-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI EUROPEAN OPEN: NZD Gives Back Some Of Friday's Outperformance

EXECUTIVE SUMMARY

- TRUMPS NATO COMMENTS DRAW SCORN, WHITE HOUSE CALLS THEM ‘UNHINGED’ - RTRS

- PHILLY FED FORECASTERS LOWER INFLATION, JOBLESS ESTIMATES - MNI

- ECB’S MARCH PROJECTIONS KEY FOR RATE PATH, DES COS TELLS POLITIS - BBG

- ECB’S PANETTA SAYS TIME FOR REVERSAL OF POLICY STANCE IS NEAR - BBG

- NEW ZEALAND CENTRAL BANK BLAMES INFLATION FOR RESTRICTIVE POLICY - RTRS

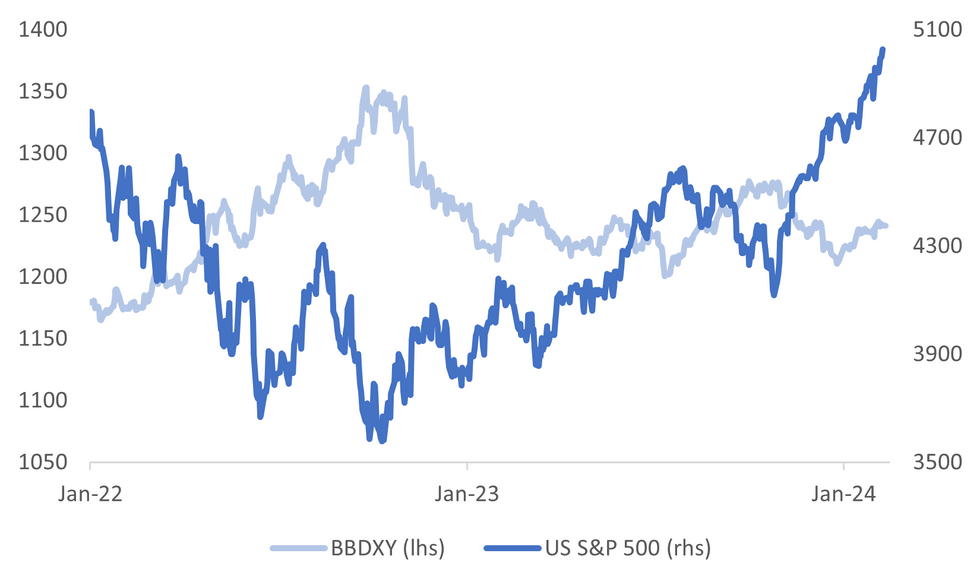

Fig. 1: US BBDXY Versus US S&P 500

Source: MNI - Market News/Bloomberg

U.K.

POLITICS (BBG): The setbacks are coming at a critical time for the prime minister, as officials in the Conservative Party grow more concerned about his struggle to establish a winning election campaign narrative. Trailing the Labour Party in the polls, the Tory plan was to spend the opening weeks of 2024 drumming into voters that the economy is turning the corner and that they should stick with Sunak rather than returning to “square one” with opposition leader Keir Starmer.

EUROPE

ECB (BBG): The European Central Bank’s new outlook for inflation and economic growth, due in March, will be pivotal for deciding when to start cutting interest rates, according to Governing Council member Pablo Hernandez de Cos. “The projections will be key to assessing, first, whether we can be sufficiently confident that our 2% medium-term target will be achieved, taking into account the associated risks, and second, the rate path that is compatible with reaching our symmetric target,” de Cos, who also heads Spain’s central bank, told Cypriot newspaper Politis in an interview published Sunday.

ECB (BBG): The European Central Bank will soon need to start cutting interest rates, according to Governing Council member Fabio Panetta. “Macroeconomic conditions suggest that disinflation is at an advanced stage, and progress toward the 2% target continues to be rapid,” he said on Saturday at the annual Assiom Forex event in Genoa. “The time for reversal of the monetary policy stance is fast approaching.”

ECB (BBG): European Central Bank Governing Council member Mario Centeno said he would prefer that interest rates fall gradually and in a steady way instead of dropping more rapidly. “In the logic of stability, I would prefer that interest rates fall in a gradual way, without hesitations, rather than in a hurry,” the Portuguese central bank governor said in an interview published Saturday on TSF radio’s website. “Normally, when central banks have to act in a more rapid way, it means that something isn’t going well in this process.”

FISCAL (BBG): The European Union hashed out a preliminary agreement on fiscal reform that will aim to reduce debt and protect investment in key areas such as defense and the green transition.

AGRICULTURE (BBC): Europe's farmers have ramped up protests against EU measures and rising prices, with roads blocked in Poland, Hungary, Spain and Belgium.

GERMANY (DW): Berlin's partial rerun of the 2021 vote has seen much lower turnout than a normal vote tends to attract, slight gains for right-of-center parties, and slight losses for the members of the current national coalition.

ITALY (MNI): Italy will try to persuade its European Union partners that the upcoming approval of new EU fiscal rules means the old regulations should be partly suspended in a “transitional year” before the revised strictures come into force, allowing them to shift part of their interest bill to the end of a future adjustment period, Italian government sources told MNI.

FINLAND (RTRS): Alexander Stubb of the centre-right National Coalition Party narrowly won Finland's presidential election on Sunday, defeating liberal Green Party member Pekka Haavisto, who conceded defeat. Stubb is pro-European and a strong supporter of Ukraine who has taken a tough stance towards Russia.

U.S.

FED (MNI): Analysts expect a stronger U.S. labor market amid less inflation than they did three months ago and see little slowing in the economy, a Federal Reserve Bank of Philadelphia survey released Friday showed.

NATO (RTRS): U.S. President Joe Biden and top western officials criticized former president Donald Trump on Sunday after he suggested the United States might not protect NATO allies who aren't spending enough on defence from a potential Russian invasion. "America’s leadership on the world stage and support for our allies is critical to keeping the American people safe here at home," said Biden in a statement.

POLITICS (RTRS): A narrowly divided U.S. Senate moved closer to passing a $95.34 billion aid package for Ukraine, Israel and Taiwan on Sunday, showing undiminished bipartisanship despite opposition from Republican hardliners and Donald Trump. The Democratic-led Senate voted 67-27 in a rare Sunday session to clear the latest procedural hurdle and moved the foreign aid measure toward an ultimate vote on passage in the coming days.

OTHER

IRAN (RTRS): Iran and the United States have exchanged messages throughout Israel's four-month-old war on Hamas in Gaza, including about Lebanese armed group Hezbollah, the Iranian foreign minister said on Saturday. "During this war and in the recent weeks, there was an exchange of messages between Iran and America," Hossein Amirabdollahian said through a translator at a press conference capping a day-long visit to Beirut.

ISRAEL (RTRS): Israeli strikes on Gaza's southern city of Rafah killed 22 people and wounded dozens, local health officials said on Monday, after U.S. President Joe Biden told Israel not to attack Rafah without a credible plan to protect civilians.

NEW ZEALAND (RTRS): New Zealand's top central banker on Monday said the inflation challenge was still not over and cited broad financial pressure for retaining a "restrictive monetary policy" position. Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr, appearing before a parliamentary committee, said the current inflation rate at 4.7% was still too high and that the board's aim was to continue to slow it down to around 2%.

NEW ZEALAND (BBG): Fonterra Co-operative Group increased its 2023/24 season forecast Farmgate Milk Price forecast range to NZ$7.30-NZ$8.30 per kgMS, up from NZ$7.00-NZ$8.00/kgMS. Seen a lift in demand, primarily from the Middle East and South East Asia, for reference commodity products and this has been reflected in GDT price.

MARKET DATA

NEW ZEALAND JANUARY BNZ/SEEK JOB ADS RISE 0.8% M/M; PRIOR -1.7%

MARKETS

US TSYS: Tsys Slightly Stronger On Low Volume, Holding Above Support Levels

TYH4 is currently trading at 110-23, + 04+ from New York closing levels.

As expected a slow start to the week for markets, treasuries largely unchanged in Asia trading.

- The past month has seen downside pressure on US Tsys, testing the 110-22+ area multiple times, the first support zone and the bear trigger, closing the past week below support at 110-18+ solidifying the break, next support zone remains at 110-16 Dec 13th low, and a level we touched during the Friday session, however only very briefly a break here would open up a move to the Dec 11th lows, of 109-31+.

- To the upside, initial key resistance has been defined at 113-06+, Feb 1 high, where a breach would reinstate a bullish theme. First resistance is 111-11, the 20-day EMA.

- Cash yields have range bound over the past few months, the 10yr has been trading within the 3.80%/4.20% area, closely Friday at 4.175% a break above the 4.20% level would open up a move to the Dec 12 highs of 4.28%.

- Key event risk this week is with the US CPI on Wednesday Est of 0.2% vs 0.3% previously, while retail sales and Claims are expected on Friday.

- Look ahead: Monday data calendar includes NY Fed Inflation Expectations, and more Fed commentary from Fed Gov Bowman, Richmond Fed Barkin MN Fed Kashkar and MN Fed Kashkari.

Fig 1: US 10yr Futures

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Cheaper, Narrow Ranges, Subdued Session With No Cash Tsys

ACGBs (YM -6.0 & XM -2.5) are holding cheaper after dealing in relatively narrow ranges in today’s Sydney session. With the domestic calendar light, local participants have likely been on headlines and US tsys watch.

- However, today’s news flow has been light, with US tsy futures dealing slightly stronger. Cash Us tsys have not been trading in today’s Asia session due to a Japanese holiday.

- Key event risk this week is US CPI on Wednesday, and US Retail Sales and Claims data on Thursday.

- Cash ACGBs are 2-5bps cheaper, with the AU-US 10-year yield differential 1bp tighter at -3bps. The 3/10 curve is flatter.

- Swap rates are 3-4bps higher.

- The bills strip has bear-steepened, with pricing -2 to -6.

- RBA-dated OIS pricing is 3-6bps firmer across meetings beyond August. A cumulative 39bps of easing is priced by year-end compared to 67bps at the start of February.

- Tomorrow, the local calendar sees Westpac Consumer and NAB Business Confidence, along with remarks by Marion Kohler, RBA’s Head of Economic Analysis, at the Australian Business Economists Annual Forecasting Conference in Sydney.

NZGBS: Cheaper But Off The Session’s Worst Levels, Subdued Session

NZGBs closed 2-4bps cheaper across benchmarks but off the local session’s worst levels. Nevertheless, with the domestic calendar light, local participants have extended Friday’s sell-off, prompted by ANZ Bank's hawkish OCR forecast change. ANZ Bank now anticipates that the RBNZ will raise the official cash rate (OCR) by a cumulative 50bps (this month and in April) to 6.0%.

- The 2-year yield currently sits 30-35bps higher than last week's start. The 10-year yield is 20bps higher, with its yield differential with ACGBs 15bps wider.

- Swap rates are 3-5bps higher.

- RBNZ dated OIS pricing is 3-6bps softer across meetings out to August. That said, the cumulative easing priced by year-end has been pared to 51bps from a peak of 5.68% versus around 100bps of easing off 5.53% at the end of January.

- RBNZ Chief Economist Paul Conway will speak to the ANZ Investor Tour in Wellington tomorrow. There will be no new economic information or insights presented in this engagement.

- The NZ Government will deliver the Budget on May 30.

- Tomorrow, the local calendar sees Inflation Expectations, ahead of REINZ House Sales, Card Spending and Food Prices on Wednesday. The RBNZ Policy Decision is on 28 February.

FOREX: NZD Gives Back Some Of Friday's Outperformance, Steady Trends Elsewhere

Outside of some NZD weakness, G10 markets have started this week in a muted fashion. The BBDXY sits little changed, last near 1241.6. Most EM Asia markets are closed, including China, Hong Kong and Singapore for LNY, while Japan markets are also out.

- Cross asset moves have been quiet as well, US equity futures sit close to flat, while US Tsy futures have drifted a touch higher.

- NZD/USD is close to session lows in recent dealings, last near 0.6130, around 0.3% lower than NY closing levels from Friday. this puts us back sub the 20 and 50-day EMAs, albeit just.

- Comments from RBNZ Governor Orr may have weighed at the margin. He stated that higher inflation is why policy rates are staying restrictive. Orr is appearing before parliament today. He also noted that "we’ll be back at the end of this month again with our updated views on the wisdom of that stance and the length which we have to be there" (per BBG).

- At face value this doesn't suggest a further tightening in rates is being considered, although tomorrow we get inflation expectations and Orr speaks early on Friday morning local time. It seems that if the data warrants it, that policy will stay "restrictive" for longer rather than hiking again at this juncture. In November, the RBNZ projections didn't imply an easing until H1 2025.

- Elsewhere, AUD/USD has been dragged down by NZD, a touch, last near 0.6520, but the AUD/NZD cross has firmed. We were last near 1.0635, but off session highs of 1.0640. Lows from last week came in at 1.0586.

- USD/JPY sits in the 149.20/25 in recent dealings little changed for the session.

- Looking ahead, the Fed’s Bowman, Barkin and Kashkari make appearances, BoE’s Bailey and the ECB’s Lane, Cipollone and Buch speak. In terms of data there are January NY Fed 1-yr inflation expectations and US budget statement. US CPI on Tuesday will be watched closely.

ASIA PAC EQUITIES: Equities Lower As Asia Enjoys LNY

It's a slow day for equities, especially with most of Asia observing Lunar New Year. US Equity Futures remain largely unchanged as the market anticipates the US CPI release on Wednesday.

- In Australia, equities are trending lower today, currently down by 0.20%. Health stocks, particularly CSL due to disappointing Phase 3 AEGIS-II trial results, causing their equity of 5.10%. Miners are also contributing to the downturn, with the ASX Metals and Mining Index 0.66% lower at 5880. A crucial level to watch is 5800, and a break below could signal further weakness, possibly moving towards the year lows of 5600. WBC Consumer Confidence and NAB Business Confidence/Conditions are on the agenda for tomorrow, with Employment data due on Thursday.

- New Zealand equities have dipped after remarks from the RBNZ Governor and Deputy Governor, emphasizing persistently high inflation and the system's capacity to handle elevated interest rates. The NZX50 is down 0.72%. Looking ahead, 2yr Inflation expectations are due tomorrow, followed by House Sales and Food prices on Wednesday.

- Indonesia equities are trending higher today, up by 0.40%, driven by financials, especially Bank Mandiri, higher by 2.20% continuing it's strong performance following a positive earnings outlook announcement last week. Note that Indonesia's Presidential elections are held on Wednesday, which will be a public holiday.

- Philippines equities show a slight decline today off 0.20%, lacking significant earnings or market headlines. Investors might be looking to secure profits after the PSEi hit 1-year highs on Thursday. The PSEi has witnessed 130m of inflows this year, with 42m of that coming in the past week.

OIL: Crude Consolidates In Thin Holiday Trading Ahead Of Monthly Reports

Oil prices have given up some of their gains from late last week with trading thin due to much of Asia closed for holidays. WTI is down 0.6% to $76.41/bbl off the intraday low of $76.18 and Brent is down 0.5% to $81.78/bbl and has been moving in a narrow range. The USD index is slightly lower.

- Oil has sold off today on news that Iran has been talking with Hamas in Beirut to find a “diplomatic solution”. Iran commented that progress is being made on the situation in Gaza including the release of Israeli hostages, according to Bloomberg. Later today US President Biden and King Abdullah of Jordan will speak.

- Geopolitical developments continue to support crude but concerns over excess supply persist given scepticism that OPEC members will stick to quotas and Plains All American Pipeline saying that output from the US Permian Basin of West Texas and New Mexico is expected to rise almost 5% before year-end. Revised forecasts will be included in the OPEC and IEA monthly reports due this week.

- Later the Fed’s Bowman, Barkin and Kashkari make appearances, BoE’s Bailey and the ECB’s Lane, Cipollone and Buch speak. In terms of data there are January NY Fed 1-yr inflation expectations and US budget statement. US CPI on Tuesday will be watched closely.

GOLD: Steady After Friday’s Drop

Gold is little changed in the Asia-Pac session, after closing 0.5% lower at $2024.26 on Friday.

- Friday’s move locked in a weekly decline for bullion, as traders weighed the outlook for interest rates ahead of crucial US CPI data on Wednesday and Retail Sales on Thursday.

- With limited economic data on Friday, the market focused on revisions to US CPI data after Fed Waller highlighted the importance of the adjustments to confirm the downward trend for inflation in a recent speech. Overall, CPI revisions provided only minor and offsetting adjustments that did little to change the outlook that the Fed will be pivoting to rate cuts in the coming months.

- US Treasuries finished Friday moderately weaker, with yields 2-3bps higher. US Treasury futures are dealing slightly stronger in today's Asia-Pac session, with cash bonds not trading due to a Japanese holiday.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/02/2024 | 0945/1045 |  | EU | ECB's Lane keynote speech at conference | |

| 12/02/2024 | 1315/1415 |  | EU | ECB's Lane participates in 'post-pandemic' roundtable | |

| 12/02/2024 | 1420/0920 |  | US | Fed Governor Michelle Bowman | |

| 12/02/2024 | 1550/1650 |  | EU | ECB's Cipollone participates in panel on Euro@25 | |

| 12/02/2024 | 1600/1100 | ** |  | US | NY Fed Survey of Consumer Expectations |

| 12/02/2024 | 1800/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/02/2024 | 1800/1800 |  | UK | BOE's Bailey lecture at Loughborough University | |

| 12/02/2024 | 1900/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.