-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

*MNI EUROPEAN OPEN: Gold Correction Continues

*Chart updated correctly

EXECUTIVE SUMMARY

- KAPLAN SAYS LOOSE FISCAL IS HOLDING UP FED CUT - MNI INTERVIEW

- POLICY MOVE EYED IF INFLATIONS MEETS 2% - BOJ’S UEDA - MNI BRIEF

- SUZUKI: ENVIRONMENT IN PLACE FOR INTERVENTION IF NEEDED - BBG

- CHINA MAY STILL CUT MLF RATE FURTHER TO REDUCE FUNDING COST - CSJ

- U.S. TAKES AIM AT CHINESE BANKS AIDING RUSSIA WAR EFFORT -- WSJ

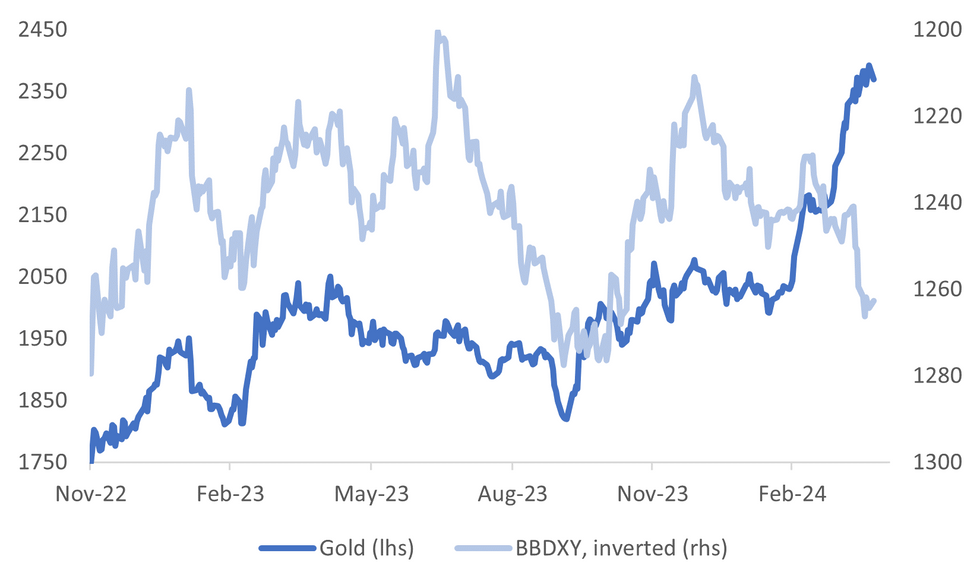

Fig. 1: Gold Correction Continues From Recent Record Highs

Source: MNI - Market News/Bloomberg

U.K.

IMMIGRATION (BBG): Rishi Sunak’s government is preparing to get the first deportation flights to Rwanda off the ground by July after the UK prime minister’s flagship law to declare the African nation a “safe” destination for asylum seekers cleared its final hurdle in Parliament.

NATO (BBC): The PM is travelling to Poland on Tuesday to meet Polish Prime Minister Donald Tusk and the secretary general of the Nato defence alliance - and promise more money to support Ukraine. The UK will provide an additional £500m to Kyiv on top of the £2.5bn allocated for this financial year.

EUROPE

EU (MNI): Between five and 10 European Union states are likely to face excessive deficit procedures based on 2023 deficit and debt data validated by Eurostat on Monday, EU sources told MNI.

UKRAINE (BBG): US President Joe Biden told his Ukrainian counterpart Volodymyr Zelenskiy that his administration would move quickly to distribute security assistance if the Senate votes this week to approve an aid package including $61 billion for Kyiv.

DEFENCE (POLITICO): Sunak visits Germany for the first time as prime minister Tuesday, with German Chancellor Olaf Scholz expected to seek clear assurances on British defense spending after decades of real-terms cuts.

ECB (BBG): The European Central Bank can’t be the solution to the funding challenges for the green transition as it’s legally impossible and would risk stoking inflation, Governing Council member Francois Villeroy de Galhau said.

EU (BBG): European Central Bank President Christine Lagarde reiterated that Europe and the US should avoid excessively offering economic perks in a bid to boost growth.

“We should not become engaged in a subsidy race between our economies, which creates a zero-sum game,” Lagarde said Monday in a speech at Yale University.

U.S.

FED (MNI INTERVIEW): Former Dallas Fed President Robert Kaplan told MNI the central bank needs to refrain from cutting interest rates perhaps all the way through this year depending on incoming data, blaming the lack of relief on loose fiscal policy he says is propping up services inflation.

US/CHINA (WSJ): The U.S. is drafting sanctions that threaten to cut some Chinese banks off from the global financial system, arming Washington's top envoy with diplomatic leverage that officials hope will stop Beijing's commercial support of Russia's military production, according to people familiar with the matter.

OTHER

JAPAN (MNI BIREF): Bank of Japan Governor Kazuo Ueda said on Tuesday the BOJ would tweak the degree of easy policy through adjustments to the unsecured overnight call loan rate if inflation rises to its 2% target as expected.

JAPAN (BBG): Japanese Finance Minister Shunichi Suzuki says in parliament the environment is in place to intervene in the foreign exchange market if needed.

BRAZIL (MNI BRIEF): Central Bank of Brazil Governor Roberto Campos Neto said on Monday that his board is navigating a scenario of greater uncertainty, which is why it is so hard to provide solid forward guidance.

CHINA

POLICY (CSJ): China’s central bank is still likely to further lower its medium-term lending facility (MLF) rates to help reduce financing cost for the economy, although domestic banks’ benchmark lending rates were kept unchanged on Monday, China Securities Journal reports Tuesday, citing analysts.

POLICY (PEOPLE’S DAILY): China vows to strengthen coordination between fiscal, monetary policies and financial reforms, improve basic currency injection and money supply control mechanisms, says the Communist Party theory study group of finance ministry in a commentary on People’s Daily.

MARKETS (XINHUA): China will design rules and formulate policies using market concepts and continue to deepen capital market reform, Xinhua News Agency reported citing Premier Li Qiang. It is necessary to improve issuance, trading and delisting systems to promote a virtuous cycle of investment and financing, said Li.

MARKETS (SECURITIES TIMES): Central Huijin, a Chinese sovereign fund may have purchased more than CNY300 billion in A-share ETFs in Q1, Securities Times reported citing the Q1 report of public funds. Central Huijin said early February it would expand the scope of ETF holdings, continue to increase the scale of holdings, and resolutely maintain the smooth operation of the capital market.

CHINA MARKETS

MNI: PBOC Conducts CNY2 Bln Via OMO Tues; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo on Tuesday, with the rates unchanged at 1.80%. The operation has led to no change to the liquidity after offsetting the maturity of CNY2 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8116% at 10:02 am local time from the close of 1.8351% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 47 on Monday, the same as the close on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1059 on Tuesday, compared with 7.1043 set on Monday. The fixing was estimated at 7.2444 by Bloomberg survey today.

MARKET DATA

AUSTRALIA JUDO BANK APRIL FLASH COMPOSITE PMI 53.6; PRIOR 53.3

AUSTRALIA JUDO BANK APRIL FLASH MFG PMI 49.9; PRIOR 47.3

AUSTRALIA JUDO BANK APRIL FLASH SERVICES PMI 54.2; PRIOR 54.4

JAPAN JIBUN BANK APRIL FLASH COMPOSITE PMI 52.6; PRIOR 51.7

JAPAN JIBUN BANK APRIL FLASH SERVICES PMI 54.6; PRIOR 54.1

JAPAN JIBUN BANK APRIL FLASH MFG Mfg PMI 49.9; PRIOR 48.2

MARKETS

US TSYS: Treasury Futures Are Little Changed, Ranges Tight

- Treasury futures have done very little on Tuesday, ranges are tight (10Y - high 107-30+, low 107-27) and volumes are on the low side, following on from the US session when volumes were at about 60% verse the 20-day average, Jun'24 10Y contract is now unchanged from NY closing levels at 107-28, a downward trend remains and a bear cycle remains in play, initial support is at 107-13+ (Apr 16 low), while initial resistance is 108-22+ (Apr 19 high).

- Cash Treasury curve little changed Today, with the 2Y yield +0.5bps to 4.976%, 10Y +0.4bps to 4.613%, the 2y10y is unchanged at -35.879.

- Across local rate markets, NZGBs are 4-5bps lower, ACGBs are 1-4bps lower and JGBs are 1-5bps higher, in the EM space INDON & PHILIP yields are 1-4bps lower.

- Projected rate cut pricing running steady to mildly lower vs. late Friday lvls: May 2024 -2.6% w/ cumulative -0.6bp at 5.322%; June 2024 at -16.2% w/ cumulative rate cut -4.7bp at 5.282%. July'24 cumulative at 11.6bp, Sep'24 cumulative -22.3bp.

- Looking ahead: Philadelphia Fed Non-Manufacturing Activity, S&P Global US PMI, New Home Sales

JGBS: Futures Downtick, BoJ Gov. Ueda’s Comments Add Pressure, Mixed Results For 2Y Supply

JGB futures are holding a downtick, -2 compared to the settlement levels.

- There hasn’t been much in the way of domestic data drivers to flag, outside of the previously outlined Jibun Bank Flash PMIs.

- (MNI) BoJ Governor Ueda said the BoJ would tweak the degree of easy policy through adjustments to the unsecured overnight call loan rate if inflation rises to its 2% target as expected. (See linkICYMI)

- Cash US tsys are little changed in today’s Asia-Pacific session.

- Today’s 2-year supply demonstrated mixed demand metrics. The low price met dealer expectations and the auction tail was unchanged from last month. However, the cover ratio declined to 3.481x from 4.072x in March.

- This outcome is likely to be perceived as disappointing, especially considering the optimistic tone set by other JGB auctions in April.

- The cash JGB curve has maintained its bear-steepening, with yields flat to 4bps higher. The benchmark 10-year yield is little changed at 0.887%, just shy of the YTD high of 0.891%.

- The swaps curve has twist-steepened, pivoting at the 10s, with rates 1bp lower to 5bps higher. Swap spreads are tighter out to the 7-year and wider beyond.

- Tomorrow, the local calendar will see PPI Services data alongside BoJ Rinban Operations covering 3-25-year+ JGBs.

AUSSIE BONDS: Richer, Narrow Ranges, Awaiting Q1 CPI Tomorrow

ACGBs (YM +3.0 & XM +4.0) are slightly richer after dealing in narrow ranges so far in the Sydney session. With Q1 CPI data due for release tomorrow and US tsys showing no net movement in today’s Asia-Pac session, local participants have largely sat on the sidelines.

- Q1 CPI will be watched closely as it feeds into the RBA’s updated outlook published on May 7 and thus also its decision-making.

- Bloomberg consensus expects it to ease to 3.5% y/y from 4.1% but for the quarterly rise to pick up. Trimmed mean is forecast to drop to 3.8% from 4.2%, helped by favourable base effects.

- (MNI) Given the upward surprise to NZ’s domestic inflation in Q1, there is a risk the services component remains “sticky”, which the RBA is monitoring closely (See link).

- Cash ACGBs are 3-4bps richer, with the AU-US 10-year yield differential at -33bps, its cycle low.

- Swap rates are 3-5bps lower, with the 3s10s curve flatter.

- The bills strip has twist-flattened, pivoting at late-whites, with pricing -2 to +3.

- RBA-dated OIS pricing is little changed across meetings. A cumulative 17bps of easing is priced by year-end.

- Later today, the US calendar will see Philadelphia Fed Non-Manufacturing Activity, S&P Global US PMIs and New Home Sales.

NZGBS: Richer & Just Off Best Levels, NZ-US 10Y Differential Unchanged

NZGBs closed 5bps richer across benchmarks, just off session bests. In the absence of domestic data, local participants have used US tsys for directional guidance.

- The NZ-US 10-year yield differential is unchanged versus yesterday’s local close. At +22bps, the differential sits around its tightest level since mid-2021. Before this narrowing started in March, the differential had oscillated between +30 and +80bps since late 2022.

- Swap rates closed 5-6bps lower.

- RBNZ dated OIS pricing closed is 2-5bps softer for meetings beyond August, with November leading. A cumulative 54bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Trade Balance data.

- Also tomorrow, Australia will release Q1 CPI data. Bloomberg consensus expects it to ease to 3.5% y/y from 4.1% but for the quarterly rise to pick up. Trimmed mean is forecast to drop to 3.8% from 4.2%, helped by favourable base effects.

- (MNI) Given the upward surprise to NZ’s domestic inflation in Q1, there is a risk the services component remains “sticky”, which the RBA is monitoring closely (See link)

FOREX: A$ Posts Modest Gains, Suzuki States Ready To Intervene If Needed

The BBDXY sits down a touch, last just under 1264.0 in the first part of Tuesday trade. Outside of some modest AUD gains, overall moves have been muted though.

- Cross asset sentiment has been steady, with US equity futures close to flat after opening in the red. US yields sit close to unchanged as well, amid light news flow (the Fed is in the blackout period).

- After rising 0.5% on Monday, AUDUSD is up 0.15% so far today to 0.6460, breaking above initial resistance at 0.6457, April 18 high, opening up 0.6498, 20-day EMA. The pickup in private sector activity seen in Q1 was sustained into Q2 according to the Judo Bank preliminary PMIs for April.

- Equities are generally stronger in the region, although once again China markets are underperforming.

- The Kiwi is the worst performing G10 currency today although only slightly lower while ranges remain tight. NZD/USD was last near 0.5915. AUD/NZD is up 0.10% and back above 1.0900 at 1.0912. The pair now eyes a test of the 1.0920 area that it failed to break above back on the 15 & 16th April. Note we have Q1 AU CPI tomorrow.

- USD/JPY sits just under 154.75 in recent dealing. Earlier comments from FinMin Suzuki provided some support for the yen. He noted the environment was in place for intervention if needed. There was little follow through to yen gains though. Earlier we had a pick in Japan's manufacturing PMI for April (preliminary) but this didn't impact FX sentiment.

- Looking ahead, US preliminary April Global S&P PMIs are due, new home sales and Philly & Richmond Fed indices as well as European PMIs print. BoE’s Pill and Haskel speak.

ASIA EQUITIES: China & HK Equities Mixed, CSRC Announcement Helping HK Equities

Hong Kong and China equity are mixed today, with Hong Kong equities outperforming again today after the CSRC announced five measures to promote Chinese companies listing in Hong Kong with companies expected to shift their fundraising plans to Hong Kong following recent tightening of domestic listing rules. China’s CB to further lower its MLF rates to help reduce financing cost for the economy, according to analysts.

- Hong Kong equities are surging higher today with the HSTech Index up 2.85% and now testing both the 20 & 50-day EMAs, while the 14-day RSI has ticked into positive territory at 50, the Mainland Property Index up 1.17% however still remains below all EMA's and 14-day RSI is below 50 although it's ticking higher, while the HSI is up 1.64% and has now broken back above 100-day EMA with a potential move to the 200-day EMA at 17,266. China Mainland equities are underperforming this morning, with the CSI300 down 0.56% and now testing the 50 & 100-day EMA, levels we have remained above since mid Feb, a break below here could signal a further leg down and a test of the 3,400 level. Small-cap indices are mixed with the CSI1000 down 0.50% while the CSI2000 is up 0.60%.

- China Northbound had an inflow of 1.4b yuan on Thursday, momentum has been decreasing over the past week with the 5-day average at -2.68billion, while the 20-day average sits at -1.28billion yuan.

- Analysts suggest that China's central bank may lower its medium-term lending facility (MLF) rates in the third quarter to reduce financing costs for the economy. This move could also lead to a decrease in banks' loan prime rates and help address local debt risks, according to experts cited by the China Securities Journal. However, there are concerns about the shrinking room for further reduction in loan prime rates due to pressure on banks' net interest margins caused by declining lending rates

- Recent measures by China's securities regulator to support IPOs in Hong Kong are expected to lead mainland firms to shift their fundraising plans to the city, bolstering its status as a premier listing destination. The move follows tightening regulations on domestic listings and aims to enhance connectivity between Hong Kong and mainland capital markets, although the impact may not be immediate due to ongoing global uncertainties.

- Looking ahead, HK CPI Composite later today & Trade Balance on Thursday, while the calendar for China remains quiet.

ASIA PAC EQUITIES: Asian Equities Head Higher Ahead Of Busy Earnings Week

Regional Asian equities are higher today, benchmark indexes in Japan, South Korea and Australia are up, while US equity futures are unchanged after US markets ended a run of down days led higher by Nvidia. Concerns remain around rising interest rates, stubborn inflation, and geopolitical risks although these tensions look to be cooling with focus for the moment turning to corporate earnings as about 40% of the S&P are set to report this week. Economic data from Australia and South Korea suggests some inflationary pressures but remains relatively subdued.

- Japanese equities are higher today recovering further from the sell-off on Friday. The Nikkei 225 index is up 0.31% to 37,555 and has now consolidated back above the 100-day EMA, while the broader Topix has outperformed recently and is now testing the 20-day EMA, up 0.21% to 2,668. Investors will be closely monitoring the earnings report of Nidec, a Kyoto-based manufacturer of precision and automotive motors. Many investors are cautious, waiting to see if the company's financial performance will differ from previous disappointing results in the EV sector. Additionally, attention is on the yen, which is trading close to a 34-year low against the dollar at 154.75, prompting investors to watch for any indications of potential verbal intervention or concrete measures by Japanese authorities to bolster the currency.

- South Korean equities are higher today, with PPI for March indicating a cooling of domestic inflationary pressure, with a smaller month-on-month rise compared to February, signaling progress in the broader disinflation process, while agricultural prices saw a notable increase, contributing to a modest year-on-year rise of 1.6%. The Kospi has traded back above the 100-day EMA, up 0.14% to 2,633.53. Focus now turns to GDP tomorrow.

- Taiwan equities are higher today ending a run of down days up 1.10%, the Taiex has just broken back above the 50-day EMA and now trades down 5.90% from recent highs after being down as much as 7.62% on Friday. Late Monday Taiwan's unemployment rate was unchanged in March at 3.4% as expected, looking ahead Industrial Production for march is expected out with consensus of 7.25% up from -1.10% in Feb.

- Australian equities are following wider markets higher today the ASX200 is up 0.46% and now up 2.70% from lows made on Friday, the index is now testing the 50-day EMA levels at 7,684. Industrials are the only sector in the red today, as Health Care stocks lead the way. Earlier Judo Bank PMIs showed an increased from the March, while focus will turn to CPI due out tomorrow.

- Elsewhere in SEA, New Zealand Equities are down 0.41%, Singapore equities are 1.22% higher ahead of March CPI due out later today, Malaysian equities up 0.40%, Philippines equities are up 0.93%, while Indonesian equities are up 0.67%

OIL: Crude Stabilising As Geopolitics Settle, Supply In Focus

Oil prices are up moderately during today’s APAC session after falling 0.1% on Monday. While fighting in Gaza continues and there is no further escalation of tensions between Israel and Iran, crude may range trade again. WTI is up 0.5% to $82.29/bbl after falling to $81.86 and Brent is 0.4% higher at $87.39 but tested $87 earlier. The USD index is down slightly.

- The US extended sanctions on Iran’s oil to include financing but analysts don’t expect the new measures to have a material impact on Iran’s crude exports, according to Bloomberg.

- Derivatives markets are easing with the premium Brent calls had over puts disappearing but the spread between the two nearest futures contracts continues to signal a tight market, as stated by Bloomberg.

- With geopolitical developments not currently driving energy prices, attention returns to fundamentals. US API inventory data is released later today. There has been sizeable crude stock builds in recent weeks while product inventories continue to decline.

- Later US preliminary April Global S&P PMIs, new home sales and Philly & Richmond Fed indices as well as European PMIs print. BoE’s Pill and Haskel speak.

GOLD: Biggest Decline In Almost Two Years

Gold is 1% lower in the Asia-Pacific session, after tumbling 2.7% to $2327.30 on Monday. This was the largest decline in almost two years.

- The yellow metal is now at its lowest level in a week, as geopolitical tensions in the Middle East ease.

- The move was not isolated to gold, with silver off by around 5% on the day, leaving it approximately 9% lower than the April high. As a result, the gold/silver ratio is back above the 200-dma, after dipping below earlier in the month.

- Bloomberg reports that bullion’s 16% YTD gain through last Friday could spur some reserve managers to consider slowing down their purchases should gold struggle to retain its mojo. The same mindset could affect Chinese savers who have been a notable source of demand.

- According to MNI’s technicals team, the trend condition in gold is unchanged and the outlook remains bullish, with sights on $2452.5, a Fibonacci projection, on the upside. Initial firm support is at $2310.2, the 20-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/04/2024 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 23/04/2024 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/04/2024 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/04/2024 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/04/2024 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/04/2024 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/04/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/04/2024 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/04/2024 | 0800/0900 |  | UK | BOE's Haskel Panelist at Econometric Seminar | |

| 23/04/2024 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/04/2024 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/04/2024 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/04/2024 | 1115/1215 |  | UK | BOE's Pill Speech at University of Chicago | |

| 23/04/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/04/2024 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/04/2024 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 23/04/2024 | 1400/1000 | *** |  | US | New Home Sales |

| 23/04/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/04/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.