-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RESEND: Budget Day In The UK

EXECUTIVE SUMMARY

- FED LIKELY TO HIKE 25BPS NEXT WEEK - EX OFFICIAL (MNI)

- FED'S BOWMAN SAYS BANKING SYSTEM REMAINS RESILIENT (MNI)

- FED TO CONSIDER TOUGHER RULES FOR MIDSIZE BANKS AFTER SVB, SIGNATURE FAILURES (WSJ)

- SIGNATURE BANK FACED CRIMINAL PROBE AHEAD OF FIRM’S COLLAPSE (BBG)

- HUNT TO UNVEIL ‘BUDGET FOR GROWTH’ WITH BILLIONS PLEDGED FOR BUSINESS (FT)

- JAPAN'S BIG FIRMS OFFER LARGEST PAY RISES IN DECADES (RTRS)

- BOJ'S UEDA TO WAIT AND WATCH AS 10-YR YIELD SINKS (MNI)

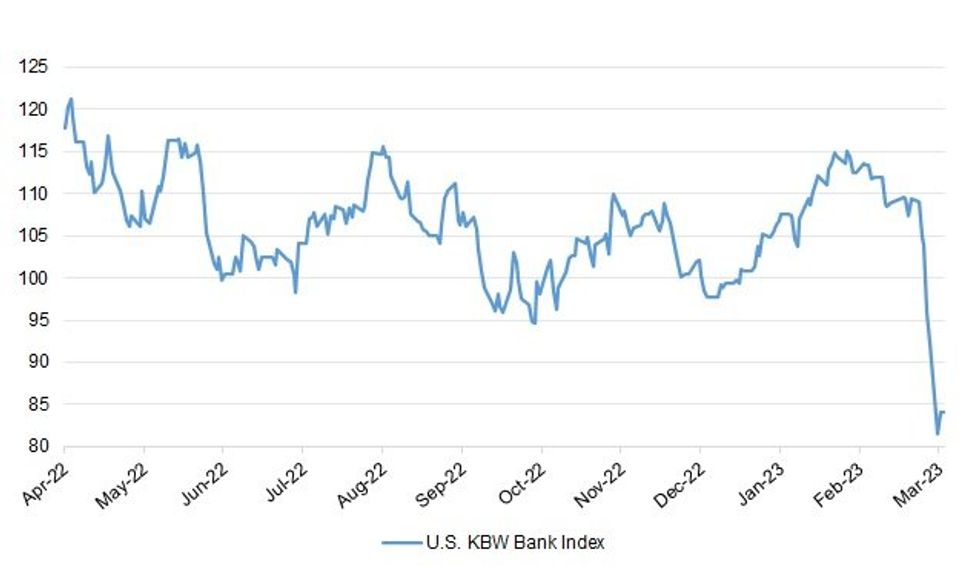

Fig. 1: U.S. KBW Bank Index

Source: MNI - Market News/Bloomberg

UK

FISCAL: Jeremy Hunt will on Wednesday announce billions of pounds to boost business investment and measures to bolster Britain’s workforce, including a big expansion in childcare, in a “Budget for growth”. The chancellor has pledged that business will be the main beneficiary of any tax cuts in his Budget, but he is constrained by a tough fiscal backdrop and a vow to hold down spending to tame inflation. (FT)

FISCAL: A £4bn expansion of free childcare for one- and two-year-olds in England is expected to be announced in the budget on Wednesday as part of a wider drive to help people into work and boost growth. (Guardian)

FISCAL: Jeremy Hunt will deliver his maiden Budget on Wednesday against a backdrop of falling global inflation and lower predicted borrowing costs as pressure grows for him to abandon a tax raid. (Telegraph)

BREXIT: The leader of Northern Ireland’s main unionist party has called for “further clarification, reworking and change” to the new post-Brexit trade deal for the region agreed by London and Brussels after months of wrangling. (FT)

EUROPE

BANKS: Intesa Sanpaolo (ISP.MI) is not offering higher remuneration on its retail deposits and has only moved to pass on higher interest rates to its key corporate customers, its finance chief told investors on Tuesday according to a person who attended the meeting. (RTRS)

BONDS: A historic dash into safe-haven government bonds following the collapse of U.S. lender Silicon Valley Bank (SVB) last week will prove short lived, one of Europe's biggest bond investors said on Tuesday. (RTRS)

U.S.

FED: The Federal Reserve will likely approve a quarter-point interest rate increase next week as focus shifts from strong economic data to restoring confidence in the banking system, former senior Bank for International Settlements official and ex-New York Fed research director Stephen Cecchetti told MNI. (MNI)

FED: A Fox reporter tweeted the following on Tuesday: “@federalreserve is likely to tighten another 25 bps despite sentiment Powell will hold amid SBV implosion/lower inflation, bank CEOs tell @FoxBusiness. Reason: 6% CPI is still too high & holding rates would be an indication of serious systemic flaws in the banking system.” (MNI)

FED/BANKS: The U.S. banking system remains resilient and on a solid foundation, Federal Reserve Governor Michelle Bowman said Tuesday, in a speech days after after the collapse of Silicon Valley Bank and Signature Bank. (MNI)

FED/BANKS: Senate Banking Chairman Sherrod Brown said Tuesday that he sees little chance Congress will tighten bank regulations following the collapse of Silicon Valley Bank and Signature Bank, and is urging the Federal Reserve to act unilaterally to impose tougher regulations and pause interest rate increases. (BBG)

FED/BANKS: The Federal Reserve is rethinking a number of its own rules related to midsize banks following the collapse of two lenders, potentially extending restrictions that currently only apply to the biggest Wall Street firms. A raft of tougher capital and liquidity requirements are under review, as well as steps to beef up annual “stress tests” that assess banks’ ability to weather a hypothetical recession. (WSJ)

BANKS: The Securities and Exchange Commission and the Justice Department are investigating how Silicon Valley Bank became the second largest bank failure in U.S. history, NBC News reported Tuesday. (CNBC)

BANKS: The largest U.S. banks didn’t submit a bid for Silicon Valley Bank over the weekend, largely because they were initially excluded from the sales process by the Federal Deposit Insurance Corp. and ran out of time as a result, people familiar with the matter said. (Semafor)

BANKS: Troubled lender SVB Financial Group said on Tuesday Goldman Sachs Group Inc had bought its bond portfolio before federal regulators took the bank into receivership. (RTRS)

BANKS: The world’s largest private investment firms are exploring the purchase of loans from the remains of Silicon Valley Bank after the collapse of the tech-focused lender last week. (FT)

BANKS: Creditors of Silicon Valley Bank’s parent company have formed a group in anticipation of a potential bankruptcy filing, through which they hope to profit from a sale of the collapsed firm’s private-wealth and other units, according to people familiar with the matter. (WSJ)

BANKS: Silicon Valley Bank’s lack of a chief risk officer for much of last year is being examined by the Federal Reserve as part of its probe of the bank’s failure, two people familiar with the matter said. (BBG)

BANKS: US prosecutors were investigating Signature Bank’s work with crypto clients before regulators suddenly seized the lender this past weekend, according to people familiar with the matter. (BBG)

BANKS: The White House is carefully monitoring developments at First Republic and other smaller banks after actions to protect depositors following the collapse of Silicon Valley Bank (SVB) last week, an official said on Tuesday. (RTRS)

BANKS: Both parties are drawing battle lines over the collapses of Silicon Valley Bank and Signature Bank, while acknowledging regulatory reform faces a steep — if not impossible — climb in Congress. (Axios)

BANKS: The government should temporarily insure every bank deposit in the country to shore up confidence in the U.S. financial system, a senior GOP lawmaker said Tuesday. (POLITICO)

BANKS: A group of Democrats led by Sen. Elizabeth Warren of Massachusetts and Rep. Katie Porter of California will unveil legislation Tuesday to restore bank regulations that were undone under then-President Donald Trump in 2018, seeking to fix what they say was the cause of Silicon Valley Bank's collapse. (NBC)

BANKS: Sen. Jon Tester (D-Mon.) called on the Federal Reserve and federal regulators to “claw back” bonuses that were reportedly paid to Silicon Valley Bank executives just hours before the federal government took over the now-defunct bank. (The Hill)

BANKS: The chief executive of Charles Schwab, a bank and brokerage, said the company has ample liquidity, moving to allay concerns about a "doomsday scenario" that has weighed broadly on bank stocks after the failure of two U.S. lenders since Friday. "We have not raised capital and we are not in the market at this point for M&A transactions," Walt Bettinger, the chief executive of Charles Schwab, told Reuters in an interview on Tuesday. (RTRS)

BANKS: Regional lender Comerica Inc on Tuesday said it has a more diverse, stable and "sticky" deposit base and it remains well capitalized and highly liquid. (RTRS)

BANKS: Bank of America Corp. mopped up more than $15 billion in new deposits in a matter of days, emerging as one of the big winners after the collapse of three smaller banks dented confidence in the safety of regional lenders. (BBG)

BANKS/RATINGS: First Republic Bank was placed on credit watch negative by S&P Global Ratings after the government closed two other lenders in the past week, adding to worries about volatile deposit flows. (BBG)

FISCAL: The Federal Deposit Insurance Corp said its withdrawal of a record $40 billion in U.S. Treasury Funds on Friday as it seized control of Silicon Valley Bank will not affect when the Treasury runs out of operating room under the debt ceiling. (RTRS)

EQUITIES: Apple Inc. is delaying bonuses for some corporate divisions and expanding a cost-cutting effort, joining Silicon Valley peers in trying to streamline operations during uncertain times, according to people with knowledge of the situation. (BBG)

OTHER

GLOBAL TRADE: Talks continue to extend a deal to allow grain shipments from Ukraine's Black Sea ports ahead of a deadline later this week, the United Nations and Turkey said on Tuesday, after Kyiv rejected a Russian push for a reduced 60-day renewal. (RTRS)

U.S./CHINA: TikTok’s leadership is discussing the possibility of separating from ByteDance Ltd., its Chinese parent company, to help address concerns about national security risks. (BBG)

U.S./CHINA/TAIWAN: Representative Ken Calvert, Tom Cole, Steve Womack, Dave Joyce, Edward Case and Mike Garcia will visit Taiwan Wednesday and Thursday as part of a visit to the region, according to a statement from American Institute in Taiwan, the US’s de facto embassy in Taipei. (BBG)

BOJ: The fall in Japan's 10-year bond rate could make it easier for the Bank of Japan to tweak its yield curve control policy, though incoming governor Kazuo Ueda is unlikely to change policy in April given volatility triggered by the collapse of Silicon Valley Bank and a desire to establish good relations with the government, MNI understands. (MNI)

BOJ: Outgoing Bank of Japan Governor Haruhiko Kuroda said on Wednesday that the BOJ continues to carefully monitor the impact of the collapse of Silicon Valley Bank on financial markets. (MNI)

BOJ: Many Bank of Japan board members assessed the BOJ needed more time to examine the effects of December's modification of its yield curve control policy on market functioning at the January 17-18 meeting, the minutes released Wednesday showed. (MNI)

JAPAN: Japan's top companies offered their largest pay increases in a quarter century on Wednesday, as the outcome of annual labour talks showed Japan Inc heeding Prime Minister Fumio Kishida's calls for higher wages to counter a surge in inflation. (RTRS)

JAPAN: Japan's banking sector won't face incidents similar to the collapse of U.S. lender Silicon Valley Bank due to differences in the structure of bank deposits, Finance Minister Shunichi Suzuki said on Wednesday. (RTRS)

AUSTRALIA: Australia’s slowing economy and rising interest rates are likely to drive higher housing and business loan losses for banks, regulators said, while adding that lenders’ “unquestionably strong” capital requirements mean they can withstand any shock. (BBG)

AUSTRALIA: Households will face power price rises of up to 23.7 per cent and businesses up to 25.4 per cent from July 1 under the Australian Energy Regulator’s draft electricity “safety net” prices for next financial year. (AFR)

NEW ZEALAND/RATINGS: New Zealand’s credit grades with S&P Global Ratings could come under pressure if the nation’s current account deficit remains too big. (BBG)

SOUTH KOREA: South Korea will create the world's largest semiconductor cluster in the Seoul metropolitan area by attracting 300 trillion won (US$229.81 billion) in investments as part of efforts to secure a competitive edge in the sector, the industry ministry said Wednesday. (Yonhap)

SOUTH KOREA/JAPAN: South Korean President Yoon Suk Yeol said on Wednesday that cooperation with Japan is vital in confronting North Korea's growing threats and protecting global supply chains, calling on both countries to not snarl relations in domestic politics. (RTRS)

CANADA: Canada’s financial institutions are stable and resilient, the country’s Finance Minister Chrystia Freeland says in a statement. (BBG)

MEXICO: Mexico's regional economies face a "difficult context" for growth going forward despite a general expectation for continued recovery, a senior official at the country's central bank said in a webcast presentation on Tuesday. (RTRS)

BRAZIL: “Meeting of the budget board should take place this week and we are going to start analyzing the fiscal framework proposal that will be presented by Finance Minister Fernando Hadadd,” Brazil Chief of Staff Rui Costa told journalists after a cabinet meeting in Brasilia. (BBG)

BRAZIL: An executive at Brazilian state development bank BNDES said on Tuesday the bank aims to pay out the equivalent of 2% of the country's Gross Domestic Product (GDP) by 2026. (RTRS)

RUSSIA: A U.S military MQ-9 surveillance drone crashed into the Black Sea on Tuesday after being intercepted by Russian fighter jets, in the first such incident since Russia's invasion of Ukraine over a year ago. (RTRS)

RUSSIA: Ukraine's top military command is unanimously in favour of defending the sector of eastern Ukraine, including the besieged city of Bakhmut, and inflicting maximum losses on the enemy, President Voldoymyr Zelenskiy said on Tuesday. (RTRS)

RUSSIA: A group of senators from both parties is pressing the Pentagon for more information on what it would take to send F-16 jets to Ukraine. (POLITICO)

RUSSIA: On Friday, John Kirby, the spokesperson for the National Security Council, made a surprise announcement at a White House press briefing. U.S. intelligence, he said, had determined that the Kremlin was plotting to topple another European democracy. “Russian actors, some with current ties to Russian intelligence, are seeking to stage and use protests in Moldova as a basis to foment a manufactured insurrection against the Moldovan government,” Kirby declared. (Yahoo)

SOUTH AFRICA: We expect the South African government's planned South African rand (ZAR) 254 billion ($14 billion) debt relief agreement will address Eskom's near-term debt obligations once implemented and give Eskom room to focus on operational improvements and electricity sector reform targets.(S&P)

COLOMBIA: Colombia’s government is proposing to redirect the pension contributions of millions of workers away from private managers and into the public system, while setting up a fund intended to neutralize the impact this would have on the local bond market. (BBG)

ENERGY: Russian President Vladimir Putin said on Tuesday (Mar 14) that last year's blasts on the Nord Stream gas pipelines had been carried out on a "state level", dismissing the idea an autonomous pro-Ukraine group was responsible as "complete nonsense". (CNA)

METALS: Peruvian mining exports dropped 19.8% in January compared to the same month last year, the sector’s business chamber said on Tuesday, in the wake of devastating protests that have rocked the country in recent months. (RTRS)

OIL: Uncertainty in the global economy is limiting “clarity” about the outlook for oil markets and means the “sensible and only course of action” for Opec-plus is to stick to the production pact agreed last October, Saudi Energy Minister Prince Abdulaziz bin Salman said in an interview with Energy Intelligence this week. The minister also commented on market interventions by consumer nations such as the G7 price cap on Russian oil and the proposed Nopec bill in the US, and on tight global oil production capacity. (Energy Intelligence)

OIL: En route to New Delhi this month, US officials proclaimed themselves satisfied that India is buying Russian oil below G-7 price caps designed to undercut Moscow’s war in Ukraine without disrupting global energy flows. (BBG)

CHINA

ECONOMY: China's employment is basically stable and a rise in the jobless rate for February is due to seasonable factors, Fu Linghui, spokesperson for the National Bureau of Statistics (NBS), said on Wednesday. (RTRS)

ECONOMY: The China Banking and Insurance Regulatory Commission (CBIRC) said risks were “generally controllable” and the economy was recovering rapidly with the financial system operating smoothly, according to a read-out of the first leadership meeting since the Two Sessions. (MNI)

ECONOMY: Shanghai will take measures to support trade, consumption and investment to secure the economic rebound, according to a recent leadership meeting. (MNI)

ECONOMY: It’s “very likely” that China’s leisure travel market will be better in 2023 than 2019, Accor Chief Executive Officer Sebastien Bazin said in an interview with Bloomberg TV on Wednesday. (BBG)

YUAN: China's foreign exchange regulator said on Friday it would continue to maintain prudent operation and healthy development of the country's FX market, while fending off external shocks and risks. The State Administration of Foreign Exchange (SAFE) also reiterated that the regulator would guarantee the safety, liquidity and value of China's FX reserve assets, it said in a statement on its website. (RTRS)

PBOC: China's central bank said on Wednesday that it would step up financing support for private micro- and small-enterprises, according to a statement released on its website. The People's Bank of China will support reasonable bond financing needs for private companies, the central bank said in the statement after a work meeting. (RTRS)

PBOC: The People’s Bank of China said it will respond in an appropriate way to US measures to contain China, echoing a call from President Xi Jinping to defend the economy against external threats. (BBG)

PENSIONS: China will introduce further reform measures this year to boost national pension planning, raise pension levels and expand the inclusivity of pension supply, according to Yicai.com. (MNI)

BONDS: China’s bond trading was disrupted on Wednesday morning after the regulator reportedly told money brokers to suspend their data feeds amid security concerns. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY381 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) conducted CNY104 billion via 7-day reverse repos and CNY481 billion via 1-year MLF on Wednesday, with the rates unchanged at 2.00% and 2.75%, respectively. The operation has led to a net injection of CNY381 billion after offsetting the maturity of CNY4 billion reverse repos and CNY200 billion MLF today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0000% at 09:35 am local time from the close of 2.0780% on Monday.

- The CFETS-NEX money-market sentiment index closed at 47 on Tuesday, the same as the close on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8680 WEDS VS 6.8949 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.8680 on Wednesday, compared with 6.8949 set on Tuesday.

OVERNIGHT DATA

CHINA FEB INDUSTRIAL PRODUCTION +2.4% Y/Y YTD; MEDIAN +2.6%

CHINA FEB RETAIL SALES +3.5% Y/Y YTD; MEDIAN +3.5%

CHINA FEB FIXED ASSET INVESTMENT EX-RURAL +5.5% Y/Y YTD; MEDIAN +4.5%

CHINA FEB SURVEYED UNEMPLOYMENT RATE 5.6%; MEDIAN 5.3%; DEC 5.5%

NEW ZEALAND Q4 BOP CURRENT ACCOUNT BALANCE -NZ$9.458BN; MEDIAN -NZ$7.675BN; Q3 -NZ$11.401BN

NEW ZEALAND Q4 CURRENT ACCOUNT GDP RATIO YTD -8.9%; MEDIAN -8.5%; Q3 -8.5%

SOUTH KOREA FEB UNEMPLOYMENT RATE 2.6%; MEDIAN 3.0%; JAN 2.9%

SOUTH KOREA JAN L MONEY SUPPLY +1.2% M/M; DEC -0.5%

SOUTH KOREA JAN M2 MONEY SUPPLY -0.2% M/M; DEC +0.1%

MARKETS

US TSYS: Curve Flattens In Asia

TYH3 deals at 110-28+, -0-01, operating in a limited 0-06 range on volume of ~70K.

- Cash Tsys sit 2bps cheaper to 1bp richer, the curve has twist flattened pivoting around 10s, with Friday's post-PCE flattening impulse ultimately proving somewhat sticky.

- Asia-Pac participants faded Friday's post-PCE cheapening in early dealing, perhaps using the opportunity to square short positions as we approach month end.

- The lingering impact of Friday's PCE print then saw Tsys retreat from session highs as the front end of the curve was pressured. However, Friday's lows remain intact in TU futures.

- We also saw some light steepener flow in the STIR space.

- Little meaningful macro headline flow was seen through the Asia-Pac session.

- In Europe today the Eurozone Economic Sentiment Indicator is the highlight of an otherwise thin data calendar, with ECB's Lane & De Cos, as well as BoE's Broadbent, headlining the regional speaker slate. Further out we will see Durable Goods Orders, Pending Home Sales and Dallas Fed Manf Activity. Fedspeak from Governor Jefferson will also cross.

JGBS: Curve Steeper On BoJ Rinban Tweak, Shunto Outcome Eyed

Weakness in the super-long end of the JGB curve dominated, with 20+-Year paper 13-16bp cheaper into the close. The remainder of the JGB benchmarks show 1bp richer to 6bp cheaper as the curve twist steepens. 10-Year JGB yields print ~0.33%.

- The long end weakness was seen on the back of the Y50bn purchases that were deployed in the BoJ’s Rinban covering the 25+-Year zone. This amount is below the lower boundary of the Y100-300bn purchase band for the sector set out in the Bank’s monthly Rinban plan. Prevailing market conditions seemingly emboldened the BoJ when it came to trimming the size of longer dated purchases (there was also a trimming of the Bank’s 5- to 10-Year JGB purchases, to the lower bound of its purchase band in that sector). Weakness in the longer end seemingly capped a rally in the intermediate zone, with futures operating within the lower half of the overnight session range, -44into the bell.

- Swap rates sit 3-11bp higher, with swap spreads wider through 5s then tighter beyond that point.

- One other factor that may have applied pressure to JGBs was growing expectations for a multi-year high round of pay rises in the shunto wage talks.

- Policymaker rhetoric continued to play down any worry surrounding the Japanese banking sector in the wake of the SVB meltdown.

- Lower tier economic data and 20-Year JGB supply headline tomorrow’s local docket.

AUSSIE BONDS: Curve Twist Flattens Ahead Of Employment Data Tomorrow

ACGBs close at or near session bests (YMM3 -3.2 & XMM3 +1.5) largely following the direction of U.S. Tsys as the cash curve twist flattened in Asia-Pac trade. Cash ACGB curve also twist flattened with the 3-year benchmark 3bp cheaper and the 10-year 2bp richer. Some leakage from NZGB cheapening on current account deficit and bond rating concerns was also likely at play. AU/US 10-year yield differential narrowed 11bp to -23bp.

- Swaps closed with rates +1bp to -2bp with the 3s10s curve 3bp flatter and the 3/10 EFP box flatter.

- Bills strip twist flattened with pricing +2 to -10bp.

- RBA dated OIS softened 5-16bp across meetings with April returning to pricing a tightening, albeit small (15% chance of a 25bp hike).

- After focusing on developments abroad for much of the week, February’s Employment Report is slated for release tomorrow. After two consecutive monthly declines the market is looking for a strong result (BBG consensus +50k) to defuse expectations of labour market stagnation. Complicating matters is the larger-than-normal number of people who indicated that they had a job to go to in the January report.

- Until then, the market will likely keep an eye on U.S. Tsys through the release of U.S. PPI and Retail Sales data.

NZGBS: Weaker As S&P Warns About Current Account Deficit

NZGBs close 16-17bp weaker with bond rating comments from S&P regarding the current account deficit weighing on the market going into the bell. NZ/US and NZ/AU 10-year yield differentials pushed respectively 5bp and 12bp wider.

- Q4 Current Account data released today showed a worse-than-expected deterioration with a -8.9% of GDP print (8.5% expected).

- BBG ran with comments from S&P that it would need to see the current account deficit narrow over the next 12 to 18 months otherwise there would be “increased pressure on the AA+ rating.”

- Swaps are 11-19bp cheaper, implying wider short-end and tighter long-end, with the 2s10s curve 8bp flatter.

- RBNZ dated OIS firms 5-22bp. April meeting pricing closed with 25bp of tightening. Terminal OCR expectations closed at 5.36%.

- Locally, Q4 GDP is slated for release tomorrow. After remaining surprisingly resilient in the face of aggressive tightening, recent data has become patchier.

- With BBG consensus expecting -0.2% Q/Q versus the +0.7% forecast by the RBNZ in its February MPS the local market has potentially another domestic driver to focus on tomorrow.

- In the interim, the market will likely keep an eye on U.S. Tsys through the release of U.S. PPI and Retail Sales data.

EQUITIES: Signs Of Life In China Housing Market Doesn't Shift Sentiment

All major regional markets are higher in the equity space, but gains have been trimmed as the session has progressed. Some markets are comfortably away from best levels, while US equity futures have tracked close to flat. The firmer US cash Tsy yield backdrop in the front end this afternoon (2yr near session highs around 4.32/4.33%, before edging lower) has likely curbed sentiment to a degree.

- The HSI is close to +1% firmer at this stage. China developers are doing better, a Bloomberg gauge up 2.43%, the first gain in 8 sessions. China's activity data showed less of a drag from property investment, while property sales rose. Part of this is likely base effects, but it may also signal a trough point from late last year for the troubled sector.

- Other China activity figures were much closer to expectations, with IP slightly softer than forecast. The market may have been hoping for more upside surprises given the recent PMI prints. The CSI 300 is +0.20% at this stage.

- Elsewhere relief in the financial sector has benefited regional banks. The Topic is up 0.75% at this stage. Tech gains are also helped. The Kospi +1.30%, while the Taiex is +0.42%.

- In SEA, Indonesian stocks are somewhat lagging, the JCI only just in positive territory. At the other end of the spectrum, Thailand stocks are up +2.60%.

GOLD: Bullion Stabilises With Increased Pricing Of Fed March Hike

Gold prices have been moving in a very narrow range during the APAC session after falling 0.5% on Tuesday following the post-SVB rally. It is currently around $1903.50/oz after an intraday high of $1905.68 and low of $1900.04 earlier. Prices are up 5% from last week’s low. The USD index is down slightly.

- Bullion’s upward momentum lost steam when a larger probability of a 25bp hike at the Fed’s March 22 meeting was priced in by the market. Prices remain above the 50-day simple moving average. Support is at $1871.60, the March 13 low, and resistance is at $1923.20.

- US February retail sales print later and are expected to decline after January’s very strong readings. The PPI for February is also released and expected to post smaller monthly rises than in January.

OIL: Crude Begins Recovery During Session, But Volatility Likely To Persist

Oil prices are up over a percent today after falling almost consistently since March 6. WTI is up 1.5% during APAC trading to be around $72.35/bbl after falling 4.4% on Tuesday. It is down 10% since last week’s peak. Brent is heading towards $80 and is currently up 1.4% to $78.50, close to the intraday high. The USD index is flat.

- Crude was supported today by stronger equities across the region and data from China indicating that the economic recovery is underway. Oil prices sank on fears that US banking problems would lead to a drop in demand. Volatility in the market is likely to continue while it waits for clarification on the banking sector and the Fed.

- China’s IP data today showed that production of energy-related products rose at the start of 2023 with crude oil up 1.8% y/y and crude processing +3.3% y/y.

- US February retail sales print later and are expected to decline after January’s very strong readings. The PPI for February is also published and expected to post smaller monthly rises than in January. Official EIA crude stocks and the IEA monthly report are released later today.

FOREX: Greenback Little Changed In Asia

BBDXY is little changed in Asia today, NZD and JPY are both marginally pressured.

- USD/JPY prints at ¥134.50/60 ~0.3% firmer today. Higher Yields in the short end of the US Treasury curves are weighing on the yen.

- Kiwi is pressured, printing at $0.6220/25. The pair fell from session highs, which were just ahead of the 200-day EMA ($0.6267) as S&P flagged that New Zealand's credit rating could come under pressure, link here. Early in the session Q4 Balance of Payments printed at -$9.458bn, wider than the 7.675bn deficit forecast. The prior read was also revised wider to -$11.403bn.

- AUD/USD was firmer post China activity data, which showed better than expected housing related outcomes. Other prints were close to expectations and A$ gains weren't sustained, now back sub 0.6690 (although AUD/NZD is still higher, last near 1.0750). For AUD/USD Upside resistance comes in at $0.6739, 20-Day EMA.

- Elsewhere moves have been modest with little follow through, EUR and GBP are marginally firmer.

- Regional equities are firmer, Hang Seng is ~1% firmer and US Equity futures are marginally firmer. The US Treasury curve is flatter.

- Final read of French CPI and EU Industrial Production headline an otherwise thin docket in Europe. Further out we have US Business Inventories, Retail Sales, PPI and Empire Manufacturing.

FX OPTIONS: Expiries for Mar15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.7bln), $1.0696-00(E1.8bln), $1.0730-50(E3.5bln), $1.0800-10(E932mln), $1.0830-50(E1.8bln)

- USD/JPY: Y126.00($2.5bln), Y130.00($1.0bln), Y133.00($1.6bln), Y134.00($541mln), Y135.00($668mln)

- GBP/USD: $1.1895-00(Gbp1.0bln)

- AUD/USD: $0.6675(A$502mln), $0.6720(A$926mln)

- USD/CAD: C$1.3500($744mln), C$1.3575-00($1.5bln), C$1.3725($837mln), C$1.3930-45($1.1bln)

- USD/CNY: Cny6.8600($1.2bln), Cny6.9500($1.9bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/03/2023 | 0700/0800 | *** |  | SE | Inflation report |

| 15/03/2023 | 0745/0845 | *** |  | FR | HICP (f) |

| 15/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 15/03/2023 | 1000/1100 | ** |  | EU | Industrial Production |

| 15/03/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 15/03/2023 | - |  | UK | Chancellor Delivers Spring Budget, OBR Forecasts, Likely DMO Remit | |

| 15/03/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 15/03/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 15/03/2023 | 1230/0830 | *** |  | US | PPI |

| 15/03/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/03/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/03/2023 | 1400/1000 | * |  | US | Business Inventories |

| 15/03/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/03/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 15/03/2023 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.