-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Who Will Replace Brainard?

EXECUTIVE SUMMARY

- AUSTAN GOOLSBEE UNDER CONSIDERATION TO SERVE AS FED’S VICE CHAIR (WSJ)

- WHITE HOUSE TO MOVE QUICKLY TO NOMINATE SOMEONE FOR FED VICE CHAIR SEAT (RTRS)

- ECB’S LAGARDE REAFFIRMS INTENTION FOR HALF-POINT MARCH HIKE (BBG)

- TOP CHINA NEWSPAPER SEES ROOM FOR CUTS IN KEY LENDING RATE, RRR (BBG)

- BOJ WILL SCALE DOWN ULTRALOOSE POLICY THIS YEAR (NIKKEI SURVEY)

- CHINA WARNS OF RETALIATION AGAINST U.S. OVER BALLOON SAGA (BBG)

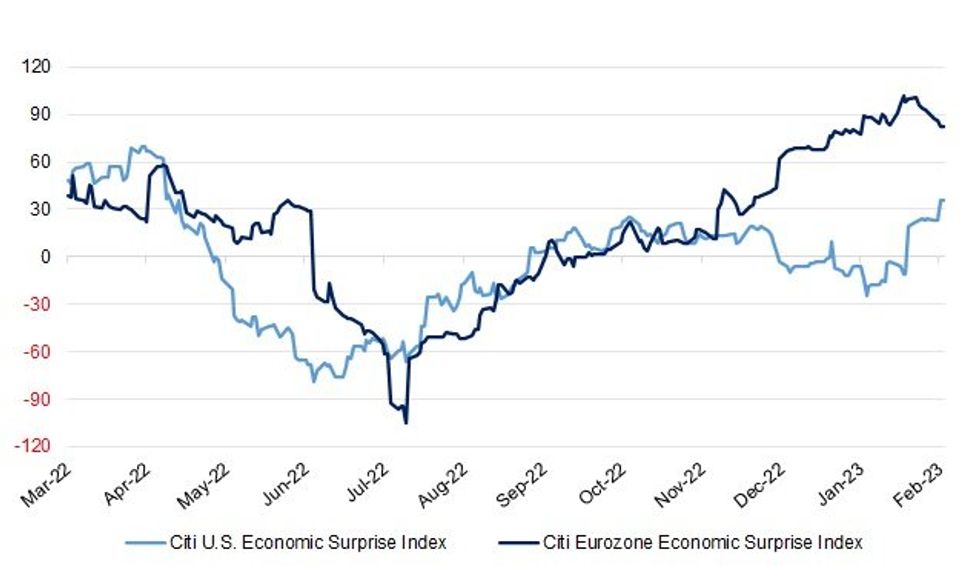

Fig. 1: Citigroup U.S. & Eurozone Economic Surprise Indices

Source: MNI - Market News/Bloomberg

UK

FISCAL/POLITICS/ECONOMY: Public sector pay rises must stay below 5 per cent next year to control inflation, the Treasury has told ministers in a move that could prolong strikes beyond the summer. (The Times)

BREXIT: A deal on the Northern Ireland Protocol could be sealed early next week, after more than a year of negotiations. (BBC)

EUROPE

ECB: President Christine Lagarde reiterated that the European Central Bank intends to raise borrowing costs by another half-point next month. (BBG)

ECB: The European Central Bank will raise its deposit rate at least twice more, taking the terminal rate to 3.25% in the second quarter, with a vast majority of economists polled by Reuters saying the greater risk is it goes even higher. (RTRS)

EU/FISCAL: The European Commission probably won’t lift its current freeze on funds to Hungary even if the member country fulfilled all requirements in time, Development Minister Tibor Navracsics said in an interview aired on Inforadio Wednesday. (BBG)

GERMANY: Germany needs a 360 degree change in the economic environment for business in order to improve competitiveness, German Finance Minister Christian Lindner said in Helsinki on Wednesday. (RTRS)

SPAIN: Two associations representing Spanish banks launched legal moves to challenge the country’s new bank revenue tax. (BBG)

NORWAY: Norway’s government said on Wednesday it would consider taxing electricity exports and impose other changes to its energy market to preserve more power for domestic use and keep a lid on prices. (RTRS)

U.S.

FED: The White House is considering nominating Austan Goolsbee, who became president of the Federal Reserve Bank of Chicago last month, to serve as vice chair of the Federal Reserve’s board of governors, according to people familiar with the matter. (WSJ)

FED: The administration of President Joe Biden will move quickly to nominate someone for the U.S. Federal Reserve vice chair seat in the near future but does not have anyone to preview at this time, a White House official said on Wednesday. (RTRS)

FED: White House officials have reached out to a key Democratic ally in the Senate to discuss filling the vacant role of Fed vice chair, with the Wall Street Journal reporting that Chicago Fed President Austan Goolsbee is under consideration for the post. Senate Banking Chairman Sherrod Brown says he spoke Wednesday with White House officials about the vacancy created by President Joe Biden’s decision to name Vice Chair Lael Brainard to be his top economic adviser. (BBG)

ECONOMY/FISCAL: U.S. President Joe Biden warned union workers Wednesday about the state of the economy and the threats that House Republicans and their policies pose to rank-and-file members. (CNBC)

FISCAL: The United States Treasury will exhaust its emergency measures to prevent a debt default sometime between July and September unless Congress raises the $31.4 trillion debt limit, the Congressional Budget Office projected Wednesday. (CNBC)

POLITICS: Former U.N. ambassador Nikki Haley called on Republicans to move on from "stale ideas" and "faded names," a veiled swipe at her former boss Donald Trump, as she made her first stop on Wednesday in a campaign for the 2024 presidential nomination. (RTRS)

POLITICS: Donald Trump’s former chief of staff Mark Meadows has been subpoenaed by the special counsel investigating the former president and his role in the January 6, 2021, insurrection, a source familiar with the matter told CNN. (CNN)

EQUITIES: The Justice Department has ramped up work in recent months on drafting a potential antitrust complaint against Apple Inc., according to people familiar with the matter. (WSJ)

EQUITIES: House Judiciary Chair Jim Jordan, R-Ohio, sent subpoenas to five Big Tech companies on Wednesday, demanding communications between the companies and the U.S. government to “understand how and to what extent the Executive Branch coerced and colluded with companies and other intermediaries to censor speech.” (CNBC)

OTHER

GLOBAL TRADE: Europe must not respond to the U.S. Inflation Reduction Act with excessive subsidies, German Finance Minister Christian Lindner said in Helsinki on Wednesday, as the European Union debates ways to respond to the multibillion-dollar package. (RTRS)

U.S./CHINA: The Senate has passed by unanimous consent two non-binding resolutions condemning China for the spy balloon that flew over the US. (BBG)

U.S./CHINA: China warned that it will retaliate against the US over violations of its sovereignty, potentially escalating the lingering balloon dispute just as top diplomats from both nations plan to attend a security conference in Germany. (BBG)

U.S./CHINA: Senior American officials increasingly believe the Chinese spy balloon that was shot down off the coast of South Carolina in early February was originally supposed to conduct surveillance over U.S. military bases in Guam and Hawaii, but winds carried it off course to Alaska, Canada and finally the continental United States. (New York Times)

U.S./CHINA: A key adviser on China to President Joe Biden is set to depart the White House National Security Council at a tumultuous time in the US relationship with Beijing. (BBG)

U.S./CHINA: China's industrial and information development is facing a more severe and complex external environment because of escalating U.S. suppression of the nation's advanced manufacturing industry, China's industry minister wrote in an article published in Communist Party journal Qiushi. (RTRS)

U.S./CHINA/TAIWAN: The United States hopes that China will not use any visits by members of Congress as a pretext for military action in Taiwan, a senior U.S. diplomat said on Wednesday, and urges all countries to warn Beijing against conflict over the issue. (RTRS)

EU/CHINA: China is willing to fully resume exchanges in all fields with France and further advance high-level exchanges, China’s top diplomat Wang Yi said at the meeting with French president Emmanuel Macron on Feb. 15, Xinhua reports. (BBG)

BOJ: Kazuo Ueda, the government's nominee to become next Bank of Japan (BOJ) governor, will speak at a confirmation hearing at the lower house of parliament on Feb. 24, a ruling party official said on Thursday. (RTRS)

BOJ: The Bank of Japan will curtail its ultraloose monetary policy in some fashion by the end of the year as the central bank undergoes a changing of the guard, analysts predicted in a Nikkei survey. All 20 BOJ watchers polled said the bank will likely revise the yield curve control tool sometime this year. (Nikkei)

AUSTRALIA: Treasure Jim Chalmers says the unemployment rate outcome on Thursday was an “expected outcome.” “We have been expecting an uptick in the unemployment rate as the economy slows a bit as the obvious consequence of a slow global economy mixed with the impact of interest rate rises here in our own economy,” he said. (Sky)

NEW ZEALAND: Finance Minister Grant Robertson says the Treasury’s latest accounts show the Government’s books are in good shape to respond to the challenges of Cyclone Gabrielle and cost of living pressures. (Stuff NZ)

SOUTH KOREA: South Korean prosecutors on Thursday requested an arrest warrant for the head of the main opposition Democratic Party, Lee Jae-myung, in an investigation into development projects and bribery allegations. (RTRS)

MEXICO: Mexico central bank Deputy Governor Jonathan Heath said in tweet unemployment data reflects “substantial improvement.” (BBG)

MEXICO: Mexico central bank Deputy Governor Irene Espinosa said monetary policy will remain restrictive to bring down inflation, Reforma reports citing her remarks at an event. (BBG)

RUSSIA: Russia will call a meeting of the U.N. Security Council on Feb. 22 to discuss "sabotage" of the Nord Stream gas pipelines, the Russian mission to the United Nations said on Wednesday, according to the state-run RIA news agency. (RTRS)

RUSSIA: Russia continues to access foreign chips and technology through intermediaries like Iran, a senior US official responsible for regulating exports said. (BBG)

ISRAEL: The United Nations Security Council is considering a draft resolution, seen by Reuters on Wednesday, that would demand Israel "immediately and completely cease all settlement activities in the occupied Palestinian territory." (RTRS)

WORLD BANK: World Bank President David Malpass will step down on June 30 after more than four years at the helm of the multilateral development bank, the bank said on Wednesday. It was not immediately clear why Malpass, who was appointed by then-President Donald Trump, was departing before the end of his five-year term. (RTRS)

METALS: One of Europe’s largest aluminum producers warned Russian supplies are selling at a steep discount on the continent, threatening competitors who already have suffered over the past year from surging power prices. (BBG)

ENERGY: Europe still faces a risk of natural gas supply shortages this year unless it further curbs demand, according to the International Energy Agency. (BBG)

CHINA

POLICY: China will boost income of urban and rural residents and improve the consumption power of low and middle-income residents, the state planner said on Thursday. (RTRS)

FISCAL: Fiscal revenue will grow in China this year although the growth rate will not be too high, Liu Kun, China's finance minister said, state media reported. "The foundation for economic recovery is not yet solid and there is great uncertainty for fiscal revenue," Liu cautioned. (RTRS)

FISCAL: A $2 trillion swathe of China’s local bond market is approaching a risky inflection point as issuers struggle to refinance maturing debt. (BBG)

PBOC: There is still room for Chinese banks to cut 5-year loan prime rates, although the PBOC kept its one-year policy loan rate unchanged at 2.75% Wednesday, China Securities Journal reports, citing analysts. (BBG)

PBOC: The People's Bank of China (PBOC) will promote the further two-way opening up of China’s financial markets, and ensure more support for the real economy in 2023, according to minutes from the central banks’ recent Financial Market Work Conference. (MNI)

PBOC/MONEY MARKETS: The PBOC’s decision to increase the net amount of its medium-term lending facility (MLF) in February will help curb a rise in money market rates, which will help stabilise market expectations and allow banks to support economic growth by providing credit to the economy at a lower cost, according to the Securities Daily. (MNI)

YUAN: China's cross-border capital flows were stable in January, and the supply and demand of foreign exchange inside and outside the country was balanced, according to Wang Chunying, deputy director of the State Administration of Foreign Exchange. (MNI)

CHINA MARKETS

PBOC SETS YUAN CENTRAL PARITY AT 6.8519 THURS VS 6.8183 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8519 on Thursday, compared with 6.8183 set on Wednesday.

PBOC NET INJECTS CNY34 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) conducted CNY487 billion via 7-day reverse repos on Thursday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY34 billion after offsetting the maturity of CNY453 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0136% at 9:23 am local time from the close of 2.0086% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Wednesday, the same as the close on the previous trading day.

OVERNIGHT DATA

JAPAN JAN TRADE BALANCE -¥3.4966TN; MEDIAN -¥3.9767TN; DEC -¥1.4518TN

JAPAN JAN ADJUSTED TRADE BALANCE -¥1.8213TN; MEDIAN -¥2.4000TN; DEC -¥1.7242TN

JAPAN JAN EXPORTS +3.5% Y/Y; MEDIAN -1.7%; DEC +11.5%

JAPAN JAN IMPORTS +17.8% Y/Y; MEDIAN +20.6%; DEC +20.7%

JAPAN DEC CORE MACHINE ORDERS +1.6% M/M; MEDIAN +2.8%; NOV -8.3%

JAPAN DEC CORE MACHINE ORDERS -6.6% Y/Y; MEDIAN -6.1%; NOV -3.7%

AUSTRALIA JAN EMPLOYMENT CHANGE -11.5K; MEDIAN +20.0K; DEC -20.0K

AUSTRALIA JAN FULL-TIME EMPLOYMENT CHANGE -43.3K; DEC +14.4K

AUSTRALIA JAN PART-TIME EMPLOYMENT CHANGE +31.8K; DEC -34.3K

AUSTRALIA JAN UNEMPLOYMENT RATE 3.7%; MEDIAN 3.5%; DEC 3.5%

AUSTRALIA JAN PARTICIPATION RATE 66.5%; MEDIAN 66.6%; DEC 66.6%

AUSTRALIA FEB MELBOURNE INSTITUTE CONSUMER INFLATION EXPECTATIONS +5.1% Y/Y; JAN +5.6%

AUSTRALIA JAN CBA HOUSEHOLD SPENDING -6.9% M/M; DEC +0.3%

AUSTRALIA JAN CBA HOUSEHOLD SPENDING +5.2% Y/Y; DEC +2.2%

AUSTRALIA JAN FX TRANSACTIONS MARKET +A$602MN; DEC +A$1.865BN

AUSTRALIA JAN FX TRANSACTIONS GOVERNMENT -A$628MN; DEC -A$1.885MN

AUSTRALIA JAN FX TRANSACTIONS OTHER +A$1.102BN; DEC -A$2.059BN

NEW ZEALAND DEC NET MIGRATION +4,581; NOV +7,354

MARKETS

US TSYS: Richer In Asia, Cross-Market Flows Dominate

TYH3 deals at 112-07, +0-05+, a touch off the top of the 0-11+ range on volume of ~138K.

- Cash Tsys sit 1-2bp richer across the major benchmarks.

- Cross-market flows from ACGBs dominated in early dealing, as Tsys initially followed ACGBs lower pre-Australian labour market report.

- An unexpected uptick in Australian unemployment then saw ACGBs unwind early losses facilitating a recovery from session lows in Tsys.

- Pockets of screen buying in TY futures aided the bid, with a block buyer in FV futures also noted.

- The richening held through the remainder of the session.

- ECB speak from Panetta headlines the European session. Further out we have PPI, Jobless Claims, Housing Starts and the Philadelphia Fed Manufacturing Index. Cleveland Fed President Mester and St Louis Fed President Bullard will cross. We also have the latest 30-Year TIPS supply.

JGBS: Move Away From Session Cheaps Holds Into Close

JGBs recovered from session cheaps after futures initially extended on their overnight session downtick, with spill over from a bid in wider core global FI markets providing some impetus early on.

- Futures are -13 into the bell, while cash JGBs deal either side of unchanged with little in the way of uniform direction noted. 10s have been limited by their proximity of the upper boundary of the BoJ’s YCC settings.

- Domestic headline flow continues to be centred on all things BoJ, with the latest Nikkei survey revealing that all 20 respondents said that “the Bank will likely revise the yield curve control tool sometime this year.”

- Elsewhere, there was confirmation that the government’s choices for the BoJ leadership positions will appear in their respective lower house hearings on 24 February.

- 5-Year JGB supply went well, even with the coupon on the new line being adjusted lower (0.2% vs. last month’s new 0.3% line), adding a fresh firming bias to afternoon trade.

- Local data flow generated a slightly narrower than expected trade deficit for January (although we still saw the widest headline monthly trade deficit on record), alongside softer than expected core machine orders, although that didn’t move the needle for the space.

- Tomorrow’s local docket is virtually empty.

JGBS AUCTION: 5-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.0329tn 5-Year JGBs:

- Average Yield: 0.216% (prev. 0.393%)

- Average Price: 99.92 (prev. 99.55)

- High Yield: 0.216% (prev. 0.399%)

- Low Price: 99.92 (prev. 99.52)

- % Allotted At High Yield: 87.9205% (prev. 81.0659%)

- Bid/Cover: 3.977x (prev. 3.661x)

JGBS AUCTION: 12-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.84768tn 12-Month Bills:

- Average Yield: -0.0959% (prev. -0.0616%)

- Average Price: 100.096 (prev. 100.062)

- High Yield: -0.0859% (prev. -0.0318%)

- Low Price: 100.086 (prev. 100.032)

- % Allotted At High Yield: 33.7376% (prev. 50.5907%)

- Bid/Cover: 3.816x (prev. 4.396x)

AUSSIE BONDS: Labour Market Report Sparks A Sharp Reversal

Aussie rates futures extended overnight session weakness ahead of domestic employment data, before reversing sharply on an unexpected uptick in unemployment and a soft headline employment figure.

- While the January employment data appeared to deliver tentative signs of labour market cooling, post-data briefings by the Big-4 banks all signalled caution re: taking a firm view. Factors deemed to be in play included “seasonal patterns”, “a greater than usual ‘holiday effect’” and the fact that “the ABS reported “more people than usual with a job indicating they were starting…work later in the month.”

- YM and XM were -10.0 to -13.0 early, only to surge 15-16bp before closing +2.0 and -2.0, respectively.

- AU/U.S. 10-year yield differential is 4bp lower at -2bp, narrowing post-data.

- Swap rates also reversed the early push higher, with the 3s10s curve 4bp steeper.

- Bills closed 1-6bp, bull steepening, also more than reversing early losses.

- Immediate RBA-dated OIS was a tad lower with an 88% chance of a 25bp hike priced for next month. Terminal rate expectations (Sep/Oct-22) continued to fluctuate between 4.10%-4.22%, closing at 4.12%. It traded near the top of the range pre-data.

- ANZ now forecasts the RBA cash rate target peaking at 4.10% in the current cycle.

- Supply matters headline locally tomorrow.

NZGBS: Mid-Session Rally On AUS Jobs Data

Today delivered another session of U.S. Tsy-induced weakness in the morning, followed by a solid short-end-led rally sparked by market-friendly Antipodean data.

- Today’s major catalyst was the weaker-than-expected Australian employment data. NZGBs yields were up as much as 7-8bp ahead of the release. By the end of trading the 2-year benchmark had managed to reverse that move, closing 2.5bp richer. Further out, NZGBs rallied but not enough to completely wipe anyway morning weakness with the 5-year benchmark yield ending up 2bp and the 10-year benchmark up 5bp.

- Swap moves were less dramatic with the mid-session turnaround equating to a -4bp move in the 2-year rate and a -0.5bp move in the 10-year. The 2s10s curve was 7bp steeper on the day.

- RBNZ-dated OIS now shows just under 50bp of tightening for this month's meeting, continuing the recent pull lower. Terminal OCR pricing saw a more prominent move, declining to sub-5.35% versus the week’s high of ~5.50%.

- KiwiBank suggested that the RBNZ should stand pat at this month’s meeting, in lieu of Cyclone Gabrielle, although the bank does still expect the RBNZ to ultimately deliver a hike. This view weighed on the OIS strip ahead of the Australian data.

- The NZ Debt Management Office successfully sold NZ$200mn May-28, NZ$150mn Apr-33 and NZ$50mn Apr-37 with cover ratios of 3.48x, 2.57x and 2.72x, respectively (more than smooth passage after last week's uncovered auction in the belly).

EQUITIES: Dip Buyers Emerging?

Regional equities have rebounded today, particularly the higher beta plays. The late US equity rally from Wednesday has helped, while US futures have tracked higher in the first part of trade today (Eminis +0.15%, Nasdaq +0.37%). Talk of China efforts to boost consumption is likely to have aided sentiment for China bourses and across the region.

- The HSI is up 2.20% at this stage, with the China Enterprise Index slightly better at +2.50%. With both indices 8-10% off Jan highs, dip buyers may be starting to emerge.

- Onshore the CSI 300 is up around 1%. Yesterday a speech by Xi Jinping from late last year was released, stressing efforts to boost lower and middle income consumption this year. Local papers reported the President calling on local governments to do more to boost consumption.

- Elsewhere, tech plays in South Korea (1.88%) and the Taiex (0.88%) are firmer. Offshore investors have added +$133.1mn to local shares in Korea. Japan stocks are +0.77% for the Nikkei at this stage.

- The ASX 200 is +0.80%, while Indonesian stocks are the only major bourse within the region lower, off 0.2% at this stage. A big onshore property developer, Waskita, is seeking to delay a bond payment, which has weighed on sentiment at the margin.

GOLD: Bullion Stabilises After Wednesday’s Post-Retail Sales Slump

Gold prices are up 0.2% to $1840.50/oz after falling a percent on Wednesday following the strong US retail sales report driving up yields and the USD. Bullion reached a high today of $1842.64 following a low of $1834.56. The USD DXY is down 0.2%.

- Gold is now trading below its 50-day simple moving average as better US data and Fed comments point to further tightening. Wednesday’s low of $1830.66 has now formed initial support.

- Later today the Fed’s Mester, Bullard and Cook all speak. A hawkish tone from these officials would send bullion down further. In terms of data, there will be more detail on the inflation front from the January PPI, which is expected to see a pickup in monthly increases but the annual rates should ease. There are also January housing starts & permits, jobless claims and Philadelphia and NY business indices for February.

OIL: Crude Rising On Hopes Of Increased Demand From China

Oil prices are higher today as the market is hoping for economic stimulus in China. They fell on Wednesday in the wake of a strong US crude stock build and robust US retail sales. Brent is up 0.5% today to $85.80/bbl after falling 0.35% yesterday and WTI is up 0.6% to $79.09 after -0.7%, both are close to their intraday highs.

- Brent remains above its 100-day simple moving average while WTI is approaching its 100-day MA. Brent and WTI have been holding above the February 9 support levels.

- The US EIA reported a significant 16.28mn build in crude inventories after 2.42mn the previous week. The stock build this year is being driven by a reduction in refining due to maintenance and December’s cold snap and so the usually refined crude is being stockpiled despite lower imports and higher exports.

- The UAE energy minister pointed to the US crude stockpiling as an indicator that there is plenty of supply. It is unlikely that OPEC+ will change its output quotas any time soon.

- The IEA revised up its 2023 oil demand forecasts by 0.1mbd to 2mbd.

- Later today the Fed’s Mester, Bullard and Cook all speak. In terms of data, there will be more detail on the inflation front from the January PPI, which is expected to see a pickup in monthly increases but the annual rates should ease. There are also January housing starts & permits, jobless claims and Philadelphia and NY business indices for February.

FOREX: USD Pressured On Firmer Equities

The greenback is softer in Asia-Pac today as firmer US and Regional equities have boosted risk sentiment.

- AUD was pressured in the immediate aftermath of the January Australian Labour Market report. The unemployment rate ticked higher to 3.7% from 3.5%. AUD/USD fell, finding support below $0.6880.

- Local banks have played down the weakness in the Australian Labour report, as the ABS figures noted a larger than usual increase in the number of unemployed who had a job to go to in the future. This suggests that we may see a rebound in Feb.

- Losses were pared as rising equities boosted risk sentiment, with the AUD/USD rising above $0.69 handle lasting printing $0.6920/25.

- NZD/USD prints at $0.6305/10, ~0.4% firmer today. Kiwi was pressured in early trade, Kiwibank noted that they felt given the impact of Cyclone Gabrielle the RBNZ shouldn't hike rates next week. Support was seen below $0.6260, before a ~0.8% trough to peak rally sees the pair deal above its 200-Day EMA.

- USD/JPY has moderated some of yesterday's gains, and is testing its 200-day EMA. The pair is ~0.3% softer, last printing ¥133.75/85. January Trade Balance printed ~¥3.5tn deficit, which was narrower than expectations.

- The USD weakness has helped EUR and GBP tick higher. Both are ~0.2% firmer. NOK and SEK are benefiting from improved risk sentiment both up ~0.3%.

- Cross asset wise; Hang Seng is up ~2% and e-minis are ~0.2% firmer. BBDXY is down ~0.2%. 10 Year Us Treasury Yields are ~2bps lower.

- ECB speak from Panetta headlines the European session. Further out we have US PPI, Jobless Claims, Housing Starts and Philadelphia Fed Manufacturing Index. Cleveland Fed President Mester and St Louis Fed President Bullard will also cross.

FX OPTIONS: Expiries for Feb16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0750-60(E540mln)

- USD/JPY: Y128.50($550mln)

- EUR/GBP: Gbp0.8930-50(E976mln)

- NZD/USD: $0.6200(N$671mln)

- USD/CAD: C$1.3435-50($1.1bln), C$1.3550($906mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/02/2023 | 0915/1015 |  | EU | ECB Panetta in Discussion at Centre for European Reform | |

| 16/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 16/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 16/02/2023 | 1330/0830 | *** |  | US | PPI |

| 16/02/2023 | 1330/0830 | *** |  | US | Housing Starts |

| 16/02/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 16/02/2023 | 1345/0845 |  | US | Cleveland Fed's Loretta Mester | |

| 16/02/2023 | 1500/1600 |  | EU | ECB Lane Dow Lecture at NIES London | |

| 16/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 16/02/2023 | 1600/1100 |  | CA | BOC Governor Macklem at House of Commons hearing | |

| 16/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 16/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 16/02/2023 | 1700/1700 |  | UK | BOE Pill Fireside Chat at Warwick University Think Tank | |

| 16/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 16/02/2023 | 1830/1330 |  | US | St. Louis Fed's James Bullard | |

| 16/02/2023 | 1945/2045 |  | EU | ECB de Guindos Students Discussion | |

| 16/02/2023 | 2100/1600 |  | US | Fed Governor Lisa Cook | |

| 16/02/2023 | 2255/1755 |  | CA | BOC Deputy Beaudry speaks on "The importance of the Bank of Canada’s 2% inflation target" | |

| 16/02/2023 | 2315/1815 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.