-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: PBOC Increases Gold Reserves

MNI BRIEF: Japan Q3 GDP Revised Up On Net Exports, Capex

MNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI EUROPEAN OPEN: Risk Off On Israel Strike, But Away From Worst Levels

EXECUTIVE SUMMARY

- ISRAEL LAUNCHES STRIKE ON IRAN, US OFFICIALS SAY - BBG

- ISRAEL RETALIATES AGAINST IRAN WITH ‘LIMITED’ STRIKE, US WAS GIVEN ADVANCED WARNING - FOX NEWS

- FED’S BOSTIC - RATE CUT LIKELY AT END OF YEAR - MNI BRIEF

- FED COULD WAIT UNTIL 2025 TO LOWER RATES - KASHKARI - MNI BRIEF

- JAPAN MARCH CORE CPI RISES 2.6% VS. FEB’S 2.8% - MNI BRIEF

- BOJ AIMS TO CUT JGB BOND BUYING LEVEL IN JULY - MNI POLICY

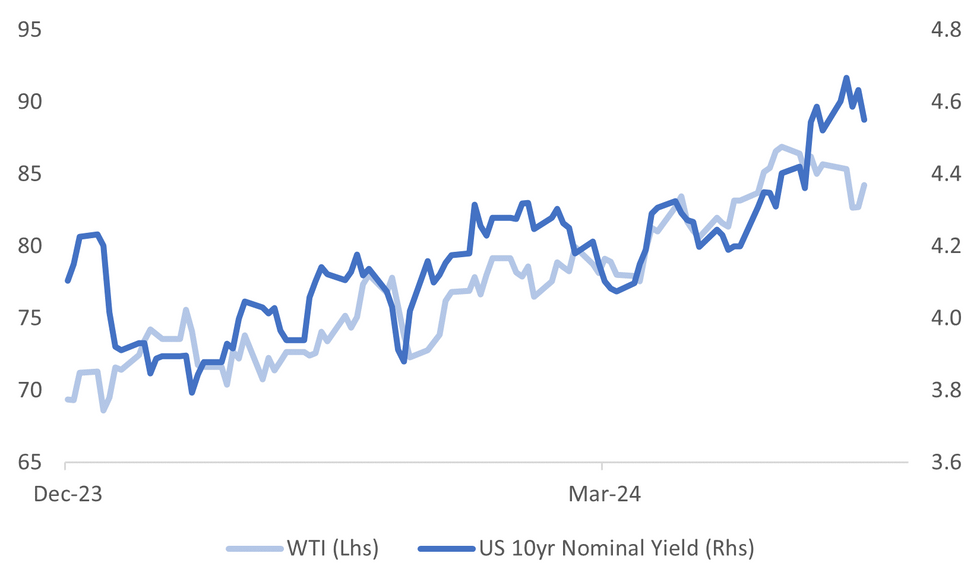

Fig. 1: WTI Oil Price & US Nominal 10yr Yield

Source: MNI - Market News/Bloomberg

EUROPE

ECB (ANSA): “Disinflation is continuing and this will lead the European Central Bank to reconsider the restriction” of monetary policy, Governing Council member Fabio Panetta said, according to Ansa.

ENERGY (BBG): The European Union’s demand for liquefied natural gas, which provided a key lifeline during the energy crisis, will likely peak this year as the region accelerates its renewables transition, according to the bloc’s energy regulator.

U.S.

FED (MNI BRIEF): Atlanta Fed President Raphael Bostic said Thursday he’s comfortable keeping interest rates steady, reiterating it will not be appropriate to lower borrowing costs until toward the end of the year.

FED (MNI BRIEF): Minneapolis Federal Reserve President Neel Kashkari on Thursday said the central bank will need to be patient and wait until convinced inflation is falling to target, potentially waiting until 2025 to lower rates.

MIDEAST (WSJ): The Biden administration is pushing for a long-shot diplomatic deal in coming months that presses Israeli Prime Minister Benjamin Netanyahu to accept a new commitment to Palestinian statehood in exchange for diplomatic recognition by Riyadh, U.S. and Saudi officials said.

MIDEAST (FOX NEWS): Israel carried out limited strikes in Iran early Friday in retaliation for Tehran firing a barrage of missiles and drones at Israel late Saturday. Fox News Digital has confirmed there have been explosions in Isfahan province where Natanz is located though it is not clear whether it has been hit. Natanz is the site of one of Iran's nuclear facilities, though state television has described all sites in the area as "fully safe." A well-placed military source has told Fox that the strike was "limited." Sources familiar said the U.S. was not involved and there was pre-notification to the U.S. from the Israelis.

OTHER

MIDEAST (BBG): Israel launched a retaliatory strike on Iran less than a week after Tehran’s rocket and drone barrage, according to two US officials, raising fears of a widening conflict across the Middle East.

OIL (BBG): Oil jumped after US officials said Israel had struck targets in Iran, with Brent rallying on concerns over the potential for a wider regional conflict that could endanger crude supplies.

MIDEAST (RTRS): The United States on Thursday effectively stopped the United Nations from recognizing a Palestinian state by casting a veto in the Security Council to deny Palestinians full membership of the world body.

IRAN (BBG): A top Iranian general said his country may reconsider its nuclear policies if Israel threatens to attack its atomic sites, an implicit warning that Tehran might race toward a nuclear weapon as rhetoric continued to escalate in the wake of its April 13 drone and missile attack.

JAPAN (MNI POLICY): The Bank of Japan is toying with how it can lower the scale of its Japanese government bond-buying programme without injecting volatility into the rates market or sharply raising long-term yields and could potentially lower the largely ambiguous JPY6 trillion monthly level found within its March board communications to JPY5 trillion at the July 30-31 meeting, MNI understands.

JAPAN (MNI BRIEF): The year-on-year rise of Japan's annual core consumer inflation rate decelerated to 2.6% in March from February’s 2.8%, showing the pass-through of cost increases is weakening, data released by the Ministry of Internal Affairs and Communications showed on Friday.

JAPAN (MNI BRIEF): Japanese corporate demand for bank financing over the last three months driven by increased sales and capital investment, and the worsening of fund-raising, senior loan officer opinion survey on bank lending practices released by the Bank of Japan showed on Friday.

CHINA

HOUSING (SECURITIES DAILY): Chinese cities may further relax restrictions on homes purchases to boost sentiment in the property market, the Securities Daily reported, citing an analyst.

US TSYS ( 21st Century Business): China's holdings of U.S. Treasury bonds fell by USD22.7 billion in February from January, with total holdings decreasing to USD775 billion, approaching the lowest since 2009, 21st Century Business Herald reported. China's concerns focus on the risk of falling U.S. bond prices caused by the Federal Reserve's potential delay to interest-rate cuts.

POLICY (SECURITIES DAILY): China’s stronger-than-expected Q1 growth will make the government less likely to increase stimulus policies in the short term, according to Wang Tao, chief China economist at UBS. Wang said Q1 performance was driven mainly by exports, growth in added value for the services industry, and steady results in industrial production and investment.

CONSUMER (SECURITIES DAILY): The China Consumer Expo held in Hainan has closed with 55,000 buyers attending this years’ event, up 10% y/y, according to data released by the organisers. Sellers launched 1,462 new products during the event, up 45% y/y, with the number of visitors reaching 373,000.

CHINA MARKETS

MNI: PBOC Conducts CNY2 Bln Via OMO Fri; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo on Friday, with the rates unchanged at 1.80%. The operation has led to no change to the liquidity after offsetting the maturity of CNY2 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8375% at 09:29 am local time from the close of 1.8555% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 45 on Thursday. the same as the close on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1046 on Friday, compared with 7.1020 set on Thursday. The fixing was estimated at 7.2458 by Bloomberg survey today.

MARKET DATA

JAPAN MARCH NATIONAL CPI Y/Y 2.7%; MEDIAN 2.8%; PRIOR 2.8%

JAPAN MARCH NATIONAL CPI EX FRESH FOOD Y/Y 2.6%; MEDIAN 2.7%; PRIOR 2.8%

JAPAN MARCH NATIONAL CPI EX FRESH FOOD, ENERGY Y/Y 2.9%; MEDIAN 3.0%; PRIOR 3.2%

MARKETS

US TSYS: Tsys Futures Off Earlier Highs, Yields 6-9bps Lower

- Treasury futures have gapped higher after reports of explosions in Iran. 10Y futures surged + 29+ to an intraday high of 108-22+ just below initial resistance of 108-25+, the contract has reversed half of the move and now trades at 108-09+ up +19 from NY closing levels.

- Cash treasuries were 10-15bps lower as headlines came out, we have reversed some of those moves to now trade 6-9bps lower for the day, the 2y is -6.4bps at 4.920%, while the 10Y is -8.4bps at 4.549%

- Across local Asian markets, NZGBs are 5-6bps lower, ACGBs 2-5bps lower, while EM space, INDON yields are 1-4bps higher, while PHILIP yields are 1-3bps higher.

- Market moves have been dominated by the middle east tension, however there have been some fed speakers with the Fed's Williams saying there is no urgency to cut rates, while Bostic spoke earlier this morning reiterating his view of just one cut this year (MNI - see link here).

- Looking ahead: There is no economic data to report Friday while Chicago Fed Goolsbee will participate in a moderated Q&A at a SABEW conference (1030ET) ahead of the Fed blackout late Friday.

JGBS: Futures Sitting Richer But Off Israeli Strike Highs, BoJ To Scale Back JGB Buying

JGB futures are stronger in the Tokyo afternoon session, +22 compared to the settlement levels, but well off session highs tied to news that Israeli missiles have hit sites in Iran.

- Cash US tsys are dealing 6-9bps richer across benchmarks, although they have retraced from the peak levels seen during the Asia-Pacific session.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined National CPI, which missed expectations.

- (MNI) The Bank of Japan is toying with how it can lower the scale of its Japanese government bond-buying programme without injecting volatility into the rates market or sharply raising long-term yields and could potentially lower the largely ambiguous JPY6 trillion monthly level found within its March board communications to JPY5 trillion at the July 30-31 meeting. (See link)

- The cash JGB curve bull-flattened, with yields flat to 4bps lower. The benchmark 10-year is 2.8bps lower at 0.841% versus the YTD high of 0.891% set this week.

- The swaps curve has richened, led by the 7-10-year zone, with rates 1-5bps lower. Swap spreads are mixed.

- The local calendar is empty on Monday, ahead of Jibun Bank PMIs and 2-year supply on Tuesday. The BoJ Policy Decision is on Friday.

AUSSIE BONDS: Spike Richer on Israeli Strike Pared, Q1 CPI On Wednesday

ACGBs (YM +5.0 & XM +3.5) spiked higher after news broke that Israeli missiles had struck sites in Iran, according to ABC. The market initially reacted with a spike of up to 10 points from session lows. However, these gains have since been pared back.

- Cash US tsys are dealing 6-9bps richer across benchmarks, although they have retraced from the peak levels seen during the Asia-Pacific session.

- The Middle East tension has dominated market moves, however, there have been some fed speakers with the Fed's Williams saying there is no urgency to cut rates. Fed Bostic spoke earlier this morning reiterating his view of just one cut this year (MNI - see link).

- Later today, Chicago Fed Goolsbee will participate in a moderated Q&A at a SABEW conference ahead of the Fed blackout late Friday.

- Swap rates are 3-5bps lower, with the 3s10s curve steeper.

- The bills strip has bull-flattened, with pricing +1 to +6.

- RBA-dated OIS pricing has reversed early weakness to be 3-4bps softer for 2025 meetings. A cumulative 20bps of easing is priced by year-end.

- Next week, the local calendar sees Judo Bank PMIs on Tuesday, ahead of Q1 CPI on Wednesday.

- On Monday, the AOFM plans to sell A$800mn of the 0.5% Sep-26 bond.

NZGBS: Spikes Richer With Global Bonds After Israel Strikes Iran

NZGBs closed 4bps richer, aligning with the significant rally in global bonds during today's Asia-Pacific session, driven by reports of Israeli missile strikes on sites in Iran, as reported by ABC.

- Markets had moved ahead of the confirmation with reports regarding the closing of Iranian airspace. It appears flights had been diverted away from Iranian Airspace. There seemed to be little flight activity over central Iran where the explosions occurred near Isfahan.

- Cash US tsys are dealing 6-9bps richer across benchmarks but off the Asia-Pac session's best levels.

- Swap rates closed 3-4bps lower.

- RBNZ dated OIS pricing closed 3-7bps softer for meetings beyond July. A cumulative 60bps of easing is priced by year-end.

- Bloomberg reported that ANZ said the RBNZ will only pivot to an easing stance when it is sure it has domestic inflation under control, which will take until next year. While headline inflation will drop to 2.6% in the third quarter this year, returning to the Reserve Bank’s 1-3% target band for the first time since early 2021, that won’t be enough to trigger rate cuts.

- The next major release is Trade Balance data for March on Wednesday. Australia is also scheduled to release Q1 CPI data on Wednesday.

FOREX: Dollar Gains Pared Post Israeli Strike Headlines

Market risk aversion surged amid headlines of missile attacks from Israel on Iran. The BBDXY got to highs of 1271.06, but we now sit back close to 1266, only +0.20% firmer for the session.

- Yen and CHF rallied strongly, but also sit away from best levels. USD/JPY got to 153.59, but we are now back to 154.40/45, only marginally stronger in yen terms. USD/CHF is back near 0.9085, against earlier lows of 0.9013.

- The slightly weaker than expected Japan CPI print didn't impact yen sentiment.

- Part of the stabilization in risk sentiment has reflected that nuclear facilities in Iran were reportedly not damaged, while Fox News noted it was the strike was limited in scope, per US officials.

- Some Iranian headlines also deny an attack took place and hat reports of explosions were the activation of the country's air defence system.

- AUD and NZD remain weaker by around 0.30%, but away from session lows. AUD/USD was last around 0.6400 (earlier lows at 0.636), while NZD/USD tracks near 0.5880 in latest dealings (earlier lows 0.5852).

- US equity futures remain in the red, but losses are now under 1%. Earlier the Nasdaq future was off by 2%. US yields remain lower, but like elsewhere are up from earlier lows.

- Looking ahead, UK retail sales, German PPI and speeches from BoE's Ramsden & Mann, ECB's Nagel and Fed's Goolsbee, will be in focus.

ASIA EQUITIES: China & HK Equities Lower On Middle East Tensions, TSMC Outlook

Hong Kong and China equity are lower today growing tension in the middle east has been seen to be the major catalyst for the move lower, although the semiconductor sector has also sold off after TSMC scaled back its outlook for a chip market expansion, cautioning that the smartphone and personal-computing markets remain weak. All indices are in the red together other than defense stocks as they rally on hopes that intensifying concerns about escalating conflict in the Middle East can raise demand for their arms and weapons, while gold producers rally as spot gold see haven buyers.

- Hong Kong equities are lower across the board, the HSTech Index is the worst performer, trading down 2.60% and has broken below the 3300 level it had been holding above since early march, sellers are back in control with the Index now trading below the 20, 50, 100 & 200-day EMA, the Mainland Property Index is faring slightly better down 1.05%, while the HSI is down 1.23%. In China, equities are performing better however still all in the red with the CSI300 down 0.88%, while small-cap indices have been less impacted by global issues today with the CSI2000 & CSI1000 down about 0.90%.

- China Northbound saw an outflow of 5.28b on Thursday, flow momentum has been slightly decreasing over the past week with the 5-day average at -1.51billion, while the 20-day average sits at -0.90billion yuan.

- Mexico's federal government, influenced by pressure from the US, is reportedly denying Chinese automakers incentives for EV production, including low-cost land and tax breaks, signaling a shift from past practices. This decision follows pressure from the US to keep Chinese automakers out of the North American Free Trade Agreement zone, with US officials citing concerns about national security threats posed by Chinese vehicles, according to Reuters.

- Looking ahead, China's 1 & 5 yr LPR on Monday is the focus.

ASIA PAC EQUITIES: Equities Head Lower On Middle East Tensions, TSMC Revised Outlook

Today, regional Asian equities opened lower, primarily due to losses in tech stocks following TSMC's revised outlook for chip market expansion. Treasury yields to rose after US weekly jobless claims were released, indicating resilience in the labor market. Additionally, hawkish remarks from Federal Reserve officials dampened investor sentiment, Fed's Williams emphasized the data-dependent nature of future rate decisions, while Bostic reiterated expectations of only one rate cut this year. The market further reacted to reports of explosions near the City of Isfahan in Central Iran, leading to airspace closures and activated air defenses, resulting in a heavy sell-off of risk assets. Although major indices recovered some losses, they remain in negative territory, with declines ranging from 2% to 6%.

- Japanese stocks have gapped lower today, initially driven lower after TSMC earnings caused weakness in the tech sectors and hawkish comments from Fed speaker, while Japan then released inflation data that came in at 2.7% vs 2.8% y/y. The yen has ticked higher as investors move into haven assets on the back of growing tension in the middle east. The Nikkei is down 2.45%, the Topix is off 1.85%, while the Topix banks Index is faring better than the wider market down just 0.83%, which could be on the back of Berkshire Hathaway's record bond issuance.

- South Korean equities are lower today, the Kospi have now erased all the yearly gains, and trade off 1.00% for the year, today it tested the 200-day EMA of 2,571, we have recovered and trade back above it however still down 1.65% for the day.

- Taiwan equities were down as much as 4.95% earlier, the initial moves of on the back of weaker TSMC after they revised outlook down and the fact the stocks has accounted for 60% of the index's gains for the year, higher yields also impacted the market and then middle east tensions breaking out pushed the market to lows. The Taiex has recovered some of the early losses and now trade down 3%.

- Australian equities are lower, although one of the better performing markets today. There has been very little in the way of local market headlines for the country. Energy has been the only sector in the green today, with the ASX200 following global markets lower, currently down 1.20%

- Elsewhere in SEA, New Zealand Equities are down 0.70%, Indonesian equities are down 1.45%, Singapore down 0.60%, Philippines down 1.70% while Malaysian equities have managed to trade up 0.43%

OIL: Surges On Israel Attack On Iran Headlines, But We Are Away From Highs

All of today's focus has been on the reported strikes Israel has launched on Iran in response to last weekend's missile attacks. At this stage, details are still limited, with reports of explosions in the Iran city of Isfahan. US officials have reportedly confirmed that a strike has taken place (per BBG), while Fox news notes that the strike was limited in scope and didn't involve manned aircraft.

- Iranian related headlines have been conflicting, stating there was no missile attack, but that reports of explosions were the activation of the country's air defence system. In any event, other Iranian headlines have noted that the country's nuclear facilities are unharmed.

- This latter point has likely been a relief for markets at the margin, given the Isfahan region contains nuclear facilities.

- At the height of the market risk aversion, front month Brent crude prices got to $90.75/bbl. We now sit back near $89.10/bbl. Opening levels were close to $87/bbl. Hence, we are still +2.3% higher, tracking up for the first gain this week. We are still sub end levels from last week ($90.45/bbl).

- For Brent recent highs around $91.50/bbl remain intact. On the downside, Thursday lows come in near $86.10/bbl.

- For WTI, we were last at $84.75/bbl, up around 2.4% for the session.

GOLD: Spikes Above $2400 On News Of Israeli Strike On Iran

Gold surged above $2400 following reports of Israeli missile strikes on sites in Iran, as reported by ABC.

- Before the official confirmation, market speculation was already rife due to reports of the closure of Iranian airspace. It was noted that flights had been diverted away from Iranian airspace, particularly over central Iran, where the explosions occurred near the city of Isfahan.

- However, the initial spike has since been tempered, with the price of bullion now standing 0.5% higher at $2391, following a 0.8% increase in Thursday's closing.

- According to MNI’s technicals team, the trend condition remains unchanged, and the outlook is still bullish, with the next objective at $2452.5, a Fibonacci projection. Initial firm support is at $2293.4, the 20-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/04/2024 | 0600/0700 | *** |  | UK | Retail Sales |

| 19/04/2024 | 0600/0800 | ** |  | DE | PPI |

| 19/04/2024 | 1415/1515 |  | UK | BoE's Ramsden at Peterson Institute Conference | |

| 19/04/2024 | 1430/1030 |  | US | Chicago Fed's Austan Goolsbee | |

| 19/04/2024 | 1530/1130 |  | US | New York Fed's Roberto Perli | |

| 19/04/2024 | 1630/1730 |  | UK | BOE's Mann Panelist at Capital Flows Seminar |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.