-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Thursday, December 12

MNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN OPEN: RESEND: Japanese Gov’t Pushes Back Against Need To Tweak BoJ Accord After Source Reports

EXECUTIVE SUMMARY

- FED NEEDS HIGH RATES FOR ‘A WHILE’ TO COOL PRICES, MESTER SAYS (BBG)

- FED STILL HAS A ‘LONG WAY’ TO GO TO DEFEAT INFLATION, DALY SAYS (BBG)

- ITALIAN MINISTERS STEP UP ECB CRITICISM, WARN OF CREDIT CRUNCH (BBG)

- UK BRACES FOR WIDESPREAD STRIKES AS GOVERNMENT DIGS IN (FT)

- UK MINISTERS TO OFFER BUSINESS ENERGY SUPPORT PACKAGE UNTIL EARLY 2024 (FT)

- JAPAN GOVERNMENT DENIES PLANS TO REVISE ACCORD WITH BOJ (BBG)

- EU MULLS LOWER GAS-PRICE CAP IN LATEST PLAN TO LIMIT CRISIS (BBG)

- U.S. BEGINS BUYING BACK OIL FOR STRATEGIC PETROLEUM RESERVE (RTRS)

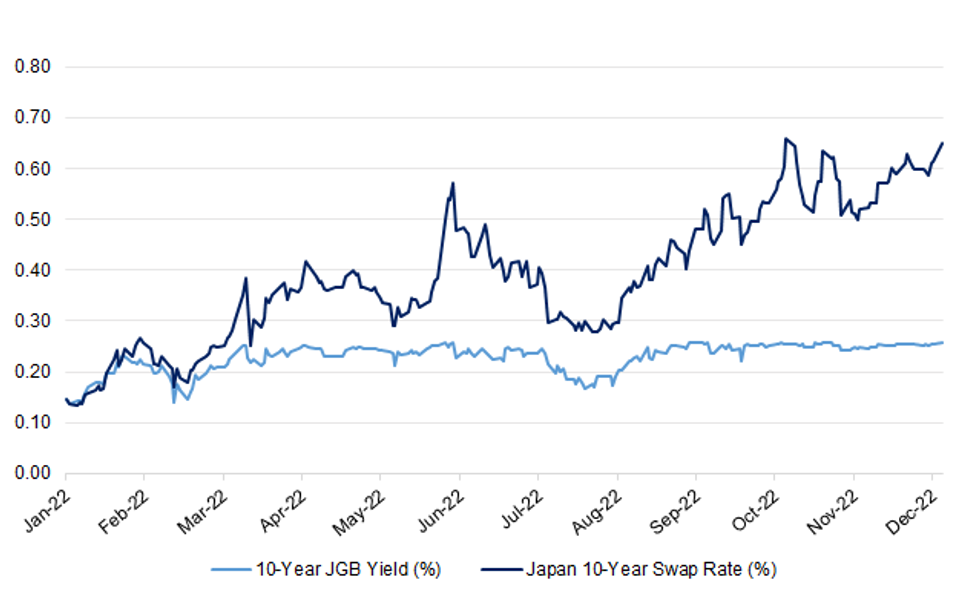

Fig. 1: 10-Year JGB Yield Vs. Japan 10-Year Swap Rate

Source: MNI - Market News/Bloomberg

UK

ENERGY: The UK is encouraging consumers to cut their energy use as part of a campaign aimed at scaling back demand for power and natural gas in the face of soaring bills this winter. (BBG)

ENERGY: Rishi Sunak has abandoned his predecessor's plan to intervene in global energy markets by spending billions of pounds on foreign gas imports. (Sky)

FISCAL/ENERGY: Ministers are close to finalising plans for a two-pronged package of support for businesses to help with energy costs all the way through next winter — when prices are feared to rise sharply again — and into spring 2024. (FT)

FISCAL/ECONOMY: Britain is bracing for one of the most disruptive weeks of strike action in recent history after the government signalled its determination to face down the unions despite calls for pay negotiations from health leaders and some Conservative MPs. Nurses, ambulance workers, customs and immigration staff, postal and rail workers will all walk out in the coming days. (FT)

ECONOMY: The UK has already entered a “shallow and protracted recession” that will hit living standards and last until the end of next year, according to a new analysis. (The Times)

BANKS/MARKETS: City of London heads have backed the government’s financial services reforms as necessary to keep London competitive outside of the EU, even if the unwinding of safeguards from the last financial crisis increases risk. However, many of the FT’s City Network — a 50-strong group of senior executives — did not believe that chancellor of the exchequer Jeremy Hunt’s “Edinburgh reforms” were significant enough to yield a second “big bang” for the City of London. (FT)

EUROPE

ECB/ITALY: Italian Defense Minister Guido Crosetto and Foreign Minister Antonio Tajani stepped up criticism of the European Central Bank’s latest rate increase and President Christine Lagarde’s hawkish rhetoric. (BBG)

GERMANY: German natural gas trader Uniper expects the European Commission to decide in coming days on whether Germany's planned bailout of the company violates state aid rules, its chief executive said, adding that any approval was likely to be tied to conditions. (RTRS)

BANKS: Swiss National Bank President Thomas Jordan has voiced support for Credit Suisse Group AG doing less investment banking, as the lender struggles to recover from billions in losses over the past two years, recent client defections and asset outflows with a strategy revamp. (BBG)

U.S.

FED: Federal Reserve Bank of Cleveland President Loretta Mester said her estimate for interest rates is higher than that of her colleagues and the central bank needs sustained tight policy to defeat inflation. (BBG)

FED: Federal Reserve Bank of San Francisco President Mary Daly said policymakers are committed to lowering inflation and are not close to accomplishing that task. (BBG)

FED: Minneapolis Fed President Kashkari tweeted the following on Friday: “These developments more likely to raise investment and thus raise R*. Higher R* doesn't argue for higher inflation target (actually the opposite).” This came in response to a tweet from hedge fund manager Bill Ackman, who suggested that “The @federalreserve 2% inflation target is no longer credible. De-globalization, the transition to alternative energy, the need to pay workers more, lower-risk, shorter supply chains are all inflationary. The Fed cannot change its target now, but will likely do so in the future.” (MNI)

FED: The Federal Reserve may avoid hiking interest rates beyond 5% if inflation keeps slowing while resisting pressure to cut for longer than investors expect, former vice chairman Alan Blinder told MNI. (MNI)

INFLATION/DATA: The Bureau of Labor Statistics said Friday that it found no evidence its systems were compromised or that there was any suspicious activity around the release of the US consumer price index earlier this week. (BBG);

CORONAVIRUS: As Covid and flu hospitalizations have climbed in the weeks since Thanksgiving, White House’s Covid-19 coordinator Dr. Ashish Jha said families will be safer at upcoming holiday gatherings if they get their updated vaccines. (CNBC)

POLITICS: The Jan. 6 select committee is preparing to vote on urging the Justice Department to pursue at least three criminal charges against former President Donald Trump, including insurrection. (POLITICO)

POLITICS: Rep. Adam Schiff, D-Calif., said Sunday that the House Jan. 6 committee has evidence that former President Donald Trump broke the law, but he declined to get specific about the criminal referrals it could make ahead of the panel's final meeting Monday. (NBC)

POLITICS: House Republicans are privately plotting to release their own 100+ page rebuttal timed to the January 6 committee report this week, Axios has learned. (Axios)

POLITICS: Sen. Joe Manchin (D-W.Va.) punted a question Sunday about whether he would leave the Democratic Party, saying "I’ll let you know later what I decide to do." (Axios)

EQUITIES: The head of Elon Musk’s family office has approached investors who helped the billionaire buy Twitter for $44bn in October to try and raise new funds as the social media company continues to bleed cash and faces heavy interest payments on its debts. (FT)

EQUITIES: Elon Musk launched a poll on Sunday asking: "Should I step down as head of Twitter?” (RTRS)

OTHER

UK/CHINA: China poses "a significant threat" to the UK and the government should move to curb its dependence on the superpower to enable it to respond to aggression or abuses by Beijing, MPs have said. (Sky)

GLOBAL TRADE: Germany has become even more dependent on Huawei for its 5G radio access network equipment (RAN) than in its 4G network despite growing worries about Chinese involvement in critical infrastructure, according to a new report. (RTRS)

GLOBAL TRADE: Tensions between the world's two superpowers are "distorting" the semiconductor market and erasing the benefits of globalization, the CEO of the world's top contract chipmaker said on Saturday in a speech that also expressed reservations over the global rush by countries to bring chip production onshore. (Nikkei)

GLOBAL TRADE: Taiwan’s government said on Saturday it would fine Foxconn, the world's largest contract electronics maker, for an unauthorized investment in a Chinese chipmaker even after the Taiwanese company said it would be selling the stake. (RTRS)

GLOBAL TRADE: EU member states have reached a deal on the world’s first major carbon border tax, finalising the details early on Sunday in the face of claims from the bloc’s key trading partners that the levy creates protectionist trade barriers. (FT)

BOJ: Japan’s top government spokesman denies reports of plans to revise a 10-year-old accord with the central bank that pledges to achieve 2% inflation. (BBG)

BOJ: The Bank of Japan (BOJ) must make its monetary policy framework more flexible and stand ready to raise its long-term interest rate target next year if the economy can withstand overseas risks, former deputy governor Hirohide Yamaguchi told Reuters. (RTRS)

BOJ: The Bank of Japan could discuss changes to its easy policy framework as early as June as the government considers revising its joint statement with the central bank on its inflation target, with a mid-year timeframe allowing the new governor time to conduct a policy review and assess wages growth, MNI understands. (MNI)

BOJ: The Bank of Japan (BOJ) could unwind its ultra-loose monetary policy between March and October next year, according to almost half the economists in a Reuters poll on Monday, much sooner than predicted in previous projections. (RTRS)

AUSTRALIA/CHINA: Foreign Minister Penny Wong will visit Beijing on Tuesday to meet with her Chinese counterpart, the latest breakthrough in the Albanese government’s bid to stabilise relations with Australia’s largest trading partner. (Sydney Morning Herald)

SOUTH KOREA: South Korea’s finance minister said on Monday the economy is slowing at a more rapid pace than previously expected and would bottom in the first half of next year. (RTRS)

SOUTH KOREA: Banks will resume bond sales "gradually" in a way that doesn't burden the market amid lingering worries over a credit crunch, Seoul's financial regulator said Monday. (Korea Times)

NORTH KOREA: North Korea fired two ballistic missiles towards the sea off the Korean Peninsula’s east coast on Sunday, South Korea’s military said. (CNBC)

NORTH KOREA: North Korea's state media KCNA said on Monday the country conducted an "important, final phase" test on Sunday for the development of a spy satellite, which it seeks to complete by April 2023. (RTRS)

HONG KONG: Hong Kong’s status as an international financial center hinges on ensuring investors have confidence that the city follows the “conventional” rule of law in place in other global hubs and maintaining its special role as a bridge between the world and China, according to Ashley Alder, the outgoing top market regulator. (BBG)

NORTH AMERICA/RATINGS: A mild recession, stubborn inflation and tighter financial conditions are the main features of the 2023 deteriorating sector outlook for the U.S. and Canada. (Fitch)

TURKEY: Turkish President Recep Tayyip Erdogan’s rival may not be able to rule the country even if he wins the country’s presidential race, the head of Turkey’s top electoral body said. (BBG)

RUSSIA: Ukraine is bracing for the possibility that Russia will sharply escalate the war in a winter offensive as Moscow tries to turn the tide on the battlefield and limit political backlash at home, a senior adviser to President Volodymyr Zelensky said on Sunday. (New York Times)

RUSSIA: UK Prime Minister Rishi Sunak will announce a major new artillery package for Ukraine at the Joint Expeditionary Force gathering on Monday in Riga, Latvia, according to a statement from his office. (BBG)

RUSSIA: The European Union implemented a new sanctions package on Russia Friday that officials hope will significantly relieve food-security problems facing developing and poor countries. (WSJ)

SOUTH AFRICA: Delegates of South Africa's ruling African National Congress (ANC) gathered on Sunday to choose a new party leader, pitting President Cyril Ramaphosa against former health minister Zweli Mkhize. (RTRS)

SOUTH AFRICA: South African state power utility Eskom said on Sunday it will decrease rotational power cuts to "Stage 5" from "Stage 6" on Monday morning at 05.30 a.m. (RTRS)

SOUTH AFRICA: South Africa has started deploying its army at power stations as theft and vandalism adds to the inability of state-owned utility Eskom Holdings SOC Ltd. to meet electricity demand. (BBG)

SOUTH AFRICA: South African Finance Minister Enoch Godongwana said plans for the government to take over part of the troubled state power utility’s debt remain on track and the pending departure of its chief executive officer hasn’t affected negotiations with bondholders. (BBG)

PERU: Peruvian President Dina Boluarte, who has said she is leading a transitional government, urged the country's Congress to pass a proposal to bring forward general elections in a news conference from the presidential palace on Saturday. (RTRS)

EQUITIES: The world’s biggest money managers are set to unload up to $100 billion of stocks in the final few weeks of the year, adding to a selloff that’s snowballed since Jerome Powell’s unequivocal message that policymakers will press on with aggressive tightening at the risk of job cuts and a recession. (BBG)

ENERGY: European Union member states will on Monday discuss a gas-price cap that’s almost one-third lower than an original proposal as they attempt to break a deadlock over the controversial proposal to contain the impact of a historic energy crisis. (BBG)

ENERGY: Germany has opened its floating liquefied natural gas terminal in the North Sea port of Wilhelmshaven, marking a crucial milestone in its quest for energy independence from Russia. (FT)

OIL: The U.S. Energy Department said on Friday it will begin buying back oil for the Strategic Petroleum Reserve, or SPR, the first purchase since this year's record 180 million barrel release from the stockpile. (RTRS)

OIL: Workers in Iran’s key oil and gas sector went on strike in several districts on Saturday as Iran’s anti-regime protests entered their fourth month. (BBG)

OIL: A winter blizzard sweeping across the northern United States has cut North Dakota's oil output by 200,000 to 250,000 barrels per day (bpd), or 18% to 22%, state Pipeline Authority Director Justin Kringstad estimated on Friday. (RTRS)

OIL: Colombia is targeting a 15% increase in crude oil output by using "enhanced recovery" technologies to take advantage of higher energy prices, even as it pushes towards decarbonization, Minister for Mines and Energy Irene Velez said in an interview. (RTRS)

CHINA

CORONAVIRUS: More than a month after China started seeing an exponential surge in Covid cases, the country has only reported two virus deaths, defying the experience of other, more vaccinated and better resourced places as they reopened and fueling suspicion the true scale of fatalities is being hidden. (BBG)

CORONAVIRUS: Medical institutions should build a hierarchical diagnosis and treatment system for senior patients, Chinese experts said, as the protection of the vulnerable groups has shifted to be the focus of the country's COVID-19 prevention and treatment since many epidemic restrictions were dismantled. (Global Times)

CORONAVIRUS/ECONOMY: Chinese companies are reeling from a coronavirus wave that is immobilising workforces, threatening to close down factory production lines and bringing chaos to supply chains as truck drivers succumb to Covid-19, disruptions which analysts say will bring short-term pain but speed up China’s exit from pandemic isolation. (FT)

CORONAVIRUS: Shanghai's education bureau has asked most grades in primary, middle and high school to hold classes online from Monday as worsening COVID-19 infections hit major cities across China. (RTRS)

CORONAVIRUS: Macau's government said on Monday that it would cancel its regulations on risk zones in mainland China starting from Tuesday, the latest unwinding of stringent COVID-19 rules that have hammered revenues in the world's biggest gambling hub. (RTRS)

ECONOMY: China will eye rapid economic growth next year, said economists when attending the 2023 Global Times Annual Conference on Saturday, as a slew of measures to tackle major risks as well as promote an overall improvement in economic operations will be implemented after the tone-setting central economic meeting. (Global Times)

ECONOMY: China’s economic rebound next year depends on a recovery in aggregate demand, according to Zhu Min, former Deputy Managing Director at the International Monetary Fund. (MNI)

ECONOMY: Defusing real estate market risk and boosting domestic demand are the top priorities following the Central Economic Work Conference (CEWC), according to Han Wenxiu, the Deputy Director of Central Financial and Economic Commission. (MNI)

ECONOMY: China's business confidence hit its lowest level since at least January 2013, a survey by World Economics showed on Monday, reflecting the impact of surging COVID-19 cases on economic activity and hinting at possible recession next year. (RTRS)

PBOC: Banks may be reluctant to offer lower quotes on the five-year Loan Prime Rate (LPR) due to a rise in wholesale funding costs, despite concerted efforts by China’s government to stabilise the troubled property sector, advisers and analysts said. (MNI)

PBOC: The intensity of monetary policy next year should be no less than this year’s, with sufficient liquidity to meet the needs of the real economy and maintain stable prices for funds, the Securities Times reported citing Liu Guoqiang, deputy governor of the People’s Bank of China. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY83 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) on Monday injected CNY9 billion via 7-day reverse repos, and CNY76 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operation has led to a net injection of CNY83 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operations aim to keep year-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8185% at 9:37 am local time from the close of 1.7325% on Friday.

- The CFETS-NEX money-market sentiment index closed at 46 on Friday, flat from the close of Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9746 MON VS 6.9791 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9746 on Monday, compared with 6.9791 set on Friday.

OVERNIGHT DATA

NEW ZEALAND NOV BUSINESSNZ SERVICES PMI 53.7; OCT 57.1

Expansion levels for New Zealand's services sector eased back in November, according to the BNZ - BusinessNZ Performance of Services Index (PSI). (BusinessNZ)

NEW ZEALAND Q4 WESTPAC CONSUMER CONFIDENCE 75.6; Q3 87.6

Consumer confidence has fallen sharply heading into the holiday season, dropping to its lowest level on record. Mounting financial pressures are the major concern that is worrying households. Living costs have been skyrocketing. We’ve also seen sharp increases in borrowing costs. The weakness in consumer confidence is weighing on household spending appetites, reinforcing our expectations for a slowdown in overall economic growth. (Westpac)

MARKETS

SNAPSHOT: Japanese Gov’t Pushes Back Against Need To Tweak BoJ Accord After Source Reports

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 296.85 points at 27230.54

- ASX 200 down 14.777 points at 7133.9

- Shanghai Comp. down 44.941 points at 3122.917

- JGB 10-Yr future down 10 ticks at 147.88, yield up 0.3bp at 0.257%

- Aussie 10-Yr future down 7.5 ticks at 96.460, yield up 6.9bp at 3.524%

- U.S. 10-Yr future down -0-08+ at 114-17+, yield up 3.29bp at 3.5151%

- WTI crude up $0.66 at $74.95, Gold down $1.80 at $1791.29

- USD/JPY down 39 pips at Y136.21

- FED NEEDS HIGH RATES FOR ‘A WHILE’ TO COOL PRICES, MESTER SAYS (BBG)

- FED STILL HAS A ‘LONG WAY’ TO GO TO DEFEAT INFLATION, DALY SAYS (BBG)

- ITALIAN MINISTERS STEP UP ECB CRITICISM, WARN OF CREDIT CRUNCH (BBG)

- UK BRACES FOR WIDESPREAD STRIKES AS GOVERNMENT DIGS IN (FT)

- UK MINISTERS TO OFFER BUSINESS ENERGY SUPPORT PACKAGE UNTIL EARLY 2024 (FT)

- JAPAN GOVERNMENT DENIES PLANS TO REVISE ACCORD WITH BOJ (BBG)

- EU MULLS LOWER GAS-PRICE CAP IN LATEST PLAN TO LIMIT CRISIS (BBG)

- U.S. BEGINS BUYING BACK OIL FOR STRATEGIC PETROLEUM RESERVE (RTRS)

US TSYS: Early Cheapening Holds, BoJ Matters Dominate Asian Session

TYH3 deals at 114-18+, -0-07+, 0-02 away from the base of its 0-06+ range on volume of ~60K.

- Cash Tsys are dealing 0.5-3.0bp cheaper, with 10s leading the cheapening.

- Tsys were softer at the open as the reaction to a source report from Kyodo re: the possible revision to the Japanese gov’t-BoJ accord applied some moderate pressure on increased speculation re: nearer dated BoJ policy tweaks (early in the post-Kuroda era, with his term set to conclude in April) and related spill over from JGBs.

- Japanese Chief Cabinet Sec. Matsuno subsequently pushed back against the need for change in the accord allowing Tsys to tick away from session cheaps, before they re-cheapened into the London handover, with TY futures retesting their early Asia lows at one point.

- In Europe today we have a thin data calendar, save the latest IFO survey from Germany, although there will be some focus on the ECB speakers that are slated, given last week’s hawkish guidance from President Lagarde and the increased cross-market impact witnessed during ’22. European & U.S. digestion of the BoJ speculation & subsequent government denial will also factor into price action. Further out we have the latest NAHB House Market Index reading.

JGBS: Pressured By Speculation Surrounding Changes To BoJ Policy Accord

JGB futures are -11 into the bell, with the major cash JGB benchmarks running little changed to 6bp cheaper as the curve steepens (10s are capped by the BoJ’s YCC settings).

- The BoJ rumour mill was in full effect over the weekend, with Kyodo sources noting that the Japanese government is set to revise the BoJ accord that commits the Bank to achieving 2% inflation at “the earliest possible date.” The piece suggested that the new mandate would be more flexible around the 2% goal, which could potentially become a medium- or longer-term target. Kyodo went on to note that the matter is expected to be discussed with the new BoJ Governor (Kuroda’s term comes to an end in April). This resulted in weakness for JGBs and swap spread widening across most of the curve during the Tokyo morning.

- Japanese Chief Cabinet Secretary Matsuno subsequently pushed back against the need for a change in the accord, which put a bit of a bid back into JGBs in the early rounds of afternoon dealing, although that impulse has faded as we work towards the close.

- Note that our policy team has flagged its understanding that “the Bank could discuss changes to its easy policy framework as early as June, with a mid-year timeframe allowing the new Governor time to conduct a policy review and assess wages growth.”

- Sub-2.00x offer/cover ratios across the BoJ’s 1- to 25-Year Rinban operations also helped the early afternoon bid.

- The latest BoJ monetary policy decision headlines on Tuesday, with no changes expected (our full preview of that event will cross in the next few hours).

JGBS AUCTION: 12-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.92739tn 12-Month Bills:

- Average Yield: -0.0649% (prev. -0.1001%)

- Average Price: 100.065 (prev. 100.100)

- High Yield: -0.0449% (prev. -0.0971%)

- Low Price: 100.045 (prev. 100.097)

- % Allotted At High Yield: 32.1904% (prev. 60.0187%)

- Bid/Cover: 2.706x (prev. 3.786x)

AUSSIE BONDS: Cross-Market Flows Aid Cheapening Impulse

Aussie bonds struggled to catch a bid during Monday’s Sydney session.

- At one point we saw an extension of the steepening/weakness observed earlier in the session, with a lack of headline drivers evident. Cash ACGBs were 4.5-9.5bp cheaper across the curve at the close, while YM settled -5.0 with XM -8.0, after weakness in the latter extended through its overnight session base, pushing a pure flow element to the fore.

- Building on the flow-centric nature of the move is the fact that the AU/U.S. 10-Year yield spread is showing above 0bp, as Aussie 10s widen vs. their U.S. counterpart (that spread hasn’t closed in positive territory since mid-October). This triggered RBC into issuing a tightener recommendation in that spread. ACGBs also notably underperformed vs. NZGBs.

- Note that YM pulled lower into the close, in what looked like a liquidation of longs at first glance, although the widening of 3-Year EFP alongside the move suggested swap payside flows were also evident.

- Bills finished +2 to -4, twist steepening, with little movement noted in RBA dated OIS vs. Friday’s late Sydney levels.

- There wasn’t much in the way of meaningful idiosyncratic news flow, with headlines dominated by PM Albanese noting that Foreign Minister Wong will visit China on Tuesday.

- The minutes covering the most recent RBA monetary policy meeting headline the local docket on Tuesday.

NZGBS: Early, Modest Cheapening Reverses

NZGBs faded the early cheapening/steepening, with (delayed) impact from soft domestic data and yield appeal (outright and cross-market) perhaps at play, leaving the major NZGB benchmarks 2-3bp richer across the curve at the bell, with bull steepening in play.

- Receiver-side flows in swaps would have also aided the richening, with swap spreads little changed to a touch tighter across the curve (bull steepening was also observed on the swaps curve).

- The major RBNZ dated OIS pricing in the front end of the strip is little changed, with ~70bp of tightening priced for the Feb ’23 meeting, alongside a terminal OCR of ~5.55%.

- Local data flow saw a lower rate of expansion in the services PMI reading alongside a record low Q4 consumer confidence reading in the latest Westpac survey.

- The NZGB space was more resilient to speculation surrounding the BoJ vs. global counterparts, with some AU/NZ cross-market trades perhaps lending support as ACGBs struggled and NZGBs outperformed.

- Looking ahead, Tuesday’s local docket is headlined by the monthly round of ANZ business and consumer confidence readings.

EQUITIES: Most Markets Follow US/EU Lead Lower

(MNI Australia) Most regional equity markets are down at the start of this week, in line with US/EU bourse weakness from Friday's session. US equity futures are tracking higher but are only just in positive territory at this stage and comfortably down from best levels.

- Hong Kong equity market sentiment has again been volatile. Early positive sentiment in the tech index couldn't be sustained, with the sub-index last down 0.43%, (gains were above 2% earlier). The overall HSI is tracking -0.5% lower at this stage. Property stocks have also weighed amid fears of further fund placements by developers.

- Mainland China stocks are also down, the CSI 300 off by 1%. Covid fears are still weighing, as Shanghai will close most schools amid surging case numbers. The conclusion of the CEWC meeting, which vowed to boost domestic demand next year, has been offset by the headwinds.

- Tech sensitive plays are mostly lower, with the Nikkei 225 down over 1%.

- The Philippines main bourse is down 1.44%, mainly due to PDLT weakness amid reports of governance/budget issues.

- Indian shares, +0.40% in the first part of trading are one of the few positive stories in the region today.

GOLD: Moving Sideways At the Start Of The Week

Gold tracked higher in the first part of the session before losing some momentum. We got to a high close to $1797, before moving lower. We currently sit around $1793, little changed from NY levels at the end of last week. This leaves the precious metal slightly underperforming USD weakness today (BBDXY -0.20%).

- Overall, gold continues to respect recent ranges. Support continues to be evident around the $1775 level. Bulls likely need to see a sustained break of $1800 to turn more constructive.

- ETF gold holdings ticked higher at the end of last week.

OIL: Brent Can't Hold Above $80/bbl, But Still A Positive Start To The Week

Brent crude is starting the week on a firmer footing. We are up around 1% at this stage, tracking at $79.80/bbl (earlier highs were just above $80.50/bbl). This of course comes after late weakest towards the end of last week (-4.5% down through Thur/Fri trading). WTI is also 1% higher for the session, last trading just above $75/bbl.

- Market sentiment has been buoyed by China's growth plans for next year, particularly around reviving consumption/domestic demand. The other positive cited is the rebuild of strategic petroleum reserves by the US government, following releases earlier this year.

- Still, it remains to be seen if these factors can generate a sustained turnaround. Weaker US survey data from the Friday session last week has raised fears as we progress into 2023. Other indicators like prompt spreads also don't suggest near term tightness from a supply standpoint.

- The focus in the London/EU time zone is likely to be the EU energy ministers meeting, which is aimed at agreeing to a gas price cap level.

FOREX: USD Lower, JPY and AUD Higher

The USD is lower to start the week, but up from session lows. The BBDXY was last around 1262.50, -0.15% for the session. Much of the focus has been on the yen, following weekend reports of a possible shift in the BoJ's inflation mandate.

- USD/JPY dipped to a low of 135.77 before support emerged. The Japanese Cabinet Secretary pushed back on any change to the BoJ mandate. This took us off the lows and we last tracked around 136.20, with firmer UST yields at the back end arguably providing some support.

- AUD/USD has tracked high as well but has lost momentum this afternoon. The pair was last around 0.6705, still +0.30% for the session. News that Australian Foreign Minister Wong will visit China on Tuesday provided some support, although only at the margins.

- NZD/USD has been a laggard, last around the 0.6370/75 region, flat for the session. Weaker domestic survey data has likely weighed, with the Westpac Consumer Sentiment Index dropping to a record low. The AUD/NZD cross is back above 1.0500, last at 1.0515.

- EUR/USD is back above 1.0600 +0.20% for the session.

- Coming up, we have ECB speak and German IFO data. In the US the NAHB index prints.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/12/2022 | 0800/0900 |  | EU | ECB de Guindos Speech at Economia Forum | |

| 19/12/2022 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 19/12/2022 | 1000/1100 | ** |  | EU | Construction Production |

| 19/12/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 19/12/2022 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/12/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 19/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 19/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.