-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: NZ CPI Lower, But Domestic Pressures Still Elevated

EXECUTIVE SUMMARY

- FED’S KUGLER SEES RENEWED PROGRESS ON INFLATION - MNI BRIEF

- TRUMP SAYS WOULD LET FED CHAIR POWEL FINISH TERM: AFP/BBG

- US FLOATS IDEA OF TOUGHER TRADE RULES IN CHIP CRACKDOWN ON CHINA - BBG

- NZ CPI PRINTS LOWER THAN EXPECTED AT 3.3% Y/Y - MNI BRIEF

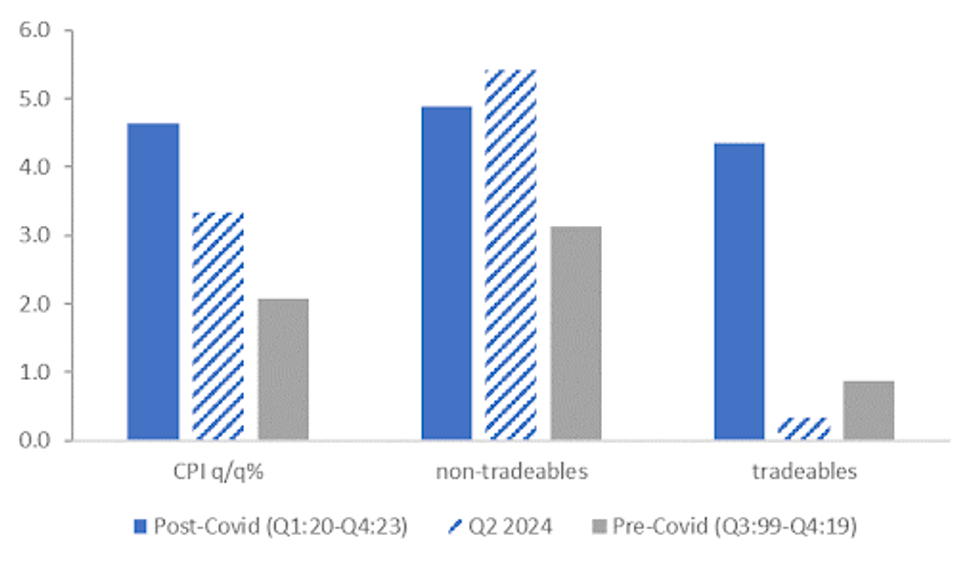

Fig. 1: NZ CPI Trending Lower, But Domestic Inflation Pressures Still Elevated

Source: MNI - Market News/Bloomberg

UK

POLITICS (BBG): “Prime Minister Keir Starmer will flesh out Labour’s plans from border control to smoking as he sets out the new UK government’s legislative agenda for the coming Parliamentary session in a King’s Speech on Wednesday.”

EUROPE

EU (MNI BRIEF): Talks between Ursula von der Leyen and the right-wing European Conservatives and Reformists group are closing in on securing her a second term as European Commission president, EP sources told MNI.

GEOPOLITICS (BBC): “European politicians and diplomats had already prepared for changes to their relationship with the US in the event of a second Donald Trump presidency. Now that the Republican candidate has chosen Ohio Senator JD Vance as his running mate, those differences appear even more stark on prospects for the war in Ukraine, security and trade.”

FRANCE (BBC): “French President Emmanuel Macron has accepted the resignation of Prime Minister Gabriel Attal's government following their centrist party's defeat in parliamentary elections. However, Mr Attal and his ministers will continue to deal with day-to-day business as a caretaker government. A left-wing alliance that won the 7 July election has so far been unable to agree on a potential candidate to replace him.”

GERMANY (RTRS): “The German cabinet plans to approve its draft for the 2025 budget on Wednesday, but there is still a gap of 17 billion euros ($18.55 billion) which needs to be filled.”

GERMANY (POLITICO): “German Chancellor Olaf Scholz plans to travel to Belgrade on Friday for a surprise visit to attend the signing of a cooperation agreement between the EU and Serbia on importing minerals, including lithium, that are critical for the EU’s digital and green transition, three people with knowledge of the preparations — who requested anonymity since they were not allowed to speak publicly — told POLITICO.”

RUSSIA/UKRAINE (BBG): “Russia and Ukraine were set to swap 180 prisoners in a deal facilitated by the United Arab Emirates, a person familiar with the matter said, in what will be the sixth exchange this year managed by the Gulf state.”

US

FED (MNI BRIEF): Federal Reserve Governor Adriana Kugler said Tuesday inflation is firmly back on a downward path that gives her growing confidence it is returning to the central bank's 2% target.

FED (MNI INTERVIEW): Fed Cuts Near, Hiring Weaker Than Appears-Wilcox

FED (AFP/BBG): “ US presidential nominee Donald Trump would let Federal Reserve Chair Jerome Powell complete his four-year term to 2026 if he returns to the White House, he said in an interview published Tuesday.”

POLITICS (BBG): “The US Secret Service boosted security around former President Donald Trump after picking up intelligence in recent weeks of an Iranian plot to assassinate him, people familiar with the matter said, adding that the threat was separate from the attempt on his life last weekend.”

POLITICS (BBG): “President Joe Biden is planning to unveil proposals that could dramatically reshape the Supreme Court, including term limits on justices who now sit on the court for life, according to a person familiar with the deliberations.”

US/CHINA (BBG): “he Biden administration, facing pushback to its chip crackdown on China, has told allies that it’s considering using the most severe trade restrictions available if companies such as Tokyo Electron Ltd. and ASML Holding NV continue giving the country access to advanced semiconductor technology.”

OTHER

NEW ZEALAND (MNI BRIEF): New Zealand’s headline consumers price index fell to 3.3% y/y in Q2, from 4% in Q1, 30 basis points lower than the Reserve Bank of New Zealand’s May forecasts.

BRAZIL (MNI BRIEF): Brazil's central bank deputy governor for monetary policy, Gabriel Galipolo, said Tuesday the recent unanchoring process of inflation expectations is a point of concern, noting that the board opted for not providing any forward guidance "keeping all alternatives open" for the next meeting, on July 31.

JAPAN (MNI POLICY): Ueda's US Concerns To Impede BOJ July Rate Hike

CHINA

LOAN PRIME RATE (SECURITIES DAILY): “China’s Loan Prime Rate may be lowered in July without a corresponding change to the medium-term lending facility as policymakers improve LPR quotations to reflect market interest rates and economic conditions better, according to Wang Qing, chief macro analyst at Golden Credit Ratings.”

INFRASTRUCTURE (CSJ): “China’s infrastructure investment is likely to reach 6-7% y/y by year-end from the 5.7% in H1, supported by accelerated issuances of project-linked ultra-long-term special treasury bonds, local government special bonds and expected fiscal expansion, China Securities Journal reported citing analysts.”

FISCAL (YICAI): “China must prioritise increasing fiscal revenues in H2 to reverse the downward trend of public finances in H1, according to Hu Xiaopeng, deputy director at the Institute of World Economics of the Shanghai Academy of Social Sciences.”

CHINA MARKETS

MNI: PBOC Net Injects CNY268 Bln Via OMO Wed; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY270 billion via 7-day reverse repo on Wednesday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY268 billion after offsetting the CNY2 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8119% at 09:25 am local time from the close of 1.9011% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 46 on Tuesday, compared with the close of 59 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1318 on Wednesday, compared with 7.1328 set on Tuesday. The fixing was estimated at 7.2646 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND Q2 CPI +0.4% Q/Q; EST. +0.5%; PRIOR +0.6%

NEW ZEALAND Q2 CPI +3.3% Y/Y; EST. +3.4%; PRIOR +4.0%

NEW ZEALAND Q2 NON-TRADABLE CPI +0.9% Q/Q; EST. +0.8%; PRIOR +1.6%

NEW ZEALAND Q2 TRADABLE CPI -0.5% Q/Q; EST. +0.1%; PRIOR -0.7%

NEW ZEALAND RBNZ Q2 SECTORAL FACTOR MODEL INFLATION +3.6% Y/Y; PRIOR 4.3%

AUSTRALIA JUNE WESTPAC LEADING INDEX UNCHANGED M/M; PRIOR 0.0%

MARKETS

US TSYS: Tsys Futures Little Changed, Curve Bear-Flattens

- Treasury futures gave back all the post NY close moves in the first half of the session today, we have since traded sideways in tight ranges. TUU4 is -0-0⅛ lower at 102-19⅝, while TYU4 is back to unchanged from NY closing levels but -0-03 from the morning highs at 111-10.

- Cash treasury curve has bear-flattened today, yields are 0.5-2bps cheaper.

- The 2s10s curve made new highs overnight of -20.680 on the back of stronger-than-expected retail sales, we now trade 7bps lower at -27.5bps.

- US futures are pricing a 6.5% chance of a rate cut in July and 100% chance of a cut in September for a cumulative cut of 26.6bps.

- Projected rate cut pricing into year end remains slightly cooler vs. late Monday levels (*): July'24 at -6.5% w/ cumulative at -1.6bp at 5.313%, Sep'24 cumulative -26.6bp (-27.5bp), Nov'24 cumulative -42.9bp (-44.1bp), Dec'24 -65.4bp (-65.8bp).

- Focus turns to Wednesday's Build Permits, House Starts, Beige Book, Tsy 20Y Bond auction reopen

JGBS: Cash Bonds Little Changed, 5-year Climate Transition Supply Tomorrow

JGB futures are weaker and at session cheaps, -7 compared to settlement levels.

- With the domestic calendar light today, the futures move away from session bests was assisted by a 1-2bps cheapening in cash US tsys in today’s Asia-Pac session.

- (MNI) Heightened uncertainty over the U.S. economy will make a Bank of Japan rate hike less likely and fuel Governor Kazuo Ueda’s cautious approach to monetary policy when the board meets July 30-31, MNI understands. (See link)

- Ueda will prefer to hold the policy interest rate until he receives evidence the U.S. economy will not deteriorate sharply. While the BoJ has not revealed whether Ueda will attend next month’s Jackson Hole economic meeting, the governor joined last year’s session and will likely make an appearance this year to gather insight into the U.S. economy.

- A former BoJ economist last week gave a roughly 40% chance of a July rate hike due to favourable trends in the Tankan survey, wages and services prices.

- Cash JGBs are slightly mixed across benchmarks, with yield movements bounded by +/- 1bp. The benchmark 10-year yield is 0.1bp lower at 1.028% versus the cycle high of 1.108%.

- Swap rates are little changed across maturities, with the curve slightly flatter and swap spreads mostly tighter.

- Tomorrow, the local calendar will see Trade Balance data alongside 5-year Climate Transition supply.

AUSSIE BONDS: Slightly Richer, June’s Employment Report Tomorrow

ACGBs (YM flat & XM +1.5) are slightly richer and sit near the bottom of today’s ranges. With the domestic calendar light, the local market has drifted with cash US tsys, which are 1-2bps cheaper in today’s Asia-Pac session after yesterday’s solid gains.

- Today’s lacklustre performance may also reflect some spillover from NZGBs. NZGB benchmarks have cheapened 3-5bps following today’s release of Q2 CPI. While the headline CPI came in moderately lower than expected, the important domestically driven non-tradeables came in slightly higher than the RBNZ expected.

- June jobs data prints tomorrow and will be watched closely for signs of a pickup in the pace of labour market easing ahead of Q2 CPI due on July 31 and the next RBA meeting on August 6.

- Even if the unemployment rate prints in line with consensus at 4.1%, the Q2 average will be close to the RBA’s May forecast of 4.0%, but still above Q1.

- Bloomberg consensus is forecasting a 20k increase in new jobs.

- Cash US tsys are 1-2bps cheaper in today’s Asia-Pac session.

- Cash ACGBs are 1bp richer, with the AU-US 10-year yield differential at +7bps.

- Swap rates are 3bps lower.

- The bills strip has bull-flattened, with pricing flat to +5.

- RBA-dated OIS pricing is 1-4bps softer across meetings. Terminal rate expectations sit at 4.40%.

NZGBS: Cheaper Despite Moderating Core Inflation

NZGBs closed on a weak note, with yields 2-3bps higher on the day and 3-5bps higher than pre-CPI levels.

- Q2 headline CPI came in moderately lower than expected at 0.4% q/q with the annual rate easing to 3.3% from 4%. It is now approaching the top of the 1-3% RBNZ target. The RBNZ had forecast 0.6% q/q and 3.6% in May.

- The important domestically-driven non-tradeables are moderating but came in slightly higher than the RBNZ expected and is unlikely to be enough for them to ease at the August 14 meeting, which is likely to be when it chooses to communicate rather than move.

- The RBNZ’s measure of core inflation from its sectoral factor model moderated to 3.6% y/y in Q2 from 4.2%, the lowest since Q3 2021 but still above the central bank’s 1-3% band.

- Swap rates closed 2-3bps higher, with the 2s10s curve flatter.

- RBNZ dated OIS pricing is little changed across meetings. Nevertheless, OIS pricing sits 18-44bps softer for meetings beyond August versus pre-RBNZ Decision levels. By year-end, a cumulative 65bps of easing is factored into the pricing.

- The local calendar is empty tomorrow.

- On Thursday, the NZ Treasury plans to sell NZ$225mn of the 3.00% Apr-29 bond, NZ$225mn of the 4.25% May-34 bond and NZ$50mn of the 2.75% Apr-37 bond.

FOREX: NZD Bounces On Sticky Domestic Inflation, But AUD/NZD Supported On Dips

An NZD bounce has been the main focus in Asia Pac markets today, which came post firmer than expected domestic inflation pressures. The BBDXY sits little changed, last near 1251.5, as the major haven't shifted greatly against the USD.

- NZD/USD last tracked near 0.6070, slightly off session highs (0.6082), but around 0.35% higher. Recent lows are marked just under 0.6040. The Q2 inflation report was a mixed bag, with weaker headline relative to expectations, while non-tradables eased but not as much as the market and the RBNZ projected (0.9% versus 0.8% forecast).

- The RBNZ’s measure of core inflation from its sectoral factor model moderated to 3.6% y/y in Q2 from 4.2%, the lowest since Q3 2021 but still above the central bank’s 1-3% band.

- The AUD/NZD cross fell to lows of 1.1073, but sits back at 1.1100 in recent dealings. As we noted in this piece here, there is risks of divergence between Aust and NZ CPI reads. Recent highs in the cross rest at 1.1152. AUD/USD has risen a touch, last near 0.6740.

- USD/JPY has been steady for much of the session, last near 158.35, close to end levels from NY trade Wednesday.

- In the cross asset space, US equity futures are lower, off 0.15-0.30%, with Nasdaq futures underperforming. US yields sit a touch higher, led by the front end, but this is only recouping modest losses from Tuesday trade in the US.

- A wide ranging interview by US Presidential Candidate Trump (given to BBG) stated Fed Chair Powell would serve his full term, although Trump warned against cutting cuts ahead of the US election in November.

- Looking ahead, we have UK inflation and a speech from the new UK PM. US data and more Fed speak is also out.

ASIA STOCKS: HK & China Equities Head Lower As Market Await Third Plenum Update

China & Hong Kong's equity markets are off earlier highs, after reports that Biden was looking into trade restrictions on companies that provide advanced semiconductors technology to China, growing odds that Trump will win the upcoming election and finally the market is also awaiting policy announcements from the China's Third Plenum.

- Hong Kong equities are mixed today, the HSTech Index is 0.90% higher and now 1.50% higher over the past week. Meanwhile, property stocks are performing well with the Mainland Property Index 2.86% and the HS Property Index is 1.30%, the wider HSI is little changed.

- China equity markets are lower today with the CSI 300 is 0.20% lower, small-cap indices are lower today with the CSI 1000 down 0.50% and the CSI 2000 down 1%, the growth focused ChiNext is 0.44% higher, while a less closely followed index the Beijing SE 50 Index has surged 5.90%, this Index tracks small to medium high growth tech stocks.

- JD Vance, named as Donald Trump’s running mate and Vice President has emphasized China as America's biggest threat in a recent Fox News interview. Vance stated that a Trump administration would focus on China rather than the war in Ukraine, proposing negotiations to end the conflict in Ukraine to concentrate on the Chinese threat. This underscores the likely hawkish stance of their administration towards Beijing if elected.

- Looking ahead, focus will again be on any headlines from the Third Plenum policy meetings.

ASIA PAC STOCKS: Asia Stocks Mixed, Semiconductors Hit On Biden's Trade Restrictions

Asian equities are mixed today, the moves have been driven by optimism that the Federal Reserve will soon cut interest rates with the markets now pricing a 100% chance of a cut in September, leading to a surge in riskier market segments. The MSCI Asia Pacific Index rebounded from a three-day decline, buoyed by fresh highs in U.S. shares, although gains were moderated by sell off this afternoon in Japanese stocks following U.S. warnings of stricter trade rules with China. Despite geopolitical concerns over a potential Trump presidency, the overall sentiment was positive, with rising expectations for rate cuts and supportive economic data boosting confidence.

- Japanese equities are off earlier highs after reports that the Biden administration is considering stringent trade restrictions on companies like Tokyo Electron if they continue providing advanced semiconductor technology to China. Tokyo Electron which makes up about 2.80% of the Nikkei 225 dropped as much as 7.6%, with the weakness confined to the chip sector. However, the broader market remained focused on the positive prospects of U.S. interest rate cuts and a potential economic soft landing. The Nikkei 225 is 0.25% lower, while the wider Topix is 0.38% higher.

- South Korean stocks are lower today as investors have looked to take profits after two days of gains. Major tech and automotive stocks like Samsung Electronics and Hyundai Motor saw declines. Conversely, SK Innovation surged 7.15% on merger news, while Korean shipbuilder stocks have surged to multi-year highs driven by expectations of strong second-quarter earnings and US industrial gains amid rate-cut bets. The Kospi is 0.60% lower, while the Kosdaq trades 0.50% lower.

- Taiwan equities are lower this morning, recently foreign investors have been heavy sellers of Taiwan equities with an outflow of $2.2b over the past week, the TWD is weaker on the back of this selling and currently sits back near two week lows. TSMC is also lower after Biden announced potential tariffs on semiconductors names and Trump questioning if it's the US duty to protect Taiwan. The Taiex is 1.23% lower.

- Australian equities are higher today, and mirror the rally in US equities overnight. The ASX200 is up 1% and is back above 8,000. Miners led the gains, supported by gold reaching its highest price ever and details from BHP’s quarterly production report.

- New Zealand equities are higher today, after Q2 headline CPI came in moderately lower than expected at 0.4% q/q with the annual rate easing to 3.3% from 4%. Overnight GDT price index rose 0.40%, with strong performance in "fats" which offset a fall in "powders". The NZX 50 is up 0.76%

- Elsewhere, Singapore equities are 0.10% higher, Malaysian equities are 0.65% higher, Indonesian equities are are little changed while Philippines equities are 0.50% lower.

OIL: Crude Little Changed, EIA US Inventory Data Out Later

Oil prices are little changed after falling over a percent on Tuesday. Data showing another US crude inventory drawdown has been unable to lift markets. WTI is down 0.1% to $80.69/bbl after falling to $80.45 and Brent is -0.1% to $83.66 after $83.43. The stronger US dollar weighed on crude yesterday but today the USD index is flat.

- Bloomberg reported that US crude inventories fell 4.44mn after a 1.9mn barrel drawdown the previous week, according to people familiar with the API data. Gasoline rose 365k and distillate 4.92mn. The official EIA data is released later today and another decline would be the third in a row.

- After OPEC reported in its July report that the group had produced above its quota in June, Russia has said that it will reduce output further during the summer given it hasn’t met its commitment.

- Later the Fed’s Barkin and Waller both speak on the economy and the Beige Book is published. June UK CPI and final June euro area CPI print, as well as US June housing and IP data.

GOLD: Fresh All-Time High

Gold is steady in the Asia-Pac session, after hitting a fresh all-time high of $2482.42.

- Bullion closed 1.9% higher at $2469.08 on Tuesday, as traders placed stronger bets on Federal Reserve rate cuts this year and weighed an uncertain outlook for US politics.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- US Treasuries finished near session bests on Tuesday with the long-end out-performing. The US 10-year yield finished 7bps lower at 4.16% versus a 4bp drop for the US 2-year to 4.42%. The early session sell-off following stronger-than-expected US Retail Sales data was completely reversed.

- Retail sales printed flat (-0.02% unrounded) growth m/m, slower than the +0.3% registered in May (upward rev from 0.1%), but above the -0.3% expected. Sales ex-autos (+0.4% vs 0.1% expected) and ex-auto/gas (+0.8% vs +0.2% expected) beat and with higher revisions.

- Gold has rallied by over 50% since late 2022, underpinned by demand from central banks, to diversify reserves and reduce their reliance on the US dollar.

- According to MNI’s technicals team, the breach of the bull trigger suggests technical conditions remain firmly in bullish territory.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/07/2024 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 17/07/2024 | 0600/0700 | *** |  | UK | Producer Prices |

| 17/07/2024 | 0900/1100 | *** |  | EU | HICP (f) |

| 17/07/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/07/2024 | 1030/1130 |  | UK | King's Speech | |

| 17/07/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 17/07/2024 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/07/2024 | 1230/0830 | *** |  | US | Housing Starts |

| 17/07/2024 | 1300/0900 |  | US | Richmond Fed's Tom Barkin | |

| 17/07/2024 | 1315/0915 | *** |  | US | Industrial Production |

| 17/07/2024 | 1335/0935 |  | US | Fed Governor Christopher Waller | |

| 17/07/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 17/07/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 17/07/2024 | 1800/1400 |  | US | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.