-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: UK jobless rate seen higher

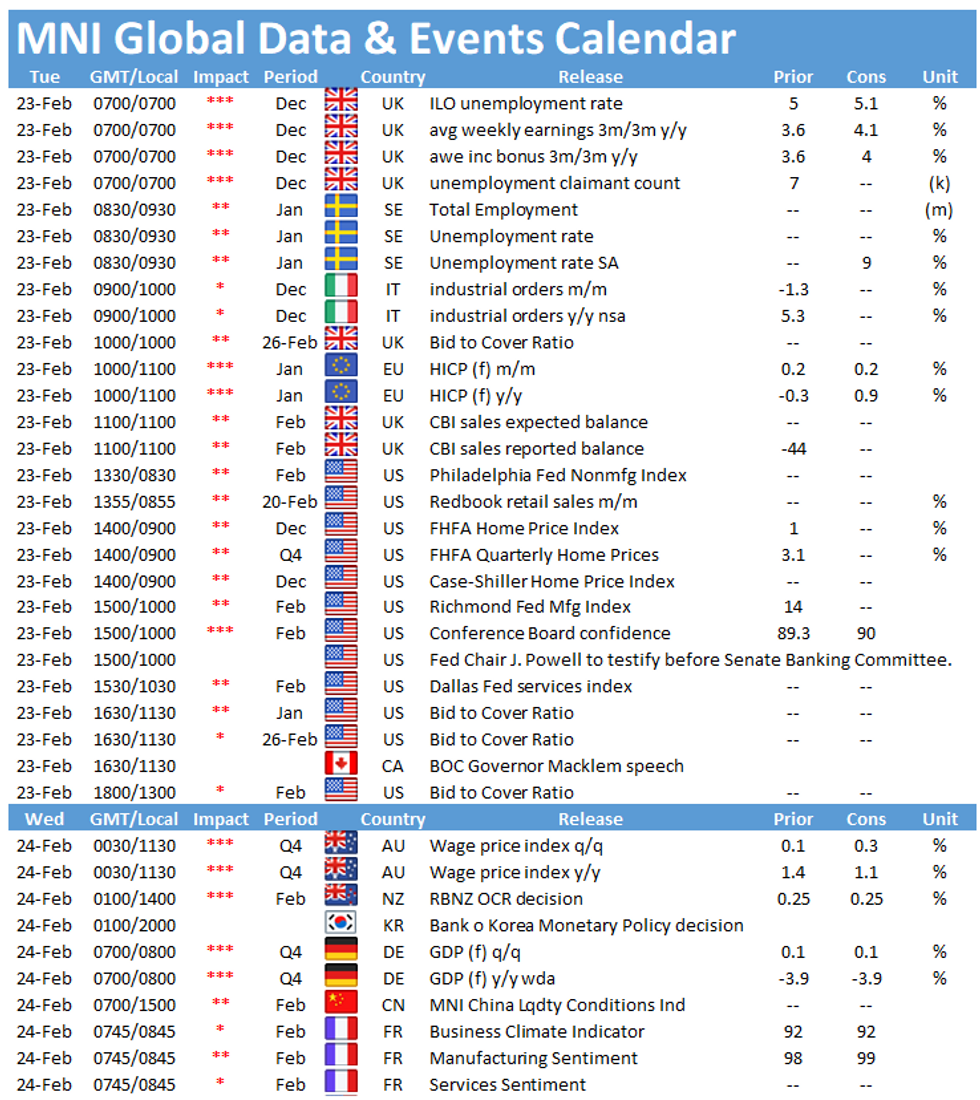

Tuesday kicks off with the publication of the UK's labour report at 0700GMT followed by EZ final inflation figures at 1000GMT. The main data event to follow in the US is the release of US consumer confidence at 1500GMT.

UK unemployment forecast to rise

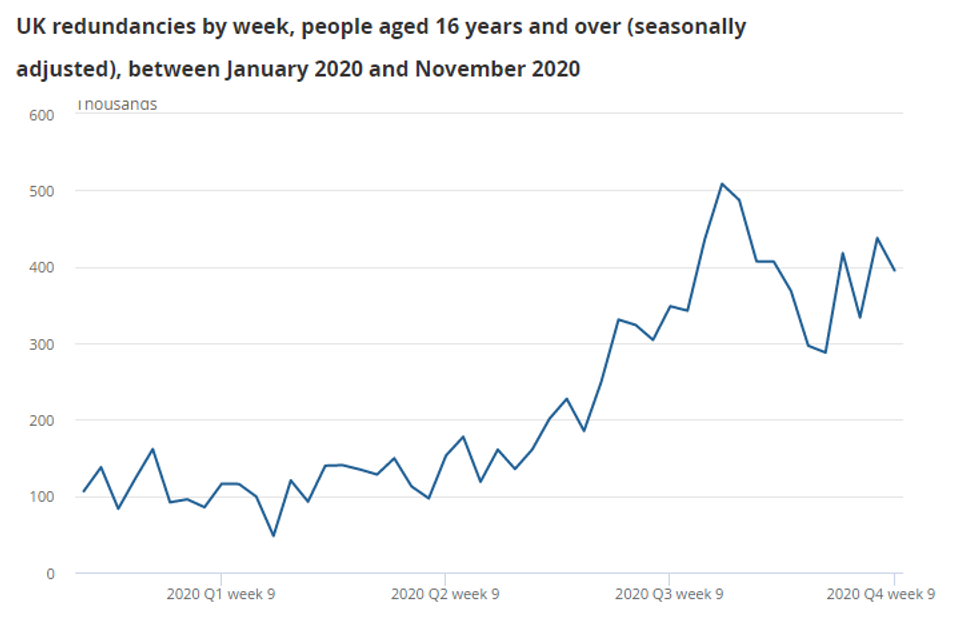

The UK jobless rate is expected to tick up slightly in December to 5.1% after rising to 5.0% in the previous month. This would mark the sixth consecutive increase. November's rate was the highest level since early 2016. More up-to-date PAYE data showed an uptick of payrolled employees in December, although since February 2020 there were 828,000 fewer people in payrolled employment. Forward looking survey evidence provides a mixed picture for the labour market. The KPMG/Rec jobs report showed a sharp fall in permanent placements in January due to the lockdown which also led to an uptick in temporary billings. The report further noted a decline in starting salaries and an increase in redundancies in January. However, the CIPD/Adecco labour market outlook survey suggests that firms intend to hire more staff in Q1, mainly driven by the private sector.

Source: Office for National Statistics - Labour Force Survey

EZ final inflation seen at flash estimate

Final inflation is forecast to be in line with the flash result that showed a sharp increase to 0.9% in January. This would be the first positive reading after five consecutive months of negative rates. Core inflation rose significantly as well to 1.4%, up from 0.2% seen in December. The end of the German VAT cut played a major role in the rebound of inflation. Inflation is likely to rise further from March onwards due to energy price base effects. However, the ECB stated in their economic bulletin that underlying price pressure is subdued due to weak demand and low wage pressure.

US consumer confidence projected to tick up marginally

Consumer confidence in the US is expected to edge slightly higher to 90 in February, up from 89.3 seen in January. While the present situations index declined in January, the expectations index increased. The main driver of January's decrease in the current assessment was still the pandemic, although consumer's expectations for the economy and jobs improved. Around a third of respondents expect business conditions to improve in the next six months. Similar survey evidence suggests a downside risk in February. The preliminary Michigan consumer sentiment indicator ticked down in February, mainly driven by the expectations index.

The events calendar remains quiet with the only highlights in terms of speakers being Fed's Jerome Powell, and BOC's Tiff Macklem.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.