-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Dollar Supported, Yields Steady Ahead Of US CPI Print

EXECUTIVE SUMMARY

- BIDEN, XI TO ANNOUNCE DEAL FOR CHIAN TO CRACK DOWN ON FENTANYL - BBG

- YELLEN SEES LIMITED GLOBAL ECONOMIC IMPACT SO FAR: ISRAEL LATEST - BBG

- BOJ SEES NO SHARP RISE IN 10-YEAR RATE: SENIOR AIDE - MNI BRIEF

- AUSTRALIAN CONSUMERS REMAIN GLOOMY AS BUSINESSES SHOW RESILIENCE - BBG

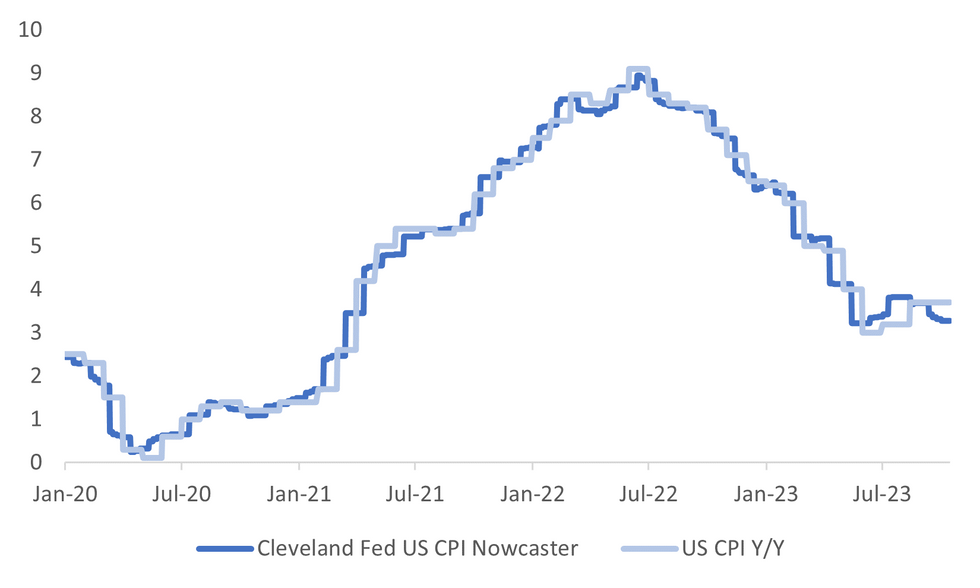

Fig. 1: US CPI Y/Y Versus Cleveland Fed Nowcaster

Source: MNI - Market News/Bloomberg

U.K.

FISCAL (BBG): A Labour government would seek to end the stealth raid on the incomes of working households and give businesses lasting tax relief on investment, Shadow Chancellor Rachel Reeves said as she pledged to tackle poor living standards and economic growth.

EUROPE

ITALY (BBG): Moody’s Investors Service has backed itself into a corner by placing Italy on the brink of being branded as junk, according to a former leading sovereign analyst.

COMMODITIES (BBG): The European Union reached a deal on measures to become more self-sufficient in the key raw materials it needs to help power the clean energy transition.

ESG (BBG): Banks, asset managers and other financial firms have won a reprieve from Europe’s most consequential ESG regulation to date, as a wave of intense industry lobbying pays off.

UKRAINE (BBC): Russian state media on Monday published and swiftly retracted reports of a withdrawal of forces from positions on the left (eastern) bank of the Dnipro River.

MIDEAST (POLITCO): Israel cannot stay in Gaza after the war, EU top diplomat Josep Borrell said on Monday while presenting his vision ahead of his trip to Israel and the Palestinian territories.

POLAND (POLITCO): Almost a month after the election that defeated the Law and Justice (PiS) party, Poland’s parliament held its inaugural session and voted in a new leadership showing that power has decisively shifted away from the old ruling party.

U.S.

US/CHINA (BBG): Joe Biden and his Chinese counterpart, Xi Jinping, are set to announce an agreement that would see Beijing crack down on the manufacture and export of fentanyl, according to people familiar with the matter, potentially delivering the US president a major victory.

FISCAL (RTRS): U.S. House of Representatives Speaker Mike Johnson's plan to avoid a partial government shutdown secured tentative support from top Senate Democrat Chuck Schumer on Monday, even as some of Johnson's hardline Republican colleagues pushed back against it.

FISCAL (BBG): US Treasury Secretary Janet Yellen said she disagrees with Moody’s Investors Service’s shift to a negative outlook on the country’s Aaa credit rating, expressing confidence in the economy and in Treasuries as a safe asset.

US/ISRAEL (RTRS): U.S. President Joe Biden said hospitals in the Gaza Strip must be protected and he hoped for "less intrusive" action by Israel as Israeli tanks advanced to the gates of the besieged enclave's main hospital.

OTHER

CORPORATE (WSJ): Canadian miner Teck Resources is in advanced talks to sell its coal assets to mining and trading giant Glencore in a deal that would cap a lengthy saga and be one of the biggest in mining this year.

MIDEAST (BBG): Yellen said officials gathered for the APEC summit in San Francisco haven’t yet seen “much economic impact”from the conflict so far but said they did discuss the potential risks from the war continuing.

JAPAN (MNI BRIEF): The Bank of Japan does not expect the 10-year interest rate to rise significantly above the 1% reference level, according to a senior Bank of Japan official.

JAPAN (RTRS): The Bank of Japan (BOJ) will aim to create conditions for raising prices and lifting wages through increases in corporate profits and household incomes instead of cost-push inflation, its deputy governor Shinichi Uchida said on Tuesday.

JAPAN (RTRS): Japanese Finance Minister Shunichi Suzuki said on Tuesday that the government would take all possible steps necessary to respond to currency moves, repeating his usual mantra that excessive swings were undesirable.

AUSTRALIA (BBG): Australia’s consumer confidence slumped in November following the Reserve Bank’s resumption of interest-rate increases, while firms reported an improved environment even as they fret over the outlook for the economy.

CHINA

BANKING (YICAI): China’s banking risks remain controllable with key indicators at a reasonable range, according to the People’s Bank of China. A recent PBOC report found 4,000 commercial banks were low risk, with 300 classified as high risk which accounted for less than 2% of all banking assets.

DEPOSIT RATES (CSJ/BBG): Chinese rural lenders followed suit in trimming their deposit rates since late-Oct., after similar moves by big banks in early Sept., China Securities Journal reported Tuesday.

YUAN (CSJ/BBG): China’s yuan exchange rate will continue to stabilize on the back of a recovering domestic economy and a pause in rate hikes by the US Federal Reserve, China Securities Journal reported Tuesday, citing analysts.

YUAN (YICAI): China will implement policies to improve cross border FX transfers to boost trade and support the real economy, according to the State Administration of Foreign Exchange. In an article, SAFE said new policies will allow more SMEs access to high-quality FX services and banks will have more credit-management autonomy.

RRR (CSJ/BBG): China may continue to push for lower policy rates and reduce bank reserve requirements in 4Q to firm up the economic recovery, China Securities Journal reported.

CHINA MARKETS

MNI: PBOC Injects Net CNY71 Bln Via OMO Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY424 billion via 7-day reverse repo on Tuesday, with the rate unchanged at 1.80%. The operation has led to a net injection of CNY71 billion after offsetting the maturity of CNY353 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8667% at 09:34 am local time from the close of 1.8774% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 41 on Monday, compared with the close of 49 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1768 Tuesday vs 7.1769 Monday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1768 on Tuesday, compared with 7.1769 set on Monday. The fixing was estimated at 7.2887 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA OCT EXPORT PRICE M/M 0.5%; PRIOR 1.8%

SOUTH KOREA OCT EXPORT PRICE Y/Y -9.5%; PRIOR -8.9%

SOUTH KOREA OCT IMPORT PRICE M/M 0.5%; PRIOR 3.0%

SOUTH KOREA OCT IMPORT PRICE Y/Y -10.2%; PRIOR -9.6%

NEW ZEALAND OCT FOOD PRICES M/M -0.9%; PRIOR -0.4%

AUSTRALIA NOV WESTPAC CONSUMER CONFIDENCE INDEX 79.9; PRIOR 82.0

AUSTRALIA NOV WESTPAC CONSUMER CONFIDENCE M/M -2.6%; PRIOR 2.9%

AUSTRALIA OCT NAB BUSINESS CONFIDENCE -2; PRIOR 0

AUSTRALIA OCT NAB BUSINESS CONDITIONS 13; PRIOR 12

MARKETS

US TSYS: Narrow Ranges In Asia, CPI On Tap

TYZ3 deals at 107-13+, -0-00+, a 0-06 range has been observed on volume of ~48k.

- Cash tsys sit flat to 1bp richer across the major benchmarks, light bull flattening is apparent.

- Tsys have observed narrow ranges in Asia with little follow on moves, the proximity to this evenings US CPI print has perhaps limited activity.

- There was little in the way of meaningful macro newsflow. A recovery from session lows was seen alongside an uptick in the USD.

- Eurozone GDP and Employment headlines in Europe today, the aforementioned CPI print provides the highlight further out. The MNI preview is here. There are a number of Fed speakers due with NY Fed President Williams the standout.

JGBS: Futures Firm As 5yr Supply Well Received & US Tsy Firmness, Q3 GDP On Tap Tomorrow

JGB futures sit near session highs in afternoon dealing, last 144.63, +.25 (session highs at 144.67). The positive catalysts coming from well digested 5yr supply and a tick higher in US Tsy futures (last 117-14).

- The 5yr auction registered a higher than expected cut-off price per BBG, while the bid to cover ratio rose to 4.17 from 4.06 prior (see this link). The last 5yr auction was held on October 11.

- Cash JGBs sit lower in yield terms, led by the 5yr. We were last at 0.40% (down nearly 3bps), while the 10yr yield was 0.86%, off a touch for the session so far.

- Swap rates are slightly weaker in yield terms, off between 2 to 3bps from the 5yr to 40yr tenors. The 10yr swap rate is back sub 1.05%.

- Tomorrow, we have Q3 GDP as the main focus data wise. The market consensus looks for a modest q/q contraction in growth.

AUSSIE BONDS: Marginally Richer In Asia, Q3 Wages Due Tomorrow

ACGBs sit ~1bp richer across the major benchmarks, XM and YM are little changed from opening levels as narrow ranges persisted for the most part.

- RBA dated futures are stable, pricing a terminal rate of 4.50% in May 24 with ~10bps of cuts by Dec 24.

- There were several releases of local data today, Westpac Consumer Confidence fell 2.6% in November to 79.9. NAB Business Conditions ticked higher to 13 from 12, Confidence fell to -2 and the prior read was revised lower to 0.

- Goldman Sachs noted this morning that they see a near-term upside side of higher inflation and rates but see the RBA on hold before gradual easing in Q4 2024 (BBG).

- Due tomorrow we have Q3 Wage Price Index, a rise of 1.3% Q/Q is expected, the prior read was 0.8% Q/Q.

NZGBS: Marginally Richer On Tuesday, Card Spending Due Tomorrow

NZGBs sit 2-3bps richer across the major benchmarks, light bull steepening is apparent. Early gains marginally extended as Tsys ticked away from session lows however ranges remain narrow.

- 10 Year NZ US Swaps remain stable and last print at +51bps.

- RBNZ dated OIS currently price a terminal rate of ~5.50% in Feb 24 with ~15bps of cuts by Oct 24.

- On the wires this morning October Food Prices fell 0.9% M/M, the prior read was -0.4% M/M. Goldman Sachs noted that they see a near-term upside side of higher inflation and rates but see the RBNZ on hold before gradual easing in Q4 2024 (BBG).

- RBNZ Governor Silk also noted in a speech this morning that previous tightenings are showing an impact in terms of reducing demand and inflationary pressure. This suggests the better business activity outlook painted by the ANZ survey needs to show up in demand, inflation indicators, before shifting the RBNZ outlook.

- Due early in tomorrow's session we have October Card Spending and Sep Net Migration.

FOREX: Muted Asian Session As US CPI In View

There was a muted Asian session across G-10 FX, the greenback is a touch firmer. BBDXY is up ~0.05% however activity has been limited as participants look forward to this evening's US CPI print. The cross asset space has also been muted, US Tsy yields are little changed and e-minis are a touch firmer.

- Kiwi is marginally lower, NZD/USD is down ~0.1% at $0.5870/75. The pair sits at the base of its daily range, a $0.5870/85 range has been observed for the most part today.

- Yen is little changed this morning, USD/JPY fell ~0.5% from its fresh YTD in yesterday's NY session. The pair pared losses and sits at ¥151.65/70. Technically a break of yesterday's high (¥151.95) opens ¥152.20, 3.00 proj of Jul 14-21-28 price swings. Support comes in at ¥150.25, 20-Day EMA. Cross wise EUR/JPY and GBP/JPY have printed fresh multi-year highs this morning.

- AUD/USD is marginally softer however a $0.6370/85 range has been observed for the most part in Asia. Technically a short term bull cycle remains in play, resistance is at $0.6449, high from Nov 8. Support is at $0.6330, 76.4% retracement of Oct 26 - Nov 6 rally.

- Elsewhere in G-10 most majors are softer but only marginally so.

- The October US CPI print is the highlight of today's session, prior to the release we have Eurozone Q3 GDP and Employment.

EQUITIES: Regional Markets Mostly Tracking Higher, China/HK Lagging

Regional equity markets are mostly higher in Tuesday trade to date, although China and Hong Kong markets sit marginally lower at the break. US futures have ticked higher, with Eminis last near 4428.5, comfortably within recent ranges and close to the simple 50-day MA. Nasdaq futures sit at 15575, up ~0.18%, so outperforming at the margins.

- Sentiment has likely been aided by the uptick in US Tsy futures, with back end yields down a touch, but overall ranges remain reasonably tight as we await the US CPI print later.

- At the break, the HSI sits 0.10% lower, while the CSI 300 is around flat. The Shanghai Composite is a touch firmer (+0.10%). Tomorrow delivers the 1yr MLF decision and October activity data. China President Xi and US President Biden are expected to meet on the sidelines of the APEC summit., which may be keeping some investors on the sidelines.

- Earlier headlines crossed from BBG that the two leaders will announce a deal for China to crack down on Fentanyl production and exports.

- South Korean markets have outperformed, led by tech and battery names. Earlier, President Yoon reinforced the short selling ban (see this BBG link). Offshore and institutional investors have been buyers today, while local retail investors have sold.

- The Taiex is also higher, +0.55%, led by TSMC. Japan's Topix is +0.70%, likewise for the Nikkei 225, with a weaker yen helping at the margins, with Toyota leadings gains.

- The ASX 200 has risen 0.90, led by resource/materials names, as commodity prices rose in Monday trade.

- In SEA, sentiment is mixed.

OIL: Crude Up Ahead Of US CPI, IEA Report Due

Oil prices are marginally higher during the APAC session after OPEC reiterated its positive demand expectations but have been trading in a narrow range ahead of today’s US CPI release. A stronger print would be negative for crude as it may signal further Fed tightening, which could impact energy demand. The USD index is up almost 0.1% and close to today’s high.

- WTI is up 0.4% to $78.54/bbl after a high of $78.71 followed by a low of $78.37. Brent is also 0.4% higher at around $82.83 after rising to $82.96 and then falling to $82.64.

- The IEA publishes its monthly report today which will be looked at closely to see if it is in line with OPEC on the demand outlook. OPEC described recent oil moves as driven by “overblown negative sentiment”.

- API US inventory data is also released. The American Automobile Association has said that the Thanksgiving period will be the busiest since 2019, according to Bloomberg.

- Later the focus is on October US CPI (see MNI CPI Preview), especially core, but there are also real earnings, UK September labour market data, and Q3 euro area GDP/employment. In terms of speakers, the Fed’s Williams, Jefferson, Barkin, Barr, Mester and Goolsbee speak as well as the ECB’s Lane and Enria.

GOLD: Bullion Range Trading Ahead Of US CPI

Gold prices have been trading in narrow ranges this week as markets wait for today’s October US CPI data. A stronger print would be negative for bullion as it may signal further Fed tightening. They are down 0.1% today to $1944.84/oz after rising 0.3% to $1946.92. Today bullion reached an intraday high of $1948.45 before falling to a low of $1944.46. The USD index is up 0.1% and close to today’s high.

- Trend conditions for gold remain bullish and November’s trend lower is seen as corrective. Moving average studies highlight a rising trend. The bull trigger is at $2009.40, October 27 high. Initial support is $1938.10, 50-day EMA, which has been breached and opened up $1908.30, October 16 low.

- Later the focus is on October US CPI (see MNI CPI Preview), especially core, but there are also real earnings, UK September labour market data, and Q3 euro area GDP/employment. In terms of speakers, the Fed’s Williams, Jefferson, Barkin, Barr, Mester and Goolsbee speak as well as the ECB’s Lane and Enria.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/11/2023 | 0700/0800 | *** |  | SE | Inflation Report |

| 14/11/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/11/2023 | 0800/0900 |  | EU | ECB's Lane participates in SNB-FRB-BIS Conference | |

| 14/11/2023 | 0800/0300 |  | US | New York Fed's John Williams | |

| 14/11/2023 | 1000/1100 | *** |  | EU | GDP (p) |

| 14/11/2023 | 1000/1100 | * |  | EU | Employment |

| 14/11/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 14/11/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 14/11/2023 | 1030/0530 |  | US | Fed Vice Chair Philip Jefferson | |

| 14/11/2023 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 14/11/2023 | 1200/1200 |  | UK | BOE's Dhingra panellist at Festival of Economics | |

| 14/11/2023 | 1330/0830 | *** |  | US | CPI |

| 14/11/2023 | 1345/1345 |  | UK | BOE's Pill speech at the Festival of Economics | |

| 14/11/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 14/11/2023 | 1500/1000 |  | US | Fed Vice Chair Michael Barr | |

| 14/11/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 14/11/2023 | 1745/1245 |  | US | Chicago Fed's Austan Goolsbee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.