-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Risk Aversion Rises On Geopolitical Concerns

EXECUTIVE SUMMARY

- IRAN HELPED PLOT ATTACK ON ISRAEL OVER SEVERAL WEEKS - WSJ

- FED’S BOWMAN SAY SHE EXPECTS HIGHER RATES NEEDED TO CURB PRICES - BBG

- LAGARDE CONFIDENT ECB’S POLICY WILL BRING INFLATION BACK TO GOAL - BBG

- NEUTRAL UPDATE NEEDED AFTER FOURTH PAUSE - EX RBA - MNI

- JAPAN LIKELY WON’T INTERVENE TO REVERSE YEN DOWNTREND- EX-TOP CURRENCY DIPLOMAT SAYS - RTRS

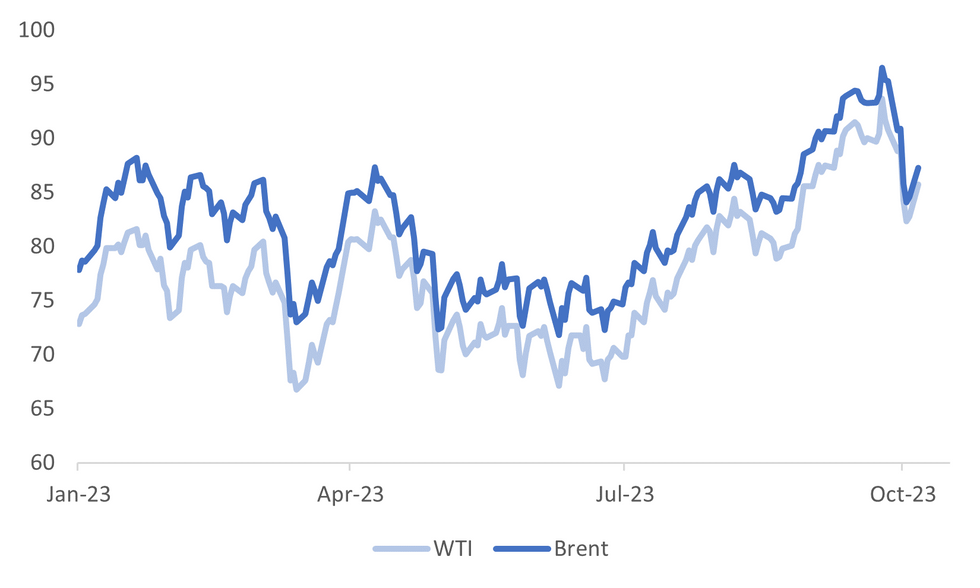

Fig. 1: Oil Benchmarks Rebound On Middle East Geopolitical Uncertainty

Source: MNI - Market News/Bloomberg

U.K:

POLITICS: “Britain's opposition Labour Party is on course to win a landslide victory at a national election expected next year, according to an opinion poll published on Saturday.” (RTRS)

BANKING: Metro Bank Holdings Plc has clinched a £925 million ($1.1 billion) financing package, a deal that will impose a 40% haircut on some bondholders and see Colombian financier Jaime Gilinski take a controlling interest. (BBG)

EUROPE:

ECB: “The European Central Bank’s policy will help tame inflation, according to President Christine Lagarde. “We want to bring inflation to 2% and we will succeed,” Lagarde told La Tribune Dimanche in an interview, adding that an inflationary spiral “must absolutely be avoided.” (BBG)

ECB: “European Central Bank President Christine Lagarde said the IMF has cut its forecasts for the global economy. “The International Monetary Fund has revised down its growth projections worldwide, except for the United States,” Lagarde told La Tribune Dimanche in an interview, according to a transcript on the ECB’s website.” (BBG)

ECB/FISCAL: “Euro-area governments are choosing not to pursue budgetary policies that support the European Central Bank’s efforts to tame inflation, according to Governing Council member Klaas Knot.” (BBG)

GERMANY: "Voters in two German states used a pair of regional elections on Sunday to chastise the three parties in chancellor Olaf Scholz’s coalition, as projections showed an upsurge in support for the radical right." (FT)

ITALY: “The recent surge in Rome’s borrowing costs show investors are positioning for a combination of weak growth and high debt, outgoing Bank of Italy Governor Ignazio Visco told the Financial Times.” (FT)

U.S.

FED: “Federal Reserve Governor Michelle Bowman said she’s sticking with her call that interest rates will likely need to increase further to return inflation to the Fed’s 2% goal quickly.” (BBG)

LABOR: “The UAW International Union says 4,000 UAW members at Mack Trucks have voted to reject a tentative agreement, it says in a post on X, the platform formerly known as Twitter. (BBG)

OTHER

MIDDLE EAST: “Iranian security officials helped plan Hamas's Saturday surprise attack on Israel and gave the green light for the assault at a meeting in Beirut last Monday, according to senior members of Hamas and Hezbollah, another Iran-backed militant group.” (BBG)

ISRAEL: Israel’s army was still battling the final Hamas militants who remained on its territory on Sunday evening 36 hours after their devastating attack on the Jewish state. But the country’s leadership was already turning its attention to the next stage of the fighting. (FT)

JAPAN: “Japan likely won't seek to reverse the yen's downtrend with exchange-rate intervention as recent falls reflect economic fundamentals, former top currency diplomat Naoyuki Shinohara told Reuters.” (RTRS)

AUSTRALIA: The Reserve Bank of Australia is likely to revise its models on the relation between employment, wages and monetary policy to better reflect how the economy, particularly the labour market, has responded to higher rates, according to a former senior Reserve economist. (MNI)

CHINA

TRAVEL: “Spending and travel over China’s Golden Week holiday undershot official expectations for growth, adding pressure on policymakers to be more aggressive with stimulus.” (BBG)

PROPERTY: “Home sales in most cities declined during the Golden Week holiday, despite property developers promoting more discounted projects. The average daily transaction area in 35 major cities dropped by about 20% compared with the same period last year, data by China Index Academy showed.” (21st Century Business Herald)

INFRASTRUCTURE: “China’s local governments may add urban regeneration to the list of projects supported by special bond issuance, the China Securities Journal reported.” (CSJ)

CHINA MARKETS

MNI: PBOC Drains Net 299 Bln Via OMO Mon; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY20 billion via 7-day reverse repo on Monday, with the rate unchanged at 1.80%. The operation has led to a net drain of CNY299 billion after offsetting the maturity of CNY319 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8000% at 09:29am local time from the close of 1.7577% before 7-day long holiday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 28 on last trading day before golden week holiday, compared with the close of 50 on the previous day. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1789 Monday Vs 7.1798 Thursday (28th September).

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1789 on Monday, compared with 7.1798 set before the golden week holiday. The fixing was estimated at 7.2975 by Bloomberg survey today.

MARKETS

US TSYS: Futures Firmer In Asia, Cash Closed Today

TYZ3 deals at 107-07+, +0-12+, a 0-20 range has been observed on volume of ~153k.

- Cash tsys are closed today due to the observance of the Columbus Day holiday.

- Futures firmed in early trade as local participants digested the Hamas/Israel conflict which began over the week. The bid in TY was seen alongside the USD firming, and Oil rising ~5 before paring gains. WTI now sits a touch above the $86/barrel handle, up ~4%.

- TYZ3 was unable to sustain its rally above resistance at 107-14 (Oct 3 high), gains were pared and ranges were narrow with little follow through on moves for the remainder of the session.

- Flow wise, the highlight was block buyers in FV (2.7k and 2.2k lots).

- The data docket is empty today, Fedpseak from Dallas Fed President Logan and VC Barr is due.

AUSSIE BONDS: Futures Richer But Off Early Sessions Highs, Consumer & Business Confidence Data Tomorrow

ACGBs (YM +6.0 & XM +1.5) have pared early Hamas/Israel Conflict-inspired gains but continue to deal richer.

- US tsy futures are also off the early Asia-Pac session high of 107-20+ to be dealing at 107-08, +0-13 from NY closing levels. Cash US tsys are closed today for the Columbus Day holiday.

- The local calendar has been empty so far today, with Foreign Reserves data due later.

- Cash ACGBs are 2-5bps richer, with the 3/10 curve steeper.

- Swap rates are 3-5bps lower, with EFPs 1-2bps wider.

- The bills strip has bull-flattened, with pricing +1 to +6.

- RBA-dated OIS pricing is 2-6bps softer across meetings, with Dec’24 leading.

- Tomorrow, the local calendar sees Westpac Consumer and NAB Business Confidence data.

NZGBS: Richer But Early Geopolitical-Induced Gains Pared

NZGBs closed richer but off the session’s best levels, with benchmark yields 1-2bps lower. With the local docket empty today, local participants have been on headlines and US tsys watch following the weekend’s escalation in Middle East tensions.

- US tsy futures are dealing richer in early Asia-Pac dealings at 107-06, +0-11 from NY closing levels, but are well off the early session high of 107-20+.

- Cash US tsys are closed today for the Columbus Day holiday.

- Swap rates are flat to 1bp lower, with implied swap spreads mixed.

- BNZ Job ads index falls 2.3% m/m following a 2.1% gain in August.

- RBNZ dated OIS pricing is 1bp softer for meetings out to July’24 and 3-5bps softer beyond.

- The data docket is relatively light this week, with Net Migration on Wednesday, Food Prices on Thursday and Business NZ Mfg PMI and Card Spending on Friday.

FOREX: Greenback Firms On Geopolitical Tensions

The USD has firmed in Asia and sits at session highs after the market digested the geopolitical tensions between Hamas and Israel. Oil has firmed, WTI is up ~4% and sits at the $86/barrel handle. US Tsy Futures are also firmer, cash Tsys are closed today due to the observance of a national holiday, whilst e-minis are down ~0.8%.

- AUD/USD sits down ~0.5% last printing at $0.6350/55 a touch above session lows. Technically the pair remains bearish, support comes in at $0.6287, 2.00 projection of the Jun 16-Jun 29-Jul 13 price swings. Resistance is at $0.6399 the 20-Day EMA.

- Kiwi marginally pared losses however NZD/USD remains down ~0.3% and sits at $0.5970/75. Support came in ahead of the 20-Day EMA ($0.5948) in early dealing.

- Yen is holding its early gains dealing in a narrow range for the most part a touch above the ¥149 handle. The uptrend in USD/JPY remains intact, resistance is at ¥150.13 the high from Oct 3 and bull trigger.

- Elsewhere in G-10 EUR and GBP are down ~0.3% following the broader USD move.

- The docket is thin today with the market firmly focused on any further development in the Hamas/Israel conflict.

EQUITIES: Geopolitical Tensions Weigh On US Futures, China Markets Down On Return

Regional equity markets are mostly tracking lower in the first part of Monday trade. A number markets are out though, with Japan, South Korea and Taiwan closed for holidays. Hong Kong stocks haven't commenced trading yet either due to adverse local weather conditions. US equity futures are down sharply, as the market digests the news from the weekend of the surprise Hamas attack on Israel.

- Eminis are down a little over 0.80% at this stage, last near 4306. We haven't tested sub 4300 yet, while Friday lows near 4240 remain some distance away. Nasdaq futures are down by a similar amount.

- No doubt focus will be on concern around escalation of the Israel/Hamas conflict to wider parts of the Middle East, with focus on spillover to oil prices and broader risk appetite.

- The other focus point has been the return of China markets after the Golden Holiday week break. At this stage, sentiment is weaker, with the CSI 300 off by nearly 0.60% at the break. Anecdotes around holiday spending were below government estimates, albeit up strongly compared to 2022 (per BBG reports, see this link), while housing activity was also weaker than hoped for (see this link).

- The CSI 300 was off by more than 1% in early trade, but these losses have been pared somewhat.

- Thailand shares remain under pressure in SEA. The SET off a further 0.70% at this stage. The index back to late 2020 levels. Criticism of the government's proposed cash hand out by former heads of the BOT is one area of concern, while higher oil prices will also be weighing.

- Most other markets are weaker, but losses are reasonably modest at this stage.

OIL: Crude Higher On Raised Geopolitical Tensions, Significant Uncertainty

Oil prices rose sharply in response to raised tensions in the Middle East following the weekend’s atrocities. Crude rose over 5% during APAC trading but is now off its intraday highs. There is concern that if hostilities spread to other parts of the region then oil production could be impacted. If it appears that they will be short-lived and contained, then the rise in prices is likely to be reversed. The USD index is 0.2% higher on safe haven flows.

- Brent rose 5.2% to an intraday high of $89 but is now around $87.69/bbl. WTI is now holding just above $86 at $86.06 but earlier it rose 5.4% to a high of $87.24. WTI prompt spreads widened but imply that fundamentals haven’t changed.

- There are reports that Iran was involved in the Hamas attack on Israel and reprisals on Iran could risk crude shipping through the Strait of Hormuz, which the state has previously warned it could close. According to Bloomberg, around 17mn barrels of crude and condensate are shipped through the passage every day. Only recently the US eased sanctions on Iran to allow more oil shipments.

- Later the Fed’s Logan, Barr and Jefferson speak. There is no data due to the Columbus Day holiday. The ECB’s de Guindos and Enria are also scheduled to appear. IMF/World Bank annual meetings take place today and tomorrow.

GOLD: Sharply Higher After Shock Attacks By Gaza Militants

Gold prices have risen by 1% in the Asia-Pacific trading session, driven by increased demand for safe-haven assets following a shock attack by Gaza militants over the weekend, which has escalated tensions in the Middle East.

- This gain follows a 0.7% increase observed on Friday, rebounding from its lowest level since March. Gold had been facing downward pressure due to signals from the Federal Reserve that indicated a commitment to maintaining tight monetary policy, which negatively impacted non-interest-bearing assets.

- Friday's surge in US nonfarm payrolls exceeded expectations, leading to a notable uptick in US Treasury yields. However, it's important to note that various aspects of the report presented a more mixed picture, which helped ease the initial knee-jerk spikes in Treasury yields. Dip buyers, short covering, and technical buying ahead of the Columbus Day long weekend helped trim bond losses.

- In addition to these market dynamics, over the weekend, Fed Governor Michelle Bowman expressed concern about persistently high US inflation rates and indicated that further monetary tightening was likely to be necessary.

- In summary, gold's recent price movements reflect a complex interplay of factors, with geopolitical events in the Middle East, monetary policy signals from the Federal Reserve, and economic data releases all influencing the precious metal's performance.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/10/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 09/10/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 09/10/2023 | 0800/1000 |  | EU | ECB's de Guindos Speaks at Conference | |

| 09/10/2023 | 0900/0500 | * |  | US | Business Inventories |

| 09/10/2023 | 1315/0915 |  | US | Fed's Michael Barr | |

| 09/10/2023 | 1500/1100 | ** |  | US | NY Fed Survey of Consumer Expectations |

| 09/10/2023 | 1730/1330 |  | US | Fed Vice Chair Philip Jefferson | |

| 09/10/2023 | 2000/2100 |  | UK | BoE's Mann speaks at NABE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.