-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: US TSYS Curve Flattens In Asia

EXECUTIVE SUMMARY

- FED’S DALY SAY NEUTRAL RATE COULD BE HIGHER - MNI BRIEF

- SCOPE FOR CHINA FISCAL, MONETARY STIMULUS SEENS AS LIMITED - MNI

- UK WAGE GROWTH COOLS As JOB CUTS MOUNT AND FIRMS CAP COSTS - BBG

- RBA RATE HIKES ARE COOLING PRICES, THOUGH LAGS REMAIN, KENT SAYS - BBG

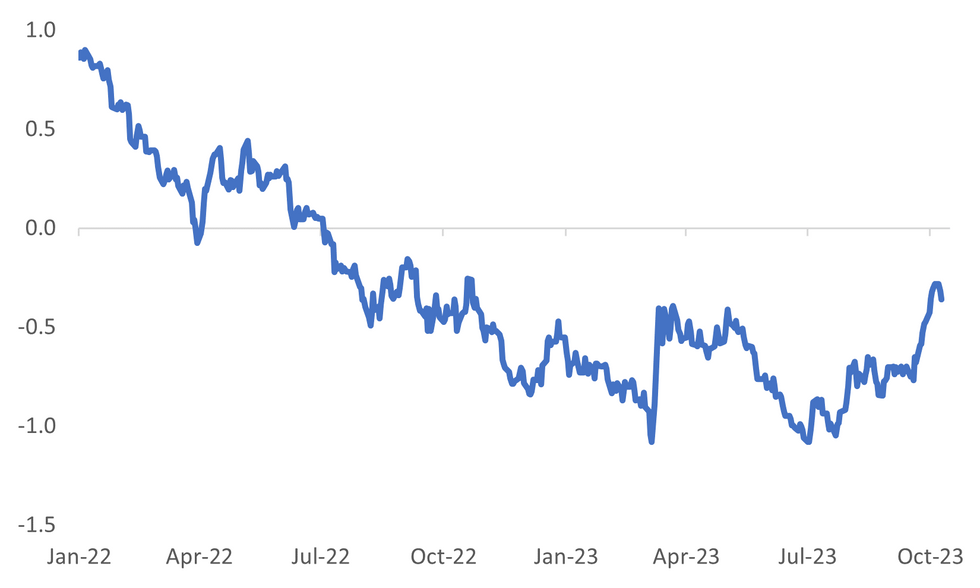

Fig. 1: US TSY 2/10s Curve

Source: MNI - Market News/Bloomberg

U.K

BOE: “The Bank of England may need to raise interest rates at least one more time and keep them there through much of next year, according to IMF assumptions, undermining hopes that the central bank may soon start cutting.” (BBG)

WAGES: “UK starting salaries and pay for temporary workers rose at their slowest pace in two and a half years in September, adding to signs that the labor market is cooling as higher interest rates weigh on the economy.” (BBG)

EUROPE

FINLAND: “Finland is on alert as it suspects a gas pipeline leak in the Baltic Sea was caused by a deliberate act of destruction, fueling concerns about the safety of Europe’s energy infrastructure.” (BBG)

U.S.

FED: The neutral rate of interest could be higher than pre-pandemic, San Francisco Fed President Mary Daly said Tuesday, weighing into a lively debate within the Federal Reserve system about what level of interest rates neither stimulates nor slows economic growth. (MNI BRIEF)

US/ISRAEL: “President Joe Biden said the US is speeding military assistance to Israel following Hamas’ surprise assault, and will stand by the Jewish state as it strikes back against the Palestinian militant group.” (BBG)

OTHER

JAPAN: “Japanese people’s views of China were the most negative since 2014 in a survey conducted by think tank Genron NPO in August and September.” (BBG)

SOUTH KOREA: “Samsung Electronics Co. reported its fourth straight quarterly sales decline, reflecting the severity of a sector-wide slump that continues to weigh on the world’s biggest maker of memory chips.” (BBG)

SOUTH KOREA: “Kia Corp's unionised workers in South Korea will go on a partial strike for six working days from Oct. 12 after three months of talks with the company stalled over wage increases and an extension of the retirement age, the company's union said.” (RTRS)

AUSTRALIA: “Australia’s most aggressive monetary policy tightening in about three decades is working to cool inflation, though lags in transmission mean the full effects of interest-rate increases to-date are still to be felt.” (BBG)

AUSTRALIA/CHINA: “China has conveyed its disapproval to Australia over a visit to Taiwan by former Prime Minister Scott Morrison, according to a Beijing diplomat, with the trip threatening to undermine efforts by both countries to improve relations ahead of a state visit later this year.” (BBG)

NEW ZEALAND: “Rabobank releases 3q survey of farmer confidence, in emailed statement. Shows net 72% of farmers expect agricultural economic conditions to deteriorate in the coming 12 months, up from 57% in 2q.” (BBG)

NEW ZEALAND: “New Zealand is seeing a record inflow of migrants, adding to risks that inflation pressures may persist longer than the central bank expects.” (BBG)

CHINA

POLICY: China will continue to face economic headwinds this year as consumption remains soft, the property sector fails to rebound and monetary and fiscal easing remains limited in its scope despite market positioning for further accommodative policies, economists and advisors told MNI. (MNI)

BANKS: “No new refinancing projects of listed banks have passed the final review since the securities regulator announced new rules to control large amounts of refinancing and restrict listed companies which fall on debut or fall below net-asset value to refinance in August.” (Yicai)

CARS: “China’s financial regulator will ease rules for people applying for loans to buy cars and reduce down-payment requirements to boost consumption, 21st Century Business Herald reports, citing a government document.” (BBG)

STOCK MARKET: “More private funds have built long positions in Chinese equities in anticipation that a slump in the market is close to an end, Securities Times reports, citing fund managers.” (SECURITIES TIMES)

CHINA MARKETS

MNI: PBOC Drains Net 315 Bln Via OMO Weds; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY102 billion via 7-day reverse repo on Wednesday, with the rate unchanged at 1.80%. The operation has led to a net drain of CNY315 billion after offsetting the maturity of CNY417 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8505% at 10:16 am local time from the close of 1.8684% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 41 on Tuesday, compared with the close of 49 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1779 Wednesday Vs 7.1781 Tuesday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1779 on Wednesday, compared with 7.1781 set on Tuesday. The fixing was estimated at 7.2841 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND AUGUST NET MIGRATION SA 9980; PRIOR 6440

SOUTH KOREA AUGUST BOP GOODS BALANCE $5060.9MN; PRIOR $4438.5MN

SOUTH KOREA AUGUST BOP CURRENT ACCOUNT BALANCE $4809.8MN; PRIOR $3737MN

SOUTH KOREA 1-10 OCTOBER EXPORTS Y/Y -1.7%; PRIOR -7.9%

SOUTH KOREA 1-10 OCTOBER IMPORTS Y/Y 8.4%; PRIOR 11.3%

SOUTH KOREA 1-10 OCTOBER TRADE BALANCE -$5.3BN; PRIOR -$1.6BN

AUSTRALIA SEPTEMBER CBA HOUSEHOLD SPENDING Y/Y 1.8%; PRIOR 2.1%

MARKETS

US TSYS: Curve Flattens In Asia

TYZ3 deals at 107-24, +0-01, a 0-06+ range was observed on volume of ~67k.

- Cash tsys sit 2bps cheaper to 4bps richer across the major benchmarks, the cure has twist flattened pivoting on 7s.

- Ranges were relatively narrow in today's Asian session, the early move higher was unwound in the short end of the curve as local participants perhaps used the opportunity to close long positions/add fresh shorts.

- The highlight flow was a FV (11,950 lots) - US (3,850 lots) flattener.

- Early in today's session SF Fed President Daly noted the neutral rate of interest could be higher than pre-pandemic.

- The docket is light in Europe today, further out we have PPI and the minutes of the September FOMC meeting. Fedspeak from Gov Bowman, Gov Waller and Atlanta Fed President Bostic is also due. The latest 10-Year Supply is also due.

JGBS: Futures Richer & At Session Highs, 5Y Supply Digestion Adequate

In afternoon dealings, JGB futures are sitting near Tokyo session highs, +9 compared to settlement levels.

- Today the local calendar has been light, with Machine Tool Orders due later today.

- Hence, local participants have likely been on headlines and US Tsys watch. Cash US Tsys are 3bps cheaper to 3bps richer in Asia-Pac dealings, with the curve flatter.

- Cash JGBs are mixed, with yield movements bounded by +0.2bp (1-year) to -2.5bps (30-year). The benchmark 10-year yield is 1.0bps lower at 0.773%. It is also lower than the cycle high of 0.814% set late last week.

- The 5-year JGB yield is 0.4bp lower at 0.311%, after today’s supply. Today's supply saw only adequate demand, with the low price meeting dealer expectations. The cover ratio of 4.056x was lower than the 4.415x recorded at the previous month's auction. However, it is worth noting that today's cover was the third highest for a 5-year auction in the past 12 months.

- The swaps curve has bull-flattened, with rates 0.4bp to 4.2bps lower. Swap spreads are tighter.

- Tomorrow the local calendar sees PPI, Core Machine Orders, Bank Lending Incl Trusts and Tokyo Avg Office Vacancies data. BOJ Board Member Noguchi is also due to give a speech in Niigata.

AUSSIE BONDS: Twist Flattening Of the Curve Remains, Household Spending Holds Up

The ACGB futures curve (YM -2.0 & XM +3.0) has twist-flattened further in Sydney’s afternoon.

- CBA’s household spending insights (HSI) for September showed that consumption is holding up in value terms with Q3 seeing stronger growth than Q2 as consumers continue to spend savings and labour income remains robust. However, the HSI suggests that spending volumes are still contracting. It has a very high correlation with the ABS retail sales data and suggests a small rise for September.

- The RBA Assistant Governor Kent spoke today on the “Channels of Transmission”. His comments on the central bank’s monetary stance were consistent with the latest meeting statement including that “some further tightening” may be needed and the RBA remains very data-dependent.

- Cash ACGBs are 2bps cheaper to 3bps richer, with the AU-US 10-year yield differential 3bps lower at -21bps.

- Swap rates are flat to 5bps lower, with the 3s10s curve flatter.

- Bills strip pricing is flat to -2.

- RBA-dated OIS pricing is little changed across meetings.

- (AFR) Australians devote a greater share of their income to mortgage repayments than any other advanced economy, the IMF has revealed, as it downgraded its forecasts for the local economy and warned inflation will be higher than previously thought. (See link)

- Tomorrow, the local calendar sees Consumer Inflation Expectations data.

NZGBS: Closed On The Local Session’s Best Levels, Net Migration Strong

NZGBs closed at local session highs, with benchmark yields 3bps lower. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined net migration data.

- Bloomberg reports that the record inflow of migrants adds to risks that inflation pressures may persist longer than the central bank expects, quoting ASB Bank Senior Economist Mark Smith, who said “We expect the RBNZ to take out insurance and to retain restrictive OCR settings.” (See link)

- Hence, local participants have likely been guided by US Tsy dealings in the Asia-Pac session. Cash US Tsys are 1bp cheaper to 5bps richer in Asia-Pac dealings, with the curve flatter.

- Swap rates are flat to 6bps lower, with the 2s10s curve and implied swap spread box flatter.

- RBNZ dated OIS pricing is little changed across meetings, with terminal OCR expectations at 7.70%.

- Tomorrow, the local calendar sees Food Prices, ahead of Business NZ Mfg PMI and Card Spending data on Friday.

- Tomorrow, the NZ Treasury plans to sell NZ$200mn of the 4.5% May-30 bond, NZ$225mn of the 2.0% May-32 bond and NZ$75mn of the 2.75% May-51 bond.

FOREX: Greenback Steady In Asia

The USD is little changed in Asia, for the most part ranges have been narrow with little follow through on moves. The US Tsy Curve has flattened, and US Equity Futures are a touch firmer.

- Kiwi is pressured and is the weakest performer in the G-10 space at the margins. NZD/USD has trimmed yesterdays gains sitting at $0.6030/35 down ~0.3%.

- AUD/USD is also lower, however the pair has observed a narrow range for the most part. Technically the outlook remains bearish, support comes in at $0.6287 2.00 projection of the Jun 16-Jun 29-Jul 13 price swing. Resistance is at $0.6501, high from Sep 29.

- Yen unwound early gains and now sits little changed from opening levels. The pair is still in an uptrend, key support is at ¥147.43 the low from Oct 3 and resistance is at ¥150.16 high from Oct 3 and bull trigger.

- Elsewhere in G-10, EUR and GBP are a touch firmer however ranges have been narrow.

- In Europe today we have the final read of September CPI from Germany, and ECB 1- and 3-Year Inflation Expectations for August.

EQUITIES: Regional Markets Higher, Led By South Korea

Regional equities are higher across the board. South Korean markets are the standout performers (Kospi +2.5%). These moves follow positive sentiment in Tuesday US and EU trade. US futures sit slightly higher in latest dealings, with the Nasdaq slightly outperforming (+0.17%), while Eminis were only marginally higher, last near 4394.

- In the cross asset space, the US Tsy curve has flattened, while USD FX indices are close to steady.

- The Kospi has benefited from a Samsung earnings beat. The Kospi is up over 2.5% at this stage, the Kosdaq, +3%. Offshore investors have added +$152.3mn to local shares so far today.

- The Taiex is also tracking higher in Taiwan, up 0.85%. TSMC may reportedly see stronger AI-related demand next year per EDN (see this BBG link).

- The Hang Seng is +1.44% at the break. We had a strong rally in the Golden Dragon index during US trade on Tuesday. Renewed China stimulus hopes is aiding sentiment. For mainland China shares, the CSI 300 is +0.38% higher at the break.

- Japan stocks are higher, but the Topix is around +0.10% firmer, so lagging some of the gains seen elsewhere in North East Asian markets.

- The ASX 200 is +0.60% higher in Australia, while in SEA, only the Singapore bourse is tracking lower at this stage.

OIL: Crude Range Trading While Watching Geopolitical Events

Oil prices are moderately higher during the APAC session today as they range trade given the significant uncertainty stemming from recent events in Israel. Markets are watching closely for any expansion of the tensions into Iran. A risk premium was added to oil on Monday but it hasn’t widened while the aggression is contained within Israel/Gaza. The USD index is flat.

- Brent is up 0.3% to $87.96/bbl. It approached $88 earlier but only reached $87.99, the intraday high. Earlier it fell to $87.70. WTI is 0.3% higher at $86.20 and has also been in a narrow range between $85.83 and $86.26.

- The Saudi Press Agency is relating that Saudi Arabia will continue to support OPEC+ in ensuring a balanced oil market.

- There are tentative hopes that demand from China may increase after reports that the government deficit will be allowed to widen to boost growth.

- Russian product exports fell to a 3-year low in the first week of October due to its diesel export ban and a drop in refinery utilisation due to seasonal maintenance, according to Bloomberg.

- Later the Fed’s Bowman, Waller, Bostic and Collins speak plus the September Fed minutes are released. On the data front, US September PPI is released. There is also US crude and petroleum inventory data. The ECB’s Lagarde and Panetta will attend the IMF/World Bank annual meetings.

GOLD: Steady As Global Market Consolidate Moves Sparked By The Middle East Conflict

Gold is steady in the Asia-Pac session, after closing little changed on Tuesday at $1860.40.

- Bullion is dealing near the highest level this month after the conflict in the Middle East drew haven demand.

- The recent surge in precious metal prices can also be attributed to an emerging change in the sentiment regarding the Federal Reserve's policy outlook. There is a growing consensus among US policymakers that the recent spike in US Treasury yields, which reversed course on Monday, could potentially serve as an alternative to implementing further hikes in the Fed funds rate. It's worth noting that higher interest rates typically have a negative impact on gold, which doesn't yield interest.

- According MNI’s technicals team, the bearish theme in gold was put on pause Monday after a second session of gains. Monday’s bounce put prices back above $1850. Nonetheless, the recent sell-off resulted in a break of support at $1901.1 and this was followed by a breach of $1884.9, the Aug 21 low. This confirmed a resumption of the downtrend that started early May. The focus is on $1804.9, the Feb 28 low and a key support. On the upside, firm resistance is at $1878.2, the 20-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/10/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 11/10/2023 | 0815/0415 |  | US | Fed Governor Michelle Bowman | |

| 11/10/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 11/10/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 11/10/2023 | 1230/0830 | * |  | CA | Building Permits |

| 11/10/2023 | 1230/0830 | *** |  | US | PPI |

| 11/10/2023 | 1415/1015 |  | US | Fed Governor Christopher Waller | |

| 11/10/2023 | 1615/1215 |  | US | Atlanta Fed's Raphael Bostic | |

| 11/10/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 11/10/2023 | 1800/1400 | * |  | US | FOMC Rate Decision |

| 11/10/2023 | 2030/1630 |  | US | Boston Fed's Susan Collins |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.