-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD Recovery Continues, NZD/USD Breaks Lower

EXECUTIVE SUMMARY

- FED’s DALY SAYS ‘NOT THERE YET’ ON INFLATION - MNI BRIEF

- PEOPLE CLOSE TO BIDEN SAY HE APPEARS TO ACCEPT HE MAY HAVE TO LEAVE THE RACE - NYT

- CONSUMPTION RISKS COULD MAKE BOJ HIKE HARDER - MNI POLICY

- JAPAN JUNE CORE CPI RISES 2.6% VS. MAY +2.5% - MNI BRIEF

- CHINA TO PROMOTE MIGRATES’ RIGHTS, REFORM HUKOU - MNI BRIEF

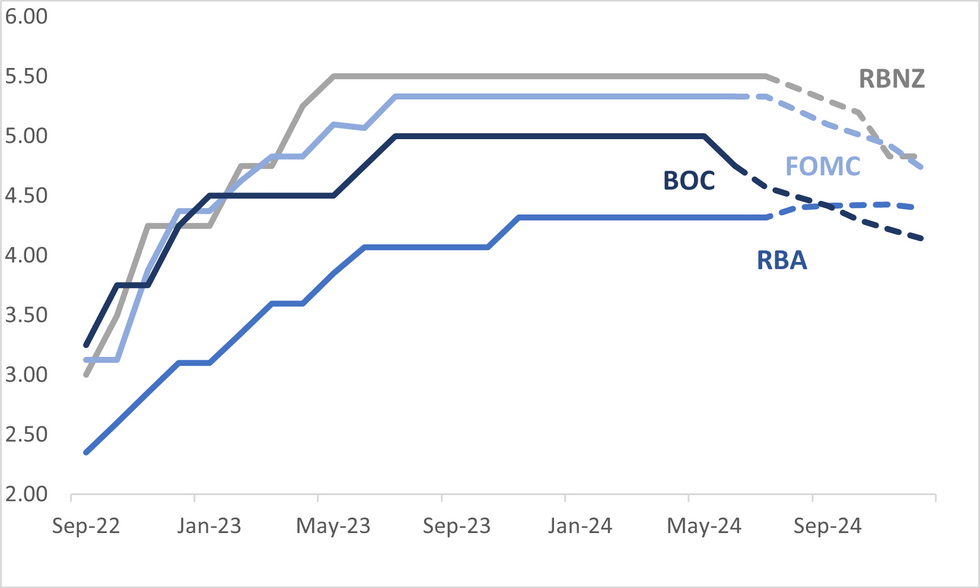

Fig. 1: $-Bloc STIR Outlook

Source: MNI - Market News/Bloomberg

UK

CONSUMER (BBG): “Labour’s landslide election victory had a muted impact on the mood of UK households, though consumer confidence still edged up to a near three-year high.”

EUROPE

ECB (MNI ECB WATCH): The European Central Bank left monetary policy unchanged Thursday and gave no firm indication on a future rate path, reaffirming that policy decisions would remain data dependent and be made on a meeting-by-meeting basis.

FRANCE (BBG): “ French lawmakers reelected a centrist candidate from Emmanuel Macron’s party to a second term leading the National Assembly in a sign the president’s coalition may be best placed to form a new government after he dissolved the legislature last month.”

US

FED (MNI BRIEF): The Federal Reserve is making progress toward bringing inflation back to its 2% target but it’s too soon to claim victory, San Francisco Fed President Mary Daly said Thursday.

FED (MNI BRIEF): Federal Reserve Governor Michelle Bowman said Thursday the central bank should ensure the discount window is used more effectively when the financial system is under duress such as during last year's bank failures.

FED (MNI BRIEF): Chicago Fed President Austan Goolsbee on Thursday said the Federal Reserve might need to ease interest rates soon in order to avoid an unwanted sharper deterioration in the labor market.

POLITICS (NYT): “One person familiar with President Biden’s thinking cautioned that he had not yet made up his mind to leave the race, after three weeks of insisting that almost nothing would drive him out. Several people close to President Biden said on Thursday that they believe he has begun to accept the idea that he may not be able to win in November and may have to drop out of the race, bowing to the growing demands of many anxious members of his party.”

POLITICS (CBS)/BBG): “Republican Donald Trump has widened his lead against President Joe Biden by five points nationally, according to a CBS News/YouGov survey. Trump also leads Vice President Kamala Harris 51% to 48% in a hypothetical matchup, the poll says.”

POLITICS (RTRS): "Donald Trump described on Thursday how he narrowly survived an attempt on his life, telling a rapt audience at the Republican National Convention in his first speech since the attack that he was only there "by the grace of Almighty God.""

OTHER

JAPAN (MNI POLICY): Consumption Risk Could Make BOJ Hike Harder

JAPAN (MNI POLICY): Unchanged Core-Core CPI View To Stay BOJ Rate Hike

JAPAN (MNI BRIEF): The year-on-year rise of Japan's annual core consumer inflation rate accelerated to 2.6% in June from May’s 2.5% due to higher energy prices and firm food prices excluding perishables, data released by the Ministry of Internal Affairs and Communications showed on Friday.

ISRAEL (NYT): "The Israeli military said in a statement that it was looking into the reports that there had been an aerial target. An explosion in central Tel Aviv killed at least one person and injured several others, the Israeli authorities said early Friday morning."

CHINA

REFORM (MNI BRIEF): China plans to promote public services for migrate workers while pushing reform to household registrations, or the Hukou system, and advance market-oriented reforms in monopoly sectors, said Han Weixiu, deputy director in charge of routine work at the Office of Central Financial and Economic Affairs Commission in a press conference on Friday.

FISCAL REFORM (MNI BRIEF): China will strengthen fiscal efforts and maintain an accommodative monetary stance to boost the economy, which is suffering from insufficient demand, said Han Wenxiu, deputy director in charge of routine work at the Office of Central Financial and Economic Affair Commission in a press conference on Friday.

CONSUMER (MNI BRIEF): China will aim to expand consumer demand and quicken the development of emerging industries to help offset the property slowdown and rising trade tensions, said Han Wenxiu, deputy director in charge of routine work at the Office of Central Financial and Economic Affair Commission in a press conference on Friday.

REFORM (CSJ): “China will further centralise fiscal power and increase expenditure of central government to reduce burdens on local authorities who will likely obtain more tax sources to deal with fiscal difficulties, including localisation of consumption taxes, China Securities Journal reported on Friday citing analysts.”

SMES (ECONOMIC DAILY): “China will likely push restructuring and mergers of small- and medium-sized banks and optimise policies to broaden the channels for their capital supplementation to advance their reform and risk mitigation, the Economics Daily reported on Friday.”

CHINA MARKETS

MNI: PBOC Net Injects CNY57 Bln Via OMO Fri; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY59 billion via 7-day reverse repo on Friday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY57 billion after offsetting the CNY2 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8000% at 09:28 am local time from the close of 1.8973% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 50 on Thursday, compared with the close of 45 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1315 on Friday, compared with 7.1285 set on Thursday. The fixing was estimated at 7.2713 by Bloomberg survey today.

MARKET DATA

JAPAN JUNE NATIONAL CPI Y/Y 2.8%; MEDIAN 2.9%; PRIOR 2.8%

JAPAN JUNE NATIONAL CPI EX FRESH FOOD Y/Y 2.6%; MEDIAN 2.7%; PRIOR 2.5%

JAPAN JUNE NATIONAL CPI EX FRESH FOOD, ENERGY Y/Y 2.2%; MEDIAN 2.2%; PRIOR 2.1%

UK JUNE GfK CONSUMER CONFIDENCE -13; MEDIAN -12; PRIOR -14

MARKETS

US TSYS: Tsys Futures Edge Lower, Fed Speak & Corp Earnings Later

- Treasury futures are lower today, with the front-end underperforming. The initial selling look to coincide with reports Biden was considering setting aside after more senior Democrats called for him to consider it, betting markets now show Kamala Harris as the likely nominee.

- TUU4 is -0-01⅞ at 102-16¼, while TYU4 is -0-05+at 111-01+.

- Tsys flows: Earlier there was a large block seller of 10,000 TYU4, DV01 650k, while in tsys option we have seen decent size buying of TYU4 puts.

- The cash treasury curve has bear-flattened today with the 2yr +1.4bps at 4.485%, while the 10yr is +0.4bp at 4.206%.

- The market slightly cooled on rate cut projections on Thursday with a chance of a July'24 cut at 4.5%, September also cooled to 95.5% from 100% a day earlier with the market pricing a total of 64bps of cuts into year-end

- The data calendar is light on today, there will be Fed speakers including Williams and Bostic while focus will largely be on corporate earnings.

JGBS: Cash Bond Bull-Flattener, Rtrs Poll Swings Further To No Change From BoJ In July

JGB futures are sitting flat compared to settlement levels after giving up gains initiated by today’s National CPI data.

- Outside of the previously outlined National CPI, there hasn't been much in the way of domestic data drivers to flag.

- (Straits Times) “Japan's government cut 2024's growth forecast on July 19 as consumption took a hit from rising import costs due to a weak yen."

- A Reuters poll indicates that 76% of economists (up from 61% in the previous poll) expect the BoJ to hold interest rates at the July meeting. Additionally, 59% believe the BoJ will taper monthly bond purchases to around 5 trillion yen as a first step. Economists are split on the timing of a rate hike, with 43% expecting it in October, 30% in September, and 24% in July.

- The cash JGB curve has bull-flattened, with yields flat to 3bps lower across benchmarks. The benchmark 10-year yield is 0.5bp lower at 1.037% versus the cycle high of 1.108%.

- Swap rates are flat to 2bps lower out to the 30-year and 1bp higher beyond. Swap spreads are mostly tighter.

- On Monday, the local calendar will see Tokyo Condominiums for Sale data alongside an Enhanced Liquidity Auction covering OTR 1-5-year JGBs.

AUSSIE BONDS: Dealing On A weak Note, Light Local Calendar Next Week

ACGBs (YM -2.0 & XM -5.0) are holding weaker but off Sydney session cheaps. With the domestic calendar light, the local market has drifted with cash US tsys, which are flat to 1bp cheaper. The US calendar is also light today.

- The latest round of ACGB Nov-27 supply saw firm pricing, the weighted average yield printing through prevailing mids and the cover ratio jumping to a robust 4.3929x. Notably, today’s auction cleared with a low number of successful bidders, indicating aggressive bids from those investors.

- The AOFM announced that a new 21 December 2035 Treasury Bond is planned to be issued via syndication in the week beginning 22 July 2024 (subject to market conditions). The issue size is expected to be around $10 billion.

- Cash ACGBs are 2-5bps cheaper, with the AU-US 10-year yield differential at +8bps.

- Swap rates are 1-3bps higher, with the 3s10s curve steeper.

- The bills strip is cheaper, with pricing -2 to -4.

- RBA-dated OIS pricing is 1-4bps firmer across meetings, with February 2025 leading. Terminal rate expectations sit at 4.44%.

- The local calendar is empty next week apart from Preliminary Judo Bank PMIs on Wednesday.

NZGBS: Strong Outperformance Versus $-Bloc Has Continued

Short-end NZGBs closed near the session's best levels, with the 2-year benchmark yield 1bp lower. The 10-year yield closed 3bps higher. The long end's underperformance likely reflected the ~1bp cheapening in cash US tsys during today’s Asia-Pac session and yesterday’s modest sell-off.

- Today's move has continued NZGB's strong performance since the RBNZ’s surprising bullish tilt on July 10. NZGB benchmark yields are 27-36bps lower than pre-RBNZ decision levels, with the 2/10 curve 10bps steeper.

- It also continued NZGB’s outperformance versus its $-bloc counterparts. The NZ-US 10-year yield differential has narrowed by 1bp today to +17bps, its tightest level since late 2022. This differential had oscillated between +20 and +80bps since late 2022.

- The NZ-AU 10-year yield differential closed 3bps tighter at +8bps, its lowest level since August 2022.

- The swaps curve twist-steepened, with rates 2bps lower to 3bp higher.

- RBNZ dated OIS pricing closed with 2025 meetings 4-10bps softer. A cumulative 67bps of easing is priced by year-end.

- Monday’s local calendar will see Trade Balance data.

FOREX: USD Index Near Week Highs, NZD/USD Falters As NZ-US 2yr Spread Breaks Sub 0bps

The USD index has mostly been supported in the first part of Friday trade, although overall moves have been fairly modest. The index, above 1254, sits close to weekly highs (although is still sub pre US CPI levels from the prior week). NZD/USD has been the weakest performer, off around 0.3%.

- US front end yields have ticked higher today, last near 4.49% for the US 2yr Tsy. This has provided some support for the USD. The Fed's Daly spoke earlier, she acknowledged the improvement in inflation, but that we still have a way to go. Her comments were largely in line with other Fed speakers, there was no reaction from the market.

- US equity futures are modestly higher, but the regional backdrop has been softer, with tech related indices underperforming. Headlines are coming out around China's Third Plenum, with focus on boosting domestic demand, but details are light at this stage.

- NZD/USD last tracks sub 0.6030. the NZ-US 2yr swap spread is now sub 0bps, fresh multi year lows. The NZ 2yr swap has maintained a fairly step downtrend, last sub 4.23%. The earlier bounce in the week due to stickier domestic inflation pressures proved to be fleeting. At the margins, NZD/USD is the worst performer in the G10 FX space this past week (down nearly 1.5%).

- Such trends have also aided a further move higher in the AUD/NZD cross, which is up above 1.1100 although still sub recent highs. AUD/USD has seen some support sub 0.6700.

- USD/JPY dipped sub 157.10 in early trade but had no follow through. We last track near 157.45, little changed for the session. June National CPI was a touch below expectations, not adding anything to the June rate hike case. 76% of economists surveyed by RTRS expects a steady rate hand at the meeting.

- Looking ahead, we have UK retail sales, followed by more Fed speak later on.

ASIA STOCKS: China & HK Stocks Mixed As Onshore Equities Find Support

Chinese and Hong Kong equity markets are mixed today, with investors disappointed around the lack of updates that came from the Third Plenum. The update that came late Thursday, emphasized "high-quality development" but lacked detailed measures to boost demand or address the property slump, with investors now awaiting more details expected to be released in the coming weeks. Some of China's major equity benchmarks are trading higher today, while Chinese stocks listed in HK sell-off, leading to speculation that the National Team is in the market which ties in with earlier reports from Bloomberg that the China National team has been active over the past month in supporting the market.

- Hong Kong equities are lower today, with property the worst performing after a lack of any policy update from the Third Plenum to support the troubled sector, the Mainland Property Index is down 3.65%, while the HS Property Index is down 3.10%. The HSTech Index is down 1.70%, while the wider HSI is down 2%.

- China major equity benchmarks are higher today which could be due to the National team stepping in to support the markets. The CSI 300 up 0.10%, CSI 1000 up 0.36%, CSI 2000 up 85% and the ChiNext is 0.40% higher.

- In the property space, Sino-Ocean Group announced that about half of its Class A debt lenders support a debt-management proposal involving $5.6 billion of existing debt. However, an ad-hoc group of creditors strongly opposes the proposal, citing concerns over transparency and calling for better terms, while the company also faces a potential liquidation hearing set for September 11.

- On Monday we have China 1yr & 5yr LPR rates which are expected to be left unchanged and in Hong Kong CPI Composite.

ASIA PAC EQUITIES: Equities Lower As Concerns Linger Around US Trade Restrictions

Asian markets are lower today, the moves are a continuations from a decline in US equities overnight and persistent concerns about economic weakness, while the market is also disappointing in a lack of any real policy announcement out of the Third Plenum. The MSCI is on track for its largest fall in almost three months, local Asian currencies have all fallen verses the USD. Chip stocks continue the recent sell off as concern lingers around the US imposing fresh restrictions on companies selling products to China. TSMC earnings beat estimates, although has fallen for a third straight day.

- Japanese equities are mixed early, with tech stocks showing some signs of a rebound while cyclical stocks slide on soft US jobs data. Disco corp fell over 4% after 1Q operating income loss, the company manufacture products used in the process of making semiconductor and other electronic products, which contributed the most to the 0.50% fall in the Topix. Tokyo Electron which posted it's largest two day drop since 2015 has rebounded 2.20% this morning, although the Nikkei 225 is trading 0.30% lower. Earlier, Japan June National CPI was a touch below market expectations with headline rising 2.8% y/y, vs 2.9% est, the market is now pricing in a 40% chance of a hike on July 30th, down from 50% chance on Thursday.

- South Korean equities are lower this morning, the KRW is on track for its biggest weekly drop in more than a month as foreigner investors continue to dump local stocks. The sell-off in stocks is largely due to comments from Biden Administration around tougher trade restrictions on companies that use any US technology in products they sell to China. The Kospi is 1.44% lower, while the small-cap Kosdaq is trading 0.25% higher implying the losses are constrained to the larger tech names such as Samsung (-2.75%) and Sk Hynix (-1.40%).

- Taiwan equities are lower today, with TSMC down 2.39% despite strong second-quarter results and an increased full-year revenue forecast and is now on track for the third consecutive day. Foreign investors have been dumping local stocks at the fastest rate this year, this has also impacted the TWD which is about 0.45% lower today. The Taiex is currently down 1.80%.

- Australian equities are lower today with miners the worst performing sector, with the ASX 200 trading 1% lower. Banking watchdog APRA has agreed to reduce the amount of capital Westpac must hold in reserve by $500 million in response to the lender's improved risk management, per ABC. New Zealand Equities are 0.60% lower.

- In EM Asian markets, Indonesian equities are 0.70% lower, Singapore equities are 0.80% lower while Malaysian equities are 0.20% higher and Philippines equities are 1.40% higher.

OIL: Range Bound, As Demand/Supply News Flows Offsets

Oil prices are a little lower in the first part of Friday dealing. Brent front month contracts sit near $84.75/bbl, off around 0.40%. Earlier lows were just under $84.50/bbl. At this stage, Brent is tracking 0.30% lower for the week. WTI front month was last $82.35/bbl, off 0.60% at this stage, but still slightly above end levels last Friday.

- Broader trends in oil remain within recent ranges. For Brent we are close to the key EMAs, with the 200-day just under $84/bbl. Earlier lows this week came in at $83.30/bbl. July 12 highs rest at $86.35/bbl.

- Earlier moves in oil reflected a firmer USD backdrop, although we have moved away from best levels. This is keeping a cap on upside momentum, while prospects of easier Fed policy, coupled with signs of tighter supply earlier this week (after the EIA reported an unexpected crude draw) is keep dips supported.

- The other focus points for markets is the Third Plenum on China, where headlines point to efforts to boost domestic demand, but details remain light at this stage.

- Finally, wildfires in Canada are being watched as a possible supply threat (see this BBG link).

GOLD: Pullback After Hitting Fresh All-Time High Earlier This Week

Gold is 0.7% lower in today’s Asia-Pac session, after closing 0.6% lower at $2445.08 on Thursday.

- Recent weakness comes after bullion hit a fresh all-time high of $2483.73 earlier this week.

- A recent slowdown in seasonal demand for physical gold may weigh on prices if current interest from tactical investors and exchange-traded product inflows are not sustained, according to Standard Chartered Plc analyst Suki Cooper. “We remain cautious of a softer floor in the coming weeks,” she wrote in a note. (as per BBG)

- Gold remains up nearly 20% since the start of the year, with much of the gains fueled by large purchases from central banks, strong consumer appetite in China and demand for haven assets amid geopolitical tensions.

- According to MNI’s technicals team, the trend condition in gold remains bullish and the breach of key resistance at $2,450.1, the May 20 high, opens the $2500.00 handle next.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/07/2024 | 0600/0700 | *** |  | UK | Retail Sales |

| 19/07/2024 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 19/07/2024 | 0600/0800 | ** |  | DE | PPI |

| 19/07/2024 | 0800/1000 | ** |  | EU | EZ Current Account |

| 19/07/2024 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/07/2024 | 1230/0830 | ** |  | CA | Retail Trade |

| 19/07/2024 | 1440/1040 |  | US | New York Fed's John Williams | |

| 19/07/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 19/07/2024 | 1700/1300 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.