-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI GLOBAL MORNING BRIEFING: UK GDP Set To Slow In Q3

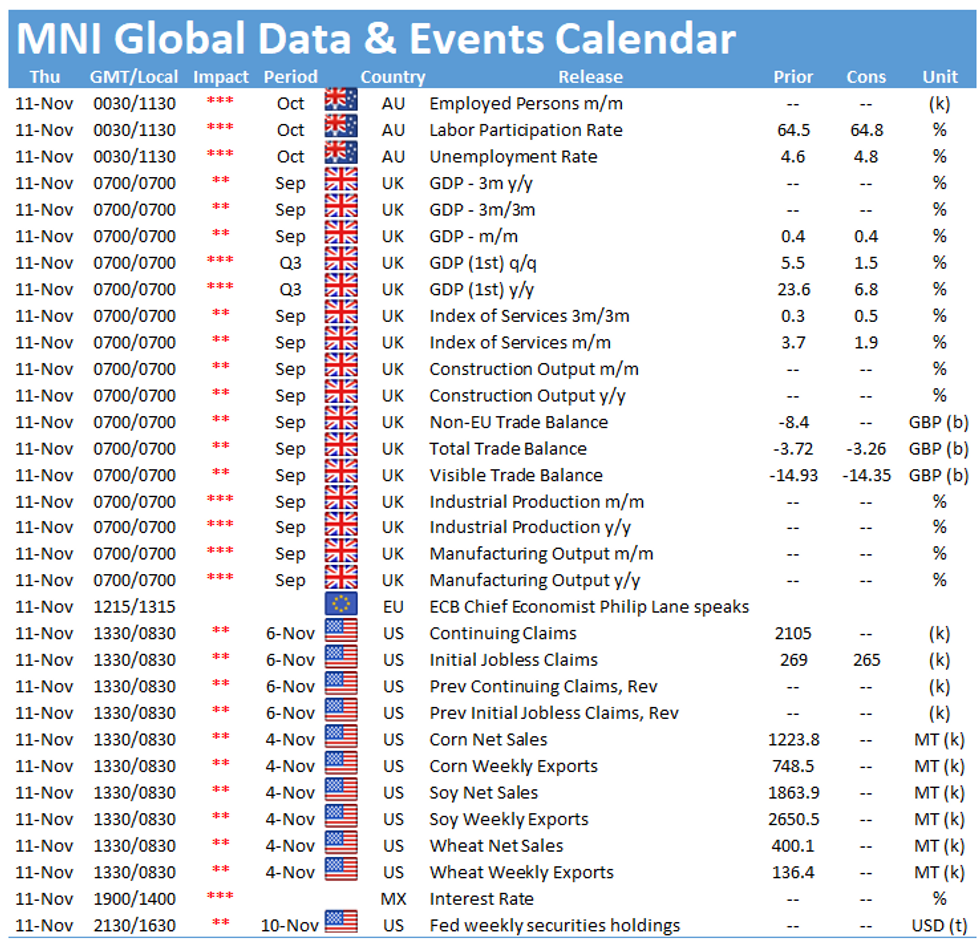

With U.S. markets closed, Thursday's highlights are the early release of UK Q3 growth data and the late announcement of the Mexican central bank's policy decision.

UK Growth Likely Slowed in Q3 (0700GMT)

The UK economy is seen having expanded by 1.5% in Q3, forecasts show, in line with forecasts published in the Bank of England's Monetary Policy Report last week. However, achieving that pace of growth is contingent on monthly growth of 0.5% in September, according to an Office for National Statistics official, assuming no revisions to August (originally reported as +0.4%) and July (-0.1%).

But consumer sentiment appeared to flag through the autumn, with retail sales slumping 3.9% in the third quarter, which is scheduled to shave 0.2 percentage points from output over the period, according to the ONS.

Weak retail activity, coupled with a 16% decline in car sales between July and September, could sap service sector growth. The wholesale and retail sector -- which includes auto trade -- comprises 10.4% of output. Car output, accounting for approximately 10% of total manufacturing, contracted by 12% in Q3, according to data released by the SMMT.

However, both categories staged dramatic rebounds between August and September, which could keep September activity in the black, despite petrol shortages that hit the country during the final week of the month. Automobile output rose by 80% in September while sales surged more than three fold.

The composite purchasing managers index rose slightly in September, to 54.9 from 54.8, with the services index rising slightly and the manufacturing component falling. The construction PMI declined to 52.6 from 55.2 in August, after official data showed the sector contracting in both July and August.

Mexican central bank set to hike ((1900GMT)

Analysts unanimously expect Banxico to continue their tightening cycle at the November meeting, our emerging markets team note.

However, given the persistent upward trajectory of inflation readings and the associated pressure on inflation expectations, opinions are mixed on whether the board should accelerate the pace of hikes.

So far, consensus points toward another 25bp hike from 4.75% to 5.00% as the most probable outcome, with individual voting likely to come under particular scrutiny for assessing the future path of policy.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.