-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Pandemic Headlines Remain At Fore Into Year End

EXECUTIVE SUMMARY

- U.S. COVID DEATHS FALL EVEN AS OMICRON SURGES (BBG)

- FAUCI PREDICTS OMICRON COVID WAVE WILL PEAK IN U.S. BY END OF JANUARY (CNBC)

- PARIS TO REQUIRE MASKS OUTDOORS (BBG)

- ITALY TO EASE ISOLATION RULES (BBG)

- J&J BOOSTER SLASHED OMICRON HOSPITAL STAYS IN SOUTH AFRICA (BBG)

- SOME EVERGRANDE BONDHOLDERS YET TO RECEIVE COUPONS DUE TUESDAY (BBG)

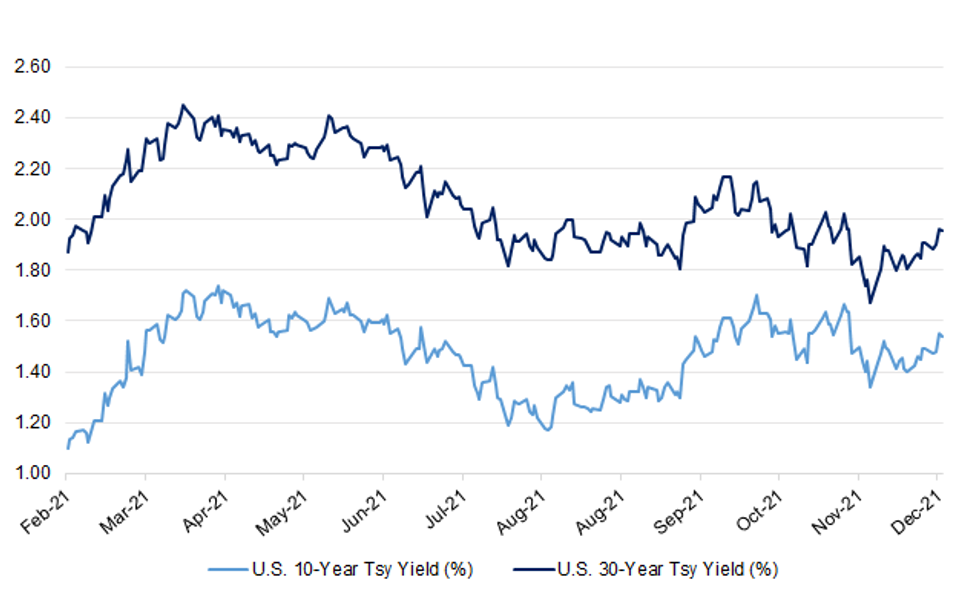

Fig. 1: U.S. 10- & 30-Year Tsy Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Coronavirus "surge hubs" will be set up at hospitals across England in preparation for a potential wave of Omicron admissions, the NHS has said. The eight temporary sites will each have capacity for around 100 patients, with building work starting this week. Unlike earlier "Nightingale" hospital units, they will be added to existing hospitals with plans to identify sites for a further 4,000 beds if needed. NHS medical director Prof Stephen Powis said the service was on "war footing". The NHS is often required to deploy extra beds in the winter months but the UK has seen a record number of new Covid cases this week, with 183,000 daily cases reported on Wednesday. (BBC)

CORONAVIRUS: Sajid Javid has told MPs there will be "no quick fix" to the growing Covid testing crisis, with officials warning that the system will be overwhelmed within days. On Wednesday, Mr Javid, the Health Secretary, privately admitted that there was a worldwide shortage of tests. Business leaders have warned of an effective New Year lockdown as workers unable to get tested are forced to stay at home. Boris Johnson was criticised for telling partygoers to get tested even though no PCR tests were available to book anywhere in England for much of Wednesday, while pharmacies are having to wait days for deliveries of lateral flow home testing kits. (Telegraph)

CORONAVIRUS: Nicola Sturgeon has said it is her "expectation" that new COVID restrictions in Scotland will be in place until 17 January, as she urged people to "stay at home right now more than normal". (Sky)

BREXIT: The European Central Bank aims to complete a detailed assessment of how international banks manage their EU business by early next year, in a move that risks triggering a stand-off with UK regulators over the location of senior staff and capital. International banks are concerned they could face competing demands from eurozone and UK regulators over how they structure their European operations once the ECB completes its so-called “desk-mapping” exercise — a detailed review of how banks have set up their EU operations, including where they locate staff and capital. The assessment is designed to establish how widely banks use various techniques to transfer the risk of EU operations outside the bloc, in particular to the UK, where many had based their European operations before Brexit. (FT)

EUROPE

FRANCE: People in Paris will be required to wear masks outside beginning Dec. 31 in an effort to slow the spread of new Covid-19 infections, the French police said on Wednesday. The order, which applies to everyone over the age of 11, was needed because of the surge in cases in the city from the omicron variant, the police said in a statement. There are exceptions to the rule, including for cyclists, people in cars and those practicing a sport. France reported a record 208,099 new infections on Wednesday. (BBG)

ITALY: Italy’s government is set to ease quarantine rules in a bid to keep essential services running. Ministers are discussing whether to lift the quarantine requirement completely for people who come into contact with a Covid-19 case if they have had three vaccine doses, according to a government official. The isolation time would also be cut to five days from seven for vaccinated people whose most recent dose was more than 120 days before exposure, the official said. Non-vaccinated people will still need to isolate for 10 days, the official said. In the U.S., the Centers for Disease Control and Prevention said this week that anyone who has Covid-19 can leave isolation after five days if they are no longer experiencing symptoms, cutting the recommended period in half. (BBG)

U.S.

CORONAVIRUS: Virus deaths in the U.S. are declining even as Covid-19 cases rise, according to federal health officials who suggested the surging omicron variant may cause less suffering than other strains. Cases jumped 60% from the prior week, in large part due to the omicron variant, Centers for Disease Control and Prevention Director Rochelle Walensky said during a briefing. In the same period, deaths fell 7% to a seven-day average of about 1,100 per day. (BBG)

CORONAVIRUS: Dr. Anthony Fauci on Wednesday predicted that the latest wave of the coronavirus pandemic may hit its peak in the U.S. by the end of January. “It’s tough to say,” said Fauci, President Joe Biden’s top medical advisor, when asked on CNBC’s “Closing Bell” at what point the current surge in infections, fueled by the omicron variant, will start to recede. “It certainly peaked pretty quickly in South Africa,” where the highly transmissible new variant was identified last month, Fauci said. “It went up almost vertically and turned around very quickly.” “I would imagine, given the size of our country and the diversity of vaccination versus not vaccination, that it likely will be more than a couple of weeks, probably by the end of January, I would think,” Fauci said. Fauci also said it is technically possible that omicron could hasten the end of the pandemic, if it proves true that that variant, with its high degree of transmissibility, replaces other strains of the virus that cause more severe infections. “I would hope that’s the case,” Fauci said when asked about that possibility, but “there’s no guarantee that that would happen.” But “if you have a very transmissible virus that replaces another virus, and [the replacement virus] has less of a degree of severity, that would be a positive outcome,” he said. “But you can never guarantee,” he stressed. “This virus has fooled us before. Remember we thought with the vaccines everything was going to be fine, and along came delta, which threw a monkey wrench into everything.” (CNBC)

CORONAVIRUS: White House chief medical advisor Dr. Anthony Fauci on Wednesday said Americans should avoid large New Year’s Eve parties as the highly transmissible omicron variant drives U.S. Covid cases to their highest levels of the pandemic. However, Fauci said small gatherings with family and close friends are low risk if everyone at the gathering is vaccinated and boosted if they are eligible. (CNBC)

CORONAVIRUS: Students and staff in the Washington D.C. public school system will need to test negative for COVID-19 in order to return to the classrooms from winter break next Wednesday. (Axios)

CORONAVIRUS: Ohio Governor Mike DeWine is deploying an additional 1,250 National Guard members to aid hospitals in northern Ohio unable to cope with depleted staffing amid record Covid-19 hospitalizations. The Cleveland Clinic, a world-renowned medical research institute and one of Ohio’s largest employers, is down 2,700 staff—roughly 10% of its medical caregiving workforce—due to quarantines, Robert Wyllie, the clinic’s chief medical officer said during a news conference. And the remaining staff must take care of more patients than ever. (BBG)

OTHER

GLOBAL TRADE: Micron Technology Inc. said its output of some computer memory will be hit by the closing of the Chinese city of Xi’an aimed at limiting a fresh outbreak of the Covid-19 virus. The U.S. company uses a test and assembly facility located in Xi’an. The chipmaker said it will be able to meet most of its customer demand, but new supply arrangements may cause delays. (BBG)

U.S./CHINA/HONG KONG: U.S. Secretary of State Antony Blinken on Wednesday called on Chinese and Hong Kong authorities to immediately release staff members of the pro-democracy media outlet Stand News who were arrested after a police raid. (RTRS)

CORONAVIRUS: More than 1.63 million people worldwide were reported to have Covid-19 on Wednesday, the third day in a row with more than a million infections, as the omicron variant continues to spread. The number will smash the global record set on Monday, with 1.49 million cases reported, when Johns Hopkins University posts the final daily tally on its virus tracker at midnight in Baltimore. The higher transmissibility of the omicron variant, plus its shorter incubation period, ability to evade existing immunity and higher reproduction number, is expected to drive records in the days to come. (BBG)

CORONAVIRUS: The World Health Organization on Wednesday cautioned that omicron has not spread widely among the populations most at risk, making it difficult to determine whether or not the Covid variant is inherently less severe than previous strains of the virus. Dr. Abdi Mahamud, the WHO’s incident manager for Covid, said data from South Africa suggesting omicron causes milder illness is encouraging, but the variant has mostly infected younger people so far who generally develop less severe disease from Covid. “We all want this disease to be milder, but the population it affected so far is the younger. How it behaves in the elderly population, the vulnerable — we don’t know yet,” Mahamud said during a press briefing in Geneva. (CNBC)

CORONAVIRUS: A booster shot with Johnson & Johnson’s vaccine significantly reduced the risk that health care workers in South Africa would be hospitalized with a Covid-19 infection caused by the omicron variant, a study showed. The effectiveness of the booster increased with time, rising to 85% protection against hospitalization when the shot was given one to two months earlier, up from 63% for the first two weeks. The study was published on the online website medRxiv, without undergoing peer review. (BBG)

JAPAN: Less than a fifth of Japan’s biggest firms plan on raising pay at the pace targeted by Prime Minister Fumio Kishida, according to a Nikkei survey, highlighting the heavy lifting the premier faces as he tries to get firms to redistribute more income to workers. The survey of major company chief executives showed only 18% intended to boost pay by 3% or more at upcoming spring labor negotiations. Some 43% of firms said they’ll hike pay by 2% to 3%, while around 10% of companies said they won’t raise paychecks at all, the poll showed. (BBG)

AUSTRALIA: Prime Minister Scott Morrison has outlined a new definition of a close contact and “how they should isolate and be tested” which will come into effect in four states and the ACT from midnight on Thursday. The new definition and accompanying rules will come into effect at midnight tonight in New Wales, Victoria, Queensland, South Australia and the ACT. Tasmania will follow on the 1 January, and the Northern Territory and Western Australia will be making announcements in the next few days to confirm how they will be moving to these new definitions. Mr Morrison said, “except in exceptional circumstances, a close contact is a household contact, or household-like, of a confirmed case only”. “A household contact is someone who lives with a case or has spent more than four hours with them in one house, accommodation or care facility setting.” “You are only a close contact if you are living with someone or have been in an accommodation setting with someone for more than four hours who has actually got COVID. “It is not someone who is in contact with someone who has had COVID. It is with someone specifically who has COVID,” he emphasised. The Prime Minister said under the new rules a confirmed COVID-19 case would have to isolate for seven days from the positive result. (Sky)

TURKEY: Turkey's Finance Minister Nureddin Nebati said on Wednesday that stability in the Turkish lira and the government's price inspections will ensure a slow fall in inflation, which is expected to exceed 30% in December according to a Reuters poll. In an interview with broadcaster CNNTurk, Nebati said inflation will fall to single digits in 2023 and will cease to be the economy's chronic problem. (RTRS)

TURKEY: Turkey’s Finance and Treasury Minister Nureddin Nebati urged citizens to file lawsuits against individuals over their comments on the lira after authorities probed some of them on suspicion of attempting to manipulate Turkey’s exchange rate. Nebati said the government “can do nothing” to address financial woes of individuals who invested in foreign currencies and suffered losses when the lira recovered as much as 73% on Dec. 20 when authorities announced a series of controversial measures to put it on a more stable footing. (BBG)

TURKEY: Turkey increases deposit insurance limit to 200,000 liras ($15,730) from 150,000 liras, according to Savings Deposit Insurance Fund decree in official gazette. Deposits in Turkish banks will be guaranteed up to 200,000 lira by the government. The increase is to take place as of 2022. (BBG)

TURKEY: Turkish companies will be required to get permission for sugar exports, according to decree published in official gazette. (BBG)

RUSSIA: President Joe Biden plans to speak by phone with Russian President Vladimir Putin on Thursday amid an alarming Russian military buildup on its shared border with Ukraine. The call, the second known discussion between the two leaders this month, comes as Washington and European allies warn Moscow that invading its ex-Soviet neighbor will trigger economic and political countermeasures. “We are prepared for diplomacy and for a diplomatic path forward but we are also prepared to respond if Russia advances with a further invasion of Ukraine,” a senior Biden administration official, who spoke on the condition of anonymity in order to share details ahead of the call, said Wednesday. “We have coordinated with our allies to impose severe sanctions on the Russian economy and financial system far beyond what was implemented in 2014,” the official said, referring to Moscow’s 2014 invasion of Crimea. (CNBC)

RUSSIA: The U.S. is prepared to provide Ukraine with further assistance should a further invasion proceed, a senior administration official says ahead of a Thursday call between President Joe Biden and Russian President Vladimir Putin. The U.S. is also ready for stronger sanctions than ever before and continues to be gravely concerned over Russian troop buildup at the Ukraine border, official says. (BBG)

RUSSIA: The foreign ministers of Germany, France, Britain and the United States discussed the situation at the Ukrainian border and upcoming dialogue formats with Russia, Germany's foreign ministry said on Twitter on Wednesday. (RTRS)

RUSSIA: Russian GDP growth is estimated at 5.2% y/y in November, the Economy Ministry said in a report. November GDP seen 0.3% m/m. 11-month GDP growth seen at 4.7% y/y. (BBG)

MIDDLE EAST: Saudi King Salman said on Wednesday that Saudi Arabia was concerned about Iran's lack of cooperation with the international community on its nuclear and ballistic missile programmes. King Salman bin Abdulaziz, who was addressing the kingdom's advisory Shura Council, added that he hoped Iran will change its "negative" behaviour in the region and choose the direction of dialogue and cooperation. (RTRS)

METALS: The Turkish Metal Union said it has decided to strike after holding talks with the Turkish Employers Association of Metal Industries, according to statements from three companies that are members of the association. Negotiations are still in progress. Strike date yet to be determined by the union. (BBG)

ENERGY: European gas prices slumped for a sixth day, the longest losing streak in more than a year, as cargoes of the liquefied fuel head to the continent just as industrial shutdowns and warm weather curb demand. Futures fell as much as 9.9% on Wednesday as a flotilla of U.S. LNG cargoes headed to the region, while several vessels that were sailing to Asia have now diverted to Europe. More supplies are coming after record prices earlier this month forced factories to halt or slow output, curbing demand just as the continent faces unseasonably warm temperatures. (BBG)

ENERGY: Russian President Vladimir Putin said on Wednesday the Nord Stream 2 undersea gas pipeline would help to calm a surge in European gas prices and was ready to start exports now a second stretch of the pipeline has been filled. (RTRS)

OIL: Saudi Arabia's King Salman said on Wednesday the OPEC+ production agreement was "essential" to oil market stability and stressed the need for producers to comply with the pact. The king, in an annual speech to the advisory Shura Council carried on state media, said market stability and balance are a pillar of Saudi energy policy and efforts by the world's top oil exporter to maintain spare capacity had proven important to safeguarding energy supply security. "The Kingdom ... confirms its keenness for the continuation of the OPEC+ agreement due to its essential role in oil market stability and also stresses the importance of compliance by all participating countries with the agreement," the king said. (RTRS)

OIL: Kuwait's candidate to lead the Organization of the Petroleum Exporting Countries (OPEC) has widespread support from the group, with current secretary general Mohammad Barkindo not expected to seek re-election, two sources told Reuters. (RTRS)

OIL: China’s government cut the amount of crude oil import quota awarded to independent oil refiners and favored large, complex processors as it seeks to reform the sector. Beijing granted 109 million tons of allowances to 42 private refiners in the first batch for 2022, according to officials from companies that received notification of the allowances. That was 11% less than in the first tranche for this year. Almost 40% of the quota was awarded to three mega-refineries: Zhejiang Petroleum & Chemical Corp., Hengli Petrochemical Co. and Shenghong Group. These companies operate large, sophisticated plants that are less pollutive than the smaller so-called teapots, most of which are in Shandong province. (BBG)

MARKETS: Wall Street investors believe inflation will remain a major roadblock for markets in 2022 and stocks will only see muted returns, according to a new CNBC Delivering Alpha investor survey. We polled about 400 chief investment officers, equity strategists, portfolio managers and CNBC contributors who manage money about where they stood on the markets for the rest of 2021 and next year. The survey was conducted this week. More than half of the respondents said inflation is their biggest worry for 2022. Thirty percent said the Federal Reserve raising rates at the wrong time is their top concern, while 17% said the economic impact of a lingering pandemic is their No. 1 worry. (CNBC)

CHINA

POLICY: China will promote consumption to underpin the economy, as well as stabilise trade and foreign investment, Shanghai Securities News reported following a Ministry of Commerce meeting outlining work for next year. Efforts should promote the upgrade of urban and rural consumption and meet people’s demands for mid-to-high-end products and services, the newspaper said citing Chen Lifen, research fellow at the Development Research Center of the State Council. It is necessary to strengthen cross-cycle policies to stabilise imports and exports, and attract more foreign investment and expand opening markets, the meeting said. (MNI)

POLICY: China will issue a record amount of treasury bonds in 2022, and will guide overall interest rates lower for the issuance, a senior official at the finance ministry said. China will also guide more long-term foreign investors into its treasury bond market, Wang Xiaolong, director of the Treasury Department, Ministry of Finance, said during a meeting. A transcript of his speech was published late on Wednesday. (RTRS)

POLICY: China should seize the current favourable opportunity to increase counter-cyclical policies before any U.S. rate hike, by accelerating the initiative-taking fiscal policy and titling prudent monetary policy to loosening, the Economic Information Daily reported citing Sheng Songcheng, a former PBOC official. China should take multiple measures to cope with short-term downward pressures, as any long-term structural reforms will be impossible without economic stability, said Sheng, combating ideas about monetary tightening to help prevent real estate and local government debt risks. Investment will be the main driver to boost growth next year as it takes time for consumption and service industries to recover while exports could weaken, Sheng said. (MNI)

PBOC: MNI: PBOC Urged To Seize Dovish Chance Before Fed Rate Hike

- The People’s Bank of China should take advantage of a window of opportunity to further ease monetary conditions in coordination with fiscal expansion to counter a H1 economic slowdown before a likely rate hike by the U.S. Federal Reserve reduces policy space later in the year, advisors and experts familiar with monetary policy told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BANKS: Commercial banks in China are finding it hard to meet the requirement of boosting lending to SMEs, due to a lack of safe assets as SMEs’ anti-risk capabilities are weak amid the economic downturn, the 21st Century Business Herald reported citing credit managers. China’s top banking regulator asked the big five state-owned banks to achieve an annual growth of 30% in new inclusive loans, while inclusive loans increased by 24.6% y/y as of October, 9.7 percentage points higher than the average growth of other loans, the newspaper said. Such “asset shortage” even affects the financial market with the rate of 10-year China Government Bond approaching a new low and the discounting rate of bank bills once falling to close to zero, the newspaper said. (MNI)

EVERGRANDE: Some holders of two China Evergrande Group dollar bonds with coupons due Tuesday said they had yet to receive payment, after the stressed developer failed to meet interest obligations on other offshore debt earlier this month. Evergrande owes $204.8 million on an 8.75% note and $50.4 million on a 7.5% dollar bond. The company has a 30-day grace period to deliver the payments before a default can be declared, according to a bond issuance document seen by Bloomberg News. The company didn’t immediately respond to a request for comment sent outside of normal business hours. The investors said they hadn’t received payment as of 10:45 p.m. Hong Kong time on Wednesday. They asked not to be identified because they’re not authorized to speak publicly on the matter. (BBG)

EVERGRANDE: China Evergrande Group plans to cut its stake in a mainland-listed property developer after failing to repay debt on time, underscoring the firm’s liquidity woes and recent missed bond coupons. Its Kailong unit plans to sell as much as 6% of China Calxon Group Co., according to a statement to the Shenzhen stock exchange late Wednesday. Calxon also warned that Kailong may have to liquidate its entire 13.6% stake in the firm after pledging the shares as collateral for a loan in a deal with Citic Securities. Calxon has a market capitalization of 4.58 billion yuan ($719 million). (BBG)

OVERNIGHT DATA

SOUTH KOREA NOV INDUSTRIAL PRODUCTION +5.1% M/M; MEDIAN +2.5%; OCT -2.9%

SOUTH KOREA NOV INDUSTRIAL PRODUCTION +5.9% Y/Y; MEDIAN +3.4%; OCT +4.5%

SOUTH KOREA NOV CYCLICAL LEADING INDEX -0.4 M/M; OCT -0.4

CHINA MARKETS

PBOC INJECTS NET CNY90 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY100 billion via seven-day reverse repos with the rate unchanged at 2.2% on Thursday. This operation has injected net CNY90 billion after offsetting the maturity of CNY10 billion reverse repos, according to Wind Information.

- The operation aims to maintain liquidity towards year-end, the PBOC said on its website.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2556% at 10:05 am local time from the close of 2.3650% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 50 on Wednesday vs 49 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3674 THU VS 6.3735 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3674 on Thursday, compared with 6.3735 set on Wednesday.

MARKETS

SNAPSHOT: Pandemic Headlines Remain At Fore Into Year End

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 45.09 points at 28861.82

- ASX 200 up 3.593 points at 7513.4

- Shanghai Comp. up 20.425 points at 3617.59

- JGB 10-Yr future down 24 ticks at 151.6, yield up 0.8bp at 0.071%

- Aussie 10-Yr future down 9.5 ticks at 98.32, yield up 9.8bp at 1.629%

- US 10-Yr future up +0-01 at 130-08, yield down 0.69bp at 1.5427%

- WTI crude up $0.07 at $76.63, Gold down $6.02 at $1798.67

- USDJPY up 14 pips at 115.09

- U.S. COVID DEATHS FALL EVEN AS OMICRON SURGES (BBG)

- FAUCI PREDICTS OMICRON COVID WAVE WILL PEAK IN U.S. BY END OF JANUARY (CNBC)

- PARIS TO REQUIRE MASKS OUTDOORS (BBG)

- ITALY TO EASE ISOLATION RULES (BBG)

- J&J BOOSTER SLASHED OMICRON HOSPITAL STAYS IN SOUTH AFRICA (BBG)

- SOME EVERGRANDE BONDHOLDERS YET TO RECEIVE COUPONS DUE TUESDAY (BBG)

BONDS: Core FI Coils In Asia

A block lift of TYH2 futures (+2.1K) followed some light screen buying in Asia, allowing the contract to extend to fresh session highs, before backing off. Still, the contract remains in a particularly narrow 0-03+ range, well within the boundaries observed in recent weeks, last +0-01 at 130-08. Cash Tsys sit ~0.5-1.0bp richer across the curve, with the belly leading the bid. There hasn’t been anything in the way of notable macro headline flow observed overnight. Weekly jobless claims data & the latest MNI Chicago PMI print headline the NY docket on Thursday.

- The overnight weakness witnessed in JGB futures extended in Tokyo trade, with the contract hitting the bell -26 vs. Wednesday’s settlement levels. A technical break below the Nov 30 low has added to bearish momentum after the formation of a double top pattern earlier this month. Cash JGB trade saw 7s lead the way lower, cheapening by ~2bp, while super long swap spreads widened, pointing to a futures driven move which was aided by payside flows in the long end of the swap curve. Local headline flow remained light ahead of the 4-day weekend that will be observed in Japan. A Nikkei poll pointed to a mere 18% of firms looking to raise wages by a degree that would satisfy the wishes of Japanese PM Kishida (+3%).

- Aussie debt markets coiled during Sydney dealing, with little to drive the space out of tight ranges during the final full session of the calendar year. That left YM -5.5 and XM -9.5 at the bell. EFPs were narrower on the day. Meanwhile, the Bill strip closed 1-5 ticks cheaper through the reds. Local headline flow was light, with PM Morrison confirming the previously touted loosening of COVID restrictions re: isolation protocols.

EQUITIES: China Outperforms On Easing Hopes

Most of the major regional equity indices were little changed on the day during Thursday’s Asia-Pac session. Mainland Chinese indices were the exception to the broader rule, benefitting from increased speculation re: deeper monetary and fiscal easing in ’22, with continued year-end related OMO liquidity injections from the PBoC also supporting sentiment. U.S. e-mini futures are little changed after the S&P 500 & DJIA lodged record closing levels on Wednesday as the Santa rally extended.

GOLD: Consolidating Around $1,800/oz

The pullback from Wednesday’s highs in U.S. real yields allowed bullion to reclaim the $1,800/oz mark, with that move consolidating during Asia-Pac dealing. That leaves spot little changed, just above $1,800/oz. Bulls need to force a break of the 61.8% retracement of the Nov 16-Dec 15 downleg ($1,830.0/oz) to open the way higher, while support comes in at the Dec 21 low, followed by the channel base drawn off the Aug 9 low.

OIL: Marginal Gains In Asia, WTI & Brent Operate Within Wednesday’s Ranges

WTI & Brent crude futures sit ~$0.25 above their respective settlement levels, well within the ranges observed on Wednesday. A reminder that Wednesday’s weekly U.S. DoE inventory release resulted in some intraday volatility. There hasn’t been much in the way of market moving news since the New York bell.

- Wednesday saw RTRS sources suggest that “Kuwait's candidate to lead OPEC has widespread support from the group, with current secretary general Mohammad Barkindo not expected to seek re-election.” Elsewhere, the Saudi King stressed that market stability and balance are a pillar of Saudi energy policy.

- Focus remains pinned on next week’s OPEC+ gathering.

FOREX: Antipodeans Lodge Modest Outperformance In Limited Asia Trade

The Antipodeans outperformed in the G10 FX space during Asia hours, although the moves are very modest, with the major USD pairs generally operating within ~10 pips of Wednesday’s closing levels at typing. There has been nothing in the way of notable headline flow for market participants to latch onto.

- The NZD sits atop the G10 FX pile. Perhaps some spill over from the uptick in U.S. equities during the NY session has provided some support for the NZD. NZD/USD has traded as high as $0.6849 and last deals at ~$0.6840. With the Dec 23 high now breached, bulls turn their attention to the Dec 1 high ($0.6868). To the downside, the 21-DMA has acted as support since it was breached from below on Dec 22. Key support is some way lower, at the YtD low ($0.6702).

- USD/JPY traded as high as Y115.07, adding ~10 pips in the process. As mentioned, there hasn’t been much in the way of notable headline flow to drive broader macro sentiment, while JPY markets have thinned out ahead of the elongated Tokyo weekend. Technically, bulls look to initial resistance in the form of the Nov 26 high (Y115.37), with any sustained break there exposing the Nov 24 high/bull trigger (Y115.52). Bulls remain in control from a technical perspective, with bears needing to force a breach of the 20-day EMA to start reasserting some control.

- U.S. weekly jobless claims data and the latest MNI Chicago PMI print headline Thursday’s docket, with a call between U.S. President Biden & his Russian counterpart Putin also set to garner attention. Until then, headline watching will be at the fore.

FX OPTIONS: Expiries for Dec30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1284-90(E589mln), $1.1330-40(E771mln)

- EUR/GBP: Gbp0.8375(E541mln), Gbp0.8635(E583mln)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.