-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI EUROPEAN OPEN: USD Higher/Equities Lower As Risk Aversion Grips Asia Pac

EXECUTIVE SUMMARY

- FED’S BARKIN SAYS HASN'T MADE UP MIND ON JULY MOVE - MNI

- YELLEN SEES LOWER RECESSION RISK, SAYS CONSUMER SLOWDOWN NEEDED - BBG

- UK CONSUMER CONFIDENCE IMPROVES TO STRONGEST IN 1.5 YEARS - BBG

- JAPAN MAY CORE CPI RISES 3.2% AGAINST APR’S 3.4% - MNI BRIEF

- ANY RBA QT SALES TO BE GRADUAL AND SLOW - MNI

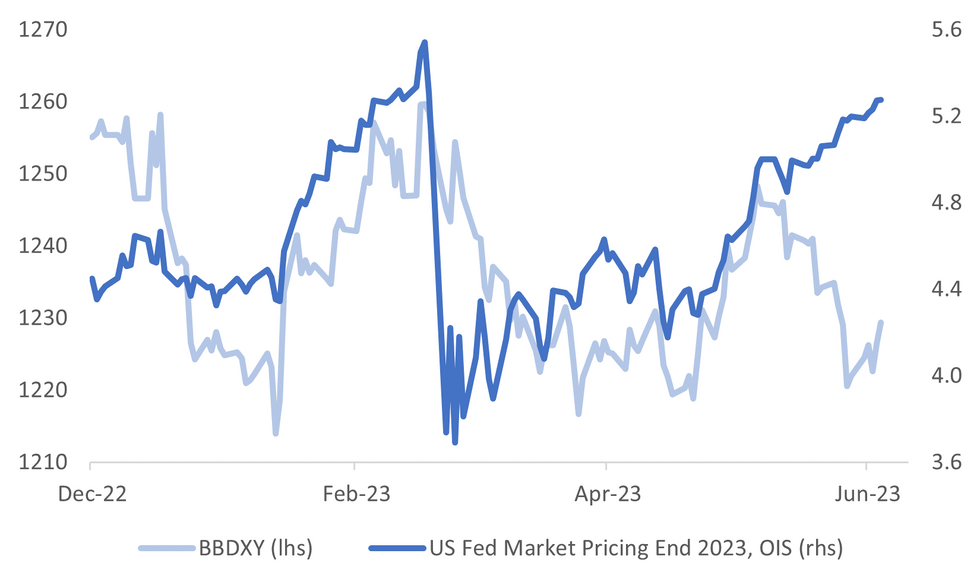

Fig. 1: BBDXY & End 2023 Fed Pricing (OIS)

Source: MNI - Market News/Bloomberg

U.K.

ECONOMY: UK consumer confidence improved more than expected, reaching its strongest level in 17 months despite elevated inflation and soaring interest rates. The market research firm GfK Ltd. said its measure of sentiment rose 3 points to minus 24 in June. Economists had expected a reading of minus 26. (BBG)

EUROPE

UKRAINE: Ukrainian missiles on Thursday struck one of the few bridges linking the Crimea Peninsula with the Ukrainian mainland, Russian-appointed officials said, cutting one of the main supply routes for Russian occupation forces in southern Ukraine. Meanwhile on the eastern front, Ukrainian forces were containing Russian troops and have not allowed "a single metre" of Russian advances, Ukraine's Deputy Defence Minister Hanna Maliar said on the Telegram app on Thursday. (RTRS)

EU/CHINA: Europe is charting a new way forward for its relations with China, but officials in the region say they are wary about the risk of retaliation if they get it wrong. There has been growing momentum behind the idea of de-risking from China. At a G7 meeting in late May, both the U.S. and Europe agreed to reduce their dependency on Beijing — rather than completely cut ties. (CNBC)

U.S.

FED: (MNI) WASHINGTON - Richmond Fed President Thomas Barkin said Thursday he is not yet sure whether the FOMC should resume rate hikes in July after it left the federal funds rate on hold this month in a 5%-5.25% range. “I have been from the start a believer in slowing the boat now as we approach the dock, so I’m still waiting for the haze to clear,” he told reporters during a press briefing. “I could get convinced that there’s still more to do, I could be convinced that we’ve done enough. I don’t prejudge July.” (MNI)

ECONOMY: Treasury Secretary Janet Yellen sees diminishing risk for the US to fall into recession, and suggested that a slowdown in consumer spending may be the price to pay for finishing the campaign to contain inflation. On the chance of a recession, Yellen said “my odds of it, if anything, have gone down — because look at the resilience of the labor market, and inflation is coming down.” She spoke in an interview with Bloomberg News Thursday. (BBG)

OTHER

JAPAN: (MNI) TOKYO - Japan's annual core consumer inflation rate printed at 3.2% y/y in May from April's 3.4%, Ministry of Internal Affairs and Communications data showed Friday. Higher food prices excluding fresh food and lower energy price drove the result and could force the BOJ to revise up its the median forecast for core CPI this fiscal year above 2% from April’s 1.8%. The strong price view may also prompt the BOJ to change its outlook that the y/y rise in core CPI will fall below 2% toward the middle of fiscal 2023. (MNI)

JAPAN: Japan's core consumer inflation exceeded forecasts in May and an index excluding fuel costs rose at the fastest annual pace in 42 years, highlighting broadening price pressure that will keep the central bank under pressure to phase out its massive stimulus. The increase was driven by steady price hikes for food and daily necessities, suggesting a drag on consumption from the rising cost of living facing households, analysts say. (RTRS)

JAPAN: Japan's factory sentiment likely improved in the second quarter for the first time since mid-2021, thanks to an eased chip supply crunch for automakers, a Reuters poll of economists showed on Friday. While slowing global demand has dragged on manufacturers' recovery, the service-sector mood is expected to have extended gains above pre-pandemic levels led by a tourism boom, helping to underpin the world's third-largest economy. (RTRS)

AUSTRALIA: The Reserve Bank of Australia would sell its bond holdings incrementally over a long time period to reduce impact on financial markets, while reducing its interest-rate risk, should the board decide to conduct quantitative tightening after Sept 30, MNI understands. Major banks will pay back a large proportion of money borrowed during the depths of the pandemic via the term-funding facility in September and a decision – if any – will come after the Reserve gauges the market impact of those maturities. Despite recent media reports to the contrary, the RBA has not solidified its plans or the mechanism QT could use, such as selling the bonds back to the government’s bond issuer, the Australian Office of Financial Management, or offering them publicly. (MNI)

INDIA: US President Joe Biden and Indian Prime Minister Narendra Modi announced a series of defense and commercial deals designed to improve military and economic ties between their nations during Thursday’s state visit at the White House. General Electric Co. plans to jointly manufacture F414 engines with state-owned Indian firm Hindustan Aeronautics Ltd. for the Tejas light-combat aircraft, as part of an effort to improve defense- and technology-sharing as China becomes more assertive in the Indo-Pacific. (BBG)

CHINA

MARKETS: The Hang Seng China Enterprises Index falls as much as 2%, with tech names being among the biggest drags. The gauge is now down more than 6% for the week, set to be its worst since early March. (BBG)

OVERNIGHT DATA

NZ MAY ANZ TRUCKOMETER HEAVY M/M 1.8%; PRIOR -2.2%

AU JUNE P JUDO BANK PMI Mfg 48.6; PRIOR 48.4

AU JUNE P JUDO BANK PMI SERVICES 50.7; PRIOR 52.1

AU JUNE P JUDO BANK PMI COMPOSITE 50.5; PRIOR 51.6

JAPAN MAY NATL CPI Y/Y 3.2%; MEDIAN 3.2%; PRIOR 3.5%

JAPAN MAY NATL CPI EX FRESH FOOD Y/Y 3.2%; MEDIAN 3.1%; PRIOR 3.4%

JAPAN MAY NATL CPI EX FRESH FOOD, ENERGY Y/Y 4.3%; MEDIAN 4.2%; PRIOR 4.1%

JAPAN JIBUN BANK PMI Mfg 49.8; PRIOR 50.6

JAPAN JIBUN BANK PMI SERVICES 54.2; PRIOR 55.9

JAPAN JIBUN BANK PMI COMPOSITE 52.3; PRIOR 54.3

JAPAN TOKYO DEPT STORE SALES Y/Y 8.0%; PRIOR 11.5%

JAPAN NATIONWIDE DEPT STORE SALES Y/Y 6.3%; PRIOR 8.6%

MARKETS

US TSYS: Slightly Richer In Asia-Pac

TYU3 is currently trading at 112-27, +03+ versus NY closing levels.

- Cash tsy yields are trading 1.1bp to 1.7bp lower across major benchmarks in Asia-Pac trade with the 5-year outperforming.

- Outside the release of Japan’s May CPI there has been few meaningful drivers in the Asian session.

- The remainder of today’s session is relatively thin in terms of data releases with flash PMIs for the UK, Germany, the Eurozone and the US as the highlights. UK retail sales are also out.

- Japan’s sovereign debt is emerging as the most appealing outside the US. That’s the finding of a Bloomberg analysis of 24 government bond markets globally based on 10-year yields, currency-hedge costs and volatility. (See link ICYMI)

JGBS: Futures Push Into Positive Territory, Rinban Operations Supportive

JGB futures push to new session highs at 148.82 in the Tokyo afternoon session, after this morning’s BoJ Rinban operations saw flat to negative spreads and lower cover ratios. JBU3 is currently trading at 148.80, +4 compared to the settlement levels.

- Slightly higher-than-expected core and core-core CPI readings for May failed to hold the JGB futures in negative territory despite clearly adding to the risks of an upside revision to the BoJ's inflation outlook in July. Market participants appear to have focused on BoJ board rhetoric this week which has pushed back against the need for any YCC tweaks at the July meeting.

- Cash JGB yields have moved lower beyond the 1-year zone. The outperformers on the curve have been the 4-year (1.4bp richer) and 20-year (1.5bp richer) zones. The benchmark 10-year yield is 0.8bp higher at 0.371%, below the BoJ's YCC limit of 0.50%.

- Swap rates are lower across the curve with swap spreads generally tighter.

- The local calendar next week sees PPI Services (Mon), Coincident & Leading Indicators (Tue), Retail Sales (Fri), International Investment Flows (Fri) and Consumer Confidence (Fri).

- BoJ Summary Of Opinions for the June meeting will released on Monday.

- The MoF plans to sell 20-year (Tue) and 2-year (Thu) JGBs next week.

AUSSIE BONDS: Cheaper, 3-Year Futures Bounce Off Jun-22 Low

ACGBs sit weaker (YM -6.0 & XM -1.0) but off session cheaps. 3yr futures traded as low as 95.960, the Jun-22 low on the continuation contract. According to MNI’s technicals team, clearance of this level would confirm a critical bearish medium-term development and signal scope for an extension towards 95.451, a Fibonacci projection.

- Cash ACGBs are 1-6bp cheaper with the 3/10 curve flatter and the AU-US 10-year yield differential -3bp at +22bp.

- Swap rates are 2-7bp higher with the 3s10s curve flatter.

- The bills strip bear steepens with pricing -4 to -9.

- RBA dated OIS are 4-10bp firmer for meetings beyond October with early’24 leading.

- ACGBs sit above NZGBs but below JGBs. That’s the finding of a Bloomberg analysis of 24 government bond markets globally based on 10-year yields, currency-hedge costs and volatility. (See link)

- The highlight of next week’s local calendar is the release of the CPI Monthly (May) on Wednesday. The calendar also sees May readings for Job Vacancies (Thu), Retail Sales (Thu) and Private Sector Credit (Fri).

- The AOFM plans to sell A$300mn of the 1.75% 21 June 2051 bond on Wednesday. It also plans to sell index-linked bonds: A$100mn of Nov-27 and A$50mn of Aug-40.

NZGBS: Closed On A Negative Tone, Global Bond Watch After Yesterday’s Sell-Off

NZGBs ended the session on a negative tone, experiencing an increase of 3-4bp in benchmark yields with the 2/10 curve flatter. In the absence of significant local catalysts, market participants were likely watching headlines and closely monitoring US tsys following the sell-off in global bonds triggered by central bank actions yesterday.

- Cash tsy yields are trading 1.2bp to 1.9bp lower across major benchmarks in Asia-Pac trade with the 5-year outperforming.

- Swap rates are 3-5bp higher with implied swap spreads little changed.

- RBNZ dated OIS pricing is 1-6bp firmer across meetings with May’24 leading.

- NZ is to begin weekly Treasury bill tenders from July 1.

- Japan’s sovereign debt is emerging as the most appealing outside the US. NZGBs sit above UK Gilts but below ACGBs. That’s the finding of a Bloomberg analysis of 24 government bond markets globally based on 10-year yields, currency-hedge costs and volatility. (See link)

- The local calendar is light next week with ANZ Business (Thu) and Consumer Confidence (Fri) as the highlights.

- The remainder of today’s session is relatively thin in terms of data releases with flash PMIs for the UK, Germany, the Eurozone, and the US as the highlights. UK retail sales are also out.

FOREX: USD Higher As Risk Aversion Grips Asia Pac Markets

The BBDXY index has spent most of the Asia Pac session on the front foot. We are comfortably above Thursday session highs, last in the 1229.40/50 region, +0.25% for the session and back to mid June levels.

- Dollar support has been evident in the cross asset space, with equities weaker throughout the region and in terms of US futures (Emini last 4406, -0.40%). The weakness in HK markets, which returned today after yesterday's holiday has been evident. The HSI off nearly 2%, while the China Enterprise Index is down a little over 2%. China markets remain closed until Monday.

- US yields have ticked down but this hasn't weighed on USD sentiment, although JPY is clearly outperforming the rest of the G10. Expectations that global core yields may have to go higher to tame inflation appears to be weighing on broader risk appetite today.

- USD/JPY dips sub 143.00 have been supported, the pair last near 143.10/15. Core CPI was stronger than expected for May, but didn't produce meaningful yen strength. We haven't heard any fresh rhetoric from the authorities today re yen weakness.

- AUD/USD is the weakest performer, down 0.70% and not far off 0.6700, which is around the 50-day EMA. In addition, to the headwinds outlined above, commodities are lower as well, with copper, iron ore, and oil all down.

- NZD/USD is weaker as well, although outperforming the AUD, the pair last just under 0.6150. NOK is down nearly 0.80%, last under 10.7, unwinding some of Thursday's outperformance, albeit with liquidity light in Asia Pac hours.

- Looking ahead, we have UK retail sales coming up, then EU and UK PMIs. In the US session, Fed speak from Bullard, Bostic and Mester is due, along with PMIs.

EQUITIES: Hong Kong Markets Negative Return, Japan Stocks Halt 10 Week Bull Run

Regional equities are weaker, with losses particularly prominent in HK and Japan markets. This has weighed on US equity futures, which have steadily edged down for much of the Asia Pac session. Eminis were last off nearly 0.50% and close to the 4400 region. Nasdaq futures are down by a similar amount.

- The return of Hong Kong markets, after yesterday's holiday, has seen fresh downside in major indices. The HSI is down close to 2% at the break, the China Enterprise Index slightly weaker at -2.06%.

- Some catch up, with the China Dragon Index generally under pressure this week in US trade, coupled with hawkish central surprises from Thursday, appear headwinds. Fresh stimulus calls continue as well, although China markets don't return until Monday.

- Japan markets have seen notable losses as well, the Nikkei 225 off nearly 1.9% at this stage. Losses have been fairly broad based. If we don't see a sharp turnaround before the close, it will be the first weekly loss for the Nikkei since the start of April.

- The Kospi is down close to 1%, while the ASX 200 continues its recent correction, off 1.30%.

- In SEA markets are mostly weaker, although losses are lower than NEA at this stage.

OIL: Thursday's Sell-Off Extends, Tracking Lower For The Week

Brent's sell off from the Thursday session has extended in the first part of Friday trade. We were last near $73.20/bbl, down a further 1.2%, after falling 3.86% in Thursday trade. This leaves us comfortably lower for the week, off 4.4% at this stage. WTI is under $68.70/bbl, following a similar trajectory.

- For Brent, bears will target a move back sub the $72/bbl level, which has marked lows so far this month. On the upside the 20-day EMA sits around $75.55, while the 50-day is around $76.85/bbl.

- This latter resistance point has generally capped upside in oil since late April.

- Despite some positive signs around US demand and lower crude stockpiles this week, oil has been weighed by global headwinds, with a less supportive risk backdrop particularly evident today.

- Coming up, the focus will be on EU/UK and US PMI preliminary prints for June, which will provide an update on the global economy's health.

GOLD: Setting Up For Largest Weekly Decline Since February

Gold is slightly lower in the Asia-Pac session, after closing lower for the fourth straight day for a cumulative loss of around 2%. With global central banks signalling overnight that they need to stay hawkish for longer to bring down inflation, gold is setting up for its largest weekly loss since early February.

- The BoE delivered a hawkish surprise by hiking 50bp to 5.0%, bringing the total tightening this cycle to 475bp. The Norges Bank also surprised with a 50bp hike and maintained a tightening bias.

- During Fed Chair Powell's second day of policy testimony to Congress, he reiterated the prevailing view that if the economy continues to perform as expected, it would be appropriate to raise rates again this year.

- The BoC published the Minutes of the June meeting, revealing the underlying strength of the Canadian economy and concerns regarding the trajectory of inflation was likely to deliver more tightening.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/06/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 23/06/2023 | 0700/0900 | *** |  | ES | GDP (f) |

| 23/06/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/06/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/06/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/06/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/06/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/06/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/06/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/06/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/06/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/06/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/06/2023 | 0915/0515 |  | US | St. Louis Fed's James Bullard | |

| 23/06/2023 | 1200/0800 |  | US | Atlanta Fed's Raphael Bostic | |

| 23/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/06/2023 | 1245/1445 |  | EU | ECB Panetta in BIS Conference Discussion | |

| 23/06/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 23/06/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/06/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 23/06/2023 | 1530/1630 |  | UK | BOE Announces Q3-23 Active Gilt Sales Schedule | |

| 23/06/2023 | 1740/1340 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.