-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI EUROPEAN OPEN: USD/JPY Gains Continue, 2023 Highs Within Sight

EXECUTIVE SUMMARY

- FED SET FOR JUNE CUT, RISKS LATER MOVE - SHEETS - MNI INTERVIEW

- MARCH" DOT PLOT" TO SHOW FEWER FED CUTS, EX-OFFICIALS SAY - MNI

- CHINA’S MARCH LOAN PRIME RATE UNCHANGED - MNI BRIEF

- UEDA's FAST MOVE TRIGGERS SPLIT ON WHETHER BOJ IS DONE HIKING - BBG

- NEW ZEALAND WILL HAVE SCOPE TO CUT CASH RATE THIS YEAR, IMF SAYS - BBG

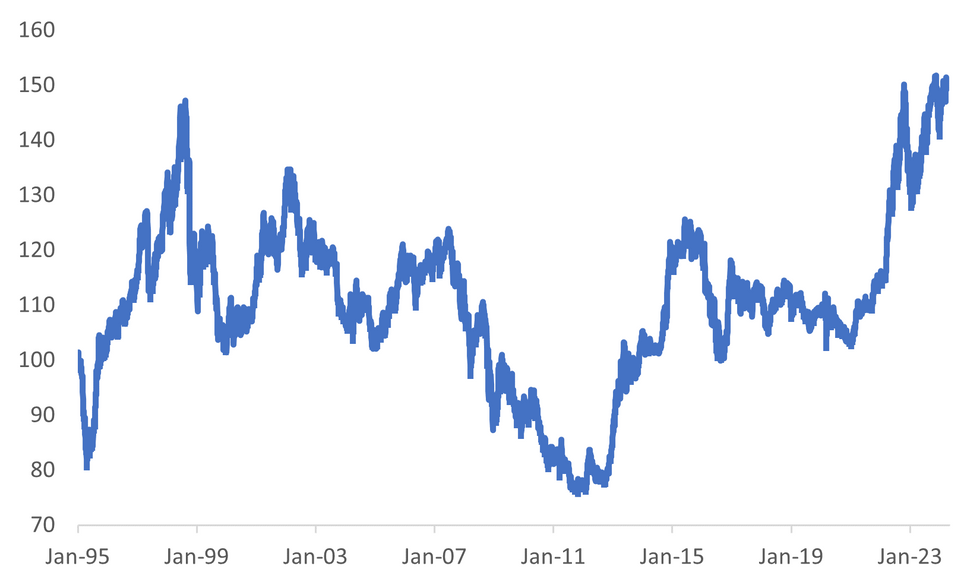

Fig. 1: USD/JPY Spot Closing In On 2023 Highs

Source: MNI - Market News/Bloomberg

U.K.

FISCAL (BBG): The opposition Labour Party’s chancellor-in-waiting Rachel Reeves pledged a fundamental “course correction” for the UK economy, saying the country needed to invest in growth and solve underlying structural problems to break the grip of stagnation.

EUROPE

ECB (REUTERS): European Central Bank policymaker Martins Kazaks said on Tuesday he was “comfortable” with investor bets on three interest rate cuts by the central bank by the end of the year.

SWITZERLAND (MNI SNB WATCH): With inflation continuing to surprise policymakers to the downside, a March rate cut by the Swiss National Bank will not come as a surprise, although a move at the June meeting -- which follows those by the Federal Reserve and the European Central Bank-- remains most likely.

CZECH (MNI CNB WATCH): The Czech National Bank is expected to cut its repo rate by 50 basis points to 5.75% on Wednesday, as it follows a conservative approach to lowering rates despite recent downside surprises to price pressures and growth worries.

TURKEY (MNI CBRT WATCH): The Central Bank of Turkey is expected to keep its policy rate unchanged at 45% for a second month after its meeting on Thursday, with local elections nearing, though a small minority of analysts see a chance that it may be unable to wait as inflation continues to rise and hikes by 250 basis points.

U.S.

FED (MNI INTERVIEW): The Federal Reserve can take its time to assess incoming economic data but the baseline is the central bank starts its easing cycle in June, former Fed board economist Nathan Sheets told MNI, adding that the risks are tilting toward a later cut.

FED (MNI INTERVIEW): The Federal Reserve's wait-and-see mode on monetary easing will be limited by political constraints and the timing of the November elections, meaning the first interest rate cut is likely in June and not later, former Fed Board division of monetary affairs chief Vincent Reinhart told MNI.

FED (MNI): Federal Reserve officials are likely to signal less urgency to lower interest rates this year than they had in December after disinflation lost momentum in January and February, with a majority penciling in two or three rate cuts for 2024 in projections to be updated Wednesday, former Fed officials told MNI.

FISCAL (NYT): President Biden will issue a multibillion-dollar award to Intel on Wednesday to expand its chip production in the United States, people familiar with the decision said, as the president champions his economic policies during a tour of the Southwest.

CHINA (BBG): The US government is apparently looking to sanction some Chinese semiconductor companies connected with Huawei after its new 7-nm chip was used in a new phone last year.

OTHER

ISRAEL (BBG): Israeli Prime Minister Benjamin Netanyahu will speak with Senate Republicans via video on Wednesday, less than a week after the chamber’s top Democrat, Chuck Schumer, called for elections to replace him.

JAPAN (BBG): Now that Japan increased interest rates for the first time since 2007, investors and economists are divided over how long it will take before the central bank opts for another hike.

AUSTRALIA/CHINA (BBG): Australia is preparing for a visit by Chinese Premier Li Qiang, the country’s second-most senior leader, in a sign that improving relations between Canberra and Beijing weren’t upended by recent setbacks.

NEW ZEALAND (BBG): New Zealand will have scope to start cutting interest rates later this year as inflation returns to its target band, the International Monetary Fund said in a staff report that contrasts with the central bank’s view.

CHINA

PBOC (BBG): China Securities Regulatory Commission’s newly appointed chairman Wu Qing and 3 others have been named as members of People’s Bank of China’s monetary policy committee, according to the central bank’s updated member list released on Tuesday.

PBOC (MNI BRIEF): China's Loan Prime Rate remained unchanged on Wednesday according to a People's Bank of China statement, in line with market expectation following the February's significant LPR cut and the hold of a key policy rate on March 15.

MARKETS (SECURITIES TIMES): China’s securities sector will likely face accelerating mergers and acquisitions and increasing industry concentration, as the country aims to launch first-class investment banks, Securities Times reported citing market insiders.

CONSUMER (21ST CENTURY BUSINESS HERALD): Chinese Premier Li Qiang has signed an order promulgating increased protection of consumer rights, according to the 21st Century Business Herald. The document clarifies the government’s responsibility for protecting the interests of buyers, and instructs administrative departments to increase supervision and law enforcement.

FOREIGN INVESTMENT (YICAI): Authorities will implement a new 24-point plan aimed at relaxing foreign investment access in the economy including science and technological innovation sectors, according to the State Council. Officials will support foreign institutions to operate bank card clearing services, and expand the business scope of bond market participation.

CHINA MARKETS

MNI: PBOC Conducts CNY3 Bln Via OMO Weds; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY3 billion via 7-day reverse repo on Wednesday, with the rates unchanged at 1.80%. The operation has led to no change to the liquidity after offsetting CNY3 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8158% at 09:39 am local time from the close of 1.8867% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 48 on Tuesday, compared with the close of 47 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0968 on Wednesday, compared with 7.0985 set on Tuesday. The fixing was estimated at 7.1991 by Bloomberg survey today.

MARKET DATA

NZ 1Q WESTPAC CONSUMER CONFIDENCE RISES TO 93.2; PRIOR 88.9

NZ CURRENT ACCOUNT DEFICIT 6.9% GDP IN YEAR TO DEC.; EST. -7.0%; PRIOR -7.4%

NZ 4Q CURRENT ACCOUNT DEFICIT NZ$7.837B; EST. -NZ$7.800B; PRIOR –NZ$10.974B

CHINA 5-YR LPR 3.95%; MEDIAN 3.95%; PRIOR 3.95%

CHINA 1-YR LPR 3.45%; MEDIAN 3.45%; PRIOR 3.45%

MARKETS

US TSYS: Treasury Futures Edge A Touch Higher Ahead of FOMC

- Jun'24 10Y futures have done very little today, with volumes very low and ranges tight we made lows of 110-04 during the morning session and trade just of highs of 110-07 at 110-06+ up +02 since NY closed.

- Looking at technical levels: Initial resistance is seen at 110-26 (20-day EMA), while above here 110-30+ (Mar 14 high) yesterday’s move lower to 109-24+ and piercing of the bear trigger at 109-25+ (Feb 23 low) could signal further weakness and has opened up a potential retest of 109-14+ (Nov 28 low).

- There has been little in the way of headlines other than the US is weighing up sanctioning Huawei's chipmaking network

- Looking ahead: MBA Mortgage Applications later Today, while all eyes will be on the FOMC on Thursday.

UK DATA: XpertHR: Pay Awards Lowest Since Sep '22; Survey Indicates Further Falls

- XpertHR median basic pay award in the 3 months to the end of February 2024 fell for the second consecutive month to +4.8%Y/Y (vs a revised +5.0%Y/Y prior - originally 5.1%Y/Y) - the lowest level since September 2022.

- On top of the normal monthly rolling quarter, XpertHR conducted a survey of 213 pay award forecasts for 2024, representing close to a quarter of a million UK employees from 158 organisations in the run-up to the April period. The median pay award forecast for 2024 is 4% with the modal forecast at 5% (with most in the 3-5% range).

- XpertHR notes that "Close to half (47%) of forecast pay awards are expected to be lower than the 2023 award employees received. Around one-third (34%) are expected to be the same, whilst just 19% are expected to be worth more than the previous settlement."

- Coupled with the second consecutive in the quarterly rolling data, this points to the start of a more meaningful downward trend for wage data. Last week's official ONS wage data softened a little more than expected.

- There is still a fair amount of variability in pay awards with lower quartile at +4.0%, and upper quartile at +6.0%. It will be interesting to watch the upper quartile when the NLW is increased by 9.8% in April - and whether that pulls up the median awards, too.

- Data were collected between 1st December 2023 and 29th February 2024, based on 94 pay settlements covering 181,174 employees.

AUSSIE BONDS: Subdued Session Ahead Of FOMC Decision

ACGBs (YM flat & XM +2.0) sit slightly richer after dealing in relatively narrow ranges in today’s Sydney session. With the domestic calendar empty today, trading has been all about consolidating yesterday’s post-RBA rally ahead of the FOMC Decision later today.

- Cash ACGBs are flat to 2bps richer, with the AU-US 10-year yield differential 2bps higher at -23bps.

- Swap rates are 1-3bps lower.

- The bills strip is slightly mixed, with pricing +1 to -1.

- RBA-dated OIS pricing is little changed. Given that OIS pricing aligned with the unanimous consensus among Bloomberg analysts, expecting a status quo decision yesterday, minimal market reaction in front meetings was anticipated. Likewise, year-end easing expectations have only slightly softened to 38bps compared to 36bps before the decision.

- Where there has been a notable reaction has been in terminal rate expectations. Before yesterday's meeting, the anticipated terminal rate stood at the effective cash rate of 4.32%. However, following the RBA's decision to remove the explicit tightening bias, there has been a softening of 5bps to 4.27%.

- Tomorrow, the local calendar sees the February Employment Report along with Judo Bank PMIs (Mar P). Consensus expects a 40k increase in Jobs, with the Unemployment Rate falling from 4.1% to 4.0%.

NZGBS: Strong Session, Plays Catch-Up With ACGBs, Focus Turns To FOMC Decision

NZGBs closed at the session’s best levels, with benchmark yields 7bps lower. With domestic data printing better than expected (Q4 Current Account Deficit narrower and Q1 Consumer Confidence higher), the intraday richening appears linked to offshore influences, namely the stronger lead from US tsys overnight and the post-RBA rally in ACGBs.

- There have been no cash US tsy dealings in Asia today, with Japan out for a public holiday.

- ACGBs are dealing 5-6bps richer than their levels at yesterday's local close. The local market was closed when the RBA delivered its decision.

- The NZ-AU 10-year yield differential closed 1bp tighter than yesterday’s closing level at +47bps.

- Swap rates closed 5-7bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed is 4-7bps softer for meetings beyond July. A cumulative 62bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Q4 GDP.

- Before then, the market focus will be on the FOMC Decision.

- Tomorrow, the NZ Treasury plans to sell NZ$250mn of the 1.5% May-31 bond and NZ$250mn of the 3.5% Apr-33 bond.

FOREX: Yen Weakness Continues, Fed Up Next

Outside of fresh yen weakness, overall G10 FX moves have been fairly muted. The BBDXY sits marginally higher, last near 1241, largely on account of fresh weakness.

- USD/JPY pushed through 151.00 in the first part of Wednesday trade. We have held above that level since and as we approach the cross over with EU/London the pair has hit fresh highs for the session at 151.45./50

- The is nearly 0.40% weaker in yen terms versus end levels in NY on Tuesday. Focus remains on 2023 highs at 151.91, although this may raise fresh intervention risks. Japan markets have been closed today for a local holiday, which has likely kept rhetoric absent.

- Depressed vol levels and the sharp push higher in risk reversals in the pair points to upside USD/JPY pressures, with markets not expecting an aggressive BoJ tightening cycle and still accommodative financial conditions.

- EUR/JPY continues to track higher, the pair last at 164.60, fresh highs back to 2008.

- NZD/USD is a little lower sub 0.6050, despite better current account data for Q4. We also had a rise in consumer confidence. We sit marginally above recent lows, while headlines crossed from the IMF stating there is scope for the RBNZ to cut later this year.

- AUD/USD has outperformed NZD at the margins, last near 0.6530, close to unchanged for the session. Higher commodity prices, coupled with weaker NZ dairy prices likely helping the move. The AUD/NZD cross is above 1.0800, to fresh highs back to late Jan.

- The main focus coming up later we will be the FOMC.

ASIA EQUITIES: HK & China Equities Edge Higher As Markets Await FOMC Later

Hong Kong and China equities have opened lower, but have for the most part reversed those losses to trade unchanged to slightly higher. There has been little in the way of market headlines or drivers today. Earlier, China kept 1yr & 5yr LPR unchanged at 3.45% & 3.95%, respectively. Chinese data-tech companies rose after the nation plans to improve cross-border data flows as part of the initiative to further attract foreign investment, while the US weighs sanctioning Chinese Chip manufacturers. Overall it has been a very subdue day as investors in the region take a break post BoJ the RBA yesterday, Japan is also out and finally ahead of the FOMC later Today.

- Hong Kong equities are slightly higher today, with the Mainland property Index being the top-performing sector, up 0.65% although the index is off 7.90% from its recent highs made on March 14th, the HSTech Index is up 0.40%, after opening the morning down 1%, while the HSI is now up 0.18% In China, equities markets are slightly higher, with the smaller cap CSI1000 the best performing, up 0.31%, while the large cap CSI300 is up 0.20%

- China Northbound flows were -7.0 billion yuan on Tuesday, with the 5-day average at 2.80 billion, while the 20-day average sits at 3.31 billion yuan.

- China's property-debt crisis has intensified, with developers facing court battles over debt restructuring plans and potential liquidation orders. At least 23 companies have received wind-up petitions in Hong Kong, with five ordered to wind up. The crisis has particularly impacted China Evergrande Group, fined for falsely inflating revenue, while other smaller peers like Redsun Properties Group Ltd. and Kaisa Group Holdings Ltd. are also facing legal challenges amid a backdrop of substantial defaults totaling $111 billion in onshore and offshore bonds.

- Siemens warns of a persistent China slowdown after flagging disappointing demand in China for its key digital industries division. This comes on the back of Apple recently announcing their sales to China had slumped by 24%.

- Hong Kong's fast-tracked approval of domestic security legislation has raised concerns from the US, European Union, and UK about potential limitations on open discussion in the global finance hub. Despite Chief Executive John Lee's assertion that the move is a patriotic endeavor, critics worry it could further erode fundamental freedoms and political pluralism in Hong Kong.

- The Biden administration is contemplating blacklisting several Chinese semiconductor firms, including those linked to Huawei Technologies Co., to further restrict Beijing's access to semiconductor technology, with a focus on companies producing chips or semiconductor manufacturing gear. This move is part of a broader US campaign to curtail China's semiconductor and AI ambitions, and it could impact companies like Qingdao Si’En, SwaySure, Shenzhen Pensun Technology Co. (PST), ChangXin Memory Technologies Inc., Shenzhen Pengjin High-Tech Co., and SiCarrier.

- Looking ahead, the calendar is light for the remainder of the week.

ASIA PAC EQUITIES: Regional Equities Mixed, Japan Out, FOMC Later Today

Regional Asian equities are mixed today, following a slow start post BoJ and RBA decisions yesterday, with Japan observing a public holiday. Meanwhile, markets are awaiting the FOMC meeting later today, where it's widely expected to keep rates on hold, and attention will be largely focused on the dot plot, which has become the de facto monetary policy forecast. There have been few market headlines this morning.

- Japanese equities are closed today for Vernal Equinox Day.

- South Korean equities have opened higher on Wednesday, tracking gains made overnight in the US. There have been very few market headlines, other than South Korea announcing it will ease the tax burden for companies enhancing returns for shareholders, following up on its pledge to improve valuations and boost the local stock market. Meanwhile, Samsung shares jumped 4% as shareholders gathered for the AGM; the Kospi is up 1.25%.

- Taiwanese equities are slightly lower today, down 0.06%. The Philadelphia SE Semiconductor Index was down 0.94% on Tuesday, weighing on some semiconductor names in the region. Later today, Taiwan has export order data due out with expectations of a decline from the prior month to 1.2% for February, while tomorrow the Central Bank meets and is expected to keep rates on hold at 1.875%.

- Australian equities have closed lower today, after spending most of the day up as miners dragged the market lower while the financial sector was the top-performing sector, Looking ahead, tomorrow Australia has employment data out. Chinese Foreign Minister Wang Yi met with Australia's Foreign Minister Wong earlier in hopes of ending a bitter three-year trade war. The ASX200 closed down 0.10%.

- Elsewhere in SEA, New Zealand equities closed higher today, up 0.13% ahead of GDP data tomorrow. Singapore equities are 0.25% higher, while Malaysian equities are down 0.25%, Thailand equities are down 0.26% after their largest foreign investment outflow on record on Tuesday and finally Indonesian equities are unchanged ahead of the BI rate decision later today.

OIL: Crude Range Trading Ahead Of Fed Decision

Oil prices have traded in a narrow range to be down moderately during APAC trading today but are still up more than 2% on the week. WTI is 0.2% lower at $82.57/bbl, close to the intraday high, and Brent is also down 0.2% to $87.25. The market is waiting for the Fed decision out later today. While it is widely expected to be on hold this month, concerns that rate cuts will be delayed and thus pressure demand have weighed on crude. The USD index is flat.

- Supply developments are being watched closely given geopolitical issues and the IEA’s shift to forecast a deficit this year.

- Bloomberg reported a 1.52mn barrel crude inventory drawdown last week, a lot more than expected, according to people familiar with the API data. While distillate stocks rose 500k, gasoline fell a further 1.6mn pointing to robust demand. The official EIA data is out later today.

- JP Morgan has estimated that Ukrainian attacks on Russian refineries have reduced its capacity by 900kbd and it could take weeks or even months for it to come back on line. As a result, Russia will increase its crude exports from western ports by almost 200kbd which may rise if there are further attacks. Lower refining demand in Russia would normally put downward pressure on oil prices, but the market has added a geopolitical risk premium as Ukraine continues to target energy infrastructure.

- Later the Fed decision and projections are announced (see MNI Fed Preview). Also, the ECB’s Lagarde, Lane and Schnabel all appear. In terms of data, UK CPI/PPI for February print.

GOLD: Consolidates Ahead Of FOMC Decision

Gold is slightly stronger in the Asia-Pac session, after closing 0.1% lower at $2157.59 on Tuesday.

- Recent price action in the yellow metal is best viewed as consolidation ahead of today’s FOMC meeting.

- Bullion was supported by US Treasuries, which finished with yields 1-5bps lower. The strength in US bonds indicates a market that is relatively unconcerned about the FOMC outcome. The consensus anticipates an unchanged policy stance, with the median dot indicating three rate cuts expected this year.

- According to MNI’s technicals team, the recent break above $2135.4, the Dec 4 high, reinforced bullish conditions and signaled scope for $2206.6 next, a Fibonacci projection. Short-term conditions are overbought and a deeper retracement would allow this set-up to unwind. Firm support is at $2117.4, the 20-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/03/2024 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 20/03/2024 | 0700/0700 | *** |  | UK | Producer Prices |

| 20/03/2024 | 0700/0800 | ** |  | DE | PPI |

| 20/03/2024 | 0845/0945 |  | EU | ECB's Lagarde at ECB and its Watchers Conference | |

| 20/03/2024 | 0900/1000 | * |  | IT | Industrial Production |

| 20/03/2024 | 0930/1030 |  | EU | ECB's Lane in panel at ECB and its Watchers Conference | |

| 20/03/2024 | 1000/1100 | ** |  | EU | Construction Production |

| 20/03/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 20/03/2024 | 1345/1445 |  | EU | ECB's Schnabel in panel at the ECB and its Watchers Conference | |

| 20/03/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 20/03/2024 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/03/2024 | 1730/1330 |  | CA | BOC Minutes (Summary of Deliberations) | |

| 20/03/2024 | 1800/1400 | *** |  | US | FOMC Statement |

| 21/03/2024 | 2145/1045 | *** |  | NZ | GDP |

| 21/03/2024 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 21/03/2024 | 2350/0850 | ** |  | JP | Trade |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.