-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, December 13

MNI US OPEN - UK Economy Contracts for Second Straight Month

MNI EUROPEAN OPEN: NZ Yields Surge As Economy Expected To Avoid Recession & Borrowings Higher

EXECUTIVE SUMMARY

- CHINA'S SPECIAL ENVOY LI HUI MET ZELENSKIY - BBG

- FLORIDA GOVERNOR DeSANTIS TO ENTER US PRESIDENTIAL RACE NEXT WEEK - RTRS

- AUSSIE UNEMPLOYMENT TICKS UP TO 3.7% - MNI

- NEW ZEALAND TREASURY NOW EXPECTS ECONOMY TO AVOID RECESSION - BBG

- JAPAN EXPORTS CONTINUE TO RISE AT A SLOWER PACE - MNI

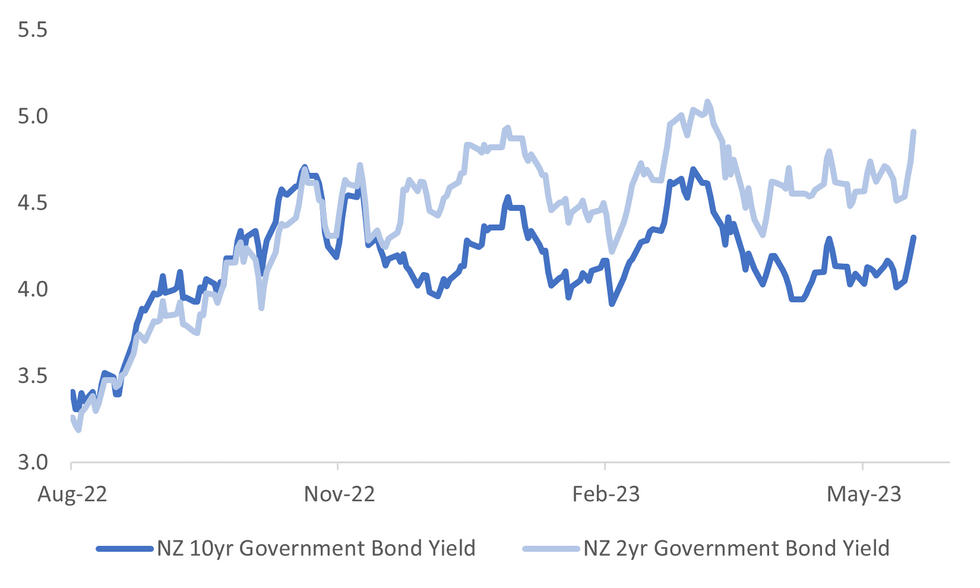

Fig. 1: NZ Government Bond Yields Pushing Higher Again

Source: MNI - Market News/Bloomberg

U.K.

TECH: Rishi Sunak will announce a “semiconductors partnership” with the Japanese government during a visit to Tokyo on Thursday as the UK seeks to reduce geopolitical risk by diversifying its chip supply chain. (FT)

STRIKES: UK Tories gamble political future on enacting tough strike rules. (BBG)

HOUSING: Era of huge house price rises in the UK to end say OBR economist (BBG)

EUROPE:

UKRAINE: Ambassador Li Hui, special representative of the Chinese government for Eurasian Affairs, visited Ukraine May 16-17 and met President Volodymyr Zelenskiy, Foreign Minister Dmytro Kuleba as well as other officials, the Chinese foreign ministry says. (BBG)

EMISSIONS: Europe's emissions fall below lockdown levels on energy crisis (BBG)

U.S.

POLITICS: Florida Republican Governor Ron DeSantis will officially enter the 2024 U.S. presidential race next week, according to two sources familiar with the decision, immediately becoming Donald Trump's biggest rival for the Republican nomination and shaking up a contest that largely has been one-sided. (RTRS)

TECH: Montana Governor Greg Gianforte on Wednesday signed legislation to ban the Chinese-owned TikTok from operating in the state, making it the first U.S. state to ban the popular short video app. (RTRS)

TECH: Micron Technology Inc. is poised to land about ¥200 billion ($1.5 billion) in financial incentives from the Japanese government to help it make next-generation memory chips in the country, according to people familiar with the matter, the latest step in Tokyo’s effort to bolster domestic semiconductor production. (BBG)

OTHER

JAPAN: Prime Minister Fumio Kishida met with the heads of the world’s largest chipmakers on Thursday in Japan’s latest move to boost its domestic semiconductor sector amid a global rethink of economic security. (BBG)

JAPAN: Exports rose 2.6% y/y in April, the 26th consecutive rise, but slowed from March's 4.3% gain, Ministry of Finance data showed Thursday. The deceleration followed a decline in overseas demand. The data was in line with the Bank of Japan’s view that exports would be flat due to the impact of the slowing global economy. Bank officials expect the U.S. economy to slow from mid-2023, decreasing Japan’s exports and production. (MNI)

AUSTRALIA: The seasonally adjusted unemployment rate jumped to 3.7% in April from March’s 3.5%, according to Australian Bureau of Statists data released today. The move higher beat expectations the rate would hold steady. The data showed the participation rate had decreased to 66.7%, while the underemployment rate fell to 6.1%. (MNI)

AUSTRALIA: China’s ambassador to Australia announces that China will allow the import of Australian timber from Thursday, ABC reports. Ambassador says that Chinese customs notified the Australian government yesterday of the change (BBG)

NZ: New Zealand will avoid a recession as more tourist arrivals, cyclone recovery and government spending support growth, according to Treasury Department forecasts. (BBG)

N.Z: Recession risks and reconstruction costs from Cyclone Gabrielle are delaying New Zealand’s post-Covid fiscal repair, S&P said in a statement. If a somewhat expansionary fiscal stance adds to the import bill, this could further weaken external accounts and erode headroom for the sovereign ratings on New Zealand. (BBG)

BRAZIL: Brazil's economic ministers on Wednesday highlighted the potential for monetary easing to kick off, while the central bank continued to signal caution due to concerns over expectations of rising inflation. (RTRS)

CHINA

GEOPOLITICS: President Xi Jinping will seek to deepen Beijing’s influence in Central Asia at a major summit, reminding a parallel Group of Seven conclave of China’s sway outside the US-led world order. (BBG)

YUAN: The recent fall of Chinese yuan won’t be sustained in light of China’s continued economic recovery and the yuan may bounce back as the Federal Reserve’s push to hike rates is easing, Chinese state media Securities Daily reports, citing analysts. (BBG)

TOURISM: Domestic consumption, which Chinese policymakers want to play a greater role in powering the world's second-largest economy, has recovered since COVID restrictions were lifted in December, but has consistently underwhelmed so far this year. (RTRS)

SMEs: Shanghai unveiled a package of policies aimed at the high-quality development of the city's SMEs, according to Wu Jincheng, director of the Shanghai Economic and Information Technology Commission. (MNI)

HOUSE PRICES: China’s two- and three-tier cities need further measures to boost confidence in the housing market, as prices decline in April, according to analysts interviewed by the Securities Daily. One analyst noted April’s data showed first-tier cities had maintained upward momentum from Q1, but second- and third-tier cities had slowed. (MNI)

TECH: China’s foreign exchange and financial sector should prioritise support for tech and innovation firms to achieve high-quality development, according to Pan Gongsheng, head of State Administration of Foreign Exchange (SAFE). (MNI)

CHINA MARKETS

PBOC Injects CNY2 Billion Via OMOs Thursday

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Thursday, with the rates unchanged at 2.00%. The operation has led to an unchanged liquidity after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9906% at 09:29 am local time from the close of 1.8557% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 46 on Wednesday, compared with the close of 45 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 6.9967 THURS VS 6.9748 WED

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9867 on Thursday, compared with 6.9748 set on Wednesday.

OVERNIGHT DATA

NZ Q1 PPI OUTPUT Q/Q 0.3%; PRIOR 0.9%

NZ Q1 PPI INPUT Q/Q 0.2%; PRIOR 0.5%

JAPAN APR TRADE BALANCE -¥432.4bn; MEDIAN -¥600bn; PRIOR -¥755.1bn

JAPAN APR TRADE BALANCE ADJ -¥1017.2bn; MEDIAN -¥1084.2bn; PRIOR -¥1213.5bn

JAPAN APR EXPORTS Y/Y 2.6%; MEDIAN 3.0% PRIOR 4.3%

JAPAN APR IMPORTS Y/Y -2.3%; MEDIAN -0.6% PRIOR 7.3%

JAPAN FOREIGN BUYING JAPAN STOCKS MAY 12 ¥808.3bn; PRIOR ¥373.1bn

JAPAN FOREIGN BUYING JAPAN BONDS MAY 12 ¥1075.5bn; PRIOR -¥216.5bn

JAPAN JAPAN BUYING FOREIGN BONDS MAY 12 ¥1121.6bn; PRIOR -¥635.2bn

JAPAN JAPAN BUYING FOREIGN STOCKS MAY 12 ¥9.6bn; PRIOR -¥455.4bn

JAPAN APR TOKYO CONDOMINIUMS FOR SALE Y/Y -30.3%; PRIOR -2.1%

AU MAY CONSUMER INFLATION EXPECTATION 5.2%; PRIOR 4.6%

AU APR EMPLOYMENT CHANGE -4.3k; MEDIAN 25k; PRIOR 61.1k

AU APR FULL-TIME EMPLOYMENT CHANGE -27.1k; PRIOR 82.5k

AU APR PART-TIME EMPLOYMENT CHANGE 22.8k; PRIOR -21.4k

AU APR UNEMPLOYMENT RATE 3.7%; MEDIAN 3.5%; PRIOR 3.5%

AU APR PARTICIPATION RATE 66.7%; MEDIAN 66.7% PRIOR 66.8%

MARKETS

US TSYS: Marginally Richer In Asia

TYM3 deals at 114-21, +0-03, with a 0-05 range observed on volume of ~76k.

- Cash tsys sit ~1bp richer across the major benchmarks.

- Tsys firmed on spillover from ACGB's as Australia's unemployment rate ticked higher in April, however the move had little follow through and gains were pared.

- Narrow ranges persisted for the remainder of the session.

- A block buyer in TU (2.49k lots) added a layer of support.

- FOMC dated OIS price a terminal rate of ~5.1% in June, there are ~60bps of cuts priced for 2023.

- There is a thin docket in Europe today, further out we have Initial Jobless Claims and Philadelphia Fed Business Outlook. Fedspeak from Gov. Jefferson, VC Barr and Dallas Fed President Logan is on the wires. The latest 10 Year TIPS supply will cross.

JGBS: Futures Heavy, Lacklustre BoJ Rinban Operations

JGB futures push to session lows in the Tokyo afternoon session, -24 versus settlement levels, after the morning’s BoJ Rinban operations covering 1-10-year and 25-Year+ JGBs showed flat to positive spreads and slightly higher cover ratios.

- US tsys push away from session bests assisted the cheapening in JGBs in the afternoon session.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined weaker-than-expected trade data which only appeared to provide a brief pop higher in JGB futures at the start of the Tokyo session.

- Cash JGBs are mixed with the 1-year and 7-year zones 1.4bp cheaper but little changed in between. The 10-40-year zones are flat to 0.9bp cheaper. The benchmark 10-year yield is 0.9bp higher at 0.379% with the 20-year yield flat at 0.976%, after yesterday's auction-induced decline of 3.7bp.

- The swap curve twist steepens with rates 0.1bp lower to 1.1bp higher. Swap spreads are wider except for the 1-year and 7-year zones.

- Tomorrow sees the release of the National CPI release for April along with the weekly auction of 3-month bills.

AUSSIE BONDS: Post-Jobs Data Spike Richer Is Unwound

ACGBs sit mid-range (YM -6.0 & XM -4.0) after the post-employment spike higher was all but reversed in after trade. The April Employment Report undershot expectations with a print of -4.3k m/m versus expectations of +25k and delivered an unexpected lift in the unemployment rate to 3.7% (3.5% est.) from 3.5%.

- A closer examination of the data, which revealed that the actual rise in the unemployment rate was only 1.2% before rounding and that March employment had been revised higher from 53k to 61.1k, saw the market quickly reverse course.

- A move away from the session best level for US tsys and sharply higher NZGB yields post-budget likely aided the ACGB reversal.

- Cash ACGBs are 1-2bp richer post-data but 4-6bp cheaper on the day with the AU-US 10-year yield differential +1bp at -9bp.

- Swap rates are sitting mid-range with 6-8bp higher and EFPs 1-2bp wider.

- The bills strip is steeper with pricing -1 to -13.

- RBA dated OIS are 4-10bp firmer on the day for meetings beyond September.

- The local calendar is light until Retail Sales on May 26.

- With the US calendar relatively light today, US tsys are likely to be on headline watch, particularly about debt ceiling negotiations.

NZGBS: Yields Sharply Higher, Stimulatory Budget, Increased Borrowings

NZGBs closed sharply cheaper with 2-year and 10-year benchmark yields respectively 17bp and 9bp higher after the NZ Treasury says the budget is stimulatory and so rates will stay “higher for longer”.

- An expansionary budget in an already capacity-constrained economy is likely to concern the RBNZ. RBNZ dated OIS closed 8-18bp firmer for meetings beyond May. 31bp of tightening is priced for next week’s meeting.

- The FY23 deficit is forecast to be considerably larger than predicted in December by $3.4bn or 0.9pp. FY24 deficit is to widen to $7.6bn or 1.8% of GDP. The return to surplus has been delayed a year to 2026 (0.1% of GDP) due to repair costs from recent extreme weather. The debt ratio should peak at 22% in FY24.

- The forecast 2023/24 NZ Government Bond programme has been increased to NZ$34 billion, NZ$4 billion higher than that published at the Half Year Economic and Fiscal Update 2022. The forecast NZGB programmes for 2024/25, 2025/26, and 2026/27 have all been increased, by NZ$2 billion, NZ$10 billion and NZ$4 billion respectively.

- Swap rates closed 10-17bp higher with the 2s10s curve 7bp flatter and implied swap spreads sharply narrower.

- The local calendar sees the release of April trade data tomorrow.

EQUITIES: North East Asia Stocks Outperform On Tech Optimism

Regional stock markets are mostly higher, led again by Japan bourses. North East Asia markets have mostly outperformed South East Asia, as tech sentiment continues to drive gains. US futures sit close to flat after a positive Wednesday session.

- Japan's Topix is up over 1%, with the index now tracking higher for 5 straight sessions. Tech sentiment has again been positive. Micron will reportedly start making advanced chips in Japan with the aid of government subsidies. This is expected to boost local supplies, while Japan PM Kishida met the heads of other tech firms from South Korea and Taiwan, hence there is scope for further partnership/investments. Sony is also tracking higher after it was reported the company is considering spinning off its financial unit.

- In Taiwan, the Taiex is up a further 1%, with the index back to June 2022 levels (above 16000). Again, semiconductors are leading the move higher. Positive spill over from Japan news is helping, along with optimism around the demand outlook. The Kospi is +0.65%, with offshore investors adding a further $167.7mn to local shares.

- The HSI is also higher +1.1%, with the underlying tech index +1.73%. This comes despite weaker Tencent trends, after a disappointing earnings update. Alibaba reports later today. Mainland China shares are higher, but up a more subdued +0.38% for the CSI 300 at this stage. SoE firms are doing better on the back of strong ETF demand.

- In SEA, Thai stocks are performing the strongest, up near 0.9%, although who the next PM will be remains uncertain at this stage.

FOREX: AUD Pressured, NZD Firmer In Asia

The antipodeans have dominated G-10 FX in Asia on Thursday, AUD was pressured after the latest Labour Market Report showed that the unemployment rate ticked higher in April. NZD firmed after the NZ Treasury noted they now expect the economy to avoid recession, with GDP growth of 3.2% in 2022/23. New Zealand also increased its bond issuance program by $20bn over 4 years.

- AUD/USD sits at $0.6645/50, the pair is down ~0.2%. In April the unemployment rate nudged higher to 3.7% from 3.5%. Support was seen below $0.6635 and losses were marginally pared.

- NZD/USD is ~0.2% firmer and deals a touch below the 200-Day EMA ($0.6263), a break through here opens the high from May 11 at $0.6385.

- Yen is marginally firmer, however ranges have been narrow with little follow through on moves. Wednesday's highs were tested in early dealing however they remain in tact for now.

- Elsewhere in G-10 moves have been limited, BBDXY is little changed from yesterday's closing levels.

- Cross asset flows are mixed; e-minis are a touch lower and Hang Seng is ~1.2% firmer. US Treasury Yields are ~1bp lower across the curve.

- There is a thin docket in Europe today, further out we have US Initial Jobless Claims and Existing Home Sales.

OIL: Crude Holds Onto Most Of Wednesday’s Gains, But Still Jittery

Oil prices are down around 0.4% during the APAC session but have been trading in narrow ranges. They rose around 2.5% yesterday on increased confidence there would be a timely solution to the US debt-ceiling impasse. WTI is around $72.56/bbl up from the intraday low of $72.49, while Brent is $76.68 after a low of $76.57. The USD index is slightly higher.

- Demand concerns persist in the crude market driven by lacklustre data from China and continued US rate hikes. It continues to worry that there will be a recession in the US. While there have been some supply disruptions, overall it remains solid as Russia does not appear to have cut output despite its reassurances that it will to support prices.

- Later the Fed’s Jefferson gives a speech on the economic outlook and Barr and Logan are also speaking. On the data front, there is US April existing home sales, the leading index, jobless claims and the May Philadelphia Fed index. ECB President Lagarde is also due to speak.

GOLD: Hovering At Three Week Lows In Asia-Pac Trade

Gold is hovering close to its lowest level in nearly three weeks at 1982.15 in Asia-Pac trade. The positive sentiment surrounding the resolution of the US debt-ceiling issue increased risk appetite, diminishing gold's appeal as a safe-haven asset. President Joe Biden expressed confidence in reaching an agreement to avert a default, and House Speaker Kevin McCarthy remained hopeful about a deal.

- The price of bullion has declined by 1.7% in the previous two sessions.

- Additionally, the strengthening of the US dollar and rising US Treasury yields are further factors weighing on gold, which lacks interest-bearing properties.

- According to MNI’s technical team, gold trend conditions are bullish, however, the yellow metal remains in a bearish cycle and the recent move lower is corrective. Support to watch is 1976.8, the 50-ema and 1963.3, the April 19 low.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/05/2023 | 0630/0830 |  | EU | ECB de Guindos Remarks at PwC Seminar | |

| 18/05/2023 | 0745/0845 |  | UK | BOE Pill Opens CCBS Macro-finance Workshop | |

| 18/05/2023 | 0915/1015 |  | UK | BOE Bailey Broadbent, Ramsden give TSC evidence on QE, QT at Bank, Threadneedle St | |

| 18/05/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 18/05/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 18/05/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 18/05/2023 | 1305/0905 |  | US | Fed Governor Philip Jefferson | |

| 18/05/2023 | 1330/0930 |  | US | Fed Vice for Supervision Michael Barr | |

| 18/05/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 18/05/2023 | 1400/1000 |  | US | Dallas Fed's Lorie Logan | |

| 18/05/2023 | 1400/1000 |  | CA | BOC publishes Financial System Review | |

| 18/05/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 18/05/2023 | 1500/1100 |  | CA | BOC Governor press conference to discuss Financial System Review | |

| 18/05/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 18/05/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 18/05/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 18/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 18/05/2023 | 1900/1500 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.