-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Jobs On The Mind

- Fed outlines wind-down of SMCCF, little impact foreseen.

- State-media reports out of China point to the PBoC adopting a more active liquidity management approach in June.

- U.S. labour market data will headline over the next couple of sessions.

BOND SUMMARY: Soft 10-Year JGB Supply, RBA Speculation Does The Rounds

T-Notes are unchanged at 131-30 at typing, holding to a narrow 0-02+ range overnight, on volume of ~46K. Headline flow remains light. Cash Tsys are little changed to 0.5bp cheaper across the curve. Eurodollar futures trade -0.25 to +1.0 through the reds. Flow has been headlined by downside interest in EDZ3 via the options space, which saw 5.5K of the 2EZ1 99.000/98.875 put spread trade vs. the 2EZ1 99.250/99.375 call spread, with a market contact pointing to buying of the put spread vs. selling of the call spread. Thursday's domestic focus is set to fall on labour market data (weekly claims & ADP employment) ahead of Friday's NFP print, with the latest ISM services survey and a raft of Fedspeak also due.

- It seems that desks were a little complacent re: the prospects surrounding the smooth takedown of today's 10-Year JGB supply, with the average price only just matching the broader expectations for the low price (per the BBG dealer poll), as the cover ratio slid to the lowest witnessed at a 10-Year auction since '15. Elsewhere, the tail widened vs. the previous auction. Crimped 10-Year ranges since the BoJ's March decision, questions over market functioning and a lack out outright/relative value appeal likely hampered takedown today. Futures softened in the wake of the auction results, briefly printing below yesterday's settlement level, before recovering from fresh session lows to last trade +1 on the day, while cash JGBs sit little changed to 0.5bp cheaper across the curve. Elsewhere, the Asahi suggested that PM Suga is likely to call a snap election in the Autumn, after the end of Paralympic games. The report also suggested that the government is considering compiling a new stimulus package ahead of the snap election. Household spending data headlines the local economic docket on Friday.

- YM unch., XM +1.5 in Sydney. XM is back from best levels after running out of steam just ahead of the previously flagged resistance in the form of the May 27 high (98.430), peaking at 98.425 after shorts were squeezed in early Sydney dealing. Elsewhere, domestic data was solid to firm, but had no real impact on the space. There has been plenty of speculation doing the rounds after an appearance from RBA Governor Lowe was added to the docket for 6 July, the day of the Bank's key July decision (the addition came late on Wednesday). The title of the address is "Today's Monetary Policy Decision" and it will come 90 minutes after the decision & accompanying statement are released. It has become common practice for Lowe to conduct such addresses in the wake of key monetary policy decisions, and many have suggested that he could use the address to temper any hawkish reaction in the wake of the decisions surrounding QE & the Bank's yield targeting scheme. Still, this didn't impact the market. A portion of today's AOFM Note tender was allotted at negative yields. This isn't a new concept, with excess liquidity in the domestic banking system pressuring yields and x-ccy basis still providing attractive comparative entry points for offshore participants. Housing finance data headlines the local docket on Friday, with the release of the AOFM's weekly issuance slate & A$1.0bn of ACGB 0.25% 21 November 2025 supply also due.

JAPAN: Bond Flows Headline Within Weekly International Security Flow Data

There were several points of note in this week's international security flow data:

- Japanese investors upped the pace of their net sales of foreign bonds from the previous week, although the level witnessed remained shy of weekly levels seen in both April & February of this year.

- Foreign investors shed a relatively small net amount of Japanese bonds in the most recent week, after 2 weeks of decent net purchases.

- The direction of net flows surrounding equities flipped on both sides of the ledger, although net flows remained limited.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1090.0 | -550.7 | -1112.9 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 129.4 | -88.6 | 345.1 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -30.1 | 1189.0 | 1664.4 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 181.3 | -223.2 | -368.6 |

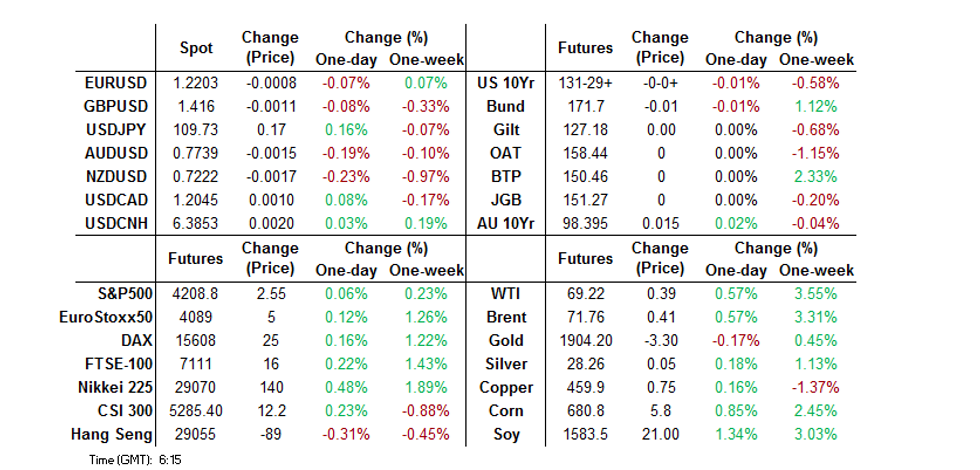

FOREX: Greenback Rises From Yesterday's Lows

The greenback bounced which saw AUD and NZD come under pressure, Antipodean/USD crosses down around 13 pips. Australian PM Morrison announced support for hotspots impacted by COVID-19. Elsewhere The trade surplus widened less than expected as exports missed estimates, while retail sales rose 1.1%, in line with forecasts. RBNZ Deputy Gov Bascand spoke late on Wednesday and said that loose policy will not last forever and noted supply driven price pressures.

- Yen is softer, USD/JPY up 12 pips, final Jibun Bank services PMI fell to 46.5 for the sixteenth straight month of contraction, while composite slipped to 48.8 from 51.0. Meanwhile Asahi reports suggested that PM Suga is likely to call a snap election in the Autumn, after the end of Paralympic games. The report also suggested that the government is considering compiling a new stimulus package ahead of the snap election.

- Yuan stuck to a fairly narrow range, the PBOC fixed above sell-side estimates indicating a preference for a weaker yuan after a brief hiatus yesterday. Elsewhere May Caixin services PMI printed 55.1 from 56.3 previously, composite PMI fell to 53.8 from 54.7. There were reports that US President Biden is planning on amending a US investment ban on companies linked to China's military.

FOREX OPTIONS: Expiries for Jun03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000-15(E1.4bln), $1.2067-75(E587mln), $1.2100-15(E1.3bln-EUR puts), $1.2150-70(E532mln), $1.2300-05(E1.0bln-EUR puts)

- USD/JPY: Y109.00-10($1.7bln-USD puts), Y109.15-25($1.1bln), Y109.45-50($695mln), Y109.98-110.00($1.5bln)

- GBP/USD: $1.3990-00(Gbp653mln), $1.4100(Gbp721mln)

- AUD/USD: $0.7715-25(A$622mln), $0.7835-40(A$812mln)

- USD/CNY: Cny6.42($700mln)

ASIA FX: Mixed

The greenback rose after closing at the day's lows, performance was mixed though as local dynamics came into play amid decent risk appetite.

- CNH: Yuan stuck to a fairly narrow range and heads into the close weaker, the PBOC fixed above sell-side estimates indicating a preference for a weaker yuan after a brief hiatus yesterday. Elsewhere May Caixin services PMI printed 55.1 from 56.3 previously, composite PMI fell to 53.8 from 54.7. There were reports that US President Biden is planning on amending a US investment ban on companies linked to China's military.

- SGD: Singapore dollar hugged a narrow range and heads into Europe flat, data from IHS Markit showed Singapore MAY PMI at 54.4 from 51.8 previously. Singapore will allow the use of Sinovac Biotech's vaccine after the WTO approved it as part of its emergency use listing. There were 34 new cases reported in the past 24 hours, the highest since May 24.

- TWD: Taiwan dollar strengthened, bouncing from the biggest decline in three-weeks yesterday and helped by firmer risk appetite and gains in the Taiex.

- KRW: The won strengthened but is off best levels. Government ministries and state agencies have requested a 6.3% hike in their budgets for next year as they seek to cope with post-pandemic economic recovery and implement key policy projects, said the MOF.

- MYR: Ringgit gained for the second day, buoyed by the rally in oil prices.

- IDR: Rupiah is flat but has resisted the gains in USD, markets digest yesterday's data that shows CPI rose above estimates.

- PHP: Peso is higher, recouping some of its losses from the past two days. BSP Gov Diokno said yesterday that the central bank was open to further easing.

ASIA RATES: PBOC To Inject Liquidity In June According To Reports

- INDIA: Yields higher in early trade. Markets await today's INR 320bn bond sale with the auction bought forward due to tomorrow's RBI rate announcement. Activity could be subdued today as traders anticipate additional liquidity measures will be announced by the central bank tomorrow.

- SOUTH KOREA: Futures head into the close 17 ticks higher but off best levels having gapped higher at the open. Government ministries and state agencies have requested a 6.3% hike in their budgets for next year as they seek to cope with post-pandemic economic recovery and implement key policy projects, said the MOF. Their budget proposals amount to a combined KRW 593., up KRW 35.2tn from the previous year. The MOF said it plans to maintain an expansionary fiscal policy next year to underpin an economic recovery from the pandemic, but it will also seek to enhance fiscal soundness amid mounting national debt.

- CHINA: Repo rates fell on reports that the PBOC would inject additional liquidity in June. The PBOC matched maturities with injections today but operations will be closely watched in the coming weeks. Futures are flat. May Caixin services PMI printed 55.1 from 56.3 previously, composite PMI fell to 53.8 from 54.7. There were reports that US President Biden is planning on amending a US investment ban on companies linked to China's military.

- INDONESIA: Yields mixed across the curve, markets digest comments from the finance ministry earlier this week where it confirmed intentions to narrow the budget deficit to less than 3% of gross domestic product by 2023 despite the fiscal uncertainty engendered by the pandemic.

EQUITIES: Broad Gains

A mostly positive day for equity markets in the Asia-Pac region. Markets in South Korea lead the way higher with gains of ~1% as government ministries and state agencies request a 6.3% hike in their budgets for next year. Markets in Japan are higher as the vaccination programme gathers pace. Gains in China are subdued after reports that US President Biden is planning on amending a US investment ban on companies linked to China's military. US futures are higher, late yesterday Fed's Harker said the central bank would seek to avoid a taper tantrum, markets have one eye on tomorrow's NFP data.

GOLD: U.S. Jobs Data Eyed

Steady U.S. real yields and a pullback from intraday best levels in the DXY have allowed spot gold to reclaim $1,900/oz over the last 24 hours, with little fresh to note from a technical perspective as bullion trades a few dollars above the round number at typing. U.S. labour market dynamics will likely be key for gold during the remainder of the week, with ADP employment and weekly initial jobless claims data due on Thursday, ahead of the release of the latest monthly employment report on Friday.

OIL: Crude Futures On Track For Third Straight Rise

Oil is higher again in Asia-Pac trade on Thursday, on track for a third day of gains. WTI & Brent sit ~$0.40 above their respective settlement levels. Delayed API data yesterday showed headline crude stocks fell 5.36m bbls, markets will look to official DOE inventory data later today to confirm this, which would be the biggest draw in a month. Meanwhile negotiations with Iran have been adjourned until next week. Markets expect little material outcome from the discussions, with Tehran's lack of compliance with nuclear curbs likely hindering any near-term oil supply deal.

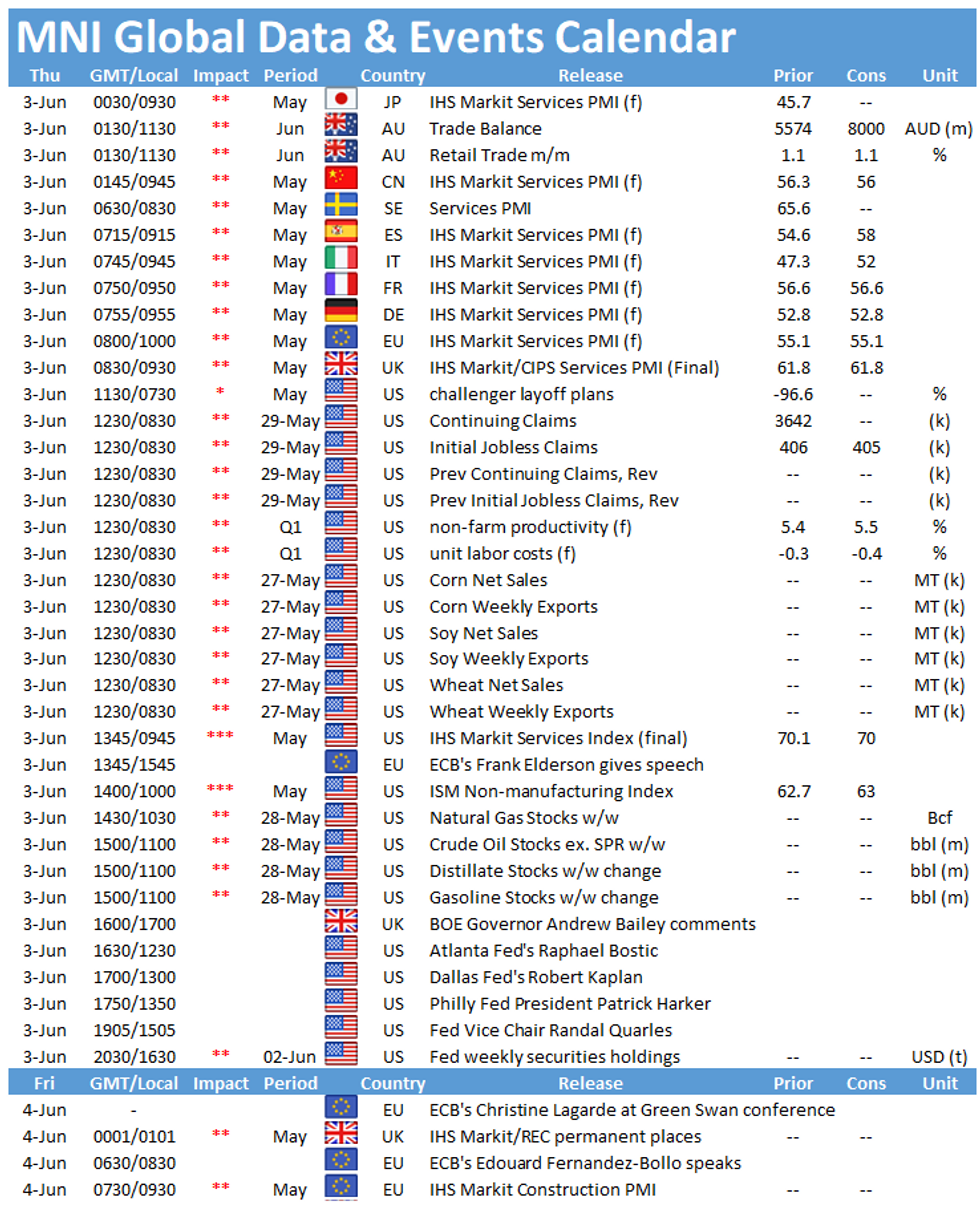

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.