-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese COVID Jitters Dominate

EXECUTIVE SUMMARY

- FED'S COLLINS DECLINES TO SAY HOW FAR FED WILL HIKE RATES (RTRS)

- FED'S BOSTIC SEES HIGHER 'LANDING' RATE, SMALLER DEC HIKE (MNI)

- RISHI SUNAK WON’T SEEK SWISS-STYLE RELATIONSHIP WITH BRUSSELS

- TORIES WANT TO CUT TAXES BEFORE NEXT ELECTION, SAYS NADHIM ZAHAWI (TELEGRAPH)

- BEIJING REPORTS COVID DEATHS, STOKING FEARS OF CURBS (BBG)

- COVID ZERO RETURNS TO CHINESE CITY RUMORED TO BE REOPENING (BBG)

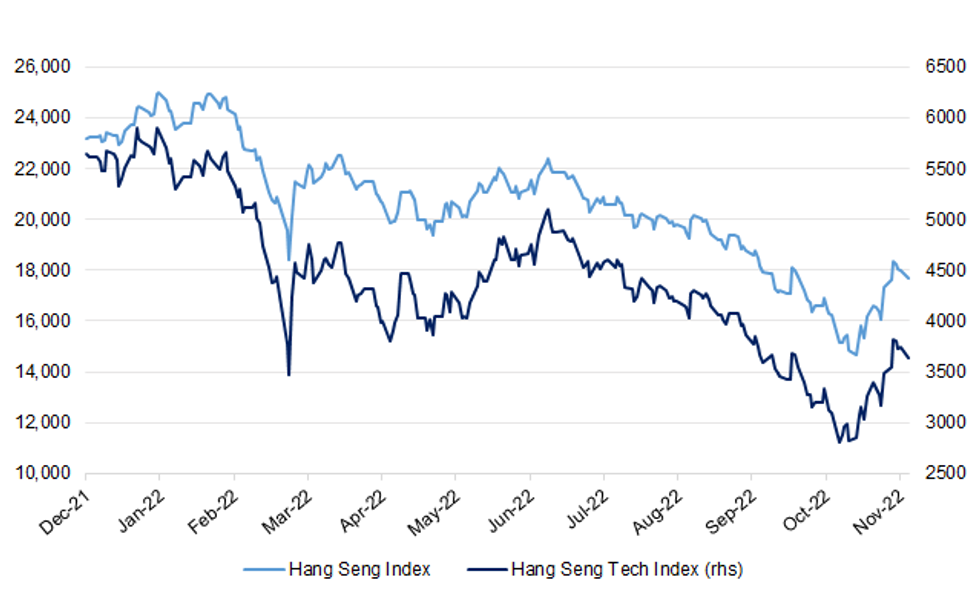

Fig. 1: Hang Seng & Hang Seng Tech Indices

Source: MNI - Market News/Bloomberg

UK

FISCAL: The Conservatives still want to cut taxes before the next election, party chairman Nadhim Zahawi has said, amid growing anger from party members over the Autumn Statement. (Telegraph)

FISCAL: Tory MPs are desperately hoping that a surprise spring economic revival will allow Jeremy Hunt to alter his tax-raising plans, amid warnings that the chancellor’s “stealth tax” autumn statement will extinguish the party’s election hopes. (Guardian)

ENERGY/FISCAL: Middle earners face a fresh income squeeze as the Government examines plans for “social tariffs”, which would see the energy bills of vulnerable households subsidised through levies on bills paid by the better off. (Telegraph)

POLITICS: Conservative MPs have faced a mixture of “anger and disbelief” from local members over the Autumn Statement as backbenchers prepare to speak out in the Commons. (Telegraph)

POLITICS: Jeremy Hunt’s Autumn Statement has failed to reassure the public about the economy and their personal finances, a new poll has found. (Telegraph)

POLITICS: The UK business community is shifting away from Rishi Sunak’s Conservatives and engaging more with Labour, according to an opposition MP who leads parliamentary scrutiny of the government’s business policies. (BBG)

ECONOMY: The chancellor's Autumn Statement offered no plan to revive economic growth, the head of the UK's biggest business lobby group has told the BBC. (BBC)

ECONOMY: Jeremy Hunt is to revive the idea of an industrial strategy after it was scrapped by his predecessor Kwasi Kwarteng, who said, while business secretary, that he wanted to move away from the “brand”. (Sunday Times)

BREXIT: Rishi Sunak has ruled out a Swiss-style relationship with the EU in which Britain would obey rules made in Brussels. Government figures have been talking privately about closer economic ties with the EU, citing Switzerland as an example, The Sunday Times reported. (The Times)

BREXIT: Rishi Sunak will on Monday face pressure from business to soften the economic effects of Brexit, including opening the doors to more immigration to fill holes in the country’s labour market. (FT)

NORTHERN IRELAND: The UK government will introduce new legislation today to extend the deadline for forming an executive in Northern Ireland. (Sky)

EUROPE

ECONOMY: The likelihood that the eurozone will fall into a deep recession this winter is receding according to economists who have scaled back their projections. (FT)

FRANCE: France will spend 8.4 billion euros ($8.67 billion) to help companies pay their energy bills, in a bid to cushion the impact of rising electricity and gas prices and help them compete with German businesses, its finance minister said on Saturday. (RTRS)

ITALY: Italy's new right-wing government plans to announce some 30 billion euros in new spending on Monday in a budget for next year, mainly focused on curbing the impact of high energy prices while postponing some of its most lavish election promises. (RTRS)

ITALY: Italy's cost of funding will rise to around 1.5% by year-end from a record low of 0.1% in 2021, Italian debt chief Davide Iacovoni anticipated to Reuters on Friday. Such a level would be the highest since 2013, after the euro zone debt crisis, when it rose to 2.08%, according to Treasury data. The head of the Italian Debt Management also told Reuters that conditions were not there for a U.S. dollar-denominated issue by the end of the year. "Market scenarios have radically changed, costs are too high and it would not be worth issuing a U.S. dollar bond before year-end", Iacovoni said, adding the Treasury was still committed to the U.S. bond market. (RTRS)

RATINGS: Sovereign rating reviews of note from after hours on Friday include:

- Fitch affirmed Italy at BBB; Outlook Stable

- Fitch affirmed Sweden at AAA; Outlook Stable

- Moody's affirmed Malta at A2, Outlook changed to Stable from Negative

- S&P affirmed Ireland at AA-, Outlook revised to Positive

- S&P affirmed Slovakia at A+; Outlook Negative

- DBRS Morningstar confirmed Lithuania at A (high), Stable Trend

U.S.

FED: The Federal Reserve might raise interest rates more than anticipated to combat high inflation but officials can slow the pace of tightening next month, Atlanta Fed President Raphael Bostic said in a speech on Saturday. (MNI)

FED: Federal Reserve Bank of Boston President Susan Collins on Friday declined to say how far the central bank will need to raise rates given uncertainty over the economic outlook. Fed rate rises this year have been swift and put monetary policy in a “different phase,” Collins told reporters on the sidelines of a conference hosted by the Boston Fed. But with questions rising over the stopping point for those increases, Collins said “I won’t give you a number.” The current federal funds target rate is between 3.75% and 4%. Collins is a voting member of the rate-setting Federal Open Market Committee. The Fed is widely expected to raise rates again at its December policy meeting. (RTRS)

POLITICS: Former President Donald Trump will be the subject of a second special counsel investigation, this one focused on his handling of classified documents found at his Mar-a-Lago home and “key aspects” of the investigation into his role in the Jan. 6 attack on the Capitol, Attorney General Merrick Garland said Friday. (NBC)

POLITICS: Twitter's new owner Elon Musk has said Donald Trump's account has been reinstated after running a poll in which users narrowly backed the move. (BBC)

OTHER

GLOBAL TRADE: President Xi Jinping started his week overseas mending ties with the US, and ended it with European leaders making the case for resisting the Biden administration’s sweeping chip curbs on China. (BBG)

GLOBAL TRADE: Chinese authorities are recruiting workers from villages and busing them to Foxconn’s iPhone assembly lines after the Apple partner suffered a staff exodus from its central China factory last month during a Covid-19 outbreak. (FT)

U.S./CHINA: U.S. Vice President Kamala Harris spoke briefly with Chinese leader Xi Jinping on Saturday in another step toward keeping lines of communication open between the two biggest economies. (ABC)

U.S./CHINA: U.S. Vice President Kamala Harris said on Sunday she had told China's President Xi Jinping that Washington does not seek confrontation with China but welcomes competition. "We welcome competition but we do not see conflict, we do not seek confrontation," Harris told a news conference at the U.S ambassador’s residence in Bangkok, ending an Asia trip that included meeting the Chinese leader. Harris said she also reiterated to Xi a message from President Joe Biden that "we intend to keep open lines of communication available because ... it is in the best interest of the globe and each nation". (RTRS)

U.S./CHINA: The US and China have resumed formal talks on climate change, amid friction over whether -- and how much -- the world’s top greenhouse gas emitters should contribute to helping nations bearing the brunt of global warming. (BBG)

U.S./CHINA: Kevin McCarthy, the Republican leader in the U.S. House of Representatives, said on Sunday he would form a select committee on China if he is elected speaker of the chamber, accusing the Biden administration of not standing up to Beijing. (RTRS)

EU/CHINA: Germany's foreign ministry plans to tighten the rules for companies deeply exposed to China, making them disclose more information and possibly conduct stress tests for geopolitical risks, a confidential draft document seen by Reuters said. (RTRS)

BOJ: The Bank of Japan faces mounting pressure to adjust its ultraloose monetary policy following October price data showing inflation significantly above its 2% target, with some market watchers predicting a tightening within a year. (Nikkei)

BOJ: The Bank of Japan’s 2% inflation target isn’t appropriate, and the next governor should assess whether it should be changed as the easy money policies deployed to achieve it have delayed structural reforms needed to boost productivity and wages, former BOJ executive director Kenzo Yamamoto told MNI. (MNI)

JAPAN: Japanese Prime Minister Fumio Kishida's government has suffered another setback ahead of its push to advance an economic stimulus plan in the parliament, with a third cabinet member resigning under pressure in just a month. Minoru Terada, minister for internal affairs and communications, stepped down Sunday following revelations of campaign finance irregularities. (Nikkei)

RBNZ: Shadow Board members recommend another hike in the Official Cash Rate (OCR) in the Reserve Bank’s upcoming November meeting. However, there was a range of views on the size of the increase. (NZIER)

SOUTH KOREA: South Korea’s Finance Minister Choo Kyung-ho, Bank of Korea Governor Rhee Chang-yong, Financial Services Commission Chairman Kim Joo-hyun and Financial Supervisory Service Governor Lee Bok-hyun have met every Sunday since mid-Oct., Maeil Business Newspaper reports, citing sources. (BBG)

HONG KONG: Hong Kong’s Hospital Authority chief has warned that a rapid rise in Covid-19 cases has put the city on the verge of cutting non-emergency services to meet increasing demand from patients infected with the virus. (SCMP)

NORTH KOREA: North Korea's foreign minister on Monday accused U.N. Secretary General Antonio Guterres of siding with the United States and failing to maintain impartiality and objectivity. (RTRS)

BOC: The Bank of Canada will raise its key interest rate a final half point Dec 7 and hold at 4.25% over the foreseeable future, Conference Board of Canada economist Pedro Antunes told MNI, with tight policy needed to keep inflation on a downward path in an economy he says will defy predictions of a painful recession. (MNI)

TURKEY: Turkey carried out air strikes against US-backed Kurdish militant groups in Iraq and northern Syria in retaliation for a deadly bombing that targeted civilians in Istanbul a week ago. (BBG)

TURKEY/RATINGS: Sovereign rating reviews of note from after hours on Friday include:

- Fitch affirmed Turkey at B; Outlook Negative

MEXICO/RATINGS: Fitch affirmed Mexico at BBB-; Outlook Stable

BRAZIL: Brazilian Economy Minister Paulo Guedes said on Friday the alleged conflict between social needs and fiscal sustainability posed by the new government-elect reveals "ignorance" and "technical inability" to solve problems. Speaking at an event hosted by the ministry, he said any retreat in any economic dimension in relation to what the current administration is doing will be a mistake. (RTRS)

RUSSIA: The White House said Friday that only Ukrainian President Volodymyr Zelensky can decide to open peace talks with Russia, rejecting the notion that it was pressing Kyiv to negotiate. (AFP)

RUSSIA: The U.N. nuclear watchdog, the International Atomic Energy Agency (IAEA), on Sunday condemned an attack on the Russian-controlled Zaporizhzhia nuclear power plant in Ukraine, demanding that those behind the explosions cease immediately. (RTRS)

SOUTH AFRICA: The Department of Public Enterprises says government and Eskom will find the money for diesel supplies. The utility has run out of fuel to help keep the lights on. (eNCA)

SOUTH AFRICA: South Africa’s state-owned power utility Eskom Holdings SOC Ltd. will resume power cuts from 5 p.m. on Sunday through Wednesday Nov. 23 due to high levels of breakdowns and depleted emergency generation reserves. (BBG)

SOUTH AFRICA/RATINGS: Sovereign rating reviews of note from after hours on Friday include:

- S&P affirmed South Africa at BB-; Outlook Positive

METALS: The London Metal Exchange’s decision not to ban Russian metal from its warehouses has triggered a rush to conclude contracts with the country’s two big producers. (BBG)

ENERGY: U.S. liquefied natural gas (LNG) company Freeport LNG said it was targeting a mid-December restart for its Texas export plant, which has been shut for six months after a fire, pending regulatory approval. (RTRS)

OIL: China's oil imports from Russia jumped 16% in October from the same month last year to just behind top supplier Saudi Arabia, as state-run firms stocked up before a European embargo over Russia's invasion of Ukraine kicked in. (RTRS)

CHINA

CORONAVIRUS: Beijing reported two more Covid deaths on Sunday as cases spiked, heightening concern the capital could see a return of tougher restrictions. (BBG)

CORONAVIRUS: A city near Beijing that was rumored to be a test case for China dispensing with all virus restrictions has suspended schools, locked down universities and asked residents to stay at home for five days, a potential sign officials are reverting to tighter Covid Zero curbs as cases multiply. (BBG)

CORONAVIRUS: Students in schools across several Beijing districts buckled down for online classes on Monday after officials called for residents in some of its hardest-hit areas to stay home, as COVID cases in China's capital and nationally ticked higher. (RTRS)

CORONAVIRUS: Local authorities in the Baiyun District of the southern Chinese city of Guangzhou locked down the area for five days from Nov. 21 to Nov. 25 as COVID-19 cases continue to mount. (RTRS)

CORONAVIRUS: China should rectify excessive Covid controls, while avoiding the relaxation of Covid prevention in the name of refining control measures, said Xinhua News Agency in a commentary. (MNI)

CORONAVIRUS: Macau will require mainland visitors to undergo one Covid nucleic acid test on day two of their arrivals, according to a government statement. (BBG)

PBOC: The People’s Bank of China is expected to further promote credit expansion with structural tools and increase the quota of policy bank-backed financial instruments to boost investment, China Securities Journal reported citing analysts. (MNI)

PBOC: China's reference lending rate remained unchanged on Monday, which was in line with market expectations as the central bank kept a key policy rate steady last Tuesday. (MNI)

PROPERTY: More tier-two cities are likely to relax restrictions for home purchases and loans following Xi’an efforts to boost demand for second-hand housing, according to the China Business Journal. (MNI)

BUSINESS: China has been left more reliant on large global businesses for direct foreign investment as strict Covid rules have alienated small and medium-sized firms, with prospective investors keen for Beijing to provide greater access and policy clarity, British Chamber of Commerce China managing director Steven Lynch told MNI. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY2 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) on Monday injected CNY3 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY2 billion after offsetting the maturity of CNY5 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.6830% at 9:47 am local time from the close of 1.7213% on Friday.

- The CFETS-NEX money-market sentiment index closed at 46 on Friday vs 44 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 7.1256 MON VS 7.1091 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1256 on Monday, compared with 7.1091 set on Friday. (MNI)

OVERNIGHT DATA

NEW ZEALAND OCT CREDIT CARD SPENDING +1.0% M/M; SEP +0.6%

NEW ZEALAND OCT CREDIT CARD SPENDING +24.8% Y/Y; SEP +34.0%

SOUTH KOREA NOV FIRST 20-DAY TRADE BALANCE -US$4.4180BN; OCT -US$4.9540BN

SOUTH KOREA NOV FIRST 20-DAY EXPORTS -16.7% Y/Y; OCT -5.5%

SOUTH KOREA NOV FIRST 20-DAY IMPORTS -5.5% Y/Y; OCT +1.9%

MARKETS

SNAPSHOT: Chinese COVID Jitters Dominate

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 1.03 points at 27900.33

- ASX 200 down 12.531 points at 7139.3

- Shanghai Comp. down 30.072 points at 3067.584

- JGB 10-Yr future up 2 ticks at 149.40, yield up 0.1bp at 0.25%

- Aussie 10-Yr future up 2.5 ticks at 96.410. yield down 2.8bp at 3.582%

- U.S. 10-Yr future up 0-06+ at 112-16, yield down 4.1bp at 3.7878%

- WTI crude down $0.87 at $79.21, Gold down $4.58 at $1746.10

- USD/JPY up 13 pips at Y140.50

- FED'S COLLINS DECLINES TO SAY HOW FAR FED WILL HIKE RATES (RTRS)

- FED'S BOSTIC SEES HIGHER 'LANDING' RATE, SMALLER DEC HIKE (MNI)

- RISHI SUNAK WON’T SEEK SWISS-STYLE RELATIONSHIP WITH BRUSSELS

- TORIES WANT TO CUT TAXES BEFORE NEXT ELECTION, SAYS NADHIM ZAHAWI (TELEGRAPH)

- BEIJING REPORTS COVID DEATHS, STOKING FEARS OF CURBS (BBG)

- COVID ZERO RETURNS TO CHINESE CITY RUMORED TO BE REOPENING (BBG)

US TSYS: Chinese COVID Worry & Fedspeak From Bostic Provide Support In Asia

Tsys firmed in Asia, with COVID worry out of China (localised restrictions in some of the big cities, in addition to the deaths of 3 elderly Beijing citizens, although some of those individuals had complex health issues) garnering most of the attention. This weighed on equities and crude, providing a bid for the USD & Tsys in the process.

- Cash Tsys sit 3-4bp richer across the curve, with the 2-/10-Year yield spread registering the deepest level of inversion witnessed during the current cycle in Asia-Pac hours.

- Elsewhere, the weekend saw Atlanta Fed President Bostic (’24 voter) support the idea of a stepdown in the pace of hikes in December, while he conceded that the terminal rate may be a little higher than previously envisaged he pointed to a desire to deliver a cumulative 75-100bp of tightening during the remainder of the current cycle (which would leave the Fed Funds target at 4.75-5.00%).

- This came after Friday saw Boston Fed President Collins (’22 voter) suggest that a 75bp hike would be on the table at the December FOMC.

- Overnight flow was headlined by a block buyer of FV futures (+1,720).

- Looking ahead, NY hours will see the release of the Chicago Fed national activity index, 5-Year Tsy supply and Fedspeak from Daly (’24 voter).

JGBS: Futures Recover While Long End Struggles

JGB futures unwound their overnight losses as the Tokyo session wore on, with the impetus from the broader bid in core global FI markets surrounding the previously outlined COVID worries in China (more localised restrictions & guidance in some of the big cities, in addition to the deaths of 3 elderly Beijing citizens over the weekend, some of whom had complex health conditions) and an average to low round of offer/cover ratios in BoJ Rinban operations covering 1- to 25-Year JGBs lending support.

- That left JGB futures +2 ahead of the bell, although the long end struggled to catch a bid after the early weakness That was perhaps linked to catch-up to Friday’s weakness in U.S. Tsys, leaving the major cash JGB benchmarks flat to 4bp cheaper at the bell, as the curve steepened.

- Local headlined flow was dominated by continued headwinds for PM Kishida, who lost a cabinet member to a resignation surrounding campaign financing irregularities.

- Looking ahead, a liquidity enhancement auction for off-the-run 1- to 5-Year JGBs will headline on Tuesday, ahead of Wednesday’s national holiday & resultant JGB market closure.

AUSSIE BONDS: Firmer & Flatter On Chinese COVID Worry, Supportive Cash Flow Noted

Aussie bond futures finished a touch shy of their respective Sydney peaks, with the light widening bias in EFPs perhaps partially indicative of the deployment of the cash flows from the maturity of ACGB Nov-22 and notable coupon payments in the ACGB sphere, which we flagged earlier today.

- YM finished +1.0, while XM was +2.5. Wider cash ACGB trade saw 1-4bp of richening, with the super-long end outperforming as the curve bull flattened.

- Local headline flow was light, leaving the aforementioned cash flow and previously covered macro drivers (most notably the COVID situation in China) at the fore, resulting in a bid for the space and an unwind of the early losses, inspired by overnight price action in futures/U.S. Tsys.

- Bills finished +2 to -3 through the reds, with the strip twist steepening.

- Looking ahead, this week’s local docket is headlined by RBA Governor Lowe’s Tuesday dinner address on “Price Stability, the Supply Side and Prosperity.”

NZGBS: Swap Spreads Widen A Touch Ahead Of RBNZ

NZGBS nudged away from session cheaps on the latest round of COVID developments in China. However, the move in the space was very limited, leaving the major benchmarks 2.0-3.5bp cheaper at the bell, as the curve bear flattened after some initial catch up to Friday’s cheapening in U.S. Tsys.

- Swap rate moves were marginally more pronounced, resulting in some light swap spread widening across the curve. This may have been a result of some pre-RBNZ hedging via payside swap flow.

- A reminder that the wider consensus looks for a 75bp hike in the OCR at this week’s RBNZ meeting, before the Bank’s 3-month hiatus.

- Just over 65bp of tightening is priced into RBNZ dated OIS covering this week’s meeting, with a terminal rate of just over 5.10% priced. Both measures were incrementally higher vs. late Friday levels.

- Looking ahead, monthly trade balance data headlines the domestic docket on Tuesday.

FOREX: Flight To Safety To Start The Week

The USD is higher against all the majors at the start of the week, albeit to varying degrees. Traditional safe havens JPY and CHF have outperformed amid cross asset headwinds from the equity/commodity space. The main driver of sentiment has been negative China covid developments, as restrictions rise to curb the spread of the current outbreak.

- The BBDXY is +0.30%, last around 1286.60. EUR/USD is down sub 1.0300 (last 1.0285, -0.40%). Losses in the pair have accelerated somewhat this afternoon. Recent lows come in around 1.0270/80. GBP/USD has fallen to 1.1835/40.

- USD/JPY has crept higher, last just above 140.50. USD/CHF is just above 0.9550.

- AUD/USD was an underperformer, not helped by China developments, but found some support under 0.6640 (last 0.6645). NZD/USD is back to 0.6135, outperforming the weaker AUD trend though. AUD/NZD touched close to 1.0800 in the early trading today, lows last seen in April. Relative central bank divergences continue to weigh on the cross.

- Coming up later is Germany's PPI and BoE’s Cunliffe speech, while in the US the Chicago Fed’s November National Activity Index is out. The Fed's Daly ('24 voter) also speaks.

FX OPTIONS: Expiries for Nov21 NY cut 1000ET (Source DTCC)

EUR/USD: $1.0200-25(E1.1bln), $1.0280-00(E563mln)

USD/JPY: Y140.00($1.1bln)

USD/CAD: C$1.3300($554mln)

USD/CNY: Cny7.1000($590mln)

OIL: Oil Prices Weighed Down By Covid Restrictions In China

Oil prices are down again today, as news of new Covid restrictions in China boosted the USD and reinforced Friday’s crude demand concerns. WTI and Brent are currently down around 1% from the NY close after ending last week sharply lower.

- Oil prices remain in narrow ranges. WTI crude is off of its intraday low of $79.18 and trading under $80/bbl at $79.20 after reaching a high of $80.30 earlier. Brent is also off its low of $86.40 at around $86.75. It reached a high of almost $88 earlier in the session.

- Winter oil demand has so far been declining, despite the impending European sanctions against Russian oil. (ANZ)

- Goldman Sachs also reduced its oil price forecasts for Q4 by $10/bbl, now expecting Brent to rise to only $100. The revision was principally due to the prospect of further Covid restrictions in China.

- The only events of note tonight are BoE’s Cunliffe speech and the Chicago Fed’s November National Activity Index.

GOLD: Stronger USD Weighs On Gold Prices

After falling throughout the Friday overnight session, gold prices have trended down again during APAC trading. They rose slightly to a high of $1753.05 and then fell to a low of $1743.97 and are now trading around $1747. The USD has been boosted (+0.2%) by a risk-off move in the wake of increased Covid restrictions in China and is weighing on bullion.

- Gold remains above the October 4 high of $1729.50 pointing to bullish short-term trend conditions. $1800 is the next level to watch and key resistance is at $1807.90. Initial support is at $1702.30, the November 9 low.

- There is little overnight to drive gold prices, as they have recently been dependent on the direction of the debate surrounding the next Fed move and economic data. The only events of note are BoE’s Cunliffe speech and the Chicago Fed’s November National Activity Index.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 19/11/2022 | 1345/1345 |  | UK | BOE Dhingra Panels Ditchley Economics Conference | |

| 19/11/2022 | 1845/1345 |  | US | Atlanta Fed's Raphael Bostic | |

| 20/11/2022 | 1930/2030 |  | EU | ECB Lagarde at European Roundtable for Industry | |

| 21/11/2022 | 0115/0915 |  | CN | PBOC LPR | |

| 21/11/2022 | 0700/0800 | ** |  | DE | PPI |

| 21/11/2022 | 0905/0905 |  | UK | BOE Cunliffe Speech at Warwick Conference | |

| 21/11/2022 | 1530/1530 |  | UK | DMO Announces Agenda for Consultation Meetings | |

| 21/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 21/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 21/11/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 21/11/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 21/11/2022 | 1800/1300 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.