-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

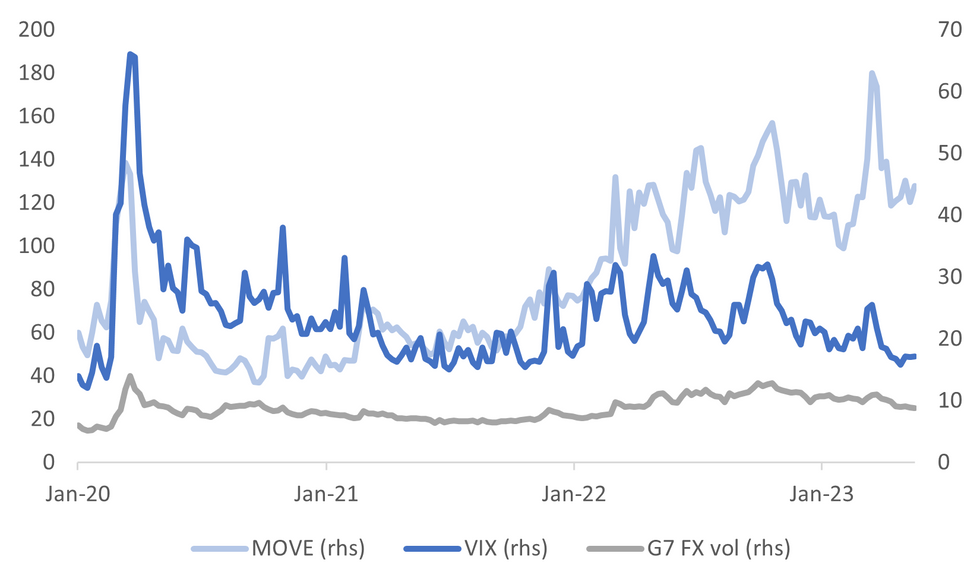

MNI EUROPEAN OPEN: Volatility Measures Well Off 2023 Highs As US Debt Talks Set To Resume

EXECUTIVE SUMMARY

- BIDEN, McCARTHY DEBT CEILING MEETING PLANNED FOR TUESDAY AFTERNOON (RTRS)

- US AND EU STEP UP EFFORTS TO COORDINATE SANCTIONS POLICIES - (FT)

- EU URGED TO CRACK DOWN ON IMPORTS OF INDIAN FUELS MADE WITH RUSSIAN OIL - (FT)(FT)

- CHINA YOUTH JOBLESS RATE AT 20.4% IN APRIL - (BBG)

- RBA DETERMINED TO BRING INFLATION DOWN - MAY MINUTES (MNI)

Fig. 1: Volatility Measures Well Below 2023 Highs

Source: BofA/J.P.Morgan/MNI - Market News/Bloomberg

U.K.

FISCAL: One in five taxpayers in the UK will be paying tax at higher rates by 2027 as a result of a stealth raid by Prime Minister Rishi Sunak, according to new analysis. The research by the Institute for Fiscal Studies warned that 2.5 million more people will be paying rates of 40% or more if income tax thresholds remain frozen. (BBG)

EUROPE:

GEOPOLITICS: The US and EU are boosting efforts to share information and co-ordinate sanctions policies, in a bid to make joint western economic and financial punishments more effective against Russia and other countries. On Tuesday, Washington and Brussels are expected to announce they are “committed to working more closely on sanctions as a key tool to address shared foreign policy goals”, according to a prepared statement by the US Treasury seen by the Financial Times. (FT)

OIL: The EU should crack down on India reselling Russian oil as refined fuels including diesel into Europe, the bloc’s chief diplomat has said, as western nations move to tighten sanctions on Moscow’s energy sector. Josep Borrell, the EU’s high representative for foreign policy, told the Financial Times that Brussels was aware that Indian refiners were buying large volumes of Russian crude oil before processing it into fuels for sale in Europe, saying for the first time the EU should act to stop it. (FT)

MARKETS: Microsoft Corp.’s $69 billion takeover bid for games developer Activision Blizzard Inc. came back from the brink after the European Union gave its blessing for one of the biggest deals in history. In a decision diametrically opposed to findings by British and US antitrust authorities, EU regulators said on Monday that the transaction could actually boost competition and make the fledgling cloud-gaming market better. (BBG)

U.S.

DEBT: President Joe Biden and Republican House of Representatives Speaker Kevin McCarthy on Monday prepared for critical debt-ceiling talks, with a little more than two weeks to go before the U.S. government could run short of money to pay its bills. Democratic and Republican staff were working to find common ground on spending levels and energy regulations before a 3 p.m. EDT (1900 GMT) Tuesday meeting between Biden, McCarthy and the three other top congressional leaders. (RTRS)

DEBT: Treasury Secretary Janet Yellen warned that the US is already paying a price for its failure to raise the federal debt limit, as talks between the White House and lawmakers from both parties continued into a second week. (BBG)

DEBT: House Speaker Kevin McCarthy said ongoing talks to avert a historic US default were yielding little progress, even as President Joe Biden announced plans to meet with congressional leaders on Tuesday. “We are nowhere near reaching a conclusion,” McCarthy said Monday on Capitol Hill, adding he felt that ongoing staff-level meetings are “not productive at all.” (BBG)

OIL: The US is soliciting bids for up to 3 million barrels of sour crude oil to refill its depleted Strategic Petroleum Reserve. Deliveries into the emergency government stockpile are planned for August, with awards to be announced in June, the Energy Department said in its solicitation Monday. The move marks the agency’s second attempt to begin replenishing the Strategic Petroleum Reserve after it released more than 200 million barrels last year, in part to curb high energy prices. (BBG)

OTHER

RBA: (MNI) Sydney - The Reserve Bank of Australia is determined to bring inflation back to its 2-3% target and will do “what is required” to meet its goal, including further interest-rate increases, according to the May minutes released Tuesday. (MNI)

JAPAN: The Japanese government will allow seven of nation’s major power companies to raise household electricity prices from June, a move likely to add to inflationary pressure. (BBG)

NZ: New Zealand Labour government is set to reveal a worse budget bottom line and economic outlook on Thursday as it delivers what it calls a “no frills” 2023-24 budget to avoid fuelling inflation. (RTRS)

SOUTH KOREA: Canadian Prime Minister Justin Trudeau will arrive in South Korea on Tuesday for a summit with President Yoon Suk Yeol as the two countries seek to boost cooperation on security and critical minerals used in batteries. (RTRS)

THAILAND: The Move Forward Party's (MFP) bid to form a governing coalition may not be plain sailing after a number of senators made it clear they will not support its prime ministerial candidate. (Bangkok Post)

CHINA

ECONOMY: Industrial production, retail sales were weaker than forecast. Youth unemployment rate surges to record high of 20.4%. China’s consumer spending and industrial activity grew at a slower pace than expected in April, adding to signs the recovery in the world’s second-largest economy is losing momentum. (BBG)

JOBS: Unemployment among China’s youth rose above 20 per cent for the first time in April, data released on Tuesday showed, creating a “worrying sign” for the overall economic recovery. The jobless rate for the 16-24 age group hit a record high of 20.4 per cent in April, up from 19.6 per cent in March, the National Bureau of Statistics (NBS) confirmed. (SCMP)

INFLATION: China’s CPI will remain low in May and June due to the high-base effects of last year, according to the recently released People’s Bank of China’s Q1 policy report. However, the economy will record faster consumer price increases later in the year, when policy measures take effect and the gap between supply and demand closes, the central bank said. The report also noted China should maintain a prudent monetary policy to avoid high inflation and banking instability experienced by developed countries. The PBOC said the economy does not face deflation risk, as M2, social financing and growth are expanding. Authorities will prioritise supervising the SME banking sector to mitigate risks, the report said. (Source: 21st Century Herald)

INFLATION: China’s consumer and factory-gate prices may pick up after bottoming out in the second quarter, according to a report by the Shanghai Securities News, citing analysts. (BBG)

FX: The yuan is expected to remain stable this year, as spill over from developed nations' monetary tightening eases and economic fundamentals improve, according to Wang Chunying, deputy director and spokesperson of the State Administration of Foreign Exchange. Speaking at a recent press conference, Wang said independent market actors determined the current FX rate and supply, and demand was balanced. China’s capital account remained stable and orderly, as foreign investors were increasingly attracted to CNY assets, which helped stabilise the FX market, he said. (MNI)

POPULATION: On the International Day of Families, Chinese authorities took the timely opportunity to stress the importance of boosting population quality while making fresh pledges of support for childbirth, as deepening demographic challenges continue to have an outsized impact on the world’s second-largest economy. (SCMP)

CHINA MARKETS

PBOC NET INJECTS CNY25 Billion TUESDAY

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Tuesday, with the rates unchanged at 2.00%. The operation, plus the CNY125 billion MLF conducted Monday, has led to a net injection of CNY25 billion after offsetting the maturity of CNY2 billion reverse repo and CNY100 billion MLF today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7789% at 09:31 am local time from the close of 1.8130% on Monday.

- The CFETS-NEX money-market sentiment index closed at 47 on Monday, compared with the close of 48 on Friday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 6.9506 TUES VS 6.9654 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9506 on Tuesday, compared with 6.9654 set on Monday.

OVERNIGHT DATA

AU WESTPAC MAY CONSUMER CONF M/M -7.9%; PRIOR 9.4%

AU WESTPAC MAY CONSUMER CONF INDEX 79.0; PRIOR 85.8

CHINA APR INDUSTRIAL PRODUCTION Y/Y 5.6%; MEDIAN 10.9%; PRIOR 3.9%

CHINA APR RETAIL SALES Y/Y 18.4%; MEDIAN 21.9%; PRIOR 10.6%

CHINA APR FIXED ASSETS EX RURAL YTD Y/Y 4.7%; MEDIAN 5.7%; PRIOR 5.1%

CHINA APR PROPERTY INVESTMENT YTD Y/Y -6.2%; MEDIAN -5.7%; PRIOR -5.8%

CHINA APR RESIDENTIAL PROPERTY SALES YTD Y/Y 11.8%; PRIOR 7.1%

CHINA APR SURVEYED JOBLESS RATE 5.2%; MEDIAN 5.3%; PRIOR 5.3%

MARKETS

US TSYS: Marginally Firmer In Asia

TYM3 deals at 115-11+, +0-04, a touch off the top of the 0-06 range on volume of ~50k.

- Cash tsys sit ~2bps richer across the major benchmarks.

- Tsys firmed through today's Asian session benefiting from spillover from ACGBs in lieu of falling Australian Consumer Confidence and the minutes of the May RBA meeting noted that the 25bp hike was finely balanced.

- Moves have had limited follow through as we remain well within recent ranges.

- A meeting between President Biden, House Leader McCarthy and other congressional leaders has been scheduled for Tuesday afternoon.

- In Europe today preliminary Eurozone GDP is on the wires, further out Canadian CPI and US Retail Sales, Industrial Production and Business Inventories cross. Fed VC Barr testifies before Congress and Fedspeak from Cleveland Fed President Mester, NY Fed President Williams and Chicago Fed President Gooldsbee crosses.

JGBS: Futures Holding Uptick, Narrow Range Ahead of Q1 GDP & 20-Year Supply

During the afternoon trading session in Tokyo, JGB futures have been trading within a narrow range and are slightly stronger at +7 compared to the settlement levels. Since there are no domestic data releases or supply-side factors affecting the market, local traders have been focused on monitoring US tsys as they await the release of the Euro Area's Q1 GDP and US Retail Sales later today.

- Cash US tsys are 2-3bp lower in early Asia-Pac trade, assisted by disappointing monthly economic data from China.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined news that the Japanese government will allow seven of the nation’s major power companies to raise household electricity prices by between 14% to 42%.

- Cash JGBs are slightly stronger across the curve apart from the 1-year and 3-year zones. Yields are 0.1-0.9bp lower with the 30-year the strongest The benchmark 10-year yield is 0.2bp lower at 0.405%, after yesterday’s 1.6bp increase.

- Swap rates are flat to 1.0p lower out to the 20-year zone, and slightly higher beyond. Swap spreads tighter out to the 10-year zone and wider beyond.

- The local calendar heats up tomorrow with the release of Q1 GDP and 20-year JGB supply.

AUSSIE BONDS: Weaker, Off Cheaps, Awaits WPI

ACGBs sit weaker (YM -3.0 & XM -2.0), off session cheaps, after the RBA Minutes signalled that the May decision to hike 25bp was a close call, with a no change outcome discussed. Members acknowledged the significant uncertainties surrounding the economic outlook, but on balance, they judged that a further increase in interest rates was warranted to bring inflation back to target.

- Richer US tsys in Asia-Pac trade also assisted the move off session lows.

- Cash ACGBs are 2bp richer after the Minutes release to be 2bp cheaper on the day with the AU-US 10-year yield differential +2bp at -4bp.

- Swap rates are 1-2bp higher on the day with the 3s10s curve flatter.

- Bills are 2bp stronger after the Minutes with pricing flat to -3.

- RBA-dated-OIS are slightly softer after the Minutes, sitting 1bp softer to 2bp firmer across meetings.

- Tomorrow sees the release of the Wage Price Index for Q1. After last quarter’s surprisingly soft print despite the minimum wage lift, the market will be watching to see if that result is reversed in Q1.

- Until then, all eyes will be on global bonds as they navigate Q1 GDP in the Euro Area and April Retail Sales in the US.

NZGBS: Weaker Fuelled By Hike & Budget Deficits Fears

NZGBs closed at session cheaps, 8-11bp weaker, as the market digests Westpac’s 6.0% OCR forecast and the prospect of a worse-than-expected deficit when the budget is handed down on Thursday. NZGBs underperformed the $-Bloc with NZ/US and NZ/AU 10-year yield differentials closing respectively 6bp and 3bp higher.

- Swap rates closed 5-9bp higher with the 2s10s curve 4bp flatter.

- RBNZ dated OIS closed 6-11bp firmer for meetings beyond May. The May meeting has 25bp of tightening priced.

- Non-Resident Bond Holdings data showed an increase from 60.3% in March to 62.1% in April, its highest level since 2017.

- The local calendar is light again tomorrow ahead of the Budget on Thursday. The government has signalled that Budget 2023 will focus on alleviating cost-of-living pressures, fast-tracking recovery from Cyclone Gabrielle, and maintaining public services, but not much else. The operating balance is expected to reach surplus in 2025/26, one year later than previously flagged.

- In Australia, the Wage Price Index is scheduled for release tomorrow with the market closely watching to see if last quarter’s soft outcome is reversed.

- Until then, all eyes will be on global bonds as they navigate Q1 GDP in the Euro Area and April Retail Sales in the US.

EQUITIES: Japan Stocks Hit Multi-Decade Highs, China Markets Struggle Amid Data Misses

Regional equities are once again trading mixed. Japan stocks remain solid performers, with the Topix printing multi decade highs. Weaker April activity data has weighed on China equity bourses, although losses haven't been large. Hong Kong equities are also still higher at this stage. US futures are in the red with Eminis down ~0.20%, last near4142.

- Japan's Topix is around +0.50% at this stage, which is fresh highs back to August 1990 (last near 2125.00 in index terms). A combination of positive earnings momentum, share buybacks and continued inflows (both domestically and from abroad) is aiding sentiment.

- The CSI 300 is down slightly, while the Shanghai Composite is flat. Weaker April activity figures have weighed at the margin. We have seen Northbound stock connect outflows today (-3.92bn yuan), the first daily outflow since the 4th of May (if sustained for the rest of the session).

- The HSI is +0.39% at this stage, we did see a surge in the Golden Dragon index in US trade on Monday (+4.07%). Famed money manager Michael Burry increased holdings in Alibaba and JD.com, which aided sentiment in the tech space.

- The ASX 200 is down -0.30%, with the softer Westpac/ANZ consumer sentiment readings weighing on consumer related stocks. Miners have also been indifferent with commodity prices struggling somewhat post the China data.

- The Kospi is up +0.10%, but the Taiex has outperformed +1.35%, following a strong gain for the SOX index in US trade on Monday.

FOREX: USD Little Changed In Asia

The greenback is little changed from Mondays closing levels in Asia, BBDXY is flat. Ranges across G-10 have been mostly narrow with little follow through.

- Kiwi is the strongest performer in the G-10 space at the margins, NZD/USD prints at $0.6250/55 ~0.1% firmer today. The pair sits a touch off session highs and has moved above its 20-Day EMA today.

- AUD is marginally pressured, AUD/USD prints at $0.6690/95 down ~0.1%. The RBA minutes of the May meeting noted that the decision to hike 25bps was finely balanced. AUD briefly extended losses as Chinese data was softer than expected before recovering to current levels.

- Yen is little changed dealing in a narrow range around the ¥136 handle.

- Elsewhere in G-10 ranges have been narrow in Asia, EUR is a touch firmer.

- Cross asset wise; e-minis are down ~0.2% and US Treasury Yields are ~2bps softer across the curve.

- In Europe today preliminary Eurozone GDP is on the wires, further out Canadian CPI and US Retail Sales, Industrial Production and Business Inventories cross.

OIL: Crude Holds Onto Gains But Off Highs Following Disappointing China Data

Oil prices have extended Monday’s gains during today’s APAC session, despite April China data coming in on the downside. They are up another 0.4% with WTI around $71.40/bbl following an earlier intraday high of $71.79 and Brent about $75.56 after a high of $75.95. Both are approaching resistance levels of $73.93 and $77.61 respectively. The USD index is flat.

- While the hoped for surge in demand from China is looking less likely, the US announced that it will buy up to 3mn barrels of sour crude in August for the Strategic Petroleum Reserve (SPR), helping to support oil prices.

- Despite the weaker-than-expected China data, processing of crude remained near a record high. China’s disappointing post-pandemic recovery plus expectations of a US recession have weighed on oil prices this year. The market also continues to be nervous about the US debt ceiling talks.

- Supply issues persist though with Canadian wildfires disrupting around 300kbd of crude and issues with shipments from Iraqi Kurdistan persisting. However, Russian shipments continue to indicate that output isn’t being reduced there.

- Later the IEA publishes its monthly outlook report and industry data on US fuel stocks is also released.

- The Fed’s Mester, Barr, Williams, Goolsbee and Logan are all scheduled to speak today. US April retail sales will be watched closely. NY Fed services business activity for May, April IP and March business inventories print as well. UK and euro area employment data, euro area Q1 GDP and Canadian April CPI are released.

GOLD: Unchanged In Asia-Pac, Weaker Dollar & Debt Ceiling Talks Supporting

In Asia-Pacific trading, gold is little changed at 2016.61, after closing +0.3% to $2016.49 having gyrated its way higher with the USD index steadily unwinding Friday’s sizeable gain.

- Further debt ceiling talks between the White House and Congressional leaders are set for Tuesday and are expected to hit roadblocks. A key Republican Congressional leader signalled Monday they're far apart from President Joe Biden on debt limit negotiations, lending support to gold.

- With the Federal Reserve coming to the end of its hiking cycle, market analysts are looking for a supportive medium-term outlook for gold.

- MNI's technical team reports that gold is still on an uptrend, marked by a series of higher highs and higher lows. Moving average studies are also indicating a bullish setup. Investors are closely monitoring the March 8 high of $2070.4, which is the immediate target before the all-time high of $2075.5. Meanwhile, the key support level remains at $1969.3, which was the low point recorded on April 19th.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/05/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 16/05/2023 | 0900/1100 | *** |  | EU | GDP (p) |

| 16/05/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 16/05/2023 | 0900/1100 | * |  | EU | Employment |

| 16/05/2023 | 0900/1100 | ** |  | IT | Italy Final HICP |

| 16/05/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/05/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/05/2023 | - |  | EU | ECB de Guindos in ECOFIN Meeting | |

| 16/05/2023 | 1215/0815 |  | US | Cleveland Fed's Loretta Mester | |

| 16/05/2023 | 1230/0830 | *** |  | CA | CPI |

| 16/05/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 16/05/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 16/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/05/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 16/05/2023 | 1400/1000 | * |  | US | Business Inventories |

| 16/05/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 16/05/2023 | 1400/1000 |  | US | Fed Vice Chair Michael Barr | |

| 16/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 16/05/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 16/05/2023 | 1615/1215 |  | US | New York Fed's John Williams | |

| 16/05/2023 | 1915/1515 |  | US | Dallas Fed's Lorie Logan | |

| 16/05/2023 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic | |

| 16/05/2023 | 2300/1900 |  | US | Chicago Fed's Austan Goolsbee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.