-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Turkey Election Likely Headed For Runoff, US Debt Talks On Tuesday

EXECUTIVE SUMMARY

- US DEBT CEILING TALKS TENTATIVELY SET FOR TUESDAY: NBC

- G7 LEADERS TO TARGET RUSSIAN ENERGY, TRADE IN NEW SANCTIONS STEPS - RTRS

- TURKEY FACES RUNOFF ELECTION WITH ERDOGAN LEADING - RTRS

- ITALY OVERHAULS PLANS FOR €200BN IN EU COVID RECOVERY FUNDS - FT

- RBA NEEDS TO CUT NAIRU ESTIMATE - EX-STAFFERS (MNI)

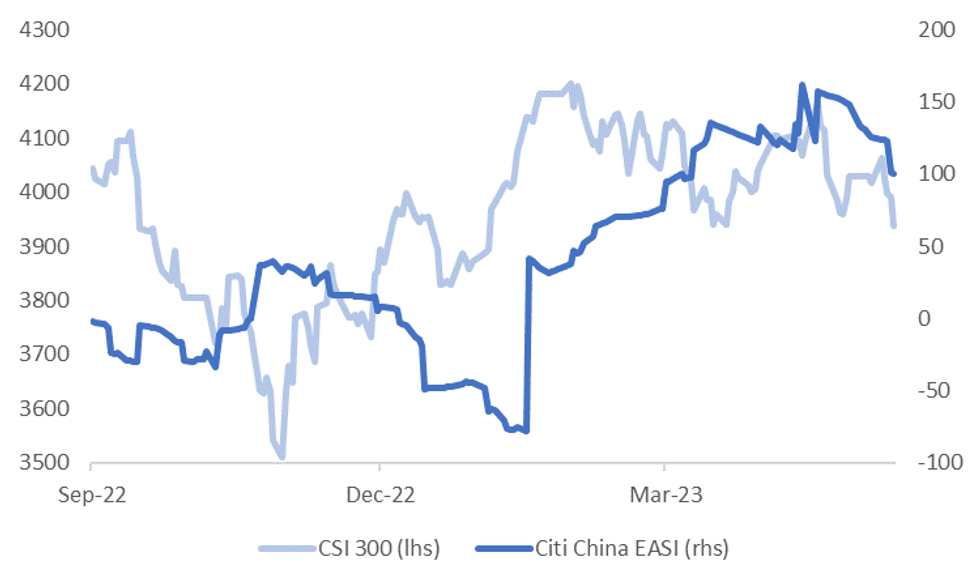

Fig. 1: CSI 300 Versus Citi China EASI

Source: Citi/MNI - Market News/Bloomberg

U.K.

Trade: UK and Switzerland are kicking off negotiation for a new free trade agreement (BBG)

EUROPE

ECB: The European Central Bank is in the final leg of its historic cycle of interest-rate increases, according to Vice President Luis de Guindos. “We have now entered the home stretch of our monetary policy tightening path,” Guindos told Il Sole 24 Ore. “And that’s why we are returning to normality, to 25 basis-point steps.” (BBG)

ECB: The European Central Bank needs to stick carefully to a data-dependent approach in weighing when and how much to raise interest rates, Governing Council member Ignazio Visco said. “We have agreed as a governing council to stick to the data as it becomes available,” Visco said in an interview after the Group of Seven finance chiefs meeting in Niigata, Japan. (BBG)

TURKEY: Turkey headed for a runoff vote after President Tayyip Erdogan led over his opposition rival Kemal Kilicdaroglu in Sunday's election but fell short of an outright majority to extend his 20-year rule of the NATO-member country. (RTRS)

ITALY: Italy is overhauling how it will spend €200bn of the EU’s Covid-19 recovery funds as it tries to avoid squandering cash on wasteful projects, or even worse, failing to spend the money in time. (FT)

U.S.

DEBT: A meeting between President Joe Biden and Congressional leaders to discuss the US debt ceiling has been tentatively set for Tuesday, NBC Capitol Hill Correspondent Julie Tsirkin says in a tweet, citing ‘multiple people familiar” with the situation. (NBC)

DEBT: U.S. President Joe Biden said on Sunday he expects to meet with congressional leaders on Tuesday for talks on a plan to raise the nation's debt limit and avoid a catastrophic default. Speaking to reporters in Delaware, Biden said he remained optimistic about agreeing on a deal. (RTRS)

DEBT: President Joe Biden said budget talks to avert a catastrophic US default are moving along and that negotiators will know more in the coming days. “We’ve not reached the crunch point yet but there’s real discussion about some changes we all could make,” Biden told reporters Saturday before boarding Air Force One. “But we’re not there yet.” (BBG)

DEBT: Treasury Secretary Janet Yellen will update Congress on how close the US is to defaulting on its financial obligations within the next two weeks and defended the steep rise of debt issuance under the Biden administration. (BBG)

OTHER

G7: Leaders of the Group of Seven (G7) nations plan to tighten sanctions on Russia at their summit in Japan this week, with steps aimed at energy and exports aiding Moscow's war effort, said officials with direct knowledge of the discussions. (RTRS)

G7: G7 finance ministers have warned of “heightened uncertainty” surrounding the global economy and the need to address regulatory gaps in the banking system in the wake of financial sector turmoil. (FT)

G7: Under the shadow of swelling risks to the global economy, finance chiefs from the world’s wealthy nations presented a united front with more support for Ukraine, a plan for diversifying supply chains and a vow to fill gaps in financial regulation. (BBG)

US/JAPAN/SOUTH KOREA: The leaders of Japan, the US and South Korea plan to hold a trilateral meeting in Hiroshima this week on the sidelines the Group of Seven nations summit to try to strengthen coordination and to respond to common challenges, according to a South Korean official. (BBG)

ARGENTINA: Argentina will announce on Monday a new round of emergency government measures, including raising interest rates 600 basis points to 97 per cent, to try to stave off the country’s worst economic crisis in two decades. (FT)

JAPAN: A meeting of the government's top economic council on Monday focused on whether recent rises in inflation and wage growth suggest Japan is approaching a sustained exit from deflation. (RTRS)

SOUTH KOREA/JAPAN: Samsung to build chip development facility in Japan, $222m investment expected to spur collaboration between Japan, South Korea. (Nikkei)

INDIA: The ruling Bharatiya Janata party has lost control of a crucial southern state to the Indian National Congress in a closely watched election, dealing a rare political setback to prime minister Narendra Modi a year before a national poll. (FT)

AUSTRALIA: The Reserve Bank of Australia should lower its estimate of the unemployment rate compatible with stable inflation as the post-Covid labour market runs hot, former RBA economists told MNI. The RBA’s Non-Accelerating Inflation Rate of Unemployment (NAIRU) estimate remains unchanged from its pre-Covid 4.5%, despite a downward trajectory leading into the pandemic (see chart below), according to Blair Chapman, director at Deloitte Access Economics and a former RBA research economist and lead analyst. (MNI)

AUSTRALIA: Newmont Corp. is nearing a deal to acquire Newcrest Mining Ltd. for about A$29.4 billion ($19.5 billion), according to people familiar with the matter, creating the world’s biggest gold miner. (BBG)

NZ: New Zealand announced an NZ$1 billion ($619 million) flood and cyclone recovery package as part of its yearly budget, after being smashed by rough weather including a cyclone that ravaged the country’s North Island. (BBG)

NZ: The budget’s 2023 Flood and Cyclone recovery package “will boost resilience against future extreme weather events with an investment of NZ$100 million ($62 million) in flood protection,” ministers say in statement. (BBG)

THAILAND: Thailand's opposition secured a stunning election win on Sunday after trouncing parties allied with the military, setting the stage for a flurry of deal-making over forming a government in a bid to end nearly a decade of conservative, army-backed rule. (RTRS)

CHINA

GEOPOLITICS: Chinese Communist Party’s mouthpiece issues national security warning to foreign firms after Capvision raids. (SCMP)

EXPORTS: Guangdong exported CNY1.68 trillion of goods and services over January to April, an increase of 5.4% y/y, according to data from the Guangdong Branch of the General Administration of Customs. The export sector benefited from the border reopening with Hong Kong, with mechanical and electrical products up 2.3% y/y accounting for 66% of the regions total exported value. New growth areas have increased strongly with lithium batteries and solar batteries up 35.4%, and 102.4%. Guangzhou‘s customs area exported over 11,000 new energy vehicles, up 316.1% y/y, which has become a new growth point for foreign trade. (Source: 21st Century Herald). (MNI)

CHINA/AUSTRALIA: Australia has pushed back firmly on China’s calls for greater foreign investment access, with Trade Minister Don Farrell defending blocking purchases on national security grounds, while moving quickly to resolve biosecurity bottlenecks delaying electric vehicle imports by Chinese firms. (AFR)

CHINA MARKETS

PBOC NET DRAINS CNY2BN VIA OMOs MONDAY

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos and CNY125 billion via 1-year MLF on Monday, with the rates unchanged at 2.00% and 2.75%, respectively. The operation has led to a net drain of CNY2 billion after setting off the maturity of CNY4 billion reverse repo today, while the MLF will inject CNY25 billion into the market after offsetting the maturity of CNY100 billion MLF Tuesday, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9564% at 09:31 am local time from the close of 1.8089% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 48 on Friday, compared with the close of 50 on Monday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 6.9654 MON VS 6.481 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9654 on Monday, compared with 6.9481 set on Friday.

OVERNIGHT DATA

NZ APR PERFORMANCE SERVICES INDEX 49.8; PRIOR 53.8

JAPAN APR PPI M/M 0.2%; MEDIAN 0.0%; PRIOR 0.1%

JAPAN APR PPI Y/Y 5.8%; MEDIAN 5.6%; PRIOR 7.4%

CHINA MAY 1YR MLF RATE 2.75%; MEDIAN 2.75%; PRIOR 2.75%

CHINA MAY 1YR MLF VOLUMES 125bn YUAN; MEDIAN 100bn YUAN; PRIOR 170bn YUAN

MARKETS

US TSYS: Little Changed In Muted Asian Session

TYM3 deals at 115-13+, -0-00+, with a 0-04 range observed on volume of ~44k.

- Cash tsys sit little changed across the major benchmarks.

- Tsys have observed narrow ranges with little follow through on moves in Monday's Asian session.

- A recovery off session lows in e-minis, and mild pressure on the USD helped tsys firm off early lows. A fall in WTI futures also added a layer of support.

- Little meaningful macro news flow crossed.

- A meeting between President Joe Biden and Congressional leaders to discuss the US debt ceiling has been set for Tuesday.

- In Europe today we have German Whole Prices and Eurozone Industrial Production, further out US Empire Manufacturing is on the wires. Fedspeak from Atlanta Fed President Bostic, Chicago Fed President Goolsbee and Minneapolis Fed President Kashkari will cross.

JGBS: Futures Sitting Weaker, Near Cheaps After PPI Beat

JGB futures sit near Tokyo session cheaps in afternoon trading, -24 versus settlement levels.

- Higher-than-expected April PPI, which came ahead of monthly CPI data later in the week, appears to have assisted today’s relatively weak performance.

- 5-year supply saw relatively smooth digestion with the low price coming in line with dealer expectations, although the cover ratio did decline, and the tail increased since last month's auction.

- Cash JGBs are 0.3-1.2bp weaker across the curve, except for the 2-year zone, with the curve steeper. The benchmark 10-year yield is 1.2bp higher at 0.402%, below the BoJ's YCC limit of 0.50%. The 5-year benchmark is 0.4bp cheaper at 0.111%, little changed from levels prevailing before the JGB supply.

- The swap curve bear steepens with swap spreads wider outside of the 1-year zone.

- The local calendar is light tomorrow ahead of Q1 GDP (preliminary) on Wednesday and National CPI on Friday.

- BoJ Rinban operations covering 1-10-year and 25-Year+ JGBs are scheduled for tomorrow ahead of 20-year JGB supply on Wednesday.

- Further afield, the global calendar is light ahead of tomorrow’s data dump in China, the Euro Area's Q1 GDP and US Retail Sales.

AUSSIA BONDS: Weaker, At Cheaps, RBA Minutes Tomorrow

ACGBs are weaker (YM -8.0 & XM -7.5), near session cheaps, after trading in a relatively narrow range for the Sydney session. Without meaningful economic data or headlines, the local market has traded in sympathy with US tsys, ahead of a heavy domestic calendar. US tsys are little changed in Asia-Pac trade, holding near cheaps seen in the NY session ahead of the weekend.

- Cash ACGBs are 7-8bp cheaper with the AU-US 10-year yield differential unchanged at -7bp.

- Swap rates are 7-8bp higher with the 3s10s curve flatter.

- The bills strip has bear steepened with pricing -5 to -11.

- RBA dated OIS are 2-9bp firmer across meetings with late ‘23/early ’24 leading. A 16% chance of a 25bp hike is priced for June. the expected terminal rate has moved back to 3.96%, just shy of the post-May hike high of 3.97%. The move higher in terminal rate expectations has been assisted by a firming in US STIR, which troughed ahead April non-farm payrolls.

- The local calendar heats up tomorrow with the release of RBA Minutes for May, ahead of Q1 Wage Price Index (Wed) and the April Employment (Thu).

- Further afield, the global calendar is light ahead of tomorrow’s data dump in China, the Euro Area's Q1 GDP and US Retail Sales.

NZGBS: Cheaper, Tight Range, Budget on Thursday

NZGBs closed 3-4bp, near session cheaps, after trading in a relatively tight range. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined announcement of the NZ$1 billion flood and cyclone recovery package. Accordingly, local participants appeared content to be on headlines and US tsys watch throughout today’s session.

- Swap rates closed 2-3bp higher with the 2s10s curve flatter, and the implied long-end swap spread tighter.

- RBNZ dated OIS closed 1-5bp firmer out to Feb’24 with 22bp of tightening priced for the upcoming May 24 meeting.

- The PSI index fell from a revised 53.8 in March to 49.8 in April. The current level is below the long-term average of 53.6 for the first time since December.

- The local calendar is light ahead of the Budget on Thursday.

- Before then, the local market is likely to eye the release of Australia's of the RBA Minutes for May tomorrow, Q1 Wage Price Index on Wednesday, and the April Employment Report on Thursday.

- Further afield, the global calendar is light ahead of tomorrow’s data dump in China, the Euro Area's Q1 GDP (2nd estimate) and US Retail Sales.

FOREX: Antipodeans Firmer, Yen Pressured In Asia

AUD and NZD are the strongest performers in the G-10 space at the margins today, both are ~0.2% higher on Monday. The Yen is pressured, USD/JPY has printed its highest level since May 3.

- AUD/USD is now up ~0.2% printing at $0.6660/65. Resistance is seen at $0.6818 10 May high. NAB has returned to its February call that rates will peak at 4.1% in August or possibly July.

- Kiwi is also 0.2% firmer, benefitting from spillover in the AUD as well as improved risk sentiment as e-minis tick off session lows to sit unchanged from Fridays closing levels.

- Yen is pressured, USD/JPY prints at ¥136.10/20 this is the highest level in the pair since May 3rd, bulls target high from May 3 at ¥136.63. Apr PPI was marginally firmer than expected, printing at 0.2% M/M above the expected 0.0%.

- Elsewhere in G-10 EUR is 0.1% however ranges have been narrow thus far.

- Cross asset wise; e-minis are flat however the contract was down ~0.3% in early dealing. BBDXY is little changed as are US Treasury Yields.

- In Europe today we have German Whole Prices and Eurozone Industrial Production, further out US Empire Manufacturing crosses.

EQUITIES: Japan Still Outperforming, While China Shares Struggle

Most regional equity markets are tracking lower, although Japan markets remain a standout performer. The HSI is positive, but only modestly higher, while China mainland shares remain under pressure. US equity futures have mostly been in the red, but have recovered this afternoon from earlier lows. Eminis last near 4138.5, almost unchanged for the session.

- China shares continue to track lower, the CSI down 0.24% at this stage, while the Shanghai Composite Index is down nearly 1%. The CSI 300 is very close to multi-month lows. The on-hold MLF decision may have disappointed some in the market, while China's clamp down on data security may also be weighing on the outlook.

- The HSI is a touch higher, last +0.14%, while the Tech sub-index is down slightly. We did see a pull back in the China Dragon index during Friday trade in the US.

- Japan stocks are showing more positive momentum, the Topix around +0.85% firmer at this stage. Weaker yen levels (with JPY back to 136.15/20) are helping at the margin, while positive carry over from corporate earnings results is the other positive.

- The Kospi and Taeix are both down modestly, while the ASX isn't too far away from flat.

- The SET, in Thailand, couldn't sustain early positive momentum post Sunday's election results, with the opposition parties outperforming those aligned with the military. The SET was last -0.80%.

OIL: Crude Weaker Again Today, Tuesday Contains Key Events

Oil is down around 0.8% during APAC trading after falling 1.1% on Friday, as the market remained nervous regarding US debt ceiling negotiations and China’s lacklustre recovery. It is now down over 5% since the May 9 close. Brent is now around $73.58/bbl while WTI is under $70 at $69.50. The USD index is flat so far today.

- Brent and WTI remain above support levels of $71.28 and $68.43 respectively.

- Key events for crude this week include a swathe of data relating to China’s domestic economy and the IEA monthly outlook both released on Tuesday, as the demand outlook has been a key concern for oil markets. There is also US API inventory data on the supply side.

- Later today the European Commission releases updated economic forecasts. There is also March euro area IP data and the US New York Empire manufacturing index for May.

GOLD: Slightly Stronger In Asia-Pac, Showing Relative Resilience

In early Asia-Pacific trading, gold has firmed $3.29 (+0.16%) to 2014.02, continuing the relative resilience it displayed in trading ahead of the weekend. Gold declined a modest 0.2% to 2010.77 despite an increase in US tsy yields and a second day of dollar strength.

- MNI's technical team reports that gold is still on an uptrend, marked by a series of higher highs and higher lows. Moving average studies are also indicating a bullish setup. Investors are closely monitoring the March 8 high of $2070.4, which is the immediate target before the all-time high of $2075.5. Meanwhile, the key support level remains at $1969.3, which was the low point recorded on April 19th.

- Gold prices have remained above $2000 for the month of May, as investors anticipate the end of the Federal Reserve's tightening cycle. Concerns about the impasse over the US debt ceiling have also contributed to bullish market sentiment.

- Gold could reach $US2100 per ounce by December as US banking woes, high interest rates and uncertainty around the debt ceiling dampen the global economic outlook and boost safe-haven demand, ANZ economists predict.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/05/2023 | 0600/0800 | *** |  | SE | Inflation report |

| 15/05/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 15/05/2023 | - |  | EU | ECB Lagarde & Panetta in Eurogroup Meeting | |

| 15/05/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 15/05/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 15/05/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/05/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/05/2023 | 1315/0915 |  | US | Minneapolis Fed's Neel Kashkari | |

| 15/05/2023 | 1400/1000 |  | CA | BOC Financial System Survey report | |

| 15/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 15/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 15/05/2023 | 1600/1700 |  | UK | BOE Pill Monetary Policy Report Q&A | |

| 15/05/2023 | 2000/1600 | ** |  | US | TICS |

| 15/05/2023 | 2100/1700 |  | US | Fed Governor Lisa Cook Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.