Stable), Slovenia (current rating: A; Outlook Stable) & Switzerland (current rating: AAA; Outlook Stable)

- Moody’s on Latvia (current rating: A3; Outlook Stable)

- DBRS Morningstar on Luxembourg (current rating: AAA, Stable Trend)

U.S.

FED: There is still a high risk of U.S. inflation rising further or remaining stubbornly high and the Federal Reserve should err on the side of tightening too much, Cleveland President Loretta Mester said Thursday. (MNI)

FED: Federal Reserve Bank of Kansas City President Esther George on Thursday joined a growing chorus of officials calling for slower interest-rate increases in coming months, arguing a "steady and deliberate approach" to hikes would help avoid contributing to market volatility. (MNI)

FED: The Federal Reserve should still raise its benchmark interest rate slightly above a 4.5%-4.75% rate despite the “welcome’ consumer price data released earlier Wednesday, said San Francisco Fed President Mary Daly on Thursday. Daly said she wanted to get the Fed’s policy rate to a “sufficiently restrictive” level where it can be confident inflation will come down. (MarketWatch)

INFLATION: Mr. Biden took quick credit for the slowdown in the Consumer Price Index on Thursday, saying in a statement that his policies are helping to cool price gains while acknowledging there could be more struggles ahead. (New York Times)

OTHER

U.S./CHINA: President Joe Biden’s top national security aide said the US will brief Taiwanese officials on the president’s upcoming meeting with China’s Xi Jinping and expressed confidence that Taipei would feel secure about its support from the US. (BBG)

U.S./CHINA: Two influential Republican lawmakers are introducing legislation to ban TikTok from use in the US, and criticized the Biden administration for insufficient action against the Chinese-owned social media platform. (BBG)

U.S./CHINA: More than 1,000 shipments of solar energy components worth hundreds of millions of dollars have piled up at U.S. ports since June under a new law banning imports from China's Xinjiang region over concerns about slave labor, according to federal customs officials and industry sources. (RTRS)

EU/CHINA: The German government is planning to direct more German foreign investments into markets outside of China in order to reduce dependency on the world's second-largest economy. Following a proposal by Economy Minister Robert Habeck, the governing coalition under Chancellor Olaf Scholz has agreed to revise the mechanism of so-called investment guarantees, according to ministerial sources. (DPA)

BOJ: The Bank of Japan will probably need another policy review after Governor Haruhiko Kuroda steps down from his long-held post in April, according to a recent member of the central bank’s board. (BBG)

JAPAN: Japan’s top currency diplomat Masato Kanda said on Friday that he was closely watching forex market moves with a high sense of urgency and that if needed, authorities remained ready to take action. (RTRS)

JAPAN: Finance Minister Shunichi Suzuki says the US doesn’t see Tokyo’s FX policy as problematic, given that the Treasury’s latest currency report didn’t show much change in its view on Japan. (BBG)

JAPAN: Japan’s ruling Liberal Democratic Party and junior coalition partner Komeito are set to agree on the need for the capability to launch counterattacks against foreign missile threats, Sankei reports, citing unidentified party sources. (BBG)

AUSTRALIA: Australian Prime Minister Anthony Albanese on Friday said his government will consider all measures, including introducing a price cap on gas, to rein in high energy prices, but ruled out introducing a mining tax on companies. (RTRS)

SOUTH KOREA: South Korea announces additional steps to provide liquidity to project finance asset-backed commercial paper market. (BBG)

SOUTH KOREA: South Korea’s 9 major brokerages will expand its program to buy asset-backed commercial paper for smaller brokerages, Maeil Business Newspaper reports, citing unidentified sources. (BBG)

SOUTH KOREA: South Korea’s finance minister said on Friday the government was preparing further steps aimed at boosting dollar supply on the foreign exchange market. (RTRS)

BOK: South Korea's top central banker said Friday that it is a top priority to ensure price stability and reduce inflation pressure through monetary tightening but worried there are "growing signs of stress" in various sectors amid recent steep interest rate hikes. (Yonhap)

BOK: A monetary policymaker of the Bank of Korea (BOK) on Friday underlined the need for "simple" and "direct" communication when the central bank tries to send signals to the market on its future policy directions. (Yonhap)

NORTH KOREA: U.S. President Joe Biden will discuss with his South Korean counterpart Yoon Suk-Yeol the broader threat posed by North Korea in the cyber domain during an upcoming trip to Asia, U.S. National Security Advisor Jake Sullivan said on Thursday. Speaking at a White House briefing, Sullivan said Washington remained concerned about the possibility of North Korea conducting another nuclear test. (RTRS)

BOC: In much the same way that Canadian households were forced to adjust on the fly to high and escalating prices, Canada's job market and overall economy will see some painful changes in the coming months as Canada's central bank steps up its fight to wrestle inflation into submission. (CBC)

TURKEY: The cost of Turkey’s FX-indexed deposits program is expected to be less for the central bank than the Finance Ministry, Treasury and Finance Minister Nureddin Nebati says during parliamentary budget talks on Thursday. (BBG)

MEXICO: The Bank of Mexico hiked its key interest rate by 75 basis points to a record 10.00% on Thursday, in a split decision that left the door open to future hikes but cast doubt on how aggressively it would continue its monetary tightening cycle. (RTRS)

BRAZIL: Brazil President-elect Luiz Inacio Lula da Silva chose a left-leaning team to lead his planning and budget working group during the transition government, a move that’s likely to rattle investors who are already worried about his spending plans. (BBG)

BRAZIL: Brazil’s top economists are sounding the alarm about inflation at meetings with the central bank as the upcoming administration of Luiz Inacio Lula da Silva pushes for more spending. (BBG)

BRAZIL: Brazilian President-elect Luiz Inacio Lula da Silva dismissed a sharp sell-off of the country's currency and stock market on Thursday as investors grew nervous about his spending plans after he beat right-wing President Jair Bolsonaro in last month's election. "I have never seen the market so sensitive. It's funny that the market didn't get nervous with four years of Bolsonaro," he told reporters. (RTRS)

RUSSIA: Ukraine's defence minister said on Thursday it would take Russia at least a week to withdraw its troops from the southern city of Kherson and that winter would slow down operations on the battlefield, giving both sides a chance to recuperate. (RTRS)

RUSSIA: The United States will allow some energy-related transactions with several Russian entities including Sberbank, VTB Bank and Alfa-Bank to continue through May 14, the Treasury Department said on Thursday. (RTRS)

PERU: Peru's central bank increased its benchmark interest rate by 25 basis points to 7.25% on Thursday, as expected, the 16th consecutive hike as monetary policymakers in the copper-producing Andean nation battle stubbornly high inflation. (RTRS)

MARKETS: Goldman Sachs CEO David Solomon said Thursday that he expects capital markets to recover in the upcoming months. (CNBC)

OIL: Oil-laden tankers risk being left languishing at sea if insurers do not urgently get clarity on an unfinished G7 and European Union plan to cap the price of Russian crude, two senior industry executives told Reuters. (RTRS)

CHINA

PBOC: The People’s Bank of China may consider a small reserve requirement ratio cut by the end of this year when a large amount of medium-term lending facility matures and drains liquidity, China Securities Journal reported citing analysts. (MNI)

YUAN: A recent yuan rally looks set to reverse as export headwinds mount and amid signs the People’s Bank of China has reduced to use its so-called “counter-cyclical factor” in daily fixings, policy advisors and currency experts told MNI, anticipating a more volatile and broader trading range during the rest of the year. (MNI)

CREDIT: The sharp falls in China’s October credit and aggregate finance data indicate weak financing demand and that counter-cyclical policies need to be strengthened to promote credit expansion in infrastructure, manufacturing and real estate, Yicai.com reported citing analysts. (MNI)

ECONOMY: China’s growth will slow to 2-3% despite hopes for a robust rebound once Covid restrictions are relaxed, as the nation’s new leadership confront a legacy of too much debt and a bumpy transition to consumption-led growth, Beijing University professor Michael Pettis told MNI. (MNI)

CORONAVIRUS: China cuts quarantine period for inbound travelers to 8 daysfrom 10 days previously with new measures to optimize Covid controls, NationalHealth Commission says in a statement on its website. (BBG)

CORONAVIRUS: China’s daily Covid infections exceeded 10,000 for the first time since April, with Beijing’s cases at the highest level in more than a year, as the country’s top leaders urged more targeted restrictions aimed at controlling the virus. (BBG)

REITS: The CSRC aims to include more quality projects in the new energy, water conservation and new-style infrastructure sectors into pilot REITs, China Securities Journal reports on its front page, citing an unidentified person close to regulators. (BBG)

CHINA MARKETS

MNI: PBOC NET INJECTS CNY9 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) on Friday injected CNY12 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net injection of CNY9 billion after offsetting the maturity of CNY3 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9009% at 9:37 am local time from the close of 1.8861% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 43 on Thursday vs 44 on Wednesday.

CHINA SETS YUAN CENTRAL PARITY AT 7.1907 FRI VS 7.2422 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1907 on Friday, compared with 7.2422 set on Thursday.

OVERNIGHT DATA

JAPAN OCT PPI +9.1% Y/Y; MEDIAN +8.8%; SEP +10.2%

JAPAN OCT PPI +0.6% M/M; MEDIAN +0.7%; SEP +1.0%

NEW ZEALAND OCT BUSINESSNZ MANUFACTURING PMI 49.3; SEP 51.7

New Zealand's manufacturing sector fell into contraction for the first time in 2022, according to the latest BNZ - BusinessNZ Performance of Manufacturing Index (PMI). The seasonally adjusted PMI for October was 49.3 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 2.4 points lower than September, and the lowest level of activity since August last year when there was a nation-wide COVID related lockdown. BusinessNZ's Director, Advocacy Catherine Beard said that the October result for New Zealand mirrors similar results overseas. "Given the global PMI signaled a second successive monthly contraction to stand at 49.4, it appears New Zealand now has a common thread with many other countries of decreasing production and a drop in demand for new orders. Looking at the specifics of the sub-index results, the two key sub-index values of Production (49.9) and New Orders (44.7) both fell into contraction, with the latter falling significantly from its near 60-mark in August. In addition, Employment (48.9) experienced its lowest level of activity since November 2021". Manufacturers have continued their negative mindset, with the proportion of negative comments at 61.6%, almost unchanged from 61.5% for September. Staff shortages and a fall off in new orders were mentioned by a significant proportion of manufacturers. BNZ Senior Economist, Doug Steel stated that “new orders are falling while the PMI stocks index remains expansionary and firmly above its long-term norms. A low orders-to-inventory ratio typically bodes ill for production ahead". (BusinessNZ/BNZ)

NEW ZEALAND OCT FOOD PRICES +0.8% M/M; SEP +0.4%

SOUTH KOREA NOV 1-10 TRADE BALANCE -USD2.05BN

SOUTH KOREA NOV 1-10 EXPORTS -2.8% Y/Y

SOUTH KOREA NOV 1-10 IMPORTS -6.7% Y/Y

MARKETS

SNAPSHOT: China Outlines Optimised COVID Controls As New Case Count Pulls Higher

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 811.92 points at 28258.02

- ASX 200 up 193.983 points at 7158

- Shanghai Comp. up 40.841 points at 3076.973

- JGB 10-Yr future up 39 ticks at 149.50, yield down 1.2bp at 0.241%

- Aussie 10-Yr future up 6.5 ticks at 96.340. yield down 6.3bp at 3.656%

- U.S. 10-Yr future down 0-05+ at 112-11, cash Tsys are closed

- WTI crude up $0.19 at $86.66, Gold down $0.35 at $1755.10

- USD/JPY up 56 pips at Y141.54

- BOE TO START LONG GILTS UNWIND FROM NOV 29 (MNI)

- JEREMY HUNT PLOTS TO HIT SMALL BUSINESSES WITH STEALTH VAT RAID (TELEGRAPH)

- ECB MUST ACT ‘DECISIVELY’ TO FIGHT HIGH INFLATION, NAGEL SAYS (BBG)

- SNB'S MAECHLER SAYS MORE RATE HIKES COULD BE NECESSARY (RTRS)

- YUAN WEAKNESS SEEN RESUMING AS EXPORTS SLOW AMID OUTFLOWS (MNI)

- CHINA COVID CASES TOP 10,000, BEIJING HIGHEST IN OVER A YEAR (BBG)

- CHINA NHC UNVEILS DETAILED MEASURES OPTIMIZING COVID CONTROLS (BBG)

US TSYS: Futures Lower, China’s Refinement Of COVID Restrictions Applies Light Pressure Into London

Tsy futures operate around session lows as we move into London hours, with news re: the implementation of China’s optimised COVID restrictions (which include a rollback of the country’s international travel restrictions and reduced quarantine time for international travellers) applying some light pressure late in Asia-Pac dealing. A reminder that such adjustments had been flagged via news wire source reports in recent days.

- E-minis have extended to fresh session highs, breaching their respective Thursday peaks, in the wake of the news, while USD/CNH has pulled lower.

- The rally in Asia-Pac equities had already knocked U.S. Tsy futures away from best levels before the news out of China crossed.

- Previous headline flow flagging a multi-month high for new COVID cases in China had little impact on the day.

- TYZ2 is -0-07+ at 112-09, 0-01 off the base of its 0-10 range on volume of ~94K.

- Cash Tsys are closed on Friday owing to the observance of the Veterans Day holiday.

- Looking ahead, Friday’s docket will be headlined by the latest UoM sentiment survey, with the inflation expectations components generating the most interest when it comes to that release.

JGBS: Curve Flattens Post-U.S. CPI, Long End Looks Better For Domestic Investors

JGB futures have ticked back towards session lows ahead of the Tokyo close, last printing +32 on the day (after surging in the overnight session in lieu of the softer than expected U.S. CPI reading), with news of China’s freshly-deployed optimised COVID prevention settings (an unwind of international travel bans and reduced quarantine time for international travellers) applying some modest pressure.

- Cash JGBs have held on to the bulk of their early richening, running 1-8bp richer across the curve, with the super-long end leading, resulting in bull flattening. This comes as the wider international FX-hedged yield picture for Japanese investors indicates the potential for further onshore-based JGB long end demand.

- Local headline flow was muted, with familiar overtures re: the FX market dominating.

- The latest liquidity enhancement auction for off-the-run 5- to 15.5-Year JGB went well, as was expected, with firm spread dynamics providing a light post-auction bid for the space.

- Looking ahead, the latest batch of BoJ Rinban operations headline Monday’s limited domestic docket.

JGBS AUCTION: Liquidity Enhancement Auction For OTR 5- To 15.5-Year JGBs Results

The Japanese Ministry of Finance (MOF) sells Y499.6bn of 5- to 15.5-Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.047% (prev. +0.001%)

- High Spread: -0.035% (prev. +0.003%)

- % Allotted At High Spread: 33.9130% (prev. 23.8297%)

- Bid/Cover: 3.930x (prev. 6.391x)

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y4.87593tn 3-Month Bills:

- Average Yield -0.1113% (prev. -0.1176%)

- Average Price 100.0299 (prev. 100.0316)

- High Yield: -0.1061% (prev. -0.1079%)

- Low Price 100.0285 (prev. 100.0290)

- % Allotted At High Yield: 29.3383% (prev. 63.9927%)

- Bid/Cover: 3.607x (prev. 3.095x)

AUSSIE BONDS: Back From Best Levels On Wider Bid For Risk

ACGBs pulled back from best levels as the Sydney day wore on, with the post-U.S. CPI bid waning as risk-positive flows came to the fore.

- China’s move to outline its “optimised” COVID controls saw a wind back of international flight restrictions and reduced post-travel quarantine periods for travellers, as had been flagged in recent news wire source reports.

- Still, this failed to impact Aussie bond futures, with the news crossing around the Sydney close. That left YM +9.0 and XM +6.5 come the close. The wider ACGB curve bull steepened, but the pullback from best levels saw the curve work away from session steeps, leaving the major benchmarks 3-9bp richer late in the day.

- Bills were 5-9bp richer through the reds at the bell, comfortably off of best levels, bull flattening. RBA dated OIS was softer on the day, in lieu of yesterday’s U.S. CPI print, with ~19bp of tightening now priced for next month’s RBA meeting & a terminal cash rate of ~3.75% observed on the strip.

- Next week’s AOFM issuance slate is somewhat vanilla, while semi-issuance saw NSWTC mandate banks for a benchmark round of Feb-35 supply, which would have applied some marginal pressure.

- Next week’s domestic docket is headline by the minutes from the latest RBA meeting, the monthly labour market report and quarterly WPI data.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 16 November it plans to sell A$900mn of the 3.00% 21 November 2033 Bond.

- On Thursday 17 November it plans to sell A$1.0bn of the 24 February 2023 Note, A$1.0bn of the 10 March 2023 Note & A$500mn of the 12 May 2023 Note.

- On Friday 18 November it plans to sell A$700mn of the 2.75% 21 November 2029 Bond.

NZGBS: Off Best Levels, Bull Steepening

NZGBs followed the global pullback from their U.S. CPI-inspired richest levels of the session, with the major benchmarks going out 16-22bp richer as the curve bull steepened. Swap spreads were little changed to a touch narrower across the curve.

- RBNZ dated OIS was little changed after the early adjustment lower, which was also inspired by Thursday’s U.S. CPI readings. Just over 60bp of tightening is priced for this month’s RBNZ meeting, with terminal rate pricing now sitting at ~5.05%.

- Local data saw an uptick in the M/M rise in food prices (+0.8% M/M in Oct vs. +0.4% in Sep), while the BusinessNZ manufacturing PMI moved into contractionary territory for the first time in over a year. The collators of the PMI noted that “new orders are falling while the PMI stocks index remains expansionary and firmly above its long-term norms. A low orders-to-inventory ratio typically bodes ill for production ahead.”

- Local news flow saw the Government announce that Kainga Ora’s future financing requirements will be met by loans from New Zealand Debt Management (NZDM), rather than private markets. Spreads of the entities bonds narrowed vs. NZGBs on the news.

- REINZ property market data, the quarterly PPI reading and non-resident bond holding data headline next week’s local docket.

EQUITIES: Tech Sensitive Indices Dominate The Rebound

All the major Asia Pac indices are higher, with tech sensitive bourses leading the rebound, in line with overnight moves and the sharp pullback in US yields post the CPI print. US futures have had a relatively quiet session. S&P and Nasdaq futures have largely moved sideways, albeit with a slight downside bias.

- The HSI is among the best performers, up around 5.5% at this stage. The tech sub-index is +7.80% firmer, although we are away from opening highs by around 2.25%. Note overnight the China Dragon Index rose 7.50%, snapping a 3-day losing streak.

- For mainland shares, the CSI 300 last printed +2.10%, the Shanghai Composite Index +1.50%. The underlying property sub-index is +4.19%. There is hope that current lockdown measures will be less impactful on economic activity, although covid case numbers continue to climb, now above 10k. The health authorities continue to emphasize that optimizing covid control policies is not a loosening in restrictions.

- The other focus point will be Monday's meeting between President Xi and US President Biden, particularly from a tech outlook perspective (if this sector is raised).

- The Taiex is +3.5%, with TSMC leading the way. The Nikkei 225 is +2.75%. Kospi gains are +3.15%, with offshore investors adding +$375.8mn to local shares.

- South East Asian markets are also higher, but gains are under 2%.

OIL: Lags Broader Risk Rally

Brent crude last tracked just below $94/bbl, still broadly stuck between its simple 50-day MA ($92.60/bbl) and the 100-day MA ($97.35/bbl). We are slightly above NY closing levels, +0.30%, which is building on Thursday's +1.10% gain. WTI is around $86.70, tracing out a similar trajectory.

- Still, oil has lagged the broader risk rally over the past 24 hours, post the US CPI miss, particularly relative to the equity space and some base metals like copper. Brent crude is currently tracking -4.7% down for the week.

- There is concern around the demand backdrop, with oil not receiving much benefit this week from on-going speculation around a potential shift in China's CZS.

- Earlier next week also has a number of important event risks for crude. On Monday the OPEC monthly report will be published, this is followed by the IEA monthly report on Tuesday.

- The G20 meeting also kicks off in Bali on Tuesday, while we also get an update on monthly economic activity in China, with industrial production, among other indicators due.

GOLD: Edges Lower, But Tracking +4% Higher For The Week

Gold is slightly down from overnight highs, last tracking close to $1750, -0.30% for the session so far. This follows the 2.85% gain for Thursday's session, amid a sharp pullback in the USD and lower UST yields.

- Dips today towards $1747 have been supported today, which also coincides with pullbacks seen in the NY trading session after the post CPI induced bounce subsided.

- For the week, the precious metal is currently up over 4%, building on last week's gain of 2.25%.

- From a technical standpoint, resistance is evident around the 200-day EMA ($1756.65). Note on the downside the 100-day EMA comes in at $1718.21.

FOREX: China COVID Rules Adjustment Triggers Risk-On Flows, USD/JPY Trims Early Gains

USD/JPY gained in a relief rally as Tokyo participants went online following the pair's 3.75% sell-off Thursday in reaction to below-forecast U.S. CPI figures. Buying momentum ran out of steam at Y142.48 and the rate halved its initial gains, albeit the yen remains the worst performer in G10 FX space.

- The partial unwinding of USD/JPY gains was driven by a pullback in broader greenback strength, with the BBDXY index refreshing its 2-month lows. The USD came under further pressure as risk sentiment picked up late doors, which allowed the BBDXY to fall below 1,290. Note that cash Tsys did not trade because of a public holiday in the U.S.

- Reports of China loosening some COVID-19 controls triggered a round of risk-on flows, with USD/CNH staging a clean breach of yesterday's low and moving below its 50-DMA for the first time since mid-Aug. Health authorities scrapped COVID flight suspensions and reduced quarantine times.

- The Aussie cemented its position as the best G10 performer on reports from China. AUD/USD broke above yesterday's high as a result, while NZD/USD tested yesterday's peak. Antipodean cross AUD/NZD attacked resistance from its 200-DMA.

- On tap today are UK GDP & activity indicators, final German CPI & flash U.S. Uni. of Mich. Sentiment. Central bank speaker slate features ECB's Holzmann, Panetta, de Guindos, Lane, de Cos & Centeno, as well as BoE's Haskel & Tenreyro.

FX OPTIONS: Expiries for Nov11 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9955-65(E1.3bln), $1.0000(E1.8bln), $1.0050-65(E1.4bln), $1.0240(E2.2bln)

- USD/JPY: Y144.40-50($560mln)

- GBP/USD: $1.1600(Gbp503mln)

- AUD/USD: $0.6475(A$624mln), $0.6575(A$680mln)

- USD/CAD: C$1.3605-20($1.2ln)

- USD/CNY: Cny7.20($1.1bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/11/2022 | 0700/0700 | *** |  | UK | GDP First Estimate |

| 11/11/2022 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 11/11/2022 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 11/11/2022 | 0700/0700 | ** |  | UK | Trade Balance |

| 11/11/2022 | 0700/0700 | *** |  | UK | Index of Production |

| 11/11/2022 | 0700/0700 | ** |  | UK | Index of Services |

| 11/11/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 11/11/2022 | 1200/1300 |  | EU | ECB Panetta Speaks at ISPI | |

| 11/11/2022 | 1200/1300 |  | EU | ECB de Guindos Q&A at Encuentro de Economia en S'Agaro | |

| 11/11/2022 | 1310/1310 |  | UK | BOE Tenreyro Speech at Society of Professional Economists | |

| 11/11/2022 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 11/11/2022 | 1600/1700 |  | EU | ECB Lane Panels Jacques Polak Conference | |

| 11/11/2022 | 1600/1600 |  | UK | BOE Haskel Seminar at Bank of Israel |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.