-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Firmer Than Expected CPI Data To Get RBA's Attention

EXECUTIVE SUMMARY

- GERMANY TO QUASH RECESSION FEARS WITH 2023 GROWTH FORECAST (BBG)

- GLOOMIER UK ECONOMY GROWTH PROSPECTS LEAVE JEREMY HUNT WITH BLACK HOLE IN BUDGET (TIMES)

- SWISS NATIONAL BANK'S SCHLEGEL SAYS TOO EARLY TO SOUND INFLATION ALL CLEAR (RTRS)

- AUSTRALIAN INFLATION DATA FIRMER THAN EXPECTED

- NZ INFLATION BELOW RBNZ EXPECTATIONS, STILL COMFORTABLY ABOVE TARGET

- U.S. AND GERMANY SET TO SEND TANKS TO UKRAINE, BREAKING DEADLOCK (BBG)

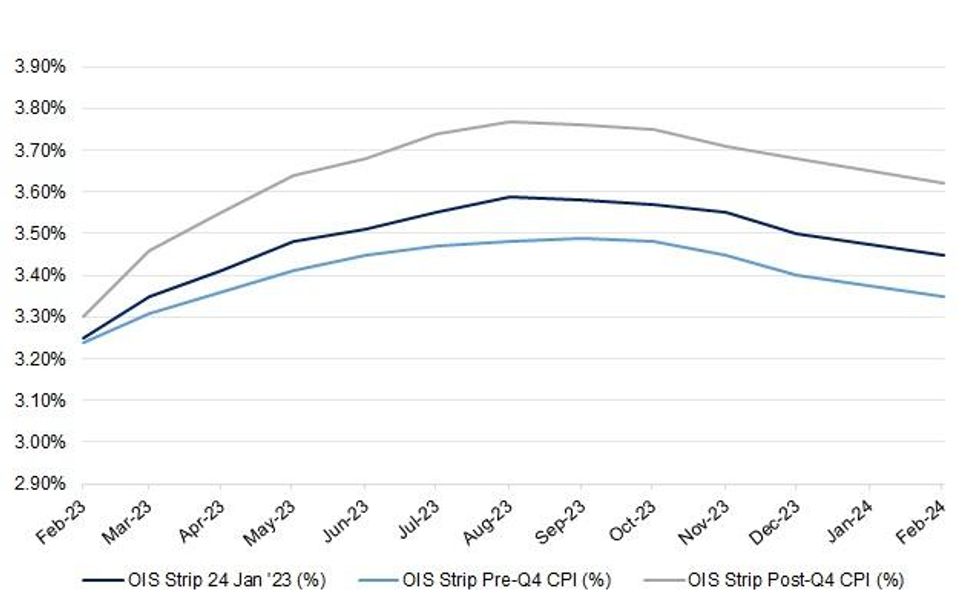

Fig. 1: RBA Dated OIS Moves

Source: MNI - Market News/Bloomberg

UK

FISCAL: Britain’s prospects for growth have declined, leaving the chancellor with a multibillion-pound hole before the budget in March, the government’s spending watchdog has warned. In a private submission to the Treasury, the Office for Budget Responsibility told Jeremy Hunt that it overestimated the prospects for medium-term growth in the economy last year and it intends to revise its forecasts down. (The Times)

ECONOMY: Confidence among employers about the state of the economy fell below levels recorded in the depths of the pandemic as the cost of living crisis intensified at the end of last year. (The Times)

EUROPE

GERMANY: The German government expects Europe’s biggest economy to grow by 0.2% this year instead of the 0.4% contraction it predicted in October, according to people familiar with new forecasts to be published Wednesday. (BBG)

SNB: Swiss National Bank Vice Chairman Martin Schlegel said on Tuesday it was too early to sound the 'all-clear' on inflation in Switzerland, despite an expected decline in the rate of price rises. (RTRS)

SWITZERLAND: Swiss President Alain Berset’s political woes deepened after parliamentary auditors announced a probe into alleged leaks of pandemic information by his former press chief to the boss of the country’s biggest tabloid newspaper, Blick. (BBG)

U.S.

FISCAL: U.S. Treasury Secretary Janet Yellen activated another extraordinary cash management measure on Tuesday to avoid breaching the federal debt limit, suspending daily reinvestments in a large government retirement fund that holds Treasury debt, the department said. In a letter notifying Congress of the move to access the Government Securities Investment Fund (G Fund), Yellen did not alter a projected early June deadline for when the Treasury may no longer be able to pay the nation's bills without an increase in the $31.4 trillion statutory borrowing limit. (RTRS)

FISCAL: A solution that would allow the United States to avoid defaulting on its debt needs to come from President Joe Biden and House Speaker Kevin McCarthy, Senate Republican leader Mitch McConnell said on Tuesday. (RTRS)

POLITICS: Lawyers for former Vice President Mike Pence said a “small number” of classified documents were found at his home in Carmel, Indiana, last week. (CNBC)

EQUITIES: Microsoft executives on Tuesday told analysts to expect a continuation of the weak pace of business that emerged in December, which hurt the software maker’s fiscal second quarter results. (CNBC)

EQUITIES: The U.S. Justice Department on Tuesday filed its second antitrust lawsuit against Google in just over two years. It’s the latest sign the U.S. government is not backing down from cases against tech companies even in light of a mixed record in court on antitrust suits. (CNBC)

EQUITIES: Trading in more than 200 stocks on the New York Stock Exchange was briefly halted shortly after the market opened Tuesday due to an apparent technical issue, and many abnormal early trades will be canceled. (CNBC)

OTHER

GLOBAL TRADE: Treasury Secretary Janet Yellen said Japan and the European Union would need to negotiate new trade agreements with the U.S. to meet the mineral-sourcing requirements for an overhauled electric-vehicle tax subsidy. (WSJ)

GEOPOLITICS: The Biden administration has confronted China’s government with evidence that suggests some Chinese state-owned companies may be providing assistance for Russia’s war effort in Ukraine, as it tries to ascertain if Beijing is aware of those activities, according to people familiar with the matter. (BBG)

GEOPOLITICS: US Secretary of State Antony Blinken is likely to ask his counterparts in Beijing next month whether Chinese companies are supporting Russia’s war against Ukraine, the State Department said on Tuesday – a red line that Washington has emphasised often since the start of the conflict. (SCMP)

NATO: Sweden wants to restore dialogue with Turkey over the applications by Sweden and Finland applications to quickly join NATO, Swedish Prime Minister Ulf Kristersson said on Tuesday. (RTRS)

NATO: The Biden administration on Tuesday reiterated that it supports Finland and Sweden joining NATO at the earliest opportunity, after Finland said a pause was needed in trilateral talks with Turkey on Finland and Sweden's application to join the military alliance. (RTRS)

BOJ: Prime Minister Fumio Kishida will make a decision on the next Bank of Japan (BOJ) governor while watching future economic trends, he said on Wednesday. (RTRS)

BOJ: The Bank of Japan will have to wait until August to gain good insight in whether wage increases are gaining traction, though inflation is expected to moderate over coming months, a former BOJ chief economist said. (MNI)

BOJ: The Bank of Japan is likely to start phasing out extraordinary measures such as yield curve control within months of a new governor taking the helm in April, according to a former executive director in charge of monetary policy during the pandemic. (BBG)

AUSTRALIA/CHINA: Talks between Chinese and Australian agencies are increasing, Prime Minister Anthony Albanese said on Wednesday, in a sign of the growing thaw in relations between the two trading partners. (RTRS)

NEW ZEALAND: New Zealand’s new prime minister has said responding to cost of living pressures is his government’s “absolute priority”, as his swearing-in coincided with the release of stubbornly high inflation figures. (Guardian)

NEW ZEALAND: The Government will sharpen its focus on supporting New Zealanders dealing with cost of living pressures in a difficult global environment as annual inflation remained unchanged. "We know it is hard out there for New Zealanders in making ends meet. As the Prime Minister has said, the Government’s focus will narrow to support New Zealanders struggling to pay their grocery bills and mortgages," Grant Robertson said. (Voxy)

RBNZ: We hold and manage foreign reserves in order to be able to intervene in the New Zealand dollar (NZD) market for financial stability or monetary policy reasons. Foreign reserves are safe and liquid assets held in currencies, such as United States dollars, Euros, and Australian dollars. (RBNZ)

SOUTH KOREA/CHINA: South Korea's internet safety watchdog said Wednesday a Chinese hacking group has launched a cyberattack against 12 South Korean academic institutions. (Yonhap)

BOK: South Korea's central bank said on Wednesday that the country's consumer spending for this year is likely to be weaker than its earlier projections, given the recent trends of weakening purchasing power for households and house price declines. (RTRS)

NORTH KOREA: The United States may consider appointing a special envoy solely dedicated to issues related to North Korea should there be active dialogue with the reclusive country, a state department spokesperson said Tuesday. (Korea Herald)

NORTH KOREA: Authorities in the North Korean capital, Pyongyang, have ordered a five-day lockdown due to rising cases of an unspecified respiratory illness, Seoul-based NK News reported on Wednesday, citing a government notice. (Guardian)

TURKEY: If production and employment are prioritized, interest rates shouldn’t be raised, Minister of Finance and Treasury Nureddin Nebati tells daily Milliyet in interview. (BBG)

MEXICO: Mexico’s inflation still hasn’t shown clear signals that it has reached its peak, but it could be, Banxico’s Deputy Governor Jonathan Heath said on Twitter. (BBG)

MEXICO: Petroleos Mexicanos plans to issue bonds in the coming weeks as the indebted Mexican state oil company looks to pay off maturities coming due in the first quarter, according to three people familiar with the situation. (BBG)

BRAZIL: Petrobras said it has not yet been formally notified about the company’s board members’ nominees from its internal committees, according to a filing. (BBG)

BRAZIL: Brazil’s Jair Bolsonaro will have to undergo additional surgery upon returning home, his doctor was quoted as saying by a local newspaper, which did not specify when the former president intends to end his US vacation. (BBG)

RUSSIA: The US and Germany are poised to announce they’ll provide their main battle tanks to Ukraine, offering Kyiv a powerful new weapon to counter Russia and overcoming a disagreement that threatened to fracture allied unity. (BBG)

RUSSIA: Switzerland took a crucial step toward allowing others to re-export armaments produced in the country to Ukraine. (BBG)

RUSSIA: The possible deliveries of battle tanks by Washington to Ukraine would be a "another blatant provocation" against Russia, Anatoly Antonov, Russia's ambassador to the United States, said on Wednesday. (RTRS)

PERU: Peru’s congress extended its deadline to set a date for fresh elections that lawmakers hope will end the political crisis that has left more than 50 dead and disrupted mining, tourism and agriculture. (BBG)

CHILE: Tax reform bill will head to a vote on the floor of the Lower House when lawmakers return from the February recess, Finance Minister Mario Marcel told reporters. (BBG)

IMF: Despite a number of better inflation prints especially in the US recently, it’s too early to think about declaring a victory, International Monetary Fund Chief Economist Pierre-Olivier Gourinchas says. (BBG)

OVERNIGHT DATA

JAPAN NOV, F LEADING INDEX 97.4; PRELIM 97.6; OCT 98.6

JAPAN NOV, F COINCIDENT INDEX 99.3; PRELIM 99.1; OCT 99.6

AUSTRALIA Q4 CPI +7.8% Y/Y; MEDIAN +7.6%; Q3 +7.3%

AUSTRALIA Q4 CPI +1.9% Q/Q; MEDIAN +1.6%; Q3 +1.8%

AUSTRALIA Q4 TRIMMED MEAN CPI +6.9% Y/Y; MEDIAN +6.5%; Q3 +6.1%

AUSTRALIA Q4 TRIMMED MEAN CPI +1.7% Q/Q; MEDIAN +1.5%; Q3 +1.9%

AUSTRALIA Q4 WEIGHTED MEDIAN CPI +5.8% Y/Y; MEDIAN +5.5%; Q3 +4.9%

AUSTRALIA Q4 WEIGHTED MEDIAN CPI +1.6% Q/Q; MEDIAN +1.4%; Q3 +1.4%

AUSTRALIA DEC CPI +8.4% Y/Y; MEDIAN +7.7%; NOV +7.3%

AUSTRALIA DEC WESTPAC LEADING INDEX -0.13% M/M; NOV -0.16%

The six-month annualised growth rate in the Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, was –0.97% in December, largely unchanged on the –0.96% read in November. (Westpac)

NEW ZEALAND Q4 CPI +7.2% Y/Y; MEDIAN +7.1%; Q3 +7.2%

NEW ZEALAND Q4 CPI +1.4% Q/Q; MEDIAN +1.3%; Q3 +2.2%

RBNZ Q4 SECTORAL FACTOR MODEL INFLATION +5.8% Y/Y; Q3 +5.6%

NEW ZEALAND DEC CREDIT CARD SPENDING -1.6% M/M; NOV -2.5%

NEW ZEALAND DEC CREDIT CARD SPENDING +12.4% Y/Y; NOV +16.2%

MARKETS

US TSYS: Marginally Cheaper, Cross-Market Flows Dominate

TYH3 deals at 115-00, -0-01, a touch off the base of its 0-06+ range on volume of ~79K.

- Cash Tsys sit 0.5-1.5bp cheaper across the major benchmarks.

- An early richening was driven by a bid in Antipodean rates, as New Zealand CPI was softer than RBNZ projections, in both headline and non-tradeable terms. An early, modest bid in JGBs also assisted.

- Cheapening in ACGBs, in lieu of stronger than expected Australia CPI data then weighed on Tsys, unwinding the early bid.

- Liquidity remained impaired by the ongoing LNY holidays in Asia, with little follow through in Tsys when compared to Antipodean rates.

- UK PPI data headlines an otherwise thin European docket. Further out matters north of the border will garner attention with the latest Bank of Canada monetary policy decision due today. On the supply side we have the latest 5-Year Tsy auction.

JGBS: Futures Essentially Flat, 7- To 20-Year Zone Weakest Area On Curve

JGBs lacked anything in the way of meaningful direction during Wednesday’s Tokyo session. The major cash JGB benchmarks are 2bp cheaper to 2bp richer across the curve, with the 7- to 20-Year zone providing the weakest point on the curve throughout the session.

- Meanwhile, JGB futures held to a relatively confined range, particularly by recent standards, last dealing -1 ahead of the close.

- The swap curve twist flattened, with 30+-Year rates nudging lower, while the 7- to 20-Year zone once again saw the biggest move higher, akin to yields on the JGB curve.

- Domestic headline flow was particularly light, with PM Kishida reaffirming recent rhetoric re: the BoJ, stressing its independence, while remaining non-committal re: the potential for a tweak to the government-BoJ accord on inflation.

- Elsewhere, ministerial rhetoric touched on fiscal matters re: childcare provisions, but there was little there for markets to latch onto.

- Offer/cover ratios remained in check across the latest round of BoJ Rinban operations (covering 1- to 25-Year JGBs), sitting at 1.5-2.6x.

- The lack of domestic catalysts left swings in wider core global FI markets at the fore.

- Looking ahead, 40-Year JGB supply headlines tomorrow’s domestic docket.

AUSSIE BONDS: Two-Way On Regional CPI, RBA Dated OIS Pushes Firmer In Lieu Of Local Prints

Early Sydney trade was two-way, with the early richening inspired by an overnight bid in core global FI markets and NZ CPI data that was a little softer than the RBNZ expected.

- Firmer than expected (vs. newswire surveys) domestic CPI data then applied notable pressure, leaving YM -9.0 & XM -4.0 at the close, a touch above their respective session lows. The major cash ACGBs finished 2-10bp cheaper as the wider curve bear flattened. ACGB widened vs. global peers post-CPI.

- The headline CPI metric was a touch below the RBA’s forecast +8% Y/Y, although the trimmed mean metric topped the Bank’s +6.5% Y/Y forecast. Inflation continues to run at particularly elevated levels for this stage in the RBA hiking cycle.

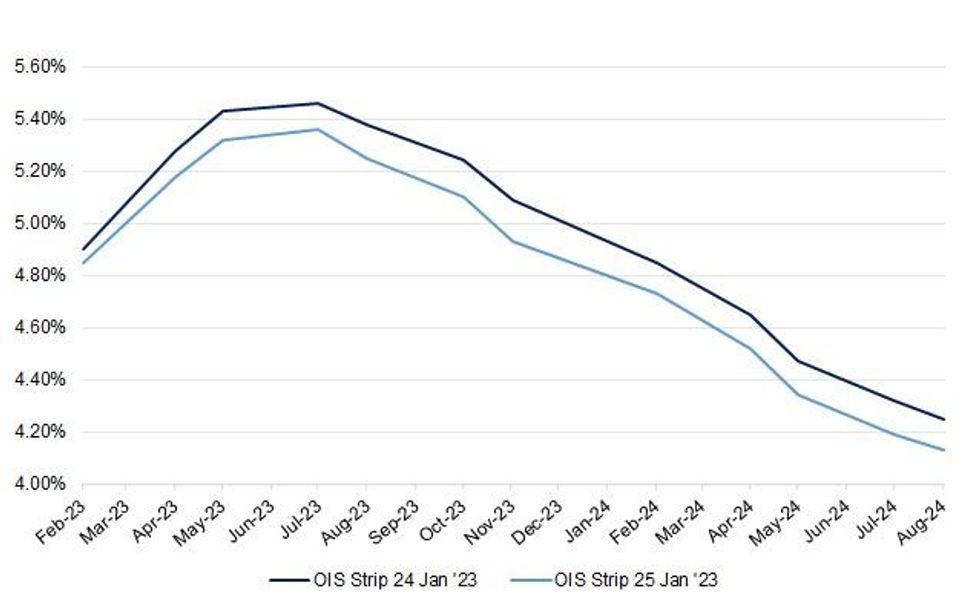

- Bills finished 13-19bp cheaper through the reds, in what was a volatile day for Aussie STIRs. RBA dated OIS now shows ~23bp of tightening for next month’s meeting, almost fully pricing a 25bp hike post-CPI. Meanwhile, terminal cash rate pricing is showing just above 3.75% late in the day after printing below 3.50% in the wake of the NZ CPI release (see chart below for a visual on intraday swings). There hasn’t been any meaningful RBA call changes from the sell-side post CPI.

- Australian markets are closed on Thursday as the country observes the Australia Day holiday.

Fig. 1: Intraday Moves In RBA Dated OIS

Source: MNI - Market News/Bloomberg

NZGBS: Firmer Post-CPI, Although Curve Steepens As Day Wears On

Q4 CPI (in both headline and the underlying non-tradables form) undershot RBNZ expectations, allowing NZGBs to add to the early richening that was derived from moves in wider core global FI markets. The RBNZ’s own sectoral factor model inflation print ticked higher.

- All 3 of the Y/Y metrics outlined above remain comfortably above the RBNZ’s inflation target.

- Firmer than expected Australian inflation crossed in the time between the domestic inflation prints, which introduced some trans-Tasman impetus and meant that it wasn’t a one-way session, with a steepening bias developing on the curve.

- The major cash NZGB benchmarks finished. Little changed to 7bp richer, with the longer end finishing over 10bp off richest levels.

- Swap rates were 2-13bp lower, also steepening, with 2-Year swap rates hovering just above YtD lows.

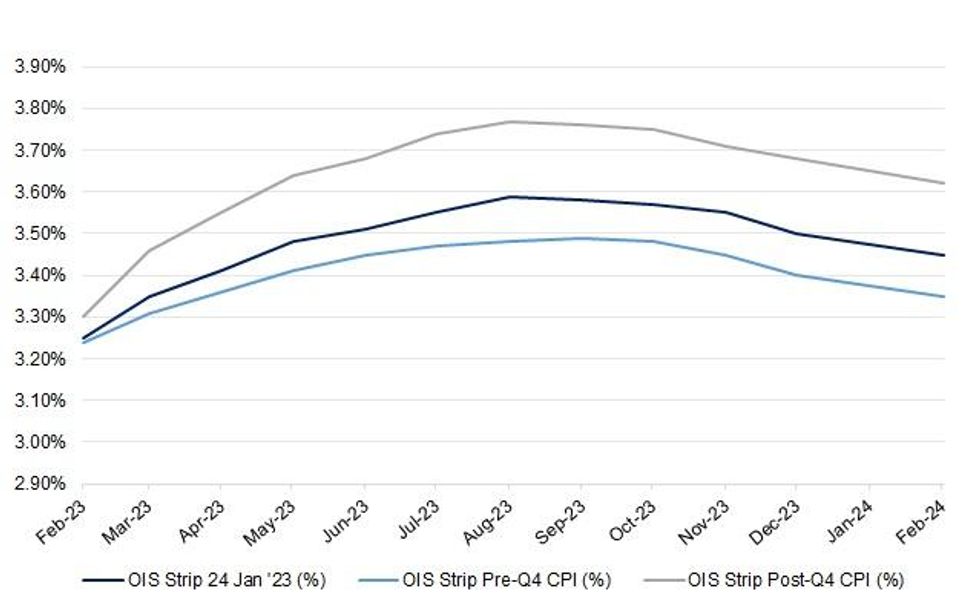

- RBNZ dated OIS initially shifted lower on NZ CPI data, before pulling off session lows in the wake of the Australian data (see the chart below for the intraday change observed on the strip).

- When it comes to the “Big 4,” ANZ & Westpac now look for a 50bp OCR hike next month (from 75bp prev.), while ASB & BNZ still look for a 75bp step (they acknowledge the chance of a 50bp move). The OIS strip prices in 60bp of tightening for next month’s meeting.

- Looking ahead, tomorrow’s local docket is headlined by the weekly NZGB auctions, covering NZGB-27, -33 & -51.

Fig. 1: Change In RBNZ Dated OIS Strip Around NZ Q4 CPI Data

Source: MNI - Market News/Bloomberg

EQUITIES: Negative US Tech Lead Doesn't Deter Asia Sentiment

Regional equities are mostly higher, despite an indifferent lead from US markets on Tuesday and negative trends in futures during today's session. Markets re-opening from the LNY break, like South Korea and Singapore have rallied, playing catch up with the firmer trend through Friday/Monday in offshore markets.

- US futures are down close to 0.4% for the S&P, near -0.7% for the Nasdaq, although we are away from worst levels. A weak revenue update from Microsoft, particularly in its could business, has weighed today.

- Still, the Nikkei 225 is +0.40% at this stage, moving above levels that prevailed pre BoJ in mid December last year.

- The Kospi is +1.33%, with offshore investors adding $490.1mn to local equities, in the first session of trading since last Friday. The Straits Times in Singapore is +1.80% at this stage.

- The ASX 200 is down slightly at this stage, while Indian indices have fallen 0.60/0.70% in the first part of trade, as weakness in the Adani Group weighs.

GOLD: Prices Lower On Higher US Yields But Trend Bullish

Bullion fell during Tuesday’s NY session on the better-than-expected PMIs but then bounced back after the weak Richmond Fed Index. It ended the day up 0.3% but during the APAC session it has taken a step down to $1931.45/oz (-0.3%) on the back of higher Treasury yields. Today it reached a high of $1937.35 and a low of $1929.03. The USD is trading sideways.

- Gold reached a new cycle high of $1942.54 on Tuesday and moving average studies are bullish. Firm resistance is now at $1963.70 (76.4% retracement of Mar-Sep 2022 bear leg).

- Bullion is currently up 5.9% so far this month on growing US recession fears and expected slowing of Fed tightening.

OIL: Crude Consolidates After Sharp Fall

After a sharp fall on Tuesday, oil prices are slightly higher during the APAC session. WTI is up 0.2% to $80.30/bbl after reaching a low of $80.08 and a high of $80.66. Brent is flat to around $86.40 after a high of $86.81 and low of $86.27. Again recession fears are being balanced by an expected increase in Chinese demand. The USD is flat.

- On the upside, Brent failed to break through resistance at $89.18 on Tuesday, the December 1 high.

- Representatives from OPEC members have said that they expect the advisory committee to recommend that output quotas are unchanged at next week’s meeting. (bbg)

- API data showed another build in US crude stocks. They rose 3.4mn barrels in the latest week and gasoline inventories rose 0.6mn but distillate fell 1.9mn. The EIA data is out later today.

FOREX: A$ Dominates Post CPI Beat

USD indices are slightly lower, but the main story today has been the AUD surge, with AUD/USD breaching 0.7100 (+0.80% for the session), and strongly outperforming on crosses. This came after the stronger than expected domestic inflation data.

- The stronger inflation data, which was uniformly above market expectations, has pushed market pricing to a 25bps hike for the February meeting. One sell-side house reportedly sees risks of a 50bps move. Yield differentials have swung back in AUD's favor, the 2yr spread to -1.07bp, +15bps for the session. A$ bulls will eye August 11 2022 highs at 0.7137.

- AUD/NZD is up around 1%, last near 1.0940, meeting resistance close to the simple 100-day MA (1.0956).

- NZ inflation came in below RBNZ expectations, which has worked against the NZD and yield momentum for the currency. NZD/USD fell to 0.6467, but dips have been supported, last around 0.6485/90.

- US equity futures are lower, led by weakness in the tech space, but this hasn't impact sentiment a great deal today. USD/JPY is slightly higher, last around 130.50. Kishida came across the wires with a number of headlines related to the BoJ but this hasn't impact sentiment. The PM stated specific monetary tools are for the BoJ to decide.

- EUR/USD is around 1.0900 currently, slightly up on NY closing levels.

- Looking ahead, the BoC decision is due, while in Germany the IFO prints.

FX OPTIONS: Expiries for Jan25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1975(E556mln), $1.2000(E563mln), $1.2050-70(E658mln), $1.2090-1.2100(E519mln), $1.2230-40(E1.2bln-EUR puts), $1.2245-55(E936mln)

- USD/JPY: Y103.25-35($601mln-USD puts)

- GBP/USD: $1.3370-80(Gbp689mln)

- AUD/USD: $0.7550(A$2.8bln), $0.7650(A$1.4bln), $0.7690-0.7700(A$700mln), $0.7750(A$768mln), $0.7800(A$711mln)

- USD/CAD: C$1.2700($603mln-USD puts), C$1.2900($536mln-USD puts)

- USD/CNY: Cny6.5700($1bln)

- USD/MXN: Mxn19.50($550mln), Mxn20.00-01($543mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/01/2023 | 0700/0700 | *** |  | UK | Producer Prices |

| 25/01/2023 | 0700/0800 | ** |  | SE | PPI |

| 25/01/2023 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 25/01/2023 | 0800/0900 | ** |  | ES | PPI |

| 25/01/2023 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 25/01/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 25/01/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 25/01/2023 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 25/01/2023 | 1500/1000 |  | CA | Bank of Canada Monetary Policy Report | |

| 25/01/2023 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 25/01/2023 | 1600/1100 |  | CA | Bank of Canada Governor press conference | |

| 25/01/2023 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/01/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.