-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese Regulatory Burden Grows

EXECUTIVE SUMMARY

- CHINA TAKES NEXT STEP IN TAMING BIG TECH WITH PERSONAL DATA LAW (BBG)

- CHINA DELAYS VOTE ON HONG KONG ANTI-SANCTIONS LAW (SCMP)

- SYDNEY & NEW ZEALAND EXTEND LOCKDOWNS

- ORR: NEXT RBNZ MEETING 'LIVE' EVEN IF OUTBREAK PERSISTS (BBG)

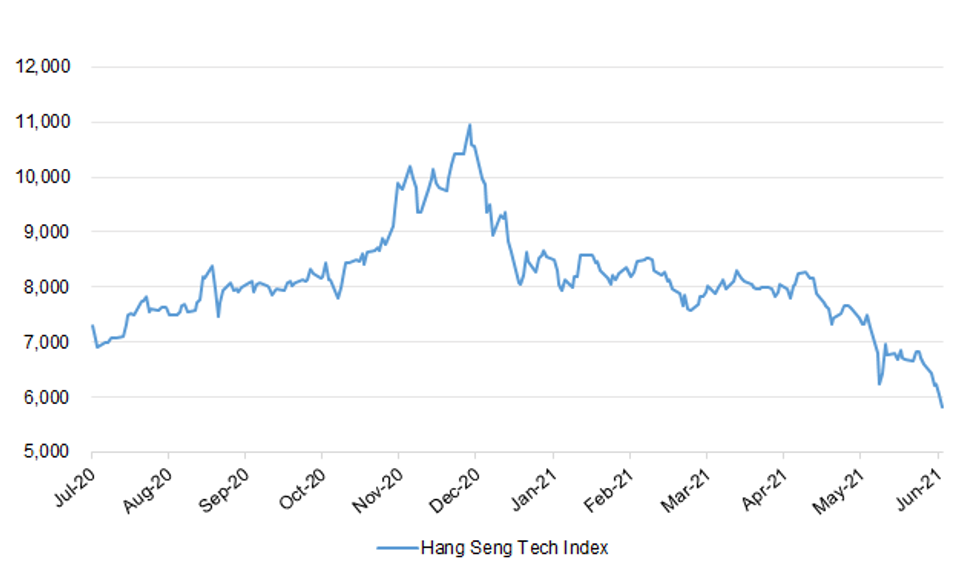

Fig. 1: Hang Seng Tech Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The mass rollout of Covid booster vaccines to all over-50s this autumn could be shelved, with government scientists considering limiting third jabs to the most vulnerable. The NHS had drawn up plans to roll out a booster programme from September, based on interim advice from the Joint Committee on Vaccination and Immunisation (JCVI). But sources close to the committee told The Telegraph there is limited evidence to support such an approach and a "far more restricted" group, focused on those most in need, may be targeted. The JCVI is expected to issue final recommendations by early September, with Sajid Javid, the Health Secretary, having said he anticipated a rollout starting later the same month. (Telegraph)

ECONOMY: MNI REALITY CHECK: UK Summer Season To Underpin Retail Sales

- UK retail sales likely rose modestly in July, extending a marginal increase seen in June, with clothing sales reviving as social events return to the summer calendar, key industry leaders told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

EUROPE

FISCAL: MNI INTERVIEW: Eurozone Debt Reform Essential, But Treaty Stays

- The eurozone should reform strict rules on borrowing but changing European treaties is too hard and key provisions including a 60% debt-to-GDP limit cannot be ignored, a senior German member of the European Parliament's biggest conservative force told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

GERMANY: SPD candidate Scholz can expand his lead in the race for the Chancellery. Green candidate Baerbock and Union candidate Laschet lose. This is shown by the new ARD Germany trend. In the competition between the candidates for chancellor in the federal election in September, the SPD candidate Olaf Scholz has risen sharply in favor of the voters. In a direct election, instead of 35 percent, as at the beginning of August, 41 percent would now vote for the SPD politician - an increase of six percentage points. This is shown by the results of the ARD Germany trend for the ARD morning magazine. On the other hand, it looks bad for the other two candidates for chancellor: Only 16 percent (-4) would prefer Armin Laschet in the Chancellery, after 20 percent at the beginning of the month. And for the Greens' first candidate for chancellor, Annalena Baerbock, only twelve percent of the voters would vote, also four percentage points less than last. Three out of ten voters (31 percent; +2) can or still do not want to commit to any of the three politicians. (Tages Schau)

GERMANY: The German economy is on track for a lasting, probably stronger recovery in the third quarter driven by lively domestic demand after gross domestic product expanded by 1.5% on the quarter from April to June, the finance ministry said on Friday. A third wave of coronavirus infections and a longer-than-expected lockdown caused the economy, Europe's largest, to shrink by 2.1% in the first three months of the year compared to the previous quarter. The finance ministry said in its monthly report that sentiment surveys and forward-looking indicators such as truck toll mileage pointed to "unbroken optimism" among businesses and high activity in the economy over the summer months. (RTRS)

SWITZERLAND: The Swiss expect next month's popular initiative to raise the tax on income from capital, such as dividends or rent, to fail. Nearly three quarters of respondents anticipate the measure will be rejected, according to a poll for national broadcaster SRG. Still, the survey conducted earlier in August found 46% of respondents backed the initiative, while 9% were undecided. Switzerland's left is pushing to increase levies, arguing inequality has risen and want the proceeds used for social-welfare projects. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- S&P on Estonia (current rating: AA-; Outlook Stable) & Switzerland (current rating: AAA; Outlook Stable)

U.S.

FED: Federal Reserve Chair Jerome Powell will speak on "the economic outlook" at next week's Jackson Hole, Wyoming symposium, the central bank said on Thursday. The generic description for the highly anticipated speech contrasts with last year's more specific listed subject for the address, "Monetary Policy Framework Review," and gives investors and analysts no immediate clues on the Fed's timeline for withdrawing its support for the economy. Minutes of the Fed's July meeting suggest policymakers are coalescing around beginning to taper their $120 billion in monthly asset purchases before the end of the year. Some analysts expect Powell to lay out a clearer roadmap next week, particularly if he wants to keep the door open to an earlier start to tapering as favored by some Fed policymakers worried by recent high readings on inflation. Powell himself has argued that those readings are likely temporary. (RTRS)

ECONOMY: U.S. Treasury Secretary Yellen says delta variant may challenge local markets, economy. (BBG)

FISCAL: The Biden administration said in a letter to lawmakers Thursday that it's "appropriate" for expanded unemployment benefits to expire as scheduled in a little more than two weeks, but that states and local governments can use pandemic-relief funds for added help beyond the deadline amid the surge of the delta variant. (BBG)

CORONAVIRUS: The U.S. recorded more than 1 million Covid-19 shots on Thursday, topping that level for the first time in almost seven weeks, a White House official said. Of the 1.02 million doses, 562,000 were given to people who were getting their first shot. (BBG)

CORONAVIRUS: The U.S. Centers for Disease Control and Prevention has pushed back by one week a meeting by a group of outside advisers who were set to review Covid booster shots as debate swells about the need for a third dose. The Advisory Committee for Immunization Practices, originally scheduled to meet and possibly make a recommendation about the need for boosters on Aug. 24, is now set to convene the following week. (BBG)

CORONAVIRUS: Once delta infections begin to slow down, Covid-19 could become an endemic disease that remains in the population at low levels, like the flu, though Covid-19 is much deadlier. Unlike the flu that requires annual shots, Fauci said he doubts Covid will need recurrent boosters to maintain high levels of protection. "I doubt seriously but I don't know for sure that we're going to be able to say 'we're going to no longer need boosts every X numbers of months,' I don't think that's going to be the case, I think this third shot will take us a long way," Fauci said. (CNBC)

CORONAVIRUS: CDC Director Dr. Rochelle Walensky said Thursday that Americans may not need yearly Covid-19 booster shots, suggesting that a third shot may sufficiently strengthen the long-term protection of Pfizer or Moderna's vaccines. Walensky's remarks come a day after she other top U.S. health officials said they plan to start offering boosters to all eligible Americans eight months after their second vaccine shots. The effectiveness of mRNA vaccines lessens over time, particularly for anyone at high risk for dangerous coronavirus complications or for those who were immunized early in the vaccine rollout, Walensky and several of the country's top medical officials said in a statement Wednesday. (CNBC)

CORONAVIRUS: Florida and Texas are opening free monoclonal antibody centers to treat a surge in Covid-19 patients in both states, hoping early intervention will help keep people out of the hospitals and save more lives — even as the governors of both states fight local officials on mask and vaccine mandates. (CNBC)

CORONAVIRUS: Tennessee intensive care beds are full in most metropolitan areas because of the wave of Covid-19 patients, state hospital officials said on Thursday. (BBG)

CORONAVIRUS: Georgia Governor Brian Kemp signed an executive order Thursday prohibiting local governments from requiring masks or other Covid-19 protection measures at private businesses. He said the order was prompted by mask mandates in Atlanta and Savannah, both of which have been in place for weeks. Savannah Mayor Van Jones has also said he is considering limiting indoor crowd sizes. (BBG)

CORONAVIRUS: Pressure is mounting on New York City Mayor Bill de Blasio to reverse his stance on a virtual option for students. (BBG)

CORONAVIRUS: All Oregon teachers, support staff and volunteers must be vaccinated by Oct. 18, or within six weeks of full vaccine approval by the U.S. Food and Drug Administration, whichever is later, Governor Kate Brown said Thursday. (BBG)

CORONAVIRUS: Apple Inc. is delaying its return to corporate offices from October until January at the earliest because of surging Covid-19 cases and new variants, according to a memo sent to employees on Thursday. The company told staff it would confirm the re-opening timeline one month before employees are required to return to the office. Apple had previously aimed to require all staff to return to corporate offices by early September before delaying that until October. When employees are required to return, they will be expected to work at the office at least three days a week -- Mondays, Tuesdays, and Thursdays -- with remote work on Wednesday and Friday available. (BBG)

OTHER

U.S./CHINA: Chinese authorities have shut down a U.S. labor auditor's local China partner, escalating Beijing's campaign to counter forced-labor allegations in its northwest Xinjiang region and potentially complicating efforts by multinationals to certify supply chains in the country. China-based Shenzhen Verite, which is affiliated with U.S. labor rights nonprofit Verite Inc., was closed following an April raid on its offices by Chinese security forces, according to people with knowledge of the matter. Though Verite was a small player in China's auditing industry, companies including Walt Disney Co. and Apple Inc. have hired the Amherst, Mass.-based company to consult on labor issues at Chinese factories. The closure of its Shenzhen-based partner means that Verite has effectively lost its ability to operate in the Chinese market, depriving companies of a potential channel to conduct labor audits and research in China. (WSJ)

GEOPOLITICS: Vice President Kamala Harris' upcoming trip to Vietnam and Singapore will show that the Biden administration is committed to a "free and open Indo-Pacific" and that the United States is in the region to stay, a senior administration official said on Thursday. Harris' trip to Asia aims to establish deeper ties with a network of allies in Southeast Asia, which the United States considers key to checking Chinese expansion. (RTRS)

GEOPOLITICS: U.S. federal health officials are investigating emerging reports that the Moderna coronavirus vaccine may be associated with a higher risk of a heart condition called myocarditis in younger adults than previously believed, according to two people familiar with the review who emphasized the side effect still probably remains uncommon. The investigation, which involves the Food and Drug Administration and the Centers for Disease Control and Prevention, is focusing on Canadian data that suggests the Moderna vaccine may carry a higher risk for young people than the Pfizer-BioNTech vaccine, especially for males below the age of 30 or so. The authorities also are scrutinizing data from the United States to try to determine whether there is evidence of an increased risk from Moderna in the U.S. population. (Washington Post)

CORONAVIRUS: The United States is expanding manufacturing of Covid-19 vaccines to donate more doses to countries that don't have as much access to the life-saving shots. "We are now working on greatly expanding the capacity to allow us to donate hundreds and hundreds of millions of doses to the low and middle income countries," Dr. Anthony Fauci, medical advisor to the president, said in an interview Thursday on CNBC's "Closing Bell." (CNBC)

HONG KONG: China's top legislative body has postponed a vote on a proposal to impose an anti-sanctions law on Hong Kong, the South China Morning Post reported, delaying a move that could put global firms in the cross-hairs of a conflict between the world's two largest economies. The central government "hopes to listen to further views on the matter," the newspaper reported, citing a person familiar with the matter. No other details, such as when the legislation might be approved, were provided. The National People's Congress Standing Committee had been expected to pass a resolution Friday adding China's anti-sanctions legislation to Hong Kong's Basic Law. The city would likely need to pass local legislation before it can be fully implemented, said Chief Executive Carrie Lam, adding that doing so before the current Legislative Council term ends on Oct. 30 would be "an extremely tight timetable." (BBG)

AUSTRALIA: Sydney's two-month long lockdown will be extended until at least the end of September as the delta variant outbreak in Australia's most populous city worsens. From Monday, outdoor mask-wearing will be mandatory when outside, except when exercising, in all regions throughout New South Wales, Premier Gladys Berejiklian said. A curfew will be placed on areas of western Sydney hardest hit by the outbreak. More than half of Australia's 26 million people are in lockdown. In New Zealand, the country's three-day lockdown was due to be lifted on Friday in most areas, though that plan may be in jeopardy after a report of 11 new cases. The outbreaks are placing unprecedented pressure on the so-called Covid Zero strategy pursued by both countries since the start of the pandemic. (BBG)

AUSTRALIA/CHINA: The China-Australia trade bubble may burst with iron ore prices returning to a more regular range and as China curbs its steel production to reduce carbon emissions, the Global Times said in an editorial. Demand for iron ore has also slowed with unprecedented rains across the country and the pandemic disrupted some production, the newspaper said. The iron ore trade may shift to a buyer's market as China, the world's largest iron ore consumer, pushes ahead with carbon neutrality targets, the newspaper said. China's total imports from Australia rose 37.4% y/y in the first seven months even as China tried to limit imports due to deteriorating bilateral relations. (MNI)

NEW ZEALAND: The NZ Herald notes that "New Zealand's level-4 lockdown has been extended nationwide until 11:59pm on Tuesday after confirmation the Covid-19 outbreak has spread to Wellington. The government will decide on Monday - based on latest cases and information - whether to reduce levels or extend by region, the Herald understands." (NZ Herald)

RBNZ: New Zealand central bank Governor Adrian Orr gave the clearest indication yet that policy makers plan to raise the official cash rate at their next meeting in October, even if there are still cases of Covid-19 in the community. "Of course October is a live meeting," Orr said in an interview Friday on Bloomberg Television. Covid cases alone would not prevent the Reserve Bank from tightening policy, he said, adding it would take "a significant shock to demand" to change that view. "What we've learned through time is that incomes remain strong, demand bounces back very quickly, and that these rolling lockdowns will continue for a while," Orr said. "We have to focus very much on our purpose, which is of course the inflation and employment mandate that we have." (BBG)

SOUTH KOREA: South Korea decided to extend curfew hours for restaurants and cafes under the toughest social distancing restrictions by one hour, Prime Minister Kim Boo-kyum announced Friday, as the country struggles to contain the spread of COVID-19. Restaurants and cafes in regions under Level 4 social distancing rules will be required to close at 9 p.m., an hour earlier than the current 10 p.m., starting Monday. The readjustment was announced as the government decided to extend its tough social distancing restrictions for two more weeks. The greater Seoul area, encompassing the capital, Gyeonggi Province and the western port city of Incheon, will remain under Level 4 distancing rules, while most of other regions will be subject to Level 3 until Sept. 5. (Yonhap)

MEXICO: Mexico is evaluating how to regulate worker conditions in the nation's fast growing gig economy, which could involve legal changes, said Labor Minister Luisa Maria Alcalde. The country is working with the Social Security Institute and Mexico City authorities on a plan to regulate digital platforms, Alcalde said in an interview Thursday. There's no proposal yet, she said, but there should be a clearer plan in the coming months. App contractors around the globe have pushed for an expansion of labor rights, leading the U.K. Supreme Court to rule that Uber Technologies Inc. drivers are workers who should get paid for wait time, and Spain's Labor Ministry to pledge access to social security. Companies like Uber and DiDi Global Inc argue that the current arrangement gives drivers freedom to be their own bosses and put otherwise idle resources to use. (BBG)

TURKEY: Europe cannot isolate itself from the migration problem by tightly sealing its own borders, Turkey President Recep Tayyip Erdogan said. Turkey is increasing security at its eastern border with Iran and deporting illegal migrants from Afghanistan, Erdogan said. Turkey does not have to be Europe's refugee depot, he added. (BBG)

BRAZIL: Brazilian lawmakers plan to modify the text of the tax reform bill in the next two weeks and attempt a vote on the proposal in the first week of September, Folha de S. Paulo newspaper reported without citing how it obtained the information. Economy Ministry representatives became worried about changes made in the bill during recent negotiations and suggested abandoning the bill, a move which displeased Lower House Speaker Arthur Lira. Dividends to have a progressive tax, Folha said. Presidential Palace representatives are concerned about govt's new social program, which is linked with tax reform, Folha said. (BBG)

SOUTH AFRICA: In a statement issued on Thursday 19 August, Eskom said that should further generating capacity losses occur, they will have no choice but to once again plunge the country into darkness. "Eskom would like to appeal to the members of the public to reduce the usage of electricity as the power system is under severe pressure following the loss of four generating units since this morning," they said. (The South African)

AFGHANISTAN: Video showed the advancing insurgents inspecting long lines of vehicles and opening crates of new firearms, communications gear and even military drones. "Everything that hasn't been destroyed is the Taliban's now," one U.S. official, speaking on the condition of anonymity, told Reuters. Current and former U.S. officials say there is concern those weapons could be used to kill civilians, be seized by other militant groups such as Islamic State to attack U.S.-interests in the region, or even potentially be handed over to adversaries including China and Russia. (RTRS)

AFGHANISTAN: The U.S. government is "laser focused" on the potential for a terrorist attack in Afghanistan by a group like ISIS-K, a sworn enemy of the Taliban, White House national security adviser Jake Sullivan told NBC Nightly News on Thursday. (RTRS)

ISRAEL: Loud explosions shook the Syrian capital late on Thursday as state media reported Israeli airstrikes around Damascus. The state-news agency SANA said Syrian air defenses confronted the Israeli planes, while the pro-Syrian government Cham FM Radio reported airstrikes in the Damascus countryside and in the central province of Homs. (AP)

CHINA

PBOC: China's central bank is expected to further cut banks' reserve requirement ratios in line with the "cross-cycle adjustment" policies that lean toward loosening and also to ensure the market's rising liquidity needs are met, the China Securities Journal reported citing the consensus of several analysts. There is a CNY2.45 trillion total of MLFs maturing in Q4 that may need to be renewed, the newspaper said citing analyst Zhou Yue of Zhongti Securities. Cutting RRRs is also in line with the government's push to promote low-carbon and emission-reduction initiatives, as the PBOC also signalled it would provide low-cost capital to qualified financial institutions, the newspaper said. However, the market doesn't expect this month's LPR, to be announced today, to change nor that the PBOC would lower interest rates as the economy hasn't significantly slowed, the newspaper said. (MNI)

PBOC: The Chinese central bank will guard the main gate of money supply, Governor Yi Gang said at a Communist Party history study event recently, according to a statement from PBOC. (BBG)

EQUITIES: China has passed legislation setting out tougher rules for how companies handle user data, a move pushing forward its campaign to curb big tech's influence. The legislature of the Asian nation approved the Personal Information Protection Law, the China Central Television said in a report on Friday morning. Details of the new legislation were not immediately released but earlier drafts required firms to get user consent to collect, use and share information, and to provide a way for them to opt out. Companies found breaking the rules could face fines of up to 50 million yuan ($7.7 million) or 5% of their annual revenue. (BBG)

EQUITIES: Cyberspace Administration of China releases car data security management rules to regulate data processing activities, protect the legitimate rights and interests of individuals and organizations. Car data processing companies are required to reduce the disorderly collection and illegal abuse of data. (BBG)

EQUITIES: Executive of an unnamed liquor producer will attend a symposium held by Chinese regulator over market order of liquor industry, Caijing reports. The executive expects the meeting to be routine before peak sales season. It's also possible that the regulator has noticed big price fluctuations of certain liquor products, the executive is cited as saying. A notice circulating online shows the State Administration of Market Regulation will hold a symposium with liquor producers Friday over market order, Securities Times reports. (BBG)

CREDIT: China Evergrande Group, the country's most indebted developer, said it will ensure its property project construction and delivery, resolve debt risks and maintain the market and financial stability, the 21st Century Business Herald reported citing the company after its executives were summoned by banking regulators in an unprecedented meeting. The developer has been selling its assets including in electric vehicles and the Internet, while two buyers are taking interest in its subsidiary Shengjing Bank, the newspaper said. Concern over the developer's financial health intensified in June when it failed to pay some commercial paper on time. (MNI)

OVERNIGHT DATA

JAPAN JUL CPI -0.3% Y/Y; MEDIAN -0.4%; JUN -0.5%

JAPAN JUL CPI EX-FRESH FOOD -0.2% Y/Y; MEDIAN -0.4%; JUN -0.5%

JAPAN JUL CPI EX-FRESH FOOD & ENERGY -0.6% Y/Y; MEDIAN -0.8%; JUN -0.9%

MNI DATA BRIEF: Japan July Core CPI Drop Narrows From June

- Japan's July annual core consumer inflation rate fell 0.2% y/y, for the 12th straight drop, following -0.5% in June on lower mobile phone charges, data from the Ministry of International Affairs and Communication released on Friday. The underlying inflation rate measured by the core-core CPI (excluding fresh food and energy) fell 0.6% y/y in July, improving from -0.9% in June. Bank of Japan officials will likely maintain the view that the underlying trend excluding special factors remains solid, judging from prices for services and eating and drinking services - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

NEW ZEALAND JUL CREDIT CARD SPENDING -0.6% M/M; JUN

NEW ZEALAND JUL CREDIT CARD SPENDING +6.9% Y/Y; JUN

SOUTH KOREA JUL PPI +7.1% Y/Y; JUN +6.6%

UK AUG GFK CONSUMER CONFIDENCE -8; MEDIAN -7; JUL -7

CHINA MARKETS

PBOC INJECTS CNY10 BLN VIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1760% at 09:25 am local time from the close of 2.0570% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 54 on Thursday, flat from the close of Wednesday.

CHINA SETS YUAN CENTRAL PARITY AT 6.4984 FRI VS 6.4853 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4984 on Friday, compared with the 6.4853 set on Thursday, marking the weakest fixing since Apr 21.

PBOC KEEPS LPR UNCHANGED FOR 16TH MONTH

- China's central bank on Friday left its benchmark rate for loans unchanged for the 16th straight month, according to a statement on the People's Bank of China website. The Loan Prime Rate, guiding companies' cost of borrowing, remains at 3.85% for the one-year maturity and 4.65% for five years - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MARKETS

SNAPSHOT: Chinese Regulatory Burden Grows

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 245.23 points at 27035.94

- ASX 200 up 1.465 points at 7466.1

- Shanghai Comp. down 57.404 points at 3408.151

- JGB 10-Yr future up 5 ticks at 152.4, yield down 0.6bp at 0.01%

- Aussie 10-Yr future up 1.0 tick at 98.940, yield down 1.1bp at 1.072%

- U.S. 10-Yr future up 0-01 at 134-11+, yield down 1bp at 1.2333%

- WTI crude up $0.39 at $64.08, Gold up $5.72 at $1786.06

- USD/JPY down 3 pips at Y109.72

- CHINA TAKES NEXT STEP IN TAMING BIG TECH WITH PERSONAL DATA LAW (BBG)

- CHINA DELAYS VOTE ON HONG KONG ANTI-SANCTIONS LAW (SCMP)

- SYDNEY & NEW ZEALAND EXTEND LOCKDOWNS

- ORR: NEXT RBNZ MEETING 'LIVE' EVEN IF OUTBREAK PERSISTS (BBG)

BOND SUMMARY: Core FI Fails To Find A Spark On Friday

U.S. Tsy dealing was limited in Asia-Pac hours, with T-Notes operating in a 0-03 range, last 0-00+ at 134-11, while cash Tsys are little changed to ~1.0bp richer across the curve. Regulatory matters in China continue to provide the highlights on the headline front, and perhaps provided very modest support to the space. A ~30K lift of EDZ1/H2 was seen in Asia hours after heavy selling in the front end of the outright strip on Thursday.

- Another sedate Tokyo session for JGBs, with some peripheral headlines surrounding the local COVID situation, but nothing in the way of market-meaningful input. Futures +6, with the major cash JGB benchmarks little changed to 1.0bp richer out to 20s (5s outperform), while 30s and 40s are marginally cheaper on the day (longer dated swap spreads are a touch tighter as a result of the cheapening in JGBs). The monthly JSDA data pointed to trust banks buying a record net amount of super-long JGBs in July, while foreign investors lodged a record round of net buying of 10-Year JGBs in the same month.

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y4.06124tn 3-Month Bills:

- Average Yield -0.1239% (prev. -0.1122%)

- Average Price 100.0309 (prev. 100.0280)

- High Yield: -0.1162% (prev. -0.1122%)

- Low Price 100.0290 (prev. 100.0280)

- % Allotted At High Yield: 49.4865% (prev. 60.3417%)

- Bid/Cover: 5.025x (prev. 5.308x)

AUSSIE BONDS: ACGB April 2025 Auction Results

The Australian Office of Financial Management (AOFM) sells A$700mn of the 3.25% 21 April 2025 Bond, issue #TB139:

- Average Yield: 0.2696% (prev. 0.4620%)

- High Yield: 0.2700% (prev. 0.4650%)

- Bid/Cover: 8.0786x (prev. 3.6063x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 79.5% (prev. 23.8%)

- Bidders 51 (prev. 36), successful 9 (prev. 13), allocated in full 2 (prev. 7)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- "Subject to market conditions, a new 21 November 2032 Treasury Indexed Bond (TIB) is planned to be issued via syndication in the week beginning 23 August 2021. The Joint Lead Managers for the issue are National Australia Bank Limited; UBS AG, Australia Branch; and Westpac. In conjunction with the issue, the AOFM is prepared to buy back holdings of the outstanding 1.25% 21 February 2022 TIB line. Holders of the 21 February 2022 TIB will be given an opportunity to submit offers of that bond whether or not they choose to participate in the 21 November 2032 TIB issue."

- On Wednesday 25 August it plans to sell A$1.0bn of the 1.25% 21 May 2032 Bond.

- On Thursday 26 August it plans to sell A$1.0bn of the 26 November 2021 Note & A$1.0bn of the 25 February 2022 Note.

- On Friday 27 August it plans to sell A$1.0bn of the 0.25% 21 November 2024 Bond.

FOREX: CAD Sustains Further Losses; Antipodean Pairs Pressured By Lockdowns

Sentiment remained broadly negative in Asia, the greenback continued its move higher early in the session but has retreated as the session wears on, brining major pairs back towards neutral levels heading into Europe.

- AUD/USD is down 6 pips, but well off worst levels. The Sydney lockdown was extended until the end of September, there were 642 new coronavirus cases reported, down from a record 681 yesterday.

- NZD/USD is down 4 pips having recovered from session lows. In New Zealand the countrywide lockdown was extended to midnight on 24 August; there were 3 case discovered in Wellington, the outbreak had previously been contained to Auckland. New Zealand PM Ardern said the country was in a "reasonable position" on the outbreak.

- USD/JPY is up 9 pips. Data showed CPI fell less than expected in July, dropping 0.3% against a consensus of a 0.4% decline. Core-Core CPI fell 0.6% against an estimated decline of 0.8%.

- USD/CNH rose 58 pips, the PBOC kept LPR rates on hold – there was an outside chance of a cut after some of the recent dovish PBOC moves, but state media telegraphed that the PBOC is unlikely to cut LPR rates in August.

- USD/CAD continued to March higher, gaining some 27 pips despite little in terms of idiosyncratic headline flow and slight bounce in oil.

- Elsewhere UK GfK consumer confidence printed -8 in August compared to -7 expected, GBP/USD is down 9 pips while EUR/USD is up 9 pips.

- Looking ahead markets await German PPI data and US retail sales figures.

FOREX OPTIONS: Expiries for Aug20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1675(E506mln), $1.1700(E831mln), $1.1800(E737mln)

- USD/JPY: Y106.80($1bln), Y108.70-75($1.1bln), Y110.00-20($880mln)

- AUD/USD: $0.7425(A$750mln)

- USD/CAD: C$1.2575-85($630mln), C$1.2600($693mln), C$1.2700($570mln)

- USD/CNY: Cny6.4700($1.4bln)

EQUITIES: Another Broadly Negative Session In Asia

Equity markets in the Asia-Pac time zone ended the week with another broadly negative session, sentiment remains negative as markets contemplate the spread of the delta variant of coronavirus and China's regulatory crackdown. Markets in mainland China led the way lower, the CSI 300 down over 2%, ChiNext declined 3.1%, the most since July 27. The healthcare/medical sector is the latest in the crosshairs of China's regulatory watchdogs while Evergrande was also told to resolve its debt problems which added to negative sentiment. Markets in Japan are lower to the tune of around 0.6%, some peripheral headlines surrounding the local COVID situation, but nothing in the way market-meaningful input, CPI fell slightly less than expected. Markets in New Zealand also lower after coronavirus cases were discovered in Wellington, the outbreak had previously been confined to Auckland. In the US futures were lower after a mixed finish on Thursday.

OIL: On Track For Weekly Loss

Crude futures rose slightly in Asia on Friday but are still set to end the week with losses. WTI is up $0.27 from settlement at $63.96,/bbl, Brent is up $0.26 at $66.71/bbl, both benchmarks on track to finish with losses of around 6.5%. The WTI benchmark is now over 18% off the July highs, meaning further weakness could tip oil into bear market territory. WTI has support at $63.17 - 1.00 proj of the Jul 6 - 20 - 30 price swing while resistance is seen at $67.48 - High Aug 13, Brent has support at $63.89 - Low May 21, while resistance is seen at, $65.75 - Low May 24 support turned resistance.

GOLD: In The Recent Range

Participants have showed a lack of conviction over the last 24 hours or so, allowing spot gold to operate within the confines of the recently observed range, last dealing ~+$5/oz at ~$1,785/oz. A reminder that the USD (broader DXY) has printed fresh multi-month highs over the last 24 hours, while our weighted U.S. real yield indicator has consolidated in the upper end of the range witnessed since mid-July. Next week's annual Jackson Hole Symposium, hosted by the Kansas City Fed, presents the next key macro event risk for bullion. Participants will eye any discussions surrounding the tapering topic, with Fed Chair Powell's address set to headline.

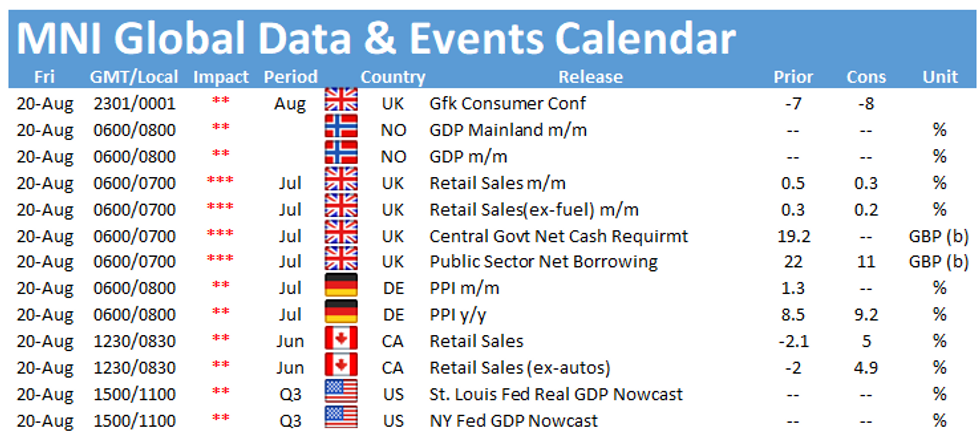

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.