-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump's First Post Election Interview

MNI POLITICAL RISK ANALYSIS - Week Ahead 9-15 Dec

MNI EUROPEAN OPEN: Market Vol. Continues As China Flags Unswerving Commitment To ZCS

EXECUTIVE SUMMARY

- CHINA TO ‘UNSWERVINGLY’ KEEP TO COVID ZERO POLICY, DASHING HOPES (BBG)

- CHINA'S COVID RESURGENCE SPURS NEW CURBS, FOXCONN IMPOSES RESTRICTIONS (RTRS)

- SENIOR WHITE HOUSE OFFICIAL INVOLVED IN UNDISCLOSED TALKS WITH TOP PUTIN AIDES (WSJ)

- JEREMY HUNT TO OUTLINE £60BN OF TAX RISES AND SPENDING CUTS (GUARDIAN)

- GERMANY EARMARKS $83 BILLION FOR GAS, POWER PRICE CAP IN 2023 (RTRS)

- CHINESE CHIP DESIGNERS SLOW DOWN PROCESSORS TO DODGE US SANCTIONS (FT)

- APPLE TRIMS NEW IPHONE OUTPUT BY 3 MILLION UNITS AS DEMAND COOLS (BBG)

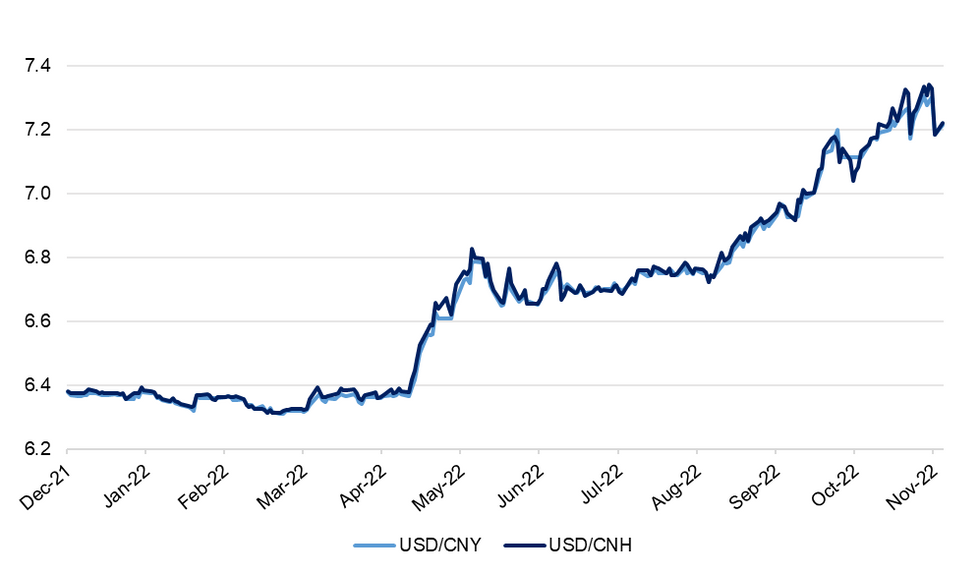

Fig. 1: USD/CNY Vs. USD/CNH

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE/GILTS: The Bank of England risks hurtling toward another bond market crisis as new signs of strain bubble up and threaten to force another intervention, City traders have warned. (Telegraph)

FISCAL: Rishi Sunak has warned that people cannot expect the state to “fix every problem” as he vowed to regain the trust of voters by being honest about the scale of the economic difficulties ahead. (The Times)

FISCAL: Jeremy Hunt has been warned by Treasury officials he must “think the unthinkable” and consider breaking the Conservatives’ tax lock pledge or the pensions triple lock or increase benefits by less than inflation to plug a £50 billion black hole. (The Times)

FISCAL: Jeremy Hunt will set out tax rises and spending cuts totalling £60bn at the autumn statement under current plans, including at least £35bn in cuts, the Guardian understands. (Guardian)

FISCAL: Middle-class workers face paying up to £10 billion more in income tax as Jeremy Hunt considers drastically reducing the relief they currently enjoy on their pension contributions. (Telegraph)

FISCAL: Electric cars are to be subject to vehicle excise duty for the first time under measures to be introduced by Jeremy Hunt, the UK chancellor, in this month’s Autumn Statement. (FT)

ECONOMY: Economic output and optimism fell last month to their lowest levels since the third national lockdown in February 2021 amid fears of a looming recession. (The Times)

PROPERTY: The Liberal Democrats have called for the creation of a £3bn mortgage protection fund to assist families who are seeing their repayments soar. (Sky)

PROPERTY: Property funds are dumping assets worth more than £1bn on to the London market as pressure mounts to meet redemption requests, with estate agents warning that they will have to accept big discounts in order to sell. (FT)

EUROPE

ECB: France’s central bank chief has warned that it may take up to three years to bring inflation under control and that the European Central Bank (ECB) will continue to raise interest rates as long as underlying inflation is still rising. (Irish Times)

FISCAL: EU officials will make a fresh bid at Monday’s Eurogroup meeting of eurozone finance ministers to persuade member states to better align their fiscal policies and energy support measures with the European Central Bank’s monetary policy stance, officials told MNI, admitting that their chances of success were modest. (MNI)

EUROGROUP: Ireland will nominate Paschal Donohoe to serve a second term as president of the Eurogroup even though he will no longer be Ireland's finance minister when his term in Europe comes to an end in January, the government said on Friday. (RTRS)

GERMANY: Germany will spend 83.3 billion euros ($83 billion), or 42% of a major protection scheme launched last month, to finance a cap on gas and power prices in 2023 in a bid to protect Europe's top economy, according to a draft proposal seen by Reuters. (RTRSTRS)

FRANCE: A study ordered by the French finance ministry found that the agricultural sector, including food companies and retailers, aren’t taking advantage of inflation to disguise higher margins. (BBG)

FRANCE: Several US funds are pushing the French state to lift its €10bn buyout offer to minority shareholders of energy utility EDF and asking France’s market regulator to recommend a price bump, adding to pressure from investors unhappy with the terms of the nationalisation. (FT)

FRANCE: For about half a century, France’s largest far-right party has been led by just two people: its founder, Jean-Marie Le Pen, and his daughter Marine. On Saturday, rank-and-file members chose an outsider as their new chief. (BBG)

ITALY: Italy's new government unveiled its first public finance targets on Friday, hiking borrowing to finance support measures for families and firms struggling with sky-high energy costs. (RTRS)

SWITZERLAND: Switzerland is experiencing a severe labor shortage that’s only going to get worse as more workers retire, the nation’s top private employer told a newspaper. (BBG)

RATINGS: Sovereign credit rating reviews of note from after hours on Friday include:

- Fitch affirmed France at AA; Outlook Negative

BANKS: The European Central Bank has clashed with UniCredit over the Italian lender’s plans to return cash to shareholders and its failure to leave Russia, according to people familiar with the matter. (FT)

U.S.

FED: Even as global central banks rapidly tightened financial conditions this year, U.S. households, banks and businesses have so far been able to adapt, Federal Reserve Vice Chair Lael Brainard said as the Fed released its semiannual report on financial stability. (RTRS)

FED: The Fed raised its benchmark federal-funds interest rate this week by 0.75 percentage point, or 75 basis points, at its fourth consecutive meeting to a level between 3.75% to 4%. That level is high enough to slow economic activity, and the question now is how much higher rates must go to sufficiently restrain demand to bring down inflation, said Boston Fed President Susan Collins in an interview Friday. (WSJ)

FED: The solid U.S. jobs report for October underscores why the Federal Reserve needs to raise interest rates higher than it had previously forecast in order to control inflation, Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, said Friday. (AP)

FED: It is time for the Federal Reserve to shift to smaller interest rate hikes to avoid tightening monetary policy more than needed, and slow the pace further once risks become more "two-sided," Chicago Fed President Charles Evans said on Friday. (RTRS)

FED: Following the Federal Reserve’s recent decision to increase the federal funds rate by 0.75 percent to a target range of 3.75 percent to 4 percent – marking the sixth consecutive rate hike and the fourth consecutive super-sized rate hike in just the past eight months – today Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, sent a letter to Federal Reserve Chair Jerome Powell. In the letter, Chairwoman Waters urges Chair Powell to consider the significant pain that these rate increases may inflict on families across the country and the impact these increases are having on the cost of housing, which remains a key driver of core inflation. (U.S. House Financial Services Committee)

FED: Former Treasury Secretary Lawrence Summers sees a risk of the Federal Reserve needing to boost interest rates to 6% or higher to bring inflation under control, given a US economy that is still running strong. (BBG)

POLITICS: An optimistic President Biden on Friday predicted that Democrats would maintain control of the Senate and “have a chance to win” the House of Representatives — even as polls show surging GOP momentum ahead of Election Day. (New York Post)

POLITICS: The House committee investigating the attack on the Capitol gave former President Donald Trump an extra week to provide requested documents after lawmakers said Friday that they did not receive any records from a subpoena issued last month in connection with the Jan. 6 riot. (NBC)

POLITICS: Former President Trump's inner circle is discussing announcing the launch of a 2024 presidential campaign on Nov. 14 — with the official announcement possibly followed by a multi-day series of political events, according to three sources familiar with the sensitive discussions. (Axios)

EQUITIES/ECONOMY: Meta Platforms Inc. is planning to begin large-scale layoffs this week, according to people familiar with the matter, in what could be the largest round in a recent spate of tech job cuts after the industry’s rapid growth during the pandemic. (WSJ)

EQUITIES: US companies that missed already low Wall Street earnings expectations in the third-quarter reporting season have been punished more severely than any time since at least the turn of the millennium. (FT)

EQUITIES: Apple Inc. expects to produce at least 3 million fewer iPhone 14 handsets than originally anticipated this year, according to people familiar with its plans. (BBG)

BANKS: The U.S. Federal Reserve is seeking comment on a proposal to publish a list of depository institutions that have access to master accounts, which grant firms access to Fed payment services. (RTRS)

OTHER

GLOBAL TRADE: U.S. President Joe Biden appears ready to pressure Japan and the Netherlands even more to join efforts to block the flow of advanced chip technology to China, where it could be used to develop cutting-edge weapons. (Nikkei)

GLOBAL TRADE: Taiwan’s Foxconn, the world’s largest contract electronics maker, said on Monday it was revising down its outlook for the fourth quarter due to COVID-19 control measures at a major factory in China’s Zhengzhou. (RTRS)

GLOBAL TRADE: Japan's government warned on Saturday that new electric vehicle tax credits in the United States could ultimately deter further investment by the Japanese there and hit employment in the world's biggest economy. (RTRS)

GLOBAL TRADE: China on Sunday said it will take the necessary steps to safeguard the rights and interests of its companies after Canada last week ordered three Chinese companies to divest their investments in Canadian critical minerals, citing national security. (RTRS)

U.S./CHINA: Alibaba and start-up Biren Technology are tweaking their most advanced chip designs to reduce processing speeds and avoid US-imposed sanctions aimed at suppressing Chinese computing power. (FT)

GEOPOLITICS: U.S. Secretary of State Antony Blinken said on Friday the Group of Seven countries (G7) is clear-eyed about the need to align their approach on China. (RTRS)

NATO: Sweden’s new centre-right government said it would distance itself from several Kurdish groups as the Scandinavian country’s prime minister prepares to meet Turkey’s president to persuade him to back its application to join Nato. (FT)

JAPAN: Japan's Ministry of Finance will raise 2-year government bond issuances by 100 billion yen ($679.49 million) a month from January to March to fund an economic stimulus package unveiled last month, a government draft document reviewed by Reuters showed on Monday. (RTRS)

RBA: The Reserve Bank would consider climate change risks to the Australian economy when setting monetary policy and take a more active role in cutting greenhouse emissions under a proposal put to the independent review of the bank. (Sydney Morning Herald)

SOUTH KOREA: No South Korean brokerage has taken part in repurchase transactions with the central bank as of Friday, in a sign that measures to stabilize credit markets may be working, Korea Economic Daily reported. (BBG)

NORTH KOREA: North Korea said on Monday that its recent missile launches were simulated strikes on South Korea and the United States as the two countries held a "dangerous war drill", while the South said it had recovered parts of a North Korean missile near its coast. (RTRS)

NORTH KOREA: North Korea fired four short-range ballistic missiles into the western sea on Saturday, South Korea's military said, as Seoul and Washington ended a high-profile six-day military exercise. (RTRS)

CANADA: Canada's fiscal update showed little of the restraint touted by Finance Minister Chrystia Freeland and pressure to spend may break open in next year's full budget and wipe out projections of a return to a surplus in five years, former top finance department official Don Drummond told MNI. (MNI)

MEXICO: The International Monetary Fund (IMF) on Friday forecast Mexico's economy will grow 2.1% in 2022 and 1.2% in 2023, saying "economic growth is expected to slow in the near term reflecting weaker U.S. growth and tighter global financial conditions." (RTRS)

BRAZIL: Guilherme Estrella, former director of Brazil's state-controlled oil giant Petrobras, filed a lawsuit in court to block the payment of dividends by the company. (RTRS)

RUSSIA: President Biden’s top national-security adviser has engaged in recent months in confidential conversations with top aides to Russian President Vladimir Putin in an effort to reduce the risk of a broader conflict over Ukraine and warn Moscow against using nuclear or other weapons of mass destruction, U.S. and allied officials said. (WSJ)

RUSSIA: The Biden administration is privately encouraging Ukraine’s leaders to signal an openness to negotiate with Russia and drop their public refusal to engage in peace talks unless President Vladimir Putin is removed from power, according to people familiar with the discussions. (Washington Post)

RUSSIA: Russia wants the West to ease restrictions on state agriculture lender Rosselkhozbank to facilitate Russian grain exports, according to four sources familiar with the request, made during talks to extend a deal on food shipments from Ukraine. (RTRS)

RUSSIA: Russia’s Lukoil has turned down an offer to sell its Italian refinery to a US private equity group in a decision that risks bankrupting the Sicilian plant and costing thousands of jobs. (FT)

SOUTH AFRICA: Eskom, which imposed rolling power cuts again until further notice on Sunday, will be unable to meet the electricity needs of the country over the next five years, its latest statutory assessment of the power system showed. (Business Day)

IRAN: Iran's Revolutionary Guards tested a new satellite-carrying rocket on Saturday, state media reported, a move the United States called "unhelpful and destabilising". (RTRS)

EQUITIES: Hong Kong’s Securities and Futures Commission plans to issue a new guidance next year to strengthen the risk management in futures trading, Hong Kong Economic Journal reports, citing unidentified people. (BBG)

ENERGY: Commodities giant Vitol SA is threatening to suspend gas deliveries to a German state-controlled energy business in a legal standoff that could cost the German company around €1 billion. (BBG)

OIL: The price cap on Russian oil exports to be imposed by G7 countries and Australia next month will apply only to seaborne cargoes through the first landed sale and will exclude shipping and trading costs, a coalition official said on Friday. (RTRS)

OIL: A plan to cap the price of Russian oil exports is close to being finalised, the G7 said on Friday, with details emerging of how they aim to reduce a vital source of revenue for the Kremlin while limiting the impact on supply and global prices. (FT)

OIL: U.S. President Joe Biden said on Friday a meeting with oil companies has not been scheduled, after earlier saying he was planning to talk to the firms to complain about their record profits while gas prices remain high. (RTRS)

OIL: Despite an extended streak of strong profits, shale companies are slowing their oil-field activity, keeping U.S. oil production roughly flat and offering little relief for tight global markets. (WSJ)

CHINA

CORONAVIRUS: China will “unswervingly” adhere to its current Covid controls as the country faces increasingly serious outbreaks, health officials said, damping hopes that Beijing will ease its stringent policies that have put cities and factories under prolonged lockdowns. (BBG)

CORONAVIRUS: China's escalating COVID-19 resurgence has spurred authorities and companies, including key iPhone manufacturer Foxconn, to ramp up measures to contain outbreaks, disrupting production and throwing business events into confusion. China reported on Monday 5,496 new locally transmitted COVID-19 cases for Nov. 6, the highest since May 2, when the country's commercial capital of Shanghai was put under a crushing lockdown amid its worst outbreak. (RTRS)

PBOC: China's top anti-corruption watchdog said on Saturday it is investigating Fan Yifei, one of six deputy governors of China's central bank, over "suspected serious violations of discipline and law." (RTRS)

FISCAL: China allotted part of the 2023 local government bond quota to local governments, 21st Century Business Herald reported Friday, citing unidentified officials at local fiscal departments. Regulators require local governments to start bond sale using the early allotted quota in Jan. 2023 and use the funds by end of 1H. (BBG)

POLICY: China's state planner on Monday issued a notice saying it would further improve the policy environment to encourage the development of private investment, the latest move to prop up the faltering economy facing multiple headwinds. (RTRS)

PROPERTY: Foreign companies including BlackRock, Daiwa House and Capitaland have started “bottom fishing” for bargains in China's property market, which reflects optimism about its prospects, the central bank-run newspaper Financial News reported citing analysts. (MNI)

EQUITIES: China's securities watchdog will expand the number of stocks included in the Stock Connect Scheme with Hong Kong as it promotes the opening up of capital markets to attract more domestic and foreign medium- and long-term funds, the Shanghai Securities News reported citing Fang Xinghai, vice chairman of China Securities Regulatory Commission. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY68 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) on Monday injected CNY2 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY68 billion after offsetting the maturity of CNY70 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8928% at 9:44 am local time from the close of 1.6371% on Friday.

- The CFETS-NEX money-market sentiment index closed at 49 on Friday vs 52 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 7.2292 MON VS 7.2555 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.2292 on Monday, compared with 7.2555 set on Friday.

OVERNIGHT DATA

CHINA OCT TRADE BALANCE +$85.15BN; MEDIAN +$95.97BN; SEP +$84.74BN

CHINA OCT USD EXPORTS -0.3% Y/Y; MEDIAN +4.5%; SEP +5.7%

CHINA OCT USD IMPORTS -0.7% Y/Y; MEDIAN 0.0%; SEP +0.3%

CHINA OCT TRADE BALANCE +CNY586.8BN; MEDIAN +CNY702.9B YUAN; SEP +CNY573.57BN

CHINA OCT CNY EXPORTS +7.0% Y/Y; MEDIAN +12.7%; SEP +10.7%

CHINA OCT CNY IMPORTS +6.8% Y/Y; MEDIAN +10.0%; SEP +5.2%

AUSTRALIA OCT FOREIGN RESERVES A$86.3BN; SEP A$83.6BN

MARKETS

SNAPSHOT: Market Vol. Continues As China Flags Unswerving Commitment To ZCS

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 345.15 points at 27546.16

- ASX 200 up 41.241 points at 6933.7

- Shanghai Comp. up 5.756 points at 3076.378

- JGB 10-Yr future up 9 ticks at 148.53, yield down 0.6bp at 0.251%

- Aussie 10-Yr future down 5.0 ticks at 96.090, yield up 5.3bp at 3.902%

- U.S. 10-Yr future down 0-02 at 109-31, yield down 0.63bp at 4.1521%

- WTI crude down $1.23 at $91.36, Gold down $9.52 at $1672.44

- USD/JPY up 54 pips at Y147.15

- CHINA TO ‘UNSWERVINGLY’ KEEP TO COVID ZERO POLICY, DASHING HOPES (BBG)

- CHINA'S COVID RESURGENCE SPURS NEW CURBS, FOXCONN IMPOSES RESTRICTIONS (RTRS)

- SENIOR WHITE HOUSE OFFICIAL INVOLVED IN UNDISCLOSED TALKS WITH TOP PUTIN AIDES (WSJ)

- JEREMY HUNT TO OUTLINE £60BN OF TAX RISES AND SPENDING CUTS (GUARDIAN)

- GERMANY EARMARKS $83 BILLION FOR GAS, POWER PRICE CAP IN 2023 (RTRS)

- CHINESE CHIP DESIGNERS SLOW DOWN PROCESSORS TO DODGE US SANCTIONS (FT)

- APPLE TRIMS NEW IPHONE OUTPUT BY 3 MILLION UNITS AS DEMAND COOLS (BBG)

US TSYS: Twist Flattening On Latest China Pushback To COVID Restriction Relaxation

Cash Tsys twist flattened during Monday’s Asia-Pac session after Chinese health officials pointed to unswerving commitment to the country’s dynamic COVID zero system over the weekend.

- The initial reaction to that headline flow for Tsys was to trade with a bid, although that impulse faded a little as participants weighed up the global inflationary and GDP growth impact of China’s ZCS.

- Meanwhile, source reports pointing to background U.S.-Russia discussions re: the prevention of further escalation in the Ukrainian war, as well as a bid in Hong Kong & Chinese equities (as participants continued to push that particular envelope after last week’s rally, even as re-opening names struggled in the wake of the weekend comments from Chinese health officials), applied some pressure.

- That leaves cash Tsys 2bp cheaper to 2bp richer across the curve, twist flattening (after Friday’s twist steepening) with a pivot seen around 7s. Meanwhile, TY futures print -0-02+ at 109-31, 0-02 off the base of its 0-09 overnight session range after that particular extreme held on a retest during Asia-Pac dealing. A block sale of TU futures (-2.4K) headlined on the flow side, with TY volume fairly limited at ~70K lots into Europe.

- A narrower than expected Chinese trade balance, compounded by softer than expected internals, had little impact on Tsys.

- Monday’s NY docket includes Fedspeak from Mester, Collins and Barkin (although comes in the latter rounds of NY trade and the NY-Asia crossover).

JGBS: Steeper To Start The Week

JGB futures nudged higher during the Tokyo session, after an initial downtick in reaction to weekend headline flow surrounding the Chinese ZCS situation and source reports pointing to back-channel U.S.-Russia talks re: the prevention of further escalation when it comes to the Ukrainian war.

- Still, the contract’s trading band was contained, with any rally limited by super-long end weakness on catch-up to the twist steepening pressure seen in U.S. Tsys on Friday (which has moderated from extremes during Monday’s Asia-Pac session).

- Futures print +6 into the bell, off best levels. The major cash JGB benchmarks run 1bp richer to 1.5bp cheaper across the curve, with 7s outperforming as the curve pivots around 20s.

- In local news, RTRS sources noted that 2-Year JGB issuance will increase by Y100bn during the current FY, along with a boost for 6-month bill issuance, as part of the government’s plan to fund its latest fiscal support package.

- 10-Year JGBi supply passed smoothly. The BoJ’s desire to attempt to generate meaningful wage growth via the maintenance of ultra-loose policy settings, in a bid to garner demand-pull inflationary pressure, likely facilitated smooth takedown.

- Looking ahead, Tuesday’s local docket will be headlined by the latest round of household spending and wage data, with BoJ Rinban operations covering 1- to 10-Year JGBs also due.

JGBS AUCTION: 10-Year JGBi Auction Results

Japanese MOF sells Y249.8bn 10-Year JGBis:

- High Yield: -0.733% (prev. -0.708%)

- Low Price: 107.40 (prev. 107.35)

- % Allotted At High Yield: 78.1818% (prev. 54.0000%)

- Bid/Cover: 3.2834x (prev. 3.3228x)

AUSSIE BONDS: Cheaper On The Day As Local Issuance Matters Mix With Wider Headlines

Aussie bond futures go out a little off worst levels after the initial impact of weekend comments from Chinese health officials, which pointed to the country’s unswerving commitment to its dynamic zero COVID strategy, faded.

- The initial impulse on the back of those comments provided a modest bid, before the knock-on global inflationary impact that those policy settings contribute towards, plus local issuance dynamics (the new ACGB May-34 tender via syndication was launched, set to price tomorrow) and source reports from a couple of outlets pointing to back-channel U.S.-Russia talks re: the prevention of further escalation when it comes to the Ukrainian war weighed on prices.

- Elsewhere, a bid in Chinese & Hong Kong equities helped keep the pressure on the space.

- That left YM -2.0 & XM -5.5 at the bell, with wider cash ACGB trade seeing 1.0-6.5bp of cheapening as the curve bear steepened. EFPs were little changed on the day.

- Bills run -1 to +3 through the reds, with terminal RBA cash rate pricing little changed on the day, hovering around 4%, per RBA dated OIS.

- Outside of the pricing of the new ACGB May-34, Tuesday’s local docket will be headlined by CBA household spending data as well as the latest Westpac consumer & NAB business confidence surveys.

NZGBS: Early NZGB Bid Eases As Payside Flows Emerge In Swaps

Much like the wider core global FI space, NZGBs saw a move away from Monday’s richest levels after the space initially rallied on the back of weekend headlines covering comments from Chinese health officials pointing to unwavering support for the country’s dynamic zero COVID system.

- Some weakness in ACGBs helped (with impending supply factoring into price action across the Tasman), the knock-on inflationary impact of an elongated ZCS situation in China and source reports flagging back-channel U.S.-Russia talks aimed at preventing a further escalation of the war in Ukraine were seemingly at the fore when it came to the adjustment away from richest levels.

- Elsewhere, global equities moved away from worst levels, with Hong Kong equities leading the charge, lodging firm gains during the morning session, adding a further layer of pressure.

- As a result, payside flows came to the fore in swaps, while the major cash NZGBs richened by ~1bp on the day, resulting in swap spread widening after the post-NZGB inclusion in the FTSE Russell WGBI streak of narrowing.

- The payside flows in swaps came alongside an uptick in RBNZ dated OIS, which now prices a terminal rate of just under 5.30%, with a little over 65bp of tightening priced for this month’s meeting.

- Looking ahead, inflation expectations data headlines the domestic docket on Tuesday.

EQUITIES: China/HK Equities Recover Further, Despite Push-Back On Change To Covid Stance

After a shaky start, Hong Kong shares are comfortably in positive territory, helping to drag the rest of the region higher. Lower US equity futures is providing some offset, although we are away from worst levels. Eminis and Nasdag futures sit -0.10-0.20% lower. Apple stated it would trim new Iphone output by 3m units due to moderating demand. Supply disruptions in China, due to Covid related lockdowns, was also reported earlier.

- The HSI is +3.4% at this stage, with the underlying tech index up just over 5%. China H shares are up +3.5%. These moves come despite the China health authorities pushing back fairly firmly over the weekend on any imminent shift away from the Covid zero stance. No doubt some investors are mindful that when any formal announcement does emerge, markets may have already recovered considerably.

- The rough sell-side consensus also suggests full re-opening is more likely from late Q1/early Q2 next year, while domestic covid case numbers continue to trend higher.

- Mainland China shares are also up, but only by around 0.50% for the CSI 300 and Shanghai Composite. China trade figures continue to point to near term downside economic risks, with both export and import growth below 0% in y/y terms.

- Elsewhere, the Kospi is +1%, continuing to recover, while the Taiex is +1.50% and the Nikkei 225 +1.30% at this stage. None of these markets are showing too much impact from the weaker US futures picture at this stage.

- The ASX 200 is up a little over 0.50%, lagging some of the broader tech gains seen in the region.

OIL: Prices Being Driven By Demand News As Supply Situation To Stay Tight

Oil prices started the session down on confirmation from the Chinese National Health Commission that the current zero-Covid policies remain in place while Covid cases reported are at a 6-month high. With limited transport possible in China currently, a reopening of the country would be a considerable boost to demand for oil.

- Prices have recovered slightly over the day with WTI currently trading close to $91.50 after Friday’s high of $92.87/bbl and Brent around $97.50 after $98.81. Supply in the sector remains tight, a trend which is likely to continue in 2023, and so demand concerns because of global growth uncertainty are currently driving volatility in prices.

- China’s October imports of crude oil fell 2.7% y/y year-to-date and in USD -0.5% y/y. Oil product imports fell 10.9% y/y% YTD and exports -24.5% y/y.

GOLD: Attempting A Break Above The Simple 50-Day MA

Gold is off NY closing levels by around 0.50%, unwinding a small proportion of Friday's +3.2% gain. This puts the precious metal back near $1673.50, which is line with some recovery in broader USD sentiment through the first part of today's session.

- Gold currently sits close to the simple 50-day MA ($1673.8), which has proven a reasonable resistant point going back to mid-April.

- A clean break above this level and through Friday's highs above $1680 would leave us targeting the 100-day MA around $1718.80. The recent bounce in gold has outperformed the trend in US real yields, although we remain closely aligned with USD sentiment.

- On the downside, support has been evident today ahead of the $1670 level, which is where a number of earlier highs in October/early November were recorded.

FOREX: USD Lures Participants With Risk Appetite Damped By China's Commitment To COVID Zero

Risk aversion took hold as China's National Health Commission vowed to "unswervingly" stick to the COVID Zero Strategy, pushing back against re-opening speculation from last week. Spot USD/CNH traded on a firmer footing as the greenback outperformed. The BBDXY index added 0.2% as U.S. Tsy yield curve twist flattened.

- The PBOC paused a streak of stronger-than-expected USD/CNY mid-point fixings after a nearly 2% drop in USD/CNH last Friday. The pair's reaction to the re-introduction of weakening bias into the fixing for the first time since late August was limited, with the redback already pressured by COVID Zero musings.

- The Antipodeans led the high-beta FX bloc lower on a negative lead from China, even as the aggregate BBG Commodity Index lodged some marginal gains, breaking above its 100-DMA. AUD/NZD see-sawed, having a look above Friday's high in the process, before stabilising near neutral levels.

- The yen lagged its safe haven peers USD and CHF, with U.S./Japan 2-year yield differential widening 1.8bp. Spot USD/JPY returned above the Y147 mark, with local media flagging continued political headwinds for PM Kishida's government.

- Focus turns to German & Norwegian industrial output figures, as well as comments from Fed's Collins & Barkin, ECB's Lagarde & Panetta.

FX OPTIONS: Expiries for Nov07 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9750(E1.2bln), $0.9800(E1.9bln), $0.9850-60(E631mln), $0.9935-55(E1.2bln)

- USD/JPY: Y148.60($650mln)

- GBP/USD: $1.1460-75(Gbp524mln)

- AUD/USD: $0.6425-30(A$872mln), $0.6450(A$750mln)

- USD/CNY: Cny7.1500($1.5bln), Cny7.2000($1.9bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/11/2022 | 0645/0745 | ** |  | CH | Unemployment |

| 07/11/2022 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/11/2022 | 0700/0700 | * |  | UK | Halifax House Price Index |

| 07/11/2022 | 0730/0730 |  | UK | DMO Announces Second H2-Nov Linker Synd | |

| 07/11/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 07/11/2022 | 0830/0930 |  | DE | S&P Global Germany Construction PMI | |

| 07/11/2022 | 0840/0940 |  | EU | ECB Lagarde Video Message for EC/ECB Conference | |

| 07/11/2022 | 0930/1030 | * |  | EU | Sentix Economic Index |

| 07/11/2022 | 0930/1030 |  | EU | ECB Panetta Panels EC/ECB Conference | |

| 07/11/2022 | - |  | EU | COP 27 Begins | |

| 07/11/2022 | - | *** |  | CN | Trade |

| 07/11/2022 | - |  | EU | ECB Panetta at Eurogroup meeting | |

| 07/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 07/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 07/11/2022 | 2000/1500 | * |  | US | Consumer Credit |

| 07/11/2022 | 2040/1540 |  | US | Fed's Loretta Mester and Susan Collins | |

| 07/11/2022 | 2300/1800 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.