-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Talk Of Delay To BoE QT Grows Louder

EXECUTIVE SUMMARY

- BOE TO EXAMINE GILT SALES PLAN IN WAKE OF TURMOIL (MNI)

- BOE SET TO FURTHER DELAY QUANTITATIVE TIGHTENING UNTIL GILT MARKETS CALM (FT)

- I'LL LEAD TORIES INTO NEXT ELECTION, SAYS EMBATTLED LIZ TRUSS (BBC)

- TIME RUNNING OUT FOR LIZ TRUSS, SAY TORY MPS (FT)

- NAGEL SAYS ECB MUST WITHDRAW SUPPORT QUICKLY, NOT STOP TOO EARLY (BBG)

- ECB’S VILLEROY: ECB TO HIKE AT SLOWER PACE AFTER DEPOSIT RATE REACHES 2% (FT)

- EU TO ANNOUNCE INTERIM GAS MARKET STEPS WITH NO QUICK PRICE CAP (BBG)

- WHITE HOUSE PLANNING OIL RESERVE RELEASE ANNOUNCEMENT THIS WEEK (BBG)

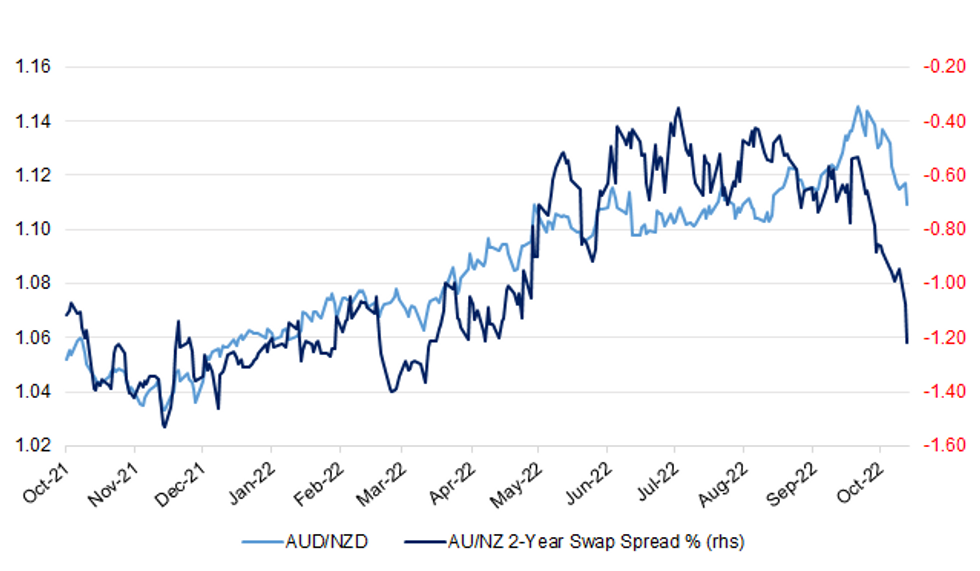

Fig. 1: AUD/NZD Vs. AU/NZ 2-Year Swap Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England is likely to delay the sale of billions of pounds of government bonds in a bid to foster greater stability in gilt markets following the UK’s failed “mini” Budget. The bank had already delayed the start of its sale of £838bn of gilts bought under its quantitative easing programme from October 6 to the end of this month. It is now expected to bow to investor pressure for a further pause until the market becomes calmer. The Financial Times has learnt that the bank’s top officials have come to this view after judging the gilts market to be “very distressed” in recent weeks, a view backed by its Financial Policy Committee. (FT)

BOE: Recent market turmoil means the Bank of England’s five-member Executive will need to consider pushing back the start of active gilt sales from Oct 31, though the initially positive reaction to government U-turns on tax cuts and fiscal support for higher energy prices may ease concerns over further delays to the plans. (MNI)

FISCAL: Britain's new finance minister Jeremy Hunt said on Monday that the economic forecasts which the country's independent fiscal watchdog OBR is set to publish by the end of this month will show government debt falling as a proportion of income. (RTRS)

FISCAL: Britain's new finance minister Jeremy Hunt said on Monday he was forming an Economic Advisory Council to provide him with "independent expert advice" as he tries to lead the economy out of a crisis of confidence among investors. (RTRS)

POLITICS: Liz Truss has insisted she will lead the Tories into the next general election, despite U-turns leaving her battling to salvage her authority. The PM apologised for making mistakes, after the new chancellor Jeremy Hunt junked almost all of her tax-cutting plans to stabilise market turmoil. She added her month-old premiership "hasn't been perfect," but she had "fixed" mistakes. (BBC)

POLITICS: There were two prime ministerial performances in the House of Commons on Monday, but neither of them were delivered by Liz Truss. The first, by House of Commons leader Penny Mordaunt, reminded Tories of what it is to have a leader who can command the chamber. (FT)

POLITICS: British Prime Minister Liz Truss met earlier on Monday with lawmaker Graham Brady, who heads up the committee in charge of running Conservative Party leadership contests, The Guardian reported, citing sources from Truss's office. (RTRS)

EUROPE

ECB: The European Central Bank must continue to rapidly roll back monetary support and not halt interest-rate increases too early, according to Governing Council member Joachim Nagel. (BBG)

ECB: Villeroy declined to comment on Macron’s concerns. But he expressed irritation at the idea the ECB risked pushing the economy into recession, saying this “misses the point”. The “predominant” risk was not higher rates, but the energy crisis. The ECB would continue to “go quickly” until its deposit rate reached 2 per cent — the so-called neutral rate of interest at which it neither stimulates nor restricts the economy — at the end of the year. Any increases beyond that point would be at “a more flexible and slower pace”, he said. The ECB aims to start shrinking the €9tn balance sheet that ballooned during the pandemic once rates are at neutral. Villeroy said from the end of this year the bank could stop replacing some of the bonds maturing under its €3.26tn asset purchase programme. (FT)

FISCAL/ENERGY: The European Union plans to propose using as much as 40 billion euros ($39.2 billion) from the bloc’s budget to support people and companies struggling to cope with high prices caused by the energy crisis. (BBG)

GERMANY: German Chancellor Olaf Scholz has ordered that the lifespan of the country's last three nuclear power plants should be extended until April 15 next year “at the longest,” according to a letter obtained by POLITICO. (POLITICO)

FRANCE: The time for talking is over, French Finance Minister Bruno Le Maire said on Monday, as the government ordered more fuel depot staff back to work to try to restore petrol supplies, disrupted by strikes for weeks. (RTRS)

ITALY: Giorgia Meloni, expected to be named Italian prime minister, and her coalition partner Silvio Berlusconi had a cordial meeting on Monday and aim to quickly form a "cohesive" government, their parties said. (RTRS)

U.S.

EQUITIES: Microsoft laid off employees in teams across the company, according to affected employees who spoke to Insider. This week's layoffs affect less than 1,000 employees, according to a person familiar with the matter. (Business Insider)

OTHER

GLOBAL TRADE: The US chip curbs on Taiwan semiconductor industry has not much impact as the ban targets high-performance computing chips, which are designed by US companies and produced by Taiwan, Minister of Economic Affairs Wang Mei-hua told reporters in Taipei. (BBG)

BOJ: The Bank of Japan board is expected to revise up its median forecast for inflation this fiscal year as corporate pass-through of cost increases has been stronger and more broad than predicted in July, MNI understands. (MNI)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Tuesday he had no intention of stepping down, when asked by an opposition lawmaker on whether he would take responsibility for failing to achieve his 2% inflation target and hurting the economy with a weak yen. (RTRS)

JAPAN: Japanese Finance Minister Shunichi Suzuki said on Tuesday authorities would respond appropriately to excessive currency moves driven by speculators, as the yen fell to a fresh 32-year low to the dollar. (RTRS)

RBA: The Reserve Bank’s decision to reduce the size of the interest rate rises this month had been “finely balanced” with the risk of a global and domestic economic slowdown, but further interest rate rises are likely to be required, minutes from the central bank’s October board meeting show. (Guardian)

RBA: The Reserve Bank of Australia slowed the rate at which it has been raising interest rates earlier this month, but it could still outpace its global central bank peers over coming months if conditions warrant, RBA Deputy Governor Michele Bullock said Tuesday. (Dow Jones)

RBNZ: New Zealand’s main opposition National Party doesn’t want the government to reappoint Reserve Bank Governor Adrian Orr for another five-year term, preferring a 12-month extension until after the 2023 election. (BBG)

MEXICO: A near-certain US recession next year will likely pull Mexico’s economy into a contraction, Bloomberg Economics’ models show. (BBG)

BRAZIL: Brazilian presidential candidate Luiz Inacio Lula da Silva saw his lead over incumbent President Jair Bolsonaro slightly drop ahead of the Oct. 30 runoff vote, according to a survey by pollster IPEC published on Monday. (RTRS)

RUSSIA: Russia still has not notified the United States about exercises of its nuclear forces that Washington has said it expects Moscow to soon carry out, a senior U.S. military official said on Monday. (RTRS)

RUSSIA: The United States will hold Russia accountable for "war crimes", the White House said on Monday, hours after Russia attacked Ukrainian cities with drones during morning rush hour, killing at least four people in an apartment building in Kyiv. (RTRS)

TURKEY: The Turkish Central Bank said on Tuesday it revised the securities maintenance ratio to 5% from 3% and that further steps as part of its "liraization strategy" will be taken in the rest of the year and in 2023. (RTRS)

SOUTH AFRICA: South Africa’s state-owned ports and rail operator reached a three-year wage deal with its biggest labor union, with its members agreeing to immediately call off a strike that caused a costly slowdown of exports of minerals and other goods. (BBG)

SOUTH AFRICA: South Africa’s energy utility company said it will reduce power due to the breakdown of five generators at five power stations overnight. The cuts will be implemented until further notice. (BBG)

EQUITIES: South Korea is considering temporarily banning short selling of shares and activating a stock market stabilization fund if there’s a risk that the Kospi index will fall below the key psychological 2,000 level, Chosun Ilbo newspaper reported. (BBG)

METALS: Rio Tinto on Tuesday forecast annual iron ore shipments at the lower end of its outlook after third-quarter iron ore deliveries fell amid weak global demand, particularly in top metals consumer China. (Mining.com)

METALS: Vale SA, the world’s No. 2 iron ore producer, churned out more of the steelmaking ingredient than expected last quarter to add further pressure to prices that have been battered by recession fears. (BBG)

ENERGY: The European Union is unveiling a new emergency package to tackle the energy crunch, betting on steps to bolster solidarity among member states. But the bloc will refrain from immediate gas-price caps amid political divisions and concerns over security of supply. (BBG)

ENERGY: Spain’s national gas grid operator Enagas said on Monday it may have to reject unloads of liquefied natural gas (LNG) due to overcapacity at its terminals. (RTRS)

OIL: The United Arab Emirates (UAE) on Monday said it fully stands with Saudi Arabia in its efforts to support energy stability and security, UAE state news agency (WAM) reported, citing a foreign ministry statement. (RTRS)

OIL: India is averse to joining a US-led global initiative to cap prices of Russian crude oil, two people aware of the matter said, as it gets a steep discount on oil cargoes from Russia and wants to maintain the relationship with its long-time strategic partner. As the world’s third-largest oil importer, India’s stand is likely to influence the efficacy of the price cap plan. (Mint)

OIL: The Biden administration is moving toward a release of another 10 million to 15 million barrels of oil from the nation’s emergency stockpile in a bid to balance markets and keep gasoline prices from climbing further, according to people familiar with the matter. (BBG)

CHINA

POLITICS: Chinese leader Xi Jinping is preparing to name loyalists to top positions in the Communist Party hierarchy, according to people close to party leaders, in a move that would strengthen his hand as he confronts mounting challenges at home and abroad—from a sluggish domestic economy to Western resistance to Beijing’s ambitions on the world stage. (WSJ)

ECONOMY: China should switch its economic growth focus to a greater reliance on the domestic market before weakening external demand reaches an inflection point, wrote Guan Tao, a former foreign exchange official and now global chief economist of BOC Securities, in a blog post. (MNI)

PBOC: China’s reserve ratio is unlikely to be cut this month as the central bank has just renewed medium-term lending facility and the market liquidity gap is small, Shanghai Securities News reports, citing analysts and traders. (BBG)

PBOC: The People’s Bank of China’s roll-over of a maturing CNY500 billion medium-term lending facilities with the same amount on Monday will provide commercial banks with ample liquidity to increase lending in Q4 and signals increased support for the real economy, China Securities Journal reported citing analysts. (MNI)

PROPERTY: Several Chinese cities including Tianjin and Shijiazhuang have seen the mortgage rate for first-home buyers drop below 4% in October after the People’s Bank of China allowed eligible cities with fast falling home prices to let rates fall below the floor of 4.1%, the Securities Daily reported. (MNI)

PROPERTY/CREDIT: Chinese junk dollar bonds have dropped to a record low, as a property crisis sparked by a crackdown on excessive borrowing and a slide in home sales shows few signs of turning around without more policy steps. (BBG)

CORONAVIRUS: Some indoor facilities including cinemas, museums, gyms and bars in Nanjing are shut from Tuesday amid a Covid outbreak in the eastern Chinese city, according to a local government statement. (BBG)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.0% on Tuesday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7252% at 9:26 am local time from the close of 1.4647% on Monday.

- The CFETS-NEX money-market sentiment index closed at 50 on Monday vs 45 on Friday.

CHINA SETS YUAN CENTRAL PARITY AT 7.1086 TUES VS 7.1095 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1086 on Tuesday, compared with 7.1095 set on Monday.

OVERNIGHT DATA

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 82.2; PREV 84.6

Consumer confidence plunged 2.8% as inflation expectations jumped to its highest since late July when petrol prices last peaked. (ANZ)

NEW ZEALAND Q3 CPI +7.2% Y/Y; MEDIAN +6.5%; Q2 +7.3%

NEW ZEALAND Q3 CPI +2.2% Q/Q; MEDIAN +1.5%; Q2 +1.7%

NEW ZEALAND Q3 CPI TRADEABLE +2.2% Q/Q; MEDIAN +1.2%; Q2 +1.9%

NEW ZEALAND Q3 CPI NON-TRADEABLE +2.0% Q/Q; MEDIAN +1.8%; Q2 +1.4%

NEW ZEALAND Q3 SECTORAL FACTOR MODEL INFLATION +5.4% Y/Y; Q2 +5.2%

NEW ZEALAND SEP NON-RESIDENT BOND HOLDINGS 57.7%; AUG 58.4%

MARKETS

SNAPSHOT: Talk Of Delay To BoE QT Grows Louder

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 396.19 points at 27171.95

- ASX 200 up 120.56 points at 6785

- Shanghai Comp. up 4.796 points at 3089.738

- JGB 10-Yr future up 5 ticks at 148.25, yield down 0.5bp at 0.25%

- Aussie 10-Yr future up 11.5 ticks at 96.070, yield down 11.9bp at 3.904%

- U.S. 10-Yr future up 0-11+ at 111-02, yield down 4.32bp at 3.9651%

- WTI crude up $0.67 at $86.13, Gold up $9.16 at $1659.24

- USD/JPY down 21 pips at Y148.83

- BOE TO EXAMINE GILT SALES PLAN IN WAKE OF TURMOIL (MNI)

- BOE SET TO FURTHER DELAY QUANTITATIVE TIGHTENING UNTIL GILT MARKETS CALM (FT)

- I'LL LEAD TORIES INTO NEXT ELECTION, SAYS EMBATTLED LIZ TRUSS (BBC)

- TIME RUNNING OUT FOR LIZ TRUSS, SAY TORY MPS (FT)

- NAGEL SAYS ECB MUST WITHDRAW SUPPORT QUICKLY, NOT STOP TOO EARLY (BBG)

- ECB’S VILLEROY: ECB TO HIKE AT SLOWER PACE AFTER DEPOSIT RATE REACHES 2% (FT)

- EU TO ANNOUNCE INTERIM GAS MARKET STEPS WITH NO QUICK PRICE CAP (BBG)

- WHITE HOUSE PLANNING OIL RESERVE RELEASE ANNOUNCEMENT THIS WEEK (BBG)

US TSYS: Firmer As Asia Fades NY Weakness & Reacts To BoE QT Delay Reports

Tsys firmed into London hours on the back of an FT source report which suggested that “the Bank of England is likely to delay the sale of billions of pounds of government bonds in a bid to foster greater stability in gilt markets following the UK’s failed “mini” Budget.”

- The space was already trading on the front foot as Asia faded the cheapening observed in Monday’s NY session, after the NY move lacked a clear headline driver.

- That leaves TYZ2 +0-11+ at 111-02, 0-02 off the top of its 0-14 overnight range, operating on decent volume of ~115K (~38K of which has crossed since the BoE story from the FT hit an hour ago). Cash Tsy trade sees 3.0-5.5bp of richening across the curve, with the 5- to 7-Year zone leading and the long end lagging.

- On the flow side, we have seen block sellers of TY futures (-1.8K & -1.9K), pre-BoE headlines, a block sale of TYX2 109.50 puts (-5K) which triggered screen-based flows and screen buying of FVZ2 107.50 calls.

- Gilt markets will be eyed once again, especially given the broader market reaction surrounding the FT story.

- Tuesday’s NY docket will see the release of industrial production data, as well as TIC flows and the NAHB housing market index. We will also get Fedspeak from Bostic & Kashkari.

JGBS: Curve Steepens Little Around 20-Year Supply Dynamics

JGBs have been subjected to some light steepening pressure, after the super-long saw some modest concession into 20-Year JGB supply. Cash JGBs run 0.5bp richer to 1.5bp cheaper ahead of the close, twist steepening.

- The auction saw the low price miss wider dealer expectations, although the cover ratio ticked higher and the tail width moderated from that seen in September. We remind you that last month’s auction was particularly weak, meaning that last month’s cover ratio (which was the lowest observed at a 20-Year auction since ’12) and particularly wide tail provide very low comparison bars. This month’s cover ratio was pretty much bang in line with the 6-auction average.

- The super-long end failed to rally, even as JGB futures caught a light bid on the back of the previously covered speculation re: a delay to the BoE’s implementation of QT. JGB futures trade +6 into the bell, sticking to a narrow range within the boundaries established during the overnight session.

- BoJ Governor Kuroda stressed that JPY weakness is becoming a factor re: inflation (this comes after various reports, including one from our own policy team, flagged an incoming upside adjustment to the BoJ’s inflation projection for the current FY).

- An address from BoJ’s Adachi headlines tomorrow’s domestic docket.

JGBS AUCTION: 20-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y972.7bn 20-Year JGBs:

- Average Yield: 1.123% (prev. 0.894%)

- Average Price: 99.62 (prev. 100.09)

- High Yield: 1.133% (prev. 0.945%)

- Low Price: 99.45 (prev. 99.25)

- % Allotted At High Yield: 57.5980% (prev. 96.6666%)

- Bid/Cover: 3.263x (prev. 2.506x)

AUSSIE BONDS: Firmer After Two-Way Offshore Cross Currents Drive Activity

Aussie bonds latched on to the wider bid in core global FI markets which came on the back of an FT report which pointed to the likely delay of the BoE’s QT plans, allowing the space to move to best levels of the Sydney session, with YM +9.5 and XM +11.5 ahead of the bell, just off their respective peaks.

- Cash ACGBs run 7-11.5bp richer, with the 10- to 12-year zone outperforming for much of the day.

- EFPs sit wider, albeit off session wides, with the 3-/10-Year box flattening a touch.

- Bills are 2p cheaper to 12bp richer, twist flattening, after bear flattening earlier in the session. RBA dated OIS has seen receive side flow in the wake of the BoE story from the FT, with terminal rate pricing back below 4.00% after showing above 4.10% in the wake of a firmer than expected NZ CPI print earlier in the session.

- The initial impulse from data seen across the ditch weighed on Aussie bonds before the broader core FI bid provided support at different stages of the day.

- An address from RBA Deputy Governor Bullock and the minutes from the October RBA meeting failed to move the needle for markets.

- Looking ahead, the Westpac leading index and A$800mn of ACGB Apr-29 supply are due on Wednesday.

NZGBS: CPI Triggers RBNZ Repricing, Front-End Weakness & Payside Swap Flow

NGBS ultimately twist flattened on Tuesday, recovering from their post NZ-CPI lows, with the firmer than expected headline and non-tradable readings triggering a repricing of RBNZ tightening expectations.

- RBNZ dated OIS now price a terminal OCR of ~5.25%, just over 20bp higher on the day and in line with the most aggressive of the new calls from the “Big 4” domestic banks (held by ASB), albeit shy of the intraday peak of just over 5.35%.

- Cash NZGBs were 7.5bp cheaper to 0.5bp richer at the close, pivoting around 10s.

- Payside flow dominated in swaps post-CPI, with swap spreads wider across the curve. 2-Year swap rates printed a fresh cycle high of 5.20% before moderating, closing at 5.14%, just over 14bp higher on the day.

- Elsewhere, we saw the RBNZ sectoral factor inflation model accelerate to +5.4% Y/Y in Q3 (against an upwardly revised +5.2% in Q2).

- A light bid in the U.S. Tsy space and lack of overtly hawkish rhetoric from RBA Deputy Governor Bullock across the Tasman, along with the relatively late cycle nature of the NZ economy, probably allowed the space to stabilise a little.

- Non-resident bond holdings of NZ bonds slipped to 57.7% in Sep vs. 58.4% in Aug.

- Tomorrow’s local docket is empty.

OIL: Oil Prices In A Holding Pattern As Market Struggles With Conflicting Forces

Oil prices are up slightly on the day as markets continue to struggle between signs that the market is tight and global demand concerns. WTI is up about 0.4% to around $86/bbl and the 20-day moving average held as a floor for prices. Brent is up around 0.4% to $92/bbl.

- The Whitehouse is planning an announcement this week relating to a release from the strategic oil reserve of a possible 10 to 15 million barrels to ease pressure on gasoline prices ahead of the mid-term elections, according to Bloomberg. There is also talk of an export cap being imposed on diesel and gasoline in November.

- The oil market remains worried by the impact that China’s continued Zero-Covid policy will have on demand.

- On the supply front, the OPEC+ output cuts hit in November, there’s been unwinding of investments in Russia by foreign entities, and the US EIA also reduced its shale-oil supply forecasts for October to 9mbd from 9.12mbd. However, it expects November production to be up slightly to 9.11mbd.

GOLD: Holding Yesterday's Gains

Gold is holding up better than most other commodities (e.g. copper and iron ore). The precious metal sits just above $1651 currently, slightly up on NY closing levels. We gained 0.34% yesterday, amid a broad pull back in the USD.

- Today the USD is slightly firmer against the likes of EUR, GBP & AUD, which has knocked gold off earlier highs, just above $1653.50, but we remain above overnight lows around $1647.

- In terms of topside levels, we did get above $1668 overnight, while moves into the $1670/80 region have generally capped gold since late last week.

- Outside of USD gyrations, the broader technical set up for gold still looks to be a negative one. We are still within striking distance of lows from last week around $1640.

- The steady picture in US real yields is likely lending some support though. The real US 10yr is not breaking higher, holding in a 1.55-1.65% range in recent weeks.

FOREX: NZD Soars As Hot CPI Print Boosts OCR-Hike Bets, GBP Gains On Potential For BoE QT Delay

The kiwi dollar held the bulk of gains registered on the back of an expectation-busting consumer inflation report, while the fluctuation in risk appetite drove price action across the wider G10 FX space. In New Zealand data, headline inflation printed at +7.2% Y/Y, considerably above the median estimate (+6.5%) and RBNZ projection (+6.4%), supporting the case for continued aggressive monetary tightening from the RBNZ. The insights from the Stats NZ report were reinforced by the RBNZ's preferred metric of core inflation (sectoral factor model), which accelerated to an all-time high of +5.4% Y/Y.

- The addition of hawkish OCR-hike bets sees the OIS strip price ~70bp worth of tightening at the November meeting (+10.9bp on the day), while 2-Year swaps soared to levels last seen in 2008. This came alongside a flurry of hawkish revisions to sell-side views, as the choir of voices calling for a 75bp rate hike next month grew louder, while terminal rate estimates were reset higher.

- Initial risk-on flows were starting to moderate, when a leap higher in U.S. e-mini futures reinstated the positive tone. E-mini S&P 500 contract extended through last week's highs, clearing its 20-EMA in the process, which sent the BBDXY index to new session lows (1,337.57).

- Shortly thereafter, another round of greenback sales came on the back of an FT report noting that the BoE was likely to delay quantitative tightening in pursuit of greater stability in gilt markets. Cable spiked to fresh session highs, testing the $1.1400 figure, while the BBDXY sank to its lowest point since Oct 7 (1,336.69).

- Greenback weakness provided some reprieve to the yen, even as it was the second-worst G10 performer. Participants remained on intervention watch, as top officials stuck to their familiar script, with FinMin Suzuki noting that they "will be watching markets with a sense of urgency today."

- Focus turns to German ZEW survey, U.S. industrial output & Canadian housing starts. Speeches are due from Fed's Bostic & Kashkari, ECB's Makhlouf & Schnabel and Riksbank's Jansson.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/10/2022 | 0800/1000 |  | IT | Trade Balance | |

| 18/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/10/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 18/10/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 18/10/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 18/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/10/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 18/10/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/10/2022 | 1600/1800 |  | EU | ECB Schnabel Alumni Event at Uni Mannheim | |

| 18/10/2022 | 1800/1400 |  | US | Atlanta Fed's Raphael Bostic | |

| 18/10/2022 | 2000/1600 | ** |  | US | TICS |

| 18/10/2022 | 2130/1730 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.