-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD Pressured Ahead Of NFP

EXECUTIVE SUMMARY

- WHITE HOUSE’s SULLIVAN TO TRAVEL TO SAUDI ARABIA THIS WEEKEND (RTRS)

- US BANKERS URGE SEC TO PROBE SHORT SALES REDUCE ‘ABUSIVE’ TRADING (RTRS)

- APPLES’S IPHONE SALES REBOUND AFTER HOLIDAY CHALLENGES (FT)

- CHINA APRIL CAIXIN SERVICES PMI 56.4 VS 57.8 IN PREVIOUS MONTH (DJ)

- RBA LAYS OUT POTENTIAL FUTURE INFLATION TRIGGERS (MNI)

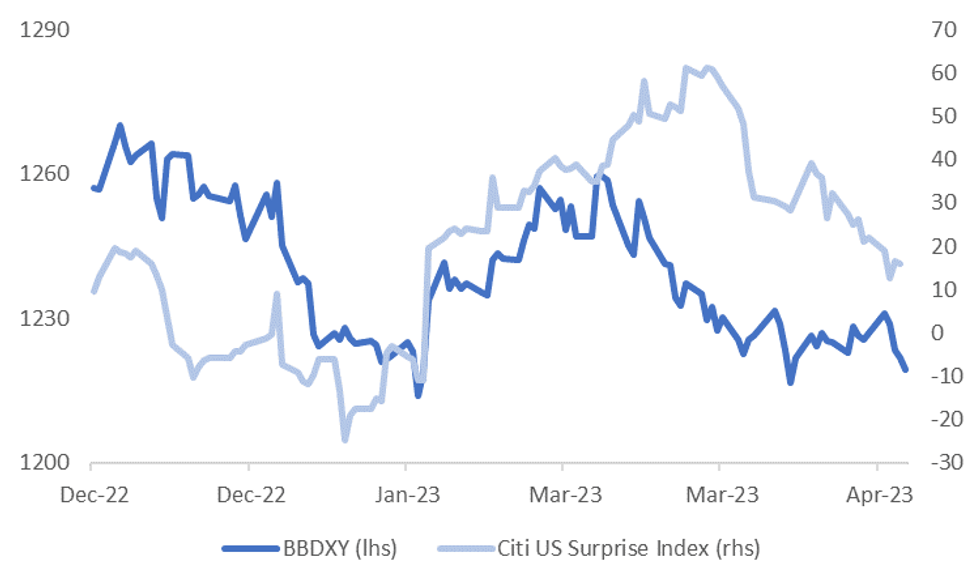

Fig. 1: USD BBDXY Versus Citi US Surprise Index

Source: CITI/MNI - Market News/Bloomberg

UK

POLITICS: The UK’s governing Conservatives on Friday faced the prospect of losing as many as 1,000 councillors in local elections as voters in many parts of England turned against the party after a tumultuous year. (FT)

U.S.

BANKING: The American Bankers Association on Thursday urged federal regulators to investigate a spate of significant short sales of publicly traded banking equities that it said were "disconnected from the underlying financial realities." (RTRS)

BANKING: U.S. federal and state officials are assessing whether "market manipulation" caused the recent volatility in banking shares, a source familiar with the matter said on Thursday, as the White House vowed to monitor "short-selling pressures on healthy banks." (RTRS)

GEOPOLITICS: White House national security adviser Jake Sullivan said on Thursday he will travel to Saudi Arabia this weekend for talks with Saudi leaders, as the United States seeks to bolster often-frayed ties with Riyadh.(RTRS)

TECH: US Commerce Secretary Gina Raimondo responded positively to a request for US Chips Act support for chip-related cos in addition to chipmakers, Taipei-based Central News Agency reports, citing Taiwan’s Minister-Without-Portfolio John Deng. (BBG)

TECH: A bipartisan group of US senators introduced legislation that would allow President Joe Biden to sign a tax agreement with Taiwan, addressing an issue that businesses on both sides have pointed to as a barrier for further investment. (BBG)

TECH: Apple’s iPhone shipments bounced back from supply chain disruptions in the holiday period, though revenue still declined year on year for the second quarter in a row due to what it described as a “tougher” economic environment and currency headwinds. (FT)

OTHER

AUSTRALIA: Inflation could persist if productivity remains weak, firms expand margins as costs ease, higher prices push wages higher than expected, or rents rise faster than anticipated, according to the Reserve Bank of Australia’s Statement on Monetarypolicy released Friday. (MNI)

PHILIPPINES: Philippine President Ferdinand Marcos Jr. said he has secured over $1.3 billion in investment pledges from his US trip, touting economic deals that he said would create 6,700 new jobs. (BBG)

CHINA

ECONOMY: Sales revenue from consumer-related sectors in China rose by 24.4% during the Labor Day holiday compared to last year’s holiday, reflecting stronger spending, Shanghai Securities News reports, citing VAT invoice data from State Taxation Administration. (BBG)

ECONOMY: A private gauge of China's service sector declined in April but stayed in expansion territory, as consumers shifted to close-contact services after Beijing lifted Covid-19 restrictions. The Caixin China services purchasing managers index fell to 56.4 in April from 57.8 in March, Caixin Media Co. and S&P Global said Friday. (DJ)

GEOPOLITICS: Chinese Foreign Minister Qin Gang assured his Russian and Indian counterparts of deepening bilateral ties, promising that "coordination and cooperation" will only grow stronger, in a show of solidarity with two of China's biggest neighbours.(RTRS)

PROPERTY: Local government revenue from land sales was down 27% y/y in Q1, with Zhejiang and Guizhou province falling 40% and 30%, according to Yicai. Citing analysts, the drop reflects the slow recovery of the real estate sector – a strong driver of land sales in the country. A local official said the impact on local finance was significant, although corresponding expenses on demolition and re-housing of residents had also decreased. Experts said the government should introduce further measures to stabilise the real-estate sector in the short term and develop other revenue sources including property, and resources taxes in the long run. (MNI)

PROPERTY: House sales during the May holiday were up 25% y/y but remained around 20% lower than comparable 2019 data, according to Yicai.com. The news outlet said demand fell due to a tourism surge. Market players noted released pent up demand in H2 2022 likely drove Q1 recovery and might not be sustainable. Analysts called for measures to restore long-term buyer confidence including optimised purchase restrictions and support for families with two or more children. (MNI)

ECONOMY: Shenzhen has passed laws to re-introduce the operation of roadside stalls and street vendors in an effort to boost consumption in the city, according to Yicai. Authorities in Shenzhen are following similar developments in Shanghai, Beijing and Lanzhou, and the new rules will take effect from September 1. Yicai cites Beijing and Shanghai as having made trials, which regulated the orderly operation and dispersion of sellers. The number of stalls in Shanghai decreased from a recorded 47,000 in 2007 to 5,759 in 2022, the news outlet said.(MNI)

CHINA MARKETS

PBOC NET DRAINS CNY162 BILLION VIA OMOs FRIDAY

The People's Bank of China (PBOC) conducted CNY3 billion via 7-day reverse repos on Friday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY162 billion after offsetting the maturity of CNY165 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9413% at 09:42 am local time from the close of 1.9212% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 47 on Thursday, compared with the close of 43 on last trading day before May Day holiday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 6.9114 FRI VS 6.9054 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9114 on Friday, compared with 6.9054 set on Thursday.

OVERNIGHT DATA

AU MAR HOME LOANS M/M 4.9%; MEDIAN -0.3%; PRIOR -1.0%

AU MAR OWNER-OCCUPIER LOANS M/M 5.5%; PRIOR -1.2%

AU MAR INVESTOR LOANS 3.7%; PRIOR -0.6%

CHINA APR CAIXIN SERVICES PMI 56.4; MEDIAN 57.0; PRIOR 57.8

CHINA APR CAIXIN COMPOSITE PMI 53.6; PRIOR 54.5

MARKETS

Narrow Ranges For TY, Cash Closed In Asia, NFP In View

TYM3 deals at 116-09, -0-09, with a narrow 0-04+ range observed on volume of ~30k.

- Cash tsys are closed in Asia today due to the observance of a national holiday in Japan and will re-open in the London session.

- TY has observed narrow ranges with little follow through on moves, the proximity to today's NFP print as well as the reduced liquidity due to the aforementioned Japanese holiday may be keeping some participants on the sidelines.

- The space looked through the latest SoMP from the RBA and a softer than forecast Caixin Services PMI print.

- April NFP print provides the highlight data wise today, the MNI preview of the event is here. Fedspeak from Minneapolis Fed's Kashkari, St Louis Fed President Bullard and Fed Governor Cook will also cross.

At Cheaps Ahead of US Non-Farm Payrolls

ACGBs sit at session lows (YM -1.0 & XM -3.0) ahead of US non-farm payroll later today. The immediate market reaction to forecast changes contained in the RBA’s quarterly Statement on Monetary Policy appeared more like an unwind of pre-release strength. However, the post-statement cheapening gathered momentum in afternoon trade. Volumes were however relatively low ahead of US Non-Farm Payrolls, particularly with cash tsys closed until the London session. US tsy futures trading was muted in Asia-Pac.

- Cash ACGBs are 1-3bp cheaper with the 3/10 curve 2bp steeper and the AU-US 10-year yield differential flat at -4bp.

- 3s10s swaps curve twist steepened with rates 1bp lower to 3bp higher with 3-year EFP 2bp tighter.

- Bills pricing is flat to +3.

- RBA dated OIS pricing is flat to 3bp firmer after the statement but 1-3bp softer on the day.

- The local calendar releases April NAB Confidence and March Building Approvals on Monday.

- Until then, the local participants will be watching US tsys as they navigate April Non-Farm Payrolls.

- The AOFM announced that it plans to sell A$150mn of the 0.75% 21 November 2027 Index Linked bond on Tuesday, May 9 and A$800mn of the 3.25% 21 April 2029 bond on Wednesday, 10 May.

NZGBS: Richer, Curve Steeper, Outperforms ACGBs

NZGBs closed 3-5bp richer with the 2/10 cash curve adding 2bp to yesterday’s steepening move. NZGBs outperformed ACGBs with the NZ-AU 10-year yield differential 4bp tighter. The 2-3bp cheapening in ACGBs after the release of the RBA’s quarterly Statement on Monetary Policy appeared to be more of an unwind of pre-release strength with the net reaction muted.

- Local participants are likely to have largely remained on the sidelines ahead of US Non-Farm Payrolls, particularly with cash tsys closed until the London session due to the observance of a national holiday in Japan. US tsy futures trading was muted in Asia-Pac.

- Swap rates closed flat to 5bp lower with the 2s10s curve 5bp steeper and long-end implied swap spread wider.

- RBNZ dated OIS closed 2-4bp softer across meetings with 23bp of tightening priced for the May 24 meeting.

- The local calendar next week sees April Credit Card Spending, REINZ House Sales and Manufacturing PMI data along with March Net Migration and the RBNZ’s Inflation Expectation data for Q1.

- In Australia, NAB Confidence (Apr) and Building Approvals (Mar) are slated for early in the week.

- Until then, the local market will eye US tsys as they navigate the release of Non-Farm Payrolls for April later today.

Greenback Pressured In Asia

The greenback is pressured in Asia, rising US Equity futures and a firmer Hang Seng have boosted risk appetite on Friday. BBDXY is at its lowest level of the week dealing at 1219.20, the April low at 1214.06 is the next support level.

- AUD is the strongest performer in the G-10 space at the margins. AUD/USD prints at $0.6730/35 up ~0.6% and at its highest level of the week. The 50-Day EMA has been cleared and the next level for bulls is $0.6772 high from Apr 20. RBA's SoMP didnt move the dail as the forecasts were in line with what the RBA said on Wednesday. The AUD has looked through a fall in the Iron Ore prices with prices now below $95/tonne as demand softens in China.

- Kiwi is also firmer, NZD/USD is up ~0.5%. The pair broke through its 200-Day EMA yesterday and has extended gains in Asia today.

- USD/JPY is a touch about the ¥134 handle, the pair is down ~0.2% today.

- Elsewhere in G-10 EUR and GBP are both 0.3% firmer benefiting from the broad based pressure on the greenback.

- The highlight today is the April NFP print, the MNI preview of the event is here.

Steady Ahead Of US NFP

Gold has largely tracked sideways in the first part of Friday trade ahead the US non-farm payrolls print. We currently sit close to $2050, little change versus Thursday closing levels, with a $2045.56 to $2053 range so far today. Recent highs come in around the $2060 region. On the downside, the 20-day EMA sits back closer to $2000.

- Gold has benefited from the weaker USD tone today, not fazed by the firmer US equity futures backdrop. The BBDXY is at fresh week to date lows sub 1220.

- For the week gold is up an impressive 3%, as global recession fears are still apparent. Gold ETF holdings are a touch below recent highs.

Edging Up From Recent Lows, But Still ~8% Lower For The Week

Brent crude is tracking higher so far today, last just above $73/bbl, which is +0.80% above Thursday closing levels. Still, we are still tracking more than 8% lower for the week, which is the third straight week of losses. WTI had a much quieter start at the open compared to yesterday and is ticking higher as well, last above $69/bbl.

- For Brent, we have consolidated above $72/bbl after testing below this level earlier in the week. A break below this level would open up a test of previous YTD lows near $70/bbl.

- Recessionary fears, coupled with a still comfortable supply backdrop, continues to weigh on sentiment more broadly. We need to get back above $75/bbl to turn sentiment more favorable in the near term.

- Saudi Arabia cut oil prices for Asian markets for June delivery late yesterday, albeit not as much as some in the market expected.

- Also note, US National Security Advisor Sullivan is visiting Saudi Arabia this weekend to meet with the country's leaders.

Regional Picture Mixed Despite Higher US Futures

Once again regional equities are mixed, with China bourses underperforming, along with Indonesia. US futures are higher, led by the tech side, following Apples earnings update late in the US on Thursday. Nasdaq futures currently track 0.50% higher, Eminis around +0.40%, both indices are close to session highs.

- Hong Kong shares are tracking higher, albeit away from best levels. The HSI last +0.64% at the break. The Golden Dragon Index rallied in US trade, buoyed by a potential Alibaba IPO, which is likely aided sentiment today.

- Still, China mainland shares are down. The CSI 300 off 0.50% at the break. The weaker than expected Caixin services PMI, while still comfortably in expansion territory, moved off recent highs. This has taken some of the shine off the outlook at the margins.

- The JCI in Indonesia is down over 1.4% with resource names weighing. The index continues to underperform for May.

- Japan and South Korea markets are closed today.

- The ASX200 is up modestly, last +0.30%.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/05/2023 | 0545/0745 | ** |  | CH | Unemployment |

| 05/05/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 05/05/2023 | 0630/0830 | *** |  | CH | CPI |

| 05/05/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 05/05/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/05/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 05/05/2023 | 0800/1000 | * |  | IT | Retail Sales |

| 05/05/2023 | 0800/1000 |  | EU | ECB Elderson Speech at European University Institute | |

| 05/05/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 05/05/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 05/05/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 05/05/2023 | 1230/0830 | *** |  | US | Employment Report |

| 05/05/2023 | 1645/1245 |  | US | Minneapolis Fed's Neel Kashkari | |

| 05/05/2023 | 1700/1300 |  | US | St. Louis Fed's James Bullard | |

| 05/05/2023 | 1700/1300 |  | US | Fed Governor Lisa Cook | |

| 05/05/2023 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.