-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Set For A Divided Congress

EXECUTIVE SUMMARY

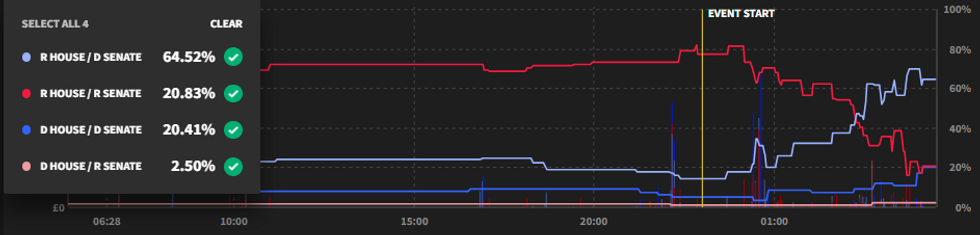

- BETTING MARKETS SWING BEHIND SPLIT CONGRESS (MNI)

- ECB’S WUNSCH SAYS MILD SLOWDOWN MIGHT MEAN MORE RATE HIKING (BBG)

- RISHI SUNAK COULD RAISE TOP RATE OF INCOME TAX, BREAKING TORIES' MANIFESTO PROMISE (TELEGRAPH)

- UK HOUSEHOLDS FACE THREAT OF HIGHER COUNCIL TAX (THE TIMES)

- BEIJING COVID CASES HIT FIVE-MONTH HIGH; GUANGZHOU DISTRICT SHUT (BBG)

- RUSSIA AND US TO RESUME NUCLEAR TALKS AS UKRAINE WAR RAGES ON (BBG)

Source: Smarkets

Source: Smarkets

UK

FISCAL: Rishi Sunak is considering expanding the top rate of income tax next week after the Treasury warned that more money was needed to protect pensions and benefits. The Telegraph understands that raising the 45 per cent top rate, or lowering the £150,000 annual income threshold at which it kicks in are options now being discussed. (Telegraph)

FISCAL: Rishi Sunak and Jeremy Hunt are weighing up plans that would increase council tax and pull more people into the top rate of income tax as they “think the unthinkable” to balance the books. (The Times)

ECONOMY: Businesses may need even more support now than during the pandemic to deal with Covid’s repercussions, post-Brexit regulatory changes and a bleak economic outlook, the president of the British Chambers of Commerce has warned. (The Times)

POLICY: Liz Truss’s plans for low-tax investment zones to boost UK economic growth are due to be axed by chancellor Jeremy Hunt in next week’s Autumn Statement. (FT)

EUROPE

ECB: ECB President Lagarde tweeted the following on Tuesday: “I was delighted to meet with @NorgesBank First Deputy Governor Pål Longva and Second Deputy Governor @OysteinBorsum at the @ecb today. Our institutions face common challenges: high inflation and the impact of Russia’s war in Ukraine.” (MNI)

ECB: The European Central Bank may need to raise interest rates more than investors expect if the euro zone faces only a mild downturn, according to Governing Council member Pierre Wunsch. (BBG)

ECONOMY: Wages in six euro area countries rose sharply in October, new data published by the Central Bank of Ireland shows, although continued uncertainty and a worsening economic outlook mean pay packet increases may have peaked despite tight labour market conditions. (MNI)

ITALY: The European Commission will send a mission to Italy in early December to examine the new government’s requests for an expansion of its EUR200 billion Recovery and Resilience Plan in response to inflation, and for parts of the plan to be repurposed towards energy projects, an EU official told MNI. (MNI)

U.S.

POLITICS: Dems Flipping GOP House Seats Sees Betting Market Shift: Betting markets continuing to price in a split Congress with Democrat control of the Senate and Republican control of the House as the most likely outcome as of 2130PT/0030ET/0530GMT. (MNI)

EQUITIES: Tesla Inc. Chief Executive Officer Elon Musk sold at least $3.95 billion of the electric-vehicle maker’s shares just days after closing his buyout of Twitter Inc. (BBG)

OTHER

NATO: Sweden will live up to security commitments it made to Turkey before becoming invitees to NATO, Prime Minister Ulf Kristersson said on Tuesday following a meeting with Turkey's President Tayyip Erdogan to discuss hurdles to Stockholm's bid to join the alliance. "I want to reassure all Turks, Sweden will live up to all the obligations made Turkey in countering the terrorist threat," Kristersson said. (RTRS)

USMCA: Mexico Economy Minister Raquel Buenrostro sees “no problem” in ongoing talks with the US and Canada, since they are both willing to resolve disputes over the USMCA trade agreement, she said in a speech to the Mexican Senate on Tuesday. (BBG)

BRAZIL: Brazil’s President-elect Luiz Inacio Lula da Silva appointed a mix of liberal and left-leaning economists to his government transition team, reflecting the broad coalition that helped him defeat Jair Bolsonaro last month. (BBG)

BRAZIL: Vice President Elected Geraldo Alckmin said on Tuesday budget exemption value to pay for expenses on social programs, resumption of works and investment is not defined yet. (BBG)

BRAZIL: The party of Brazilian President Jair Bolsonaro, recently defeated by former president Luiz Inacio Lula da Silva, will vote for A constitutional amendment (PEC) planned by Lula to allow a budget waiver to cover social welfare costs if it is in the public interest, its leader Valdemar Costa Neto said on Tuesday. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelensky said he was open to “genuine peace talks” with Russia, following pressure from Western backers to signal readiness for negotiations amid concerns about the rising costs of the eight-month war. Mr. Zelensky said Ukrainian conditions for talks included returning Ukrainian control over its territories, compensating Kyiv for Moscow’s invasion and bringing to justice perpetrators of war crimes. (WSJ)

RUSSIA: The rise of outspoken hardliners in the Kremlin is alarming insiders fearful the Russian president will heed their calls for even more confrontation abroad and sweeping repression at home. (BBG)

RUSSIA: Russia and the US expect to meet in the coming weeks to talk about resuming inspections of atomic weapons sites under the New START treaty, a small step toward reviving arms-control talks suspended since the Russian invasion of Ukraine. (BBG)

RUSSIA: Italy’s efforts to secure financing to keep an Italian oil refinery owned by Lukoil up and running despite new sanctions on Russia kicking in next month have hit obstacles, three people close to the matter said. (RTRS)

TURKEY: Turkey’s official gazette publishes law on various changes in income tax law and other laws, after being approved by President Recep Tayyip Erdogan. (BBG)

PERU: Peru's prime minister on Tuesday challenged the legislature to a confidence vote, raising tensions once again between state powers in the Andean nation, which has been roiled by political infighting for years. (RTRS)

ENERGY: The European Union's executive body told its 27 member countries at a seminar on Monday that it was not possible to create a gas price cap that would not affect long-term contracts or supply security, two diplomatic sources told Reuters. (RTRS)

ENERGY: The British government is struggling to secure long-term gas supply deals with foreign states as ministers fret about leaving taxpayers on the hook if gas prices fall in the coming years. (FT)

OIL: Oman's energy minister Salim al-Aufi said on Tuesday he saw oil prices coming down from the range of $90 a barrel after the winter season. (RTRS)

OIL: Russia has surpassed Iraq and Saudi Arabia as India’s largest supplier of oil, according to independent research companies, as Asia’s third-largest economy cashes in on steep price discounts caused by sanctions against Moscow. (FT)

OIL: U.S. crude production and petroleum demand will both rise in 2022 as the economy grows, the U.S. Energy Information Administration (EIA) said in its Short Term Energy Outlook (STEO) on Tuesday. EIA projected that crude production will rise to 11.83 million barrels per day (bpd) in 2022 and 12.31 million bpd in 2023 from 11.25 million bpd in 2021. That compares with a record 12.29 million bpd in 2019. (RTRS)

CHINA

YUAN: Striking the right balance between pro-growth policies and Beijing’s Covid-Zero strategy will be crucial in delivering a recovery to restore confidence in China’s economy, curb capital outflows and support the yuan, former People’s Bank of China monetary policy committee member Yu Yongding told MNI. (MNI)

FISCAL: China’s macro leverage (debt-to-GDP) ratio increased 0.8 percentage points to 273.9% in Q3, slower than the rise of 4.9 percentage points in Q2, as both the household and corporate sectors conservatively expanded debt, Yicai.com reported, citing a report by National Institution for Finance & Development. (MNI)

FDI: Foreign direct investment in Shanghai fell 5.5% y/y to USD27.35 billion in the first three quarters, implying FDI across July to September was positive and a rebound from the 38.9% slump in the second quarter, Securities Daily reported. (MNI)

ECONOMY/CORONAVIRUS: Local governments including Hefei, Fuzhou and Zhengzhou cities are trying to ensure the normal operation of construction activities amid Covid outbreaks, Yicai.com reported. (MNI)

CORONAVIRUS: New Covid cases in Beijing jumped to the highest level in more than five months, with officials alarmed by infections being found outside of quarantine that show the virus is still spreading in the community. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY10 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) on Wednesday injected CNY8 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY10 billion after offsetting the maturity of CNY18 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8383% at 9:31 am local time from the close of 1.8193% onTuesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Tuesday vs 49 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 7.2189 WEDS VS 7.2150 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.2189 on Wednesday, compared with 7.2150 set on Tuesday.

OVERNIGHT DATA

CHINA OCT CPI +2.1% Y/Y; MEDIAN +2.4%; SEP +2.8%

CHINA OCT PPI -1.3% Y/Y; MEDIAN -1.5%; SEP +0.9%

JAPAN SEP BOP CURRENT ACCOUNT BALANCE +Y909.3BN; MEDIAN +Y250.0BN; AUG +Y694.2BN

JAPAN SEP BOP ADJUSTED CURRENT ACCOUNT BALANCE +Y670.7BN; MEDIAN Y0BN; AUG +Y104.8BN

JAPAN SEP BOP TRADE BALANCE -Y1.7597TN; MEDIAN -Y1.6837TN; AUG -Y2490.6BN

JAPAN OCT ECO WATCHERS SURVEY CURRENT 49.9; MEDIAN 50.0; SEP 48.4

JAPAN OCT ECO WATCHERS SURVEY OUTLOOK 46.4; MEDIAN 50.1; SEP 49.2

JAPAN OCT BANK LENDING INCL. TRUSTS +2.7% Y/Y; SEP +2.3%

JAPAN OCT BANK LENDING EXCL. TRUSTS +3.0% Y/Y; SEP +2.6%

NEW ZEALAND OCT TOTAL CARD SPENDING +1.0% M/M; SEP +2.5%

NEW ZEALAND OCT RETAIL CARD SPENDING +1.0% M/M; SEP +1.3%

SOUTH KOREA OCT UNEMPLOYMENT RATE 2.8%; MEDIAN 2.9%; SEP 2.8%

SOUTH KOREA OCT BANK LENDING TO HOUSEHOLDS KRW1058.8TN; SEP KRW1059.5TN

MARKETS

SNAPSHOT: Set For A Divided Congress

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 171.54 points at 27700.57

- ASX 200 up 40.43 points at 6999.3

- Shanghai Comp. down 9.7 points at 3054.334

- JGB 10-Yr future up 47 ticks at 148.88, yield down 0.1bp at 0.251%

- Aussie 10-Yr future up 17.5 ticks at 96.130, yield down 17.2bp at 3.862%

- U.S. 10-Yr future down 0-00+ at 110-08+, yield up 0.63bp at 4.1297%

- WTI crude down $0.47 at $88.44, Gold down $4.08 at $1708.34

- USD/JPY down 1 pips at Y145.67

- BETTING MARKETS SWING BEHIND SPLIT CONGRESS (MNI)

- ECB’S WUNSCH SAYS MILD SLOWDOWN MIGHT MEAN MORE RATE HIKING (BBG)

- RISHI SUNAK COULD RAISE TOP RATE OF INCOME TAX, BREAKING TORIES' MANIFESTO PROMISE (TELEGRAPH)

- UK HOUSEHOLDS FACE THREAT OF HIGHER COUNCIL TAX (THE TIMES)

- BEIJING COVID CASES HIT FIVE-MONTH HIGH; GUANGZHOU DISTRICT SHUT (BBG)

- RUSSIA AND US TO RESUME NUCLEAR TALKS AS UKRAINE WAR RAGES ON (BBG)

US TSYS: Likely Split Congress Does Little For Tsys

A contained round of Asia-Pac dealing leaves cash Tsys running little changed to 1.5bp cheaper across the curve into London trade, with intermediates leading the modest downtick observed across most of the curve. TYZ2 prints -0-03 at 110-06, around the middle of its 0-08+ overnight range, with volume running at a healthy ~98K.

- The latest indications point to a split Congress when all is said and done with the Midterms, with the most likely outcome seeing the Republican Party re-take the House, while the Democrats are expected to maintain control of the Senate.

- Early indications of a strong Republican showing weren’t followed through on a national level, allowing the Tsy space to tick away from early session cheaps.

- A downtick for e-minis has also provided support for the space.

- Note that a split Congress would likely bring worry surrounding fiscal impasse (read the debt ceiling and government shutdowns) to the fore, given the nature of the relatively hardline Republican House leadership.

- Looking ahead, Fedspeak from Williams and Barkin, in addition to 10-Year Tsy supply, will provide the highlights outside of the ongoing Midterm vote counts.

JGBS: Notable Flattening After 30-Year Supply Goes Well

Tuesday’s bid in core global FI markets, a recovery from the base of a limited Asia-Pac range for U.S. Tsys and a solid round of 30-Year JGB supply helped JGBS to firm on Wednesday.

- The major cash JGBs run flat to ~9bp richer into the bell with the long end outperforming. Meanwhile 7s are outstripping the bid in surrounding tenors owing to the bid in futures, with JGB futures 45 ticks firmer on the day, building on overnight gains. Cash JGBs are set to go out at richest levels of the day.

- In terms of the auction details, 30-Year JGB supply saw the low-price print above wider expectations, with the cover ratio nudging up to a more “normal” level after last month’s auction saw the lowest round of 30-Year JGB cover since early ’21. Elsewhere, the tail narrowed from a wide base.

- We would suggest there was some worry re: digestion of the auction, given the size of the reaction on the back of a fairly unremarkable round of internals.

- Local headline flow saw a wider than expected current account surplus and familiar tones from the government re: FX matters, which didn’t impact the space.

- Looking ahead, weekly international security flow data and the monthly money supply readings will cross on Thursday.

JGBS AUCTION: 30-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y727.7bn 30-Year JGBs:

- Average Yield: 1.561% (prev. 1.480%)

- Average Price: 96.71 (prev. 98.32)

- High Yield: 1.567% (prev. 1.496%)

- Low Price: 96.60 (prev. 98.00)

- % Allotted At High Yield: 60.1443% (prev. 91.3793%)

- Bid/Cover: 3.282x (prev. 2.887x)

JGBS AUCTION: 6-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y3.32456tn 6-month Bills:

- Average Yield: -0.1148% (prev. -0.1712%)

- Average Price: 100.057 (prev. 100.085)

- High Yield: -0.1007% (prev. -0.1591%)

- Low Price: 100.050 (prev. 100.079)

- % Allotted At High Yield: 48.3438% (prev. 72.2400%)

- Bid/Cover: 3.667x (prev. 3.971x)

AUSSIE BONDS: Notably Firmer As The Day Wore On

Aussie bonds generally tracked the relatively limited U.S. midterm-driven gyrations in U.S. Tsys during the first half of the Sydney session, before extending higher and outperforming after a shallower bid came into Tsys.

- We didn’t see much in the way of overt domestic/idiosyncratic triggers to drive the outperformance, which extended as the major futures contracts made a meaningful break above their respective overnight highs, leaving cross-market moves and the breach of overnight session highs at the fore when it comes to explainers.

- Softer than expected Chinese CPI data may have helped the space find a base earlier in the session, with the passage of yesterday’s ACGB May-34 syndication also removing supply-related pressure.

- That left YM +11.0 & XM +17.0 at the close. Cash ACGBs sit 10-17bp richer across the curve, after 10s outperformed all day.

- EFPs were wider, with the 3-/10-Year box bull steepening.

- Bills print 2-9bp richer through the reds, bull flattening.

- Looking ahead, an address from RBA Deputy Governor Bullock, with the topic of “The Economic Outlook” in front of the ABE annual dinner headlines during the Sydney evening.

NZGBS: NZGBs Hold Firm

NZGBs held on to the bulk of their early gains, after playing catch up to Tuesday’s richening in core global FI markets, showing little reaction to the contained swings in U.S Tsys that surrounded the ongoing U.S. midterm election results.

- That left NZGBs 7-9bp richer across the curve at the close, with swap spreads marginally mixed across the curve.

- News from the Treasury that the new green NZGB May-34 will launch next week (sized at NZ$2-3bn) may have resulted in some underperformance for the longer end of the NZGB curve, alongside swap spread tightening in that zone.

- RBNZ dated OIS came in a touch on the day, with terminal OCR pricing printing just below 5.40% vs. 5.45% late on Tuesday. Pricing for this month’s meeting was a touch softer as well, with just under 70bp of tightening now priced.

- Looking ahead, Thursday will see the release of the RBNZ’s Review and Assessment of the Formulation and Implementation of Monetary Policy, with manufacturing PMI data and the weekly round of NZGB issuance also slated.

EQUITIES: China Stocks Still Down Despite Fresh Developer Support

Aggregate China/HK indices are struggling again, despite fresh support measures for the real estate developer segment. US futures are slightly up at this stage, but have been range bound for much of the session as the market processes the mid-term election results. A Republican controlled House, but Democrat controlled Senate is now a potential outcome (see this link for more details).

- The CSI 300 is off 0.75% at this stage, the Shanghai Composite -0.35%. China headline inflation data came in softer than expected, underscoring a weak domestic demand backdrop. Coupled with a further lockdown for part of Guangzhou and rising covid case numbers, has dented sentiment.

- Property related stocks have done better, the Shanghai composite sub-index up 2.3%. Onshore media stated that the financing backdrop for developers is improving, while a funding program, available to developers, along with other private firms, was boosted to 250bn yuan.

- The HSI is down around 1.5% at this stage, with the underlying tech sub-index off 2.26%.

- The Kospi (+1%) and Taiex (+1.75%) are faring better, aided by Samsung and TSMC gains. Offshore tech gains have continued to impress in the first part of this week. The Nikkei 225 has been a laggard though, -0.50%.

- The ASX 200 is +0.60% at this stage, with mining names the main drivers.

OIL: Prices Range Bound As News Impacts Both Supply And Demand Outlook

Oil prices have been range bound and are in line with their New York close at around $95/bbl for Brent and $88.50 for WTI, as tight supply balances demand fears. WTI has been trading between $88.50-$89.50.

- The market is watching the results of the US mid-term elections closely for any impact they may have on the USD. So far the outcome is unclear. A weaker USD would be positive for oil prices as it makes it cheaper for foreign buyers.

- Beijing reported the highest number of Covid cases in more than 5 months, which raised concerns that any reopening would be delayed, but the lockdown in the area around the iPhone plant was lifted. The market still hopes that there will be some easing of restrictions in China but currently there is little to suggest anything is planned.

- On the supply front, the US revised down its 2023 oil production forecast to 12.31 mbd signalling that its shale oil is unlikely to be able to boost global supply in a tight market. The latest US API data showed a build in crude inventories of 5.618 mn barrels not completely unwinding last week’s 6.53 mn drawdown. Already low stocks of distillate fell a further 1.8 mn barrels but gasoline rose 2.6 mn. The EIA data will be out overnight.

GOLD: Edges Down From Multi Week Highs

As has been the case this week, gold is giving back some gains from the overnight session during Asian trading hours, but only modestly. The precious metal last sits close to $1708.5, down from overnight highs around $1717, and -0.20% below NY closing levels.

- To recap, gold surged 2.2% for yesterday's session, continuing to benefit from lower USD levels. Gold may have also benefited from safe haven flows related to weakness in the crypto space, although gold was already pushing higher before these trends emerged.

- US yields also moved lower, the real 10yr yield back to 1.64% overnight (-5bps). This was also reflected in the nominal space, although the 2yr and 10yr have been relatively steady today.

- The market may still be eyeing a test of the 100-day EMA ($1716.95), which cap gains overnight. On the downside the 50-day comes in at $1681.43.

FOREX: Yen Takes Lead With U.S. Midterms In Spotlight, USD/JPY Shows Below 50-DMA

The greenback oscillated and the yen capitalised on its safe haven status as participants monitored incoming updates on the midterm elections in the U.S., where the Republicans moved closer to taking control of the House and the Senate race remained a toss-up. The prospect of a split Congress kept the BBDXY index in check.

- Spot USD/JPY probed the water below its 50-DMA for the first time since mid-August on two failed attempts to consolidate below that moving average. The rate fell to Y145.20 in early trade, but recovered over the Tokyo fix. Trader sources told Bloomberg that Tokyo-based leveraged accounts sold USD/JPY early on, which brought FX option strikes at Y145.00 into focus. The next round of sales sent the pair to Y145.18, but the bulk of those losses were quickly retraced. When this is being typed, USD/JPY trades ~15 pips shy of neutral levels.

- Spot USD/CNH turned bit on the back of China's inflation data. CPI printed at +2.1% Y/Y versus +2.4% expected, while PPI came in at -1.3% versus the median estimate of -1.5%. The impact of a miss in China's consumer inflation spilled over into the Antipodeans, applying some modest pressure to the space.

- Final U.S. wholesale inventories will take focus after hours. Today's central bank speaker slate features Fed's Williams & Barkin, BoE's Haskel & Cunliffe, ECB's Elderson & RBA's Bullock. The U.S. midterm elections remain under the microscope as the results keep coming in.

FX OPTIONS: Expiries for Nov09 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9900-09(E690mln)

- USD/JPY: Y147.00($543mln)

- USD/CAD: C$1.3520($780mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/11/2022 | 0700/0800 | ** |  | SE | Private Sector Production |

| 09/11/2022 | 0800/0300 |  | US | New York Fed's John Williams | |

| 09/11/2022 | 1000/1100 |  | EU | ECB Elderson Panels EMEA Event at COP27 | |

| 09/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 09/11/2022 | 1300/1300 |  | UK | BOE Haskel Speech at Digital Futures at Work | |

| 09/11/2022 | 1500/1000 | ** |  | US | Wholesale Trade |

| 09/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 09/11/2022 | 1600/1100 |  | US | Richmond Fed's Tom Barkin | |

| 09/11/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/11/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.