-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN MARKETS ANALYSIS: NZD Vol. Observed Overnight, Chinese PMIs Miss

- NZD saw options-related vol. overnight as AUD/NZD cracked below NZ$1.0400.

- Chinese equities and the yuan underperformed in their respective spheres in the wake of disappointing official Chinese PMI data.

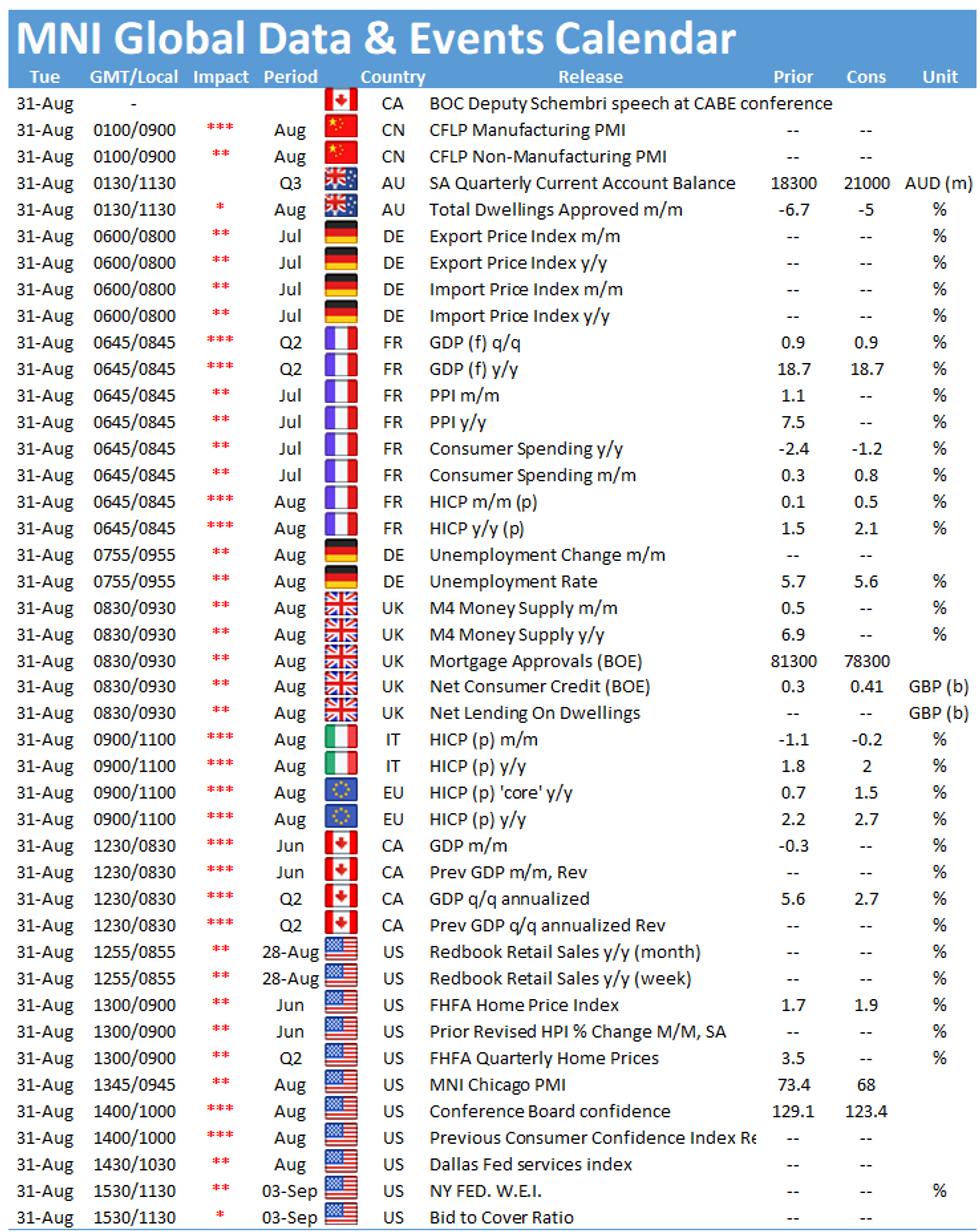

- The latest U.S. MNI Chicago PMI & consumer confidence prints, as well as the Eurozone CPI readings, are set to take focus on the data front today. Meanwhile, the central bank speaker slate includes ECB's Holzmann, Knot & Lane as well as Riksbank's Floden.

BOND SUMMARY: Core FI Off Best Levels In Tight Asia Trade

A softer than expected non-manufacturing PMI out of China saw a contractionary print for the first time since Feb '20 (and was accompanied by a largely in line with exp. manufacturing print) provided some support for T-Notes, although the contract stuck to a thin 0-04+ range in Asia dealing. The contract last deals +0-03 at 133-20, 0-02 off highs, while the major cash Tsy benchmarks trade little changed to ~0.8bp firmer on the day. The PMI data represent the latest round of disappointing economic releases out of China, with worry evident re: the country's growth trajectory and expectations building for increased fiscal support (via an uptick in local government bond issuance) in the coming months. Tuesday's U.S. docket will be headlined by the latest MNI Chicago PMI print and consumer confidence reading.

- A lacklustre Tokyo session saw JGB futures add incrementally to their modest overnight uptick, before some cheapening was witnessed, with the contract last -2. Cash JGB trade has seen 7s outperform, richening by ~1.0bp with the remainder of the curve printing somewhere between little changed and ~0.5bp richer on the day. Speculation surrounding budget requests for next FY and a potential cabinet reshuffle did the rounds. 2-Year JGB supply passed smoothly, especially when you consider the perceptions around a lack of onshore demand, with the cover ratio ticking higher and price tail narrowing vs. the prev. auction. Elsewhere, the low price topped broader dealer exp. (which stood at 100.26, per the BBG dealer poll). Offshore interest likely aided the takedown of today's auction.

- Aussie bond futures stuck to tight ranges, leaving YM +0.5 & XM unch. at typing. Local data was mixed, with private sector credit topping exp., building approvals missing and a slightly narrower than exp. Q2 BoP current a/c surplus observed alongside an as exp. net export contribution to GDP reading (-1.0ppt). The space also looked through the previously flagged Chinese PMI readings and today's NSW COVID case count, which was a little shy of yesterday's record print. Elsewhere on the COVID front, Canberra extended its lockdown through mid-Sep.

FOREX: AUD/NZD Dips Amid Broken Barrier Chatter, Loonie Lags G10 Pack

AUD/NZD plunged to its lowest point since Apr 2020 amid talk of broken barrier option at NZ$1.0400, with BBG trader source pointing to poor liquidity in the NZD leg. The Kiwi dollar remained comfortably the best G10 performer and modest improvement in the local Covid-19 situation may have helped it cling onto the bulk of gains registered on the back of the aforementioned downswing in AUD/NZD. New Zealand reported 49 new cases today, the lowest number in six days and all of them in Auckland. The alert level in all areas south of Aotearoa's largest city will be moved down a notch at midnight today.

- Other commodity-tied currencies traded on a softer footing as crude oil cheapened. The loonie suffered the largest loss amid uncertainty surrounding the outcome of PM Trudeau's political gambit, with the Premier set to fight an uphill re-election battle after calling a snap poll.

- Spot USD/CNH crept higher before giving away most gains. The rate showed a muted reaction to a miss in China's official Non-M'fing PMI, which unexpectedly flipped into contraction.

- The greenback struggled for any momentum and the DXY printed its worst levels in two weeks while testing its 50-DMA.

- London trading reopens after a UK bank holiday, with U.S. MNI Chicago PMI & consumer confidence, German unemployment and EZ CPI set to take focus on the data front today. Central bank speaker slate includes ECB's Holzmann, Knot & Lane as well as Riksbank's Floden.

ASIA FX: Yuan Lags Peers After Soft PMI

The greenback struggled for direction and DXY printed worst levels in two weeks as it tested its 50-DMA, most Asia EM currencies therefore managed gains despite mostly risk off sentiment in the region.

- CNH: Offshore yuan heads into Europe flat, USD/CNH crept higher before giving away most gains. The rate showed a muted reaction to a miss in China's official Non-M'fing PMI, which unexpectedly flipped into contraction.

- SGD: Singapore dollar is stronger, though USD/SGD has stayed above yesterday's low of 1.3440. There were 147 new coronavirus cases in the past 24 hours, above 100 for the seventh day.

- TWD: Taiwan dollar is stronger USD/TWD lower for the sixth session out of the past seven. The increase yesterday was the biggest one-day gain in six weeks as the rate played catch up with a weaker USD and TWD benefitted from foreign inflows into the Taiex.

- KRW: Won is stronger, benefitting from industrial production data and the announcement of an expansionary 2022 budget that represents an 8.3% increase on this year.

- MYR: Markets closed for National Day.

- IDR: Rupiah is higher, Pres Widodo announced an extension to Covid-19 restrictions through Sep 6, while loosening curbs in some localities, after the daily nationwide case count fell to the lowest point since Jun 3.

- PHP: Peso rose, BSP Gov Diokno told reporters that the central bank expects consumer-price inflation to settle within +4.1%-4.9% Y/Y range this month. Higher LPG, electricity and food prices as well as peso weakness are seen as key drivers of inflation, but may be offset by cheaper oil and lower rice prices to some degree.

- THB: Baht is stronger, Thailand reported its lowest daily count of new Covid-19 infections in more than a month and the lowest number of deaths in two weeks. There are a slew of Thai data releases coming up today, including BoP current account balance and trade balance

ASIA RATES: PBOC Brings August Liquidity Addition To CNY 200bn

- INDIA: Yields lower in early trade, 10-Year yield dropping to its lowest since August 18. It is a busy session today; participants will digest GDP data and a speech from RBI Governor Das today. Das will speak at the annual FIMMDA-PDAI conference later today, he said last week that the RBI is in no hurry to adjust policy settings and will telegraph any changes to markets well in advance, emphasizing that the recovery has some way to go. Meanwhile fiscal deficit data is on the docket and Q2 GDP figures will be published at 1300BST/1730IST. GDP is expected to have grown 21% Y/Y. Indian states will sell bonds today.

- SOUTH KOREA: Futures higher with cash yields lower and some bull steepening evident. South Korea has proposed a record high budget of KRW 604.4tn for next year as it plans to maintain expansionary fiscal spending to cement the economic recovery and narrow social gaps caused by the pandemic; the budget represents an 8.3% rise from the current year. The government plans to submit the budget proposal to the National Assembly on Friday for approval. To finance the budget South Korea will issue up to KRW 77.6tn, bringing total issuance in 2022 to KRW 167.4tn; this compares to KRW 186.3tn in 2021 and issued KRW 174.5tn in 2020.

- CHINA: The PBOC injected a net CNY 40bn via OMO's today, the fifth day of injections heading into month-end that brings additional liquidity to CNY 200bn. The PBOC has reiterated that the injections are to ensure liquidity into month end and should not be seen as easing, the Central Bank injected a net CNY 40bn at the end of July and CNY 100bn at the end of June. The overnight repo rate rose some 38bps to 2.2087% while the 7-day repo rate fell 5bps to 2.35%. Bond futures higher for a third straight session amid some risk off sentiment in the region. 10-Year just shy of a contract high of 100.235 hit at the start of August.

- INDONESIA: Curve twist flattens, Pres Widodo announced an extension to Covid-19 restrictions through Sep 6, while loosening curbs in some localities, after the daily nationwide case count fell to the lowest point since Jun 3. Indonesia's Markit M'fing PMI will be released tomorrow, just hours ahead of the monthly CPI report. Last Friday, Bank Indonesia estimated August CPI to be +1.57% Y/Y based on their weekly survey.

EQUITIES: China Leads The Way Lower

A mostly negative session for markets in the Asia-Pac region, shaking off a positive lead from the US where major indices once again hit record highs. Bourses in China lead the way lower with losses of around 1.4%; PMI data fell with non-manufacturing in contractionary territory while the regulatory crackdown continues. The CSRC said it will target private equity funds that are sold to the general public instead of targeted investors in a bid to address embezzlement of assets. Chinese President Xi said China must strengthen anti-monopoly work and will push forward reform. Markets in Japan are also lower, Japanese media suggested that PM Suga considers a plan to hold the general election on Oct 17. In South Korea markets managed to stay in positive territory after the government announced plans for another expansionary budget that is 8.3% bigger than the current year. In the US futures are higher, the S&P 500 recorded a record high yesterday – the 12th in August. Markets look ahead to CPI and GDP data from around Europe later today and will have one eye on US NFP figures later this week.

GOLD: Stable In Asia

Bullion has consolidated in Asia, with spot last dealing little changed just above $1,810/oz. This comes after the broader USD and U.S. real yields stabilised on Monday, after coming under pressure in the wake of Fed Chair Powell's comments on Friday. In turn, bullion edged away from its Asia-Pac highs during the first trading session of the week, leaving a familiar technical overlay in play.

OIL: Crude Futures Set For Worst Month Since Oct 2020

Oil is lower in Asia-Pac trade, losing ground amid risk off sentiment in the region. Crude futures finished with slight gains yesterday after recovering from session lows hit in the European morning. On a monthly basis futures are on track to finish around 6% lower, the worst week since October 2020. Markets continue to weigh the restoration of production in the Gulf of Mexico as the threat from Hurricane Ida recedes, while looking ahead to the latest OPEC+ meeting Wednesday. The group will assess the impact on demand from the spread of the delta variant and its implications for plans to return 400k bpd of supply to the market.

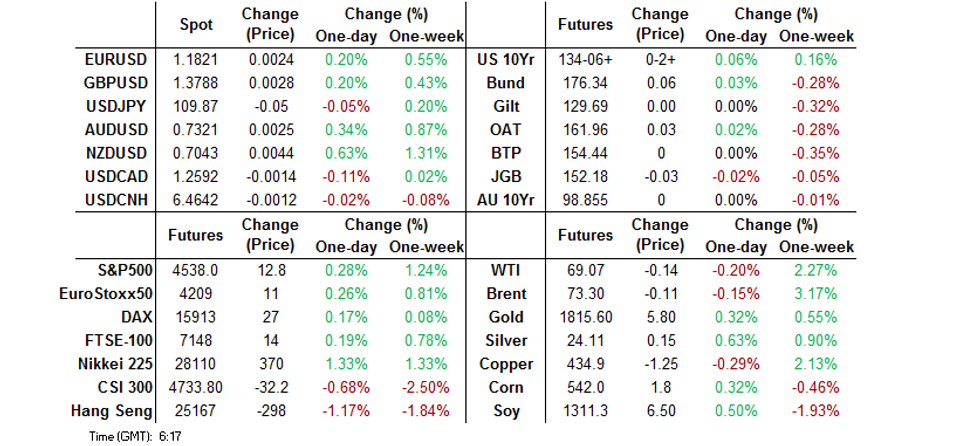

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.